From the Port of Prince Rupert to the Review Panel Re: Written Submission for the Milton Logistics Hub Project Hearing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Port of Prince Rupert Delivers Another Record Year

Port of Prince Rupert Delivers Another Record Year rupertport.com The Prince Rupert Port Authority (PRPA) announced today another record year in volume. A grand total of 29.9 million tonnes of cargo moved through the Port of Prince Rupert in 2019 – 12% more than the 26.7 million tonnes handled the previous year and the highest total volume to date for the Port. Supporting the overall positive trend was strong Follow the BCMEA performance at DP World’s Fairview Container Terminal with over 1.2 million TEUs at an increase on social media of 17% over 2018, the addition of propane volume through AltaGas’ Ridley Island Propane Export Terminal, and growth in coal handled at Ridley Terminal where cargo levels were up 18% over the previous year. (continued) We’re looking for your good news stories to share! Please submit to Grace Sullivan: [email protected] 500 – 349 Railway Street, Vancouver, British Columbia V6A 1A4 604.688.1155 www.bcmea.com January 16, 2020 The BCMEA Bulletin January 16, 2020 Port of Prince Rupert Delivers Another Record Year (continued) Northland Cruise Terminal also saw a year-over-year increase in passenger volumes of 35%, totalling over 12,400 visitors to Prince Rupert through cruise travel. “The Port of Prince Rupert’s consistent record-breaking annual volumes confirms the Port’s growing role in Canadian trade,” said Shaun Stevenson, President and CEO of the Prince Rupert Port Authority. “The Port of Prince Rupert has a reputation for offering strategic advantages to shippers. The 2019 volumes illustrate the growing market demand for the Prince Rupert gateway and further validates our plans for growth and expansion over the next several years.” PRPA’s latest economic impact study released in 2019 revealed that port-related growth has resulted in the Port of Prince Rupert handling approximately $50 billion in trade value annually and supports an estimated 3,600 direct supply-chain jobs in northern BC, $310 million in annual wages, and $125.5 million in annual government revenue. -

Chapter 5: Freight Rail

Chapter 5: Freight Rail Table of Contents Introduction .................................................................................................................................................. 3 Wisconsin’s Rail Freight Network ............................................................................................................. 3 History of freight rail in Wisconsin ........................................................................................................ 3 WisDOT’s response to changes in statewide freight rail service .......................................................... 4 Milwaukee Road ................................................................................................................................... 4 Rail Transit Commissions ...................................................................................................................... 4 Wisconsin’s current freight rail network .............................................................................................. 5 Freight rail classifications ...................................................................................................................... 5 Commodities moved ............................................................................................................................. 6 2030 freight shipments forecast ........................................................................................................... 8 Wisconsin’s intermodal facilities ....................................................................................................... -

Eastern Canada Ports Battle for Mega-Ship Calls Peter Ford, Principal, Skyrock Advisors, LLC, and Dr

Analysis: Eastern Canada ports battle for mega-ship calls Peter Ford, principal, SkyRock Advisors, LLC, and Dr. Jean-Paul Rodrigue, professor of global studies & geography, Hofstra University May 23, 2018 3:59PM EDT The Port of Montreal is the largest on Canada's east coast. [Photo credit: Port of Montreal.] Every new terminal or port development has risks, particularly in a mature market with established stakeholders. The risk can be mitigated if container volumes have a pronounced upward trend, but the financial crisis of 2007-2008 has shifted growth expectations closer to the range of 2 to 3 percent annual growth rate at the global level, but around 5 percent for the North American East Coast. Still, these figures are subject to caution considering growing trade contentions as well as technological changes in global manufacturing and supply chains with the outsourcing and offshoring model being reconsidered. Ocean carriers have responded to this environment by unprecedented industry consolidation, with more merger and acquisition activity happening in the last three years than in the decade preceding, and then further consolidating into mega-alliances with lines focusing on larger vessels to create scale economies and reduce slot costs. Many shipping lines are also involved in container terminal operations with various concession and ownership schemes. 1. All is not quiet on the East Coast front The Canadian East Coast has been a very stable market in the last 50 years with established ports, mainly Montreal and Halifax, assuming dominance. While Montreal experienced a growth relatively on par with the US East Coast, the volumes handled by Halifax barely changed in the last 20 years but have recently shown sign of upward momentum due to new services. -

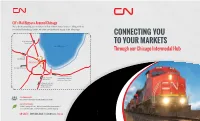

Connecting You to Your Markets

CN's Rail Bypass Around Chicago We've been connecting our customers to their markets faster for years. Along with our streamlined interchange points, we offer a truly efficient supply chain advantage. CONNECTING YOU to Vancouver and Prince Rupert TO YOUR MARKETS Lake Michigan Through our Chicago Intermodal Hub to the U.S. Midwest CHICAGO CN’s bypass rail line to Toronto and the east to Decatur and coast ports of Montreal, Indianapolis Halifax and Saint John to Memphis and the Gulf ports of Mobile and New Orleans CUSTOMER SERVICE One point of contact for all your supply chain needs. OUR GREEN PROMISE CN Rail is energy efficient. We are committed to environmental initiatives that make us the best choice for greener shipping. CN SALES | 1-888-668-4626 | [email protected] | cn.ca CN012020 Port of Prince Rupert Port of Vancouver Port of Halifax Port of The superior network solution Montreal Toronto NY/NJ for all your supply chain logistics Chicago Philadelphia CN provides a one-stop shop, including freight forwarding to Wilmington move your product along the best supply chain routes. Through our partnerships with ocean carriers and major Canadian port gateways, we offer a single line seamless service from last port of call in Asia to Chicago in only 16 days. Port of Mobile Port of New Orleans • 23 intermodal terminals across North America PORT OF PORT OF PORT OF PORT OF PORT OF PORT OF TRANSIT TIME Prince Rupert Vancouver Montreal Halifax New Orleans Mobile • Network reach to 3 coasts serving multiple TORONTO 5th am 5th am same day pm 2nd am 3rd pm 3rd pm Canadian and U.S. -

Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports

Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports July 2012 Committee for the Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports Richard A. Lidinsky, Jr. - Chairman Lowry A. Crook - Former Chief of Staff Ronald Murphy - Managing Director Rebecca Fenneman - General Counsel Olubukola Akande-Elemoso - Office of the Chairman Lauren Engel - Office of the General Counsel Michael Gordon - Office of the Managing Director Jason Guthrie - Office of Consumer Affairs and Dispute Resolution Services Gary Kardian - Bureau of Trade Analysis Dr. Roy Pearson - Bureau of Trade Analysis Paul Schofield - Office of the General Counsel Matthew Drenan - Summer Law Clerk Jewel Jennings-Wright - Summer Law Clerk Foreword Thirty years ago, U.S. East Coast port officials watched in wonder as containerized cargo sitting on their piers was taken away by trucks to the Port of Montreal for export. At that time, I concluded in a law review article that this diversion of container cargo was legal under Federal Maritime Commission law and regulation, but would continue to be unresolved until a solution on this cross-border traffic was reached: “Contiguous nations that are engaged in international trade in the age of containerization can compete for cargo on equal footings and ensure that their national interests, laws, public policy and economic health keep pace with technological innovations.” [Emphasis Added] The mark of a successful port is competition. Sufficient berths, state-of-the-art cranes, efficient handling, adequate acreage, easy rail and road connections, and sophisticated logistical programs facilitating transportation to hinterland destinations are all tools in the daily cargo contest. -

Revisiting Port Capacity: a Practical Method for Investment and Policy Decisions

Revisiting Port Capacity: A practical method for Investment and Policy decisions Ioannis N. Lagoudis Head of R&D, XRTC Ltd, Business Consultants 95 Akti Miaouli Str., 18538, Piraeus, Greece & Adjunct Faculty, University of the Aegean – Department of Shipping trade and Transport 2A Korai Str., 82100, Chios, Greece and James B. Rice, Jr. Deputy Director, MIT – Center for Transportation and Logistics 1 Amherst Street, Second Floor,Cambridge, MA 02142 Abstract The paper revisits port capacity providing a more holistic approach via including immediate port connections from the seaside and the hinterland. The methodology provided adopts a systemic approach encapsulating the different port terminals along with the seaside and hinterland connections providing a holistic estimation of port capacity. Capacity is defined with the use of two dimensions; static and dynamic. Static capacity relates to land availability or in other words the available space for use. Dynamic capacity is determined by the available technology of equipment in combination to the skill of available labor. With the presentation of a case study from a container terminal the practical use of this methodology is illustrated. Based on the data provided by the terminal operator the results showed that there is still available space to be utilised at a static level and also room more improvement at a dynamic level. The benefits stemming from the above methodology are multidimensional with the key ones being the flexible framework adjusted to the needs of each port system for measuring capacity, the productivity estimation of the different business processes involved in the movement of goods and people and the evaluation of the financial performance of the different business units and the port as a whole. -

Freight Preclearance – Gauthier

Beyond the Border Action Plan Integrated Cargo Security Strategy Prince Rupert Rail Pilot Gérald Gauthier, April 2016 1 RAC –Who we are Safety• 55 members Culture Measurement Tool • Represents virtually all railways operating in Canada today: • Class 1s (CN, CPR and US Class 1s) – private • Short lines – private • Inter-city Passenger (VIA/AMTRAK) – public • Commuter – public • Tourist – private & public Provides railway industry with unique opportunities and service capability Canadian Railways – 2014 Commodity Mix 3 Canadian Railways – Market Reach 4 Beyond the Border Rail • CN rail pilot with CBP and CBSA developed to push high risk security concerns related to import cargo to the North American perimeter • Borne from the February 2011 US-Canada “Beyond the Border Action Plan” - a shared vision for perimeter security and economic competitiveness • CN’s rail corridor from Prince Rupert BC to International Falls MN was selected for the pilot after careful review of risks and feasibility by CBP/DHS, CBSA, Transport Canada, and Industry Canada • Focus of the pilot on import containers from the pacific rim, discharged from vessel at the port of Prince Rupert BC for US destinations • “Cleared Once – Accepted Twice” to reduce level of CBP inspection at US border 5 CN Route 6 The Electronic Process • Pilot facilitated by sophisticated electronic processing between trade partners and government agencies • Canadian rail carriers developed full cycle EDI processing with the US and Canada customs agencies in 1995 and carried through to CBP’s ACE -

Hapag-Lloyd - Canadian Ports Christmas / New Year 2018-2019 Holidays Terminals Gates Schedule /Closures

Hapag-Lloyd - Canadian Ports Christmas / New Year 2018-2019 Holidays terminals gates schedule /closures Port of Montreal Montreal Gateway Terminals (MGT) Christmas week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 22-Dec-18 23-Dec-18 24-Dec-18 25-Dec-18 26-Dec-18 27-Dec-18 28-Dec-18 Open from 6:00 Open from 6:00 Open from 6:00 Closed Closed Closed Closed to 23:00 to 23:00 to 23:00 New Year week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 29-Dec-18 30-Dec-18 31-Dec-18 1-Jan-19 2-Jan-19 3-Jan-19 4-Jan-19 Open from 7:00 Open from 7:00 Open from 6:00 Open from 6:00 Closed Closed Closed to 15:00 to 15:00 to 23:00 to 23:00 Montreal / Termont Christmas week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 22-Dec-18 23-Dec-18 24-Dec-18 25-Dec-18 26-Dec-18 27-Dec-18 28-Dec-18 Open from 7:00 Open from 6:00 Open from 6:00 Closed Closed Closed Closed to 15:00 to 23:00 to 23:00 New Year week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 29-Dec-18 30-Dec-18 31-Dec-18 1-Jan-19 2-Jan-19 3-Jan-19 4-Jan-19 Open from 6:00 Open from 6:00 Closed Closed Closed Closed Closed to 23:00 to 23:00 Port of Vancouver Fraser Surrey Docks (FSD) Christmas week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 22-Dec-18 23-Dec-18 24-Dec-18 25-Dec-18 26-Dec-18 27-Dec-18 28-Dec-18 Open from 8:00 Open from 8:00 Open from 8:00 Closed Closed Closed Closed to 11:00 to 16:00 to 16:00 New Year week Saturday Sunday Monday Tuesday Wednesday Thursday Friday 29-Dec-18 30-Dec-18 31-Dec-18 1-Jan-19 2-Jan-19 3-Jan-19 4-Jan-19 Open from -

Annual Report for Fiscal Year 1931

Fifteenth Annual Report OF THE UNITED STATES SHIPPING BOARD N Fiscal Year Ended June 30 1931 UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON 1931 VMS hY she tlhpesintondmt of Documents Woahiugton D C Price 15 amts UNITED STATES SHIPPING BOARD T V OCONNON Chairman EDwAw C PL17mum Vice Chairman H I CONE Commissioner ALDmT H DENTON Commissioner JEETM60N Mrses Commissioner S S SANDB Commissioner ROLAND S SMITH Commissioner SAMOSL GOoDAcRr Secretary II TABLE OF CONTENTS 1 UNITED STATES SHIPPING BOARD Yale Letter of transmittal v Organization chart Facing 1 Or I General statement 2 Bureau of traffic 11 Bureau of re 91 Bureau of operations 36 Industrial relations division 36 Investigations division 49 Port facilities division 45 Bureau of construction 49 Bureauof law 59 Litigation and claims division 59 Contracts and opinions division 62 Admiralty division 62 Bureau of finance 63 Bureau of research 68 Secretary 70 II UNITED STATES SHIPPING BOARD MERCHANT FLEET CORPORATION Organization chart Facing 81 Organization 81 Special features of the years activities 82 Sales of vessels 82 Proposed sale of Hoboken Terminal 83 Proposed sale of 45 Broadway 83 Operating agreement 1930 84 Extent of vessel operations 84 Total results of operations during 1931 85 Cost of cargo services 85 Other operating results 86 Coaltrade 87 Changes in district offices 87 Reduction of pay rolls and administrative expenses 88 Supply and operating activities 88 Centralized purchasing 88 Fuel purchases and issues 88 Storekeeping activities 89 Stevedoring 89 Care of reserve -

DP World's Fairview Terminal in Prince Rupert Reaches 1 Million TEU Milestone

DP World’s Fairview Terminal In Prince Rupert Reaches 1 Million TEU Milestone dpworld.ca The Port of Prince Rupert and DP World celebrated a historic milestone as Fairview Container Terminal handled its millionth container (TEU) for the first time in a calendar year. On December 18th, the millionth TEU was loaded Follow the BCMEA onto the COSCO Africa with ILWU members and supply chain partners on hand to celebrate. The 40-foot container was loaded with dimensional lumber from Canfor’s Plateau mill at CN’s Prince George Transload Facility before arriving in Prince Rupert by rail. (continued) We’re looking for your good news stories to share! Please submit to Lauren Chan: [email protected] 500 – 349 Railway Street, Vancouver, British Columbia V6A 1A4 604.688.1155 www.bcmea.com January 18, 2019 The BCMEA Bulletin January 18, 2019 DP World’s Fairview Terminal In Prince Rupert Reaches 1 Million TEU Milestone (continued) “DP World is proud to have achieved the million TEU milestone,” said Maksim Mihic, General Manager DP World (Canada) Inc. “We congratulate and thank the men and women whose hard work and dedication made this achievement possible. This accomplishment is also a testament to the strong collaboration and support amongst the supply chain and community partners. We are pleased to share this historic milestone together with our partners, First Nations, ILWU, City of Prince Rupert, Prince Rupert Port Authority and CN Rail. DP World Prince Rupert is a vital link in enabling Canadian trade and this achievement reflects the potential of the port and is a sign of many more to come.” During its first full year in operation in 2008, Fairview Terminal moved a modest 182,523 TEUs. -

PRINCE RUPERT PORT AUTHORITY Submission to the Standing Senate Committee on Transport and Communications April 16, 2019

PRINCE RUPERT PORT AUTHORITY Submission to the Standing Senate Committee on Transport and Communications on Bill C-48 An Act Respecting the Regulation of Vessels that Transport Crude Oil or Persistent Oil to or from Ports or Marine Installations Located along British Columbia’s North Coast April 16, 2019 1 BILL C-48 PRINCE RUPERT PORT AUTHORITY Submission to the Standing Senate Committee on Transport and Communications April 16, 2019 The Prince Rupert Port Authority was created through the Canada Marine Act with a mandate to enable Canada’s trade with the world through the Port of Prince Rupert. By working closely with our partners and customers, we deliver supply chain innovation that has added value to Canadian products and increased Canada’s global competitiveness. Through careful stewardship, we have created sustainable prosperity for our communities, First nations, our province, and our country. PRPA fully supports the overarching goal of the mandate provided to the Minister of Transport by Prime Minister Trudeau to “…ensure that Canada’s transportation system supports our ambitious economic growth and job creation agenda” and the comment that “Canadians need a transportation system that is safe, reliable and facilitates trade and the movement of people and goods.” This mandate is entirely consistent with the purposes of the Canada Marine Act and PRPA’s purpose. Notably, the Oceans Act recognizes in its preamble that “the three oceans, the Arctic, the Pacific and the Atlantic, are the common heritage of all Canadians” and that “the oceans and their resources offer significant opportunities for economic diversification and the generation of wealth for the benefit of all Canadians, and in particular for coastal communities.” This duality of approach is not in our view contradictory but reflects Canadian values as a trading nation with a strong desire to preserve our environmental heritage. -

Ridley Island Export Logistics Platform Project

Ridley Island Export Logistics Platform Project January 28, 2020 PRINCE RUPERT PORT AUTHORITY 200-215 COW BAY ROAD P: 250 627 8899 PRINCE RUPERT, B.C. V8J 1A2 F: 250 627 8980 Ridley Island Export Logistics Platform Project Prince Rupert Port Authority Table of Contents 1 Introduction 1 1.1 Project Overview 1 1.2 Proponent Information 3 1.3 Purpose and Need for the Project 3 2 Description of the Project 5 2.1 Project Location 5 2.2 Physical Components 5 2.3 Project Capacity 8 2.4 Project Activities 9 2.4.1 Construction Phase 9 2.4.2 Operations and Maintenance Phase 10 2.5 Project Schedule 11 3 Past Studies, Land Use and Regulatory Overview 12 3.1 Past Studies 12 3.2 Land Use Designation 12 3.3 Regulatory Framework 13 4 Environmental Overview 15 4.1 Atmospheric Environment 15 4.2 Terrestrial Environment 17 4.2.1 Geology, Soils and Terrain 17 4.2.2 Ground and Surface Water 17 4.2.3 Vegetation and Wildlife 17 4.2.4 Freshwater Fish and Fish Habitat 19 4.3 Marine Environment 19 4.3.1 Marine Water Quality 19 4.3.2 Marine Vegetation, Fish and Wildlife 20 4.4 Species at Risk 21 5 Social and Economic Overview 22 5.1 Social Overview 22 5.1.1 Local Communities 22 5.1.2 Community Services and Infrastructure 22 5.1.3 Recreation and Parks 23 January 28, 2020 i Ridley Island Export Logistics Platform Project Prince Rupert Port Authority Table of Contents (Cont'd) 5.1.4 Access 23 5.1.5 Archaeology 23 5.2 Economic Overview 25 5.2.1 Port of Prince Rupert 25 5.2.2 Local Economy 27 6 Indigenous Peoples and Traditional Land Use 28 6.1 Overview 28 6.2 Potential