2020 Annual Results Analyst Briefing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HONG KONG AIRCRAFT ENGINEERING COMPANY LIMITED (Incorporated in Hong Kong with Limited Liability) (Stock Code: 44)

- 1 - The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. HONG KONG AIRCRAFT ENGINEERING COMPANY LIMITED (Incorporated in Hong Kong with limited liability) (Stock Code: 44) Announcement Continuing Connected Transactions Aircraft Maintenance Independent Financial Adviser: ING Bank N.V. HAECO and Cathay Pacific have entered into the Framework Agreement on 21st May 2007 for HAECO Group to provide the Services to Cathay Pacific Group for maintenance of Cathay Pacific Group’s aircraft for a term of 10 years ending on 31st December 2016. As Cathay Pacific is a connected person of HAECO, the transactions contemplated under the Framework Agreement constitute continuing connected transactions for HAECO under Rule 14A.14 of the Listing Rules and are subject to the reporting, announcement and independent shareholders’ requirements under Rule 14A.35. A circular containing the particulars of the Framework Agreement, a letter from the Independent Board Committee, a letter from the Independent Financial Adviser and a notice to convene the EGM, will be despatched to the shareholders of the Company as soon as practicable. Framework Agreement dated 21st May 2007 Parties: (1) HAECO (2) Cathay Pacific Particulars Pursuant to the Framework Agreement, HAECO Group provides the Services to Cathay Pacific Group for maintenance of Cathay Pacific Group’s aircraft. The Framework Agreement is for a term of 10 years ending on 31st December 2016. -

Hong Kong Office Marketview Q1 2013 CBRE Global Research and Consulting

Hong Kong Office MarketView Q1 2013 CBRE Global Research and Consulting OVERALL HONG KONG CENTRAL HONG KONG ISLAND KOWLOON Rents -0.2% q-o-q Rents -1.5% q-o-q Rents -0.6% q-o-q Rents +0.8% q-o-q NEW SUPPLY ON THE HORIZON COULD BE TOO LITTLE TOO LATE Hot Topics Current tight supply persist Three of the sites to be tendered in Oct 2013 - Mar 2014 are located in Occupiers continue to seek out cost Kowloon East, providing a possible 2.3 . There are early signs that activity effective space, but options are limited. million sq ft, although other in the CBD is slowly picking up The overall vacancy rate is just 3.3%, commercial uses or hotel development compared with previous quarters. or 2.2 million sq ft of available space, may reduce the office provision. This and over 30% of this is located in the should further consolidate the area as most expensive sub-market, Central. a key office hub. However, it may not . Decentralised districts on both Only 7% of all vacant space in Hong be until 2018, at the earliest, before Hong Kong Island and Kowloon Kong is located in decentralised Hong development is completed. continue to receive stronger Kong Island and Kowloon. interest. However, this does not A platform for rental growth always translate into new lettings Given the lack of new supply feeding as vacancy remains tight in these Government action on land into the market, we do not anticipate a areas. supply significant increase in vacancy in the The government recently announced short / medium term. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Abbreviations

ABBREVIATIONS AA Airport Authority Hong Kong ACC Apron Control Centre ACP Airport Core Programme ACS Access Control System ADSCOM Airport Development Steering Committee AIP Aeronautical Information Programme AMD/AA Airport Management Director / Airport Authority Hong Kong AOCC Airport Operation Control Centre AOD Airport Opening Date AODB Airport Operational Datebase AOR Airport Operational Readiness APM Automated People Mover AR Airport Railway ARA Airport Restricted Area ASP Airport Security Programme AVSECO Aviation Security Company Limited BAR Board of Airline Representatives in Hong Kong BHS Baggage Handling System BSM Baggage Source Message BSS Box Storage System CAD Civil Aviation Department - Page 1 of 6 - CC(CLK) Chief Co-ordinator (Chek Lap Kok) CCTV Closed Circuit Television CE Chief Executive CEO/AA Chief Executive Officer / Airport Authority Hong Kong Chairman/ Chairman / Airport Development Steering Committee ADSCOM Chairman/AA Chairman / Airport Authority Hong Kong CHS Cargo Handling System CLK Chek Lap Kok COSAC Community System for Air Cargo CPCS Cathy Pacific Catering Services (HK) Limited CPM/NAPCO Consultant Project Manager / New Airport Projects Co- ordination Office CROW CLK Ramp Operations Working Group CS Chief Secretary for Administration CSE Centre for Software Engineering Limited CSS Container Storage System CUTE Common User Terminal Equipment D/NAPCO Director / New Airport Projects Co-ordination Office DAC Door Access Control DCA Director of Civil Aviation DCEO/AA Deputy Chief Executive Officer / Airport Authority -

The Gardens on El Paseo 73-545 El Paseo, Palm Desert, California 92260

PALM DESERT — CALIFORNIA THE GARDENS ON EL PASEO 73-545 EL PASEO, PALM DESERT, CALIFORNIA 92260 UPSCALE SELECT LIFESTYLE CENTER TENANTS — — Anchored by Saks Fifth Avenue – the only upscale department store within 90 miles – the Gardens on El Paseo is the upscale lifestyle center in the Coachella Valley. The center’s affluent shopper base includes local and seasonal residents, and tourists. UNIQUE-TO- MARKET RETAILERS — Ann Taylor, Anthropologie, Brooks Brothers, Eileen Fisher, J. Jill, Johnny Was, Louis Vuitton, Pottery Barn, Sephora, Tiffany & Co., Tommy Bahama Restaurant and Shop and Williams Sonoma. LOCATION LUXURIOUS LIVING — — Located six miles south of I-10, and one block from The trade area extends 20 miles north to Desert Hwy. 111, the Gardens on El Paseo is easily accessible Hot Springs, 15 miles west to Mount San Jacinto, and from all areas of the market. It is situated next to roughly 24 miles southeast to the Salton Sea. the popular Hotel Paseo with 150 rooms, pool and spa, and the C3 Restaurant and Bar. The hotel’s The city of Palm Desert is home to some of the nation’s 3,200 FT² ballroom and 2,000 FT² event lawn draw most luxurious golf and resort communities, including significant crowds. Coachella Valley’s most upscale Big Horn, Indian Ridge and Iron Wood. cities – Indian Wells, La Quinta, Palm Desert and Rancho Mirage – surround the center. 2019 TRADE AREA DEMOGRAPHICS (SOURCES: CLARITAS, TETRAD, ENVIRONICS, ESRI) ll rights reserved. A TOURISM Population _______________________ 449,405 Households _______________________ 167,758 and its licensors are Population Growth Rate 2019-2024 ____ 5.70% RI — S Daytime Population _______________ 455,449 E Between November and May, Coachella Valley’s and its licensors. -

7. Noise Impact

Expansion of Hong Kong International Airport into a Three-Runway System Environmental Impact Assessment Report 7. Noise Impact 7.1 Introduction 7.1.1.1 This section presents the assessment of potential noise impact associated with the construction and operation phases of the project, which has been conducted in accordance with Annexes 5 and 13 of EIAO-TM as well as the technical requirements stipulated in Clause 3.4.5 and section I of Appendix C of the EIA Study Brief (ESB-250/2012). 7.2 Noise Legislation, Standards and Guidelines 7.2.1 Aircraft Noise 7.2.1.1 The principal legislation for controlling aircraft noise in Hong Kong is the Civil Aviation (Aircraft Noise) Ordinance (Cap. 312) and Civil Aviation (Aircraft Noise) (Certification) Regulations. In line with the international practice in phasing out noisier aircraft, the Ordinance stipulates that all subsonic jet aircraft flying in and out of Hong Kong shall meet the noise standard specified in Chapter 3 of Annex 16 Volume I, Part II to the Convention on International Civil Aviation. The Regulations require all subsonic jet aircraft departing or landing in Hong Kong to be certified in accordance with international established procedures. 7.2.1.2 On the other hand, the EIAO provides the fundamental legislation with established noise criteria for evaluating noise impact of designated projects and these include aircraft noise. Annex 5 of the EIAO-TM published under the EIAO sets out the criteria for evaluating the noise impact of designated projects. It prescribes the appropriate noise metrics and noise planning criteria for various types of noise sources and land uses. -

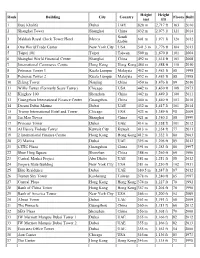

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

OFFICE LEASING Ricky Lau Deputy Managing Director Head of Offi Ce Leasing +852 2842 4501 [email protected]

Hong Kong – April 2019 MARKET IN MINUTES Offi ce Leasing Savills Research Savills team Please contact us for further information OFFICE LEASING Ricky Lau Deputy Managing Director Head of Offi ce Leasing +852 2842 4501 [email protected] William Yiu Deputy Senior Director Kowloon Offi ce Leasing Rental momentum continues in Q1 +852 2378 8664 [email protected] Central’s growth rate outpaced all other districts in Q1 as average Grade A rents hit over HK$150 per sq ft per month net eff ective. RESEARCH Simon Smith • Central replaced Wanchai/Causeway Bay as the main driver • Record low vacancy rates have helped maintain the Senior Director of growth, with rents increasing by 2.9% during the quarter. bargaining power of landlords, supporting the slight rise in Asia Pacifi c offi ce rents observed over the quarter. +852 2842 4573 • We have noticed that Island rents have outperformed [email protected] Kowloon rents for four consecutive quarters. Jimmy Wong Assistant Manager • Despite worries over the trade war, stock market volatility “ A robust offi ce market seems +852 2842 4287 and interest rate rises, the offi ce leasing market has to have shrugged off earlier [email protected] remained stable and tenants are no longer downsizing. Savills plc Savills is a leading global real concerns over interest rates, estate service provider listed on • Coworking operator KR space pulled out of all its leasing the London Stock Exchange. The company established in 1855, has deals in Hong Kong while WeWork withdrew some the trade war and fi nancial a rich heritage with unrivalled growth. -

Aviation Division

2019 Performance Review and Outlook – Aviation Division AVIATION DIVISION A Cathay Pacific Airbus A350-1000 aircraft ADVANCING WORLD-CLASS SERVICE We aim to continue to improve our products and services on the ground and in the air, to expand our fleet by acquiring fuel-efficient aircraft and to strengthen our aircraft engineering business. OVERVIEW OF THE BUSINESS AVIATION DIVISION The Aviation Division comprises a significant investment in the Cathay Pacific group and the HAECO group. Cathay Pacific group (100% Basis) Profit/(Loss) Attributable to Return on Capital Employed the Shareholders of Cathay Pacific HK$M % 6,000 8 5,000 4,000 6 3,000 2,000 4 1,000 0 2 -1,000 -2,000 0 15 16 17 18 19 15 16 17 18 19 Net Cash Generated from Capital Employed Operating Activities HK$M HK$M 20,000 150,000 120,000 15,000 90,000 10,000 60,000 5,000 30,000 0 0 15 16 17 18 19 15 16 17 18 19 SWIRE PACIFIC ANNUAL REPORT 2019 31 HAECO group (100% Basis) Profit/(Loss) Attributable to Return on Capital Employed the Shareholders of HAECO HK$M % 1,000 15 800 12 600 9 400 200 6 0 3 -200 0 -400 -600 -3 15 16 17 18 19 15 16 17 18 19 Net Cash Generated from Capital Employed Operating Activities HK$M HK$M 2,500 12,000 10,000 2,000 8,000 1,500 6,000 1,000 4,000 500 2,000 0 0 15 16 17 18 19 15 16 17 18 19 32 2019 PERFORMANCE REVIEW AND OUTLOOK AVIATION DIVISION The Cathay Pacific group Cathay Pacific owns 18.13% of Air China, the national flag carrier and a leading provider of passenger, cargo and other airline- The Cathay Pacific group includes Cathay Pacific, its wholly- related services in Mainland China. -

1 PLANNING DEPARTMENT Term Consultancy for Air Ventilation

Term Consultancy for Air Ventilation Assessment Expert Evaluation on Quarry Bay Area PLANNING DEPARTMENT Term Consultancy for Air Ventilation Assessment Services Cat A – Term Consultancy for Expert Evaluation and Advisory Services on Air Ventilation Assessment (PLNQ 37/2007) Quarry Bay Area Professor Edmund Choi City University Professional Services Limited July 2008 1 Term Consultancy for Air Ventilation Assessment Expert Evaluation on Quarry Bay Area Contents Page 1 Introduction 1 2 Objective of the Study 1 2.1 Materials for study 1 2.2 Site visit 1 3 Study Scope 2 4 Study Area 2 4.1 Site boundary and coverage 2 4.2 Site characteristic 4 5 Wind Availability 8 5.1 Wind data from MM5 simulation result and site wind availability 9 6 Flow Evaluation 15 6.1 Topographic effect 15 6.2 Effect of greenery and open space 17 6.3 Effect of building lay-out and street pattern 18 6.3.1 Existing condition 18 6.4 Evaluation of air ventilation conditions for Proposed Height Restrictions and Potential Redevelopments 23 7 Problematic areas and Mitigation 25 7.1 Problematic areas 25 7.2 Mitigation measures 25 8 Future Studies 30 9 Acknowledgement 30 Annex I – Site photographs of Quarry Bay area 31 2 Term Consultancy for Air Ventilation Assessment Expert Evaluation on Quarry Bay Area 1 Introduction In the Team Clean report published in August 2003, the Government undertook to examine the practicality of stipulating Air Ventilation Assessment (AVA) as one of the considerations for all major development or redevelopment proposals and in future plan making. Subsequently, a strategic objective to promote sustainable urban planning and design practices has been set out. -

Annex 1 12 March 2021 Buildings Covered by Compulsory Testing

Annex 1 12 March 2021 Buildings Covered by Compulsory Testing Notices A. Buildings with one or more new confirmed cases 1. Diamond Building, 195-199 Nam Cheong Street / 2A-2B Un Chau Street / 47-49 Tai Po Road, Sham Shui Po, Kowloon, Hong Kong 2. Tower 11, Wonderland Villas, 9 Wah King Hill Road, Kwai Chung, New Territories, Hong Kong 3. Tower 5, Alto Residences, 29 Tong Yin Street, Tseung Kwan O, New Territories, Hong Kong 4. Sheung Ming House of Sheung Tak Estate, 2 Tong Ming Street, Tseung Kwan O, New Territories, Hong Kong 5. Towers 1A and 1B, MALIBU, LOHAS PARK, 1 Lohas Park Road, Tseung Kwan O, New Territories, Hong Kong 6. Skylight Tower, 64 Bonham Road, Central and Western District, Hong Kong 7. High Park 99, 99 High Street, Sai Ying Pun, Hong Kong 8. Block 27, Baguio Villa, 555 Victoria Road, Pok Fu Lam, Hong Kong 9. 32A, 32B & 32C Staunton Street, Central, Hong Kong 10. Wah Fai Court, 1-6 Ying Wa Terrace, Sai Ying Pun, Hong Kong 11. Goa Building, 20-24 Hill Road, Sai Wan, Hong Kong 12. 36 Eastern Street, Sai Ying Pun, Hong Kong 13. Tower 1, The Summa, 23 Hing Hon Road, Central and Western District, Hong Kong 14. Oootopia West, 10 Yat Fu Lane, Sai Wan, Hong Kong 15. Wah Po Building, 1-1A New Praya Kennedy Town, Kennedy Town, Hong Kong 16. Blocks B & C, Kam Yuen Mansion, 3 Old Peak Road, Central and Western District, Hong Kong 17. Primrose Court, 56A Conduit Road, Central and Western District, Hong Kong 18. -

Key Actuarial Employers in Hong Kong – 2020

KEY ACTUARIAL EMPLOYERS IN HONG KONG – 2020 A.M. Best Asia-Pacific Ltd Suite 4004, Central Plaza, 18 Harbour Road, Wanchai, Hong Kong Tel: (852) 2827 3400 Website: http://www.ambest.com/about/ http://www.ambest.com/careers/index.html Accenture Suites 4103-10, 41/F One Island East, Taikoo Place, 18 Westlands Road, Quarry Bay, Hong Kong Tel: (852) 2850 8956 Website: https://www.accenture.com/hk-en https://www.accenture.com/hk-en/careers/jobsearch?jk=&sb=1 Actuarial Group 35/F Central Plaza, 18 Harbour Road, Wanchai, Hong Kong Tel: (852) 3960 6576 Website: https://www.actuarial.pt/ https://actuarial.pt/ing/recrutamento.php Aegon Insights Suites 5705-5708, One Island East, 18 Westlands Road, Island East, Hong Kong Tel: (852) 3655 8228 Website: https://www.aegon.com/home/ https://careers.aegon.com/en/vacancies/?page=1&query=&Countries=Countries-Hong-Kong Ageas Insurance Company (Asia) Limited 27/F, Cambridge House, Taikoo Place, 979 King's Road, Quarry Bay, Hong Kong Tel: (852) 2126 2280 Website: https://www.ageas.com/ https://www.ageas.com/careers AIA Company Limited 18/F, AIA Hong Kong Tower, 734 King's Road, Quarry Bay, Hong Kong Tel: (852) 2832 8888 Website: https://www.aia.com.hk/zh-hk/index.html https://www.aia.com.hk/en/about-aia/careers.html AIA Group 30/F, Hopewell Center, 183 Queen's Road East, Wanchai, Hong Kong Tel: (852) 2832 1800 Website: https://www.aia.com/en/index.html https://www.aia.com/en/careers.html AIG 7/F, One Island East, 18 Westlands Road, Island East, Hong Kong Tel: (852) 3555 0000 Website: https://www.aig.com.hk/