Page 1 E N TR a N C E SERVIC E CORRID O R END END END END

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RUSSIA and CIS a Team That Will Deliver More

HOSPITALITY AND LEISURE IN RUSSIA and CIS A teaM that Will deliVer More The DLA Piper’s Russian Hospitality & Leisure team works with the majority of international operators and many owners of internationally branded hotels in Russia and the CIS. We help you overcome the many unique challenges you will face with your hotel project across all areas of law. Partner Scott Antel, who heads our Russian/CIS Hospitality Practice was awarded the 2012 Leadership Award at the Russian Hotel Investment Forum for contribution to the hotel industry. Combining legal expertise, sector experience and knowledge of the Russian market “street” realities, we offer pragmatic solution. Our team advises Russian owner/developer clients on how the international hotel management structure works, what are best practice and key points to focus on in negotiations. From working with both owners and operators, we know the key commercial points of concern, as well as the negotiating boundaries both parties may usually allow. We can save you time and money by focusing on the key elements in negotiations. We have built a reputation for getting deals done timely and efficiently. In addition to advising on legal aspects of hotel management, our team is also active in such areas of hospitality and leisure as advising on legal aspects of design and management of golf courses, ski resorts, spa and restaurants, and on large-scale event/catering contracts. We also have represented both buyers and sellers on numerous hotel acquisitions and have structured and represented parties to multiple hotel development joint venture agreements. 02 | Hospitality and Leisure in Russia and CIS Our GloBal presence With more than 200 lawyers throughout our worldwide offices, DLA Piper’s global Hospitality & Leisure group advises owners, managers, franchisors, developers and lenders with respect to hotels and other hospitality and leisure businesses around the world. -

The Future of Guest Experience by Samantha Shankman

The Future of Guest Experience By Samantha Shankman Interviews with CEOs Skift Books of the world’s top hotel brands 2015 The Future of Guest Experience By Samantha Shankman with Greg Oates and Jason Clampet Skift Books 2015 The Future of Guest Experience By SAMANTHA SHANKMAN with GREG OATES, JASON CLAMPET AND SKIFT Published in 2015 by SKIFT 115 W. 30th St. Suite 1213 New York, NY 10001 USA On the web: skif.com Please send feedback to [email protected] Publisher: Skif Editor: Jason Clampet Copyright © 2015 Skif All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher 4 Table of Contents The Global Chains Luxury and Lifestyle Brands Craig Reid Auberge Resorts Frits van Paasschen J. Allen Smith 69 Starwood Four Seasons 8 41 Niki Leondakis Commune Hotels Christopher Nassetta Greg Dogan 72 Hilton Worldwide Shangri-La Hotels & Resorts 12 45 Insights: Kimpton and the Rise of Boutique Hotels Arne Sorenson Nicholas Clayton 75 Marriott International Jumeirah 16 47 Jason Pomeranc SIXTY Hotels Insights: Georgetown Herve Humler 76 University Rethinks Ritz-Carlton Executive Training 50 Brooke Barrett 19 Denihan Hospitality Group Sonia Cheng 79 David Kong Rosewood Hotel Group Best Western International 52 Larry Korman 21 AKA Insights: Luxury Hospitality 81 Mark Hoplamazian Returns to the Human Hyatt Hotels Element Insights: How Alex 24 54 Calderwood’s -

Quarterly Newsletter – Q2 2014

30 Warwick Street London W1B 5NH www.jll.com/hospitality EMEA Quarterly Newsletter – Q2 2014 Industry Trends • According to the World Travel & Tourism Council (WTTC), demand for international tourism remained strong in the first four months of 2014. International tourism arrivals grew 5%, the same rate as full year 2013. Prospects for the current peak tourism season remain very positive with over 450 million tourists expected to travel abroad in the May-August 2014 period. • Destinations worldwide received 317 million international overnight visitors between January and April 2014, 14 million more than in the same period of 2013. This 5% growth consolidates the strong increase registered for 2013 and is well above the long-term trend projected by the UNWTO for the period of 2010-2020 (3.8%). • The strongest growth was seen in Asia and the Pacific and the Americas (both up 6%), followed closely by Europe and Africa (up 5%). By sub-region, Northern Europe, South and Mediterranean Europe, North Africa and South Asia (all up 8%) were the star performers. • In terms of tourism expenditure, growth continues to be strong from emerging markets, in particular China, the Russian Federation, Saudi Arabia and India. Furthermore, demand from advanced economies is strengthening as the global economic situation gradually improves, with encouraging growth posted for Italy, Australia, the Republic of Korea, the Netherlands, Norway and Sweden. • According to the UNWTO confidence index, prospects remain very positive for the period May- August 2014. Confidence has picked up, particularly among the private sector, and improved further in Europe, the Americas, Asia and the Pacific and the Middle East. -

City of Edinburgh Hotel Development Schedule 2019

City of Edinburgh Hotel Development Schedule 2019 Planning, City of Edinburgh Council, March 2020 Contents Commentary Graph 1 - Hotel developments in Edinburgh 2019 Graph 2 - Historic trends Summary of hotel developments (no. of rooms) by area Table 1 - Schedule of developments completed in 2019 Table 2 - Schedule of developments under construction at year end 2019 Table 3 - Schedule of developments that gained planning consent in 2019 Table 3a - Schedule of other developments with planning consent at year end 2019 Table 4 - Schedule of developments awaiting planning determination at year end 2019 Table 5 - Schedule of closures occurring in 2019 Explanatory notes Whilst reasonable efforts have been made to verify the information in this report, the City of Edinburgh Council are unable to provide an assurance as to the accuracy, currency or comprehensiveness of tables and commentary. Users should undertake their own checks before using the data in this report as an input to policy or investment decisions. This schedule has been prepared by Planning, City of Edinburgh Council. contact: Simon Antrobus ([email protected], 0131-469-3597) Commentary Development summary Market analysis This is the thirteenth hotel schedule to be produced by the City of Edinburgh Council. It has been developed in response to the The hotel sector in Edinburgh continues to display strong signs of growing demand for hotel space in the city and the consequent growth. There was planning consent for 1,530 rooms at the end of increase in hotel planning applications and developments. The 2019. Occupancy levels for the year decreased slightly from 83.6% schedule details completions, properties under construction, to 82.9%. -

Speaker Biographies Conference Producer and Co-Founder

SPEAKER BIOGRAPHIES CONFERENCE PRODUCER AND CO-FOUNDER HARRY JAVER President - The Conference Bureau, Inc. Harry Javer is the founder and president of The Conference Bureau. In 1994, Harry created and co-founded The Lodging Conference, which is now in its 21st year. Harry is the current chairman of the AH&LEF Fund Development Committee, which is responsible for overseeing the Annual Giving Campaign. The Lodging Conference has sponsored AH&LEF scholarship recipients to attend the conference for the last 13 years. With 34 years of experience creating and running conferences, seminars, concerts and tradeshows, Harry has produced events featuring such notables as: Al Gore, Rudy Giuliani, Sir Richard Branson, Bishop Desmond Tutu, Donald Trump, Pete Peterson, Bono, Charlton Heston, Anthony Robbins, Magic Johnson, Deepak Chopra, Jerry Lewis, Joe Torre, George Foreman, Kareem Abdul-Jabbar, Joe Montana, and thousands of America’s corporate leaders. Harry is an advisor to some of the nation’s leading live event companies including One Day University, and The Learning Annex. The Conference Bureau has also co-produced the Rock N’ Roll Fantasy Camp. A graduate of Stony Brook University, Harry resides in New York City with his wife Elizabeth and son Jack. SPEAKER BIOGRAPHIES MATTHEW D. AHO Consultant - Akerman LLP Matthew Aho helps clients identify and pursue opportunities at the nexus of Cuba policy and business. During his years at the Council of the Americas, the Western Hemisphere’s premiere business membership organization, Matthew led efforts to unite senior executives of select-Fortune 500 companies with officials from the U.S. departments of State, Commerce, Treasury, and the National Security Council to discuss topics including financial services, telecommunications, energy, pharmaceuticals, hospitality, and agriculture. -

Bristol Accommodation Please Find Below Details Of

Bristol Accommodation Please find below details of hotels all within walking distance (except two) of the University of Bristol conference venue for the Computing in High Energy Physics Conference 2009. All rates quoted and the number of bedrooms are at 2006 rates and availability. We have also listed two hotels which are due to be completed by 2007; Bristol MacDonald and IBIS Hotels The Thistle Hotel Description - 4 Star Hotel located a 15-minute walk from venue Availability – Total of 182 rooms in Hotel Rates - £105.00 Inc VAT for a single occupancy room on a bed & breakfast rate Website - www.thistlehotels.com/bristol The Jurys Inn Description – 4 Star Hotel located a 15-minute walk from venue Availability – Total of 192 rooms in Hotel Rates - £120.00 Inc VAT for a single occupancy room on a bed & breakfast rate Website - www.jurysdoyle.com The Marriott Bristol Royal Description – 4 Star Hotel located a 10-minute walk from venue Availability – Total of 242 rooms in Hotel Rates - £140.00 Inc VAT for a single occupancy room on a bed & breakfast rate Website - www.marriott.co.uk The Marriott Bristol City Centre Description – 4 Star Hotel located a 10-minute car journey from venue Availability – Total of 300 rooms in Hotel Rates - £130.00 Inc VAT for a single occupancy room on a bed & breakfast rate Website – www.marriott.co.uk Novotel Description – 3 Star Hotel located a 10-minute car journey from venue Availability – Total of 131 rooms in the Hotel Rates - £95.00 Inc VAT for a single occupancy room on a bed & breakfast rate Website – -

American Hotel & Lodging Educational Foundation

American Hotel & Lodging Educational Foundation 2016 ANNUAL REPORT A Review of AHLEF’s Accomplishments OPENING DOORS TO OPPORTUNITY As the pledged contributions come in over the next five years, those RAISED $8 MILLION funds will have a real, positive impact on the Foundation’s scholarship, research and workforce development programs for many years to come. In the interim, our programs are already setting precedents. In 2016, the A Message from Foundation distributed approximately $1.45 million toward scholarships, AHLEF Chair Minaz Abji and educational programming, workforce development, cutting-edge President Joori Jeon research projects and grants. A record $849,500 was awarded in academic scholarships to 383 promising hospitality management students. We want to take this opportunity to reflect upon last year’s accomplishments Eight grants were funded to educate the public in areas such as lodging and look ahead to continuing this momentum, but first and foremost, tax rates, the beneficial impact hotels have on communities, and short- we would like to acknowledge we could not have done it without you. term online rentals. One of our biggest accomplishments was funding the AHLEF is funded solely from voluntary gifts, which are above and beyond first-ever economic impact analysis of the U.S. hotel industry, which showed association dues. Thanks to your generosity, countless lives have been that hotels support 8 million jobs, add $590 billion to the U.S. economy, changed. We are grateful for every single gift! and support $1.1 trillion in U.S. sales, including hotel revenue, guest spending and taxes. AHLA incorporated this vital data into its national For the past 18 months, we have been engaged in a capital initiative awareness campaign, Dreams Happen Here, which showcases the career called Opening Doors To Opportunity. -

Recommended Accommodation/Hotels, B&B Et

ICOMOS Advisory Committee/Comité Consultatif de l’ICOMOS Edinburgh, UK, September/Septembre 2006 Recommended Accommodation/Hotels, B&B et auberges recommandées Name Type Rating * Price Range Tel/Fax No. Web Address Email per person per night The Balmoral Hotel Five star £178.50 - T. +44 (0) 870 4607040 www.thebalmoralhotel.com [email protected] £768.50 F. +44 (0) 131 5578740 The Scotsman Hotel Five star £80.00 - T. +44 (0) 131 5565565 www.thescotsmanhotel.co.uk [email protected] £350.00 F. +44 (0) 131 6523652 The Carlton Hotel Four star £70.00 - T. +44 (0) 131 4723000 www.paramount-hotels.co.uk/carlton [email protected] £225.00 F. +44 (0) 131 5562691 Radisson Hotel Four star £45.00 - T. +44 (0) 131 5579797 www.radissonsas.com [email protected] £160.00 F. +44 (0) 131 5579789 MacDonald Hotel Four star £45.00 - T. +44 (0) 131 5504500 www.macdonaldhotels.co.uk [email protected] Holyrood £135.00 F. +44 (0) 131 5288088 Apex City Hotel Four star £50.00 - T. +44 (0) 845 6083456 www.apexhotels.co.uk [email protected] £180.00 F. +44 (0) 131 6665128 Apex Hotel Four star £35.00 - T. +44 (0) 845 6083456 www.apexhotels.co.uk [email protected] International £120.00 F. +44 (0) 131 6665128 Mount Royal Hotel Three £75.00 - T. +44 (0) 131 2257161 www.ramadajarvis.co.uk [email protected] Ramada Jarvis star £175.00 F. +44 (0) 131 2204671 Old Waverley Hotel Three £45.00 – T. -

Hotel Recommendations in Newcastle Upon Tyne

Hotel Recommendations in Newcastle Upon Tyne This list acts as a basis for finding and contacting hotels in the city centre and is not endorsed by Northumbria University. All prices are estimates and subject to change. Premier Inn Newcastle Central The Premier Inn Hotel Newcastle Central puts you in the perfect spot for exploring the best of this buzzing city. With the City Centre shops just down the road and St James Park within easy walking distance, it's all at your feet. Check out the latest trends at Eldon Square Shopping Centre. Location: 5-minute walk to City Campus / 15-minute walk to Central Train Station Newbridge Street, Newcastle Upon Tyne, NE1 8BS, United Kingdom Price: £48.50/night (breakfast: £6.99 - £8.99 extra T: +44 (0) 871 527 8802 charge/day) http://www.premierinn.com/gb/en/hotels/england/tyne- and-wear/newcastle/newcastle-city-centre-new- bridge-street.html Holiday Inn Express, Newcastle City Centre Holiday Inn Express Newcastle City Centre provides comfortable and convenient accommodation in the heart of Newcastle. Great value rates ensure guests don't pay through the roof prices for a city centre hotel. The recently refurbished bedrooms are an ideal base for exploring Newcastle's top rated tourist attractions. Location: 20-minute walk to City Campus / 6-minute Waterloo Square, St James Boulevard, Newcastle walk to Central Train Station upon Tyne, NE1 4DN T: +44 (0) 871 902 1625 Price: £55/night (incl.breakfast) http://www.expressnewcastle.co.uk/ Motel One The Design Hotel Motel One Newcastle is just a stone’s throw away from Newcastle's Central Station, about 20 minutes by car from the harbour and lies within a distance of about 12 kilometres from Newcastle International Airport. -

List of Green Hotels and Event Venues

BCA List of Green Hotels S/N Project Name Awards Postal Code 1 Amara Sanctuary Resort Sentosa Platinum 099394 2 Carlton City Hotel Singapore Platinum 078862 3 Copthorne King's Hotel Platinum 169632 4Courtyard Singapore Novena Platinum 329568 5 Furama City Centre Platinum 059804 6 Furama RiverFront, Singapore Platinum 169633 7 Genting Hotel Jurong Platinum 608516 8 Grand Copthorne Waterfront Hotel Platinum 169663 9 Grand Park City Hall Hotel Platinum 179809 10 Great World Serviced Apartments Platinum 239404 11 Holiday Inn Express (88 East Coast Road) Platinum 423371 12 Holiday Inn Express Singapore Orchard Road Platinum 229921 13 Holiday Inn Express, Clarke Quay Platinum 059573 14 Hotel Boss Platinum 199020 15 Hotel Indigo Singapore Katong Platinum 428788 16 Hotel Jen Orchardgateway Platinum 238858 17 ibis Singapore Novena Platinum 329543 18 JW Marriott Hotel Singapore South Beach Platinum 189763 19 King's Centre Platinum 169662 20 M Social Hotel Platinum 238259 21 Marina Bay Sands Platinum 018956 22 One Farrer Hotel & Spa Platinum 217562 23 PARKROYAL on Kitchener Platinum 208533 24 PARKROYAL on Pickering Platinum 058289 25 Sheraton Towers Singapore Hotel Platinum 228230 26 Sofitel Singapore City Centre (Tanjong Pagar Centre) Platinum 078885 27 Sofitel So Singapore Platinum 068876 28 Swissotel Merchant Court, Singapore Platinum 058281 29 The Singapore EDITION hotel (Boulevard 88) Platinum 248651 30 Treetops Executive Residences Platinum 258355 31 Village Hotel Albert Court Platinum 189971 32 W Singapore Sentosa Cove Platinum 098374 PLUS -

Market Snapshot Edinburgh, Uk

JULY 2011 | PRICE £75 MARKET SNAPSHOT EDINBURGH, UK Lucy Payne Market Intelligence Analyst Lara Sarheim Associate Director www.hvs.com HVS – London Office| 7‐10 Chandos Street, Cavendish Square, London W1G 9DQ, UK This market snapshot is part of a series of articles that HVS is producing every month on key hotel sectors. In writing these articles we combine the expertise of HVS with STR Global data for each market. Our analysis is based on data for a sample of 62 mainly branded properties as provided by STR Global. Highlights Edinburgh is the UK’s most important tourist destination after London, attracting more than 3.5 million visitors per annum. Tourism in the city is dominated by domestic demand, which accounts for more than 60% of arrivals, but there is still an appreciable number of international visitors; Edinburgh airport has shown significant growth in passenger numbers over the past ten years in terms of both international and domestic arrivals. The airport handled just over 8.6 million passengers in 2010 and this is set to increase as plans for expansion progress; The city benefits from a mix of leisure and business tourism, thus hotel performance remains strong all year round. As a result, the impact of the economic downturn was less severe in Edinburgh, and the city has emerged largely unscathed with occupancy, average rate and RevPAR growing year‐on‐year in 2010 and 2011. Occupancy has continued to peak in August owing to the famous Edinburgh Festival; Full year 2009 and 2010 occupancy in Edinburgh was the second highest -

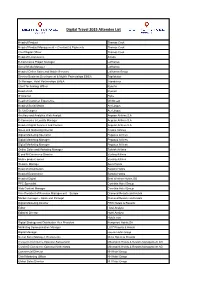

Digital Travel 2015 Attendee List

Digital Travel 2015 Attendee List Head of Product Thomas Cook Head of Product Management – Checkout & Payments Thomas Cook Chief Digital Officer Thomas Cook Head of E-Commerce Alitalia E-Commerce Project Manager Lufthansa Social Media Manager Lufthansa Head of Online Sales and Mobile Services Lufthansa Group Director Business Development & Mobile Partnerships EMEA TripAdvisor Sr Manager, Hotel Partnerships EMEA Tripadvisor Chief Technology Officer RyanAir Head of QA Ryanair IT Director Flybe Head of Customer Experience Whitbread Head of Social Media Aer Lingus Sr. Ux Designer Aer Lingus Ancillary and Analytics Web Analyst Aegean Airlines S.A E-Commerce & Loyalty Manager Aegean Airlines S.A Head of Digital Services and Content Aegean Airlines S.A Sales and Marketing Director Croatia Airlines Digital Marketing Specialist Pegasus Airlines Digital Marketing Manager Pegasus Airlines Digital Marketing Manager Pegasus Airlines Online Sales and Marketing Manager Turkish Airlines E and M-Commerce Director Vueling Airlines Mobile product owner Vueling Airlines Website Manager Apex Hotels Head of eDistribution Barcelo Hotels Head of Ecommerce Barcelo Hotels Head of Digital Best Western Hotels GB PPC Specialist Corinthia Hotel Group Web Content Manager Corinthia Hotel Group Vice President of Revenue Management – Europe Diamond Resorts and Hotels Market manager – Spain and Portugal Diamond Resorts and Hotels Digital Marketing Director FRHI Hotels & Resorts Editor Hotel Analyst Editorial Director Hotel Analyst Hotels.com Digital Strategy and Distribution