Centerpoint Energy Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In the United States Bankruptcy Court for the Southern District of Texas Houston Division

Case 17-33695 Document 1249 Filed in TXSB on 12/12/17 Page 1 of 4 IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) In re: ) Chapter 11 ) GENON ENERGY, INC., et al.,1 ) Case No. 17-33695 (DRJ) ) Debtors. ) (Jointly Administered) ) ) Re: Docket No. 1213 NOTICE OF FILING OF REDLINE OF THIRD AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION OF GENON ENERGY, INC. AND ITS DEBTOR AFFILIATES PLEASE TAKE NOTICE that on December 12, 2017, GenOn Energy, Inc., et al., the above-captioned debtors and debtors in possession (collectively, the “Debtors”) filed the proposed Order Confirming the Third Amended Joint Chapter 11 Plan of Reorganization of Genon Energy, Inc. and Its Debtor Affiliates [Docket No. 1247] (the “Proposed Confirmation Order”) with the United States Bankruptcy Court for the Southern District of Texas (the “Court”). 1 The Debtors in these chapter 11 cases, along with the last four digits of each debtor’s federal tax identification number, are: GenOn Energy, Inc. (5566); GenOn Americas Generation, LLC (0520); GenOn Americas Procurement, Inc. (8980); GenOn Asset Management, LLC (1966); GenOn Capital Inc. (0053); GenOn Energy Holdings, Inc. (8156); GenOn Energy Management, LLC (1163); GenOn Energy Services, LLC (8220); GenOn Fund 2001 LLC (0936); GenOn Mid-Atlantic Development, LLC (9458); GenOn Power Operating Services MidWest, Inc. (3718); GenOn Special Procurement, Inc. (8316); Hudson Valley Gas Corporation (3279); Mirant Asia-Pacific Ventures, LLC (1770); Mirant Intellectual Asset Management and Marketing, LLC (3248); Mirant International Investments, Inc. (1577); Mirant New York Services, LLC (N/A); Mirant Power Purchase, LLC (8747); Mirant Wrightsville Investments, Inc. -

In Re: in the UNITED STATES BANKRUPTCY COURT for THE

IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION ) ) r .J In re: Chapter I I c::. ) -J 1 0 GENON ENERGY, INC.. et a/., ) Case No. 17-33695 (DRJ) n (""") ) ~ Debtors. ) (Jointly Administered) (....) ________________________________ ) -~ ,.. "--- .,..., c. co NOTICE OF HEARING TO CONSIDER ( .,l:"" r CONFIRMATION OF THE CHAPTER 11 PLAN FILED BY THE co DEBTORS AND RELATED VOTING AND OBJECTION DEADLINES PLEASE TAKE NOTICE THAT on October 5, 2017, the United States Bankruptcy Court for the Southern District of Texas (the "Court") entered an order [Docket No. 860] (the "Disclosure Statement Order"): (a) authorizing GenOn Energy, Inc. and its affiliated debtors and debtors in possession (collectively, the "Debtors"), to solicit acceptances for the Second Amended Joint Chapter II Plan ofReorgan ization ofGenOn Energy. Inc. and its Debtor Affiliates (as modified, amended, or supplemented from time to time, the "Plan");2 The Debtors in these chapter II cases, along with the last four digits of each debtor's federal tax identification number, are: GenOn Energy, Inc. (5566); GenOn Americas Generation, LLC (0520); GenOa Americas Procurement, inc. (8980); GenOa Asset Management, LLC (1966); GenOn Capital lac. (0053); GenOn Energy Holdings, Inc. (8156); GenOa Energy Management, LLC ( 1163); GcnOn Energy Services, LLC (8220); GenOn Fund 200 I LLC (0936); GenOa Mid-Atlantic Development, LLC (9458); GenOa Power Operating Services MidWest, Inc. (3718); GenOa Special Procurement, Inc. (8316); Hudson Valley Gas Corporation (3279); Mirant Asia-Pacific Ventures, LLC ( 1770); Mirant Intellectual Asset Management and Marketing, LLC (3248); Mirant Jnternational Investments, inc. ( 1577); Mirant New York Services, LLC (N/A); Mirant Power Purchase, LLC (8747); Mirant Wrightsville Investments, Inc. -

Current Report of Genon Holdings, Inc

Current Report of GenOn Holdings, Inc. Delivered Pursuant to Section 6.01(a) of the Stockholders Agreement Date of Report: December 14, 2018 IMPORTANT EXPLANATORY NOTE On December 14, 2018, GenOn Holdings, Inc. (the “Company”) entered into the Stockholders Agreement (the “Stockholders Agreement”) with each of the stockholders party thereto from time to time (the “Stockholders”). Section 6.01(a) of the Stockholders Agreement requires the Company to furnish to the Stockholders certain of the current reports that would be required to be filed with the Securities and Exchange Commission (the “SEC”) on Form 8-K if the Company was required to file such reports with the SEC to the extent such reports relate to the occurrence of any event which would require such report to be filed, subject to the exceptions described therein. This Current Report has been prepared pursuant to the requirements of Section 6.01(a) of the Stockholders Agreement. The Company does not file reports with the SEC and the preparation of this report and the posting of this information to the Company’s website pursuant to the requirements of the Stockholders Agreement shall in no way be interpreted as an undertaking on the part of the Company to otherwise comply with all of the rules and regulations that are applicable to a company subject to the reporting requirements of the Securities Exchange Act of 1934, as amended. Item 1.01 Entry into a Material Definitive Agreement Plan of Reorganization As previously disclosed, on June 14, 2017, GenOn Energy, Inc. (“GenOn”) and certain of its directly and indirectly- owned subsidiaries (collectively, the “Debtors”) filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) and on December 12, 2017, the Bankruptcy Court entered an order (the “Confirmation Order”) confirming the Debtors’ Third Amended Joint Chapter 11 Plan of Reorganization (the “Plan”). -

IN the UNITED STATES BANKRUPTCY COURT for the SOUTHERN DISTRICT of TEXAS HOUSTON DIVISION in Re: ) Chapter 11 GENON ENERGY, INC., Et Al.,1 ) Case No

IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS HOUSTON DIVISION In re: ) Chapter 11 GENON ENERGY, INC., et al.,1 ) Case No. 17-33695 (DRJ) Debtors. ) (Jointly Administered) Re: Docket No. 1250 NOTICE OF (I) ENTRY OF ORDER CONFIRMING THE THIRD AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION OF GENON ENERGY, INC. AND ITS DEBTOR AFFILIATES AND (II) DEADLINE FOR THE FILING OF POST-PETITION INTEREST REQUESTS PLEASE TAKE NOTICE that on December 12, 2017, the Honorable David R. Jones, United States Bankruptcy Judge for the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”), entered the Order Confirming the Third Amended Joint Chapter 11 Plan of Reorganization of GenOn Energy, Inc. and Its Debtor Affiliates [Docket No. 1250] confirming the Plan2 of the above-captioned debtors and debtors-in-possession (collectively, the “Debtors”). PLEASE TAKE FURTHER NOTICE that the Effective Date of the Plan will occur after all the conditions precedent set forth in Article X.B of the Plan either occur or are waived. Under the Debtors’ Restructuring Support Agreement, the outside date for the occurrence of the Effective Date is currently set for June 30, 2018 or September 30, 2018, if regulatory approvals are still pending. PLEASE TAKE FURTHER NOTICE that the Bankruptcy Court has approved certain discharge, release, exculpation, injunction, and related provisions in Article IX of the Plan. PLEASE TAKE FURTHER NOTICE, that, pursuant to the Plan and the Confirmation Order, the deadline for filing requests for payment of Administrative Claims, other than Professional Fee Claims, shall be 30 days after the Effective Date. -

2017 Corporate Responsibility Report Corporate 2017 Stewardship

alues V 2017 CORPORATE RESPONSIBILITY REPORT CORPORATE 2017 through STEWARDSHIP CenterPoint Energy 2017 Corporate Responsibility Report Stewardship through Values We will invest our capital to support safety, growth, reliability, grid hardening and infrastructure replacement, as well as to meet regulatory requirements. Approximately 7,000 Approximately trees planted and distributed $8.3 through our billion Right Tree Right 2018-22 capital Place program spending plan $6.5 million in contributions to nonprofits Nearly 8,000 dedicated employees In the communities where we live and work, we focus our time and energy on our three strategic giving pillars: education, community development, and health and human services. 2017 CORPORATE RESPONSIBILITY REPORT : PAGE 1 Our residential customers ranked us highest in customer satisfaction among large natural gas utilities in the South region in the annual study by J.D. Power and Associates. 1.3 million power restorations during Hurricane Added Harvey 70,000+ metered customers 1 million customers enrolled CenterPoint Energy strives in Power Alert to make a positive difference Service for all of our stakeholders through our values of safety, integrity, accountability, initiative and 146,000 respect. hours volunteered PAGE 2 : CENTERPOINT ENERGY Table of Contents About This Report About This Report 2 CenterPoint Energy is pleased to report continued progress Letter to Stakeholders 3 on our corporate responsibility efforts since we published our first Corporate Responsibility Report last year. Our 2017 About CenterPoint Energy 4 report provides more insight into our efforts regarding corporate Our Business 4 responsibility and stewardship. Operations Map 6 In line with our core values of safety, integrity, accountability, 2017 Results 7 initiative and respect, we strive to address issues that are Governance 10 important to our stakeholders in a thoughtful and transparent Approach 11 manner. -

NRG Energy, Inc. (Exact Name of Registrant As Specified in Its Charter) Delaware 41-1724239 (State Or Other Jurisdiction of Incorporation Or Organization) (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year ended December 31, 2020. ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition period from to . Commission file No. 001-15891 NRG Energy, Inc. (Exact name of registrant as specified in its charter) Delaware 41-1724239 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 804 Carnegie Center , Princeton , New Jersey 08540 (Address of principal executive offices) (Zip Code) (609) 524-4500 (Registrant's telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Exchange on Which Registered Common Stock, par value $0.01 NRG New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Update: Statewide Power Generation Emergency Expected to Extend Outages for Centerpoint Energy Customers

For more information, contact Media Relations [email protected] For Immediate Release Page 1 of 3 Update: Statewide power generation emergency expected to extend outages for CenterPoint Energy customers Houston – Feb. 16, 2021 – The Texas electric system continues to face an unprecedented power shortage due to extreme winter weather. Because the state’s current power generation has fallen short of demand, significant electricity outages have resulted across Texas and are lasting longer than previously planned. CenterPoint Energy is required to comply with ERCOT’s directive to suspend electric service to a portion of its customers. The company does not generate electricity itself, so the current shortage of power capacity from the grid is not something that CenterPoint Energy directly controls. Due to the continued issues with power generators’ ability to produce electricity, CenterPoint Energy’s customers need to be prepared to be without power, potentially for the duration of the generation shortage event, which could last several more days. CenterPoint Energy continues to navigate this historic weather event to provide for the stabilization of its electric delivery system and the reliability of its natural gas infrastructure. The company’s transmission and distribution systems handled the severe weather well, and CenterPoint Energy is prepared to serve its customers when generating capacity from third-party generators is available. As an electric transmission and delivery company serving the Greater Houston area, CenterPoint Energy depends on electricity that is provided by third-party electricity generators and received through the Electric Reliability Council of Texas (ERCOT), which is responsible for managing and scheduling power on the electric grid in Texas. -

2012 NRG Corporate Responsibility Report ABOUT THIS REPORT Post-Merger NRG

2012 NRG Corporate Responsibility Report ABOUT THIS REPORT Post-merger NRG RETAIL CUSTOMERS CUSTOMER REACH The 2012 NRG Corporate Responsibility Report is our third 2.2 40 million homes published annual report and reflects a period of continued million that our generation can support residential, commercial and growth and acquisition aimed at positioning NRG for a very industrial customers different future within the energy industry. Based on input TOTAL REVENUES FOR 2012 WHERE WE DO BUSINESS from customers, investors and other stakeholders, this report outlines our strategy and commitment to a sustainable future and summarizes our 2012 progress with key metrics. $8.4 billion Since NRG’s merger with GenOn — nearly doubling the size of our generation fleet — closed in mid-December, this report GENERATION CAPACITY and the information in our GRI response matrix focuses on 2012 19 states performance of pre-merger NRG, unless otherwise specified. In 2013, we are working to integrate NRG’s larger fleet while remaining a leader in safety, adopting best practices from both 47,000 and the megawatts District of companies, establishing new baseline metrics, and setting Columbia new targets to ensure continued progress in operational and eco efficiency. The 2013 Corporate Responsibility Report will JOB CREATION fossil, nuclear and establish new baselines and targets as we move to the next renewable generation chapter of providing a more sustainable energy future. 8,000 8,800 new jobs full time GENERATING & THERMAL LOCATIONS created employees NRG’s GRI response can be found at through repowering in the and solar projects United States http://www.nrgenergy.com/responsibility/gri/2012/gri.html (2007–2014) and provides more detail and information on the GRI indicators. -

Genon Morgantown Generating Station Renewal 2017

GenOn MID-ATLANTIC, LLC. MORGANTOWN GENERATING STATION 12620 CRAIN HIGHWAY, NEWBURG, MD 20664 PART 70 OPERATING PERMIT NO. 24-017-0014 RENEWAL 2017 SECTION I SOURCE IDENTIFICATION ....................................................................4 1. DESCRIPTION OF FACILITY ..........................................................................4 2. FACILITY INVENTORY LIST ...........................................................................5 SECTION II GENERAL CONDITIONS ........................................................................9 1. DEFINITIONS ..................................................................................................9 2. ACRONYMS ....................................................................................................9 3. EFFECTIVE DATE.........................................................................................10 4. PERMIT EXPIRATION...................................................................................10 5. PERMIT RENEWAL.......................................................................................10 6. CONFIDENTIAL INFORMATION ...................................................................11 7. PERMIT ACTIONS.........................................................................................11 8. PERMIT AVAILABILITY .................................................................................12 9. REOPENING THE PART 70 PERMIT FOR CAUSE BY THE EPA.................12 10. TRANSFER OF PERMIT ...............................................................................12 -

Assessment of Corrective Measures Report Ccr Release Incident Ash Valley Refuse/Disposal Area

ASSESSMENT OF CORRECTIVE MEASURES REPORT CCR RELEASE INCIDENT ASH VALLEY REFUSE/DISPOSAL AREA Prepared for: GenOn Northeast Management Company Conemaugh Generating Station New Florence, PA 15944 Prepared by: Aptim Environmental & Infrastructure, Inc. Pittsburgh, Pennsylvania January 2019 Table of Contents ________________________________________________ List of Tables ................................................................................................................................................................. iii List of Figures ............................................................................................................................................................... iii List of Appendices ......................................................................................................................................................... iii List of Acronyms & Abbreviations ................................................................................................................................. iv 1.0 Introduction ....................................................................................................................................................... 1 2.0 Facility Overview ............................................................................................................................................... 2 3.0 Summary of the Ash Release............................................................................................................................ 3 4.0 -

US Faced with 'Good Problem' As Gas Glut Stabilizes Prices Calpine

Thursday, March 24, 2011 US faced with ‘good problem’ Merger Stories Deal Approval as gas glut stabilizes prices AEShttp://www.snl.com/interactivex/snapshot.aspx?id=4055465 Corp. EL AES Close: $12.46 -0.01 (-0.1%) Vol: 5,063,626 (78% of Avg.) by Petermailto:[email protected] Marrin Semprahttp://www.snl.com/interactivex/snapshot.aspx?id=4057062 Energy DE SRE The growth of shale gas production has stabilized natural gas prices Close: $52.04 -0.34 (-0.6%) Vol: 3,116,520 (179% of Avg.) and provides an opportunity to expand the efficient use of gas in Southernhttp://www.snl.com/interactivex/snapshot.aspx?id=4057146 California Gas Co. NG the U.S., a national producer-consumer task force said in a March FERC on March 18 approved AES Corp. subsidiary AES California 22 report. Management Co.’s Feb. 18 request to sell its ownership interest in The group, led by the Bipartisan Policy Center and the American AES Placerita to Clean Energy Systems Inc. Clean Skies Foundation, convened a yearlong review to produce the 70-page report, finding that governments need to “encourage the continued on page 3 development of domestic natural gas resources, subject to appro- priate environmental safeguards.” Comprising gas producers, distributors, consumer groups, large- teractivex/MyInteractive.aspx industrial users, independent experts, state regulatory commis- http://www.snl.com/inNow Featured on sions and environmental groups, the diverse task force noted that increased gas use can reduce air emissions, enhance energy security Wary of potential fines, PG&E requests and “improve the prospects of U.S.-based energy-intensive manu- more time to complete pipe inspections facturers.” “While we wish we could have completed all this work by now, In addition, the report said, gas is abundant. -

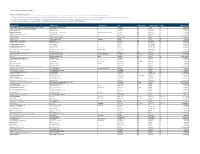

Final Creditor Listing

Just Energy Group - List of Known Creditors USD to CAD 1.2724 Notes to consolidated list of creditors 1. The attached list of creditors was prepared based on information available from the books and records of Just Energy Group Inc. and subsidiaries as of March 9, 2021 (the "Filing Date"). 2. The list is provided pursuant to section 23(1)(a) of the CCAA and regulations made thereunder. The list of creditors has been prepared without admission as to the liability for, or the quantum of, any of the amounts shown. 3. The dollar amounts are not to be used for the purpose of valuing any claims against Just Energy, as they are subject to change based on updated or additional information. 4. If a Claims Procedure is approved by the Court, creditors will be notified by the Monitor and invited to submit a proof of claim at that time. Vendor Name Address Line 1 Address Line 2 City State/Province Postal/Zip Code Country Amount ($CAD) Accounting Principals, Inc. Dba Parker+Lynch & Ajilon Profession 20 Greenway Plaza Suite 1050 Houston TX 77046 US 63,624.85 Ace American Insurance Company And Affiliates 436 Walnut St Philadelphia PA 19106 US 636,200.00 ACR Collections Inc. 100 King St W. Toronto ON M5X 1A3 CA 1,196.66 Adastra Corporation Royal Bank Plaza, South Tower 200 Bay Street, Suite 1401 Toronto ON M5J 2J2 CA 4,793.86 ADP International Services BV Po Box 842875 Boston MA 02284-2875 US 10,357.43 AEP Texas Central 539 N. Carancahua Street Corpus Christi TX 78478 US 1,834,827.47 AEP Texas North 539 N.