Brands Pin Success, Goals on Finding Right Niche

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brückenschlag in Der Krise Finden Investoren Und Immobilienmanager Zueinander Inhalt Zur Sache

Ausgabe 1 | 2010 RAUM mehr Das Immobilienmagazin von Union Investment Zuversicht US-Markt steht vor der Wende Lichtblick Nachhaltige Energiekonzepte Brückenschlag In der Krise finden Investoren und Immobilienmanager zueinander INHALT ZUR SACHE TITEL Wer seinen Immobi- Plädoyer für eine weltweite ökosoziale Marktwirtschaft lienbestand in 4 Ein hartes Stück Arbeit Die Branche besinnt sich wieder von Franz Josef Radermacher Schuss hält, punktet auf die bewährten Instrumente des Immobiliengeschäfts auch in schwierigen Zeiten. Seite 4 7 Interview Hanspeter Gondring, Studienleiter an der Dualen Hochschule Baden-Württemberg, Stuttgart 9 Studie Immobilien-Investitionsklimaindex von Union Investment steigt erneut ie Welt befindet sich in einer extrem schwierigen Situation. Als Allerdings reicht technischer Fortschritt alleine nicht. Parallel müssen Folge der wirtschaftlichen Globalisierung sieht sich das welt- gesellschaftliche Innovationen durchgesetzt werden, um die Nutzung MÄRKTE Dökonomische System in einem Prozess zunehmender Entfesse- von Ressourcen sinnvoll zu begrenzen. Dies ist heute ein Thema der 10 US-Markt Investoren beurteilen die Märkte New York, lung und Entgrenzung. Vor allem das rasche Bevölkerungswachstum Global Governance. Das bedeutet, es müssen gleichzeitig zwei For- Chicago, Seattle und Washington weiterhin unterschiedlich hin zu zehn Milliarden Menschen und das wirtschaftliche Aufholen men von Innovationen verfolgt werden: diejenige im Bereich Technik, 14 Budgethotels Preiswerte Anbieter profitieren von der Krise großer Schwellenländer wie China, Indien und Brasilien stellen unter Design und neue Materialien und diejenige im Bereich Governance, Umwelt- und Ressourcenaspekten eine gigantische Herausforderung also der Gestaltung politisch-gesellschaftlicher Strukturen. Gelingt PORTFOLIO dar. Angesichts hoher CO2-Emissionen droht womöglich schon bald es, beide in einer klugen Zukunftsstrategie zu verknüpfen, gibt es 18 Institutionelle Investoren Versicherungen und Versorgungs- die Klimakatastrophe. -

Quarterly Newsletter – Q2 2014

30 Warwick Street London W1B 5NH www.jll.com/hospitality EMEA Quarterly Newsletter – Q2 2014 Industry Trends • According to the World Travel & Tourism Council (WTTC), demand for international tourism remained strong in the first four months of 2014. International tourism arrivals grew 5%, the same rate as full year 2013. Prospects for the current peak tourism season remain very positive with over 450 million tourists expected to travel abroad in the May-August 2014 period. • Destinations worldwide received 317 million international overnight visitors between January and April 2014, 14 million more than in the same period of 2013. This 5% growth consolidates the strong increase registered for 2013 and is well above the long-term trend projected by the UNWTO for the period of 2010-2020 (3.8%). • The strongest growth was seen in Asia and the Pacific and the Americas (both up 6%), followed closely by Europe and Africa (up 5%). By sub-region, Northern Europe, South and Mediterranean Europe, North Africa and South Asia (all up 8%) were the star performers. • In terms of tourism expenditure, growth continues to be strong from emerging markets, in particular China, the Russian Federation, Saudi Arabia and India. Furthermore, demand from advanced economies is strengthening as the global economic situation gradually improves, with encouraging growth posted for Italy, Australia, the Republic of Korea, the Netherlands, Norway and Sweden. • According to the UNWTO confidence index, prospects remain very positive for the period May- August 2014. Confidence has picked up, particularly among the private sector, and improved further in Europe, the Americas, Asia and the Pacific and the Middle East. -

Hotel Membership Programs Reviewed

HOTEL MEMBERSHIP PROGRAMS OVERVIEW All information is subject to change and should be verified on the actual hotel website. The information featured below is for reference only. M ARRIOTT H OTELS HOTEL CHAIN MEMBERSHIP NAME MEMBERSHIP BENEFITS Marriott Conference Centers Exclusive Offers and Rates Renaissance Hotels No Black out dates on Rewards Stays JW Marriott Marriott Rewards Personal Preferences on File for all Hotels Edition Dedicated Customer Service Line Redemption efolio - Receipts by email Autograph Collection Priority check-in Courtyard AC Hotels For complete details, terms and more info click the Residence Inn Marriott Rewards link. Fairfield Inn & Suites TownePlace Suites Springhill Suites Marriott Vacation Club Ritz Carlton Hotels Ritz Carlton Destination Club ExecuStay Marriott Executive Apts Grand Residences H I L T O N W ORLDWIDE HOTEL CHAIN MEMBERSHIP NAME MEMBERSHIP BENEFITS Hilton Expedited Check-in DoubleTree Dedicated Reservations Service Embassy Suites HHonors Worldwide Hotel and Airlines points every stay Hilton Garden Inn Free weekday newspaper Honors Guest Manager for Special Requests Homewood Suites Redemption efolio - Receipts by email Hampton Online reward Reservations Hilton International Exclusive Offers and Rates Conrad Hotels Home2 For complete details, terms and more info click the Hilton Grand Vacations HHonors Worldwide link. Waldorf Astoria C H O I C E H OTELS HOTEL CHAIN MEMBERSHIP NAME MEMBERSHIP BENEFITS Comfort Inn Express reservations and check-in Comfort Suites Extended check-out (up to 2 hrs past standard) Quality Hotel Choice Privileges Free high-speed Internet (excl. Rodeway Inn) Free Sleep Inn long distance access (excl. Rodeway Inn) Complimentary newspaper (excl. Suburban) Clarion Hotel Cambria Suites For complete details, terms and more info click the MainStay Suites Choice Privileges link. -

2018 Hotel Brand Reputation Rankings: USA & Canada

REPORT 2018 Hotel Brand Reputation Rankings: USA & Canada October 2018 INDEX Introduction 4 Methodology 6 The Importance of Brand Reputation 7 Key Data Points: All Chain Scales 8 Key Findings 9 Summary of Top Performers 10 ECONOMY BRANDS Overview 13 Top 25 Branded Economy Hotels 14 Economy Brand Ranking 15 Economy Brand Ranking by Improvement 16 Economy Brand Ranking by Service 17 Economy Brand Ranking by Value 18 Economy Brand Ranking by Rooms 19 Economy Brand Ranking by Cleanliness 20 Review Sources: Economy Brands 21 Country Indexes: Economy Brands 22 Response Rates: Economy Brands 22 Semantic Mentions: Economy Brands 23 MIDSCALE BRANDS Overview 24 Top 25 Branded Midscale Hotels 25 Midscale Brand Ranking 26 Midscale Brand Ranking by Improvement 27 Midscale Brand Ranking by Service 28 Midscale Brand Ranking by Value 29 Midscale Brand Ranking by Rooms 30 Midscale Brand Ranking by Cleanliness 31 Review Sources: Midscale Brands 32 Country Indexes: Midscale Brands 33 Response Rates: Midscale Brands 33 Semantic Mentions: Midscale Brands 34 UPPER MIDSCALE BRANDS Overview 35 Top 25 Branded Upper Midscale Hotels 36 Upper Midscale Brand Ranking 37 Upper Midscale Brand Ranking by Improvement 38 Upper Midscale Brand Ranking by Service 39 Upper Midscale Brand Ranking by Value 40 Upper Midscale Brand Ranking by Rooms 41 Upper Midscale Brand Ranking by Cleanliness 42 Review Sources: Upper Midscale Brands 43 Country Indexes: Upper Midscale Brands 44 Response Rates: Upper Midscale Brands 44 Semantic Mentions: Upper Midscale Brands 45 Index www.reviewpro.com -

Regno Unito Regno Unito

REGNO UNITO PROFILO DEL MERCATO TURISTICO 2007 REGNO UNITO Profilo del mercato turistico 2007 1. PROFILO DI SINTESI PROFILO ECONOMICO UK • Popolazione: (Stima a metà 2006): 60.6 milioni • Popolazione con maggiore capacita’ di spesa (Sud Est/Londra) • Tasso di crescita del PIL: 2,7% (2006) • Tasso di disoccupazione: 5,5% (marzo 2007) • Tasso di inflazione: 1,8% (Settembre 2007) – Target 2%. • Salario medio annuale: £24,301 VIE DI ACCESSO • Per l’Italia non e’ richiesto alcun visto • 22 Aeroporti britannici sono collegati con l’Italia • Nel 2006 3.073.000 visitatori britannici si sono recati in Italia in aereo • Incrementano coloro che vanno in Italia via mare da 163.000 a 251.000 (+54%). IL MERCATO TURISTICO IN GENERALE 2006 • Outbound 2006: 69.5 milioni di visitatori britannici all’estero (+4,6%) di cui 55.2 mil. in Europa (79,4%) • La spesa totale per turismo e’ stata di £34.411.000 (+7%) di cui £21.344 mil. in Europa. • La spesa media per vacanza e’ stata di £495. DINAMICHE DEL MERCATO TURISTICO • Nel 2006 45.287.000 sono stati i viaggi per vacanza di cui 18.951 mil. i pacchetti tutto compreso e 26.336 mil. i viaggi indipendenti. I viaggi per affari sono stati pari a 9.102 mil. e le visite a parenti e amici 11.963 mil. I restanti 3.184 mil costituiscono il mercato di nicchia. • L’affluenza maggiore in Italia (2006) si e’ registrata nel trimestre Luglio- Settembre. I FLUSSI VERSO L’ITALIA E LA CONCORRENZA • Dati Ufficio Statistica UK : nel 2006 l’Italia e’ la quinta destinazione preferita con una quota di mercato pari al 4,8% con 3.380.000 mil. -

Hotel News April 2015

Hotel News April 2015 Featured statistics and trends New hotel openings Development activity Precis Properties has opened the 269-bed M by Montcalm IHG has announced the signing of a 121-bed Hotel Indigo in Shoreditch London Tech City, Hackney's largest and first 5- Bath, which is expected to open in late 2016. The hotel will star hotel. The 23-storey property is located opposite Moor- be rebranded from two hotels on South Parade - the Halcyon fields Eye Hospital close to Old Street station and features and Pratt's - and will be operated under franchise by St conference facilities for 250 delegates and a Spa. James's Hotel Group, part of Somerston Group. Marshall CDP has opened the 5-star 60-bed Hotel Gotham, MDL Marinas is about to commence construction of its Manchester. Bespoke Hotels will manage the hotel, which mixed-use Ocean Village waterfront development in South- includes a Private Members Bar and occupies the top seven ampton, which is scheduled to complete in June 2017. The floors of a Grade II former bank building at 100 King Street. scheme comprises three residential buildings and a 5-star 76- bed hotel that will be operated by Harbour Hotels. Heights Hospitality Operations Ltd has opened the 95- bed Temple Bar Inn on Fleet Street, Dublin 2. The 5-storey Watkin Jones Group has submitted major mixed-use plans to hotel was converted from former ESB offices by BHA Con- develop three sites in Bournemouth. The plots around Christ- struction and features twin, double, triple and quadruple church Road include 930 student bedrooms, 245,000 sq ft of rooms designed by Duignan Dooley Architects. -

City of Edinburgh Hotel Development Schedule 2019

City of Edinburgh Hotel Development Schedule 2019 Planning, City of Edinburgh Council, March 2020 Contents Commentary Graph 1 - Hotel developments in Edinburgh 2019 Graph 2 - Historic trends Summary of hotel developments (no. of rooms) by area Table 1 - Schedule of developments completed in 2019 Table 2 - Schedule of developments under construction at year end 2019 Table 3 - Schedule of developments that gained planning consent in 2019 Table 3a - Schedule of other developments with planning consent at year end 2019 Table 4 - Schedule of developments awaiting planning determination at year end 2019 Table 5 - Schedule of closures occurring in 2019 Explanatory notes Whilst reasonable efforts have been made to verify the information in this report, the City of Edinburgh Council are unable to provide an assurance as to the accuracy, currency or comprehensiveness of tables and commentary. Users should undertake their own checks before using the data in this report as an input to policy or investment decisions. This schedule has been prepared by Planning, City of Edinburgh Council. contact: Simon Antrobus ([email protected], 0131-469-3597) Commentary Development summary Market analysis This is the thirteenth hotel schedule to be produced by the City of Edinburgh Council. It has been developed in response to the The hotel sector in Edinburgh continues to display strong signs of growing demand for hotel space in the city and the consequent growth. There was planning consent for 1,530 rooms at the end of increase in hotel planning applications and developments. The 2019. Occupancy levels for the year decreased slightly from 83.6% schedule details completions, properties under construction, to 82.9%. -

Hilton Worldwide Holdings Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-36243 Hilton Worldwide Holdings Inc. (Exact name of registrant as specified in its charter) Delaware 27-4384691 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 7930 Jones Branch Drive, Suite 1100, McLean, VA 22102 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code: (703) 883-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol(s) Name of each exchange on which registered Common Stock, $0.01 par value per share HLT New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Overview: What's So Special About Hilton Brands?

Overview: What’s so Special About Hilton Brands? With 13 brands in its portfolio, Hilton surely has a lot to offer – to everyone. Perfectly tailored to meet each customer’s needs, every single Hilton brand is unique in its own way. So, how do you know which hotel is right for you? Instead of clicking around (what Hilton clearly doesn’t want you to do), keep reading to see what makes each Hilton brand stand out. 1. Canopy by Hilton Canopy hotels are excellent. They combine outstanding service, great design and local experience to deliver the ultimate. At Canopy, each guest receives a welcome gift, and enjoys free Wi-Fi. Wine, beer, and spirit tastings at the bar are on the house, which is a great opportunity for guests to relax, talk, and sample local flavors. Rooms at Canopy are remarkably beautiful – and you even get filtered fresh water, at no extra costs. Breakfast, bathrobes, and special extras are all included. People say that breakfast at the Canopy by Hilton Reykjavik City Centre is the most delicious they’ve ever had. More properties coming soon, so get set! 2. Conrad Hotels & Resorts When you book your stay at a Conrad hotel, you get to choose one out of four bathroom amenities, which include high-quality lines of products, such as essential oils, vegan hair care products, soaps, and after-shave skincare collection. You can also pick your pillow that will guarantee a better sleep, even if you usually have problems falling asleep, you prefer a firmer support, or like to sleep on a side. -

List of Green Hotels and Event Venues

BCA List of Green Hotels S/N Project Name Awards Postal Code 1 Amara Sanctuary Resort Sentosa Platinum 099394 2 Carlton City Hotel Singapore Platinum 078862 3 Copthorne King's Hotel Platinum 169632 4Courtyard Singapore Novena Platinum 329568 5 Furama City Centre Platinum 059804 6 Furama RiverFront, Singapore Platinum 169633 7 Genting Hotel Jurong Platinum 608516 8 Grand Copthorne Waterfront Hotel Platinum 169663 9 Grand Park City Hall Hotel Platinum 179809 10 Great World Serviced Apartments Platinum 239404 11 Holiday Inn Express (88 East Coast Road) Platinum 423371 12 Holiday Inn Express Singapore Orchard Road Platinum 229921 13 Holiday Inn Express, Clarke Quay Platinum 059573 14 Hotel Boss Platinum 199020 15 Hotel Indigo Singapore Katong Platinum 428788 16 Hotel Jen Orchardgateway Platinum 238858 17 ibis Singapore Novena Platinum 329543 18 JW Marriott Hotel Singapore South Beach Platinum 189763 19 King's Centre Platinum 169662 20 M Social Hotel Platinum 238259 21 Marina Bay Sands Platinum 018956 22 One Farrer Hotel & Spa Platinum 217562 23 PARKROYAL on Kitchener Platinum 208533 24 PARKROYAL on Pickering Platinum 058289 25 Sheraton Towers Singapore Hotel Platinum 228230 26 Sofitel Singapore City Centre (Tanjong Pagar Centre) Platinum 078885 27 Sofitel So Singapore Platinum 068876 28 Swissotel Merchant Court, Singapore Platinum 058281 29 The Singapore EDITION hotel (Boulevard 88) Platinum 248651 30 Treetops Executive Residences Platinum 258355 31 Village Hotel Albert Court Platinum 189971 32 W Singapore Sentosa Cove Platinum 098374 PLUS -

Hotels Near CHLA.Pdf

Travelodge Hollywood – Vermont/Sunset Hollywood Hotel 1401 North Vermont Ave. 1160 North Vermont Ave. Hollywood, CA 90027 Hollywood, CA 90029 Distance from CHLA: 0.2 miles Distance from CHLA: 0.5 miles Super 8 Motel The Dixie Hollywood Hotel 1536 North Western Ave. 5410 Hollywood Blvd. Hollywood, CA 90027 Hollywood, CA 90027 Distance from CHLA: 1.1 miles Distance from CHLA: 1.1 miles Rodeway Inn Hollywood Best Western Hollywood Hills Hotel 6826 Sunset Blvd. 6141 Franklin Ave. Hollywood, CA 90028 Hollywood, CA 90028 Distance from CHLA: 2.8 miles Distance from CHLA: 2.3 miles Dunes Inn Hilton Garden Inn Los Angeles/Hollywood 5625 Sunset Blvd. 2005 North Highland Ave. Hollywood, CA 90028 Los Angeles, CA 90068 Distance from CHLA: 1.3 miles Distance from CHLA: 3.2 miles Hollywood Downtowner Inn BLVD Hotel & Suites 5601 Hollywood Blvd. 2010 North Highland Ave. Los Angeles, CA 90028 Hollywood, CA 90068 Distance from CHLA: 1.4 miles Distance from CHLA: 3.3 miles Comfort Inn Best Western Holiday Plaza Inn 7051 Sunset Blvd. 2011 North Highland Ave. Los Angeles, CA 90028 Hollywood, CA 90068 Distance from CHLA: 3.0 miles Distance from CHLA: 3.3 miles Quality Inn Hollywood Hilton North Glendale 1520 North La Brea Ave. 100 West Glenoaks Blvd. Hollywood, CA 90028 Glendale, CA 91202 Distance from CHLA: 3.1 miles Distance from CHLA: 6.4 miles Hollywood Orchid Suites Residence Inn Burbank 1753 North Orchid Ave. 321 South First St. Los Angeles, CA 90028 Burbank, CA 91502 Distance from CHLA: 3.4 miles Distance from CHLA: 7.4 miles Discount Code: C9H Los Angeles Marriott Burbank Airport 2500 North Hollywood Way Burbank, CA 91505 Distance from CHLA: 9.4 miles Roosevelt Hotel 7000 Hollywood Blvd. -

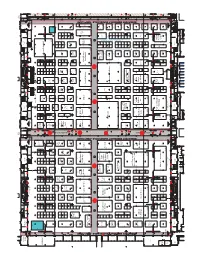

Page 1 E N TR a N C E SERVIC E CORRID O R END END END END

END END END END AED EE PLUMBING EE EMERG. RECORDING EE VESTIBULE EMERG. CONTROL STORAGE ROOM STORAGE ELEC. ELEC. ROOM SWITCHGEAR LOADING SWITCHGEAR IDF SWITCHGEAR SWITCHGEAR PLUMBING ROOM ROOM ROOM OFFICE ELEV. ELEV. OFFICE ELEV. ELEV. ELEV. DOCKS ROOM CONT. FP ELEV. IDF IDF J.C. IDF MACHINE MACHINE MACHINE J.C. MACHINE STG. FE MACHINE IDF STRG. MACHINE RM. ROOM ROOM ROOM ROOM ROOM ROOM FP EE AED FP FE AED FP AED FE FE OFFICE OFFICE OFFICE OFFICE ELECTRICAL ELECTRICAL (3Mx4M) (3Mx4M) (3Mx4M) (3Mx4M) ELECTRICAL 35'-9" CEILING HEIGHT STORAGE EMERGENCY EMERGENCY STORAGE STORAGE EMERGENCY EMERGENCY EXIT EXIT EXIT EXIT 30' N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 32'-4" 45 45 45 45 45 45 45 45 45 45 45 45 19'-8" 19'-8" A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 20'A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 A1 60' B1 A1 B1 * 35'-9" CEILING HEIGHT 11'-6" 40' 20' WallyPark **Flyte Tyme 2284 2185 2184 2085 2084 1985 1984 1885 1884 1785 1784 1685 1684 1585 1584 1485 Worldwide 1284 1185 1184 1085 984 885 884 785 784 685 684 585 30' Transportation B1 20' 20' A1 Icelandair 10' STORAGE 2283 EXPO LOUNGE 2282 2183 2182 2083 2082 1983 1982 1883 1882 1783 1782 1683 1682 1583 1582 1483 1383 1283 1282 1183 1182 1083 982 883 782 683 682 583 20' 60' A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 A1 A1 B1 A1 B1 A1 B1 A1 B1 A1FocusPointB1 Int'l A1 B1 FE FE FE FE FE FE FE 20' FE FE 10' 10' 10' 10' 10' 10' 2280 2181 2180 2080 1981 1980 1881 1880 1780 1681 1680 1581 1580 1180 1081 981 980 780 681 680 20' Taj AirMed 20' 20' 10' 10' Hotels, Int'l The 10' 2278 2179 2178 2079 2078 1979 1978