The Future of Guest Experience by Samantha Shankman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotel Koe, Tokyo

Best Urban Hotels 2018 OUR JUDGES Jasmi Bonnén Beauty entrepreneur, Copenhagen Aric Chen Design curator, Shanghai Natasha Jen Designer, New York Cherine Magrabi Creative director, Beirut Fernanda Marques Architect, São Paulo Makgati Molebatsi Art consultant, Johannesburg BEST OF THE REST Almanac, Barcelona Ace Hotel, Chicago Nobis, Copenhagen Mondrian Doha, Doha Bulgari Resort, Dubai Eden Locke, Edinburgh Puro, Gdańsk The Fontenay, Hamburg Macq 01, Hobart The Murray, Hong Kong Room Mate Emir, Istanbul Hallmark House Hotel, Johannesburg Verride Palácio Santa Catarina, Lisbon The Mandrake, London The Principal, London ban The NoMad, Los Angeles Ur Ho st t e e Hotel Monville, Montreal ls B 2 Roomers, Munich 0 1 8 Freehand, New York Winner Made, New York Moxy Times Square, New York Moxy Osaka Honmachi, Osaka Hôtel National des Arts et Métiers, Paris W Panama, Panama City The Hoxton, Paris Tribe Hotel, Perth Dream world Fera Palace Hotel, Salvador This year’s Best Urban Hotel, a fantastically furnished Sicilian palazzo, The Middle House, Shanghai plus three runners-up, as voted for by our jet-setting judging panel The Sukhothai, Shanghai Andaz, Singapore Six Senses Duxton, Singapore Asmundo di Gisira Paramount House Hotel, Sydney Catania The Vera, Tel Aviv The Broadview, Toronto Like many palazzi, Asmundo di Gisira, the public space celebrates the myth of FROM ABOVE LEFT, Hotel Indigo, Warsaw a converted 18th-century pile in Sicily’s Billonia, with a painting of the goddess by CEMENT TILES IN THE COVERED COURTYARD; second largest city, hides -

RUSSIA and CIS a Team That Will Deliver More

HOSPITALITY AND LEISURE IN RUSSIA and CIS A teaM that Will deliVer More The DLA Piper’s Russian Hospitality & Leisure team works with the majority of international operators and many owners of internationally branded hotels in Russia and the CIS. We help you overcome the many unique challenges you will face with your hotel project across all areas of law. Partner Scott Antel, who heads our Russian/CIS Hospitality Practice was awarded the 2012 Leadership Award at the Russian Hotel Investment Forum for contribution to the hotel industry. Combining legal expertise, sector experience and knowledge of the Russian market “street” realities, we offer pragmatic solution. Our team advises Russian owner/developer clients on how the international hotel management structure works, what are best practice and key points to focus on in negotiations. From working with both owners and operators, we know the key commercial points of concern, as well as the negotiating boundaries both parties may usually allow. We can save you time and money by focusing on the key elements in negotiations. We have built a reputation for getting deals done timely and efficiently. In addition to advising on legal aspects of hotel management, our team is also active in such areas of hospitality and leisure as advising on legal aspects of design and management of golf courses, ski resorts, spa and restaurants, and on large-scale event/catering contracts. We also have represented both buyers and sellers on numerous hotel acquisitions and have structured and represented parties to multiple hotel development joint venture agreements. 02 | Hospitality and Leisure in Russia and CIS Our GloBal presence With more than 200 lawyers throughout our worldwide offices, DLA Piper’s global Hospitality & Leisure group advises owners, managers, franchisors, developers and lenders with respect to hotels and other hospitality and leisure businesses around the world. -

The Hostel Market

Iberian Peninsula TABLE OF CONTENTS 03 04 05 06 08 Glossary & Introduction Key What is a Typologies Disclaimer Observations Hostel? 10 11 12 13 21 Guests’ Distribution Operators and Key Market Investment Profile Channels & Agreements Figures in Hostels Business Model 22 23 27 Outlook Market Our Team Feedback 2 es.christie.com | February 2020 GLOSSARY & DISCLAIMER ABR m Average Bed Rate. Defined as the total bed income for the period divided by the total Million number of beds occupied during the mentioned period Occ Budget Hostels Occupancy. Proportion of occupied beds over the total number of rooms Hostels with simple facilities, with limited decoration and a limited offer of F&B available in a given period facilities and other services OTAs c. Online Travel Agency Circa Propco/Opco C&Co Owner company/Operator Company Christie & Co RevPAB Design Hostels Revenue per Available Bed. Defined as bed occupancy multiplied by the average Hostels with modern facilities, furniture and decorative elements of higher quality bed rate or bed revenue divided by the number of available beds and design. They usually offer larger leisure and F&B facilities Theme Hostels F&B Unique Hostels that cover very specific needs and market niches and focus on Food & Beverage specific activities, such as sports, art and nightlife FF&E var Furniture, Fixtures & Equipment Variation GOP YoY Gross Operating Profit Year-on-year k vs Thousand Versus KPI Key Performance Indicator In line with our terms and conditions, this report may not be copied, reproduced, distributed, disclosed or revealed in whole or in part to any person without prior written agreement from Christie & Co. -

Quarterly Newsletter – Q2 2014

30 Warwick Street London W1B 5NH www.jll.com/hospitality EMEA Quarterly Newsletter – Q2 2014 Industry Trends • According to the World Travel & Tourism Council (WTTC), demand for international tourism remained strong in the first four months of 2014. International tourism arrivals grew 5%, the same rate as full year 2013. Prospects for the current peak tourism season remain very positive with over 450 million tourists expected to travel abroad in the May-August 2014 period. • Destinations worldwide received 317 million international overnight visitors between January and April 2014, 14 million more than in the same period of 2013. This 5% growth consolidates the strong increase registered for 2013 and is well above the long-term trend projected by the UNWTO for the period of 2010-2020 (3.8%). • The strongest growth was seen in Asia and the Pacific and the Americas (both up 6%), followed closely by Europe and Africa (up 5%). By sub-region, Northern Europe, South and Mediterranean Europe, North Africa and South Asia (all up 8%) were the star performers. • In terms of tourism expenditure, growth continues to be strong from emerging markets, in particular China, the Russian Federation, Saudi Arabia and India. Furthermore, demand from advanced economies is strengthening as the global economic situation gradually improves, with encouraging growth posted for Italy, Australia, the Republic of Korea, the Netherlands, Norway and Sweden. • According to the UNWTO confidence index, prospects remain very positive for the period May- August 2014. Confidence has picked up, particularly among the private sector, and improved further in Europe, the Americas, Asia and the Pacific and the Middle East. -

2018 Hotel Brand Reputation Rankings: USA & Canada

REPORT 2018 Hotel Brand Reputation Rankings: USA & Canada October 2018 INDEX Introduction 4 Methodology 6 The Importance of Brand Reputation 7 Key Data Points: All Chain Scales 8 Key Findings 9 Summary of Top Performers 10 ECONOMY BRANDS Overview 13 Top 25 Branded Economy Hotels 14 Economy Brand Ranking 15 Economy Brand Ranking by Improvement 16 Economy Brand Ranking by Service 17 Economy Brand Ranking by Value 18 Economy Brand Ranking by Rooms 19 Economy Brand Ranking by Cleanliness 20 Review Sources: Economy Brands 21 Country Indexes: Economy Brands 22 Response Rates: Economy Brands 22 Semantic Mentions: Economy Brands 23 MIDSCALE BRANDS Overview 24 Top 25 Branded Midscale Hotels 25 Midscale Brand Ranking 26 Midscale Brand Ranking by Improvement 27 Midscale Brand Ranking by Service 28 Midscale Brand Ranking by Value 29 Midscale Brand Ranking by Rooms 30 Midscale Brand Ranking by Cleanliness 31 Review Sources: Midscale Brands 32 Country Indexes: Midscale Brands 33 Response Rates: Midscale Brands 33 Semantic Mentions: Midscale Brands 34 UPPER MIDSCALE BRANDS Overview 35 Top 25 Branded Upper Midscale Hotels 36 Upper Midscale Brand Ranking 37 Upper Midscale Brand Ranking by Improvement 38 Upper Midscale Brand Ranking by Service 39 Upper Midscale Brand Ranking by Value 40 Upper Midscale Brand Ranking by Rooms 41 Upper Midscale Brand Ranking by Cleanliness 42 Review Sources: Upper Midscale Brands 43 Country Indexes: Upper Midscale Brands 44 Response Rates: Upper Midscale Brands 44 Semantic Mentions: Upper Midscale Brands 45 Index www.reviewpro.com -

Queensgate Acquires Generator Hostels from Patron Capital in €450M Transaction

Embargoed until: 13 March 2017 at 0700hrs GMT Queensgate acquires Generator Hostels from Patron Capital in €450m transaction Queensgate Investments Fund II LP, which is managed by Queensgate Investments, a private equity real estate fund manager, has agreed to purchase design-led hostel owner and operator Generator Hostels from Patron Capital, the pan-European institutional investor focused on property backed investments, and its co-investment partner, Invesco Real Estate, a global real estate manager. The transaction has an enterprise value of circa €450m and is expected to complete in May. Generator Hostels, which was held in Patron Capital’s Fund III, owns 14 predominantly freehold assets (12 operational and two under development), totalling 8,639 beds, located in London, Paris, Copenhagen, Amsterdam, Miami, Dublin, Hamburg, Barcelona, Berlin Mitte, Stockholm, Madrid, Venice, Berlin Prenzlauer Berg and Rome. Earning current revenues of over €70m, Generator Hostels targets the fast-growing sector of millennial customers, focusing on the best capital city addresses, design-led interiors, a safe environment and, most of all, attractive shared social spaces. Queensgate Investments intends to own the portfolio for the long term, enhance operations for customers, and invest in excess of €300m into adding more hostel assets. Keith Breslauer, Managing Director of Patron, said: “Generator has performed strongly under Patron’s ownership, during which time we have expanded the business significantly from just two hostels to 14, and have redefined the hostel concept into the design-led hospitality experience that today’s guests want. We are very pleased to have sold Generator to Queensgate, and are confident that the business will continue to grow and thrive under their stewardship.” Jason Kow, CEO of Queensgate Investments, said: “Generator Hostels represents high-quality freehold assets, robust revenues, an attractive lifestyle brand, and material scalability opportunities. -

Staywyse1 @Staywyse | #STAYWYSE SPONSORSSPONSORS

/staywyse1 @StayWYSE | #STAYWYSE www.conference.staywyse.org SPONSORSSPONSORS THANK YOU 2016 SPONSORS 2 GO TO CONTENTS ❱❱ partnersPartners THANK YOU 2016 PARTNERS 3 GO TO CONTENTS ❱❱ contentscontents 5 GO TO CONTENTS ❱❱ contents WELCOME 8 VENUE and FLOORPLAN 13 exhibitors 16 BUSINESS APPOINTMENTs 19 programme 22 Day 1 | thursday, 28 January 23 Day 2 | Friday, 29 January 26 DAY 3 | SATURDAY, 30 JANUARY Experience Amsterdam and Hostel Open Day 28 educational sessions 30 networking events 47 experience amsterdam 52 hostel open day 55 contacts 62 6 Innovative blend of shared hostel accommodations and private hotel rooms Dynamic Food & Beverage offerings including The Broken Shaker, 27 Restaurant, (Miami) and Café Integral (Chicago) Penthouse Suites (Chicago) and Bungalows (Miami) are available, perfect for groups that need extra gathering space MIAMI CHICAGO LOS ANGELES (2016) www.thefreehand.com www.sydellgroup.com WELCOMEWELCOME 8 GO TO CONTENTS ❱❱ welcome On behalf of WYSE Travel Confederation I am delighted to welcome you to the inaugural STAY WYSE Conference, the business conference for the hostel industry. This event takes place in the context of a time of great change and growth for the hostel industry. While cheap and basic lodging for youth and student travellers still exists, today’s hostels feature stylish design, personalised service and social atmospheres that attract loyal traveller followings on par with international hotel chains. As we will hear from expert speakers over the coming days, the dynamic hostel industry is establishing itself as one of tourisms fastest growing sectors of accommodation. We have therefore designed the STAY WYSE Conference programme to help keep you up-to-date on the latest trends so that we are all in the best position to capitalise on the hostel sector growth. -

Confidence in a Recovering Market European Hotel Market Survey 2014 Contents

Confidence in a recovering market European Hotel Market Survey 2014 Contents Foreword ................................................................................ 01 Overview of our European Hotel Market Survey 2014: Top ten highlights ................................02 Top ten highlights .............................................................04 Current trends in the hotel sector .............................10 Industry leader’s insights: Josh Wyatt .....................12 Industry leader’s insights: Philippe Bijaoui ........... 16 Industry leaders’ insights: Diane Scott and Tony Burnell ................................................................. 18 Our research was carried out in January/ February 2014 and is based on data from over 400 online interviews with a cross-section of hotel industry professionals based in over 20 countries worldwide. Any unattributed quotes which feature in this report were made by respondents to our survey. Berwin Leighton Paisner LLP Foreword Does 2014 herald a new dawn for the hotel sector? Certainly enthusiasm is running high for the majority of our respondents as the caution of the past few years gives way to hope that I am delighted to present the improved trading seen in many European locations will the results of our survey stick and that a bankable recovery will set in. Over 97% of our respondents predicted growth in European REVPAR over of over 400 respondents the next 12 months. This confidence is however measured, from the hotel sector with 63% of respondents expressing continuing concern over – investors, lenders, the stability of the Eurozone. There is also some debate as to owners, operators, whether this recovery will be long-lasting, with a number of our respondents predicting that the present momentum will developers and advisers. not be sustained beyond the next 12 to 24 months. In addition to the current buoyancy in the European market, we are seeing increased optimism and an uptick in development in the wider emerging markets, notably Africa and South East Asia. -

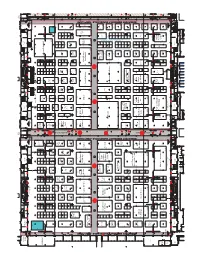

Page 1 E N TR a N C E SERVIC E CORRID O R END END END END

END END END END AED EE PLUMBING EE EMERG. RECORDING EE VESTIBULE EMERG. CONTROL STORAGE ROOM STORAGE ELEC. ELEC. ROOM SWITCHGEAR LOADING SWITCHGEAR IDF SWITCHGEAR SWITCHGEAR PLUMBING ROOM ROOM ROOM OFFICE ELEV. ELEV. OFFICE ELEV. ELEV. ELEV. DOCKS ROOM CONT. FP ELEV. IDF IDF J.C. IDF MACHINE MACHINE MACHINE J.C. MACHINE STG. FE MACHINE IDF STRG. MACHINE RM. ROOM ROOM ROOM ROOM ROOM ROOM FP EE AED FP FE AED FP AED FE FE OFFICE OFFICE OFFICE OFFICE ELECTRICAL ELECTRICAL (3Mx4M) (3Mx4M) (3Mx4M) (3Mx4M) ELECTRICAL 35'-9" CEILING HEIGHT STORAGE EMERGENCY EMERGENCY STORAGE STORAGE EMERGENCY EMERGENCY EXIT EXIT EXIT EXIT 30' N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 N710 32'-4" 45 45 45 45 45 45 45 45 45 45 45 45 19'-8" 19'-8" A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 20'A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 A1 60' B1 A1 B1 * 35'-9" CEILING HEIGHT 11'-6" 40' 20' WallyPark **Flyte Tyme 2284 2185 2184 2085 2084 1985 1984 1885 1884 1785 1784 1685 1684 1585 1584 1485 Worldwide 1284 1185 1184 1085 984 885 884 785 784 685 684 585 30' Transportation B1 20' 20' A1 Icelandair 10' STORAGE 2283 EXPO LOUNGE 2282 2183 2182 2083 2082 1983 1982 1883 1882 1783 1782 1683 1682 1583 1582 1483 1383 1283 1282 1183 1182 1083 982 883 782 683 682 583 20' 60' A1 B1 A1 B1 A1 B1 A1 B1 A1 B1 A1 A1 B1 A1 B1 A1 B1 A1 B1 A1FocusPointB1 Int'l A1 B1 FE FE FE FE FE FE FE 20' FE FE 10' 10' 10' 10' 10' 10' 2280 2181 2180 2080 1981 1980 1881 1880 1780 1681 1680 1581 1580 1180 1081 981 980 780 681 680 20' Taj AirMed 20' 20' 10' 10' Hotels, Int'l The 10' 2278 2179 2178 2079 2078 1979 1978 -

NEW YORK ‐ Vol. 2 2017 May 23 - 27

the Report: NEW YORK ‐ Vol. 2 2017 May 23 - 27 Hotel and community / ホテルとコミュニティ 1. Ace Hotel 2. NoMad Hotel 3. The Beekman Hotel 4. Sean Mac Pherson 5. 11 Howard Hotel the Report: HOTEL and Community New York has been always leading the world design in innovative and free dynamic forms. It has been giving many inspirations to the world, and that position has never been changed. However, the New York design in recent years has evolved in sophisticated way rather than just introducing new random ideas. In the beginning of the 2000s, the sense of fear walking in the public in middle of night still existed, but now that has been gone from New York City. When the city became clean and safe, the price of real-estate went up and forcing the young artists to move to the deeper Brooklyn or elsewhere. The place where new creativity can be achieved freely is no longer in Manhattan. The city has been evolving in a different way with big money. There have been some attempts to demolish the old elements from NYC and build such as amusement parks, which may be safe and clean, but making it " boring" city. However, Manhattan was protected by the regulation of landmarks and also the pride of the community would not let that happened. Thus far, not only the city has become cleaner and safer, but also it has developed into the present age of "vintage modern" with full of love and ideas to make New York a better place. Also, not just proposing new style and trend, the City attracts people just enhancing the brand of "New Yorker lifestyle" without any new attractions. -

Pricewaterhousecoopers' Fourth European Lifestyle

Hospitality Directions Europe Edition* Issue 14 September 2006 Standing out in a crowd: PricewaterhouseCoopers’ fourth European Lifestyle Hotel Survey 2006 Sea changes in consumer lifestyles continue to drive this niche segment The lifestyle hotel sector continues to be driven by a talent for innovation, spectacle, experience and value for money. These points of differentiation give it a competitive edge and have raised the bar for the hotel sector as a whole. Their position at the forefront of contemporary design has made lifestyle hotels high-profile trendsetters with real consumer appeal - but increasingly only where their product and service are aligned with the aspirations of their target customers. Higher growth – but higher volatility – Our 2006 research into the lifestyle hotel sector ranked the top 25 European lifestyle operators. This year the top players operate a total of 141 hotels with 11,386 rooms and have seen a 5.9 per cent increase in room capacity compared to a year ago. We also analysed the performance of 60 UK lifestyle hotels, accounting for over 4,000 rooms and forecast future outlook. This analysis showed that, while subject to the general UK hotel sector trends, the performance metrics of the sample displayed greater volatility than the sector as a whole and that looking forward lifestyle hotels will continue to achieve good room rate growth giving RevPAR gains of 7 per cent this year, 4.1 per cent in 2007 and 4.8 per cent in 2008. Smaller operators still leading the way – While many larger hotel chains continue to try to emulate lifestyle hotels’ distinctive offer, we found that the real action in terms of innovation and value for money is still being driven by the smaller operators - particularly in the new, up-and- coming branded budget lifestyle segment. -

Worlds Most Popular Luxury Hotel Brands 2015

1 FOREWORD The internet mediates a new relationship between Commentators and customers are challenging brands and consumers, putting customers the value of hotel star ratings and travellers are increasingly in control of brand perception over questioning which sources of information they organisations. Advances in technology (apps, niche should trust in the face of the numerous alternative social networks and crowdsourcing) have continued lists that purport to evaluate luxury hotels. to empower people beyond their previous role of more or less passive consumers to become proactive What we do know is that more than brand or media critics, champions and commentators. propaganda, today’s digitally-native guest relies on their own experience and, crucially, that relayed by This shift in power away from companies – the friends and family. This popular commentary has ‘democratisation’ of brands – is changing the art been fuelled by portals such as TripAdvisor, of branding and testing established marketing TripExpert, Booking.com and Ctrip and is forcing mechanisms. Unprecedented market transparency the industry uncomfortably away from self-rating means that without doubt brands are being to being rated. fabricated in the minds of the consumer – the sum of their thoughts and feelings about services and Travellers are developing a more sophisticated set products – rather than in the factory of a producer. of references and an opinionated view of the world upon which a truer assessment of the hospitality Nowhere is this phenomenon more apparent than industry is emerging and shaking up conventional in the hospitality industry, in which historically, perceptions. This quest for authenticity and the rise hoteliers have devised their own star classifications of peer-to-peer influence also explains the to denote their levels of service and facilities.