Automotive-191003-4Q19 Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Automotive-200103-1Q20 Strategy (Kenanga)

Sector Update 03 January 2020 Automotive NEUTRAL National Marques Overtaking on the Fast Lane ↔ By Wan Mustaqim Bin Wan Ab Aziz l [email protected] We maintain our NEUTRAL rating on the AUTOMOTIVE sector. The MIER consumer sentiment index scored 84.0 points (-9.0ppt QoQ, -23.5ppt YoY) in 3QCY19 which is below the optimistic threshold (>100pts) due to normalisation of consumer confidence post-tax holiday and weak macroeconomic outlook. Reflecting this, we are seeing car sales trending in favour of value-for-money national marques, as evident from their 11MCY19 TIV market share of 57%. Non-national marques on the other hand, are focusing on higher-margin lower-volume models (catering to higher purchasing power consumers). Notable developments in Automotive industry in 2019/2020 include: (i) national marques surpassing non-national marques in terms of market share, (ii) Proton has surpassed Honda as no.2 trailing behind Perodua, (iii) increasing number of new model launches, (iv) better incentives under National Automotive Policy 2020 (tentatively on 1QCY20), and (v) another OPR rate cut by 25bps (to 2.75%) in 2020, which should have minimal positive impact on vehicles loans. No changes to our 2019 TIV target of 600,000 units (+0.2%), and we introduce 2020 TIV target of 612,000 units (+2%) matching MAA’s target factoring the extra boost from national marques (Proton and Perodua). Our sector top-pick is BAUTO (OP; TP: RM2.65) for its defensible niche SUV market and attractive, steady dividend yield of 7.3%. National marques affirming leading market position . As of 11MCY19, the national marques (57%) continued to stay above non-national marques (43%) in terms of market share, marking a year not seen since 2013, owing to the outstanding sales from Perodua, especially after the introduction of its all-new Perodua Myvi and supported by the all-new Perodua Aruz (27,389 units delivered). -

Global Trends and Malaysia's Automotive Sector

2021-3 Global Trends and Malaysia’s Automotive Sector: Ambitions vs. Reality Tham Siew Yean ISEAS - Yusof Ishak Institute Email: [email protected] March 2021 Abstract The paper seeks to examine the development of the Malaysian automotive sector in the midst of rapid global changes in technology, consumer preferences and sustainability concerns. The sector represents a case of infant industry protection which includes, among its objectives, the state’s aspiration to nurture Bumiputera entrepreneurs as national champions for the sector. Despite close to three decades of protection, the two national car projects continue to depend on foreign partners for technology support. The National Automotive Policies (NAPs) strive to push the sector towards the technology frontier with foreign and domestic investments while seeking to be a regional hub and grooming national Bumiputera champions. The inherent conflicts in these objectives create disincentives for investments while the domestic market is held captive to the national car producers. Although policies continue to espouse grand visions, the reality is that Malaysia’s car makers continue to be inward-looking and exporting remains insignificant. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- JEL Classification: O14, O25 Keywords: Automotive Sector, Industrial Policy Global Trends and Malaysia’s Automotive Sector: Ambitions vs. Reality Tham Siew Yean 1. Introduction The use of state intervention for development has been espoused in theory and practice in many countries. The World Bank (1993) study on the East Asian miracle economies is often attributed to illustrate the success of state intervention in industrial policy. However, the study itself cautions that the use of industrial policy needs to be supported with good fundamental policies, evaluation and monitoring of the support given. -

News Release

Perusahaan Otomobil Nasional Sdn Bhd (100995-U) Persiaran Kuala Selangor, Seksyen 26, 40400 Shah Alam Selangor Darul Ehsan, Malaysia. T (+603) 5102 6000 F (+603) 5191 9120 News Release PROTON X70 AWARDED EXCEPTIONAL SCORES BY ASEAN NCAP - SUV awarded 5-star rating for occupant protection - Official public debut at KL International Motor Show Subang Jaya, 16 November 2018 – The Proton X70, the first SUV from PROTON, has successfully achieved a 5-star rating after being tested by the New Car Assessment Program for Southeast Asian Countries (ASEAN NCAP). Details for the latest round of ASEAN NCAP tests have been released, showing the newest Proton model sits near the top of its segment for occupant safety. Designed and manufactured to optimise occupant safety With a proven track record for manufacturing cars that obtain a 5-star ASEAN NCAP rating to defend – the Proton Iriz, Proton Persona, Proton Preve and Proton Suprima S are all 5-star rated, PROTON’s engineers and designers paid close attention to every detail to ensure the Proton X70 would obtain a high score based on the latest 2017-2020 testing protocol. Under the new protocol, safety assist technology is now taken into consideration and counts for 25% of the overall score. PROTON introduced Hot Press Forming (HPF) body structures, used to form the passenger cell of its cars, in 2012 and the same technology is one of the reasons why the Proton X70 is able to provide a high level of protection to its occupants. The HPF cell is supplemented with six airbags for all variants, ISOFIX child seat mounting points as well as seat belts with pretensioners and load limiters. -

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13

Journal of Advanced Vehicle System 3, Issue 1 (2016) 1-13 Penerbit Journal of Advanced Vehicle System Akademia Baru Journal homepage: www.akademiabaru.com/aravs.html ISSN: 2550-2212 Open Towards safer cars in Malaysia Access Z. Mohd Jawi 1, ∗, K.A. Abu Kassim 2, M.H. Md Isa 1,2, A. Hamzah 1, Y. Ghani 1 1 Vehicle Safety & Biomechanics Research Centre, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia 2 ASEAN NCAP Operational Unit, Malaysian Institute of Road Safety Research, 43000 Kajang Selangor, Malaysia ARTICLE INFO ABSTRACT Article history: This article discusses the framework of safer cars in Malaysia based on the Vehicle Type Received 10 October 2016 Approval (VTA) and New Car Assessment Program (NCAP). The new era of automobile Received in revised form 16 November 2016 safety is presumably come at the right time for Malaysia after the two important Accepted 25 November 2016 milestones i.e. local assembly initiative in 1960’s and the national car project in 1980’s. Available online 5 December 2016 The maturity of VTA exercise in Malaysia and the inception of ASEAN NCAP are contributing to direct and indirect pressure to car manufacturers to progressively produce safer cars. Since car pricing is driven by market competitiveness and not affected by safety upgrades, the consumers eventually would enjoy more values for their money through safer cars. In terms of car safety, the automotive ecosystem in Malaysia could as well explain the impact of NCAP in other ASEAN countries’ automotive layout. It is expected that there will be growing demand for safer vehicles and also positive response from OEMs in Malaysia and the region. -

Investigation of Ergonomics Design of Car Boot for Proton Saga (BLM) and Perodua (Myvi)

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395 -0056 Volume: 03 Issue: 08 | Aug-2016 www.irjet.net p-ISSN: 2395-0072 Investigation of Ergonomics Design of Car Boot for Proton Saga (BLM) and Perodua (Myvi) KA Shamsuddin1, SF Hannan2, TAA Razak3, KS Shafee4 1 Lecturer, Mechanical Section, Universiti Kuala Lumpur (UniKL), Malaysian Spanish Institute (MSI), Malaysia 2 Lecturer, Mechanical Section, Universiti Kuala Lumpur (UniKL), Malaysian Spanish Institute (MSI), Malaysia 3 Lecturer, Mechanical Section, Universiti Kuala Lumpur (UniKL), Malaysian Spanish Institute (MSI), Malaysia 4 Lecturer, Mechanical Section, Universiti Kuala Lumpur (UniKL), Malaysian Spanish Institute (MSI), Malaysia ---------------------------------------------------------------------***--------------------------------------------------------------------- Abstract – Ergonomics is as study of human posture. It Ergonomics is new principles, methods and data drawn concentrated on how to achieve mental and physical from a multi sources to develop engineering system in which human play a significant role. In performing an comfort. This is a new principles, methods and data drawn ergonomics studies, human variability is used as a design from a multi sources to develop engineering system in which parameter. The term success in ergonomics is measured human play a significant role. In performing ergonomics by improved productivity, efficiency, safety, acceptance of study, human variability is used as a design parameter. The the resultant system design and improved quality of term success in ergonomics is measured by improved human life (Kroemer & Kroemer-Albert 2001). The productivity, efficiency, safety, acceptance of the resultant importance of the relationship between humans and tools as it was realized in early development of the product system design and improved quality of human life. -

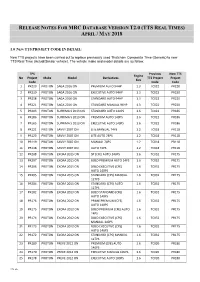

Release Notes for Mrc Database Version T2.0 (Tts Real Times) April / May 2018

RELEASE NOTES FOR MRC DATABASE VERSION T2.0 (TTS REAL TIMES) APRIL / MAY 2018 1.0 NEW TTS PROJECT CODE IN DETAIL: New TTS projects have been carried out to replace previously used Thatcham Composite Time (Generic) to new TTS Real Time (Actual/Similar vehicle). The vehicle make and model details are as follow: TPS Previous New TTS Engine No Project Make Model Derivatives TTS Project Project Size Code Code Code 1 PR220 PROTON SAGA 2016 ON PREMIUM AUTO 94HP 1.3 TC022 PR220 2 PR219 PROTON SAGA 2016 ON EXECUTIVE AUTO 94HP 1.3 TC022 PR220 3 PR218 PROTON SAGA 2016 ON STANDARD AUTO 94HP 1.3 TC022 PR220 4 PR221 PROTON SAGA 2016 ON STANDARD MANUAL 94HP 1.3 TC022 PR220 5 PR203 PROTON SUPRIMA S 2013 ON STANDARD AUTO 140PS 1.6 TC022 PR186 6 PR186 PROTON SUPRIMA S 2013 ON PREMIUM AUTO 140PS 1.6 TC022 PR186 7 PR165 PROTON SUPRIMA S 2013 ON EXECUTIVE AUTO 140PS 1.6 TC022 PR186 8 PR121 PROTON SAVVY 2007 ON LITE MANUAL 74PS 1.2 TC018 PR118 9 PR120 PROTON SAVVY 2007 ON LITE AUTO 74PS 1.2 TC018 PR118 10 PR119 PROTON SAVVY 2007 ON MANUAL 74PS 1.2 TC018 PR118 11 PR118 PROTON SAVVY 2007 ON AUTO 74PS 1.2 TC018 PR118 12 PR208 PROTON EXORA 2015 ON SP (CFE) AUTO 140PS 1.6 TC032 PR175 13 PR207 PROTON EXORA 2015 ON BOLD PREMIUM AUTO 14PS 1.6 TC032 PR175 14 PR206 PROTON EXORA 2015 ON BOLD EXECUTIVE (CFE) 1.6 TC032 PR175 AUTO 140PS 15 PR205 PROTON EXORA 2015 ON STANDARD (CPS) MANUAL 1.6 TC032 PR175 127PS 16 PR204 PROTON EXORA 2015 ON STANDARD (CPS) AUTO 1.6 TC032 PR175 127PS 17 PR182 PROTON EXORA 2013 ON BOLD STANDARD (CFE) 1.6 TC032 PR175 AUTO 140PS 18 PR176 PROTON -

News Release

Perusahaan Otomobil Nasional Sdn Bhd (100995-U) Persiaran Kuala Selangor, Seksyen 26, 40400 Shah Alam Selangor Darul Ehsan, Malaysia. T (+603) 5102 6000 F (+603) 5191 9120 News Release PROTON TO PURSUE EXPORT MARKETS IN 2021 - Saga and SUVs to spearhead growth in export sales - Target is to double export volume in the next 12 months Subang Jaya, 29 January 2021 – Following a year that saw it successfully overcoming challenges posed by the pandemic and launching a second SUV, Malaysian car manufacturer PROTON has set its sights on growing export sales in 2021. A flurry of activity in December that included the beginning of CKD operations in Kenya and the launch of the Proton X70 in Pakistan saw export sales end the year with an increase of nearly 50% compared to domestic sales that grew by 8.8%. For the coming year, the company has set itself another challenging target of doubling export sales over 2020, assuming that export activities are not overly hampered by restrictions due to the global pandemic. Spearheading the expansion will be PROTON’s most popular model, the evergreen Proton Saga, followed by the Proton X70 and Proton X50 as they are gradually introduced to more overseas markets. Exports to power PROTON’s future The export market is a vital part of PROTON’s long-term goal to be the third best-selling automotive brand in ASEAN by 2027. While sales leadership in the domestic market will always be a main priority, the company recognises that in order to grow for the future, it needs to expand its customer base and search for sales in other countries. -

PROCLAMATION of SALE MOTOR VEHICLES for Sale by Public Auction on Monday 4Th November 2019 @ 2.30 P.M Venue : Unit Nos

PROCLAMATION OF SALE MOTOR VEHICLES For Sale By Public Auction On Monday 4th November 2019 @ 2.30 p.m Venue : Unit Nos. B-0-6 & B-0-7, Ground Floor, Block B Megan Avenue II, No 12, Jln Yap Kwan Seng, Kuala Lumpur www.ngchanmau.com/auto "Prospect bidders may submit bids for the Auto e-Bidding via www.ngchanmau.com/auto. *Please register at least one (1) working day before auction day for registration & verification purposes". To get a digital copy of auction listings by Car Make / Model, please SMS or Whatsapp to 012-5310600. LEGAL OWNER : PUBLIC BANK BERHAD (6463-H) / PUBLIC ISLAMIC BANK BERHAD (14328-V) REGISTRATION YEAR OF KEY RESERVE PRICE LOT NO MAKE & MODEL REMARKS NO MAKE (YES / NO) (RM) STORE YARD : INTER PACIFIC AUTO AUCTION SDN. BHD. PANDAN SAFARI SHOPPING COMPLEX, CAR PARK (LEVEL 3) , NO. 1, JALAN PERDANA 6/10A, PANDAN PERDANA, 55300 KUALA LUMPUR (TELEPHONE NO : 03-9274 7612 / 9274 7613) VIEWING DATES: 31st October 2019, 1st & 2nd November 2019 (10.00AM - 3.00PM) & 4th November 2019 (10.00AM - 12.00PM) P101 PMN7720 NISSAN ALMERA 1.5 2016 YES 20,000 P102 WB8814L TOYOTA CAMRY 2.5 HYBRID 2015 NO 72,000 Unable to determine engine P103 BMU1800 MAZDA 6 2.0 2014/15 NO 53,000 number. Unable to determine engine P104 WA3299T FORD FIESTA SPORT 1.0 2014 NO 25,000 number. P105 PLF8070 HONDA ACCORD 2.4 2011/12 NO 26,000 P106 VBB8871 NISSAN TEANA 200 2017 NO 55,000 P107 CBU6650 NAZA CITRA 2.0 2006 NO 2,500 P108 WYG7208 PEUGEOT 208 1.6 2013 YES Engine number differ. -

Welfare Effects of Trade Barriers on Malaysian Car Industry: an Alternative Approach

WELFARE EFFECTS OF TRADE BARRIERS ON MALAYSIAN CAR INDUSTRY: AN ALTERNATIVE APPROACH Wai Kun C Lau (1718460) A Dissertation Submitted In Fulfilment Of The Requirements For The Degree of DOCTOR OF PHILOSOPHY FACULTY OF BUSINESS & LAW SWINBURNE UNIVERSITY OF TECHNOLOGY April 2020 i Abstract Malaysian car industry has been heavily protected by tariff and non-tariff tools since it was founded in 1983. Despite excessive tariffs imposed on foreign cars, the demand for foreign cars increases after the Asian financial crisis 1997 while the demand for domestic cars declines. Partial equilibrium framework is applied in this research because the car industry’s contribution to GDP is very small and the focus of this research is specifically on the car industry. Since cars are durable and differentiated, changes due to technological advancement may influence car demand. This research applies Discrete Choice model to account for car characteristics in addition to socio-economic factors for analysis of car demand in Malaysia. Logistic regression analysis results show factors that influence car demand are: horsepower, fuel consumption, and car size that is measured by number of passengers. Results suggest that non-tariff barriers and government incentives given to the civil servants have significant influence on Proton cars’ demand, and foreign car makers that have been operating in Malaysia before the founding of Proton enjoy their reputation from their historical experience and performance. While it is often believed that European cars have ostentatious value in Malaysia, the results show otherwise. Price elasticity of demand for major car makes is estimated based on the average horsepower, car size and fuel consumption. -

Development of Life Cycle Cost Model of Passenger Car By

Development of Life Cycle Cost Model of Passenger Car by Muhamad Azlan Bin Yusoff (ID: 12042) Dissertation submitted in partial fulfilment of the requirements for the Bachelor of Engineering (Hons) (Mechanical Engineering) SEPTEMBER 2012 Universiti Teknologi PETRONAS Bandar Seri Iskandar 31750 Tronoh Perak Darul Ridzuan CERTIFICATION OF APPROVAL Development of Life Cycle Cost Model of Passenger Car by Muhamad Azlan Bin Yusoff (ID: 12042) A project dissertation submitted to the Mechanical Engineering Programme Universiti Teknologi PETRONAS In partial fulfilment of the requirement for the BACHELOR OF ENGINEERING (Hons) (MECHANICAL ENGINEERING) Approved by, ___________________________ DR. MASDI BIN MUHAMMAD Universiti Teknologi PETRONAS Tronoh, Perak September 2012 i CERTIFICATION OF ORIGINALITY This is certify that I am responsible for the work submitted in this project, that the original work is my own except as specified in the references and acknowledgements, and that the original work contained herein have not been undertaken or done by unspecified sources or persons. ________________________________________ MUHAMAD AZLAN BIN YUSOFF (ID: 12042) ii ABSTRACT Life cycle costing is the process of economic analysis to assess total cost of ownership and preparation of LCC model to provide inputs in the decision making process. The decision to purchase is not only influenced by the product’s initial cost but also by the product’s expected operation and maintenance cost over its service life and disposal cost. LCC model is a simplified representation of the real world as its extract each cost elements in each cost categories and in all phases through the cost breakdown structure then translates them into cost estimating relationships. -

News Release

Perusahaan Otomobil Nasional Sdn Bhd (100995-U) Persiaran Kuala Selangor, Seksyen 26, 40400 Shah Alam Selangor Darul Ehsan, Malaysia. T (+603) 5102 6000 F (+603) 5191 9120 News Release PROTON WINS AT CARS OF MALAYSIA AWARDS - Proton Saga, Iriz and Ertiga recognised as best in class cars Subang Jaya, 13 June 2018 – PROTON achieved a sparkling performance at the first ever Cars of Malaysia Awards when three of its models, the Proton Saga, Iriz and Ertiga were acknowledged for being among the three best cars in their respective categories. Proton Saga – The evergreen Malaysian favourite The first winner for the Company was the Proton Saga, the evergreen model that remains a popular choice amongst first time car buyers. Its combination of spaciousness, stable handling and simply affordable pricing won praises from the judges and contributed to the Saga being one of the three best cars in the City Cars of Malaysia category. Proton Iriz – Small in size, big on features The fun in size and big on safety Proton Iriz was also awarded recognition in the Compact Hatchback category. A multiple award winner since it was launched in 2014, the Iriz scored highly for its safety features (HPF body structure, 6 airbags, ESC, 5 Star ASEAN NCAP), technology (ECO drive assist, voice recognition head unit) and best in class drivability (refined handling and 1.6L VVT engine). By combining those strengths with affordable ownership costs the Iriz was rewarded despite stiff competition from local and foreign rivals. Proton Ertiga – The economical MPV with lots of extras PROTON’s final winner was the Proton Ertiga, which competed in the Compact MPV category. -

LH & RH) Chrome Inner Door Handle (4Pcs/Set

85 (ADVANCE) Air-Cond Panel Switch PROTON EXORA Fog Lamp Panel Switch PROTON EXORA Door Mirror (LH & RH) Led Door Mirror (LH & RH) TOYOTA FORTUNER / HILUX PROTON PERSONA ELEGANCE * 7 wire Upgrade PERSONA “OLD” & GEN.2 Safety Belt (Rear) Security Alarm System Auto Adjustable with Motor System TOYOTA * LH. RH, Center Fog Lamp (LH & RH) Car Audio PROTON PREVE PROTON PREVE with GPS Chrome Inner Door Handle (4pcs/set) Chrome Fog Lamp Rim (LH & RH) PROTON PERSONA / EXORA PROTON EXORA © Copyright 2006 YAC AUTO (M) Sdn. Bhd. All Rights Reserved. 86 Fog Lamp (LH & RH) Fog Lamp (LH & RH) M.TRITON '09 / PROTON INSPIRA PROTON EXORA “campaign ” Chrome Front Garnish PROTON EXORA FL 'BOLD' Reverse Sensor (Colour) PROTON EXORA “campaign ” Air Scoop (w/out Paint) TOYOTA HILUX Aluminium Loading Sill PROTON EXORA/PERODUA MYVI/PERODUA ALZA YC1990 Lower Tie Frame Bar (Beaks Bar) PROTON - WIRA/WAJA/GEN.2/PERSONA PROTON - SATRIA/SATRIA NEO Blue | Gold | Red | Silver Polishing 15” Wheel Cover Door Handle Cover (4pcs/set) Silver | Titanium PEROUDA MYVI '2011 IS200 YC2947 © Copyright 2006 YAC AUTO (M) Sdn. Bhd. All Rights Reserved. 87 Head Lamp Lid Cover (2pcs/set) Head Lamp Lid Cover (2pcs/set) PERODUA MYVI '2011 PROTON EXORA Chrome | Black | Silver | White | Grey | Yellow | Chrome | Black | Silver | White | Elegance Brown | Purple | Orange | Carbon Fiber Carbon Fiber YC2987 YC3787 Tail Lamp Cover (2pcs/set) Ultra Car Seat Mat PERODUA MYVI '2011 Chrome | Black | Silver | White | Grey | Yellow | Purple | Orange | Carbon Fiber YC2997 Aluminium Loading Si (LH & RH) PROTON EXORA YC1990 Emergency Led Lid with Magnet * 36cm x 31.5cm © Copyright 2006 YAC AUTO (M) Sdn.