Investor Overview February 2020 Forward Looking Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS

Ready TRIUMPH GROUP 2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS (in millions, except per share data) TOTAL BACKLOG Fiscal Year Ended March 31 2021 2020 2019 $ in billions $ 1,870 Net sales $ 2,900 $ 3,365 $ Ready to fly Adjusted operating income 108 218 166 ( ) Adjusted net income 2 137 115 Adjusted diluted earnings per share $ (0.03) $ 2.69 $ 2.38 ( ) Cash flow from operations 173 97 (174) Total assets $ 2,451 $ 2,980 $ 2,855 Total debt 1,958 1,808 1,489 Total equity (819) (781) (573) AFTER ONE OF THE TOUGHEST YEARS OUR INDUSTRY HAS EVER NON-GAAP RECONCILIATION FACED, IT IS ENCOURAGING TO HAVE AN ABUNDANCE OF GOOD Operating (loss) income – GAAP $ (326) $ 58 $ (275) Loss on sale of assets & businesses 105 57 235 NEWS. TRIUMPH GROUP HAS EMERGED FROM FIVE YEARS OF Forward losses — — 87 SALES BY END MARKET ARDUOUS RESTRUCTURING AS A MUCH STRONGER AND MORE Restructuring 53 25 31 Legal judgment gain, net — (9) — Regional Jet .% .% Non-Aviation AGILE COMPANY. OUR MARKETS ARE POISED FOR GROWTH, AND Impairments 276 66 — Business Jet Other — 21 87 % Adjusted operating income* 108 218 166 WE ARE POSITIONED FAVORABLY AND SUSTAINABLY WITHIN Interest & other (171) (122) (115) % THEM. OUR PEOPLE ARE SUPPORTED AND FOCUSED. OUR Non-service defined benefit income 50 41 57 % 15 Less: Financing charges 3 1 Military Adjusted income before income taxes* 1 140 110 Commercial PROFITABILITY IS IMPROVING. UP IS WHERE WE ARE GOING. (3) Income taxes (6) 5 DECISIVELY, DECIDEDLY UP. Tax effect of adjustments — 3 — Adjusted net income (2) 137 115 ADJUSTED SEGMENT OPERATING INCOME Diluted earnings per share – GAAP $ (8.55) $ (0.58) $ (6.58) Per share impact of adjustments 8.52 3.27 8.96 ( ) Aerospace Adjusted diluted earnings per share $ 0.03 $ 2.69 $ 2.38 Structures Weighted average diluted shares 53.0 52.0 49.7 % *Differences due to rounding ABOUT TRIUMPH % Triumph Group, Inc. -

Supplier Attendance List

2004 Global Supplier Conference Supplier Attendance List Last Name First Name Company City State Country Sopp Robert AAR Garden City NY USA Jones Alan Able Engineering Inc. Goleta CA USA Henderson Mark Accra Manufacturing Inc Bothell WA USA Lyon Daniela Accra Manufacturing Inc Bothell WA USA Mehus Keith Accra Manufacturing Inc Bothell WA USA Farr Keith Advanced Optical Systems Huntsville AL USA Nelson Kimberly Advanced Optical Systems Huntsville AL USA Magpayo Michael Aerojet General Corp. Aerospace Industries Association Of America, Lewandowski William Inc. Arlington VA USA Feutz John AIM Aviation Auburn Inc Auburn WA USA Larson John AIM Aviation Auburn Inc Auburn WA USA Hendricksen John Air Cruisers Company Inc. Wall Township NJ USA Redento Jose Air Cruisers Company Inc. Wall Township NJ USA Belnoski Lawrence Air Products And Chemicals, Inc. Allentown PA USA McNallen John Air Products And Chemicals, Inc. Allentown PA USA Meyer James Airgas Radnor PA USA Whinfrey Thomas Aitech Chatsworth CA USA Clelland Jim Alcoa Engineered Products Lafayette IN USA Vandedrinck Caroline Alcoa Wheel And Forged Products Cleveland OH USA Thomas Paul Alcoa Chicago IL USA Kiskaddon Harry Alcoa Zappa Giorgio Alenia Aeronautica Rome Italy Assereto Roberto Alenia Aeronautica Spa Torino Italy Braccini Sergio Alenia Aeronautica Spa Pomigliano d'Arco (NA) Italy Caruso Guglielmo Alenia Aeronautica Spa Pomigliano d'Arco Italy Giuseppe Giordo Alenia Aeronautica SPA Caiazzo Vincenzo Alenia Inc. Washington, DC USA McGee Charles All Points Logistics Inc Gainesville GA USA Monkress Phillip All Points Logistics Inc Gainesville GA USA Beard Eric AMI Metals, Inc Brentwood TN USA Cole Cecil Applied Industrial Technologies Cleveland OH USA Geddes Norman Applied Systems Intelligence Inc. -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

FOCUS Government, Aerospace Anddefense Group

FOCUS Government, Aerospace and Defense Group Winter 2017 Report Vol.10, No. 1 In this Issue Strategic, Personal, Dedicated 2 Major Q4 2016 Deals in the GAD Sector 3 Performance: S&P 500 vs. GAD Investment Banking and Advisory Services Government Sector Q4 2016 FOCUS Investment Banking LLC provides a range 4 Aerospace Sector Q4 2016 of investment banking services tailored to the needs Defense Sector Q4 2016 5 M&A Activity in the GAD of government, aerospace, and defense companies. Sector These services include: 6 Selected GAD Transactions Q4 2016 Mergers & Acquisition Advisory 8 Recent FOCUS GAD Corporate Development Consulting Transactions 12 FOCUS GAD Team Strategic Partnering & Alliances Capital Financing, Debt & Equity Corporate Valuations Major Q4 2016 Deals in the GAD Sector GOVERNMENT The transaction is anticipated to accelerate growth and strengthens Rockwell Collins’ position as a leading sup- Huntington Ingalls Industries, Inc. Acquisition plier of cockpit and cabin solutions in the airline OEM of Camber Corporation market and airline aftermarket. The transaction is expected On November 2, 2016, Huntington Ingalls Industries, Inc. to generate pre-tax cost synergies of approximately $160 acquired Camber Corporation for $380 million. Camber million and lead to accretive earnings per share for Rock- provides engineering and technical services, cyber opera- well Collins in first full fiscal year with expected combined tions technology, mission critical support services, and five-year free cash flow generation more than $6 billion. training solutions to United States federal agencies includ- ing the Departments of Defense, the Veterans Administra- The transaction results in multiples of 2.9x based on B/E tion, and the Federal Emergency Management Agency. -

Women on Boards the Forum of Executive Women Executive Suites Initiative

Women on Boards The Forum of Executive Women Executive Suites Initiative Improving corporate governance. Increasing shareholder value. The time is NOW. Citizens Bank of Pennsylvania is proud to support The Forum of Executive Women in a variety of ways, including underwriting The Forum's Women on Boards report for 2004. At Citizens Bank, where women comprise 50 percent of our Leadership Team, we believe that diversity, in all of its many manifestations, results in different perspectives, new ideas, and stronger outcomes. In embracing its mission to support colleagues, customers, and community, Citizens Bank applauds The Forum for its leadership in advocating for the advancement of women in our region. About The Forum of Executive Women Founded in 1977, The Forum of Executive Women is a membership organization of 300 women of influence in Greater Philadelphia. Its members hold top positions in every major segment of the community — from finance to manufacturing, from government to healthcare, from not-for-profits to communications, from the professions to technology. As the region's premier women's organization, The Forum fulfills its mission — to advance women leaders in Greater Philadelphia — by supporting women in leadership roles, promoting parity in the corporate world, mentoring young women, and providing a forum for the exchange of views, contacts, and information. The Forum's Executive Suites Initiative advocates and facilitates the increased representation of women on boards and in top management positions of major public companies in our region. Irene H. Hannan, President Sharon Hardy, Executive Director A Four-Year Snapshot of Women On Boards % of women on boards 12% 10% 8% 6% 4% Executive 2% Summary 0% 2000 2001 2002 2003 Ensuring the Research is Current and Comparable Companies in the technology/telecommunications category have the fewest women represented in all levels of Revenues change from year to year. -

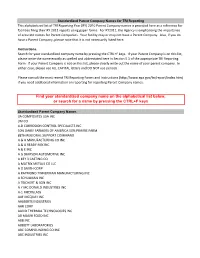

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

PHILADELPHIA Decision-Maker Audience

market at a glance PHILADELPHIA Decision-maker audience Print Circulation: 5,000 Smart Business Philadelphia saturates senior management of organizations with Print Readership: 18,500 100 or more employees. These businesses Counties covered: Bucks, Chester, account for 85% of all buying power in the Delaware, Montgomery, Philadelphia local market. 114% Digital Circulation: 4,000 2,255 1,974 310% Total Impressions per Month: 22,500 1,051 339 Market saturation: 100-499 500+ Number of employees Reaching the RIGHT COMPANIES Smart Business U.S. Census circulation Bureau data Saturation increases as company size increases because we 92% understand that there are multiple decision-makers in larger organizations. Targeting senior decision-makers: Reaching the RIGHT PEOPLE Corporate and financial managers make up 92% of our audience. This gives Smart Business Philadelphia the highest penetration Source: December 2011 of qualified decision-makers in the market. The quality of our Smart Business BPA statement controlled-circulation audience is validated by BPA Worldwide, the leading auditing organization for business publications. 1% 3% 4% Corporate Operating Prof. Other Mgmt. Mgmt. Advertiser Services: (800) 777-9383 www.sbnonline.com editorial content Past Philadelphia Cover Story Subjects ALSO AAMCO Transmissions Wal-Mart The Vanguard Group Todd Leff, CEO West Pharmaceutical How Hank Mullany uses John Bogle built the Services three strategies to get Vanguard Group using Don Morel Jr., CEO his 180,000 employees strong leadership Toll Brothers to embrace Wal-Mart’s principles Robert Toll, CEO mission Philadelphia Insurance Companies Jamie Maguire Jr., CEO Airgas Peter McCausland, CEO Comcast Business TD Bank Quaker Chemical Services Ronald Naples, CEO How Michael Carbone GSI Commerce How Bill Stemper keeps builds the next generation Michael Rubin, CEO Comcast Business of leaders at TD Bank ICT Group Services close to the John Brennan, CEO customers it serves Advanta Dennis Alter, CEO Triumph Group Richard III, CEO Viasys SEI YOH Services Randy Thurman, CEO How Alfred P. -

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2011 Parent Company names is provided here as a reference for facilities filing their RY 2012 reports using paper forms. For RY 2012, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3F CHIMICA AMERICAS INC 3G MERMET CORP 3M CO 5N PLUS INC A & A MANUFACTURING CO INC A & A READY MIX INC A & E CUSTOM TRUCK A & E INC A FINKL & SONS CO A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT & SON INC A TO Z DRYING -

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. OMB APPROVAL 3235- UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB Number: Washington, D.C. 20549 0006 FORM 13F Oct 31, Expires: 2018 FORM 13F COVER PAGE Estimated average burden hours per 23.8 response: Report for the Calendar Year or Quarter Ended: 12-31-2014 Check here if Amendment Amendment Number: This Amendment (Check only one.): is a restatement. adds new holdings entries. Institutional Investment Manager Filing this Report: Name: COWEN GROUP, INC. Address: 599 LEXINGTON AVENUE, 20TH FLOOR NEW YORK, NY 10022 Form 13F File 028-14571 Number: The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Owen Littman Title: General Counsel Phone: 212-201-4841 Signature, Place, and Date of Signing: /s/ Owen Littman New York, NY 02-17-2015 [Signature] [City, State] [Date] Report Type (Check only one.): X 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager(s).) 13F COMBINATION REPORT. -

MANUFACTURING | Career Pathways and Demand in Greater Kansas

MANUFACTURING | Career Pathways and Demand in Greater Kansas City 7.26.16 Tools & Technology Current Median Hour Certifications/ Education Job Description Openings Wage degrees offered 70 Certified Production PRODUCTION OCCUPATIONS (PACKAGING, INSPECTORS, TESTERS) GMP, QMS, ISO 9001, $13.87(KC) Job Technician, OSHA Operate or tend machines to prepare industrial or consumer products for storage or SAP Software, Excel $15.09(National) shipment. Inspect, test, sort, sample, or weigh materials or assembled products. openings Safety, OSHA Forklift High School CAD, SAP Software, 637 Industrial Maintenance Diploma & MAINTENANCE AND REPAIR WORKERS $19.23(KC) Perform work to keep machines, mechanical equipment, or the structure of an establishment Oracle, PTC Creo Job Certificate, Machine Work $20.02(National) in repair. Duties may involve pipe fitting; boiler making; insulating; welding; machining. Parametric openings Tool Tech Experience 40 CNC Mastercam, ERP $20.75(KC) Machine Technology MACHINISTS Job Set up and operate a variety of machine tools to produce precision parts and instruments. Software, Excel $21.17(National) Certificate openings EZ Pipe Software, 37 Welding (MIG) Recordkeeping software, $16.85(KC) METAL WORKERS, WELDERS, CUTTERS Certificate, Welding OmniFleet equipment Job Use hand-welding, flame-cutting, soldering equipment to weld or join metal components. $17.91(National) (TIG/MIG) Certificate maintenance openings Certification Advanced Computer or CRM, LMS, PLC, 39 INDUSTRIAL MACHINERY MECHANICS $22.57(KC) Integrated Machining -

Macro Opportunities Fund CONSOLIDATED SCHEDULE of INVESTMENTS (Unaudited) December 31, 2015

Macro Opportunities Fund CONSOLIDATED SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2015 Shares Value COMMON STOCKS† - 3.5% Consumer, Non-cyclical - 1.1% Gilead Sciences, Inc.1 15,674 $ 1,586,052 Tyson Foods, Inc. — Class A1 28,380 1,513,505 Archer-Daniels-Midland Co.1 40,430 1,482,972 UnitedHealth Group, Inc.1 11,452 1,347,214 Biogen, Inc.* 4,023 1,232,446 Cal-Maine Foods, Inc. 26,081 1,208,595 Molina Healthcare, Inc.*,1 18,779 1,129,181 Ingredion, Inc.1 11,523 1,104,364 MEDNAX, Inc.* 15,215 1,090,307 Universal Health Services, Inc. — Class B 9,099 1,087,239 Quest Diagnostics, Inc.1 15,167 1,078,981 Kroger Co. 25,787 1,078,670 Whole Foods Market, Inc.1 31,881 1,068,014 WellCare Health Plans, Inc.*,1 13,004 1,017,043 Western Union Co. 56,433 1,010,715 Darling Ingredients, Inc.*,1 92,095 968,839 HCA Holdings, Inc.*,1 14,144 956,559 Express Scripts Holding Co.*,1 10,902 952,944 St. Jude Medical, Inc.1 15,043 929,206 United Therapeutics Corp.*,1 5,712 894,556 Procter & Gamble Co.1 10,832 860,169 Cardinal Health, Inc. 9,361 835,656 General Mills, Inc.1 14,230 820,502 Laboratory Corporation of America Holdings*,1 6,360 786,350 AbbVie, Inc.1 13,213 782,738 McKesson Corp.1 3,965 782,017 Johnson & Johnson1 6,742 692,538 Dean Foods Co. 39,495 677,339 ConAgra Foods, Inc. -

Ugi Utilities Inc

UGI UTILITIES INC FORM 10-K405 (Annual Report (Regulation S-K, item 405)) Filed 12/26/1996 For Period Ending 9/30/1996 100 KACHEL BOULEVARD SUITE 400 GREEN HILLS CORPORATE Address CENTER VALLEY FORGE, Pennsylvania 19607 Telephone 610-796-3400 CIK 0000100548 Fiscal 09/30 Year SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 1996 Commission file number 1-1398 UGI UTILITIES, INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) Pennsylvania 23-1174060 (STATE OR OTHER JURISDICTION (I.R.S. EMPLOYER IDENTIFICATION NO.) OF INCORPORATION OR ORGANIZATION) 100 Kachel Boulevard, Suite 400, Green Hills Corporate Center Reading, PA 19607 (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE) (610) 796-3400 (REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE) SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None INDICATE BY CHECK MARK WHETHER THE REGISTRANT (1) HAS FILED ALL REPORTS REQUIRED TO BE FILED BY SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 DURING THE PRECEDING 12 MONTHS (OR FOR SUCH SHORTER PERIOD THAT THE REGISTRANT WAS REQUIRED TO FILE SUCH REPORTS) AND (2) HAS BEEN SUBJECT TO SUCH FILING REQUIREMENTS FOR THE PAST 90 DAYS. YES X . NO . Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.