Pakistan's Household Appliances Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trade and Poverty Case Study: Small Household Appliances

Trade and Poverty Case Study: Small household appliances Taz Chaponda Matthew Stern Draft: March 2006 This case study is part of a broader study on trade and poverty in South Africa funded by DFID, DTI and USAID. Trade and Poverty Case Study: Small household appliances 1. Introduction This case study is part of a much larger research project on trade and poverty in South Africa. The overarching project borrows from the framework developed by McCulloch, Winters and Cirera (2001) to demonstrate the different channels through which trade can impact on poverty and economic development. In particular, the project tries to measure the impact on households from lower prices and changes in production and employment in the effected industries. This is achieved by quantitative analyses as well as five sector-specific case studies. In identifying sectors for case study analysis, the project team and reference group tried to strike a balance between the likely winners and losers of trade reform. The consumer appliance sector in general, and manufacturers of small household appliances in particular, were seen as possible beneficiaries of globalisation. South Africa manufactures a diverse range of small electrical appliances and local manufacturers have won significant export contracts in the USA and Europe (AMAP 2000). The recent financial performance of these companies is impressive and their brand presence within South Africa remarkably strong. Yet the case study reveals a surprising picture. The industry has, without doubt, been a major beneficiary of globalisation. Increased international competition has forced a substantial restructuring of the domestic industry and existing suppliers have become leaner, more focused and much more profitable. -

Small Appliances and the Web: a Budding Relationship by Perry James, the NPD Group, Inc

Quarters 2 & 3, 2011 Small Appliances and The Web: A Budding Relationship By Perry James, The NPD Group, Inc. echnology and the Internet are over- whelming forces in our lives, and Tthey play an increasing role in the way consumers make purchases and pur- chase decisions. The small appliance indus- try is not immune to this trend. Eight per- cent of units, and 12 percent of dollar sales, in the 12 months ending September 2011 were purchased through online channels. More than half of small appliance con- sumers did some kind of pre-purchase prod- About Housewares MarketWatch Housewares MarketWatch reports both point-of-sale (POS) and consumer data from NPD databases. The quarterly data covers various product categories within the divisions of Small Appliances and Non-electric Housewares. The information contained on the uct research. The Internet’s role in small adopted this purchasing vehicle more for following pages is offered as a snapshot appliance sales starts well before the pur- some categories than others. Looking at of a category’s performance, both from chase, when consumers are looking for the impact of the Internet by sub-industry, the retailer (POS) and consumer information to help them decide which 41 percent of all small appliance website perspectives. The POS data covers the product is right for them. Fourteen percent sales are home environment appliances. retail channels of mass/national chains, of items sold in the 12 months ending Website sales represent nearly 10 percent of department stores, specialty stores and September 2011, and 26 percent of dollar small kitchen electrics unit sales, 8 percent drug stores (personal care and home sales, were researched online first. -

Bishop & Associates Has Just Released an Eight Chapter Report

Bishop & Associates has just released an eight chapter report covering market trends and outlooks for the Consumer Electronic Products Market. The purpose of this report is to provide: A comprehensive set of baseline numbers on consumer electronic products – in units of equipment, by region of the world, that can be used to forecast connector companies TAM/SAM in applicable connector products. Input on Consumer Electronics (CE) equipment, across official market segments that operate in the consumer space: home appliance (expanded definition), home/home-office computer equipment, and consumer electronic products. Market segment connector TAMs in dollars for regions of the world. This report includes the following consumer-oriented electronic equipment: Equipment Markets in this Report Home Entertainment Equip: Computer/ Office Equip: Home Appliance/Other Camcorders Desktop/AIO PC Continued: Compact Audio Notebook/Netbook PC Outdoor Cooking Units Digital Still Cameras Copiers Retractable Awnings VCRs Fax Machines Water Heaters DVDs Ink Jet Printers Solar Hot Water Systems Home Theatre Equipment Laser Printers Window/Portable AC MP3/Media Players Other Printers Central AC Portable Stereos Gas Boilers Radios Housewares: Oil Furnaces Satellite Radio Receivers Personal Appliances Heat Pumps Web Access devices Housewares Geothermal Systems Tape Players Well Pumps,Water Conditioning Tel Answering Devices Home Appliance/Other: Solar Elec – Private Corded Tel Receivers Trash Compactors Solar Elec – Public Cordless Tel Receivers Dishwashers Wind Energy – Private Mobile/Cell Phones Disposers Wind Energy – Public Analog CRT TV Dryers Alarm Systems Digital CRT TV Washers Smart Thermostats LCD TV Freezers Home Broadband Equipment Plasma TV Refrigerators Public Broadband/WiMax Projection TV Ranges Jacuzzis TV Combos Range Hoods Swimming Pool Equipment Bishop and Associates, Inc. -

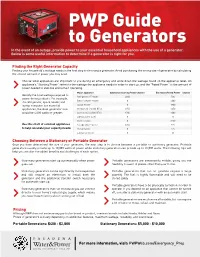

PWP Guide to Portable Generators (PDF)

Finding the Right Generator Capacity Finding your household's wattage needs is the first step to choosing a generator. Avoid purchasing the wrong size of generator by calculating the correct amount of power you may need. Choose what appliances are important to you during an emergency and write down the wattage found on the appliance label. An appliance's "Starting Power" refers to the wattage the appliance needs in order to start up, and the "Rated Power" is the amount of > power needed to stabilize and remain operating. Major Appliance Additional Starting Power (watts) Estimated Rated Power (watts) Identify the total wattage required to Ref rige rato r/Freeze r 2000 700 power those products. For example, Electric Water Heater 0 4000 if a refrigerator, space heater, and laptop computer are essential Space Heater 0 1800 > appliances, the ideal generator size Window AC [12,000 BTU) 3950 3250 would be 4,000 watts or greater. Central AC [40,000 BTU) 6700 6000 Lightbulb [75 watt) 0 75 Electric Stove 0 2100 Use this chart of common appliances Garage Door Opener 2350 875 to help calculate your capacity needs: PC Computer 0 125 Laptop Computer 0 25 Choosing Between a Stationary or Portable Generator Once you have determined the size of your generator, the next step is to choose between a portable or stationary generator. Portable generators usually provide up to 10,000 watts of power while stationary generators can provide up to 20,000 watts. The following tips will help you consider the added benefits and challenges of each option. -

20152016 Basic Appliance Repair Syllabus Fred's Appliance Academy

20152016 Basic Appliance Repair Syllabus Fred’s Appliance Academy Contact Information: Instructor: Fred Butcher Email: [email protected] Instructor: Alex Hallmark Email: [email protected] Admin: Jamie Lovejoy Email: [email protected] Phone: 4402497246 Description: At Fred's Appliance Academy, students will receive handson classroom instruction from an instructor with over 30 years experience in the appliance repair industry. The class will start with basic electrical circuitry and schematic training, followed by laundry, kitchen, and refrigeration. A variety of makes and models will be introduced to the students allowing for a complete education on appliance repair. The course wraps up with the ioAST certification exam and the NASTeC certification exam. Course Points: ● Electrical theory ● Handson experience ● Internet skills ● Schematic reading ● Proper tools ● Soft Computer Skills ● Brazing/soldering ● Troubleshooting ● Parts lookup ● Washers ● Dryers ● Refrigerators ● Dishwashers ● Microwaves ● EPA Certification ● Range hoods ● Highend product intro ● NASTeC Certification ● ioAST Certification Requirements: To successfully complete this course, it is advised that you not only pay attention in class, but take notes, and participate in the handson training sessions. While this course is designed to give you a foundation for a successful career in appliance repair, it is up to you to take the technical information learned and apply it. In order to participate in class you must have an email address that you can remotely access. Registration is open to any adult over the age of 18; students are required to be able to lift fifty (50) pounds. Students must have Type 1 608 EPA license. -

Fast Track Troubleshooting

Fast Track Troubleshooting IMPORTANT SAFETY NOTICE – “For Technicians Only” This service data sheet is intended for use by persons having electrical, electronic, and mechanical experience Model: and knowledge at a level generally considered acceptable in the appliance repair trade. SMK9175ST/XAA Any attempt to repair a major appliance may result in personal injury and property damage. The manufacturer or seller cannot be responsible, nor assume any liability for injury or damage of any kind arising from the use of this data sheet. Bulletin ASC20091027001 Fan selection issue. Publication # tsSMK9175ST Revision Date 03/21/2011 SUPPORT INFORMATION Training — Plus One http://my.plus1solutions.net/clientPortals/samsung/ Help — GSPN http://service.samsungportal.com/ Samsung Product Support TV http://support-us.samsung.com/spstv/howto.jsp Customer information videos and chat programs. Programs for Fridges, Laundry, Ranges & D/W Safety precautions WARNING: It is critical to route wires and wire harness identical to the way they were, to prevent electromagnetic interference caus- ing possible fault codes. Some semiconductor (―solid state‖) devices are easily dam- High Voltage Warning Do not attempt to aged by static electricity. Such components are called measure any of the high voltages --this includes Electrostatically Sensitive Devices (ESDs). Examples the filament voltage of the magnetron. High include integrated circuits and field-effect transistors. voltage is present during any cook cycle. Before Immediately before handling any semiconductor -

Electrical Service Requirements and Sample Load Calculations

SEISCO Product Manual — Electrical Requirements SEISCO ELECTRICAL SERVICE REQUIREMENTS & SAMPLE LOAD CALCULATIONS A. Introduction to SEISCO Electrical Requirements B. National Electric Code Rules – Load Calculations C. Sample Residential Load Calculations D. National Electric Code Rules - Branch Circuit Protection E. SEISCO Electrical Wiring & Breaker Guides F. Single and Three Phase Wiring Diagrams 1 SEISCO Product Manual — Electrical Requirements A. Introduction to Seisco Electrical Requirements The Seisco is a flow-through electric water heater that generally requires more power (kW) to operate than an electric storage tank heater. The trade-off of using more power to heat with the Seisco, only as it is needed, proves to be a better alternative to using less power while heating a storage tank heater, whether you need it or not. The energy savings associated with the flow- through (or on-demand) technology of the Seisco versus storage tank heating is discussed in the Cost Comparison section of this manual. Like most electric storage tank water heaters, the Seisco heater requires 240 volts (AC) (or 208 VAC) to operate. Several Seisco heaters require multiple double pole circuits and breakers (see the chart below for 240 volt electrical ratings and requirements). Ratings for 208 volt commercial service and 208 volt ratings can be found in the Product Description & Specification section of this manual. CHART - SEISCO ELECTRICAL RATINGS Maximum Voltage Maximum Number of Number of Circuit Circuit Seisco Power Rating Rating Current Rating Circuits Breakers Breaker Size Model (kW) (VAC) (Amps) (Two Wire) (Double Pole) (Amps) RA-9 9 240 37.5 1 1 40 RA-11 11 240 46 1 1 50 RA-14 14 240 58 2 2 30 RA-18 18 240 75 2 2 40 RA-22 22 240 91 2 2 50 RA-28 28 240 116 4 4 30 Electrical Service: The Seisco heater is considered a non-continuous heating appliance according to the definitions in the National Electric Code, sections NEC 410 and 411. -

Global Growth Trends in Small Appliance Markets Udo Jansen Global Director Small Domestic Appliances

Global Growth Trends in Small Appliance Markets Udo Jansen Global Director Small Domestic Appliances April 2018 IFA Global Press Conference © GfK April 19, 2018 | Global Growth Trends in Small Appliance Markets 1 In 2017, the global Small Appliances Market, based on NPD`s and GfK`s retail panels, reached 65.2 billion USD Small Appliances (all monitored product groups) – Global Panelmarket – 2017 . Hot beverage makers . Electric water kettles . Food preparation . Rice cookers . Toasters 65.2 . Juicers . Fun cooking . Mini ovens billion USD . Deep fryers . Barbecues . Shavers . Hair dryers . Hair stylers . Irons . Vacuum cleaners +8% . Steam Cleaner . Air treatment vs. 2016 . Electrical fans (constant currency) . Electrical heating … … and more Source: GfK- and NPD Point-of-Sale Tracking © GfK April 19, 2018 | Global Growth Trends in Small Appliance Markets 2 Innovation © GfK April 19, 2018 | Global Growth Trends in Small Appliance Markets 3 Global SDA market1 is driven by innovations and smart appliances. New products make the everyday life of consumers easier. SDA total | World Panelmarket | Sales billion € 11 32 37 Hot water dispenser 96 103 44 Personal scales with Mobile Connect. 7.1 billion 128 185 51 Foodpreparation with shredder 296 Massage mat 336 68 Espresso Full. with Mobile Connect 1.882 mn 415 Trad. filtercoffee with int. coffee grinder 477 Hybrid Groomer Window cleaner 510 Waterjet solo (Dental Care) Toothbrush Rech. with Mobile Connect. 27,7 billion 38,4 billion Slow juicers 1364 Laser/IPL hair removal Electrical cooking pots Foodpreparation with cooking function 2926 Hot Air Fryers Robot vacuum cleaners 2012 2017 Handstick rechargeable vac cleaners 1 Without U.S. -

JS Global Lifestyle (1691

4 Feb 2020 CMB International Securities | Equity Research JS Global Lifestyle (1691 HK) BUY (Initiation) Cross -selling with world-class tech and style Target Price HK$7.65 Up/Downside +48.0% Current Price HK$5.17 JS Global is the 3rd/ 2nd largest in China/ US with 8.8%/ 8.1% small appliance market share. JS global has three major brands (Joyoung, Shark and Ninja) which focus on cleaning, food preparation and cooking appliances, and generated a sales of USD 2.7bn and net profit of USD 112mn in FY18. China Home Appliance Sector Emphasis on R&D to solve consumers’ pain points. JS Global is dedicated on R&D and innovation as solving consumer pain point is a proven growth Walter Woo driver. In FY18, it spent ~USD 119mn on R&D, ~4.4% of sales (peers’ avg. is (852) 3761 8776 4.9%), and had a team of ~800, ~20% of total (peers’ avg. is 12%). We believe [email protected] recent launches: revolutionary products - 1) Multifunctional steamer S5 (2019), 2) Ninja Foodi series (2018) and evolutionary products - 3) Premium soymilk Stock Data maker K-series, 4) High-performance multifunctional blender Y88 (2019), 5) Mkt Cap (HK$ mn) 17,615 Robot vacuum Shark ION (2017) can boost growth in FY18-21E. Avg 3 mths t/o (HK$ mn) 6.80 52w High/Low (HK$) 5.95/4.69 Cross-selling in product, region, price point. Acquisition of SharkNinja in Total Issued Shares (mn) 3,407.2 2017, in our view, can unlock huge potential by leveraging existing products Source: Bloomberg and sales network, like: 1) expanding Shark & Ninja into rest of the world (e.g. -

Shimizu Town Hall Department of Public Affairs TEL: 0156–62-1151

○ Separation & Disposal Methods Due to the ① Garbage separation & disposal p. 1 ② Designated trash bags & labels p. 2 merger of the (prices and contributing stores) Tokachi Area ③ Burnable and unburnable garbage p. 3 Complex ④ Recyclable materials p. 4 Administrative (separation and disposal) Association, ⑤ Recyclable materials p. 5 from April (Used clothing/garments, small 2019 the scale appliances) ⑥ Large scale garbage disposal p. 6-8 method of Transportation of p. 9-10 disposal will household garbage to be changed. the Kuririn Center ⑦ Non-disposable & healthcare items p. 11-12 Let’s recycle correctly! ⑧ What are the 5R’s? (Do you know?) p. 13 ⑨ 4 practices for waste reduction p. 14 - 16 ○ Garbage Separation Encyclopedia SAVE Alphabetical p. 17-42 【June 2020】 Shimizu Town Hall Department of Public Affairs TEL: 0156–62-1151 p. 0 ● Reducing waste for ECO friendly living! Since April, 2003, the town of Shimizu has charged for the collection of garbage, and with the cooperation of its residents has promoted the separation and effective utilization of recyclable materials. As of April, 2019, the Shimizu office of waste management joined the Tokachi Area Complex Administrative Association and will jointly process all materials at the Kuririn Center in Obihiro. Please take note that some of the prior sorting and loading methods have changed. Furthermore, by reducing the amount of burnable and unburnable garbage, we will simultaneously create a sustainable environment while promoting the “less garbage = eco-friendly” lifestyle. Tips for an eco-friendly living have also been included, so please use them! ● Overview of recycling and disposal methods CLASSIFICATION Classification Types Example Products Burnable items Wooden products, miscellaneous paper, Burnable ① Feminine hygiene products, cat litter, pet waste, underwear, (COST: designated bag) Fish bones, shellfish, meat, produce, food waste unburnable items Glass items, tin foil, leather goods, rubber goods, etc. -

Standby and Baseload in New Zealand Houses: a Nationwide Statistically Representative Study

Standby and Baseload in New Zealand Houses: A Nationwide Statistically Representative Study Michael Camilleri, Nigel Isaacs, and Lisa French, BRANZ Ltd. ABSTRACT For the first time, a nationwide statistically representative study of standby and baseload energy consumption has been completed in New Zealand. This is based on the data collected for the Household Energy End-use Project (HEEP). The baseload of a house is the typical lowest power consumption when everything that is usually switched off is off, and was on average (112±4) W. This baseload represents the upper limit for the standby power consumption. Standby power consumption was estimated at (57±4) W, heated towel rail use at (21±2) W, and faulty refrigeration appliances (compressors always on) at (15±10) W. Some appliances with standby, and some small continuous loads that are known to be excluded, make up another (11±4) W leaving (8±12) W unaccounted. This represents a very nearly complete inventory of standby power consumption for New Zealand houses. It is unlikely that any major standby appliances are left unaccounted. Introduction Standby power is drawn by an appliance when it is not in operation but is connected to the mains. This can range from zero (e.g. a non-electronic clothes dryer) to 20 W or more (e.g. a television). These power levels may seem trivial (1 W continuous power is approximately 9 kWh per year), but since most households have many such appliances, the actual energy consumption is usually a significant fraction of the total energy consumption of a household. Standby mode is defined in the NZ standard (AS/NZ62301:2005, 2) as: The lowest power consumption mode which cannot be switched off (influenced) by the user and may persist for an indefinite time when an appliance is connected to the main electricity supply and used in accordance with the manufacturer’s instructions. -

Performance by Segment

Performance by Segment TED operates two business segments, comprising the Electronic Components Business and the Computer Networks Business. The Private Brand Business belongs to the Electronic Components Business. Electronic Components Business The Electronic Components Business handles a lineup of semiconductor products from more than 50 companies, mainly leading overseas manufacturers. Based on strengths such as technical support provided by product-specific engineers, our products are used in a wide range of final products, mainly from major appliance and electronics manufacturers. We focus efforts on the industrial equipment and automotive equipment sectors. Due to the termination of distributor agreements with one of our major business partners, Analog Devices, Inc., nearly all transactions with this company were ended in the fiscal year ended March 31, 2018. Transactions with this company by product item include general purpose IC, and by application include mainly industrial equipment, automotive equipment and communications equipment. Sales Component Ratio by Product Category (Millions of yen) 142,076 Category Main products Function Main suppliers Texas Instruments General Analog ICs ICs commonly used for a variety of Analog Devices purpose ICs Logic ICs applications NXP Semiconductors 115,018 26% ICs for image Texas Instruments / Broadcom Specialized processing Specialized ICs made for specific Pixelworks ICs ICs for communication applications Cypress Semiconductor net work inrevium (private brand) 28% NXP Semiconductors Micro