GNAM Investment Competition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Landscape Analysis of Geographical Names in Hubei Province, China

Entropy 2014, 16, 6313-6337; doi:10.3390/e16126313 OPEN ACCESS entropy ISSN 1099-4300 www.mdpi.com/journal/entropy Article Landscape Analysis of Geographical Names in Hubei Province, China Xixi Chen 1, Tao Hu 1, Fu Ren 1,2,*, Deng Chen 1, Lan Li 1 and Nan Gao 1 1 School of Resource and Environment Science, Wuhan University, Luoyu Road 129, Wuhan 430079, China; E-Mails: [email protected] (X.C.); [email protected] (T.H.); [email protected] (D.C.); [email protected] (L.L.); [email protected] (N.G.) 2 Key Laboratory of Geographical Information System, Ministry of Education, Wuhan University, Luoyu Road 129, Wuhan 430079, China * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel: +86-27-87664557; Fax: +86-27-68778893. External Editor: Hwa-Lung Yu Received: 20 July 2014; in revised form: 31 October 2014 / Accepted: 26 November 2014 / Published: 1 December 2014 Abstract: Hubei Province is the hub of communications in central China, which directly determines its strategic position in the country’s development. Additionally, Hubei Province is well-known for its diverse landforms, including mountains, hills, mounds and plains. This area is called “The Province of Thousand Lakes” due to the abundance of water resources. Geographical names are exclusive names given to physical or anthropogenic geographic entities at specific spatial locations and are important signs by which humans understand natural and human activities. In this study, geographic information systems (GIS) technology is adopted to establish a geodatabase of geographical names with particular characteristics in Hubei Province and extract certain geomorphologic and environmental factors. -

The Causes and Effects of the Development of Semi-Competitive

Central European University The Causes and Effects of the Development of Semi-Competitive Elections at the Township Level in China since the 1990s By Hairong Lai Thesis submitted in fulfillment for the degree of PhD, Department of Political Science, Central European University, Budapest, January 2008 Supervisor Zsolt Enyedi (Central European University) External Supervisor Maria Csanadi (Hungarian Academy of Sciences) CEU eTD Collection PhD Committee Tamas Meszerics (Central European University) Yongnian Zheng (Nottingham University) 1 Contents Summary..........................................................................................................................................4 Acknowledgements..........................................................................................................................6 Statements........................................................................................................................................7 Chapter 1: Introduction .................................................................................................................8 1.1 The literature on elections in China ....................................................................................8 1.2 Theories on democratization .............................................................................................15 1.3 Problems in the existing literature on semi-competitive elections in China .....................21 1.4 Agenda of the current research..........................................................................................26 -

Report 2011–5010

Shahejie−Shahejie/Guantao/Wumishan and Carboniferous/Permian Coal−Paleozoic Total Petroleum Systems in the Bohaiwan Basin, China (based on geologic studies for the 2000 World Energy Assessment Project of the U.S. Geological Survey) 114° 122° Heilongjiang 46° Mongolia Jilin Nei Mongol Liaoning Liao He Hebei North Korea Beijing Korea Bohai Bay Bohaiwan Bay 38° Basin Shanxi Huang He Shandong Yellow Sea Henan Jiangsu 0 200 MI Anhui 0 200 KM Hubei Shanghai Scientific Investigations Report 2011–5010 U.S. Department of the Interior U.S. Geological Survey Shahejie−Shahejie/Guantao/Wumishan and Carboniferous/Permian Coal−Paleozoic Total Petroleum Systems in the Bohaiwan Basin, China (based on geologic studies for the 2000 World Energy Assessment Project of the U.S. Geological Survey) By Robert T. Ryder, Jin Qiang, Peter J. McCabe, Vito F. Nuccio, and Felix Persits Scientific Investigations Report 2011–5010 U.S. Department of the Interior U.S. Geological Survey U.S. Department of the Interior KEN SALAZAR, Secretary U.S. Geological Survey Marcia K. McNutt, Director U.S. Geological Survey, Reston, Virginia: 2012 For more information on the USGS—the Federal source for science about the Earth, its natural and living resources, natural hazards, and the environment, visit http://www.usgs.gov or call 1–888–ASK–USGS. For an overview of USGS information products, including maps, imagery, and publications, visit http://www.usgs.gov/pubprod To order this and other USGS information products, visit http://store.usgs.gov Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. -

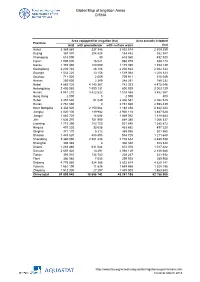

Global Map of Irrigation Areas CHINA

Global Map of Irrigation Areas CHINA Area equipped for irrigation (ha) Area actually irrigated Province total with groundwater with surface water (ha) Anhui 3 369 860 337 346 3 032 514 2 309 259 Beijing 367 870 204 428 163 442 352 387 Chongqing 618 090 30 618 060 432 520 Fujian 1 005 000 16 021 988 979 938 174 Gansu 1 355 480 180 090 1 175 390 1 153 139 Guangdong 2 230 740 28 106 2 202 634 2 042 344 Guangxi 1 532 220 13 156 1 519 064 1 208 323 Guizhou 711 920 2 009 709 911 515 049 Hainan 250 600 2 349 248 251 189 232 Hebei 4 885 720 4 143 367 742 353 4 475 046 Heilongjiang 2 400 060 1 599 131 800 929 2 003 129 Henan 4 941 210 3 422 622 1 518 588 3 862 567 Hong Kong 2 000 0 2 000 800 Hubei 2 457 630 51 049 2 406 581 2 082 525 Hunan 2 761 660 0 2 761 660 2 598 439 Inner Mongolia 3 332 520 2 150 064 1 182 456 2 842 223 Jiangsu 4 020 100 119 982 3 900 118 3 487 628 Jiangxi 1 883 720 14 688 1 869 032 1 818 684 Jilin 1 636 370 751 990 884 380 1 066 337 Liaoning 1 715 390 783 750 931 640 1 385 872 Ningxia 497 220 33 538 463 682 497 220 Qinghai 371 170 5 212 365 958 301 560 Shaanxi 1 443 620 488 895 954 725 1 211 648 Shandong 5 360 090 2 581 448 2 778 642 4 485 538 Shanghai 308 340 0 308 340 308 340 Shanxi 1 283 460 611 084 672 376 1 017 422 Sichuan 2 607 420 13 291 2 594 129 2 140 680 Tianjin 393 010 134 743 258 267 321 932 Tibet 306 980 7 055 299 925 289 908 Xinjiang 4 776 980 924 366 3 852 614 4 629 141 Yunnan 1 561 190 11 635 1 549 555 1 328 186 Zhejiang 1 512 300 27 297 1 485 003 1 463 653 China total 61 899 940 18 658 742 43 241 198 52 -

Energy Markets in China and the Outlook for CMM Project

U.S. EP.NSII Coalbed Methane Energy Markets in China and the Outlook for CMM Project Development in Anhui, Chongqing, Henan, Inner Mongolia, and Guizhou Provinces Energy Markets in China and the Outlook for CMM Project Development in Anhui, Chongqing, Henan, Inner Mongolia, and Guizhou Provinces Revised, April 2015 Acknowledgements This publication was developed at the request of the U.S. Environmental Protection Agency (USEPA), in support of the Global Methane Initiative (GMI). In collaboration with the Coalbed Methane Outreach Program (CMOP), Raven Ridge Resources, Incorporated team members Candice Tellio, Charlee A. Boger, Raymond C. Pilcher, Martin Weil and James S. Marshall authored this report based on feasibility studies performed by Raven Ridge Resources, Incorporated, Advanced Resources International, and Eastern Research Group. 2 Disclaimer This report was prepared for the U.S. Environmental Protection Agency (USEPA). This analysis uses publicly available information in combination with information obtained through direct contact with mine personnel, equipment vendors, and project developers. USEPA does not: (a) make any warranty or representation, expressed or implied, with respect to the accuracy, completeness, or usefulness of the information contained in this report, or that the use of any apparatus, method, or process disclosed in this report may not infringe upon privately owned rights; (b) assume any liability with respect to the use of, or damages resulting from the use of, any information, apparatus, method, or process -

Wuhan Department Store Group Co., Ltd.-WDS

Wuhan Department Store Group Co., Ltd.-WDS Dominating Retailing Market in Central China Market Value of Properties Increasing Substantially Net Profit Growing rapidly Business Structure Optimized to Satisfy Customers’ Demands Proper Equity Structure and Creative Incentives Boosting Efficiency WDS Summary China Shenzhen Stock Exchange Stock Exchange Code 000501.SZ Last Close CNY 19.11 Target Price CNY 24.60 Upside 28.72% 52-wk Range CNY14.39-23.74 Business Retail Sales& Sector Commercial Chains Market Cap CNY 11.31bn Share Outstanding 592mn Major Wuhan Selline Shareholder Group Free Float Co.,Ltd(21.54%)85.7%(507mn) P/B Ratio 2.05x Revenue CNY 17.52bn Net Profit CNY 799.31mn EPS CNY 1.58 BPS CNY 9.32 CPS CNY 1.61 P/CF 11.85 ROE 20.73% ROA 4.79% Team Members Yan,CUI Di,GU Chunxiao,HAO Xin,PENG Jianghao,WANG Haidong,ZHAO HIGHLIGHTS As a bellwether in retail industry in Hubei Province and even in China, WDS enjoys unparalleled competitive edge over its competitors. Located in core areas of the most developed province in central China, WDS dominates the market of retailing and supermarket. The company provides its high-and-mid-end consumers with rich fashionability and exquisiteness, thus enjoying high prestige among the customers. Due to soaring real estate price, the market value of WDS’s properties has been increasing dramatically. The company owns over 1.2 million square meters commercial real estate in core business areas in Wuhan, the value of which has risen by approximately 40% for the last few years and the trend is expected to continue. -

Minimum Wage Standards in China August 11, 2020

Minimum Wage Standards in China August 11, 2020 Contents Heilongjiang ................................................................................................................................................. 3 Jilin ............................................................................................................................................................... 3 Liaoning ........................................................................................................................................................ 4 Inner Mongolia Autonomous Region ........................................................................................................... 7 Beijing......................................................................................................................................................... 10 Hebei ........................................................................................................................................................... 11 Henan .......................................................................................................................................................... 13 Shandong .................................................................................................................................................... 14 Shanxi ......................................................................................................................................................... 16 Shaanxi ...................................................................................................................................................... -

World Bank Document

SFG2574 REV WB-Funded Project Public Disclosure Authorized Han River Inland Waterway Improvement Project in Hubei (Yakou Navigation Complex Project) Cumulative Effects Assessment Report Public Disclosure Authorized (Project Supplemental Environmental Impact Assessment Report) Public Disclosure Authorized July 2017 Public Disclosure Authorized Acronyms and Abbreviations CEA/CIA Cumulative Effects/Impacts Assessment CEQ Council for Environmental Quality EA Environmental Assessment EIA Environmental Impact Assessment ESIA Environmental and Social Impact Assessment IFC International Finance Group HRB Han River Basin MLHR Middle and Lower Reaches of Han River MEP Ministry of Environmental Protection NEPA National Environmental Policy Act (United States) NGO Non-governmental Organizations RCIA Rapid Cumulative Impact Assessment RFFAs Reasonably Foresseable Future Activities VECs Valued Environmental Components RFFA Reasonably Foreseeable Future Actions SEPA State Environmental Protection Agency WB World Bank WBG World Bank Group mu 1 hactare = 15 mu - I - Contents 1 Introduction ........................................................................................................... 1 1.1 Yakou Complex ................................................................................................................ 1 1.2 Han River Basin and Cascade Development .................................................................... 3 1.3 CEA Purpose, Scope and Methodology ........................................................................ -

FAO–China South–South Cooperation Programme

INSPIRATION, INCLUSION AND INNOVATION FAO–China South–South Cooperation Programme (2009–2019) Front cover and title page image: © Zhongshan Luo INSPIRATION, INCLUSION AND INNOVATION FAO–China South–South Cooperation Programme (2009–2019) Food and Agricultural Organization of the United Nations (Rome) 2019 Required citation: FAO. 2019. Inspiration, Inclusion and Innovation: FAO–China South–South Cooperation Programme (2009–2019). Rome. The designations employed and the presentation of material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Dashed lines on maps represent approximate border lines for which there may not yet be full agreement. The mention of specific companies or products of manufacturers, whether or not these have been patented, does not imply that these have been endorsed or recommended by FAO in preference to others of a similar nature that are not mentioned. The views expressed in this information product are those of the author(s) and do not necessarily reflect the views or policies of FAO. ISBN 978-92-5-131906-2 © FAO, 2019 Some rights reserved. This work is made available under the Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO licence (CC BY-NC-SA 3.0 IGO; https://creativecommons.org/licenses/by-nc-sa/3.0/igo). Under the terms of this licence, this work may be copied, redistributed and adapted for non-commercial purposes, provided that the work is appropriately cited. -

Harmonious Development Between Socio-Economy and River-Lake Water Systems in Xiangyang City, China

water Article Harmonious Development between Socio-Economy and River-Lake Water Systems in Xiangyang City, China Qiting Zuo 1,2, Zengliang Luo 1 and Xiangyi Ding 3,* 1 School of Water Conservancy & Environment, Zhengzhou University, Zhengzhou 450001, China; [email protected] (Q.Z.); [email protected] (Z.L.) 2 Center for Water Science Research, Zhengzhou University, Zhengzhou 450001, China 3 Department of Water Resources, China Institute of Water Resources and Hydropower Reasearch, Beijing 100038, China * Correspondence: [email protected]; Tel.: +86-10-6878-1373 Academic Editor: Karl-Erich Lindenschmidt Received: 18 September 2016; Accepted: 31 October 2016; Published: 4 November 2016 Abstract: River-lake water systems (RLS) are important carriers for matter transformation and energy transmission. Influenced by accelerated social and economic development, the structural, functional, and environmental states of RLS have been seriously damaged. It is an important problem for human beings to coordinate the contradiction between socio-economic development and the protection of RLS. In order to quantitatively study the harmonious relationship between socio-economic development and the state of RLS, the harmony theory method was used to analyze the degree of harmonious development between socio-economy and RLS in this study taking Xiangyang City as an example, and formulating corresponding harmonious optimization schemes. The results indicate that: (1) the state of RLS had a relatively small change during 2009–2014, and its spatial -

Protestant Medical Missionary Experience During the War in China 1937–1945: the Case of Hubei Province

Protestant Medical Missionary Experience During the War in China 1937–1945: The Case of Hubei Province Jocelyn Mary Chatterton School of Oriental and African Studies, University of London Submitted for the Degree of Doctor of Philosophy 1 Declaration I undertake that all material presented for examination is my own work and has not been written for me, in whole or in part, by any other person(s). I also undertake that any quotation or paraphrase from the published or unpublished work of another person has been duly acknowledged. ______________________________________________________ 2 Abstract During the war medical missionaries were able to demonstrate fully their raison d’être of service and professionalism to the Chinese and their fellow countrymen. In retrospect it can be seen that the war proved to be a golden age of opportunity for individual medical missionaries providing them with professional, personal and religious opportunity. It was a period when they felt both needed and wanted in China, and they showed great resourcefulness in response to the constraints placed upon their professional work as a result of military action. When those in occupied China lost all contact with their home bases medical missionaries shouldered additional administrative responsibilities which increased their already heavy workload. Whether in Free, or occupied China, medical missionaries were forced to make their own decisions in the field, and the bureaucratic-professional relationship with their home bases became strained. On the ground they experienced a flowering of inter-denominational co-operation. While responsible for the health of their fellow internees in the internment camps some medical missionaries were unexpectedly subjected to accusations of inexperience and nepotism. -

Explanations on Revision on Resettlement Action Plan

RPII0U Volume 1 The World Bank Financed Project Xiao-xiangExpressway, Hubei,China Public Disclosure Authorized RESETTLEMENT ACTION PLAN Public Disclosure Authorized Public Disclosure Authorized Hubei Province Xiao-xiang Expressway Resettlement Office Public Disclosure Authorized January 2002 Wuhan, China FIL COPY Explanations on Revision on Resettlement Action Plan Revision on Compensation Standards 1. Standard of expense for water supply, power connection and traffic as well as leveling the land for reconstruction is altered from "5 Yuan/Mr2 " to "375 Yuan per family whose resettlement house area is not larger than 100m2"/"750 Yuan per family whose resettlement house area is larger than 100m2". Compensation standard for family transit cost/ delay of their work and other subsidy are 150 Yuan per family. Therefore, cost of this item is increased from 962443 Yuan to 1186050 Yuan. Increased amount is 223607 Yuan. (This revision should be affirmed by higher institutions). 2. Compensation standard on brick & concrete structure is lifted from 21OYuan/m 2 to 22OYuan/m 2, which is determined by Mr. Zhang, Xuefeng (Vise Director of HPCD) and Mr. Liu, Zefu. Therefore, cost of this item is increased from 13588008 Yuan to 14235056 Yuan. Increased amount is 647048 Yuan. 3. Capital flow direction in the Capital Flowchart is consulted between Mr. Zhang, Xuefeng and Mr. Liu, Zefu. It is determined that account for land compensation should be opened in local county banks by county-level resettlement institutions. Fund application plan should be put forward by village administrative committee(VAC) and be approved by relevant county/town institutions before drawing from banks who can otherwise refuse the payment.