PNC Bank Letter of Acknowledgement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Pnc Financial Services Group Announces First Quarter 2019 Earnings Conference Call Details

CONTACTS: MEDIA: INVESTORS: Media Relations Bryan Gill (412) 762-4550 (412) 768-4143 [email protected] [email protected] THE PNC FINANCIAL SERVICES GROUP ANNOUNCES FIRST QUARTER 2019 EARNINGS CONFERENCE CALL DETAILS Annual Shareholders Meeting To Be Held April 23 PITTSBURGH, March 5, 2019 – The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the first quarter of 2019 Friday, April 12, as previously announced, at approximately 6:45 a.m. (ET). PNC Chairman, President and Chief Executive Officer William S. Demchak and Chief Financial Officer Robert Q. Reilly will hold a conference call for investors the same day at 9:30 a.m. (ET). Separately, PNC will hold its Annual Meeting of Shareholders Tuesday, April 23, 2019. Event details are as follows: First Quarter 2019 Earnings Investor Conference Call: Friday, April 12, at 9:30 a.m. (ET) • Dial-in numbers: (877) 272-3498 and (303) 223-4362 (international). • Accessible at www.pnc.com/investorevents will be a link to the live audio webcast, presentation slides, earnings release and supplementary financial information; a webcast replay will be available for 30 days. • Conference call replay will be available for one week at (800) 633-8284 and (402) 977-9140, Conference ID 21916444. 2019 Annual Meeting of Shareholders: Tuesday, April 23, at 11 a.m. (ET) • Meeting location: The PNC Financial Services Group, Inc., The Tower at PNC Plaza – James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222. • Dial-in numbers: (877) 402-9134 and (303) 223-4385 (international). • Live audio webcast accessible at www.pnc.com/investorevents or www.pnc.com/annualmeeting; webcast replay available for 30 days. -

The PNC Financial Services Group, Inc. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 ______________________________________ FORM 10-Q ______________________________________ ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-09718 The PNC Financial Services Group, Inc. (Exact name of registrant as specified in its charter) ___________________________________________________________ Pennsylvania 25-1435979 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) The Tower at PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2401 (Address of principal executive offices, including zip code) (888) 762-2265 (Registrant’s telephone number including area code) (Former name, former address and former fiscal year, if changed since last report) ___________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Trading Name of Each Exchange Title of Each Class Symbol(s) on Which Registered Common Stock, par value $5.00 PNC New York Stock Exchange Depositary Shares Each Representing a 1/4,000 Interest in a Share of Fixed-to- PNC P New York Stock Exchange Floating Rate Non-Cumulative Perpetual Preferred Stock, Series P Depositary Shares Each Representing a 1/4,000 Interest in a Share of 5.375% PNC Q New York Stock Exchange Non-Cumulative Perpetual Preferred Stock, Series Q Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

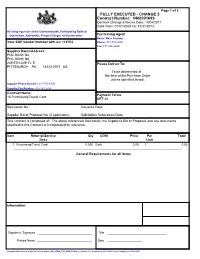

PNC Contract Overview

Page 1 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 All using Agencies of the Commonwealth, Participating Political Subdivision, Authorities, Private Colleges and Universities Purchasing Agent Name: Noss Toniann Your SAP Vendor Number with us: 114704 Phone: 717-783-2090 Fax: 717-346-3820 Supplier Name/Address: PNC BANK NA PNC BANK NA 249 5TH AVE FL 5 Please Deliver To: PITTSBURGH PA 15222-2707 US To be determined at the time of the Purchase Order unless specified below. Supplier Phone Number: 412-762-5730 Supplier Fax Number: 412-762-2784 Contract Name: Payment Terms 15 Purchasing/Travel Card NET 30 Solicitation No.: Issuance Date: Supplier Bid or Proposal No. (if applicable): Solicitation Submission Date: This contract is comprised of: The above referenced Solicitation, the Supplier's Bid or Proposal, and any documents attached to this Contract or incorporated by reference. Item Material/Service Qty UOM Price Per Total Desc Unit 1 Purchasing/Travel Card 0.000 Each 0.00 1 0.00 -------------------------------------------------------------------------------------------------------------------------------------------------------- General Requirements for all Items: Information: Supplier's Signature _________________________________ Title ____________________________________ Printed Name _________________________________ Date _____________________ Integrated Environment Systems Form Name: ZM_SFRM_STD_MMCOSRM_L, Version 1.0, Created on 06/27/2006, Last changed on 03/29/2005. Page 2 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 Supplier Name: PNC BANK NA Header Text 04-05-11 New Terms and Conditions for ActivePay added to the Contract as Addendum 1. -

SCHEDULE 13G (RULE 13D-102)

1 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ (Name of Issuer) Class B Common Stock - ------------------------------------------------------------------------------ (Title of Class of Securities) 065908105 - ------------------------------------------------------------------------------ (CUSIP Number) ---------- CUSIP No. 065908105 Page 1 of 10 Pages 1) Names of Reporting Persons S.S. or I.R.S. Identification Nos. of above persons PNC Bank Corp. 25-1435979 2) Check the Appropriate Box if a Member of a Group (See Instructions) a) [ ] b) [ ] 3) SEC USE ONLY 4) Citizenship or Place of Organization Pennsylvania Number of Shares 5) Sole Voting Power 528,911 Beneficially Owned By Each Reporting Person With 6) Shared Voting Power 0 7) Sole Dispositive Power 542,436 8) Shared Dispositive Power 0 9) Aggregate Amount Beneficially Owned by Each Reporting Person 542,736 10) Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) [ ] 11) Percent of Class Represented by Amount in Row (9) 5.1 12) Type of Reporting Person (See Instructions) HC 2 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ -

Case Study Project ����� PNC Financial Services Group Location ���� Pittsburgh, PA Product ����� DC Flexzone™ Grid

case study Project ..... PNC Financial Services Group Location .... Pittsburgh, PA Product ..... DC FlexZone™ Grid the challenge: In 2002, PNC Financial Services Group became the first major U.S. bank to apply green building practices to all its newly constructed branches. The result: PNC now has more LEED®- certified buildings than any other company in the world. “Any time we construct a building, we want to include state-of-the- art technology,” explains Mike Gilmore, PNC Director of Design and Construction Services. “And, not just technology for now, but for years down the road.” the solution: Gilmore sees the increased use of direct current (DC) in commercial buildings as one of those technologies. “As DC becomes more prevalent, it only makes sense to go in that direction,” he states. As evidence of that belief, PNC was the first company in the country to install DC FlexZone grid, a ceiling suspension system from Armstrong that can distribute safe, low voltage DC power to electrical devices in a space. Installed at PNC Realty Services Group’s offices, the grid powered lay-in light fixtures, pendants, and wall washers in both open plan and closed spaces. “As a leader in sustainability, we’re interested in anything that saves energy,” Gilmore says. “The grid goes an extra step because it deals with direct current, which saves the energy needed to convert AC to DC.” In addition to its energy-saving potential, the grid also improves the flexibility of interior spaces by providing ‘plug and play’ capabilities for moving light fixtures without the need to re-wire. -

The Tower at Pnc Plaza

Facts THE TOWER AT PNC PLAZA Description: 32 story, 781,000 sf commercial office tower The Tower at PNC Plaza is a new commercial office headquarters for Project Owner: PNC Financial Services Group. PNC Financial Services The 781,000 sf tower began Group construction in Spring 2012. PNC Architect: aspires to exceed the performance Gensler of LEED Platinum and develop the SM Completion Date: “greenest skyrise in the world.” Est. 2015 Paladino is serving as strategic advisor, guiding the owner and Objective: team through a strategic Create the “greenest skyrise in the world” – a high sustainability design process performance, net zero energy, embedded throughout design and waters and materials office construction. building Paladino Approach Results To define “beyond LEED,” Paladino performed an in-depth green building Estimated to save 45% energy market scan that included site visits to Europe’s most high performing green and 79% potable water, the buildings; a building technology scan; a competitor scan; and a community Tower team seeks to achieve scan encompassing other buildings in PNC’s territory. From there, the team “beyond LEED Platinum” developed sustainability performance criteria organized around three pillars performance that best defined “beyond LEED” in the present market: Awards • Community Builder: Support Pittsburgh's existing infrastructure, spur Eco-Structure Evergreen further development and business growth downtown and positively Award, On the Boards Category accentuate the skyline as a symbol of PNC's commitment to the city's – 2012 sustainable future. • Workplace Innovator: Attract tomorrow's leaders to Pittsburgh by utilizing innovative space planning and building systems that promote collaboration and productivity, and set the bar for a healthy indoor environment. -

Designing a Data-Driven, Humanistic High-Rise Much Attention Has Been Given to How Data and “The Cloud” Will Revolutionize the Workplace

Tower at PNC Plaza, Pittsburgh Designing a Data-Driven, Humanistic High-Rise Much attention has been given to how data and “the cloud” will revolutionize the workplace. Indeed, the way we work is rapidly changing, though many of the demands and challenges we must address are still very much physical. The case of the Tower at PNC Plaza (see Figure 1), an office building in Pittsburgh, Pennsylvania, demonstrates how extensive research, data collection and field-testing lead to a more sustainable tall building and a Ben Tranel Hao Ko happier, healthier, more productive workforce. Authors From Data to Meaning whether fi nancial, environmental, or human. Ben Tranel, Principal Hao Ko, Design Director Thus the metrics for success coalesced into Gensler “The goal is to build the greenest high-rise in three categories: community, environment, 2 Harrison Street, Suite 400 San Francisco, CA 94105 the world.” When Gary Saulson, then director and workplace. The project team set out to United States of real estate for PNC Bank, stated this establish a new benchmark in performance, t: +1 415 836 4507 f: +1 415 836 4599 aspiration for PNC’s headquarters, he both in the building itself, and for the people e: [email protected]; immediately followed his statement by who use it. [email protected] www.gensler.com asking what that would mean. The team recognized they weren’t the fi rst to Hao Ko To design an ambitious building such as this state this ambition for a project, and so they Grounded by the belief that the fundamental role is a journey that involves parsing continuous evaluated other projects fi rst. -

PNC Firstside Pittsburgh, Pennsylvania

PNC Firstside Pittsburgh, Pennsylvania Project Type: Commercial/Industrial Case No: C033009 Year: 2003 SUMMARY PNC Firstside Center is a large-scale, environmentally sustainable facility that is used for operations, processing, and many other traditional back-office functions for PNC Financial Services Group in Pittsburgh, Pennsylvania. Completed in September 2000, this five-story, 650,000-square-foot (6,038-square-meter) structure has achieved the distinction of being a LEED-certified green building under the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) program. Located on a former brownfield in downtown Pittsburgh, the edifice offers an employee-friendly environment with plenty of natural light, fresh air, and sustainable building systems. As a benefit to the city of Pittsburgh, the redevelopment of this formerly idle site brought new life and activity to this underutilized section of downtown. FEATURES Large-scale, environmentally sustainable office building First structure in the nation to earn Silver LEED certification Urban infill/brownfield redevelopment PNC Firstside Pittsburgh, Pennsylvania Project Type: Commercial/Industrial Subcategory: Office Buildings Volume 33 Number 09 April–June 2003 Case Number: C033009 PROJECT TYPE PNC Firstside Center is a large-scale, environmentally sustainable facility that is used for operations, processing, and many other traditional back-office functions for PNC Financial Services Group in Pittsburgh, Pennsylvania. Completed in September 2000, this five-story, 650,000-square-foot (6,038-square-meter) structure has achieved the distinction of being a LEED-certified green building under the U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) program. Located on a former brownfield in downtown Pittsburgh, the edifice offers an employee-friendly environment with plenty of natural light, fresh air, and sustainable building systems. -

University Banking Services Agreement This University

1 UNIVERSITY BANKING SERVICES AGREEMENT THIS UNIVERSITY BANKING SERVICES AGREEMENT ("Agreement") is effective · day of May, 2019, ("Effective Date"), and entered into by and between Fayetteville ate University, an institution of higher education organized and operated under the laws of the state of North Carolina, having offices at 1200 Murchison Rd. , Fayetteville, NC 28301 ("University") and PNC Bank, National Association, a national banking association, with its principal office at One PNC Plaza, 300 Fifth A venue, Pittsburgh, Pennsylvania 15222 ("PNC Bank"). WHEREAS, the University wants PNC Bank to offer its Program on the University's Campus. NOW THEREFORE, this Agreement sets f01th the terms pursuant to which PNC Bank will offer the Program to Constituents of University. 1. DEFINITIONS For the purposes of this Agreement, the following terms shall have the following meanings: (a) "Account" shall mean any new University-affiliated student, faculty, or staff personal checking account properly identified at the point of sale as Constituents of the University at that time and labelled by PNC Bank with an internal code identifying them as Accounts opened for University Constituents. (b) "Affiliate" shall mean, with respect to either party hereto, any entity which, directly or indirectly, owns or controls, is owned or controlled by, or is under common ownership or common control with PNC Bank or University; "control" shall mean the power to direct the management of the affairs of the entity; and "ownership" means the beneficial ownership of more than 50% of the equity of the entity. (c) "Athletic Facilities" shall mean buildings and spaces operated by the University athletic department for inter-collegiate sports events and support. -

For Sale 319 Fayetteville St Suite 108, Raleigh Nc

FOR SALE 319 FAYETTEVILLE ST SUITE 108, RALEIGH NC OVERVIEW RSF ±7,500 SF (First floor) YEAR BUILT 1920; Renovated in 2005 CLASS A LOCATION Central Business District ZONING BUS (Business District) OCCUPANCY 100% Full NUMBER OF Total of 4 tenants which include TENANTS 2 restaurants ( and 1 under contract), 1 mail and shipping store, 1 TV station ETJ RA KEVIN DUMAS COLLIERS INTERNATIONAL CCIM Designee RALEIGH - DURHAM Vice President 702 Oberlin Road, Suite 400 Raleigh, NC 27605 919 582 3148 www.colliers.com/rdu [email protected] Executive Summary Commercial Retail Space for sale directly across from the courthouse, in the hub of the Downtown Commercial Business District. This Historically designated building, once the home of the Hudson Belk Store, now a prime business spot and home to some of downtowns favorite eateries. Conveniently located next to the PNC Towers, Edison Projects, and Post Office, the building is in walking distance to all the city has to offer. Demographics 2015 Demographics 1 mile 3 mile 5 mile 10 mile Population 15,934 98,152 197,815 570,162 2010-2015 Pop. Growth Rate 1.69% 1.46% 1.54% 1.69% # of Households 6,212 35,700 75,284 228,157 Average Household Income $45,105 $60,855 $63,910 $78,741 Site Plan Suite 108 Manhattan Parking Cafe TV Station UPS Store Sono’s Aerial Nash Moore Square Square S SALISBURY ST E MARTIN ST FAYETTEVILLE ST Wake Co. Justice Wake Co. Center Clerk of Superior SITE Court E DAVIE ST Greater Raleigh Convention Red Hat Raleigh Center Lincoln Amphitheater Convention Theatre Center RESIDENTIAL 1. -

The Triangle of Sustainability: a Comparative Study of Contemporary Sustainable Architecture in Beijing and Pittsburgh

The Triangle of Sustainability: A Comparative Study of Contemporary Sustainable Architecture in Beijing and Pittsburgh by Lin Hou Bachelor of Philosophy in Architectural Studies, University of Pittsburgh, 2017 Submitted to the Graduate Faculty of Honors College in partial fulfillment of the requirements for the degree of Bachelor of Philosophy University of Pittsburgh 2017 UNIVERSITY OF PITTSBURGH Honors College This thesis was presented by Lin Hou It was defended on April 4th, 2017 and approved by Mrinalini Rajagopalan, PhD, Assistant Professor Stefan Al, PhD, Assistant Professor Melissa Bilec, PhD, Assistant Professor Drew Armstrong, PhD, Associate Professor Thesis Director: Mrinalini Rajagopalan, PhD, Assistant Professor ii Copyright © by Lin Hou 2017 iii The Triangle of Sustainability: A Comparative Study of Contemporary Sustainable Architecture in Beijing and Pittsburgh Lin Hou, B.Phil Sustainable architecture is increasingly becoming not only iconic of higher life quality, but also a great tool to reduce energy usage in response to global climate change concerns. More and more, sustainable architecture has diverse foci based on what standards (such as LEED) architects choose. Looking at those standards, and how different architects approach them, it becomes essential to look for similarities and differences. In 2015 at the United Nations Climate Change Conference, the two largest polluters— America and China—committed themselves to cut CO2 emissions. In this study I am performing a comparative analysis of two recently designed major buildings in Pittsburgh and Beijing, two top cities in America and China which are developing sustainable architecture in response to similar climate issues: the New Tower in PNC Plaza and the Parkview Green Mall in Beijing. -

CRA Decision #141 March 2008 James S

O Comptroller of the Currency Administrator of National Banks Washington, D.C. 20219 February 7, 2008 CRA Decision #141 March 2008 James S. Keller Chief Regulatory Counsel The PNC Financial Services Group, Inc. 249 Fifth Avenue One PNC Plaza, 21st Floor Pittsburgh, Pennsylvania 15222-2707 RE: Application for BLC Bank, National Association, Strasburg, Pennsylvania to merge with and into PNC Bank, National Association, Pittsburgh, Pennsylvania OCC Control No.: 2007 NE 02 022 Dear Mr. Keller: This letter is in response to the above referenced Application. Based on a thorough evaluation of all information available to the Office of the Comptroller of the Currency (“OCC”), including the representations and commitments made in the Application and the merger agreement, and by the Bank’s representatives, I approve the proposal for BLC Bank, National Association, Strasburg, Pennsylvania (“BLC Bank”), to merge with and into PNC Bank, National Association, Pittsburgh, Pennsylvania (“PNC Bank”), under the charter and title of the latter. Bank Merger Act The OCC reviewed the proposed merger transaction under the criteria of the Bank Merger Act, 12 USC 1828(c), and applicable OCC regulations and policies. Among other matters, we found that the proposed transaction would not have significant anticompetitive effects. I considered the financial and managerial resources of the banks, their future prospects, the convenience and needs of the communities to be served, and their effectiveness in combating money laundering activities and found them consistent with approval. PNC Bank, NA, Pittsburgh, PA February 7, 2008 OCC Control No.: 2007 NE 02 022 Community Reinvestment Act Review The Community Reinvestment Act (“CRA”) requires the OCC to take into account the records of the institutions proposing to engage in a merger in helping to meet the credit needs of the community, including low and moderate-income (“LMI”) neighborhoods.1 The OCC considered the CRA Performance Evaluation (PE) of each institution involved in the transaction.