THE PNC FINANCIAL SERVICES GROUP, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Pnc Financial Services Group Announces First Quarter 2019 Earnings Conference Call Details

CONTACTS: MEDIA: INVESTORS: Media Relations Bryan Gill (412) 762-4550 (412) 768-4143 [email protected] [email protected] THE PNC FINANCIAL SERVICES GROUP ANNOUNCES FIRST QUARTER 2019 EARNINGS CONFERENCE CALL DETAILS Annual Shareholders Meeting To Be Held April 23 PITTSBURGH, March 5, 2019 – The PNC Financial Services Group, Inc. (NYSE: PNC) expects to issue financial results for the first quarter of 2019 Friday, April 12, as previously announced, at approximately 6:45 a.m. (ET). PNC Chairman, President and Chief Executive Officer William S. Demchak and Chief Financial Officer Robert Q. Reilly will hold a conference call for investors the same day at 9:30 a.m. (ET). Separately, PNC will hold its Annual Meeting of Shareholders Tuesday, April 23, 2019. Event details are as follows: First Quarter 2019 Earnings Investor Conference Call: Friday, April 12, at 9:30 a.m. (ET) • Dial-in numbers: (877) 272-3498 and (303) 223-4362 (international). • Accessible at www.pnc.com/investorevents will be a link to the live audio webcast, presentation slides, earnings release and supplementary financial information; a webcast replay will be available for 30 days. • Conference call replay will be available for one week at (800) 633-8284 and (402) 977-9140, Conference ID 21916444. 2019 Annual Meeting of Shareholders: Tuesday, April 23, at 11 a.m. (ET) • Meeting location: The PNC Financial Services Group, Inc., The Tower at PNC Plaza – James E. Rohr Auditorium, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222. • Dial-in numbers: (877) 402-9134 and (303) 223-4385 (international). • Live audio webcast accessible at www.pnc.com/investorevents or www.pnc.com/annualmeeting; webcast replay available for 30 days. -

In the United States District Court for the Eastern District of Texas Marshall Division

Case 2:08-cv-00462-DF -CE Document 1 Filed 12/04/08 Page 1 of 13 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION LEON STAMBLER, § § Plaintiff, § § v. § CIVIL ACTION NO. 2:08cv462 § MERRILL LYNCH & CO., INC; § JURY TRIAL DEMANDED MERRILL LYNCH, PIERCE, FENNER & § SMITH INCORPORATED; THE CHARLES § SCHWAB CORPORATION; CHARLES § SCHWAB & CO, INC.; CHARLES § SCHWAB BANK; E*TRADE FINANCIAL § CORPORATION; E*TRADE BANK; § FIDELITY BROKERAGE SERVICES, LLC; § NATIONAL FINANCIAL SERVICES, LLC; § FMR LLC; MORGAN STANLEY; § MORGAN STANLEY & CO. § INCORPORATED; JACK HENRY & § ASSOCIATES, INC.; METAVANTE § TECHNOLOGIES, INC.; METAVANTE § CORPORATION; PAYPAL, INC.; § AMERICAN EXPRESS COMPANY; § AMERICAN BANK OF COMMERCE; § BB&T CORPORATION; BRANCH § BANKING AND TRUST COMPANY; THE § COLONIAL BANCGROUP, INC.; § COLONIAL BANK; FIRST NATIONAL § BANK GROUP, INC.; FIRST NATIONAL § BANK; HSBC NORTH AMERICA § HOLDINGS INC.; HSBC USA INC.; HSBC § BANK USA, NATIONAL ASSOCIATION; § HSBC NATIONAL BANK USA; § LEGACYTEXAS GROUP, INC.; § LEGACYTEXAS BANK; THE PNC § FINANCIAL SERVICES GROUP, INC.; § PNC BANK, NATIONAL ASSOCIATION; § PNC BANK, DELAWARE; PROSPERITY § BANCSHARES, INC.; PROSPERITY § BANK; STERLING BANCSHARES, INC.; § STERLING BANK; SUNTRUST BANKS, § INC.; SUNTRUST BANK; TEXAS § CAPITAL BANCSHARES, INC.; TEXAS § CAPITAL BANK, NATIONAL § 1 Case 2:08-cv-00462-DF -CE Document 1 Filed 12/04/08 Page 2 of 13 ASSOCIATION; U.S. BANCORP; U.S. § BANK NATIONAL ASSOCIATION; § ZIONS BANCORPORATION; ZIONS § FIRST NATIONAL BANK; and AMEGY § BANK NATIONAL ASSOCIATION § § Defendants. § § PLAINTIFF’S ORIGINAL COMPLAINT Plaintiff LEON STAMBLER files this Original Complaint against the above-named Defendants, alleging as follows: I. THE PARTIES 1. Plaintiff LEON STAMBLER (“Stambler”) is an individual residing in Parkland, Florida. 2. Defendant MERRILL LYNCH & CO., INC. -

Financial Institutions Portfolio, Series 46 Fact Card

VAN KAMPEN UNIT TRUSTS Financial Institutions Portfolio, Series 46 A sector unit trust Portfolio composition As of day of deposit Objective Asset management & custody banks Real estate services This portfolio seeks capital appreciation. The Bank of New York Mellon Corporation BK CB Richard Ellis Group, Inc. - CL A CBG portfolio seeks to achieve its objective by investing Franklin Resources, Inc. BEN Regional banks in a portfolio of stocks issued by companies Northern Trust Corporation NTRS BancorpSouth, Inc. BXS diversified within the financial services industry. Consumer finance East West Bancorp, Inc. EWBC The portfolio also seeks current dividend income American Express Company AXP Fifth Third Bancorp FITB as a secondary objective. Capital One Financial Corporation COF Huntington Bancshares, Inc. HBAN Diversified banks PNC Financial Services Group, Inc. PNC Trust specifics Comerica, Inc. CMA SunTrust Banks, Inc. STI Deposit information Wells Fargo & Company WFC SVB Financial Group SIVB Public offering price per unit1 $10.00 Investment banking & brokerage Zions Bancorporation ZION Minimum investment ($250 for IRAs) $1,000.00 Residential REITs Charles Schwab Corporation SCHW Deposit date 05/11/10 Raymond James Financial, Inc. RJF Apartment Investment & Management Termination date 05/08/12 Life & health insurance Company - CL A AIV Distribution date 09/25/10, 12/25/10, 03/25/11, AvalonBay Communities, Inc. AVB Aflac, Inc. AFL 06/25/11, 09/25/11, 12/25/11, Equity Residential EQR Lincoln National Corporation LNC 03/25/12 and final Retail REITs MetLife, Inc. MET Record date 09/10/10, 12/10/10, 03/10/11, Prudential Financial, Inc. PRU Simon Property Group, Inc. -

The PNC Financial Services Group, Inc. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 ______________________________________ FORM 10-Q ______________________________________ ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-09718 The PNC Financial Services Group, Inc. (Exact name of registrant as specified in its charter) ___________________________________________________________ Pennsylvania 25-1435979 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) The Tower at PNC Plaza, 300 Fifth Avenue, Pittsburgh, Pennsylvania 15222-2401 (Address of principal executive offices, including zip code) (888) 762-2265 (Registrant’s telephone number including area code) (Former name, former address and former fiscal year, if changed since last report) ___________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Trading Name of Each Exchange Title of Each Class Symbol(s) on Which Registered Common Stock, par value $5.00 PNC New York Stock Exchange Depositary Shares Each Representing a 1/4,000 Interest in a Share of Fixed-to- PNC P New York Stock Exchange Floating Rate Non-Cumulative Perpetual Preferred Stock, Series P Depositary Shares Each Representing a 1/4,000 Interest in a Share of 5.375% PNC Q New York Stock Exchange Non-Cumulative Perpetual Preferred Stock, Series Q Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

The Following Revised Public Summary of the PNC Financial Services Group, Inc.’S (PNC) 165(D) and IDI Resolution Plans Has Been Posted at PNC’S Request

The following revised public summary of The PNC Financial Services Group, Inc.’s (PNC) 165(d) and IDI Resolution Plans has been posted at PNC’s request. This version is substantively identical to the version that the Federal Reserve and Federal Deposit Insurance Corporation posted on their respective websites on January 10, 2013. However, this revised version addresses certain formatting and other cosmetic issues with the prior version. The PNC Financial Services Group, Inc. PNC Bank, National Association Resolution Plan: Public Executive Summary Table of Contents I. Introduction and Executive Summary .............................................................................................. 3 II. Material Entities .................................................................................................................................. 5 III. Core Business Lines .......................................................................................................................... 7 IV. Summary Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources .............................................................................................................................................. 10 V. Derivatives and Hedging Activities.................................................................................................. 16 VI. Memberships in Material Payment, Clearing and Settlement Systems.................................... 18 VII. Foreign Operations .......................................................................................................................... -

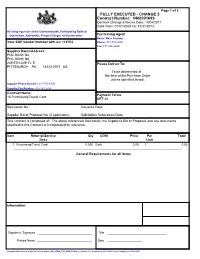

PNC Contract Overview

Page 1 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 All using Agencies of the Commonwealth, Participating Political Subdivision, Authorities, Private Colleges and Universities Purchasing Agent Name: Noss Toniann Your SAP Vendor Number with us: 114704 Phone: 717-783-2090 Fax: 717-346-3820 Supplier Name/Address: PNC BANK NA PNC BANK NA 249 5TH AVE FL 5 Please Deliver To: PITTSBURGH PA 15222-2707 US To be determined at the time of the Purchase Order unless specified below. Supplier Phone Number: 412-762-5730 Supplier Fax Number: 412-762-2784 Contract Name: Payment Terms 15 Purchasing/Travel Card NET 30 Solicitation No.: Issuance Date: Supplier Bid or Proposal No. (if applicable): Solicitation Submission Date: This contract is comprised of: The above referenced Solicitation, the Supplier's Bid or Proposal, and any documents attached to this Contract or incorporated by reference. Item Material/Service Qty UOM Price Per Total Desc Unit 1 Purchasing/Travel Card 0.000 Each 0.00 1 0.00 -------------------------------------------------------------------------------------------------------------------------------------------------------- General Requirements for all Items: Information: Supplier's Signature _________________________________ Title ____________________________________ Printed Name _________________________________ Date _____________________ Integrated Environment Systems Form Name: ZM_SFRM_STD_MMCOSRM_L, Version 1.0, Created on 06/27/2006, Last changed on 03/29/2005. Page 2 of 2 FULLY EXECUTED - CHANGE 3 Contract Number: 4400001695 Contract Change Effective Date: 10/04/2011 Valid From: 01/01/2008 To: 12/31/2012 Supplier Name: PNC BANK NA Header Text 04-05-11 New Terms and Conditions for ActivePay added to the Contract as Addendum 1. -

PNC Bank Letter of Acknowledgement

~ PNC Letter of Acknowledgement Between PNC Bank, N.A. and Executive Office for United States Trustees This Letter of Acknowledgement is made and entered into as of December 3, 2020, by and between the Executive Office for United States Trustees ("EOUST") and PNC Bank, N .A. ("PNC") (collectively, the "Parties"). Introduction The Parties acknowledge that, beginning in late 2015, PNC, on its own initiative, began an internal review of servicing practices in Chapter 13 bankruptcy cases. The review encompassed payment change notices ("PCNs"); running of post-petition escrow analyses ("escrow"); notices of post-petition fees, costs and expenses ("PPFNs"); reconciliation of home equity installment loans and lines of credit ("Home Equity Accounts"); and responses to notices of final cure (responses to "NOFCs"). As part of its review, PNC proactively provided status reports to EOUST regarding its review; remediated borrower accounts on the basis of potential harm, not actual harm; and self-reported its conclusions to EOUST. This Letter summarizes the Parties' discussions and sets forth the remediation PNC has performed and the operational enhancements it has implemented. PNC's Representation of Facts Without waiving any right or privilege, PNC represents that the following facts are accurate to the best of its knowledge and belief: A. Payment Change Notices and Escrow In the fall of 2015, PNC discovered that some of its PCNs may not have been filed or served in a timely and accurate manner. In response, PNC evaluated its PCN-related policies, processes, and procedures; met with bankruptcy servicing staff members; evaluated samples of court-filed PCNs; and reviewed its PCN end to-end operations. -

SCHEDULE 13G (RULE 13D-102)

1 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ (Name of Issuer) Class B Common Stock - ------------------------------------------------------------------------------ (Title of Class of Securities) 065908105 - ------------------------------------------------------------------------------ (CUSIP Number) ---------- CUSIP No. 065908105 Page 1 of 10 Pages 1) Names of Reporting Persons S.S. or I.R.S. Identification Nos. of above persons PNC Bank Corp. 25-1435979 2) Check the Appropriate Box if a Member of a Group (See Instructions) a) [ ] b) [ ] 3) SEC USE ONLY 4) Citizenship or Place of Organization Pennsylvania Number of Shares 5) Sole Voting Power 528,911 Beneficially Owned By Each Reporting Person With 6) Shared Voting Power 0 7) Sole Dispositive Power 542,436 8) Shared Dispositive Power 0 9) Aggregate Amount Beneficially Owned by Each Reporting Person 542,736 10) Check if the Aggregate Amount in Row (9) Excludes Certain Shares (See Instructions) [ ] 11) Percent of Class Represented by Amount in Row (9) 5.1 12) Type of Reporting Person (See Instructions) HC 2 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 ---------- SCHEDULE 13G (RULE 13d-102) INFORMATION STATEMENT PURSUANT TO RULES 13d-1 AND 13d-2 UNDER THE SECURITIES EXCHANGE ACT OF 1934 BankAtlantic Bancorp, Inc. - ------------------------------------------------------------------------------ -

Case Study Project ����� PNC Financial Services Group Location ���� Pittsburgh, PA Product ����� DC Flexzone™ Grid

case study Project ..... PNC Financial Services Group Location .... Pittsburgh, PA Product ..... DC FlexZone™ Grid the challenge: In 2002, PNC Financial Services Group became the first major U.S. bank to apply green building practices to all its newly constructed branches. The result: PNC now has more LEED®- certified buildings than any other company in the world. “Any time we construct a building, we want to include state-of-the- art technology,” explains Mike Gilmore, PNC Director of Design and Construction Services. “And, not just technology for now, but for years down the road.” the solution: Gilmore sees the increased use of direct current (DC) in commercial buildings as one of those technologies. “As DC becomes more prevalent, it only makes sense to go in that direction,” he states. As evidence of that belief, PNC was the first company in the country to install DC FlexZone grid, a ceiling suspension system from Armstrong that can distribute safe, low voltage DC power to electrical devices in a space. Installed at PNC Realty Services Group’s offices, the grid powered lay-in light fixtures, pendants, and wall washers in both open plan and closed spaces. “As a leader in sustainability, we’re interested in anything that saves energy,” Gilmore says. “The grid goes an extra step because it deals with direct current, which saves the energy needed to convert AC to DC.” In addition to its energy-saving potential, the grid also improves the flexibility of interior spaces by providing ‘plug and play’ capabilities for moving light fixtures without the need to re-wire. -

PNC Bank, National Association

PNC Bank, National Association 2018 Resolution Plan: Public Executive Summary Table of Contents I. Introduction and Executive Summary .................................................................................... 3 II. Material Entities ..................................................................................................................... 5 III. Core Business Lines .............................................................................................................. 7 IV. Summary Financial Information Regarding Assets, Liabilities, Capital and Major Funding Sources ............................................................................................................................... 10 V. Derivatives and Hedging Activities ...................................................................................... 16 VI. Memberships in Material Payment, Clearing and Settlement Systems ............................... 18 VII. Foreign Operations .............................................................................................................. 21 VIII. Material Supervisory Authorities .......................................................................................... 22 IX. Principal Officers .................................................................................................................. 23 X. Corporate Governance Structure and Processes Related to Resolution Planning ............. 24 XI. Material Management Information Systems ....................................................................... -

Leadership That Lifts Us All Recognizing Outstanding Philanthropy 2017 - 2018

Leadership That Lifts Us All Recognizing Outstanding Philanthropy 2017 - 2018 uwswpa.org Thank you to our 2017 sponsors: Premier Gold Dear Friends, As philanthropic leaders who, through their generous gifts of time and treasure, demonstrate their commitment to tackling our community’s most pressing problems, we should be proud of the impact we make on the lives of people who need our help. Through our gifts – Tocqueville Society members contributed nearly $10 million to the United Way 2017 Campaign – the most vulnerable members of our community are getting much-needed support: Dan Onorato • local children like Alijah (page 18) are matched with caring mentors who are helping them plan to continue their education after high school; • seniors like Jean (page 4) are receiving support that helps them remain in the homes they love; • people with disabilities like Kenny (page 9) are getting the opportunity to find 1 meaningful work; and • women like Sarah (page 43) are able to overcome challenges in order to gain greater financial stability. On behalf of our community, thank you for your support. Your gift helps United Way put solutions into action, making a difference and encouraging hope for a better David Schlosser tomorrow for everyone. With warmest regards Dan Onorato David Schlosser 2017 Tocqueville Society Co-Chair 2017 Tocqueville Society Co-Chair 2017 Top Tocqueville Corporations The Tocqueville Society Tocqueville Society Membership Growth United Way recognizes these United Way’s Tocqueville Society is corporations that had the largest comprised of philanthropic leaders 2011 430 number of Tocqueville Society and volunteer champions who donors for the 2017 campaign, give $10,000 or more annually to regardless of company size or United Way, creating a profound 2012 458 overall campaign total. -

The Tower at Pnc Plaza

Facts THE TOWER AT PNC PLAZA Description: 32 story, 781,000 sf commercial office tower The Tower at PNC Plaza is a new commercial office headquarters for Project Owner: PNC Financial Services Group. PNC Financial Services The 781,000 sf tower began Group construction in Spring 2012. PNC Architect: aspires to exceed the performance Gensler of LEED Platinum and develop the SM Completion Date: “greenest skyrise in the world.” Est. 2015 Paladino is serving as strategic advisor, guiding the owner and Objective: team through a strategic Create the “greenest skyrise in the world” – a high sustainability design process performance, net zero energy, embedded throughout design and waters and materials office construction. building Paladino Approach Results To define “beyond LEED,” Paladino performed an in-depth green building Estimated to save 45% energy market scan that included site visits to Europe’s most high performing green and 79% potable water, the buildings; a building technology scan; a competitor scan; and a community Tower team seeks to achieve scan encompassing other buildings in PNC’s territory. From there, the team “beyond LEED Platinum” developed sustainability performance criteria organized around three pillars performance that best defined “beyond LEED” in the present market: Awards • Community Builder: Support Pittsburgh's existing infrastructure, spur Eco-Structure Evergreen further development and business growth downtown and positively Award, On the Boards Category accentuate the skyline as a symbol of PNC's commitment to the city's – 2012 sustainable future. • Workplace Innovator: Attract tomorrow's leaders to Pittsburgh by utilizing innovative space planning and building systems that promote collaboration and productivity, and set the bar for a healthy indoor environment.