Ghana South Africa Uganda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Whether a Rwandan Born in Uganda Has Citizenship Rights

Home > Research > Responses to Information Requests RESPONSES TO INFORMATION REQUESTS (RIRs) New Search | About RIRs | Help 22 January 2008 ZZZ102691.E Uganda/Rwanda: Whether a Rwandan born in Uganda has citizenship rights; conditions under which individuals whose ancestors are not Ugandan can obtain Ugandan citizenship; whether citizens of Uganda have rights to free university education; whether international students can attend university in Uganda Research Directorate, Immigration and Refugee Board of Canada, Ottawa Citizenship rights A Rwandan born in Uganda is not automatically granted Ugandan citizenship (Uganda 18 Jan. 2008; ibid. 1995, Chapter 3, Sec. 10; US Mar. 2001, 205). Under Chapter 3, Section 10 of the Constitution of the Republic of Uganda, 1995, persons granted Ugandan citizenship by birth include: (a) every person born in Uganda one of whose parents or grandparents is or was a member of any of the indigenous communities existing and residing within the borders of Uganda at the first day of February, 1926, and set out in the Third Schedule to this Constitution; and (b) every person born in or outside Uganda one of whose parents or grandparents was at the time of birth of that person a citizen of Uganda by birth. The constitution also outlines several conditions under which an individual whose ancestors are not Ugandan can obtain Ugandan citizenship (Uganda 1995, Chapter 3, Sec. 11-12). For example, abandoned children of no more than five years of age, whose parents are unknown, are considered citizens of the country (ibid., Chapter 3, Sec. 11). An individual under the age of 18 years who is adopted by a Ugandan citizen may also be granted citizenship (ibid.). -

African Dialects

African Dialects • Adangme (Ghana ) • Afrikaans (Southern Africa ) • Akan: Asante (Ashanti) dialect (Ghana ) • Akan: Fante dialect (Ghana ) • Akan: Twi (Akwapem) dialect (Ghana ) • Amharic (Amarigna; Amarinya) (Ethiopia ) • Awing (Cameroon ) • Bakuba (Busoong, Kuba, Bushong) (Congo ) • Bambara (Mali; Senegal; Burkina ) • Bamoun (Cameroons ) • Bargu (Bariba) (Benin; Nigeria; Togo ) • Bassa (Gbasa) (Liberia ) • ici-Bemba (Wemba) (Congo; Zambia ) • Berba (Benin ) • Bihari: Mauritian Bhojpuri dialect - Latin Script (Mauritius ) • Bobo (Bwamou) (Burkina ) • Bulu (Boulou) (Cameroons ) • Chirpon-Lete-Anum (Cherepong; Guan) (Ghana ) • Ciokwe (Chokwe) (Angola; Congo ) • Creole, Indian Ocean: Mauritian dialect (Mauritius ) • Creole, Indian Ocean: Seychelles dialect (Kreol) (Seychelles ) • Dagbani (Dagbane; Dagomba) (Ghana; Togo ) • Diola (Jola) (Upper West Africa ) • Diola (Jola): Fogny (Jóola Fóoñi) dialect (The Gambia; Guinea; Senegal ) • Duala (Douala) (Cameroons ) • Dyula (Jula) (Burkina ) • Efik (Nigeria ) • Ekoi: Ejagham dialect (Cameroons; Nigeria ) • Ewe (Benin; Ghana; Togo ) • Ewe: Ge (Mina) dialect (Benin; Togo ) • Ewe: Watyi (Ouatchi, Waci) dialect (Benin; Togo ) • Ewondo (Cameroons ) • Fang (Equitorial Guinea ) • Fõ (Fon; Dahoméen) (Benin ) • Frafra (Ghana ) • Ful (Fula; Fulani; Fulfulde; Peul; Toucouleur) (West Africa ) • Ful: Torado dialect (Senegal ) • Gã: Accra dialect (Ghana; Togo ) • Gambai (Ngambai; Ngambaye) (Chad ) • olu-Ganda (Luganda) (Uganda ) • Gbaya (Baya) (Central African Republic; Cameroons; Congo ) • Gben (Ben) (Togo -

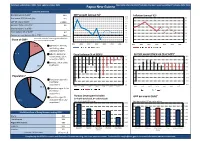

Papua New Guinea

Factsheet updated April 2021. Next update October 2021. Papua New Guinea Most data refers to 2019 (*indicates the most recent available) (~indicates 2020 data) Economic Overview Nominal GDP ($US bn)~ 23.6 GDP growth (annual %)~ 16.0 Inflation (annual %)~ 8.0 Real annual GDP Growth (%)~ -3.9 14.0 7.0 GDP per capita ($US)~ 2,684.8 12.0 10.0 6.0 Annual inflation rate (%)~ 5.0 8.0 5.0 Unemployment rate (%)~ - 6.0 4.0 4.0 Fiscal balance (% of GDP)~ -6.2 2.0 3.0 Current account balance (% of GDP)~ 0.0 13.9 2.0 -2.0 Due to the method of estimating value added, pie 1 1.0 Share of GDP* chart may not add up to 100% -4.0 1 -6.0 0.0 2013 2015 2017 2019 2021 2023 2025 2013 2015 2017 2019 2021 2023 2025 1 17.0 Agriculture, forestry, 1 and fishing, value added (% of GDP) 1 41.6 Industry (including Fiscal balance (% of GDP)~ Current account balance (% of GDP)~ 1 construction), value 0.0 40.0 1 added (% of GDP) -1.0 30.0 1 Services, value added -2.0 20.0 1 36.9 (% of GDP) -3.0 10.0 1 -4.0 0.0 1 -5.0 -10.0 Population*1 -6.0 -20.0 1 3.5 Population ages 0-14 -7.0 -30.0 1 (% of total population) -8.0 -40.0 1 35.5 2013 2015 2017 2019 2021 2023 2025 2013 2015 2017 2019 2021 2023 2025 Population ages 15-64 1 (% of total 1 population) 1 Human Development Index Population ages 65 GDP per capita ($US)~ (1= highly developed, 0= undeveloped) 61.0 1 and above (% of total Data label is global HDI ranking Data label is global GDP per capita ranking 1 population) 0.565 3,500 1 0.560 3,000 1 2,500 0.555 World Bank Ease of Doing Business ranking 2020 2,000 0.550 Ghana 118 1,500 0.545 The Bahamas 119 1,000 Papua New Guinea 120 0.540 500 153 154 155 156 157 126 127 128 129 130 Eswatini 121 0.535 0 Cameroon Pakistan Papua New Comoros Mauritania Vanuatu Lebanon Papua New Laos Solomon Islands Lesotho 122 Guinea Guinea 1 is the best, 189 is the worst UK rank is 8 Compiled by the FCDO Economics and Evaluation Directorate using data from external sources. -

The Populat Kenya

£ 4 World Population Year THE POPULAT KENYA - UGANDA - TANZANIA CI.CR.E.D. Senes THE POPULATION OF KENYA- UGANDA - TANZANIA SIMEON OMINDE Professor of Geography and Head of Department, University of Nairobi 1974 World Population Year C.I.C.R.E.D Series This study was initiated and financed by C.I.C.R.E.D. (Committee for International Coordination of National Research in Demography) to coincide with 1974 World Population Year. © Simeon Ominde © C.I.C.R.E.D. First published 1975 Printed in Kenya by Kenya Litho Ltd., P.O. Box 40775, Changamwe Road, Nairobi. CONTENTS Page PREFACE ¡v Chapter 1 The Area and Estimates of Population Growth 1 Chapter 2 Components of Population Growth 11 Chapter 3 Migration 40 Chapter 4 Population Composition 59 Chapter 5 Population Distribution 73 Chapter 6 Urbanization 88 Chapter 7 Labour Force 97 Chapter 8 Population Projection 105 Chapter 9 Population Growth and Socio-Economic Development 115 Conclusion 123 PREFACE This monograph presents the population situation in the area covered by Tanzania, Uganda and Kenya. The material has been prepared at the request of CICRED, as part of its contribution to the objectives of the World Population Year, 1974. In common with other developing countries of Africa, the East African countries are becoming acutely aware of the importance of rapid population growth and its significance to the attainment of development objectives. It has become increasingly clear that with the current rates of growth and the limited resources, the burden of socio-economic development programmes has become more serious. The search for alternative strategies to development must therefore focus attention on the impact of accelerating growth rate which leads to retardation of the rate of economic and social development. -

Ghana, Lesotho, and South Africa: Regional Expansion of Water Supply in Rural Areas

Ghana, Lesotho, and South Africa: Regional Expansion of Water Supply in Rural Areas Water, sanitation, and hygiene are essential for achieving all the Millennium Development Goals (MDGs) and hence for contributing to poverty eradication globally. This case study contributes to the learning process on scaling up poverty reduction by describing and analyzing three programs in rural water and sanitation in Africa: the national rural water sector reform in Ghana, the national water and sanitation program in South Africa, and the national sanitation program in Lesotho. These national programs have made significant progress towards poverty elimination through improved water and sanitation. Although they are all different, there are several general conclusions that can validly be drawn from them: · Top-level political commitment to water and sanitation, sustained consistently over a long time period, is critically important to the success of national sector programs. · Clear legislation is necessary to give guidance and confidence to all the agencies working in the sector. · Devolution of authority from national to local government and communities improves the accountability of water and sanitation programs. · The involvement of a wide range of local institutions—social, economic, civil society, and media — empowers communities and stimulates development at the local scale. · The sensitive, flexible, and country-specific support of external agencies can add significant momentum to progress in the water and sanitation sector. Background and context Over the past decade, the rural water and sanitation sector in Ghana has been transformed from a centralized supply-driven model to a system in which local government and communities plan together, communities operate and maintain their own water services, and the private sector is active in providing goods and services. -

The Changing Face of Money: Preferences for Different Payment Forms in Ghana and Zambia

The Changing Face of Money: Preferences for Different Payment Forms in Ghana and Zambia Vivian A. Dzokoto Virginia Commonwealth University Elizabeth N. Appiah Pentecost University College Laura Peters Chitwood Counseling & Advocacy Associates Mwiya L. Imasiku University of Zambia Mobile Money (MM) is now a popular medium of exchange and store of value in parts of Africa, Latin America and Asia. As payment modalities emerge, consumer preferences for different payment tools evolve. Our study examines the preference for, and use of MM and other payment forms in both Ghana and Zambia. Our multi-method investigation indicates that while MM preference and awareness is high, scope of use is low in Ghana and Zambia. Cash remains the predominant mode of business transaction in both countries. Increased merchant acceptability is needed to improve the MM ecology in these countries. 1. INTRODUCTION The materiality of money has evolved over time, evidenced by the emergence of debit and credit cards in the twentieth century (Borzekowski and Kiser, 2008; Schuh and Stavins, 2010). Currently, mobile forms of payment are reaching widespread use in many regions of Sub-Saharan Africa, which is the fastest growing market for mobile phones worldwide (International Telecommunication Union [ITU], 2009). For example, M-Pesa is an extremely popular form of mobile payment in Kenya, possibly due to structural and cultural factors (Omwansa and Sullivan, 2012). However, no major form of money from the twentieth century has been completely phased out, as people exercise preferences for which form of money to use. Based on the evolution of payment methods, the current study explores perceptions and utilization of Mobile Money (MM) in Ghana, West Africa and in Zambia, South-Central Africa. -

Double Taxation Treaties in Uganda Impact and Policy Implications

Double Taxation Treaties in Uganda Impact and Policy Implications July 2014 Double Taxation Treaties in Uganda Impact and Policy Implications Double Taxation Treaties in Uganda Impact and Policy Implications July 2014 3 Double Taxation Treaties in Uganda Impact and Policy Implications Table of Contents List of Abbreviations 5 Executive Summary 7 Introduction 9 Comparing the UN and OECD Double Taxation Conventions 11 Double Taxation Treaties in Uganda 13 Analyses of Selected Clauses of the Two Treaties 15 Treaty Abuses can Lead to Major Tax Losses 20 Successes with Renegotiations and Cancellations 21 Conclusion 23 Policy Recommendations for Renegotiating Positions 25 References 28 List of boxes and tables Box 1: The cost of treaty shopping to Zambia 10 Box 2: Indian round tripping through Mauritius 10 Table 1: Permanent Establishment Continuum 17 Table 2: Withholding Tax Rates 18 Table 3: Withholding Tax Rate Continuum 18 Table 4: Capital Gains Continuum 19 4 Double Taxation Treaties in Uganda Impact and Policy Implications List of abbreviations CGT Capital Gains Tax DTA(s) Double Taxation Agreement(s) DTT(s) Double Taxation Treaty (Treaties) EAC East African Community FDI Foreign Direct Investment ITA Income Tax Act, 1997 LDC Least Developed Country (Countries) MNC Multinational Companies MDG Millennium Development Goals MU Mauritius NL The Netherlands OECD Organisation for Economic Cooperation and Development PE Permanent Establishment RSA Republic of South Africa UAE United Arab Emirates UIA Uganda Investment Authority URA Uganda Revenue Authority 5 Double Taxation Treaties in Uganda Impact and Policy Implications Acknowledgments This paper was produced jointly by SEATINI-Uganda and ActionAid International Uganda. We extend our appreciation to the following for their contributions towards the production of this report: Ms Jalia Kangave, Ms Ruth Kelly, Mr Moses Kawumi, Mr Anders Reimers Larsen, Ms Sarah Muyonga, Ms Jane Nalunga, Ms Nelly Busingye Mugisha, Ms Regina Navuga and members of the Tax Justice Taskforce. -

The Charcoal Grey Market in Kenya, Uganda and South Sudan (2021)

COMMODITY REPORT BLACK GOLD The charcoal grey market in Kenya, Uganda and South Sudan SIMONE HAYSOM I MICHAEL McLAGGAN JULIUS KAKA I LUCY MODI I KEN OPALA MARCH 2021 BLACK GOLD The charcoal grey market in Kenya, Uganda and South Sudan ww Simone Haysom I Michael McLaggan Julius Kaka I Lucy Modi I Ken Opala March 2021 ACKNOWLEDGEMENTS The authors would like to thank everyone who gave their time to be interviewed for this study. They would like to extend particular thanks to Dr Catherine Nabukalu, at the University of Pennsylvania, and Bryan Adkins, at UNEP, for playing an invaluable role in correcting our misperceptions and deepening our analysis. We would also like to thank Nhial Tiitmamer, at the Sudd Institute, for providing us with additional interviews and information from South Sudan at short notice. Finally, we thank Alex Goodwin for excel- lent editing. Interviews were conducted in South Sudan, Uganda and Kenya between February 2020 and November 2020. ABOUT THE AUTHORS Simone Haysom is a senior analyst at the Global Initiative Against Transnational Organized Crime (GI-TOC), with expertise in urban development, corruption and organized crime, and over a decade of experience conducting qualitative fieldwork in challenging environments. She is currently an associate of the Oceanic Humanities for the Global South research project based at the University of the Witwatersrand in Johannesburg. Ken Opala is the GI-TOC analyst for Kenya. He previously worked at Nation Media Group as deputy investigative editor and as editor-in-chief at the Nairobi Law Monthly. He has won several journalistic awards in his career. -

Greening the Recovery in Ghana and Zambia Climate Change Is One of the Most Pressing Global Challenges

INSTITUTE OF SUSTAINABLE RESOURCES Greening the Recovery in Ghana and Zambia Climate change is one of the most pressing global challenges. According to the Intergovernmental Panel on Climate Change, action is needed to reduce global carbon emissions to net-zero by the middle of this century. Whilst Covid-19 has led to temporary reductions in emissions, the wider economic and social impacts of the pandemic risk slowing down or derailing action on climate change. This project focuses on the opportunities for integrating economic recovery and climate change policies in Ghana and Zambia. Both countries have been affected significantly by the pandemic. Reported numbers of infections and deaths are low when compared to rates in many developed economies. However, the economic impacts have been severe – for example, due to lower demand for commodities they export such oil and copper. Summary of NDC emissions targets The research team from the UK, Ghana and Zambia is Primary energy mix (2018) workingGreenhouse with gas governmentsemissions and other stakeholders to (million tonnes of CO2 equivalent) develop80 detailed plans for a low carbon recovery. This includes revisions to Ghana and Zambia’s national climate change70 strategies, known as Nationally Determined 80 Contributions (NDCs). The emissions targets included in Zambia 60 70 their first NDCs, submitted in 2015/16, are summarised Ghana below.50 They include more ambitious conditional targets 60 that depend on international assistance. Zambia 40 Ghana 50 12.6mtoe The research will explore how both countries could go 9.9mtoe 30 40 even further, and what policy options and investments could20 deliver them. This includes options for meeting 30 growing energy demand from low carbon sources rather 10 20 than fossil fuels, and the extent to which these plans could0 also help to achieve universal access to electricity. -

Country Reports

COUNTRY REPORTS DISPLACED & DISCONNECTED UNHCR CONNECTIVITY FOR REFUGEES Innovation Service COUNTRY REPORTS DISPLACED AND DISCONNECTED Made possible thanks to the generous support of: In partnership with: The GSMA represents the interests of mobile operators worldwide, uniting more than 750 operators with over 350 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors. The GSMA also produces the industry-leading MWC events held annually in Barcelona, Los Angeles and Shanghai, as well as the Mobile 360 Series of regional conferences. For more information, please visit the GSMA corporate website at www.gsma.com Follow the GSMA on Twitter: @GSMA TABLE OF CONTENTS INTRODUCTION INTRODUCTION 1 These country reports provide information on the legal situation for displaced populations, namely AFGHANISTAN 2 asylum seekers, refugees, and returnees, where relevant, regarding access to mobile services, in BANGLADESH 6 each country covered. Each report contains information on: BRAZIL 10 BURUNDI 14 • Registration and Identification of Displaced Persons CAMEROON 18 • SIM Registration CENTRAL AFRICAN REPUBLIC 22 • Know Your Customer Rules • Mobile Money CHAD 26 • Data Protection DEMOCRATIC REPUBLIC OF CONGO 30 ETHIOPIA 34 Information sources cover freely published information from the relevant regulators or ministries, JORDAN 38 academic papers and other internet sources. Specific information on the practical situation in KENYA 42 country has been provided by UNHCR local staff. LEBANON 46 MAURITANIA 50 The content of this report, including information and links, is provided free of charge and is NIGER 54 intended to be helpful to the widest range of people and organizations. -

Agreement Between South Africa and Ghana

CONVENTION BETWEEN THE GOVERNMENT OF THE REPUBLIC OF SOUTH AFRICA AND THE GOVERNMENT OF THE REPUBLIC OF GHANA FOR THE AVOIDANCE OF DOUBLE TAXATION AND THE PREVENTION OF FISCAL EVASION WITH RESPECT TO TAXES ON INCOME AND ON CAPITAL GAINS Preamble The Government of the Republic of South Africa and the Government of the Republic of Ghana desiring to conclude a Convention for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital gains, Have agreed as follows: Article 1 Persons Covered This Convention shall apply to persons who are residents of one or both of the Contracting States. Article 2 Taxes Covered 1. This Convention shall apply to taxes on income and on capital gains imposed on behalf of a Contracting State or of its political subdivisions, irrespective of the manner in which they are levied. 2. There shall be regarded as taxes on income and on capital gains all taxes imposed on total income, and on total capital gains, or on elements of income or on elements of capital gains, including taxes on gains from the alienation of movable or immovable property and taxes on the total amounts of wages and salaries paid by enterprises. 3. The existing taxes to which the Convention shall apply are: (a) in Ghana: (i) the income tax; and (ii) the capital gains tax; (hereinafter referred to as “Ghana tax”); and (b) in South Africa: (i) the normal tax; (ii) the secondary tax on companies; and (iii) the withholding tax on royalties; (hereinafter referred to as “South African tax”). -

Policy Requirements for Diaspora Engagement: the Case of Zambia: Migration and Transnationalism: Opportunities and Challenges (2

Policy Requirements for Diaspora Engagement: The case of Zambia Paul Lupunga Ministry of Finance and National Planning ZAMBIA Contents • Background Scenario –Zambia • Status – Diaspora Engagement Policies • Policy Opportunities and Threats for Zambia Background Scenario – Zambia • Location: Central/Southern Africa • Population: 12‐13 million • Poverty levels: ≈ 60 % • GDP Growth: 6‐8 % • Aid flows: 2009 ODA $300m • Remittance estimates: $70‐80m • Diaspora location: UK, USA, Canada, Australia, Southern African subcontinent, Global. Diaspora Engagement Policies • Dual citizenship (Parliament, NCC, President) • Investment promotion (Development Agency) • Census (Dept. of Registration, CSO) • Land allocation facilitation (Ministry of Lands, Ministry of Local Government) • Skilled labour recruitment (Ministry of Labour) • Remittance transmission (Bank of Zambia, Stock Exchange, private banks) • Consular assistance/ facilitation (Ministry of Foreign Affairs) Types of Diaspora Engagement Policy Capacity Building Extending Extending obligations Rights Symbolic Institution Political Investment Policies and Nation Building Incorpor- lobby promotion Building ation symbols and rhetoric Inclusive Cu S networks Building International Consular and consultative bodies Special concessions Dual Nationality Em services Tourism Mandatory payments Zones Economic Special capture** FDI for Remittance programmes transfer Knowledge Promoting Expat lobby M Conference andconventions agency Ministerial level bureaucracy Dedicated M h o us ap l ni tu t r in bassy to r a e g rin l Pr t m u rn t g ed o vot e m o i ff a ot in o vo & r i g * o ts t PR n e a n d in duct i o n Uganda Kenya Nigeria Ghana Zambia Adapted from Gamlen, 2006, p.5, *In both Uganda and Zambia in 2009 Dual Nationality was still in the stages of constitutional amendment although the provision for those amendments had been agreed.