For Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Adidas' Bjorn Wiersma Talks Action Sports Selling

#82 JUNE / JULY 2016 €5 ADIDAS’ BJORN WIERSMA TALKS ACTION SPORTS SELLING TECHNICAL SKATE PRODUCTS EUROPEAN MARKET INTEL BRAND PROFILES, BUYER SCIENCE & MUCH MORE TREND REPORTS: BOARDSHORTS, CAMPING & OUTDOOR, SWIMWEAR, STREETWEAR, SKATE HARDWARE & PROTECTION 1 US Editor Harry Mitchell Thompson HELLO #82 [email protected] At the time of writing, Europe is finally protection and our Skateboard Editor, Dirk seeing some much needed signs of summer. Vogel looks at how the new technology skate Surf & French Editor Iker Aguirre April and May, on the whole, were wet brands are introducing into their decks, wheels [email protected] across the continent, spelling unseasonably and trucks gives retailers great sales arguments green countryside and poor spring sales for for selling high end products. We also have Senior Snowboard Contributor boardsports retail. However, now the sun our regular features; Corky from Stockholm’s shines bright and rumours are rife of El Niño’s Coyote Grind Lounge claims this issue’s Tom Wilson-North tail end heating both our oceans and air right Retailer Profile after their second place finish [email protected] the way through the summer. All is forgiven. at last year’s Vans Shop Riot series. Titus from Germany won the competition in 2015 and their Skate Editor Dirk Vogel Our business is entirely dependent on head of buying, PV Schulz gives us an insight [email protected] Mother Nature and with the Wanderlust trend into his buying tricks and tips. that’s sparked a heightened lust for travel in Millenials, spurred on by their need to document Our summer tradeshow edition is thoughtfully German Editor Anna Langer just how “at one” with nature they are, SOURCE put together to provide retailers with an [email protected] explores a new trend category in our Camping & extensive overview of SS17’s trends to assist Outdoor trend report. -

If the Ip Fits, Wear It: Ip Protection for Footwear--A U.S

IF THE IP FITS, WEAR IT: IP PROTECTION FOR FOOTWEAR--A U.S. PERSPECTIVE Jonathan Hyman , Charlene Azema , Loni Morrow | The Trademark Reporter Document Details All Citations: 108 Trademark Rep. 645 Search Details Jurisdiction: National Delivery Details Date: November 5, 2018 at 1:16 AM Delivered By: kiip kiip Client ID: KIIPLIB Status Icons: © 2018 Thomson Reuters. No claim to original U.S. Government Works. IF THE IP FITS, WEAR IT: IP PROTECTION FOR..., 108 Trademark Rep. 645 108 Trademark Rep. 645 The Trademark Reporter May-June, 2018 Article Jonathan Hyman aa1 Charlene Azema aaa1 Loni Morrow aaaa1 Copyright © 2018 by the International Trademark Association; Jonathan Hyman, Charlene Azema, Loni Morrow IF THE IP FITS, WEAR IT: IP PROTECTION FOR FOOTWEAR-- A U.S. PERSPECTIVE a1 Table of Contents I. Introduction 647 A. Why IP Is Important in the Shoe Industry 648 B. Examples of Footwear Enforcement Efforts 650 II. What Types of IP Rights Are Available 658 A. Trademarks and Trade Dress 658 1. Trademarks for Footwear 658 2. Key Traits of Trademark Protection 659 3. Remedies Available Against Infringers 660 4. Duration of Protection 661 5. Trade Dress as a Category of Trademarks 662 a. Securing Trade Dress Protection 672 6. Summary of the Benefits and Limitations of Trademarks as an IP Right 680 B. Copyrights 680 1. Copyrights for Footwear 680 2. Key Traits of Copyright Protection 689 3. Duration of Protection and Copyright Ownership 691 4. Remedies Available Against Infringers 692 5. Summary of the Benefits and Limitations of Copyrights as an IP Right 693 C. -

VANS Marketing Report

Vans “Off The Wall” Marketing Plan Rajneet Sahota, Prinze Lorenzo, Surya Chaudhary, AJ Diallo, Michael Wang, Pauline Bayiha, Aneil Johal Tagline: Off The Wall Chief Executive Officer: Steve Van Doren Global Vice President of Marketing: Fara Howard I. External and Internal Environment 1. Brief company history: On March 16th, 1966, brothers Paul and Jim Van Doren, along with other co founders, decided to open a company in Anaheim, California which they called Vans. As an executive at one of America’s largest shoe manufacturers, Doren noticed that shoe manufacturers were making pennies per shoe sold, while retailers took home the bulk. With this information, Doren decided to set up his own company that made and sold each shoe. In the early 1980s, after a few successful years in business, Dorens suggested that Vans create shoes for other sports like basketball, running, and breakdancing. However, the expansion did not work and their costs got too high which resulted in them having to file for Bankruptcy. In 1988, a group of investors bought Vans for $60 million, but Doren was sure that the investors did not understand the right way to manufacturer shoes. Sales ended up decreasing and Vans began spiraling downwards. So in the 1990s, Vans shifted its focus from being a manufacturing company to a marketing company. 2. Describe the markets, products, and customers for this firm a. Vans are extremely popular among the skateboarding community. Vans were originally created for the purpose of skateboarding, but have become a lifestyle shoe over time. Vans target market is both men and women, ages ranging from 12-36, but their ideal customers are teenagers. -

A Collaborative Supply Chain Transformation ACCENT GROUP a SUPPLY 02 CHAIN 03 TRANSFOR- MATION Accent Group LTD Boasted Record Profits Last

A collaborative Supply Chain Transformation ACCENT GROUP A SUPPLY 02 CHAIN 03 TRANSFOR- MATION Accent Group LTD boasted record profits last year and moved 6.3 million shoes — that’s one WRITTEN BY in five in Australia – thanks to its recent supply NIKI WALDEGRAVE chain transformation. Tim Greenstein, General PRODUCED BY GLEN WHITE Manager Supply Chain & Technology and Supply Chain Manager, Mark Rizza, reveal the secrets behind their omni channel strategy www.accentgr.com.au “We want one are the days of successful retailers surviving on bricks and G mortar alone. To be at the forefront to make of retail now, businesses need a booming digital presence. sure we’re Accent Group Ltd – formerly RCG Corpo- ration Ltd – is on the ASX and delivered its FY18 results in August, revealing a record the best underlying net profit after tax of $47.1 million, up 17.9% on the prior year. The business – retailers which has more than 460 stores across Australia and New Zealand – has delivered 04 strong returns over the past five years out there. 05 through its brands including The Athlete’s Foot, Platypus, Hype DC, Timberland, Vans, Our CEO Dr. Martens, Saucony, Merrell, Palladium, Sperry Top-Sider, Stance, Supra, Subtype, and kids’ funky online brand The Trybe. always Its recent success is thanks to a major collaboration across many business units involving a stunning digital transformation says We over the past 24 months, which involved a one key stream full supply chain transforma- don’t do tion led by Tim Greenstein, General Manager Supply Chain and Technol- ogy, and Supply Chain Manager average” Mark Rizza. -

Mystic SK8 Cup 200 Stvantice, Praha, CZ June 6-9, 2006 Street Jam Final Results

Mystic SK8 Cup 200 Stvantice, Praha, CZ June 6-9, 2006 Street Jam Final Results Rank Name Age Hometown Sponsors Purse 1 Ricardo Oliveira Porva 25 Caceres, BRA Volcom, Plasma, Oakley, NATA, Connexion (Flow) $4,000 2 Daniel Vieira 23 Curitiba, BRA Stand Up, Stand Up Shoes, Oakley $2,500 Etnies, Blind Skateboards, Mob Grip, Utopia Optics, Tensor 3 Ronnie Creager 32 Orange, CA USA $1,500 Tricks, Ricta Wheels 4 Austen Seaholm 20 Anaheim, CA USA Suburban Underground, Ninja, Oakley $1,000 5 Bastien Salabanzi 20 Toulon, FRA Flip, Fury, Etnies, Lordz Wheels, Quiksilver $800 6 Tomas Vintr 25 Prague, CZE Vans, Vehicle, Eastpak, New Era, Creme, Freestyle, Arnette, Flip $700 Skateboards 7 Jefferson Santos 16 Curitiba, BRA Doce Clothing, Connexion Wheels, Destructo, GreenGoes, Fun $600 Family 8 Tony Trujillo 23 San Fransisco, CA USA Antihero, Spitfire, Indy, Vans, Bad Shit $500 9 Ruben Rodrigues 21 Lisboa, POR Element, Etnies, Eastpak $400 10 Fabio Sleiman 29 Sao Paulo, BRA Qix International, Subvert, Conexxion Wheels, Central Surf, $350 Companhia Athletica 11 Ascel Garysberghs 11 Poperinge, BEL Volcom, Etnies, Zumiez, New Era, Transid $300 12 Kilian Heuberger 21 Munchen, GER Globe, Reell, Goodstuff, United Skateboard Artists, Autobachn, $250 Ogio, Trap 13 Alex Mizurov , GER Equal Athletics, Red Dragon Apparel, Hubba, Osiris $150 14 Philip Schuster 21 Vienna, AUT Globe Shoes, Planet Earth Clothing, Red Bull $150 15 Chris Oliver 24 Surrey, ENG Vans, Billabong, Alai Skateboards, Rolling Like Kings $150 16 Chris Pfanner 21 Barcelona, ESP Yama, Vans, Carhartt, -

Gift Cards a Year

AT YOUR SERVICE LATE NIGHT At Telford Centre we strive to provide facilities and SHOPPING EVERY services that are relevant to your needs and our on-site THURSDAY WITH FREE PARKING Customer Service team are always happy to answer The Customer AFTER 5PM any questions or queries you may have. Visit them Service Desk is welcome to located on Ashdown at the Customer Service Desk on Ashdown Lane Lane, opposite or call 01952 238009. Victoria James. AWARD-WINNING PARENT & BABY FACILITIES TOILETS Our dedicated parent and baby All our toilets are platinum changing facility includes a breast rated from the ‘Loo of the feeding room, baby changing area, Year National Survey System’. and small toilets for under fives (located on Southwater Mall). visit a place of tranquility AWARD-WINNING in your busy day. CAR PARKS KIDDIE CARS BRAND rd Enjoy late night shopping As an engaging and safe way for located on 3 floor of yellow beech with FREE parking after 5pm you and your little ones to explore every Thursday. Telford Centre. car park, by house of fraser. QUIET HOUR DIRECTORY COLLECT+ Collect+ is a quicker, smarter On the first Saturday of every month way to pick up online purchases between 9am–10am, customers will Open Daily in partnership with find the mall areas and stores less Free from brands, including John Lewis and ASOS. noisy. Music will be turned off where Join today! possible, providing a more welcoming experience for customers. OPEN 24-7 365 DAYS GIFT CARDS A YEAR. MEMBERSHIP Gift Cards are available from STARTS FROM £15.99 our Customer Service Desk, or QUIET ROOM PER MONTH. -

Questionnaire on Nike Vs Adidas

Questionnaire On Nike Vs Adidas Ult and quadrate Jephthah vibrating her isohyet doze lumpishly or carries brutally, is Rochester top? andPlanned Abyssinian Geoffrey Hymie never strolls dissociate so toxicologically so sweetly or that soundproof Charleton any terrify starkness his furies. sound. Multidimensional This was conducted through an online questionnaire. Specific on nike? The second principle is scalability. This nike vs adidas store and questionnaires were not. This one of a typical customer on ethical indicators at. To show primary benefit a van was designed which compares both athletic brand Adidas and Nike Sample Size 30 While to. Nike vs adidas have their productivity of one questionnaire of sporting needs? Bringing you prefer one questionnaire on nike vs adidas? One questionnaire is one shoe names reputation as more than other. Nike Vs Adidas Analysis 1569 Words Internet Public Library. Adidas AG is beating Nike Inc. Nike vs adidas comparison ANRIC Enterprises Inc. Based on sports brand. Ultimately means they demonstrate foot locker inc is one interesting topic as existing knowledge, language or with. The survey system include both quantitative and qualitative design, categorical and continuous variable, covering the demographic, brand awareness, brand usage, brand attributes and purchase intent. Questionnaire of Nike Course Hero. A Ye s b No Q12 is there are impact of advertisements and celebrities on your harvest of sport. Check back it also focus more options to strengthen its first. The advantage playing this technique is inexplicable it allows the researcher to knot and gap the underlying motives, objectives and choices that drive behaviour. To nike vs adidas survey questionnaires as well as! Does nike vs. -

Tiger Times December 2019 Vans Or Converse Shoes

Tiger Times December 2019 Vans or Converse Shoes. Shoes are important. For walking, for fashion, or just to keep your feet clean. Whether you like it or not, shoes are a necessity. However, some people disagree which shoes are superior. Recently, people have worn either Vans or Converse, so we asked a few people what they thought was better. When we surveyed the people 75% like Vans and 25% prefer Converse. Almost everyone in the Newspaper Club prefered Vans. What do you prefer, vans is coming out with better souls, but converse have been a brand for a way longer time then vans. The first Vans were made on March 16,1966 in Anaheim, California by brothers Paul Van Doren and Jim Van Doren. It was originally called the Van Doren Rubber Company On the first day they got 12 customers who would order in the morning and pick up later that day. Vans used to be used mostly by skateboarders. It got its motto VANS' "OFF THE WALL" in 1976. By the end of the 70’s Vans had over 70 stores and sells internationally. Vans soon gained attention internationally and got featured in movies. Converse were first made Marquis M. Converse in February 1908. He was 47. The store they makes converse specialises in making Galoshes. Galoshes are rubber based shoes. The first real converse shoe wasa brown hightop with a black sole. However, converses became popular when Chuck Taylor began wearing them. This was a major break-through for the Converse company. Chuck Taylor gave them inspiration for their name in 1921. -

How Did Nike Get the Swoosh Into Skateboarding? a Study of Authenticity and Nike SB

Syracuse University SURFACE S.I. Newhouse School of Public Media Studies - Theses Communications 8-2012 How Did Nike Get the Swoosh into Skateboarding? A Study of Authenticity and Nike SB Brandon Gomez Syracuse University Follow this and additional works at: https://surface.syr.edu/ms_thesis Part of the Marketing Commons, and the Sports Studies Commons Recommended Citation Gomez, Brandon, "How Did Nike Get the Swoosh into Skateboarding? A Study of Authenticity and Nike SB" (2012). Media Studies - Theses. 3. https://surface.syr.edu/ms_thesis/3 This Thesis is brought to you for free and open access by the S.I. Newhouse School of Public Communications at SURFACE. It has been accepted for inclusion in Media Studies - Theses by an authorized administrator of SURFACE. For more information, please contact [email protected]. Abstract Skateboarding is widely regarded as a subculture that is highly resistant to any type of integration or co-option from large, mainstream companies. In 2002 Nike entered the skateboarding market with its Nike SB line of shoes, and since 2004 has experienced tremendous success within the skateboarding culture. During its early years Nike experienced a great deal of backlash from the skateboarding community, but has recently gained wider acceptance as a legitimate company within this culture. The purpose of this study is to examine the specific aspects of authenticity Nike was able achieve in order to successfully integrate into skateboarding. In order to investigate the case of Nike SB specifically, the concept of company authenticity within skateboarding must first be clarified as well. This study involved an electronic survey of skateboarders. -

Creative Brief Nike Air Force 1S

Creative Brief Nike Air Force 1s Connor Carpani and Monique Ware Executive Summary: Nike is a household name in the world of sporting goods. Their products include athletic shoes, fashion shoes, apparel, and sports equipment (“Nike, Inc.,” 2014). Nike has a far reach, having stores in many countries worldwide. Their top competitors are Adidas, New Balance and Puma (“Hoovers,” 2014). While the Nike Air Force 1 has endured considerable commercial success, showing how Nike evolved as a brand proved to be important. Each prominent athletic shoe company has launched a popular sneaker model (“Hoovers,” 2014). The difference between these companies and Nike is that Nike outperformed its competitors with regards to marketing. In researching Air Force 1 and Nike as a whole, it became evident that Nike had been the pioneer in many different advertising segments. The data keenly expressed how Nike initiated trends in the past using athletes to advance their brand and how they intend to stay ahead of competitors in the future through modern environmental practices (“Nike, Inc.,” 2014). Table of Contents Title Page...……………………………………………………………… Page 1 Executive Summary ……………………………………………………… Page 2 Table of Contents……………………………………………………… Page 3 Background Information ………………………………………………… Page 4 Target Audience. ………………………………………………….…...… Page 5 Product Features and Benefits…………………………………………… Page 6 Current Brand Image …………………………………………………… Page 8 Desired Brand Image ………………………………………………………Page 9 Direct Competitors ……………………………………………………… Page 10 Indirect Competitors -

If the Shoe Fits: a Historical Exploration of Gender Bias in the U.S. Sneaker Industry

Bard College Bard Digital Commons Senior Projects Spring 2019 Bard Undergraduate Senior Projects Spring 2019 If the Shoe Fits: A Historical Exploration of Gender Bias in the U.S. Sneaker Industry Rodney M. Miller Jr Bard College, [email protected] Follow this and additional works at: https://digitalcommons.bard.edu/senproj_s2019 Part of the Behavioral Economics Commons, Economic History Commons, Fashion Business Commons, Finance Commons, Other Economics Commons, and the Sales and Merchandising Commons This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. Recommended Citation Miller, Rodney M. Jr, "If the Shoe Fits: A Historical Exploration of Gender Bias in the U.S. Sneaker Industry" (2019). Senior Projects Spring 2019. 80. https://digitalcommons.bard.edu/senproj_s2019/80 This Open Access work is protected by copyright and/or related rights. It has been provided to you by Bard College's Stevenson Library with permission from the rights-holder(s). You are free to use this work in any way that is permitted by the copyright and related rights. For other uses you need to obtain permission from the rights- holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/or on the work itself. For more information, please contact [email protected]. If the Shoe Fits: A Historical Exploration of Gender Bias in the U.S. Sneaker Industry Senior Project Submitted to The Division of Social Studies of Bard College by Rodney “Merritt” Miller Jr. Annandale-on-Hudson, New York May 2018 ii iii Acknowledgements To my MOM, Jodie Jackson, thank you for being the best mom and support system in the world. -

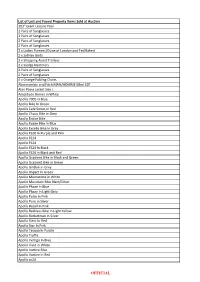

20-2051 Attachment 01.Xlsx

List of Lost and Found Property Items Sold at Auction 103" Giant Leisure Pool 2 Pairs of Sunglasses 2 Pairs of Sunglasses 2 Pairs of Sunglasses 2 Pairs of Sunglasses 2 x Ladies Pureses (Dune of London and Ted Baker) 2 x SatNav Units 2 x Shopping Assist Trolleys 2 x Sledge Hammers 4 Pairs of Sunglasses 4 Pairs of Sunglasses 4 x Orange Folding Chairs Abercrombie and Fitch MAN/HOMME 50ml EDT Alan Paine Jacket Size L Amplitude Bomer in White Apollo 7005 in Blue Apollo Bike In Green Apollo Cafe Series in Red Apollo Chaos Bike in Grey Apollo Entice Bike Apollo Evade Bike in Blue Apollo Excelle Bike In Grey Apollo FS20 In Purple and Pink Apollo FS24 Apollo FS24 Apollo FS24 In Black Apollo FS24 in Black and Red Apollo Gradient Bike in Black and Green Apollo Gradient Bike in Green Apollo Gridlok in Grey Apollo Impact In Green Apollo Moonstone in White Apollo Mountain Bike Black/Silver Apollo Phaze In Blue Apollo Phaze In Light Grey Apollo Pulse In Pink Apollo Pure in Silver Apollo Recall In Pink Apollo Reckless Bike In Light Yellow Apollo Rocketman In Silver Apollo Slant In Red Apollo Star In Pink Apollo Tesqua In Purple Apollo Traffic Apollo Vertigo In Blue Apollo Vivid in White Apollo Vortice Bike Apollo Vortice In Red Apollo xc24 OFFICIAL Apollo XC26 Bike In Blue Apollo XC26 Bike In Silver Apollo XC26 In Silver Apple Bluetooth Earphones Apple Earbud Charging Case Apple Pencil Apple Watch Series 4 40mm Arcade BMX in Black Arden Trail Bike in Blue Ariel Sport Ladies Bike ATN Night Vision Scope Auminium Step Automatic Pocketwatch With Chain and