Differences Between Fee Structure of Mobile Money Technologies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Finance for Energy Access in Uganda

DIGITAL FINANCE FOR ENERGY ACCESS IN UGANDA: PUTTING MOBILE MONEY BIG DATA ANALYTICS TO WORK Mayank Jain, Robin Gravesteijn, Arne Jacobson, Emily Gamble, Nicola Scarrone ABSTRACT Access to clean energy is a basic need that directly supports people’s livelihood, yet more than 30 million Ugandans live without electricity. Pay-as-you-go (PayGo) is a promising and innovative financing solution that can make clean energy affordable for low-income people. However, there remains significant knowledge gaps regarding the digital energy finance market’s size, outreach, growth and impact. This study leverages anonymized mobile money data of PayGo solar energy users in Uganda to gain insight on digital energy financing in Uganda. It also draws from a customer phone survey that assesses solar product adoption and quality of life improvements. We find that the Uganda solar market is growing rapidly and currently has around one million active customers. Around 12 percent of the Ugandan households own a solar home system and there is opportunity for further market expansion, especially in areas with high levels of mobile money penetration. The clean energy market is becoming more inter-connected with the digital finance market. In fact, digital energy financing through PayGo has promoted wider financial inclusion around 110,000 new mobile money customers. Likewise, when Uganda’s implemented a temporary mobile money tax it caused an immediate slow-down in PayGo uptake and new mobile money activations indicating it negatively impacted the country’s access to clean energy and formal finance. The customer survey result indicates that poorer customers seem equally able to purchase larger solar systems as compared to richer customers because of mobile money financing. -

Airtel Africa Plc Results for the Nine-Month Period Ended 31 December 2020 29 January 2021

Airtel Africa plc Results for the nine-month period ended 31 December 2020 29 January 2021 Another quarter of double-digit growth, with continued improvement in revenue growth and EBITDA profitability Highlights • Reported revenue increased by 13.8% to $2,870m with Q3’21 reported revenue growth of 19.5%. • Constant currency underlying revenue growth was 18.6%, with Q3’21 growth of 22.8%. Growth for the nine months was recorded across all regions: Nigeria up 21.6%, East Africa up 23.4% and Francophone Africa up 8.0%; and across all services, with voice revenue up 10.4%, data up 31.1% and mobile money up 34.2%. • Underlying EBITDA for the nine months was $1,297m, up 16% in reported currency while constant currency underlying EBITDA growth was 22.5%. • Underlying EBITDA margin for the nine months was 45.5%, up by 118 bps (up 144 bps in constant currency). Q3’21 underlying EBITDA margin was 46.9%. • Operating profit increased by 21.8% to $800m in reported currency, and by 29.9% in constant currency. • Free cash flow was $466m, up 20% compared to the same period last year. • Basic EPS was 5.5 cents, down 36.5%, largely due to prior year exceptional items and a one-off derivative gain. Excluding these, basic EPS rose by 19.8%. EPS before exceptional items was 5.0 cents. • Customer base up 11.0% to 118.9 million, with increased penetration across mobile data (customer base up 23.5%) and mobile money services (customer base up 29.0%). -

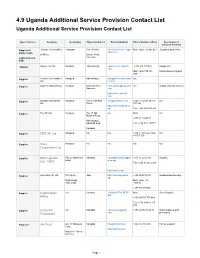

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List Type of Service Company Location(s) Physical Address Email & Website Phone Number (office) Description of Services Provided Supplier of Sunrise Commodities Kampala Plot 163/165, Monteirovincent711@y Mob: +256 712 624 624 Suppliers and millers maize, beans, ahoo.com & Millers Bombo Road, maize flour and Kawempe CSB Supplier Aponye (U) Ltd Kampala Nalukolongo aponyeonline@gmail. +256 414 270 526 Supply and com Mob: +256 772 603 transportation of grains 909 Supplier Premier Commodities Kampala Nalukolongo info@premiercommodit n/a Ltd ies.com Supplier Export Trading Group Kampala Industrial Area info.uganda@etgworld. n/a Supply of grains and oils Namanve com http://www.etgworld. com Supplier Byinzika Enterprises Kampala Plot 3, Johnston [email protected] +256 414 259 519/312 n/a Ltd Street, 277 221 http://www.biyinzika.co. ug/ Fax: +256 414 343 268 Supplier Tiny Mirrors Kampala Plot 17 Old n/a Mob: n/a Masaka Road, +256-712-666453 Nalukolongo industrial area, Fax: +256-414-274777 Kampala Supplier SRS (U) Ltd Kampala n/a n/a +256 41 285 282 +256 n/a 41 505 723 Supplier Diary Kampala n/a n/a n/a n/a Corporation Ltd Supplier MTN Uganda Plot 22 Hanninton Kampala customerservice@mt +256 31 221 2333 Supplier Road n.co.ug Ltd - VSAT Fax: +256 31 221 2233 http://mtn.co.ug/ Supplier Agro ways (U) Ltd Plot 34-60 Jinja http://www.agroways. +256 454 479 381 Supplies/warehousing ug/ Kyabazinga Mob: +256 712 Way, Jinja 404245, +256 782 391354 Supplier Capital Reef- n/a Kampala HK@CAPITALREEF. -

Privacy in Uganda

0 0 0 1 1 0 1 1 0 1 0 0 0 0 0 0 1 0 1 1 0 0 1 1 1 1 0 0 0 1 0 1 0 0 1 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0 0 0 0 1 0 1 1 0 1 0 1 0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 0 0 0 1 0 0 0 0 1 0 1 1 1 0 1 0 0 1 0 1 0 1 0 1 1 1 0 0 0 0 0 0 0 0 0 1 0 ! 0 0 1 1 0 1 1 0 0 0 1 0 1 1 0 ! 0 0 0 0 1 0 1 1 0 1 0 0 0 0 1 1 0 0 1 1 0 0 0 0 0 1 1 1 0 0 0 0 1 1 1 0 0 0 0 1 0 Privacy in Uganda 0 1 1 10 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 An Overview of0 How0 ICT Policies Infringe0 on Online Privacy 0 0 0 0 and Data Protection 0 0 0 0 0 0 0 0 0 @ CIPESA ICT Policy Briefing Series No. 06/15 December 2015 0 100110010010 1010110100 100010 010100 110101 001010 01001 001010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 110101 00101001 001 010 0 110101 00101001 001 01010 0010001 000100010100100 1000010 101001010 010100 110101 00101001 001 0 1101 001001 001010 100110 010010 1010 110100 10010 0101 1101 001001 001010 100110 010010 1010 110100 10010 01010100 001010 10010 11101 001001 001010 100110 010010 1010 110100 10010 01010100 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 110101 001001 001010 110101 00101001 001 01010 0010001 0001000101 Introduction 00 110101 00101001 001 01010 0010001 000100010100100 1000010 101001010100 001001 100010 001010 11010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 001001 00101001 001 0 001010 10010 11101 001001 001010 100110 010010 1010 110100 10010 0101010010 0010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010 10100 1001 100010 0 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 As of June 2015, Uganda had an internet penetration rate of 37% and there were 64 telephone connections per 100 inhabitants.1 This was made possible by increasing investments in the Information Communication Technologies (ICT) sector by the private sector and – to a lesser extent - the government, proliferation of affordable smart phones and a steady decrease in internet costs enabled by a liberal competitive telecommunication sector. -

Report to Parliament

INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT REPORT TO PARLIAMENT JANUARY - JUNE 2014 REPORT TO PARLIAMENT 1 JANUARY-JUNE 2014 INSPECTORATE OF GOVERNMENT JANUARY-JUNE 2014 2 REPORT TO PARLIAMENT INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT REPORT TO PARLIAMENT JANUARY - JUNE 2014 REPORT TO PARLIAMENT 3 JANUARY-JUNE 2014 INSPECTORATE OF GOVERNMENT JANUARY-JUNE 2014 4 REPORT TO PARLIAMENT INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT HEAD OFFICE Jubilee Insurance Centre. Plot 14, Parliament Avenue. P. O. Box 1682 Kampala Tel: +256-414 344 219 | +256-414 259 738 (General lines) +256-414 255 892 | +256-414 251 462 (Hotline) +256-414 347 387 Fax: +256-414 344 810 | Website: www.igg.go.ug Vision: Mission: Core Values: “Good Governance To Promote Good Governance through Integrity, with an Ethical and enhancing accountability, Transparency Impartiality Corruption Free and the enforcement of the rule of law Professionalism Society” and administrative justice in public Gender Equality and offices Equity OFFICE OF THE INSPECTOR GENERAL OF GOVERNMENT Inspector General of Government Ms. Irene Mulyagonja Kakooza Tel: +256 414 259 723 | Fax: +256 414 344 810 +256 414 257 590 | Email: [email protected] Deputy Inspector General of Government Information and Internal Inspection Division Mr. George Nathan Bamugemereire Head: Mr. Stephen Kasirye Tel: +256 414 259780 Tel: +256 414 342113 Email: [email protected] Email: [email protected] Deputy Inspector General of Government Public and International Relations Division Ms. Mariam Wangadya Head: Ms. Munira Ali Bablo Tel: +256 414 259709 Tel: +256 414 231530 Email: [email protected] Email: [email protected] DEPARTMENT OF FINANCE AND ADMINISTRATION Secretary to the Inspectorate of Government Undersecretary finance and Administration Mr. -

Uganda at 50: the Past, the Present and the Future

UGANDA AT 50: THE PAST, THE PRESENT AND THE FUTURE A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue Organised by ACODE, 93.3 Kfm and NTV Uganda at the Sheraton Hotel - Kampala – October 3, 2012 Naomi Kabarungi-Wabyona ACODE Policy Dialogue Report Series, No. 17, 2013 UGANDA AT 50: THE PAST, THE PRESENT AND THE FUTURE A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue Organised by ACODE, 93.3 Kfm and NTV Uganda at the Sheraton Hotel - Kampala – October 3, 2012 Naomi Kabarungi-Wabyona ACODE Policy Dialogue Report Series, No. 17, 2013 ii A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue 2012 Published by ACODE P.O. Box 29836, Kampala - UGANDA Email: [email protected], [email protected] Website: http://www.acode-u.org Citation: Kabarungi, N. (2013). Uganda at 50: The Past, the Present and the Future. A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue. ACODE Policy Dialogue Report Series, No.17, 2013. Kampala. © ACODE 2013 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise without prior permission of the publisher. ACODE policy work is supported by generous donations from bilateral donors and charitable foundations. The reproduction or use of this publication for academic or charitable purpose or for purposes of informing public policy is exempted from this restriction. ISBN 978 9970 34 009 5 Cover Photo: A Cross section of participants attending the Uganda @50 in 4 Hours Dialogue held on October 3, 2012 at Sheraton Hotel in Kampala. -

Mobile Money Use in Uganda: a Preliminary Study

Mobile Money Use in Uganda: A Preliminary Study Ali NDIWALANA1/3, Olga MORAWCZYNSKI2, Oliver POPOV1/4 1Mid Sweden University, Sundsvall, Sweden 2Applab, Grameen Foundation, Kampala, Uganda 3Makerere University, Kampala, Uganda 4Stockholm University, Stockholm, Sweden Abstract: As mobile phones proliferate in the developing world and Mobile Network Operators (MNOs) look for ways to diversify from voice and SMS, mobile money has emerged as an opportunity. While currently used mainly for money transfers, mobile money advocates are enthusiastic about its capability to transform the financial fabric of society, particularly for the poor. We report on a study of mobile money users in Uganda across 3 MNOs. Besides understanding current usage of mobile money, we explore different daily financial transactions of respondents. We investigate the relative importance of these transactions, their frequency, and methods of payment used. Satisfaction with current payment methods and strength of intention to use mobile money if offered for these transactions are captured. The goal is to identify potential new ways to use mobile money in Uganda. 1. Introduction As mobile phones proliferate around the developing world, new services are emerging as mobile network operators (MNOs) diversify services to compliment voice and SMS in a progressively competitive environment where the goal is improving customer retention and reducing churn (Mendes, Alampay et al. 2007). A prominent emerging service is mobile money—a term used to loosely refer to money stored using the SIM (subscriber identity module) as an identifier as opposed to an account number in the conventional banking sense. A notational equivalent in value is then kept on the SIM within the mobile phone, which is also used to transmit payment instructions. -

Mapping Uganda's Social Impact Investment Landscape

MAPPING UGANDA’S SOCIAL IMPACT INVESTMENT LANDSCAPE Joseph Kibombo Balikuddembe | Josephine Kaleebi This research is produced as part of the Platform for Uganda Green Growth (PLUG) research series KONRAD ADENAUER STIFTUNG UGANDA ACTADE Plot. 51A Prince Charles Drive, Kololo Plot 2, Agape Close | Ntinda, P.O. Box 647, Kampala/Uganda Kigoowa on Kiwatule Road T: +256-393-262011/2 P.O.BOX, 16452, Kampala Uganda www.kas.de/Uganda T: +256 414 664 616 www. actade.org Mapping SII in Uganda – Study Report November 2019 i DISCLAIMER Copyright ©KAS2020. Process maps, project plans, investigation results, opinions and supporting documentation to this document contain proprietary confidential information some or all of which may be legally privileged and/or subject to the provisions of privacy legislation. It is intended solely for the addressee. If you are not the intended recipient, you must not read, use, disclose, copy, print or disseminate the information contained within this document. Any views expressed are those of the authors. The electronic version of this document has been scanned for viruses and all reasonable precautions have been taken to ensure that no viruses are present. The authors do not accept responsibility for any loss or damage arising from the use of this document. Please notify the authors immediately by email if this document has been wrongly addressed or delivered. In giving these opinions, the authors do not accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by the prior written consent of the author This document has been prepared solely for the KAS and ACTADE. -

Gender and Innovation for Climate-Smart Agriculture

EXGeAMINnderING aWOMnd iEnN’Snovatio ACCESSn TfOor climDIGITAate-sLm PLartAT agricFORMSu lture Assessment of gender-responsiveness of RAN’s agricultural-focused Innovations Working Paper No. 260 CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) 2019 A case of Mobile Broadband in Uganda A Report Compiled and Prepared by Peace Oliver Amuge, Ednah Karamagi & Moses Owiny for and on behalf of The collaboration betweenRESEARCH PROGRAM and ON Climate Change, Agriculture and Food Security CCAFS List of Acronyms APC : Association for Progressive Communications FGD : Focus Group Discussion ICT : Information Communication Technology KBPS : KiloBytes Per Second KII : Key Informant Interview MoICT : Ministry of Information Communication and Technology MTN : Mobile Telephone Network NIITA-U : The National Information Technology Authority Uganda RCDF : Rural Communications Development Fund WOUGNET : Women of Uganda Network Source of Picture: Girls head: https://www.kissclipart.com/african-girl-icon-png-clipart-computer-icons-clip-kqvozw/download- clipart.html Digital Platform: http://files.websitebuilder.prositehosting.co.uk/fasthosts487/image/digitalplatforms2.png Page | i A collaboration between and Definition of Key Words Digital Platform : Refers to the software or hardware of a website allowing for the interaction of its usersi. For example, in Uganda commonly used ones are: Twitter, Wikipedia, Facebook, Instagram, Amazon, Kikuu, Jumia and OLX. Such platforms bring together different groups of users; with a common meeting point being the internet. More, they facilitate exchange between multiple groups - for example end users and producers - who don’t necessarily know each other. They are often key sources of networking. A Digital Platform is worth nothing without its community. Mobile Broadband: This is a form of mobile internet that supports speeds of more than 256 kbps Mobile Internet : Mobile Internet is a way of getting online when you are on the move via portable devices such as mobile phones, tablets and personal computers. -

MTN Launches Internet Solutions for Small & Growing

For Immediate Release: MTN launches Internet Solutions for Small & Growing Businesses Customized solutions address every business type The internet solutions address the needs of the market MTN Uganda guarantees 24/7 reliability and service support Kampala, Uganda – Monday, 11th March 2019: Time is money, especially in the business world where any minute lost can cause massive losses to the bottom-line. Think of a missed deadline, a delayed email or a file that just cannot upload. With more and more enterprises searching for internet speed and ‘always-on’ connectivity, MTN Uganda has launched a new reliable and affordable internet solution for start-up and growing businesses such as pharmacies, schools, restaurants, supermarkets, salons, videography or home offices. According to Sophia Mukasa, MTN Uganda Senior Manager Enterprise Products and Marketing, there is growing need for custom-made Internet solutions that respond to different needs, “Through continuous customer engagement, we have come up with services aimed at SMEs seeking reliable but affordable internet connectivity to their customers, suppliers, staff and systems.” The MTN SME internet solution offers small businesses unlimited access to the Internet with 24/7 service support and no need for data bundle top ups. It is available in the urban and out of town areas within the MTN Fiber and LTE coverage footprint across the country. In 2015, Uganda was ranked as the most entrepreneurial country with an entrepreneurship rate of 28% of its population involved in a business venture. Some of these businesses have grown and so have their internet needs: “The economy has been growing steadily and so have Ugandan businesses. -

Court Case Administration System

THE REPUBLIC OF UGANDA IN THE HIGH COURT OF UGANDA(HCT) AT KAMPALA COMMERCIAL REGISTRY CAUSELIST FOR THE SITTINGS OF : 27‐03‐2017 to 31‐03‐2017 MONDAY, 27‐MAR‐2017 BEFORE:: HON. MR. JUSTICE BILLY KAINAMURA Time Case number Case Category Pares Claim Sing Type Posion UNION LOGISTICS UGANDA LTD Hearing ‐ UNDER 1. 10:00 HCT‐00‐CC‐CS‐0175‐2015 Civil Suits USD 22,396, INTEEST COST VS STEEL ROLLING MILLS LTD Plainff's case HEARING BIPIN PANEL & ANOTHER VS SHS. 185,673,00, ORDER FOR THE Scheduling PENDING 2. 02:00 HCT‐00‐CC‐CS‐0397‐2013 Civil Suits SANDIP PATEL DEFENDANT, INTERES, COSTS conference HEARING DOLAMITE ENGINEERING SERVICES LTD VS BOARD OF SHS. 135,900,900/‐, DAMAGES, UNDER 3. 02:00 HCT‐00‐CC‐CS‐0413‐2013 Civil Suits Menon GOVERNERS JAMES OCHORA INTEREST AND COSTS HEARING MEM SSS TORORO & A Hearing ‐ Miscellaneous KINGS INVESTMENT LTD VS UNCONDITIONAL LEAVE TO APPEAR UNDER 4. 02:00 HCT‐00‐CC‐MA‐1065‐2016 Applicant's Applicaon GEMEX (U) LTD AND DEFEND, COSTS HEARING case ERASMUS BYARUHANGA VS USD 9,500, SHS.37,600,000/‐, Scheduling PENDING 5. 02:00 HCT‐00‐CC‐CS‐0011‐2015 Civil Suits SEAWAYS (K) LTD DAMAGES, INTEREST AND COSTS conference HEARING RWAMWOJO WILLY VS TOTCO SHS 366,783,400,INTEREST Scheduling UNDER 6. 02:00 HCT‐00‐CC‐CS‐0645‐2015 Civil Suits GRAINS & SEEDS (U) LTD G/DAMAGES, COSTS conference HEARING BEFORE:: HON. MR JUSTICE CHRISTOPHER MADRAMA Time Case number Case Category Pares Claim Sing Type Posion Hearing Miscellaneous MUGOYA MAWAZI VS ABC UNDER 1. -

Quality of Service Measurements for 2017-2018

RESULTS OF QUALITY OF SERVICE MEASUREMENTS FOR MOBILE VOICE TELEPHONY SERVICES IN UGANDA Uganda Communications Commission (the Commission) is the regulator of the communications sector in Uganda as established by the Uganda Communications Act 2013. The communications sector includes telecommunications, broadcasting, radio-communications, postal communications, data communication and infrastructure. One of the functions of the Commission as spelt out under the Act is to promote and safeguard the interests of consumers and operators as regards the quality of communications services and equipment. In this vain, the Commission monitors and conducts performance audits to establish the performance of operators against the Quality of Service (QoS) standard of Uganda with respect of the key performance indicators that include the following: a) Blocked call rate (target is less than or equal to 2%) and b) Dropped call rate (target is less than or equal to 2%). The Commission conducted such measurements for mobile voice telephony services in the periods August to December 2017 and August to September 2018. The operators considered during these exercises were Uganda Telecom Limited (UTL), MTN Uganda Limited, Airtel Uganda Limited and Africell Uganda Limited. Below are the findings with regard to the proportion of call attempts that were blocked and dropped in thirteen (13) of the towns across Uganda. (For each indicator, the closer to 0%, the better the performance of the respective network in the respective town.) A blocked call is a call attempt, which although is initiated within the coverage area, was not connected by the operator’s network to the called number. A dropped call is a call that is terminated by the operator's network after the call has been connected to the called number instead of the call being terminated by either the caller or called person.