Linde Equity Research TSX Performance Review 2011 Q2: TSX Composite Gives Back Q1 Gains Most Important Sectors All Register Losses in Q2 Q2 Sector Returns

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Page 1 of 2 Reporting Issuer List - Cover Page

Alberta Securities Commission Page 1 of 2 Reporting Issuer List - Cover Page Reporting Issuers Default When a reporting issuer is noted in default, standardized codes (a number and, if applicable a letter, described in the legend below) will be appear in the column 'Nature of Default'. Every effort is made to ensure the accuracy of this list. A reporting issuer that does not appear on this list or that has inappropriately been noted in default should contact the Alberta Securities Commission (ASC) promptly. A reporting issuer’s management or insiders may be subject to a Management Cease Trade Order, but that order will NOT be shown on the list. Legend 1. The reporting issuer has failed to file the following continuous disclosure document prescribed by Alberta securities laws: (a) annual financial statements; (b) an interim financial report; (c) an annual or interim management's discussion and analysis (MD&A) or an annual or interim management report of fund performance (MRFP); (d) an annual information form; (AIF); (e) a certification of annual or interim filings under National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109); (f) proxy materials or a required information circular; (g) an issuer profile supplement on the System for Electronic Disclosure By Insiders (SEDI); (h) a material change report; (i) a written update as required after filing a confidential report of a material change; (j) a business acquisition report; (k) the annual oil and gas disclosure prescribed by National Instrument -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Preparing for Growth: Capitalizing on a Period of Progress and Stability

Preparing for growth: Capitalizing on a period of progress and stability www.pwc.com/ca/canadianmine A year of stability Contents 2 A year of stability 3 Highlights and analysis 7 Agnico Eagle: Perfecting a successful 60 year-old strategy 9 Osisko Gold Royalties: Disrupting the cycle An interview with John Matheson, Partner, PwC Canada 11 Savvy investments in stable times Call it breathing room. Over the last year, into Eastern and Central Europe with its Canada’s major mining companies have Belt and Road Initiative (formerly One Belt entered a period of relative stability after and One Road) is increasing demand for weathering a frenzied period of boom, industrial products. bust and recovery. Globally, the geopolitical situation will About this report The sector has been paying down debt, likely remain volatile through 2018 and Preparing for growth is one of improving balance sheets and judiciously beyond. While bullion largely shrugged four publications in our annual investing in capital projects, on trend with off 2017’s world events, international Canadian mine series looking at the wider global mining industry in 2017. uncertainties could yet become an the realities and priorities of public Maintaining flexibility and increasing upward force on gold prices. The success mining companies headquartered efficiency are key goals for many executive of stock markets around the globe last in Canada. It offers a summary of financial analysis of the top 25 teams as they try to position themselves to year dampened general investor interest listings by market capitalization on capitalize on the next stages of the cycle. in gold equities, with the precious metal the TSX and complements our Junior Some companies have sought to enhance traditionally serving as a hedge against mine 2017 report, which analyzes the operations through acquisitions, but on market downturns, said David Smith, top 100 listings on the TSX Venture the whole, 2017 saw few eye-popping Senior Vice President of Finance and Chief Exchange (TSX-V). -

IEA: the Role of Critical Minerals in Clean Energy Transitions

The Role of Critical Minerals in Clean Energy Transitions World Energy Outlook Special Report INTERNATIONAL ENERGY AGENCY The IEA examines the full spectrum of IEA member countries: Spain energy issues including oil, gas and Australia Sweden coal supply and demand, renewable Austria Switzerland energy technologies, electricity Belgium Turkey markets, energy efficiency, access to Canada United Kingdom energy, demand side management Czech Republic United States and much more. Through its work, the Denmark IEA advocates policies that will Estonia IEA association countries: enhance the reliability, affordability Finland Brazil and sustainability of energy in its 30 France China member countries, 8 association Germany India countries and beyond. Greece Indonesia Hungary Morocco Please note that this publication is Ireland Singapore subject to specific restrictions that Italy South Africa limit its use and distribution. The Japan Thailand terms and conditions are available Korea online at www.iea.org/t&c/ Luxembourg Mexico This publication and any map included herein are Netherlands without prejudice to the status of or sovereignty New Zealand over any territory, to the delimitation of international frontiers and boundaries and to the Norway name of any territory, city or area. Poland Portugal Slovak Republic Source: IEA. All rights reserved. International Energy Agency Website: www.iea.org The Role of Critical Minerals in Clean Energy Transitions Foreword Foreword Ever since the International Energy Agency (IEA) was founded in world to anticipate and navigate possible disruptions and avoid 1974 in the wake of severe disruptions to global oil markets that damaging outcomes for our economies and our planet. shook the world economy, its core mission has been to foster secure This special report is the most comprehensive global study of this and affordable energy supplies. -

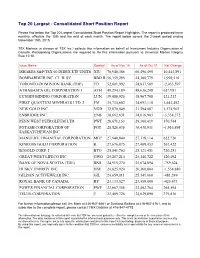

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Notice to Participating Organizations 2005-028

Notice to Participating Organizations --------------------------------------------------------------------------------------------------------------------- August 12, 2005 2005-028 Addition of Market On Close (MOC) Eligible Securities Toronto Stock Exchange will roll out MOC eligibility to the symbols of the S&P/TSX Composite Index in preparation for the quarter end index rebalancing on September 16, 2005. TSX will enable MOC eligibility in two phases: I. S&P/TSX Mid Cap Index will become MOC eligible effective September 6, 2005. II. S&P/TSX Small Cap Index will become MOC eligible effective September 12, 2005. A list of securities for each of these indices follows this notice. To ensure you are viewing the most current list of securities, please visit the Standard and Poor's website at www.standardandpoors.com prior to the above rollout dates. “S&P” is a trade-mark owned by The McGraw-Hill, Companies Inc. and “TSX” is a trade- mark owned by TSX Inc. MOC Eligible effective MOC Eligible effective September 6, 2005 September 12, 2005 S&P TSX Mid Cap S&P TSX Small Cap SYMBOL COMPANY SYMBOL COMPANY ABZ Aber Diamond Corporation AAC.NV.B Alliance Atlantis Communications Inc. ACM.NV.A Astral Media Inc. AAH Aastra Technologies Ltd. ACO.NV.X Atco Ltd. ACE.RV ACE Aviation Holdings Inc. AGE Agnico-Eagle Mines AEZ Aeterna Zentaris Inc. AGF.NV AGF Management Ltd. AGA Algoma Steel Inc. AIT Aliant Inc. ANP Angiotech Pharmaceuticals Inc. ATA ATS Automation Tooling Systems Inc. ATD.SV.B Alimentation Couche-Tard Inc. AXP Axcan Pharma Inc. AU.LV Agricore United BLD Ballard Power Systems Inc. AUR Aur Resources Inc. -

Appraisal Manual for Centrally Valued Natural Resource Property

Appraisal Manual For Centrally Valued Natural Resource Property Valuation Guidelines for Natural Resource Property Preface Preface The Department of Revenue’s Local Jurisdictions District is responsible for ensuring fair, accurate, and uniform property valuations as prescribed by Arizona statutes. The Local Jurisdictions District contains the Centrally Valued Property Unit which is responsible for producing this manual. The Centrally Valued Property Unit is responsible for determining the full cash value of certain utilities, railroads, airlines, private rail cars, mines, and other complex or geographically diverse property. With the exception of airline and private rail car valuations, the values are then transmitted for entry on the individual county tax rolls for levy and collection of property taxes. The manual is produced each year to serve as a guide in the appraisal of mines and other natural resource property. The techniques, procedures, and factors described in the manual are reviewed annually and revised in accordance with standard appraisal methods and techniques along with changes in statutes, rules, and regulations. Revisions are also made based on case law decisions. The procedures described in the manual are designed to assist the appraiser in the application of the income, cost, and market approach methods of valuation to these properties for the current tax year. This manual is intended for use in ad valorem appraisal of specific centrally valued property including producing mines, certain non-producing mines, qualifying environmental technology property and oil, gas, and geothermal interests in Arizona. The guidelines in this manual are used to establish full cash values for these properties as of January 1 of the valuation year. -

Q4 Performance Review

BEAM | Q4-2018 / Annual Performance Review February 7, 2019 8888 University Drive | Burnaby | British Columbia | Canada | www.beedie.sfu.ca/beam Agenda I. Executive Summary Blake Coombes Portfolio Manager II. Fixed Income Update Carl Davies Portfolio Manager III. Equity Update Philip Tashin Portfolio Manager IV. Going Forward Blake Coombes Portfolio Manager V. Questions VI. Appendix I. Executive Summary Blake Coombes | Portfolio Manager [email protected] I. Executive Summary BEAM Overview - Objectives 1 To preserve inflation-adjusted invested capital To outperform the equity benchmark by 150 basis points and outperform the fixed 2 income benchmark by 40 basis points on a rolling 4-year average Use ESG as a tool to conform to SFU endowment responsibilities and the UN’s 3 principles for responsible investment Provide an engaging educational experience that trains the next generation of 4 responsible and ethical finance professionals 4 Program has been a positive educational experience Alumni well prepared for first job placements Alumni Feedback Alumni Placements Other How valuable was BEAM in getting your first job? 24% Investment Banking 4.5/5.0 41% Consulting 10% Equity How was your overall experience in BEAM? Research Asset 10% Management 14% Other placements include: 4.7/5.0 ▪ Private Equity ▪ Technology ▪ Sales & Trading ▪ Corporate Finance ▪ Accounting ▪ Corporate Development ▪ Public Sector 5 Successfully recruited 12 new members New interview process contained team-based project Round 1 Round 2 All were invited for Round 2 interview Candidates separated into teams and Individual interviews were conducted presented a buy/sell recommendation on a assessing technical and behavior skills along company (2.5 hours allotted time) with market knowledge Moving Forward 9th Cohort Contracts Signed First Meeting Cohort Training Interviews Complete In Progress Jan. -

First Quantum Minerals Ltd

OFFERING CIRCULAR DATED 15 JUNE 2009 First Quantum Minerals Ltd. (continued into the province of British Columbia, Canada under the Business Corporation Act (British Columbia) with incorporation no: C0726351) U.S.$500,000,000 6.0 per cent. Convertible Bonds due 2014 convertible into Common Shares of First Quantum Minerals Ltd. ___________________________________________________________________________________ Issue Price 100 per cent. ___________________________________________________________________________________ Global Coordinator NOMURA INTERNATIONAL Joint Bookrunners and Joint Lead Managers NOMURA INTERNATIONAL MORGAN STANLEY Co-Manager RBC CAPITAL MARKETS 1 This Offering Circular (the "Offering Circular") comprises listing particulars given in compliance with the listing rules made under Section 73A of the Financial Services and Markets Act 2000 (the "FSMA") by the UK Listing Authority (the "UKLA") for the purpose of giving information with regard to First Quantum Minerals Ltd. (the "Issuer" or the "Company"), and the Issuer and its subsidiaries taken as a whole (the "Group") and the U.S.$500,000,000 6.0 per cent. convertible bonds due 2014 (the "Bonds"). Applications have been made for the Bonds to be admitted to the Official List of the UKLA and to be admitted to trading on the Professional Securities Market of the London Stock Exchange plc (the "LSE"). References in this Offering Circular to the Bonds being "listed" (and all related references) shall mean that the Bonds have been admitted to the Official List and have been admitted to trading on the Professional Securities Market. The Professional Securities Market is an unregulated market for the purposes of Directive 2004/39/EC (the Markets in Financial Instruments Directive). This Offering Circular is to be read in conjunction with all the documents which are incorporated by reference herein (see "Documents Incorporated by Reference"). -

STOXX Canada 240 Last Updated: 02.01.2018

STOXX Canada 240 Last Updated: 02.01.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 99.5 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 90.5 2 2 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 64.6 3 3 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 54.0 4 4 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 50.8 5 5 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 44.7 6 6 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 43.3 7 7 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 36.1 8 8 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 35.8 9 11 CA89353D1078 2665184 TRP.TO TRP TransCanada Corp. CA CAD Y 35.6 10 9 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 34.5 11 10 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 33.4 12 12 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENT CA CAD Y 32.9 13 13 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 22.4 14 14 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. CA CAD Y 21.1 15 15 CA87971M1032 2381093 T.TO BCT TELUS CA CAD Y 18.8 16 16 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 18.3 17 17 CA5592224011 2554475 MG.TO MG.A Magna International Inc. -

CSA Notice 44-302 - Replacement of National Instrument 44-101 Short Form Prospectus Distributions

Notices / News Releases 1.1.2 CSA Notice 44-302 - Replacement of National Instrument 44-101 Short Form Prospectus Distributions CSA NOTICE 44-302 - REPLACEMENT OF NATIONAL INSTRUMENT 44-101 SHORT FORM PROSPECTUS DISTRIBUTIONS December 16, 2005 Introduction On October 21, 2005, the Canadian Securities Administrators (CSA), published a notice relating to the replacement of National Instrument 44-101 Short Form Prospectus Distributions (Former NI 44-101) which came into effect in December 2000 with National Instrument 44- 101 Short Form Prospectus Distributions (New NI 44-101). New NI 44-101 will come into force on December 30, 2005. Substance and Purpose New NI 44-101 modifies the qualification, disclosure and other requirements of the short form prospectus system so that this prospectus system can build on and be more consistent with recent developments and initiatives of the CSA. Transition Section 2.8(1) of New NI 44-101 requires issuers to file a one-time notice of intention to be qualified to file a short form prospectus (a qualification notice) at least 10 business days prior to filing its first preliminary short form prospectus under New NI 44-101. Section 2.8(4) grandfathers issuers which have a current AIF as defined in Former NI 44-101 as at December 29, 2005 by deeming such issuers to have filed a qualification notice on December 14, 2005 (which is 10 business days prior to implementation of New NI 44- 101). Therefore, grandfathered issuers which otherwise satisfy the New NI 44-101 qualification criteria may file a preliminary short form prospectus under New NI 44-101 on or after December 30, 2005. -

First Quantum 2012 Ar

FIRST QUANTUM MINERALS LTD. 2012 Annual Report DRIVINGDRIVING VALUE. VALUE. We delivered strong Our vision to create a premier We became a significant Our exploration program had operating and financial base metals company, with nickel producer in 2012 with a busy and productive year results in 2012. From the a leading growth profile a full year of commercial which included major drilling production and sale of in copper. production at Ravensthorpe campaigns at Kansanshi and copper, nickel, gold and Letter to Shareholders, and the start-up of Kevitsa. Trident and entering into platinum group metals, we Page 3 Operations and Projects, new joint-ventures focused generated $2,950 million Pages 8, 11, 12 on early-stage copper in sales revenues. opportunities. Letter to Shareholders, Exploration, Page 16 Page 2 BOLDER,BOLDER, SMARTER,SMARTER, DRIVEN.DRIVEN. FIRST QUANTUM MINERALS LTD. is a well-established and rapidly growing mining and metals company engaged in mineral exploration, development and mining. The Company currently produces LME grade equivalent copper cathode, copper in concentrate, nickel, gold and platinum group metals. Its operations and projects are located in Zambia, Mauritania, Australia, Finland and Peru. In 2012, First Quantum produced 307,115 tonnes of copper, 36,759 tonnes of nickel, 201,942 ounces of gold, 13,808 ounces of platinum and 12,183 ounces of palladium. In 2013, the Company acquired Inmet Mining, a Canadian-based company with global operations producing copper and zinc. Unless otherwise noted, all amounts in this report are expressed in United States dollars. Kansanshi Guelb Moghrein Ravensthorpe Kevitsa Our shareholders benefit from our share price appreciation.