Screen Unit Collaborative Proposal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Providing IPTV in the IMS Network

MATEC Web of Conferences 210, 03004 (2018) https://doi.org/10.1051/matecconf/201821003004 CSCC 2018 Providing IPTV in the IMS network Ladislav Kockovic,1*, Ladislav Szeiff2 1, 2 Slovak University of Technology in Bratislava, Faculty of Electrical Engineering and Information Technology, Institute of Multimedia Information and Communication Technologies, lkovičova 3, 812 19 Bratislava, Slovak republic Abstract. Providing IPTV in the IMS network is increasingly a problem solved today. All households are gradually passing through innovation and slowly every equipment becomes the so-called intelligent or smart and can be connected to a private or public network where it can be monitored, configured, diagnosed and then repaired.. This same upgrading takes place in television, and its current output is in the form of IPTV (Internet Protocol Television) provided in the IP Multimedia Subsystem Network, a new generation network that provides both audio and video data. IMS has originated in 1999 for the 3GPP standard in the 5th edition when switching from a 2G network to a 3G network. It has supported the older GSM and GPRS networks, but also a new UMTS network. In the sixth edition, it also has began to work on WLAN networks, more voice-oriented, or speech recognition services. This paper focuses on the provision of IPTV (Internet Protocol Television) in the IMS (IP Multimedia Subsystem) network. The aim of our paper is to design IPTV services in the IMS network, define the IMS architecture and the IMS network components such as HSS (Home Subscriber Server), various types of CSCF (Call State Control Function), describe the functionality and services provided by IMS and IPTV and, finally, compare the quality of the IPTV service provided by our network and by network of selected operator. -

Scotland's Home of News and Entertainment

Scotland’s home of news and entertainment Strategy Update May 2018 STV in 2020 • A truly multi-platform media company with a balanced profit base across broadcast, production and digital o Expect around 1/3rd of profit from sources other than linear spot advertising (vs 17% today) • A magnet for the best creative talent from Scotland and beyond • A brand famous for a range of high quality programming and accessible by all Scots wherever they are in the world via the STV app • One of the UK’s leading producers, making world class returning series for a range of domestic and international players • Working in partnership with creative talent, advertisers, businesses and Government to drive the Scottish economy and showcase Scotland to the world Scotland’s home of news and entertainment 2 We have a number of strengths and areas of competitive advantage Strong, trusted brand Unrivalled Talented, connection with committed people Scottish viewers and advertisers Robust balance sheet and growing Scotland’s most returns to powerful marketing shareholders platform Settled A production relationship with business well ITV which placed for incentivises STV Profitable, growing “nations and to go digital digital business regions” growth holding valuable data 3 However, there is also significant potential for improvement •STV not famous for enough new programming beyond news •STV brand perceived as ageing and safe BROADCAST •STV2 not cutting through •News very broadcast-centric and does not embrace digital •STV Player user experience lags competition -

Final Determination Annex 2: Channel Take-Up and Substitution

BBC Scotland Competition Assessment Final Determination Annex 2: Channel Take-up and Substitution STATEMENT ANNEX Publication Date: 26 June 2018 BBC Scotland Competition Assessment – Final Determination Annex 2: Channel Take-up and Substitution A2. Channel Take-up and Substitution Introduction A2.1 In order to review the public value and assess the potential impact on fair and effective competition of the BBC’s proposal, we must first consider the audience that the new BBC Scotland channel is likely to attract. This Annex provides our assessment of the likely ’take- up’ of the BBC Scotland channel, i.e. the viewing hours the new channel is likely to attract in Scotland and the viewing share and audience reach it is likely to achieve.1 A2.2 The BBC’s proposal involves associated changes to existing BBC services, in particular BBC Two, BBC Four and CBBC HD in Scotland. We therefore also assess the effect on the viewing of BBC Two, BBC Four and CBBC in Scotland resulting from the BBC’s proposal. A2.3 We then identify the services most likely to be affected by the proposed new channel and the associated changes. We assess the potential audience substitution, including from existing BBC services and commercial services. A2.4 This Annex broadly reflects the assessment of take-up and substitution set out in our Consultation. Where relevant, we have set out the stakeholder views we received in response to our Consultation and how these, along with any further analysis, have influenced our assessment of take-up and substitution. In particular, we set out and respond to stakeholders’ views on: our take-up estimates for the new channel (paragraphs A2.104 to A2.135); and substitution from existing TV channels as a result of the BBC proposal (paragraphs A2.162 to A2.171). -

Must-Carry Rules, and Access to Free-DTT

Access to TV platforms: must-carry rules, and access to free-DTT European Audiovisual Observatory for the European Commission - DG COMM Deirdre Kevin and Agnes Schneeberger European Audiovisual Observatory December 2015 1 | Page Table of Contents Introduction and context of study 7 Executive Summary 9 1 Must-carry 14 1.1 Universal Services Directive 14 1.2 Platforms referred to in must-carry rules 16 1.3 Must-carry channels and services 19 1.4 Other content access rules 28 1.5 Issues of cost in relation to must-carry 30 2 Digital Terrestrial Television 34 2.1 DTT licensing and obstacles to access 34 2.2 Public service broadcasters MUXs 37 2.3 Must-carry rules and digital terrestrial television 37 2.4 DTT across Europe 38 2.5 Channels on Free DTT services 45 Recent legal developments 50 Country Reports 52 3 AL - ALBANIA 53 3.1 Must-carry rules 53 3.2 Other access rules 54 3.3 DTT networks and platform operators 54 3.4 Summary and conclusion 54 4 AT – AUSTRIA 55 4.1 Must-carry rules 55 4.2 Other access rules 58 4.3 Access to free DTT 59 4.4 Conclusion and summary 60 5 BA – BOSNIA AND HERZEGOVINA 61 5.1 Must-carry rules 61 5.2 Other access rules 62 5.3 DTT development 62 5.4 Summary and conclusion 62 6 BE – BELGIUM 63 6.1 Must-carry rules 63 6.2 Other access rules 70 6.3 Access to free DTT 72 6.4 Conclusion and summary 73 7 BG – BULGARIA 75 2 | Page 7.1 Must-carry rules 75 7.2 Must offer 75 7.3 Access to free DTT 76 7.4 Summary and conclusion 76 8 CH – SWITZERLAND 77 8.1 Must-carry rules 77 8.2 Other access rules 79 8.3 Access to free DTT -

Proposals for the Launch of a New BBC Scotland TV Channel SUBMISSION to OFCOM

Proposals for the launch of a new BBC Scotland TV channel SUBMISSION TO OFCOM November 2017 Proposals for the launch of a new BBC Scotland TV channel 1 Foreword 1 1.1 Why the BBC is developing a new channel for Scotland .................................................................... 1 1.2 The BBC’s proposals for a new channel for Scotland .......................................................................... 2 1.3 Regulatory approval – the public interest test ....................................................................................... 3 2 Introduction 5 3 Strategic context 8 3.1 Changing audience context .......................................................................................................................... 8 3.2 Changes in the political, social and cultural context ......................................................................... 10 3.3 Growing importance of the creative industries in Scotland............................................................. 11 4 The BBC’s proposals 14 4.1 The BBC’s initial proposals ........................................................................................................................ 14 4.2 Analysis undertaken to inform further development of the channel ........................................... 15 4.3 Final proposals for the new channel....................................................................................................... 28 4.4 Proposed changes to other BBC public services ................................................................................ -

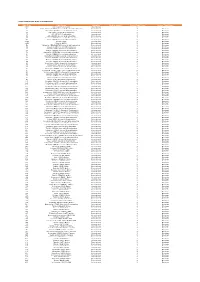

BARB Quarterly Reach Report- Quarter Q1 2018 (BARB Weeks

BARB Quarterly Reach Report- Quarter Q1 2018 (BARB weeks 2580-2592) Individuals 4+ Weekly Reach Monthly Reach Quarterly Reach 000s % 000s % 000s % TOTAL TV 55398 92.2 58520 97.4 59551 99.1 &TV 280 0.5 636 1.1 1062 1.8 4Music 2612 4.3 6687 11.1 12217 20.3 4seven 5287 8.8 13915 23.2 24467 40.7 5 USA 3875 6.4 7445 12.4 11864 19.7 5 USA+1 660 1.1 1707 2.8 3218 5.4 5SELECT 2897 4.8 8025 13.4 15051 25.0 5Spike 5198 8.7 11448 19.1 18720 31.2 5Spike+1 285 0.5 925 1.5 1971 3.3 5STAR 5769 9.6 13507 22.5 22817 38.0 5STAR+1 1014 1.7 3275 5.5 6866 11.4 Aaj Tak 116 0.2 288 0.5 606 1.0 ABN TV 135 0.2 313 0.5 629 1.0 ABP News 152 0.3 420 0.7 701 1.2 Akaal Channel 78 0.1 239 0.4 613 1.0 Alibi 1699 2.8 3609 6.0 6242 10.4 Alibi+1 497 0.8 1265 2.1 2214 3.7 AMC 107 0.2 390 0.6 928 1.5 Animal Planet 409 0.7 1170 1.9 2381 4.0 Animal Planet+1 96 0.2 276 0.5 604 1.0 ATN Bangla 122 0.2 296 0.5 560 0.9 attheraces 571 1.0 944 1.6 1374 2.3 B4U Movies 278 0.5 603 1.0 863 1.4 B4U Music 236 0.4 560 0.9 986 1.6 BBC 4 10734 17.9 22020 36.6 32361 53.9 BBC News 7614 12.7 13172 21.9 19104 31.8 BBC Parliament 623 1.0 1619 2.7 2916 4.9 BBC RB 1 882 1.5 2738 4.6 6618 11.0 BBC RB 601 1076 1.8 2674 4.5 5149 8.6 BBC1 44229 73.6 52602 87.5 56549 94.1 BBC2 32104 53.4 45295 75.4 52127 86.8 BET:BlackEntTv 237 0.4 701 1.2 1564 2.6 BLAZE 1870 3.1 3860 6.4 6546 10.9 Boomerang 947 1.6 2373 3.9 4324 7.2 Boomerang+1 524 0.9 1490 2.5 2833 4.7 Box Hits 490 0.8 1437 2.4 3045 5.1 Box Upfront 325 0.5 1040 1.7 2190 3.6 Brit Asia TV 155 0.3 411 0.7 840 1.4 BT Sport 1 2395 4.0 5183 8.6 7154 11.9 -

Codes Used in D&M

CODES USED IN D&M - MCPS A DISTRIBUTIONS D&M Code D&M Name Category Further details Source Type Code Source Type Name Z98 UK/Ireland Commercial International 2 20 South African (SAMRO) General & Broadcasting (TV only) International 3 Overseas 21 Australian (APRA) General & Broadcasting International 3 Overseas 36 USA (BMI) General & Broadcasting International 3 Overseas 38 USA (SESAC) Broadcasting International 3 Overseas 39 USA (ASCAP) General & Broadcasting International 3 Overseas 47 Japanese (JASRAC) General & Broadcasting International 3 Overseas 48 Israeli (ACUM) General & Broadcasting International 3 Overseas 048M Norway (NCB) International 3 Overseas 049M Algeria (ONDA) International 3 Overseas 58 Bulgarian (MUSICAUTOR) General & Broadcasting International 3 Overseas 62 Russian (RAO) General & Broadcasting International 3 Overseas 74 Austrian (AKM) General & Broadcasting International 3 Overseas 75 Belgian (SABAM) General & Broadcasting International 3 Overseas 79 Hungarian (ARTISJUS) General & Broadcasting International 3 Overseas 80 Danish (KODA) General & Broadcasting International 3 Overseas 81 Netherlands (BUMA) General & Broadcasting International 3 Overseas 83 Finnish (TEOSTO) General & Broadcasting International 3 Overseas 84 French (SACEM) General & Broadcasting International 3 Overseas 85 German (GEMA) General & Broadcasting International 3 Overseas 86 Hong Kong (CASH) General & Broadcasting International 3 Overseas 87 Italian (SIAE) General & Broadcasting International 3 Overseas 88 Mexican (SACM) General & Broadcasting -

995 Final COMMISSION STAFF WORKING DOCUMENT

EUROPEAN COMMISSION Brussels,23.9.2010 SEC(2010)995final COMMISSIONSTAFFWORKINGDOCUMENT Accompanyingdocumenttothe COMMUNICATIONFROMTHECOMMISSIONTOTHE EUROPEAN PARLIAMENT,THECOUNCIL,THEEUROPEANECONOMIC ANDSOCIAL COMMITTEEANDTHECOMMITTEEOFTHEREGIONS NinthCommunication ontheapplicationofArticles4and5ofDirective89/552/EECas amendedbyDirective97/36/ECandDirective2007/65/EC,fortheperiod2007-2008 (PromotionofEuropeanandindependentaudiovisual works) COM(2010)450final EN EN COMMISSIONSTAFFWORKINGDOCUMENT Accompanyingdocumenttothe COMMUNICATIONFROMTHECOMMISSIONTOTHE EUROPEAN PARLIAMENT,THECOUNCIL,THEEUROPEANECONOMIC ANDSOCIAL COMMITTEEANDTHECOMMITTEEOFTHEREGIONS NinthCommunication ontheapplicationofArticles4and5ofDirective89/552/EECas amendedbyDirective97/36/ECandDirective2007/65/EC,fortheperiod20072008 (PromotionofEuropeanandindependentaudiovisual works) EN 2 EN TABLE OF CONTENTS ApplicationofArticles 4and5ineachMemberState ..........................................................5 Introduction ................................................................................................................................5 1. ApplicationofArticles 4and5:generalremarks ...................................................5 1.1. MonitoringmethodsintheMemberStates ..................................................................6 1.2. Reasonsfornon-compliance ........................................................................................7 1.3. Measures plannedor adoptedtoremedycasesofnoncompliance .............................8 1.4. Conclusions -

Service Manual

SERVICE MANUAL LCD TV Model No. L32F1120 L32D1120 Z ZR39745 Chassis WARNING This service information is designed for experienced repair technicians only and is not designed for use by the general public. It does not contain warnings or cautions to advise non-technical individuals of potential dangers in attempting to service a product. Products powered by electricity should be serviced or repaired only by experienced professional technicians. Any attempt to service or repair the product or products dealt with in this service information by anyone else could result in serious injury or death. ©2009 Qingdao Haier Electronics Co., Ltd. All rights reserved. Unauthorized copying and distribution is a violation of law. Haier Group Chapter 1: General Information 1-1. Table of Contents 1. General Information...........................................................................1 1-1. Table of Contents 1 1-2. General Guidelines 3 1-3. Important Notice 3 1-4. How to Read this Service Manual 6 [.................................................................................... 7 3. Location of Controls and Components...........................................8 3-1. Board Location 8 3-2. Main Board & AV Board 8 3-3. Power Board 11 3-4. LCD Panel 12 4. Disassemble and Assemble.......................................................... 14 4-1 Remove the Pedestal 14 4-2 Remove the Back Cover 14 4-3 Remove the Terminal Bracket 15 4-4 Remove the Power Module 15 4-5 Remove the Main Board 15 4-6 Remove the Speaker 16 4-7 Remove the Remote Control Board 16 5. Installation Instructions..…....………………...........………….........16 5-1 External Equipment Connections 16 5-2 HDMI Connections 20 6. Operation Instructions....…....………………...........………….........23 6-1 Front Panel Controls 23 6-2 Back Panel Controls 23 6-3 Universal Remote Control 24 7. -

Mechanisms for Setting Broadcasting Funding Levels in OECD Countries

School of Communication Mechanisms for Setting Broadcasting Funding Levels in OECD Countries Research and Analysis Project Report Prepared for Te Manatu Taonga / Ministry for Culture and Heritage December 2005 2 Mechanisms for Setting Broadcasting Funding Levels in OECD Countries Research and Analysis Project Report Prepared for Te Manatu Taonga / Ministry for Culture and Heritage December 2005 3 Contents 1.0 TERMS OF REFERENCE.................................................................................................. 6 2.0 RESEARCH AIMS AND OBJECTIVES/ DELIMITATIONS .............................................. 8 3.0 METHODOLOGY ............................................................................................................. 10 4.0 OECD COUNTRY REPORTS ON PUBLIC BROADCASTING ARRANGEMENTS ...... 13 4.1 AUSTRALIA ..................................................................................................................... 14 4.2 AUSTRIA ........................................................................................................................ 20 4.3 BELGIUM ........................................................................................................................ 23 4.4 CANADA ......................................................................................................................... 28 4.5 CZECH REPUBLIC ........................................................................................................... 34 4.6 DENMARK ..................................................................................................................... -

BBC Performance Tracker 2019 Questionnaire

GfK BBC Performance Tracker V37 272.201.20323 I. SAMPLE VARIABLES RESEARCHER: If there are questions or variables that are not quotas and you want to track them, list the variable name and type here, so programming knows that you want to monitor. II. QUOTA CHECK BASED ON SAMPLE VARIABLES RESEARCHER: Insert description of the quota based on sample information. Sample plan to be provided separately. III. INTRODUCTION We are conducting a study looking at people’s attitudes to television, radio and online services in the UK, and we are keen to know your views. This study is being carried out for Ofcom (the Office of Communications), which is responsible for overseeing broadcast services in the UK. Your answers to the survey will remain completely confidential. They will never be reported on at an individual level or be used to identify you in any way. The information collected by GfK is on behalf of, and will remain, the property of Ofcom and will not be passed on to any third parties. First, we will ask you a few questions about yourself and the media you use. This will only take a few minutes. This will allow us to see whether you qualify to complete the full survey. The full survey will take 20-25 minutes depending on the media you use. IV. SCREENER BASE: ALL RESPONDENTS INTERNET USE INTU [S] In the past week, how many hours have you spent using the internet? This includes email, social media, online shopping, online gaming, browsing/searching or using apps, or watching TV programmes, films and videos, or listening to music and radio programmes online. -

Experiences of the Community Television Sector in the Migration to Digital Terrestrial Television in South Africa 2007 – 2014

EXPERIENCES OF THE COMMUNITY TELEVISION SECTOR IN THE MIGRATION TO DIGITAL TERRESTRIAL TELEVISION IN SOUTH AFRICA 2007 – 2014 Fumane Diseko-Biagini 9408727K A research report submitted to the Faculty of Humanities, University of the Witwatersrand, Johannesburg, in partial fulfilment of the requirements for the degree of Master of Arts in ICT Policy and Regulation October 2016 ABSTRACT South Africa has a nascent community television sector, which is legislated as a tier of broadcasting. This sector is important in deepening democracy, creating access to information, giving communities the space to share information, and expanding media ownership to communities beyond the public and commercial television broadcasting sectors. Since 2007, when Soweto TV was the first community television station to be licensed, the processes towards migrating analogue to digital terrestrial television have been beset with delays and the experience of the community TV sector with respect to this migration have been not well understood. The conceptual-analytical framework for this historical study of the period 2007 to 2014 drew on the key themes of sector and institutional governance including the effectiveness of policy and regulation, technological advancement, content and services. Using a constructivist methodology the key documents pertaining to broadcast digital migration were reviewed and interviews were conducted with three community TV stations, Soweto TV, Bay TV and Cape Town TV, as well as with the policy-maker, the regulator and sector experts. The findings revealed that the community television (CTV) sector was faced with problems of sector and institutional governance not being effectively addressed in legislation and regulation, stagnation as a result of lack of spectrum in the analogue television-broadcasting dispensation and limitations on content provision.