Revisiting Port Capacity: a Practical Method for Investment and Policy Decisions

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Port of Prince Rupert Delivers Another Record Year

Port of Prince Rupert Delivers Another Record Year rupertport.com The Prince Rupert Port Authority (PRPA) announced today another record year in volume. A grand total of 29.9 million tonnes of cargo moved through the Port of Prince Rupert in 2019 – 12% more than the 26.7 million tonnes handled the previous year and the highest total volume to date for the Port. Supporting the overall positive trend was strong Follow the BCMEA performance at DP World’s Fairview Container Terminal with over 1.2 million TEUs at an increase on social media of 17% over 2018, the addition of propane volume through AltaGas’ Ridley Island Propane Export Terminal, and growth in coal handled at Ridley Terminal where cargo levels were up 18% over the previous year. (continued) We’re looking for your good news stories to share! Please submit to Grace Sullivan: [email protected] 500 – 349 Railway Street, Vancouver, British Columbia V6A 1A4 604.688.1155 www.bcmea.com January 16, 2020 The BCMEA Bulletin January 16, 2020 Port of Prince Rupert Delivers Another Record Year (continued) Northland Cruise Terminal also saw a year-over-year increase in passenger volumes of 35%, totalling over 12,400 visitors to Prince Rupert through cruise travel. “The Port of Prince Rupert’s consistent record-breaking annual volumes confirms the Port’s growing role in Canadian trade,” said Shaun Stevenson, President and CEO of the Prince Rupert Port Authority. “The Port of Prince Rupert has a reputation for offering strategic advantages to shippers. The 2019 volumes illustrate the growing market demand for the Prince Rupert gateway and further validates our plans for growth and expansion over the next several years.” PRPA’s latest economic impact study released in 2019 revealed that port-related growth has resulted in the Port of Prince Rupert handling approximately $50 billion in trade value annually and supports an estimated 3,600 direct supply-chain jobs in northern BC, $310 million in annual wages, and $125.5 million in annual government revenue. -

Sea Containers Ltd. Annual Report 1999 Sea Containers Ltd

Sea Containers Ltd. Annual Report 1999 Sea Containers Ltd. Front cover: The Amalfi Coast Sea Containers is a Bermuda company with operating seen from a terrace of the headquarters (through subsidiaries) in London, England. It Hotel Caruso in Ravello, Italy. is owned primarily by U.S. shareholders and its common Orient-Express Hotels acquired the Caruso in 1999 shares have been listed on the New York Stock Exchange and will reconstruct the prop- (SCRA and SCRB) since 1974. erty during 2000-2001 with a The Company engages in three main activities: passenger view to re-opening in the transport, marine container leasing and the leisure business. spring of 2002. Capri and Paestum are nearby. Demand Passenger transport includes 100% ownership of Hoverspeed for luxury hotel accommodation Ltd., cross-English Channel fast ferry operators, the Isle of on the Amalfi Coast greatly Man Steam Packet Company, operators of fast and conven- exceeds supply. tional ferry services to and from the Isle of Man, the Great North Eastern Railway, operators of train services between London and Scotland, and 50% ownership of Neptun Maritime Oyj whose subsidiary Silja Line operates Contents fast and conventional ferry services in Scandinavia. Company description 2 Marine container leasing is conducted primarily through GE SeaCo SRL, a Barbados company owned 50% by Financial highlights 3 Sea Containers and 50% by GE Capital Corporation. Directors and officers 4 GE SeaCo is the largest lessor of marine containers in the world with a fleet of 1.1 million units. President’s letter to shareholders 7 The leisure business is conducted through Orient-Express Discussion by Division: Hotels Ltd., also a Bermuda company, which is 100% owned by Sea Containers. -

The Rail Freight Challenge for Emerging Economies How to Regain Modal Share

The Rail Freight Challenge for Emerging Economies How to Regain Modal Share Bernard Aritua INTERNATIONAL DEVELOPMENT IN FOCUS INTERNATIONAL INTERNATIONAL DEVELOPMENT IN FOCUS The Rail Freight Challenge for Emerging Economies How to Regain Modal Share Bernard Aritua © 2019 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW, Washington, DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org Some rights reserved 1 2 3 4 22 21 20 19 Books in this series are published to communicate the results of Bank research, analysis, and operational experience with the least possible delay. The extent of language editing varies from book to book. This work is a product of the staff of The World Bank with external contributions. The findings, interpre- tations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Nothing herein shall constitute or be considered to be a limitation upon or waiver of the privileges and immunities of The World Bank, all of which are specifically reserved. Rights and Permissions This work is available under the Creative Commons Attribution 3.0 IGO license (CC BY 3.0 IGO) http:// creativecommons.org/licenses/by/3.0/igo. -

Chapter 5: Freight Rail

Chapter 5: Freight Rail Table of Contents Introduction .................................................................................................................................................. 3 Wisconsin’s Rail Freight Network ............................................................................................................. 3 History of freight rail in Wisconsin ........................................................................................................ 3 WisDOT’s response to changes in statewide freight rail service .......................................................... 4 Milwaukee Road ................................................................................................................................... 4 Rail Transit Commissions ...................................................................................................................... 4 Wisconsin’s current freight rail network .............................................................................................. 5 Freight rail classifications ...................................................................................................................... 5 Commodities moved ............................................................................................................................. 6 2030 freight shipments forecast ........................................................................................................... 8 Wisconsin’s intermodal facilities ....................................................................................................... -

Eastern Canada Ports Battle for Mega-Ship Calls Peter Ford, Principal, Skyrock Advisors, LLC, and Dr

Analysis: Eastern Canada ports battle for mega-ship calls Peter Ford, principal, SkyRock Advisors, LLC, and Dr. Jean-Paul Rodrigue, professor of global studies & geography, Hofstra University May 23, 2018 3:59PM EDT The Port of Montreal is the largest on Canada's east coast. [Photo credit: Port of Montreal.] Every new terminal or port development has risks, particularly in a mature market with established stakeholders. The risk can be mitigated if container volumes have a pronounced upward trend, but the financial crisis of 2007-2008 has shifted growth expectations closer to the range of 2 to 3 percent annual growth rate at the global level, but around 5 percent for the North American East Coast. Still, these figures are subject to caution considering growing trade contentions as well as technological changes in global manufacturing and supply chains with the outsourcing and offshoring model being reconsidered. Ocean carriers have responded to this environment by unprecedented industry consolidation, with more merger and acquisition activity happening in the last three years than in the decade preceding, and then further consolidating into mega-alliances with lines focusing on larger vessels to create scale economies and reduce slot costs. Many shipping lines are also involved in container terminal operations with various concession and ownership schemes. 1. All is not quiet on the East Coast front The Canadian East Coast has been a very stable market in the last 50 years with established ports, mainly Montreal and Halifax, assuming dominance. While Montreal experienced a growth relatively on par with the US East Coast, the volumes handled by Halifax barely changed in the last 20 years but have recently shown sign of upward momentum due to new services. -

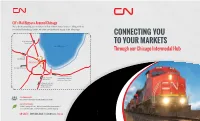

Connecting You to Your Markets

CN's Rail Bypass Around Chicago We've been connecting our customers to their markets faster for years. Along with our streamlined interchange points, we offer a truly efficient supply chain advantage. CONNECTING YOU to Vancouver and Prince Rupert TO YOUR MARKETS Lake Michigan Through our Chicago Intermodal Hub to the U.S. Midwest CHICAGO CN’s bypass rail line to Toronto and the east to Decatur and coast ports of Montreal, Indianapolis Halifax and Saint John to Memphis and the Gulf ports of Mobile and New Orleans CUSTOMER SERVICE One point of contact for all your supply chain needs. OUR GREEN PROMISE CN Rail is energy efficient. We are committed to environmental initiatives that make us the best choice for greener shipping. CN SALES | 1-888-668-4626 | [email protected] | cn.ca CN012020 Port of Prince Rupert Port of Vancouver Port of Halifax Port of The superior network solution Montreal Toronto NY/NJ for all your supply chain logistics Chicago Philadelphia CN provides a one-stop shop, including freight forwarding to Wilmington move your product along the best supply chain routes. Through our partnerships with ocean carriers and major Canadian port gateways, we offer a single line seamless service from last port of call in Asia to Chicago in only 16 days. Port of Mobile Port of New Orleans • 23 intermodal terminals across North America PORT OF PORT OF PORT OF PORT OF PORT OF PORT OF TRANSIT TIME Prince Rupert Vancouver Montreal Halifax New Orleans Mobile • Network reach to 3 coasts serving multiple TORONTO 5th am 5th am same day pm 2nd am 3rd pm 3rd pm Canadian and U.S. -

Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports

Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports July 2012 Committee for the Study of U.S. Inland Containerized Cargo Moving Through Canadian and Mexican Seaports Richard A. Lidinsky, Jr. - Chairman Lowry A. Crook - Former Chief of Staff Ronald Murphy - Managing Director Rebecca Fenneman - General Counsel Olubukola Akande-Elemoso - Office of the Chairman Lauren Engel - Office of the General Counsel Michael Gordon - Office of the Managing Director Jason Guthrie - Office of Consumer Affairs and Dispute Resolution Services Gary Kardian - Bureau of Trade Analysis Dr. Roy Pearson - Bureau of Trade Analysis Paul Schofield - Office of the General Counsel Matthew Drenan - Summer Law Clerk Jewel Jennings-Wright - Summer Law Clerk Foreword Thirty years ago, U.S. East Coast port officials watched in wonder as containerized cargo sitting on their piers was taken away by trucks to the Port of Montreal for export. At that time, I concluded in a law review article that this diversion of container cargo was legal under Federal Maritime Commission law and regulation, but would continue to be unresolved until a solution on this cross-border traffic was reached: “Contiguous nations that are engaged in international trade in the age of containerization can compete for cargo on equal footings and ensure that their national interests, laws, public policy and economic health keep pace with technological innovations.” [Emphasis Added] The mark of a successful port is competition. Sufficient berths, state-of-the-art cranes, efficient handling, adequate acreage, easy rail and road connections, and sophisticated logistical programs facilitating transportation to hinterland destinations are all tools in the daily cargo contest. -

Port of the Future Concepts, Topics and Projects - Draft for Experts Validation.Docx

Ref. Ares(2018)5643872 - 05/11/2018 D1.5 Port of the Future concepts, topics and projects - draft for experts validation.docx Deliverable D1.5 Date: 5th November 2018 Document: D1.5 Port of the Future concepts, topics and projects - draft for experts validation Page 1 of 268 Print out date: 2018-11-05 Document status Deliverable lead PortExpertise Internal reviewer 1 Circle, Alexio Picco Internal reviewer 2 Circle, Beatrice Dauria Type Deliverable Work package 1 ID D1.5 Due date 31st August 2018 Delivery date 5th November 2018 Status final submitted Dissemination level Public Table 1: Document status Document history Contributions All partners Change description Update work from D1.1 by including additional assessments and update code lists. Update the definition of Ports Of the Future Integrate deliverables D1.2, D1.3 and D1.4 Final version 2018 11 05 Table 2: Document history D1.5 Port of the Future concepts, topics and projects - draft for experts validation Page 2/268 Print out date: 2018-11-05 Disclaimer The views represented in this document only reflect the views of the authors and not the views of Innovation & Networks Executive Agency (INEA) and the European Commission. INEA and the European Commission are not liable for any use that may be made of the information contained in this document. Furthermore, the information is provided “as is” and no guarantee or warranty is given that the information fit for any particular purpose. The user of the information uses it as its sole risk and liability D1.5 Port of the Future concepts, topics and projects - draft for experts validation Page 3 of 268 Print out date: 2018-11-05 Executive summary D1.5 Port of the Future concepts, topics and projects - draft for experts validation Page 4 of 268 Print out date: 2018-11-05 1 Executive summary The DocksTheFuture Project aims at defining the vision for the ports of the future in 2030, covering all specific issues that could define this concept. -

From the Port of Prince Rupert to the Review Panel Re: Written Submission for the Milton Logistics Hub Project Hearing

PR I NCE RUPERT PORT AUTHORITY UNKI NG A WORLD OF OPPORTUNITY May 24,2019 Ms. Lesley Griffiths, Panel Chair c/o CEAA 160 Elgin Street Ottawa, ON K1AOH3 Dear Ms. Griffiths: We are writing to express our support for CN's plans to build the Milton Logistics Hub. The Port of Prince Rupert is a Canadian gateway for intermodal imports and exports to the Asia Pacific and is serviced exclusively by CN's rail network. The proposed Milton Logistics Hub· represents the supply chain infrastructure that is vital to ensure the fluidity of goods between markets. The Greater Toronto Hamilton Area (GTHA) is nearing capacity in terms of existing intermodal facilities. CN's $250 million investment will significantly improve the capacity, velocity, reliability and market reach for shippers in the Ontario market. Container volumes destined for CN's Brampton intermodal yard through Prince Rupert have grown 72.5% from 61,041 twenty-foot equivalents (TEUs) in 2015 to 105,290 TEUs in 2018. As Prince Rupert's Fairview Container Terminal moves through its next expansion to increase capacity to 1.8 million TEUs by 2022, Canada requires corresponding expansions of inland terminal capacity in order to accommodate growth in container volumes. The Milton intermodal terminal will provide the growing region of southern Ontario with much needed inland terminal capacity to support containerized imports of consumer products, auto parts, electronics and retail goods. Exporters of food and agricultural products, equipment, machinery, chemicals and metals from across the GTHA will also benefit from additional terminal capacity. Congestion at the Brampton intermodal yard has an impact on the terminal dwell time of containers bound for Toronto. -

Containerization Has So Revolutionized the Ocean Transportation of Cargo That It Is, Today, the Standard Method of Transporting Break Bulk Cargo

“ON DECK STOWAGE OF CONTAINERS” Prepared by: American Institute of Marine Underwriters Technical Services Committee Page 1 of 29 TABLE OF CONTENTS Page Introduction 3 Loss Experience 3 Types of Containers 4 Types of Containerships 6 Securing Devices of Container Vessels 8 Stowage & Collapse of Stow Issues 11 Stowage of Containers on Barges 15 Cargo Securing Manuals 17 Operational Issues 18 Comments and Recommendations 22 References 24 Revision History 25 Attachments: 26 List of Container Casualties Securing Hardware Diagrams Page 2 of 29 “On Deck Stowage of Containers” AIMU Technical Services Committee Introduction: Containerization has so revolutionized the ocean transportation of cargo that it is, today, the standard method of transporting break bulk cargo. Container ships have been plying the seas for a few decades and we are now seeing large container ships, capable of carrying 8,000 – 10,000 containers, with tiers of up to 8 high. Although this represents a tremendous economy of scale in the transporting of containers, we have seen a number of highly publicized incidents, involving the loss of large numbers of containers of containers overboard, during ocean transit. These incidents have resulted in additional damage to hundreds of other containers aboard the ship, as well as endangering the safety of the ship itself. Further, partially submerged containers pose a hazard to navigation to other vessels, particularly fishing vessels and small craft, as well as a potential environmental hazard. The first generation of container ships provided for carriage of containers on deck in tiers of only two high. The next generation allowed for carriage of containers on deck up to four tiers high. -

Introduction to Intermodal Industry

Intermodal Industry Overview - History of Containers and Intermodal Industry - Intermodal Operations - Chassis and Chassis Pools TRAC Intermodal Investor Relations 1 Strictly Private and Confidential Index Page • History of Containers and Intermodal Industry 4 • Intermodal Operations 13 • Chassis and Chassis Pools 36 2 Strictly Private and Confidential What is Intermodal? • Intermodal freight transportation involves the movement of goods using multiple modes of transportation - rail, ship, and truck. Freight is loaded in an intermodal container which enables movement across the various modes, reduces cargo handling, improves security and reduces freight damage and loss. 3 Strictly Private and Confidential Overview HISTORY OF CONTAINERS AND INTERMODAL INDUSTRY 4 Strictly Private and Confidential Containerization Changed the Intermodal Industry • Intermodal Timeline: – By Hand - beginning of time – Pallets • started in 1940’s during the war to move cargo more quickly with less handlers required – Containerization: Marine • First container ship built in 1955, 58 containers plus regular cargo • Marine containers became standard in U.S. in 1960s (Malcom McLean 1956 – Sea Land, SS Ideal X, 800 TEUs) • Different sizes in use, McLean used 35’ • 20/40/45 standardized sizes for Marine 5 Strictly Private and Confidential Containerization Changed the Intermodal Industry • Intermodal Timeline: – Containerization: Domestic Railroads • Earliest containers were for bulk – coal, sand, grains, etc. – 1800’s • Piggy backing was introduced in the early 1950’s -

Containerization in Transporting Agricultural P Erishahles JOHN E

Containerization in Transporting Agricultural P erishahles JOHN E. CLAYTON Chief, Transportation Research Branch, Transportation and Facilities Research Division, U.S. Department of Agriculture • CONTAINERlZATION seems to have geuera led r e11ewed inter e::> t, enthusiasm and activity in freight transport. Its use may be extended to all modes of transport, with the addition of many new products; and it may become worldwide. Nearly every issue of the transport press reports expansion of containerization by one firm or another, to products and regions it has not reached before. Rail transport firms are buying more van containers and piggyback trailers. Ocean carriers are planning to buy container ships or convert regular cargo ships for containerized transport to overseas points. Firms already engaged in ocean container service are planning to extend it to other parts of the world. This increased interest, enthusiasm and activity applies to con tainerized movement of both perishable and nonperishable products. What causes the increased.interest-and investment-in the piggyback-containerization technique? The answer is efficiency-a better transport job- in terms of lower cost, less product losses, and more rapid movement. Cost can be reduced because contain erization serves as an effective means of integrating the services of different transport modes and uses more fully the inherent advantages of each mode. Containerization reduces the number of handlings of individual packages which results in less loss and pilferage. It also permits quicker transfer of cargo from one transport mode to another, thus r educing transit time and increasing utilization of transport investment. It has been estimated, for example, that container ships spend only one-fifth as much time in port loading and unloading cargo as do conventional ships.