The PNC Financial Services Group, Inc. (Exact Name of Registrant As Specified in Its Charter) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fully Disclosed Broker PDF Guide

Fully Disclosed Brokers Getting Started Guide February 2018 © 2018 Interactive Brokers LLC. All Rights Reserved Any symbols displayed within these pages are for illustrative purposes only, and are not intended to portray any recommendation. 2 Contents Contents i Fully Disclosed Brokers Getting Started Guide 1 Getting Started as an IB Fully Disclosed Broker 1 Must Consider: 1 May Want to Consider: 2 Two Accounts for Brokers 2 Account Management Functions 3 Fund Transfers 3 Log In to Account Management 5 Failed Login Attempts 6 Automatic Logoff 6 Secure Login System 6 Client Accounts 9 Add Client Accounts 9 Initiate an Email Invitation to the Client 10 Broker Client Templates 10 Specify Client Fees 15 Configure Trading Permissions 17 Client Account Funds Status 18 Three-Level Broker Accounts 19 Fully Disclosed Brokers Getting Started Guide i Contents Adding an Advisor Account 19 Adding an STL Account 20 Adding a Multiple Hedge Fund Account 21 Dashboard 22 Client Account Details 24 Additional Broker Authorizations 27 Link Client Accounts 28 Funding 31 Broker Funding 31 Client Account Funding 32 Trading 35 Subscribe to Market Data 35 Log in to TWS 37 Add Market Data 37 Trade and Allocate for Clients 40 Real-time Activity Monitoring 42 View Account Balances 44 Real-time Margin Monitoring 45 Monitor Margin Requirements 46 Try PM 46 Margin Warnings 46 View Available for Trading Values 47 Fully Disclosed Brokers Getting Started Guide ii Contents View Market Value 47 View FX Portfolio Values 48 View Portfolio Values 48 The Right-Click Portfolio -

The Pnc Financial Services Group Announces First Quarter 2019 Earnings Conference Call Details

CONTACTS: MEDIA: INVESTORS: Media Relations Bryan Gill (412) 762-4550 (412) 768-4143 [email protected] [email protected] THE PNC FINANCIAL SERVICES GROUP ANNOUNCES FIRST QUARTER 2019 EARNINGS CONFERENCE CALL DETAILS Annual Shareholders Meeting To Be Held April 23 PITTSBURGH, March 5, 2019 – The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the first quarter of 2019 Friday, April 12, as previously announced, at approximately 6:45 a.m. (ET). PNC Chairman, President and Chief Executive Officer William S. Demchak and Chief Financial Officer Robert Q. Reilly will hold a conference call for investors the same day at 9:30 a.m. (ET). Separately, PNC will hold its Annual Meeting of Shareholders Tuesday, April 23, 2019. Event details are as follows: First Quarter 2019 Earnings Investor Conference Call: Friday, April 12, at 9:30 a.m. (ET) • Dial-in numbers: (877) 272-3498 and (303) 223-4362 (international). • Accessible at www.pnc.com/investorevents will be a link to the live audio webcast, presentation slides, earnings release and supplementary financial information; a webcast replay will be available for 30 days. • Conference call replay will be available for one week at (800) 633-8284 and (402) 977-9140, Conference ID 21916444. 2019 Annual Meeting of Shareholders: Tuesday, April 23, at 11 a.m. (ET) • Meeting location: The PNC Financial Services Group, Inc., The Tower at PNC Plaza – James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222. • Dial-in numbers: (877) 402-9134 and (303) 223-4385 (international). • Live audio webcast accessible at www.pnc.com/investorevents or www.pnc.com/annualmeeting; webcast replay available for 30 days. -

The Frick Building

THE FRICK BUILDING 437 GRANT STREET | PITTSBURGH, PA HISTORIC BUILDING. PRIME LOCATION. THE FRICK BUILDING Located on Grant Street across from the Allegheny County court house and adjacent to Pittsburgh City Hall, the Frick Building is just steps away from many new restaurants & ongoing projects and city redevelopments. The Frick Building is home to many creative and technology based fi rms and is conveniently located next to the Bike Pittsburgh bike rental station and Zipcar, located directly outside the building. RESTAURANT POTENTIAL AT THE HISTORIC FRICK BUILDING Grant Street is becoming the city’s newest restaurant district with The Commoner (existing), Red The Steak- house, Eddie V’s, Union Standard and many more coming soon Exciting restaurants have signed on at the Union Trust Building redevelopment, Macy’s redevelopment, Oliver Building hotel conversion, 350 Oliver development and the new Tower Two-Sixty/The Gardens Elevated location provides sweeping views of Grant Street and Fifth Avenue The two levels are ideal for creating a main dining room and private dining facilities Antique elevator, elegant marble entry and ornate crown molding provide the perfect opportunity to create a standout restaurant in the “Foodie” city the mezzanine AT THE HISTORIC FRICK BUILDING 7,073 SF available within a unique and elegant mezzanine space High, 21+ foot ceilings Multiple grand entrances via marble staircases Dramatic crown molding and trace ceilings Large windows, allowing for plenty of natural light Additional space available on 2nd floor above, up to 14,000 SF contiguous space Direct access from Grant Street the mezzanine AT THE HISTORIC FRICK BUILDING MEZZANINE OVERALL the mezzanine AT THE HISTORIC FRICK BUILDING MEZZANINE AVAILABLE the details AT THE HISTORIC FRICK BUILDING # BIGGER. -

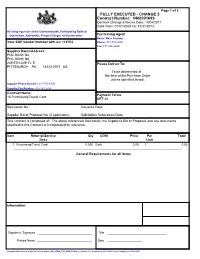

PNC Contract Overview

Page 1 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 All using Agencies of the Commonwealth, Participating Political Subdivision, Authorities, Private Colleges and Universities Purchasing Agent Name: Noss Toniann Your SAP Vendor Number with us: 114704 Phone: 717-783-2090 Fax: 717-346-3820 Supplier Name/Address: PNC BANK NA PNC BANK NA 249 5TH AVE FL 5 Please Deliver To: PITTSBURGH PA 15222-2707 US To be determined at the time of the Purchase Order unless specified below. Supplier Phone Number: 412-762-5730 Supplier Fax Number: 412-762-2784 Contract Name: Payment Terms 15 Purchasing/Travel Card NET 30 Solicitation No.: Issuance Date: Supplier Bid or Proposal No. (if applicable): Solicitation Submission Date: This contract is comprised of: The above referenced Solicitation, the Supplier's Bid or Proposal, and any documents attached to this Contract or incorporated by reference. Item Material/Service Qty UOM Price Per Total Desc Unit 1 Purchasing/Travel Card 0.000 Each 0.00 1 0.00 -------------------------------------------------------------------------------------------------------------------------------------------------------- General Requirements for all Items: Information: Supplier's Signature _________________________________ Title ____________________________________ Printed Name _________________________________ Date _____________________ Integrated Environment Systems Form Name: ZM_SFRM_STD_MMCOSRM_L, Version 1.0, Created on 06/27/2006, Last changed on 03/29/2005. Page 2 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 Supplier Name: PNC BANK NA Header Text 04-05-11 New Terms and Conditions for ActivePay added to the Contract as Addendum 1. -

PNC Bank Letter of Acknowledgement

~ PNC Letter of Acknowledgement Between PNC Bank, N.A. and Executive Office for United States Trustees This Letter of Acknowledgement is made and entered into as of December 3, 2020, by and between the Executive Office for United States Trustees ("EOUST") and PNC Bank, N .A. ("PNC") (collectively, the "Parties"). Introduction The Parties acknowledge that, beginning in late 2015, PNC, on its own initiative, began an internal review of servicing practices in Chapter 13 bankruptcy cases. The review encompassed payment change notices ("PCNs"); running of post-petition escrow analyses ("escrow"); notices of post-petition fees, costs and expenses ("PPFNs"); reconciliation of home equity installment loans and lines of credit ("Home Equity Accounts"); and responses to notices of final cure (responses to "NOFCs"). As part of its review, PNC proactively provided status reports to EOUST regarding its review; remediated borrower accounts on the basis of potential harm, not actual harm; and self-reported its conclusions to EOUST. This Letter summarizes the Parties' discussions and sets forth the remediation PNC has performed and the operational enhancements it has implemented. PNC's Representation of Facts Without waiving any right or privilege, PNC represents that the following facts are accurate to the best of its knowledge and belief: A. Payment Change Notices and Escrow In the fall of 2015, PNC discovered that some of its PCNs may not have been filed or served in a timely and accurate manner. In response, PNC evaluated its PCN-related policies, processes, and procedures; met with bankruptcy servicing staff members; evaluated samples of court-filed PCNs; and reviewed its PCN end to-end operations. -

SCHEDULE 13G (RULE 13D-102)

1 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ (Name of Issuer) Class B Common Stock - ------------------------------------------------------------------------------ (Title of Class of Securities) 065908105 - ------------------------------------------------------------------------------ (CUSIP Number) ---------- CUSIP No. 065908105 Page 1 of 10 Pages 1) Names of Reporting Persons S.S. or I.R.S. Identification Nos. of above persons PNC Bank Corp. 25-1435979 2) Check the Appropriate Box if a Member of a Group (See Instructions) a) [ ] b) [ ] 3) SEC USE ONLY 4) Citizenship or Place of Organization Pennsylvania Number of Shares 5) Sole Voting Power 528,911 Beneficially Owned By Each Reporting Person With 6) Shared Voting Power 0 7) Sole Dispositive Power 542,436 8) Shared Dispositive Power 0 9) Aggregate Amount Beneficially Owned by Each Reporting Person 542,736 10) Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) [ ] 11) Percent of Class Represented by Amount in Row (9) 5.1 12) Type of Reporting Person (See Instructions) HC 2 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ -

Case Study Project ����� PNC Financial Services Group Location ���� Pittsburgh, PA Product ����� DC Flexzone™ Grid

case study Project ..... PNC Financial Services Group Location .... Pittsburgh, PA Product ..... DC FlexZone™ Grid the challenge: In 2002, PNC Financial Services Group became the first major U.S. bank to apply green building practices to all its newly constructed branches. The result: PNC now has more LEED®- certified buildings than any other company in the world. “Any time we construct a building, we want to include state-of-the- art technology,” explains Mike Gilmore, PNC Director of Design and Construction Services. “And, not just technology for now, but for years down the road.” the solution: Gilmore sees the increased use of direct current (DC) in commercial buildings as one of those technologies. “As DC becomes more prevalent, it only makes sense to go in that direction,” he states. As evidence of that belief, PNC was the first company in the country to install DC FlexZone grid, a ceiling suspension system from Armstrong that can distribute safe, low voltage DC power to electrical devices in a space. Installed at PNC Realty Services Group’s offices, the grid powered lay-in light fixtures, pendants, and wall washers in both open plan and closed spaces. “As a leader in sustainability, we’re interested in anything that saves energy,” Gilmore says. “The grid goes an extra step because it deals with direct current, which saves the energy needed to convert AC to DC.” In addition to its energy-saving potential, the grid also improves the flexibility of interior spaces by providing ‘plug and play’ capabilities for moving light fixtures without the need to re-wire. -

See Important Disclosures and Disclaimers at the End of This Report

1/28/20 Shane Martin, CFA [email protected] 214-987-4121 MARKET STATISTICS ($CAD) COMPANY DESCRIPTION Exchange / Symbol OTC: VLEOF Voleo Trading Systems Inc. is a cutting-edge Fintech company that delivers to self- Price: $0.05 directed investors the only individual, team and investment club trading app on the Market Cap ($mm): $5.38 market. As an inherently social platform, users of Voleo can collaborate, discuss, Enterprise Value ($mm): $3.76 propose and vote on trade ideas, and follow influencers in the market on the Voleo Common Shares (M): 107.7 Leaderboard using Voleo’s patent-pending platform. Voleo operates as a discount brokerage in the US and is FINRA-licensed in all 50 states. The company offers a Float: 74% bespoke, as well as turn-key white-label solution for financial institutions around Volume (3 Month Average): 76,012 the world looking to enhance their brokerage offering and engage customers in a 52 Week Range: $0.04-$0.30 unique and gamified way. The company is headquartered in Vancouver, Canada. Industry: Information Technology BALANCE SHEET ($mm, except per sh data) 9/30/19 SUMMARY Total Cash: $1.98 • Cutting Edge Technology – Voleo has developed a cutting edge, patent- Total Assets: $2.68 pending, social trading technology for retail investors. The application is Debt: $0.00 available on iOS, android, and web applications. Equity: $2.2 • Registered Broker-Dealer – Voleo is registered in the U.S. as a broker- Equity per share: $0.02 dealer with FINRA, SIPC, and SEC. In addition, the Company also has strategic collaborations with Nasdaq and TMX Group. -

PNC Bank, National Association

PNC Bank, National Association 2018 Resolution Plan: Public Executive Summary Table of Contents I. Introduction and Executive Summary .................................................................................... 3 II. Material Entities ..................................................................................................................... 5 III. Core Business Lines .............................................................................................................. 7 IV. Summary Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources ............................................................................................................................... 10 V. Derivatives and Hedging Activities ...................................................................................... 16 VI. Memberships in Material Payment, Clearing and Settlement Systems ............................... 18 VII. Foreign Operations .............................................................................................................. 21 VIII. Material Supervisory Authorities .......................................................................................... 22 IX. Principal Officers .................................................................................................................. 23 X. Corporate Governance Structure and Processes Related to Resolution Planning ............. 24 XI. Material Management Information Systems ....................................................................... -

Agreement for Prime Brokerage Clearance Services

Agreement for Prime Brokerage Clearance Services This Agreement sets forth the terms and conditions under which the Clearing Broker, TradeStation Securities, Inc., its successors and assigns (the “Clearing Broker”) will clear securities transactions for you (hereinafter, “Customer”) with such broker- dealer as Customer may designate, from time to time, as Customer’s prime broker (“Prime Broker”), provided that the Clearing Broker has entered into a Prime Brokerage Agreement with Customer’s Prime Broker with respect to Customer’s prime brokerage transactions (hereinafter referred to as “Prime Brokerage Transaction(s)”). For the avoidance of doubt, the Clearing Broker is either (i) an executing self-clearing firm or (ii) the clearing firm of an introducing broker acting as an executing broker. 1. Establishment of Account The Clearing Broker will clear Customer’s Prime Brokerage Transactions in a broker-dealer credit account established in the name of Prime Broker and designated for Customer’s benefit. On the settlement date for each Prime Brokerage Transaction, the Clearing Broker will deliver or receive Customer’s securities to or from Prime Broker against payment in full by or to Prime Broker on Customer’s behalf. 2. Customer Trades Customer hereby authorizes the Clearing Broker to inform Prime Broker on the OMGEO/DTC ID System, or any successor system, of all the details of each Prime Brokerage Transaction Customer instructs to be cleared by the Clearing Broker for Customer’s account, including, but not limited to, the contract amount, the security involved, the number of shares or number of units, and whether the transaction was a long, short or short exempt sale or a purchase (collectively, the “Trade Data”), and Customer hereby agrees to inform Prime Broker of the Trade Data on trade date by the time designated to Customer by Prime Broker. -

The Trust Companies, National Banks and Surety

Orphans’ Court of Allegheny County Attorneys and Others Authorized To Execute Bonds and Undertakings For FIDUCIARY AND SURETY COMPANIES APPROVED FOR 2020 Hon. Lawrence O’Toole, A.J. SECTION I __________________________________________________________________ 3 ACTIVE COMPANIES _____________________________________________________ 4 APPROVED CORPORATE FIDUCIARIES ____________________________________ 5 APPROVED CASUALTY and SURETY COMPANIES _________________________ 11 ALIGNED PARTNERS TRUST COMPANY________________________________ 14 RBC TRUST COMPANY (DELAWARE) LIMITED _________________________ 15 AMERICAN HOME ASSURANCE COMPANY_____________________________ 16 AMERIPRISE BANK, FSB ______________________________________________ 20 AMERISERV TRUST and FINANCIAL SERVICES COMPANY _______________ 21 APOLLO TRUST COMPANY ___________________________________________ 23 ARCH INSURANCE GROUP, INC. _______________________________________ 24 ARDEN TRUST COMPANY ____________________________________________ 26 ASPEN AMERICAN INSURANCE COMPANY_____________________________ 29 ATLANTIC SPECIALTY INSURANCE COMPANY’S _______________________ 31 CIBC NATIONAL TRUST COMPANY. ___________________________________ 34 BANK OF AMERICA, N.A. _____________________________________________ 43 BERKLEY INSURANCE COMPANY _____________________________________ 44 BESSEMER TRUST COMPANY, N.A. ____________________________________ 46 BROWN INVESTMENT ADVISORY & TRUST COMPANY __________________ 47 THE BRYN MAWR TRUST COMPANY __________________________________ 48 CHARLES SCHWAB -

It's All About People

IT’S ALL ABOUT PEOPLE. Lyons Bancorp, Inc. 2019 ANNUAL REPORT Mission Profile The Lyons National Bank is an independent, hometown, community Lyons Bancorp, Inc. is a financial holding company headquartered bank with an expanding geographic market. Our mission is to in Lyons, New York, with assets of $1.16 billion as of December 31, safely and profitably serve all of our customers and communities 2019. Lyons Bancorp, Inc. has one banking subsidiary, The Lyons with the most professional service available. We will accomplish National Bank. The Lyons National Bank is a community bank with this by making a commitment to our most valuable assets— offices in Clyde, Lyons, Macedon, Newark, Ontario, and Wolcott our employees—to treat them with integrity, compensate them in Wayne County, Jordan in Onondaga County, Canandaigua, appropriately and provide them with the necessary systems, Farmington (coming 2020) and Geneva in Ontario County, technology, and appropriate training to enable them to become Penn Yan in Yates County, Waterloo in Seneca County, Fairport well-respected professionals. Our employees, in turn, will provide in Monroe County, and Auburn in Cayuga County. The Lyons our growing customer base with superior service and respect and National Bank has one subsidiary, Lyons Realty Associates Corp. will be leaders in promoting the quality of life in the communities we serve. Our Culture—WOW! WOW! is having a positive attitude and personal conviction to Vision provide customers and fellow employees with a level of service that The vision of The Lyons National Bank is to be the employer and exceeds their expectations during each and every encounter.