Wuhan Department Store Group Co., Ltd.-WDS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Landscape Analysis of Geographical Names in Hubei Province, China

Entropy 2014, 16, 6313-6337; doi:10.3390/e16126313 OPEN ACCESS entropy ISSN 1099-4300 www.mdpi.com/journal/entropy Article Landscape Analysis of Geographical Names in Hubei Province, China Xixi Chen 1, Tao Hu 1, Fu Ren 1,2,*, Deng Chen 1, Lan Li 1 and Nan Gao 1 1 School of Resource and Environment Science, Wuhan University, Luoyu Road 129, Wuhan 430079, China; E-Mails: [email protected] (X.C.); [email protected] (T.H.); [email protected] (D.C.); [email protected] (L.L.); [email protected] (N.G.) 2 Key Laboratory of Geographical Information System, Ministry of Education, Wuhan University, Luoyu Road 129, Wuhan 430079, China * Author to whom correspondence should be addressed; E-Mail: [email protected]; Tel: +86-27-87664557; Fax: +86-27-68778893. External Editor: Hwa-Lung Yu Received: 20 July 2014; in revised form: 31 October 2014 / Accepted: 26 November 2014 / Published: 1 December 2014 Abstract: Hubei Province is the hub of communications in central China, which directly determines its strategic position in the country’s development. Additionally, Hubei Province is well-known for its diverse landforms, including mountains, hills, mounds and plains. This area is called “The Province of Thousand Lakes” due to the abundance of water resources. Geographical names are exclusive names given to physical or anthropogenic geographic entities at specific spatial locations and are important signs by which humans understand natural and human activities. In this study, geographic information systems (GIS) technology is adopted to establish a geodatabase of geographical names with particular characteristics in Hubei Province and extract certain geomorphologic and environmental factors. -

The Causes and Effects of the Development of Semi-Competitive

Central European University The Causes and Effects of the Development of Semi-Competitive Elections at the Township Level in China since the 1990s By Hairong Lai Thesis submitted in fulfillment for the degree of PhD, Department of Political Science, Central European University, Budapest, January 2008 Supervisor Zsolt Enyedi (Central European University) External Supervisor Maria Csanadi (Hungarian Academy of Sciences) CEU eTD Collection PhD Committee Tamas Meszerics (Central European University) Yongnian Zheng (Nottingham University) 1 Contents Summary..........................................................................................................................................4 Acknowledgements..........................................................................................................................6 Statements........................................................................................................................................7 Chapter 1: Introduction .................................................................................................................8 1.1 The literature on elections in China ....................................................................................8 1.2 Theories on democratization .............................................................................................15 1.3 Problems in the existing literature on semi-competitive elections in China .....................21 1.4 Agenda of the current research..........................................................................................26 -

Report 2011–5010

Shahejie−Shahejie/Guantao/Wumishan and Carboniferous/Permian Coal−Paleozoic Total Petroleum Systems in the Bohaiwan Basin, China (based on geologic studies for the 2000 World Energy Assessment Project of the U.S. Geological Survey) 114° 122° Heilongjiang 46° Mongolia Jilin Nei Mongol Liaoning Liao He Hebei North Korea Beijing Korea Bohai Bay Bohaiwan Bay 38° Basin Shanxi Huang He Shandong Yellow Sea Henan Jiangsu 0 200 MI Anhui 0 200 KM Hubei Shanghai Scientific Investigations Report 2011–5010 U.S. Department of the Interior U.S. Geological Survey Shahejie−Shahejie/Guantao/Wumishan and Carboniferous/Permian Coal−Paleozoic Total Petroleum Systems in the Bohaiwan Basin, China (based on geologic studies for the 2000 World Energy Assessment Project of the U.S. Geological Survey) By Robert T. Ryder, Jin Qiang, Peter J. McCabe, Vito F. Nuccio, and Felix Persits Scientific Investigations Report 2011–5010 U.S. Department of the Interior U.S. Geological Survey U.S. Department of the Interior KEN SALAZAR, Secretary U.S. Geological Survey Marcia K. McNutt, Director U.S. Geological Survey, Reston, Virginia: 2012 For more information on the USGS—the Federal source for science about the Earth, its natural and living resources, natural hazards, and the environment, visit http://www.usgs.gov or call 1–888–ASK–USGS. For an overview of USGS information products, including maps, imagery, and publications, visit http://www.usgs.gov/pubprod To order this and other USGS information products, visit http://store.usgs.gov Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. -

Impacts of Human Activities on the Flow Regime of the Yangtze River

266 Changes in Water Resources Systems: Methodologies to Maintain Water Security and Ensure Integrated Management (Proceedings of Symposium HS3006 at IUGG2007, Perugia, July 2007). IAHS Publ. 315, 2007. Impacts of human activities on the flow regime of the Yangtze River QIONGFANG LI, ZHENHUA ZOU, ZIQIANG XIA, JIN GUO & YI LIU State Key Laboratory of Hydrology, Water Resources and Hydraulic Engineering, Hohai University, Nanjing 210098, China [email protected] Abstract The Yangtze River (Changjiang) is one of the most important rivers in the world, and the alterations in its hydrological regime have global-scale impacts. However, with population increase and economic growth, the flow regime of the Yangtze River has been altered to some extent by human activities, including dam construction, soil and water conservation, etc. The alteration in the flow regime of the Yangtze River will unavoidably influence its morphology and geomorphology, delta evolution and ecosystem health and stability. To assess dam-induced alterations in the flow regime of the Yangtze River quantitatively, this paper selected the Danjiangkou reservoir, the Gezhouba reservoir and the Three Gorges reservoir as case study sites, and the whole study period was divided into 4 sub-periods by the years when these three reservoirs started to store water, respectively. On the basis of the time series of daily flow discharge from six key hydrological stations (i.e. Wanxian, Yichang, Hankou, Datong, Baihe and Xiantao stations), the alterations in annual, seasonal, and monthly runoff in different sub-periods and the driving forces were explored. The output of this paper could provide reference for the assessment of impacts of human activities on the health and stability of the Yangtze River ecosystem. -

Coronavirus Outbreak Has Led to Global Shortage and Price Gouging of Surgical Masks • Resilinc Identified 213 Suppliers and 491 Sites Available in Database

1 SUPPLY Coronavirus CHAIN Outbreak RISK The case for planning, preparedness REPORT and proactive action 2nd in a Series of Conference Calls UPDATED MARCH 4, 2020 CONFIDENTIAL – FOR YOUR EYES ONLY © 2020 Resilinc Corporation. All rights reserved. 2 Speakers Moderated by: Jigar Shah Sr. Director of Marketing Resilinc Bindiya Vakil Founder and CEO Resilinc © 2020 Resilinc Corporation. All rights reserved. 3 Agenda • Background Assessing • Notes for SC professionals • Current Updates • Just the Numbers: COVID-19 Planning • Mapped: worldwide exposure • Global impact by industry • Supply chain mapped: suppliers, sites, & parts Preparedness • Recommendations • Scenarios and Planning Horizons • What Resilinc is doing • What we suggest Action • Q & A © 2020 Resilinc Corporation. All rights reserved. 4 Background © 2020 Resilinc Corporation. All rights reserved. 5 What we know about the Coronavirus (2019nCoV) • Nearly 100,000 infected with almost 3,300 fatalities Dec 31, ’19 China reports pneumonia-like cases in Wuhan to WHO China authorities reported signs of pneumonia-like outbreak in Jan 4, ’20 • Similar to SARS and MERS (2012), also the common cold, Wuhan but has spread wider Jan 9, ‘20 WHO identifies virus as a coronavirus (similar to SARS) Jan 22, ‘20 All travel in/out and intra-province transit within Wuhan is at a • Known cases are due to direct, second and third level standstill contact i.e. spreading through touching infected surfaces Jan 30, ‘20 WHO designates Coronavirus as a Global Public Health Emergency • 1 Person can spread to 2.2 people (R-naught) compared to Feb 4, ’20 South Korea: Hyundai and Kai suspend manufacturing Spanish Flu which had an R-naught of 1.8 operations Feb 11, ’20 WHO official names Coronavirus as COVID-19 • Current fatality rate 3.4%, was 2% before March (this is Feb 18, ’20 Global Economy: China will decline by an est. -

UNMASKING CORONAVIRUS the Virus Spread to 27 Countries in Just 31 Days

16-29 FEBRUARY, 2020 DownToEarthSCIENCEFORTNIGHTLY AND ENVIRONMENTON POLITICS OF FORTNIGHTLY DEVELOPMENT, ENVIRONMENT AND HEALTH Subscriber copy, not for resale `60.00 + Budget 2020 has all the ingredients for aggravating farm distress P14 Trump’s visit to India could impede access to affordable healthcare P58 CSR SPECIAL P24 UNMASKING CORONAVIRUS The virus spread to 27 countries in just 31 days. Is the world prepared for a pandemic? 01Cover.indd 1 11/02/20 12:54 PM COVER STORY/CORONAVIRUS CORONAVIRUS PANICMore than a month after the first case was reported from China, there is little the world knows about the new coronavirus. The strain remains a mystery, its symptoms deceptively similar to common cold and there are no curative or preventive vaccine or medicine. What's certain is that the virus is highly contagious. In just 45 days, it has killed over 1,000 people in China and infected more than 40,000 in 27 countries. Worryingly, we have not yet seen the peak of the spread. Is the world ready to face a pandemic? A report by Banjot Kaur and Alok Gupta 30 DOWN TO EARTH 16-29 FEBRUARY 2020 DOWNTOEARTH.ORG.IN 30-35Cover story_coronavirus.indd 30 12/02/20 2:09 PM People queue up to buy masks in PANIC Hong Kong DOWNTOEARTH.ORG.IN 16-29 FEBRUARY 2020 DOWN TO EARTH 31 PHOTOGRAPH: REUTERS 30-35Cover story_coronavirus.indd 31 12/02/20 2:09 PM COVER STORY/CORONAVIRUS HE LUNAR New Year break has been uncomfortably long and quiet Tfor almost 50 million people in China. Since January 23, the authorities have locked down some 13 cities, including Wuhan in the province of Hubei, which is the epicentre of the deadly coronavirus outbreak. -

Are China's Water Resources for Agriculture Sustainable? Evidence from Hubei Province

sustainability Article Are China’s Water Resources for Agriculture Sustainable? Evidence from Hubei Province Hao Jin and Shuai Huang * School of Public Economics and Administration, Shanghai University of Finance and Economics, Shanghai 200433, China; [email protected] * Correspondence: [email protected]; Tel.: +86-21-65903686 Abstract: We assessed the sustainability of agricultural water resources in Hubei Province, a typical agricultural province in central China, for a decade (2008–2018). Since traditional evaluation models often consider only the distance between the evaluation point and the positive or negative ideal solution, we introduce gray correlation analysis and construct a new sustainability evaluation model. Our research results show that only one city had excellent sustainable development capacity of agricultural water resources, and the evaluation value of eight cities fluctuated by around 0.5 (the median of the evaluation result), while the sustainable development capacity of agricultural water resources in other cities was relatively poor. Our findings not only reflect the differences in the natural conditions of water resources among various cities in Hubei, but also the impact of the cities’ policies to ensure efficient agricultural water use for sustainable development. The indicators and methods Citation: Jin, H.; Huang, S. Are in this research are not difficult to obtain in most countries and regions of the world. Therefore, the China’s Water Resources for indicator system we have established by this research could be used to study the sustainability of Agriculture Sustainable? Evidence agricultural water resources in other countries, regions, or cities. from Hubei Province. Sustainability 2021, 13, 3510. https://doi.org/ Keywords: water resources; agricultural water resources; sustainability; gray correlation analysis; 10.3390/su13063510 evaluation model Academic Editors: Daniela Malcangio, Alan Cuthbertson, Juan 1. -

Supplementary Data

Supplementary data Figures Figure S1 Figure S1 Top cities with the highest migrants before Spring Festival A-C, Top cities with highest migrant on Jan 22, 2020. D-F, Top cities with highest migrant on Jan 23, 2020. G-I, Top cities with highest migrant on Jan 24, 2020. A, D, G, Top 50 hot cities with high export migrants; B, E, H, Top 10 cities with high export migrant; C, F, I, Top 10 cities with high import migrants. Figure S2 Figure S2 Migration and transport index during spring festival A, Emigration from Wuhan City on Jan 23, 2020; B, Emigration from Hubei province on Jan 23, 2020; C, Traffic congestion index during 7-day festival holiday in 2020 and 2019; D, Population mobility index during 7-day festival holiday in 2020 and 2019. Tables Table S1 Hot spot value and relative risk with case number and incidence Case Number Incidence City Name Hot value Relative Risk Hot value Relative Risk Trend Huanggang 0.7201 0.133 0.4678 0.485 Ezhou City 0.5833 0.346 0.4714 0.5067 Suizhou 0.4106 0.8371 0.4739 0.4732 Wuhan 0.7822 1.77E-04 0.4766 0.4987 Yellowstone 0.6053 0.4126 0.4822 0.4702 Xiangyang 0.3047 0.8646 0.4933 0.5275 Xiaogan 0.6284 0.536 0.4941 0.4689 Xianning 0.5739 0.5933 0.4946 0.484 Tianmen 0.4501 0.5174 0.5035 0.4792 Qianjiang 0.3958 0.4191 0.504 0.4736 Shiyan 0.3538 0.8206 0.5064 0.5596 Jingzhou 0.5947 0.2856 0.5101 0.4826 Xiantao 0.5631 0.1536 0.5115 0.4868 Jingmen 0.4774 0.7351 0.5278 0.501 Yichang 0.3634 0.7426 0.5324 0.5537 Enshi 0.369 0.7142 0.5378 0.5239 Table S2 Migration index of Wuhan city and Hubei province in 2020 and -

Empirical Research on the Impact of Real Estate on Economic Development

Journal of Mathematical Finance, 2021, 11, 246-254 https://www.scirp.org/journal/jmf ISSN Online: 2162-2442 ISSN Print: 2162-2434 Empirical Research on the Impact of Real Estate on Economic Development Shichang Shen School of Mathematics and Statistics, Qinghai Nationalities University, Xining, China How to cite this paper: Shen, S.C. (2021) Abstract Empirical Research on the Impact of Real Estate on Economic Development. Journal Real estate development investment has a significant impact on economic of Mathematical Finance, 11, 246-254. development. Based on data from 17 prefecture-level cities and prefectures in https://doi.org/10.4236/jmf.2021.112014 Hubei Province from 2002 to 2018, the relationship between real estate de- Received: March 5, 2021 velopment investment and economic growth is analyzed with the help of Accepted: May 14, 2021 panel data models. The study found that there is a long-term equilibrium re- Published: May 17, 2021 lationship between the two, and there are regional differences in the impact of real estate development investment on economic growth in Hubei Province. Copyright © 2021 by author(s) and Scientific Research Publishing Inc. Among them, Wuhan has the largest impact and Shennongjia forest area has This work is licensed under the Creative the smallest impact. The impact of real estate development investment on Commons Attribution International economic growth depends on the level of regional economic development. License (CC BY 4.0). http://creativecommons.org/licenses/by/4.0/ Keywords Open Access Real Estate, Economic Growth, Panel Data Model 1. Introduction The real estate industry has been on the rise for many years. -

GNAM Investment Competition

GNAM Investment Competition RENMIN UNIVERSITY OF CHINA WUHAN DEPARTMENT STORE GROUP(WDS) October 29th, 2016 Yan, CUI Di, GU Chunxiao, HAO Xin, PENG Jianghao, Wang Haidong, ZHAO OVERVIEW WDS Summary China Shenzhen Stock • Dominating Retailing Market in Central China Stock Exchange Exchange • Market Value of Properties Increasing Substantially Code 000501.SZ Last Close CNY 19.11 • Net Profit Growing Rapidly Target Price CNY 24.60 Upside 28.72% • Business Structure Optimized to Satisfy Customers’ Demands 52-wk Range CNY14.39-23.74 • Proper Equity Structure and Creative Incentives Boosting Efficiency Business Retail Sales& Sector Commercial Chains Market Cap CNY 11.31bn Share Outstanding 592mn WDS vs SHENZHEN COMPONENT INDEX RATIO CHANGE Wuhan Selline Group Major Shareholder 60.00% Co.,Ltd(21.54%) 50.00% Free Float 85.7%(507mn) 40.00% P/B Ratio 2.05x 30.00% Revenue CNY 17.52bn Net Profit CNY 799.31mn 20.00% EPS CNY 1.58 10.00% BPS CNY 9.32 0.00% CPS CNY 1.61 -10.00% P/CF 11.85 -20.00% ROE 20.73% 2015/09/22 2015/10/13 2015/11/03 2015/11/24 2015/12/15 2016/01/05 2016/01/26 2016/02/16 2016/03/08 2016/03/29 2016/04/19 2016/05/10 2016/05/31 2016/06/21 2016/07/12 2016/08/02 2016/08/23 2016/09/13 2016/10/04 2015/09/01 ROA 4.79% WDS SHENZHEN COMPONENT INDEX 2 HIGHLIGHTS • As a bellwether in retail industry in Hubei Province and even in China, WDS enjoys unparalleled competitive edge over its competitors. -

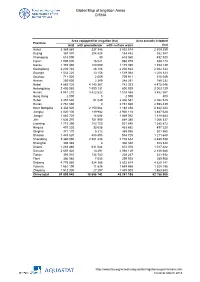

Global Map of Irrigation Areas CHINA

Global Map of Irrigation Areas CHINA Area equipped for irrigation (ha) Area actually irrigated Province total with groundwater with surface water (ha) Anhui 3 369 860 337 346 3 032 514 2 309 259 Beijing 367 870 204 428 163 442 352 387 Chongqing 618 090 30 618 060 432 520 Fujian 1 005 000 16 021 988 979 938 174 Gansu 1 355 480 180 090 1 175 390 1 153 139 Guangdong 2 230 740 28 106 2 202 634 2 042 344 Guangxi 1 532 220 13 156 1 519 064 1 208 323 Guizhou 711 920 2 009 709 911 515 049 Hainan 250 600 2 349 248 251 189 232 Hebei 4 885 720 4 143 367 742 353 4 475 046 Heilongjiang 2 400 060 1 599 131 800 929 2 003 129 Henan 4 941 210 3 422 622 1 518 588 3 862 567 Hong Kong 2 000 0 2 000 800 Hubei 2 457 630 51 049 2 406 581 2 082 525 Hunan 2 761 660 0 2 761 660 2 598 439 Inner Mongolia 3 332 520 2 150 064 1 182 456 2 842 223 Jiangsu 4 020 100 119 982 3 900 118 3 487 628 Jiangxi 1 883 720 14 688 1 869 032 1 818 684 Jilin 1 636 370 751 990 884 380 1 066 337 Liaoning 1 715 390 783 750 931 640 1 385 872 Ningxia 497 220 33 538 463 682 497 220 Qinghai 371 170 5 212 365 958 301 560 Shaanxi 1 443 620 488 895 954 725 1 211 648 Shandong 5 360 090 2 581 448 2 778 642 4 485 538 Shanghai 308 340 0 308 340 308 340 Shanxi 1 283 460 611 084 672 376 1 017 422 Sichuan 2 607 420 13 291 2 594 129 2 140 680 Tianjin 393 010 134 743 258 267 321 932 Tibet 306 980 7 055 299 925 289 908 Xinjiang 4 776 980 924 366 3 852 614 4 629 141 Yunnan 1 561 190 11 635 1 549 555 1 328 186 Zhejiang 1 512 300 27 297 1 485 003 1 463 653 China total 61 899 940 18 658 742 43 241 198 52 -

Effect of Public Health Interventions on COVID-19 Cases

Respiratory epidemiology Original research Thorax: first published as 10.1136/thoraxjnl-2020-215086 on 16 February 2021. Downloaded from Effect of public health interventions on COVID-19 cases: an observational study Weihong Qiu,1,2 Heng He,3 Peng Zhang,4 Wenwen Yang,4 Tingming Shi,5 Xing Wang,1,2 Ailian Chen,1,2 Li Xie,1,2 Meng Yang,1,2 Dongming Wang,1,2 Mingyan Li,4 Weihong Chen 1,2 ► Additional material is ABSTRACT published online only. To view Background As the epidemic of COVID-19 is gradually Key messages please visit the journal online (http:// dx. doi. org/ 10. 1136/ controlled in China, a summary of epidemiological thoraxjnl-2020- 215086). characteristics and interventions may help control its global What is the key question? spread. ► Since the outbreak, the full spectrum of the For numbered affiliations see Methods Data for COVID-19 cases in Hubei Province outbreak and the impact of non- pharmaceutical end of article. (capital, Wuhan) was extracted until 7 March 2020. interventions on COVID-19 in Hubei Province The spatiotemporal distribution of the epidemic in are still unclear. Correspondence to four periods (before 10 January, 10–22 January, 23 Professor Weihong Chen, What is the bottom line? January–6 February and 7 February–7 March) was Department of Occupational ► We analysed the effects of non- pharmaceutical and Environmental Health, evaluated, and the impacts of interventions were intervention measures, including district traffic School of Public Health, Tongji observed. interruption, wearing masks in public places Medical College, Huazhong Results Among 67 706 COVID-19 cases, 52 111 University of Science and and isolating infected patients and close (76.97%) were aged 30–69 years old, and 34 680 Technology, Wuhan, Hubei, contacts, on stopping the epidemic in Wuhan (51.22%) were women.