2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Airbus Use of Nadcap EASA Workshop – May 10, 2011

Commodity – Siglum - Reference Date Airbus Use of Nadcap EASA Workshop – May 10, 2011 Presented by Pascal Blondet - PDQC Use menu "View - Header & Footer" for Presentation title - Siglum - Reference month 200X Summary 1. What is Nadcap? 2. How Airbus is controlling Nadcap? Page 2 © AIRBUS S.A.S. All rights reserved. Confidential and proprietary document. Use menu "View - Header & Footer" for Presentation title - Siglum - Reference month 200X Summary 1. What is Nadcap? 2. How Airbus is controlling Nadcap? Page 3 © AIRBUS S.A.S. All rights reserved. Confidential and proprietary document. Use menu "View - Header & Footer" for Presentation title - Siglum - Reference month 200X What is Nadcap? The leading, worldwide cooperative program of major companies designed to manage a cost effective consensus approach to special processes and products and provide continual improvement within the aerospace industry by • Promoting and supporting common standards worldwide • Implementing common auditing and accreditation process More than 60 Subscribing Primes (50% Americas, 50% Europe) More than 4 000 Audits conducted per year More than 4200 active supplier/process accreditations About 80 Auditors (FTE) Page 4 © AIRBUS S.A.S. All rights reserved. Confidential and proprietary document. Use menu "View - Header & Footer" for Presentation title - Siglum - Reference month 200X Nadcap Commodities Special Processes • Nondestructive Testing (NDT) • Metallic Material Testing Laboratories (MTL) • Non Metallic Material Testing Laboratories (NMMT) • Heat Treating (HT) • Coatings (CT) • Chemical Processing (CP) • Welding (WLD) • Nonconventional Machining & Surface Enhancement (NMSE) Systems & Products including Special Processes • Sealants (SLT) • Distributors (DIST) • Aerospace Quality Management Systems (AQS) • Fluid Distribution Standards (FLU) • Elastomer Seals (SEALS) • Composites (COMP) Already mandated by Airbus • Electronics (ETG) Airbus engagement in Nadcap TGs but not yet mandated No Airbus engagement to date Page 5 © AIRBUS S.A.S. -

Investor Overview February 2020 Forward Looking Statements

Investor Overview February 2020 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “project”, “may”, “will”, “should”, “could”, or similar words suggesting future outcomes or outlooks. These forward-looking statements include, but are not limited to, statements of expectations of or assumptions about strategic actions, objectives, expectations, intentions, aerospace market conditions, aircraft production rates, financial and operational performance, revenue and earnings growth and profitability and earnings results. These statements are based on the current projections, expectations and beliefs of Triumph’s management. These forward looking statements involve known and unknown risks, uncertainties and other factors which could cause actual results to differ materially from any expected future results, performance or achievements, including, but not limited to, competitive and cyclical factors relating to the aerospace industry, dependence on some of Triumph’s business from key customers, requirements of capital, uncertainties relating to the integration of acquired businesses, general economic conditions affecting Triumph’s business segments, product liabilities in excess of insurance, technological developments, limited availability of raw materials or skilled personnel, changes in governmental regulation and oversight and international hostilities and terrorism. Further information regarding the important factors that could cause actual results, performance or achievements to differ from those expressed in any forward looking statements can be found in Triumph’s reports filed with the SEC, including in the risk factors described in Triumph’s Annual Report on Form 10-K for the fiscal year ended March 31, 2019. -

Supplier Attendance List

2004 Global Supplier Conference Supplier Attendance List Last Name First Name Company City State Country Sopp Robert AAR Garden City NY USA Jones Alan Able Engineering Inc. Goleta CA USA Henderson Mark Accra Manufacturing Inc Bothell WA USA Lyon Daniela Accra Manufacturing Inc Bothell WA USA Mehus Keith Accra Manufacturing Inc Bothell WA USA Farr Keith Advanced Optical Systems Huntsville AL USA Nelson Kimberly Advanced Optical Systems Huntsville AL USA Magpayo Michael Aerojet General Corp. Aerospace Industries Association Of America, Lewandowski William Inc. Arlington VA USA Feutz John AIM Aviation Auburn Inc Auburn WA USA Larson John AIM Aviation Auburn Inc Auburn WA USA Hendricksen John Air Cruisers Company Inc. Wall Township NJ USA Redento Jose Air Cruisers Company Inc. Wall Township NJ USA Belnoski Lawrence Air Products And Chemicals, Inc. Allentown PA USA McNallen John Air Products And Chemicals, Inc. Allentown PA USA Meyer James Airgas Radnor PA USA Whinfrey Thomas Aitech Chatsworth CA USA Clelland Jim Alcoa Engineered Products Lafayette IN USA Vandedrinck Caroline Alcoa Wheel And Forged Products Cleveland OH USA Thomas Paul Alcoa Chicago IL USA Kiskaddon Harry Alcoa Zappa Giorgio Alenia Aeronautica Rome Italy Assereto Roberto Alenia Aeronautica Spa Torino Italy Braccini Sergio Alenia Aeronautica Spa Pomigliano d'Arco (NA) Italy Caruso Guglielmo Alenia Aeronautica Spa Pomigliano d'Arco Italy Giuseppe Giordo Alenia Aeronautica SPA Caiazzo Vincenzo Alenia Inc. Washington, DC USA McGee Charles All Points Logistics Inc Gainesville GA USA Monkress Phillip All Points Logistics Inc Gainesville GA USA Beard Eric AMI Metals, Inc Brentwood TN USA Cole Cecil Applied Industrial Technologies Cleveland OH USA Geddes Norman Applied Systems Intelligence Inc. -

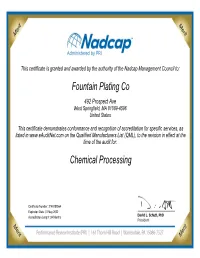

Fountain Plating Co Chemical Processing

This certificate is granted and awarded by the authority of the Nadcap Management Council to: Company Name Here Address line 1 Address line 2 Address line 3 This certificate demonstrates conformance and recognition of accreditation for specific services as listed in www.eAuditNet.com on the Qualified Manufacturers List (QML), to the revision in effect at the time of the audit for: Process Name Here Certification Number: Expiration Date: This certificate is granted and awarded by the authority of the Nadcap Management Council to: Fountain Plating Co 492 Prospect Ave West Springfield, MA 01089-4596 United States This certificate demonstrates conformance and recognition of accreditation for specific services, as listed in www.eAuditNet.com on the Qualified Manufacturers List (QML), to the revision in effect at the time of the audit for: Chemical Processing Certificate Number: 3140189564 Expiration Date: 31 May 2022 Accreditation Length: 24 Months SCOPE OF ACCREDITATION Chemical Processing Fountain Plating Co 492 Prospect Ave West Springfield, MA 01089-4596 This certificate expiration is updated based on periodic audits. The current expiration date and scope of accreditation are listed at: www.eAuditNet.com - Online QML (Qualified Manufacturer Listing). In recognition of the successful completion of the PRI evaluation process, accreditation is granted to this facility to perform the following: AC7108 Rev I - Nadcap Audit Criteria for Chemical Processing (to be used on audits on/after 21 January 2018) AC7108/01– Painting Dry Film Coatings -

What Nadcap Means to the Quality Program

What Nadcap means to the Quality Program Victor Zacarias , Global Thermal Solutions Mexico Our History as a Heat Treat partner Nuestra historia como socio en HT • Global Thermal Solutions is an • Global Thermal Solutions es un independent Pyrometry Laboratory laboratorio de pirometría que that helps aerospace companies to acompaña a las organizaciones meet Nadcap requirements. aeroespaciales con el cumplimiento de los requerimientos de Nadcap • We answer about 5 audits per year • Respondemos alrededor de 5 and hold a zero NCR record of 8 years auditorías Nadcap al año y contamos in a row in audits to AC7102/8 con un record cero NCRs en 8 años checklist consecutivos en auditorías conforme a AC7102/8 2 What is Nadcap? Qué es Nadcap? • The leading, worldwide cooperative • El programa de cooperación líder a program of major companies nivel mundial de las principales designed to manage a cost effective empresas diseñado para gestionar consensus approach to critical procesos y productos críticos con un processes and products and provide enfoque de rentabilidad y mejora continual improvement within the continua dentro de la industria aerospace industry. aeroespacial. 3 Nadcap Structure VES I T TA POLICY & FINANCIAL REPRESEN OVERSEE NADCAP PROGRAM INDUSTRY • TECHNICAL EXPERTS • DETERMINE REQUIREMENTS 4 • FINAL DECISION ON ACCREDITATION The Heat Treating Task Group El Task Group de Tratamiento Térmico • Established in 1992, they are • Establecido in 1992 es el responsable responsible for the Heat Treatment del programa de acreditación en accreditation -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

FOCUS Government, Aerospace Anddefense Group

FOCUS Government, Aerospace and Defense Group Winter 2017 Report Vol.10, No. 1 In this Issue Strategic, Personal, Dedicated 2 Major Q4 2016 Deals in the GAD Sector 3 Performance: S&P 500 vs. GAD Investment Banking and Advisory Services Government Sector Q4 2016 FOCUS Investment Banking LLC provides a range 4 Aerospace Sector Q4 2016 of investment banking services tailored to the needs Defense Sector Q4 2016 5 M&A Activity in the GAD of government, aerospace, and defense companies. Sector These services include: 6 Selected GAD Transactions Q4 2016 Mergers & Acquisition Advisory 8 Recent FOCUS GAD Corporate Development Consulting Transactions 12 FOCUS GAD Team Strategic Partnering & Alliances Capital Financing, Debt & Equity Corporate Valuations Major Q4 2016 Deals in the GAD Sector GOVERNMENT The transaction is anticipated to accelerate growth and strengthens Rockwell Collins’ position as a leading sup- Huntington Ingalls Industries, Inc. Acquisition plier of cockpit and cabin solutions in the airline OEM of Camber Corporation market and airline aftermarket. The transaction is expected On November 2, 2016, Huntington Ingalls Industries, Inc. to generate pre-tax cost synergies of approximately $160 acquired Camber Corporation for $380 million. Camber million and lead to accretive earnings per share for Rock- provides engineering and technical services, cyber opera- well Collins in first full fiscal year with expected combined tions technology, mission critical support services, and five-year free cash flow generation more than $6 billion. training solutions to United States federal agencies includ- ing the Departments of Defense, the Veterans Administra- The transaction results in multiples of 2.9x based on B/E tion, and the Federal Emergency Management Agency. -

Women on Boards the Forum of Executive Women Executive Suites Initiative

Women on Boards The Forum of Executive Women Executive Suites Initiative Improving corporate governance. Increasing shareholder value. The time is NOW. Citizens Bank of Pennsylvania is proud to support The Forum of Executive Women in a variety of ways, including underwriting The Forum's Women on Boards report for 2004. At Citizens Bank, where women comprise 50 percent of our Leadership Team, we believe that diversity, in all of its many manifestations, results in different perspectives, new ideas, and stronger outcomes. In embracing its mission to support colleagues, customers, and community, Citizens Bank applauds The Forum for its leadership in advocating for the advancement of women in our region. About The Forum of Executive Women Founded in 1977, The Forum of Executive Women is a membership organization of 300 women of influence in Greater Philadelphia. Its members hold top positions in every major segment of the community — from finance to manufacturing, from government to healthcare, from not-for-profits to communications, from the professions to technology. As the region's premier women's organization, The Forum fulfills its mission — to advance women leaders in Greater Philadelphia — by supporting women in leadership roles, promoting parity in the corporate world, mentoring young women, and providing a forum for the exchange of views, contacts, and information. The Forum's Executive Suites Initiative advocates and facilitates the increased representation of women on boards and in top management positions of major public companies in our region. Irene H. Hannan, President Sharon Hardy, Executive Director A Four-Year Snapshot of Women On Boards % of women on boards 12% 10% 8% 6% 4% Executive 2% Summary 0% 2000 2001 2002 2003 Ensuring the Research is Current and Comparable Companies in the technology/telecommunications category have the fewest women represented in all levels of Revenues change from year to year. -

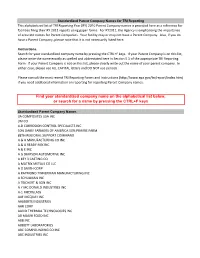

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

Ncsi-13Feb14-Sf

Nadcap Customer Support Initiative (NCSI) for Newcomers NCSI Goals • Educate individuals unfamiliar with the Nadcap process: . Nadcap – How it works . Tools and resources available • Increase awareness of expectations and requirements in order to: . Reduce the average number of nonconformances (NCR’s) . Reduce cycle time (time from audit to accreditation) . Increase number of Suppliers on Merit program 2 Contents Nadcap Defined……………………………………………..…...5 – 6 Nadcap Organizational Structure……………………………… 7 – 9 What is a Nadcap Audit? ....................................................... 11 – 13 Audit Process …………………………………………………… 14 – 31 Nadcap Procedures ……………………………………………. 18 – 19 ITAR/EAR ……………………………………………………….. 20 – 24 Supplier Merit …………………………………………………… 25 – 28 Failure Policy …………………………………..……………….. 29 – 31 Preparation Steps ………………………………………..…….. 33 – 50 During and After the Audit …………………………………….. 52 – 58 NCR Responses/RCCA …………………………..…………… 59 – 84 Supplier Advisory ………………………..……………………... 62 – 63 Additional Information ………………………………………..… 86 – 89 Nadcap Meeting Information ………………………………….. 90 – 93 Websites..…………..………………………………………….… 19, 47, 65 3 NCSI Agenda • Introduction to PRI and Nadcap • The Nadcap Audit Process • Preparation Steps • During the Audit / Post Audit • Web Tools & Additional Information 4 PRI is a not-for-profit affiliate of SAE International PRI administers the Nadcap special processes accreditation program and PRI Registrar on behalf of its Subscribing Members and industry Nadcap created by aerospace Original Equipment -

PHILADELPHIA Decision-Maker Audience

market at a glance PHILADELPHIA Decision-maker audience Print Circulation: 5,000 Smart Business Philadelphia saturates senior management of organizations with Print Readership: 18,500 100 or more employees. These businesses Counties covered: Bucks, Chester, account for 85% of all buying power in the Delaware, Montgomery, Philadelphia local market. 114% Digital Circulation: 4,000 2,255 1,974 310% Total Impressions per Month: 22,500 1,051 339 Market saturation: 100-499 500+ Number of employees Reaching the RIGHT COMPANIES Smart Business U.S. Census circulation Bureau data Saturation increases as company size increases because we 92% understand that there are multiple decision-makers in larger organizations. Targeting senior decision-makers: Reaching the RIGHT PEOPLE Corporate and financial managers make up 92% of our audience. This gives Smart Business Philadelphia the highest penetration Source: December 2011 of qualified decision-makers in the market. The quality of our Smart Business BPA statement controlled-circulation audience is validated by BPA Worldwide, the leading auditing organization for business publications. 1% 3% 4% Corporate Operating Prof. Other Mgmt. Mgmt. Advertiser Services: (800) 777-9383 www.sbnonline.com editorial content Past Philadelphia Cover Story Subjects ALSO AAMCO Transmissions Wal-Mart The Vanguard Group Todd Leff, CEO West Pharmaceutical How Hank Mullany uses John Bogle built the Services three strategies to get Vanguard Group using Don Morel Jr., CEO his 180,000 employees strong leadership Toll Brothers to embrace Wal-Mart’s principles Robert Toll, CEO mission Philadelphia Insurance Companies Jamie Maguire Jr., CEO Airgas Peter McCausland, CEO Comcast Business TD Bank Quaker Chemical Services Ronald Naples, CEO How Michael Carbone GSI Commerce How Bill Stemper keeps builds the next generation Michael Rubin, CEO Comcast Business of leaders at TD Bank ICT Group Services close to the John Brennan, CEO customers it serves Advanta Dennis Alter, CEO Triumph Group Richard III, CEO Viasys SEI YOH Services Randy Thurman, CEO How Alfred P. -

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2011 Parent Company names is provided here as a reference for facilities filing their RY 2012 reports using paper forms. For RY 2012, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3F CHIMICA AMERICAS INC 3G MERMET CORP 3M CO 5N PLUS INC A & A MANUFACTURING CO INC A & A READY MIX INC A & E CUSTOM TRUCK A & E INC A FINKL & SONS CO A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT & SON INC A TO Z DRYING