Electrolux Annual Report 2017 Shape Living for the Better Shape Living for the Better

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Repertorium 2018

Repertorium 2018 Technische voorschriften binneninstallaties Conform beveiligde toestellen Goedgekeurde beveiligingen Geattesteerde fluïda BELGISCHE FEDERATIE VOOR DE WATERSECTOR VZW BELGISCHE FEDERATIE VOOR DE WATERSECTOR VZW VOORWOORD 2018 : Conforme installaties : een noodzaak en een verplichting Belgaqua, de Belgische Federatie voor de Watersector is !er u de editie 2018 van het Repertorium met de Technische voorschriften binneninstallaties, de conform beveiligde en watertechnisch veilige toestellen, de goedgekeurde beveiligingen en gecerti!eerde "uïda van categorie 3 te presenteren. Het eerste gedeelte van deze brochure bevat de Technische Voorschriften inzake Binneninstallaties (ook private installaties genoemd), die op het openbaar waterleidingnet aangesloten zijn. Ze volgen de principes van de norm NBN EN 1717 “Bescherming tegen verontreiniging van drinkwater in waterinstallaties en algemene eisen voor inrichtingen ter voorkoming van verontreiniging door terugstroming” en van de daarin opgesomde productnormen (1). Vanaf begin 2004 werden deze Technische Voorschriften volledig opgenomen in het reglementair kader van toepassing in het Vlaamse Gewest (www.aqua"anders.be). Systematische controles van de nieuwe installaties werden ingevoerd zodat enkel de goedgekeurde installaties aan het net gekoppeld mogen worden. Gelijkaardige maatregelen zijn ook, volgens speci!eke modaliteiten, van toepassing in de andere Gewesten. Het Reglement (blz. 18) als dusdanig wordt voorafgegaan door een rijkelijk geïllustreerde educatieve voordracht over de Technische Voorschriften. Deze vervangt geenzins het reglementaire gedeelte. De afgevaardigden van de waterleidingbedrijven en de experten van Belgaqua zijn steeds beschikbaar om de essentiële regels toe te lichten. De werkbladen voor installaties en toestellen voor niet-huishoudelijk gebruik (Deel III) zijn reeds voor een groot deel herwerkt volgens de principes van de NBN EN 1717. Het secretariaat en onze experten zullen u graag adviseren. -

Study on the Competitiveness of the EU Gas Appliances Sector

Ref. Ares(2015)2495017 - 15/06/2015 Study on the Competitiveness of the EU Gas Appliances Sector Within the Framework Contract of Sectoral Competitiveness Studies – ENTR/06/054 Final Report Client: Directorate-General Enterprise & Industry Rotterdam, 11 August 2009 Disclaimer: The views and propositions expressed herein are those of the experts and do not necessarily represent any official view of the European Commission or any other organisations mentioned in the Report ECORYS SCS Group P.O. Box 4175 3006 AD Rotterdam Watermanweg 44 3067 GG Rotterdam The Netherlands T +31 (0)10 453 88 16 F +31 (0)10 453 07 68 E [email protected] W www.ecorys.com Registration no. 24316726 ECORYS Macro & Sector Policies T +31 (0)31 (0)10 453 87 53 F +31 (0)10 452 36 60 Table of contents 1 Introduction 1 2 Objectives and policy rationale 5 3 Main findings and conclusions 7 4 The gas appliances sector 11 4.1 Introduction 11 4.2 Definition 11 4.3 Overview of sub-sectors 16 4.3.1 Heating, ventilation and air conditioning (HVAC) 16 4.3.2 Domestic appliances 18 4.3.3 Fittings 20 4.4 The application of statistics 22 4.5 Statistical approach to sector and subsectors 23 5 Key characteristics of the European gas appliances sector 29 5.1 Introduction 29 5.2 Importance of the sector 30 5.2.1 Output 30 5.2.2 Employment 31 5.2.3 Demand 32 5.3 Production, employment, demand and trade within EU 33 5.3.1 Production share EU-27 output per country 33 5.3.2 Employment 39 5.3.3 Demand by Member State 41 5.3.4 Intra EU trade in GA 41 5.4 Industry structure and size distribution -

Bosch/Siemens Bauknecht Electrolux/AEG Liebherr Miele Unsachgemäßes Recycling Von Kühlgeräten – So Heizen Die Kühlsc

Unsachgemäßes Recycling von Kühlgeräten – so heizen die Kühlschrankhersteller den Klimawandel an! Bosch/Siemens Electrolux/AEG Miele 200.000 140.000 80.000 Tonnen CO2-Äquivalente Tonnen CO2-Äquivalente Tonnen CO2-Äquivalente Bauknecht Liebherr 150.000 100.000 Tonnen CO2-Äquivalente Tonnen CO2-Äquivalente Deutsche Umwelthilfe e.V. | Hackescher Markt 4 | 10178 Berlin | Thomas Fischer | Leiter Kreislaufwirtschaft | Tel.: 030 2400867-43 | [email protected] | www.duh.de So schaden die Geschäftsführer der fünf größten deutschen Kühlgerätehersteller dem Klima Deutschland hat ein Problem beim Recycling ausgedienter Kühlgeräte. Durch die unsachgemäße Entsorgung FCKW-haltiger Kühlschränke entweichen jährlich Treibhausgase, die die Atmosphäre so stark belasten wie eine Million Tonnen Kohlendioxid. Als Folge wird der Klima- wandel angeheizt und die Ozonschicht zerstört. Grund für das Entweichen großer Mengen FCKW aus alten Kühlgeräten sind mangelhafte Entsorgungspraktiken durch Recycler. Nach dem Stand der Technik müssten aus alten FCKW-haltigen Kühlgeräten mindestens 90 Prozent der enthaltenen Treibhausgase entnommen werden. Tatsächlich sind es in deutschen Recyclinganlagen aber nur 63 Prozent. Der Rest entweicht in die Umwelt. Hierfür tragen die Kühlgerätehersteller die Verantwortung, denn sie sind gesetzlich zur Entsorgung zurückgegebener Geräte verpflichtet. Die beauftragten Recycler arbeiten in Deutschland deshalb schlecht, weil die Hersteller das zulassen. Wie viel jeder der fünf großen Hersteller zur Klimaerwärmung beiträgt, hat die DUH anhand ihres geschätzten Marktanteils ermittelt. BSH Hausgeräte GmbH Vorsitzender der Geschäftsführung: Dr. Karsten Ottenberg Geschätzter Marktanteil Kühlgeräte: 20 Prozent Von der DUH geschätzter Anteil vermeidbarer Klimagas- 200.000 Tonnen CO -Äquivalente emissionen durch unsachgemäßes Kühlgeräterecycling: 2 Den konzernweiten CO -Fußabdruck zu reduzieren, ist für die BSH ein wichtiger Aussage aus dem Nachhaltigkeitsbericht: 2 Beitrag zu mehr Klimaschutz. -

FACTORY LINKS UN & PW Bertazzoni Bosch Broan Crosley Dacor

FACTORY LINKS UN & PW Alliance (Speed Queen commercial & new domestic) http://extranet.alliancels.net/ user name: [email protected] password: marcone When home page comes up, click on "Parts" at top of page. Put cursor on "Parts Connection", slide right and click on "Parts Connection Commercial". When “Parts Connection” opens, select desired box. AppliancePartsPros.com (excellent site to see a picture of a part) http://www.appliancepartspros.com/ No password needed Bertazzoni http://claimworks.servicepower.com Log in using the following user name and password combination and click “Submit”. user name: MAR54354 (case sensitive) password: bsihqopk (case sensitive) When the next screen comes up, click on “Literature” On next screen, Make sure “Bertazzoni” is selected. Select the “Service Manual” list from the “Literature Type” drop down box. Leave the “Model” box empty and then click the “Search” button. Find the Model number that you are looking for; they will only list the beginning of the models. Click on desired model to open breakdown. http://us.bertazzoni.com Bosch https://portal.bsh-partner.com/portal(bD1lbg==)/LoginFrame.htm?PORTAL_REGIONINDEX=20 user name: marcone-ct password: parts1 When page comes up, click on "Service" in the upper left corner, then click on "QuickFinder FullScreen". Then when the next window opens, insert your model in the box under "Product" and press "Enter". Broan http://parts.broan-nutone.com/broan/Shop No password needed Crosley The following refrigerator models were built by Mabe for Crosley Corp. We do not yet carry parts for Mabe. The customer will need to call Crosley at: 336.761.1212 for parts. -

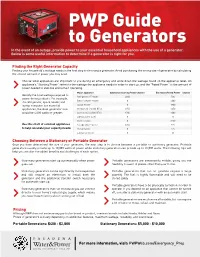

PWP Guide to Portable Generators (PDF)

Finding the Right Generator Capacity Finding your household's wattage needs is the first step to choosing a generator. Avoid purchasing the wrong size of generator by calculating the correct amount of power you may need. Choose what appliances are important to you during an emergency and write down the wattage found on the appliance label. An appliance's "Starting Power" refers to the wattage the appliance needs in order to start up, and the "Rated Power" is the amount of > power needed to stabilize and remain operating. Major Appliance Additional Starting Power (watts) Estimated Rated Power (watts) Identify the total wattage required to Ref rige rato r/Freeze r 2000 700 power those products. For example, Electric Water Heater 0 4000 if a refrigerator, space heater, and laptop computer are essential Space Heater 0 1800 > appliances, the ideal generator size Window AC [12,000 BTU) 3950 3250 would be 4,000 watts or greater. Central AC [40,000 BTU) 6700 6000 Lightbulb [75 watt) 0 75 Electric Stove 0 2100 Use this chart of common appliances Garage Door Opener 2350 875 to help calculate your capacity needs: PC Computer 0 125 Laptop Computer 0 25 Choosing Between a Stationary or Portable Generator Once you have determined the size of your generator, the next step is to choose between a portable or stationary generator. Portable generators usually provide up to 10,000 watts of power while stationary generators can provide up to 20,000 watts. The following tips will help you consider the added benefits and challenges of each option. -

Service 7000 – Leistung Aus Leidenschaft Ihr Partner Für Service Und Verkauf Sämtlicher Haushaltgeräte Aller Marken

SERVICE 7000 – LEISTUNG AUS LEIDENSCHAFT IHR PARTNER FÜR SERVICE UND VERKAUF SÄMTLICHER HAUSHALTGERÄTE ALLER MARKEN. UNSEREVON FA DERCTS VISION & FIGURESZUR WIRKLICHKEIT • Hauptsitz in +Netstal Vision: 1 Ansprechpartner für alle Haushaltgeräte • Jahrzehntelange+ mit Erfahrungder Absicht, reparieren(Gründung anstatt 1993) auszutauschen • Über 120 Mitarbeiter+ Gegründet wickeln 1993 von jährlich Martin Reithebuch mehr als 60 000 Einsätze in der ganzen Deutsch- + Hauptsitz in Netstal GL, Filialen in Gossau SG Schweiz ab + und Wangen a. d. Aare BE SH • Servicecenter in BS + 120 Mitarbeitende TG BL AG Gossau SG, JU ZH AR AI + 68‘000 EinsätzeSO pro Jahr SG Netstal GL, ZG FL LU SZ NE GL NW Martin Reithebuch, Unternehmensleiter Wangen a.A. BE OW BE UR FR GR VD TI GE VS Martin Reithebuch Unternehmensleiter 1 PARTNER FÜR ALLE MARKEN? WIE IST DAS MÖGLICH? 1970 | 50 Hersteller 1980 | 34 Hersteller 1988 | 21 Hersteller 1993 | 17 Hersteller 2013 | 7 Hersteller seit 2015 | 6 Hersteller ab 2030 | 2 Hersteller Whirlpool Whirlpool Whirlpool Whirlpool Kitchen Aid Dart & Kraft Chambers Whirlpool/ Roper Roper Bauknecht Philips Philips Whirlpool/ Ignis Philips/Bauknecht Philips/Bauknecht Bauknecht Bauknecht Bauknecht Indesit Indesit Indesit Indesit Indesit Bosch Siemens Bosch-Siemens Constructa Bosch-Siemens Bosch-Siemens Neff Constructa Balay Neff BSH BSH Gaggenau Balay Balay-Safel Balay-Safel Electrolux Gaggenau Gaggenau Gaggenau Arthur-Martin Husqvarna Vest-Frost Zanker Electrolux Granges Therma Tappan Eureka Corbero Corbero Whirlpool/ Zanussi Zanussi Bauknecht -

20152016 Basic Appliance Repair Syllabus Fred's Appliance Academy

20152016 Basic Appliance Repair Syllabus Fred’s Appliance Academy Contact Information: Instructor: Fred Butcher Email: [email protected] Instructor: Alex Hallmark Email: [email protected] Admin: Jamie Lovejoy Email: [email protected] Phone: 4402497246 Description: At Fred's Appliance Academy, students will receive handson classroom instruction from an instructor with over 30 years experience in the appliance repair industry. The class will start with basic electrical circuitry and schematic training, followed by laundry, kitchen, and refrigeration. A variety of makes and models will be introduced to the students allowing for a complete education on appliance repair. The course wraps up with the ioAST certification exam and the NASTeC certification exam. Course Points: ● Electrical theory ● Handson experience ● Internet skills ● Schematic reading ● Proper tools ● Soft Computer Skills ● Brazing/soldering ● Troubleshooting ● Parts lookup ● Washers ● Dryers ● Refrigerators ● Dishwashers ● Microwaves ● EPA Certification ● Range hoods ● Highend product intro ● NASTeC Certification ● ioAST Certification Requirements: To successfully complete this course, it is advised that you not only pay attention in class, but take notes, and participate in the handson training sessions. While this course is designed to give you a foundation for a successful career in appliance repair, it is up to you to take the technical information learned and apply it. In order to participate in class you must have an email address that you can remotely access. Registration is open to any adult over the age of 18; students are required to be able to lift fifty (50) pounds. Students must have Type 1 608 EPA license. -

02 We Are Ita.Indd

WE ARE Elica è L’elica è movimento, rotazione, strumento per avanzare. L’aria è soffi o vitale, involucro, massa impalpabile e mobile. Elica - Aria Nuova è competenza, stile, benessere. L’Aria Nuova di Elica porta con sé rinnovamento e freschezza, Prodotti per il Cooking accoglienza del nuovo, dinamismo e vitalità. Ma anche purezza di un respiro pulito e naturale e apertura verso spazi e Il Gruppo Elica nasce e si sviluppa nel settore delle cappe da cucina comportamenti ancora inesplorati e carichi di possibilità. E proprio per uso domestico, di cui oggi è leader mondiale, con una quota la capacità di muovere incontro al cambiamento, di cercare le pari al 13%. opportunità con curiosità e costanza sono le attitudini che hanno Il Gruppo progetta, produce e commercializza cappe da cucina accompagnato Elica nella sua crescita e che ancora oggi guidano ad uso domestico e, per il mercato asiatico, piani, forni e il Gruppo. sterilizzatori, sia a marchio proprio, che rappresentano il 39% dei Partendo con consapevolezza dalle proprie origini italiane e da ricavi di vendita, sia attraverso i brand dei principali produttori di un solido bagaglio di conoscenze tecniche e intuizioni estetiche, elettrodomestici e cucine, che costituiscono il 61% dei ricavi di Elica si muove con naturalezza nel mondo, portando la qualità vendita. inconfondibile del Made in Italy in un contesto industriale I prodotti a marchio proprio realizzati dal Gruppo sono mondiale. universalmente riconosciuti come oggetti unici, sia nelle forme sia Apertura, collaborazione e contaminazione di ambiti diff erenti nel contenuto tecnologico altamente innovativo. La ricercatezza sono alla base delle relazioni che Elica instaura con le persone, dei materiali insieme alla continua attenzione alla massima dentro e fuori l’azienda rendendo possibile l’impiego della migliore effi cienza e alla riduzione dei consumi assicurano la qualità del tecnologia a disposizione e il più innovativo design per realizzare prodotto fi nale. -

Fast Track Troubleshooting

Fast Track Troubleshooting IMPORTANT SAFETY NOTICE – “For Technicians Only” This service data sheet is intended for use by persons having electrical, electronic, and mechanical experience Model: and knowledge at a level generally considered acceptable in the appliance repair trade. SMK9175ST/XAA Any attempt to repair a major appliance may result in personal injury and property damage. The manufacturer or seller cannot be responsible, nor assume any liability for injury or damage of any kind arising from the use of this data sheet. Bulletin ASC20091027001 Fan selection issue. Publication # tsSMK9175ST Revision Date 03/21/2011 SUPPORT INFORMATION Training — Plus One http://my.plus1solutions.net/clientPortals/samsung/ Help — GSPN http://service.samsungportal.com/ Samsung Product Support TV http://support-us.samsung.com/spstv/howto.jsp Customer information videos and chat programs. Programs for Fridges, Laundry, Ranges & D/W Safety precautions WARNING: It is critical to route wires and wire harness identical to the way they were, to prevent electromagnetic interference caus- ing possible fault codes. Some semiconductor (―solid state‖) devices are easily dam- High Voltage Warning Do not attempt to aged by static electricity. Such components are called measure any of the high voltages --this includes Electrostatically Sensitive Devices (ESDs). Examples the filament voltage of the magnetron. High include integrated circuits and field-effect transistors. voltage is present during any cook cycle. Before Immediately before handling any semiconductor -

Press Release Stockholm, November 13, 2013

Press release Stockholm, November 13, 2013 Electrolux Capital Markets Day 2013 Electrolux today at its capital markets day presents a status update on the Group’s strategy, focusing on actions to drive profitable growth and further improve operational excellence. President and CEO Keith McLoughlin and members of senior management will hold presentations, including an in-depth view of the operations in North America. The core strategy of Electrolux is based on four pillars: profitable growth, innovation, operational excellence and people and leadership. The presentations will showcase how the strategy creates sustainable economic value, through a continuous flow of consumer-focused product innovations and through adapting the Group’s manufacturing footprint and cost structure. The program includes an overview of the current business environment and expectations for next year. Total market demand is still anticipated to be slightly positive in the fourth quarter. Market demand in 2014 is also expected to be slightly positive, with growth in North America and Asia Pacific partly offset by a flat market in Europe and a slowdown in Brazil from the high levels seen in 2013. Other factors affecting Electrolux in 2014 include a slightly positive price/mix development, with a negative price trend in Europe mitigated by a positive product mix. Cost savings will be approximately 1 billion SEK for the full year. Investments in R&D and marketing will be slightly higher than in 2013, mainly as a result of marketing costs related to product launches in Asia and higher global R&D spending. The impact on earnings from raw material costs is estimated to be roughly flat. -

Gestione Di Diversi International Manufacturing Network Per Diverse Product Line Evidenze Empiriche Da Un Caso Studio Multiplo Nel Settore Degli Elettrodomestici

UNIVERSITÀ DEGLI STUDI DI UDINE Dottorato di Ricerca in Ingegneria Industriale e dell’Informazione Ciclo XXIV Dipartimento di Ingegneria Elettrica, Gestionale e Meccanica Tesi di Dottorato di Ricerca Gestione di diversi international manufacturing network per diverse product line Evidenze empiriche da un caso studio multiplo nel settore degli elettrodomestici Dottorando: Michela Parussini Relatore: Chiar.mo Prof. Ing. Alberto Felice De Toni Anno Accademico 2011/12 INDICE INDICE DELLE FIGURE .............................................................................................. V INDICE DELLE TABELLE.......................................................................................... IX SINTESI DELLA RICERCA ........................................................................................ XI RESEARCH ABSTRACT .......................................................................................... XIII INTRODUZIONE ....................................................................................................... XV PARTE I - ANALISI DELLA LETTERATURA ......................................................... 1 INTRODUZIONE ALL’ANALISI DELLA LETTERATURA ........................................ 3 1 ORIGINI ED EVOLUZIONE DELLA LETTERATURA SUGLI INTERNATIONAL MANUFACTURING NETWORK .................................................. 7 1.1 DA INTERNATIONAL BUSINESS A INTERNATIONAL MANUFACTURING .................................................................................................. 7 1.2 DALL’INTERNATIONAL MANUFACTURING -

June 2021 Refrigerators.Pdf

CEE Super Efficient Home Appliances Initiative Refrigerator Qualifying Product List June 15, 2021 The list is updated monthly. See the CEE website (www.cee1.org) for the most recent listing. This list based on the 2014 CEE Residential Refrigerator Specification. Key • Asterisks(*) indicate that a coding variable may be used in place of the asterisks to indicate a color or feature that does not affect efficiency • Red italics indicate that a product has been discontinued. Discontinued models are no longer manufactured, but may still be available in the marketplace. • Blue italics indicate a US-only model. • Green italics indicate a Canada-only model. • Orange italics indicate an icemaker ready model. The listed model information reflects the model's performance without an automatic icemaker installed. Please click here for a list of models which meet Tier 1 specifications Please click here for a list of models which meet Tier 2 specifications Please click here for a list of models which meet Tier 3 specifications How this list is generated: Manufacturers submit energy use data to CEE for each model as determined by test procedures set by the US Department of Energy. Models are placed in the tier appropriate to their energy use. Tier eligibility is determined by calculating the percentage of product performance over the Federal Standard, rounded to the nearest whole percent. CEE does not verify manufacturer data, but does require manufacturers to submit data consistent with what they report to the US Department of Energy. Based on the increased scrutiny by the US Department of Energy and certification and verification process implemented by the US Environmental Protection Agency, you may wish to cross-reference the models listed against the ENERGY STAR® qualified product list.