Gender and Innovation for Climate-Smart Agriculture

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Finance for Energy Access in Uganda

DIGITAL FINANCE FOR ENERGY ACCESS IN UGANDA: PUTTING MOBILE MONEY BIG DATA ANALYTICS TO WORK Mayank Jain, Robin Gravesteijn, Arne Jacobson, Emily Gamble, Nicola Scarrone ABSTRACT Access to clean energy is a basic need that directly supports people’s livelihood, yet more than 30 million Ugandans live without electricity. Pay-as-you-go (PayGo) is a promising and innovative financing solution that can make clean energy affordable for low-income people. However, there remains significant knowledge gaps regarding the digital energy finance market’s size, outreach, growth and impact. This study leverages anonymized mobile money data of PayGo solar energy users in Uganda to gain insight on digital energy financing in Uganda. It also draws from a customer phone survey that assesses solar product adoption and quality of life improvements. We find that the Uganda solar market is growing rapidly and currently has around one million active customers. Around 12 percent of the Ugandan households own a solar home system and there is opportunity for further market expansion, especially in areas with high levels of mobile money penetration. The clean energy market is becoming more inter-connected with the digital finance market. In fact, digital energy financing through PayGo has promoted wider financial inclusion around 110,000 new mobile money customers. Likewise, when Uganda’s implemented a temporary mobile money tax it caused an immediate slow-down in PayGo uptake and new mobile money activations indicating it negatively impacted the country’s access to clean energy and formal finance. The customer survey result indicates that poorer customers seem equally able to purchase larger solar systems as compared to richer customers because of mobile money financing. -

Isp Interconnectivity in Uganda

1 MAKERERE UNIVERSITY ISP INTERCONNECTIVITY IN UGANDA Namuddu Caroline 14/U/12191/PS and Matovu Ronald/ 14/U/123456 A proposal submitted in partial fulfilment of the requirements for the award of Degree of Bachelor of Science in Computer Engineering of the College of Engineering, Design, Art and Technology, Makerere University. Date of Submission: May, 2018 2 3 Dedication This project is dedicated to my parents, Mr. and Mrs. Mugerwa for the staunch and stern provision they have made to and for me through the years. For the hope they have in me and the dreams I hold, for the encouragement and correction they have given me. 4 Acknowledgement It is with deepest gratitude that I appreciate the unwaveringly supportive efforts made by my supervisor, Eng. Diarmuid O’ Briain, and my co-supervisor Mr. Jonathan Serugunda who offered all form of consultation in my endeavours with this research project. I would like to greatly thank Ronald Matovu my project partner a student of Computer Engineering at Makerere University, for the unconditional help and assistance he offered during the entire project. I would still like to thank netlabsUG Research Centre for all the assistance they offered in terms of equipment, that enabled us build our testbed and providing us with same to effectively carry out our research for project. Unimaginable thanks to my parents for the moral, financial and emotional support they have given through the four years. I would like to thank and appreciate all the lecturers I have gladly had the honour of being taught by. I would like to thank God for the precious gift of life and strength. -

Airtel Africa Plc Results for the Nine-Month Period Ended 31 December 2020 29 January 2021

Airtel Africa plc Results for the nine-month period ended 31 December 2020 29 January 2021 Another quarter of double-digit growth, with continued improvement in revenue growth and EBITDA profitability Highlights • Reported revenue increased by 13.8% to $2,870m with Q3’21 reported revenue growth of 19.5%. • Constant currency underlying revenue growth was 18.6%, with Q3’21 growth of 22.8%. Growth for the nine months was recorded across all regions: Nigeria up 21.6%, East Africa up 23.4% and Francophone Africa up 8.0%; and across all services, with voice revenue up 10.4%, data up 31.1% and mobile money up 34.2%. • Underlying EBITDA for the nine months was $1,297m, up 16% in reported currency while constant currency underlying EBITDA growth was 22.5%. • Underlying EBITDA margin for the nine months was 45.5%, up by 118 bps (up 144 bps in constant currency). Q3’21 underlying EBITDA margin was 46.9%. • Operating profit increased by 21.8% to $800m in reported currency, and by 29.9% in constant currency. • Free cash flow was $466m, up 20% compared to the same period last year. • Basic EPS was 5.5 cents, down 36.5%, largely due to prior year exceptional items and a one-off derivative gain. Excluding these, basic EPS rose by 19.8%. EPS before exceptional items was 5.0 cents. • Customer base up 11.0% to 118.9 million, with increased penetration across mobile data (customer base up 23.5%) and mobile money services (customer base up 29.0%). -

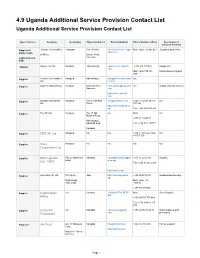

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List Type of Service Company Location(s) Physical Address Email & Website Phone Number (office) Description of Services Provided Supplier of Sunrise Commodities Kampala Plot 163/165, Monteirovincent711@y Mob: +256 712 624 624 Suppliers and millers maize, beans, ahoo.com & Millers Bombo Road, maize flour and Kawempe CSB Supplier Aponye (U) Ltd Kampala Nalukolongo aponyeonline@gmail. +256 414 270 526 Supply and com Mob: +256 772 603 transportation of grains 909 Supplier Premier Commodities Kampala Nalukolongo info@premiercommodit n/a Ltd ies.com Supplier Export Trading Group Kampala Industrial Area info.uganda@etgworld. n/a Supply of grains and oils Namanve com http://www.etgworld. com Supplier Byinzika Enterprises Kampala Plot 3, Johnston [email protected] +256 414 259 519/312 n/a Ltd Street, 277 221 http://www.biyinzika.co. ug/ Fax: +256 414 343 268 Supplier Tiny Mirrors Kampala Plot 17 Old n/a Mob: n/a Masaka Road, +256-712-666453 Nalukolongo industrial area, Fax: +256-414-274777 Kampala Supplier SRS (U) Ltd Kampala n/a n/a +256 41 285 282 +256 n/a 41 505 723 Supplier Diary Kampala n/a n/a n/a n/a Corporation Ltd Supplier MTN Uganda Plot 22 Hanninton Kampala customerservice@mt +256 31 221 2333 Supplier Road n.co.ug Ltd - VSAT Fax: +256 31 221 2233 http://mtn.co.ug/ Supplier Agro ways (U) Ltd Plot 34-60 Jinja http://www.agroways. +256 454 479 381 Supplies/warehousing ug/ Kyabazinga Mob: +256 712 Way, Jinja 404245, +256 782 391354 Supplier Capital Reef- n/a Kampala HK@CAPITALREEF. -

Privacy in Uganda

0 0 0 1 1 0 1 1 0 1 0 0 0 0 0 0 1 0 1 1 0 0 1 1 1 1 0 0 0 1 0 1 0 0 1 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0 0 0 0 1 0 1 1 0 1 0 1 0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 0 0 0 1 0 0 0 0 1 0 1 1 1 0 1 0 0 1 0 1 0 1 0 1 1 1 0 0 0 0 0 0 0 0 0 1 0 ! 0 0 1 1 0 1 1 0 0 0 1 0 1 1 0 ! 0 0 0 0 1 0 1 1 0 1 0 0 0 0 1 1 0 0 1 1 0 0 0 0 0 1 1 1 0 0 0 0 1 1 1 0 0 0 0 1 0 Privacy in Uganda 0 1 1 10 0 0 0 0 1 0 0 0 0 0 0 0 0 0 0 0 An Overview of0 How0 ICT Policies Infringe0 on Online Privacy 0 0 0 0 and Data Protection 0 0 0 0 0 0 0 0 0 @ CIPESA ICT Policy Briefing Series No. 06/15 December 2015 0 100110010010 1010110100 100010 010100 110101 001010 01001 001010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 110101 00101001 001 010 0 110101 00101001 001 01010 0010001 000100010100100 1000010 101001010 010100 110101 00101001 001 0 1101 001001 001010 100110 010010 1010 110100 10010 0101 1101 001001 001010 100110 010010 1010 110100 10010 01010100 001010 10010 11101 001001 001010 100110 010010 1010 110100 10010 01010100 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 110101 001001 001010 110101 00101001 001 01010 0010001 0001000101 Introduction 00 110101 00101001 001 01010 0010001 000100010100100 1000010 101001010100 001001 100010 001010 11010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 001001 00101001 001 0 001010 10010 11101 001001 001010 100110 010010 1010 110100 10010 0101010010 0010 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010 10100 1001 100010 0 00 110101 00101001 001 01010 0010001 000100010100100 1000010 1010010 As of June 2015, Uganda had an internet penetration rate of 37% and there were 64 telephone connections per 100 inhabitants.1 This was made possible by increasing investments in the Information Communication Technologies (ICT) sector by the private sector and – to a lesser extent - the government, proliferation of affordable smart phones and a steady decrease in internet costs enabled by a liberal competitive telecommunication sector. -

Global Information Society Watch 2009 Report

GLOBAL INFORMATION SOCIETY WATCH (GISWatch) 2009 is the third in a series of yearly reports critically covering the state of the information society 2009 2009 GLOBAL INFORMATION from the perspectives of civil society organisations across the world. GISWatch has three interrelated goals: SOCIETY WATCH 2009 • Surveying the state of the field of information and communications Y WATCH technology (ICT) policy at the local and global levels Y WATCH Focus on access to online information and knowledge ET ET – advancing human rights and democracy I • Encouraging critical debate I • Strengthening networking and advocacy for a just, inclusive information SOC society. SOC ON ON I I Each year the report focuses on a particular theme. GISWatch 2009 focuses on access to online information and knowledge – advancing human rights and democracy. It includes several thematic reports dealing with key issues in the field, as well as an institutional overview and a reflection on indicators that track access to information and knowledge. There is also an innovative section on visual mapping of global rights and political crises. In addition, 48 country reports analyse the status of access to online information and knowledge in countries as diverse as the Democratic Republic of Congo, GLOBAL INFORMAT Mexico, Switzerland and Kazakhstan, while six regional overviews offer a bird’s GLOBAL INFORMAT eye perspective on regional trends. GISWatch is a joint initiative of the Association for Progressive Communications (APC) and the Humanist Institute for Cooperation with -

Report to Parliament

INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT REPORT TO PARLIAMENT JANUARY - JUNE 2014 REPORT TO PARLIAMENT 1 JANUARY-JUNE 2014 INSPECTORATE OF GOVERNMENT JANUARY-JUNE 2014 2 REPORT TO PARLIAMENT INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT REPORT TO PARLIAMENT JANUARY - JUNE 2014 REPORT TO PARLIAMENT 3 JANUARY-JUNE 2014 INSPECTORATE OF GOVERNMENT JANUARY-JUNE 2014 4 REPORT TO PARLIAMENT INSPECTORATE OF GOVERNMENT INSPECTORATE OF GOVERNMENT HEAD OFFICE Jubilee Insurance Centre. Plot 14, Parliament Avenue. P. O. Box 1682 Kampala Tel: +256-414 344 219 | +256-414 259 738 (General lines) +256-414 255 892 | +256-414 251 462 (Hotline) +256-414 347 387 Fax: +256-414 344 810 | Website: www.igg.go.ug Vision: Mission: Core Values: “Good Governance To Promote Good Governance through Integrity, with an Ethical and enhancing accountability, Transparency Impartiality Corruption Free and the enforcement of the rule of law Professionalism Society” and administrative justice in public Gender Equality and offices Equity OFFICE OF THE INSPECTOR GENERAL OF GOVERNMENT Inspector General of Government Ms. Irene Mulyagonja Kakooza Tel: +256 414 259 723 | Fax: +256 414 344 810 +256 414 257 590 | Email: [email protected] Deputy Inspector General of Government Information and Internal Inspection Division Mr. George Nathan Bamugemereire Head: Mr. Stephen Kasirye Tel: +256 414 259780 Tel: +256 414 342113 Email: [email protected] Email: [email protected] Deputy Inspector General of Government Public and International Relations Division Ms. Mariam Wangadya Head: Ms. Munira Ali Bablo Tel: +256 414 259709 Tel: +256 414 231530 Email: [email protected] Email: [email protected] DEPARTMENT OF FINANCE AND ADMINISTRATION Secretary to the Inspectorate of Government Undersecretary finance and Administration Mr. -

Uganda at 50: the Past, the Present and the Future

UGANDA AT 50: THE PAST, THE PRESENT AND THE FUTURE A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue Organised by ACODE, 93.3 Kfm and NTV Uganda at the Sheraton Hotel - Kampala – October 3, 2012 Naomi Kabarungi-Wabyona ACODE Policy Dialogue Report Series, No. 17, 2013 UGANDA AT 50: THE PAST, THE PRESENT AND THE FUTURE A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue Organised by ACODE, 93.3 Kfm and NTV Uganda at the Sheraton Hotel - Kampala – October 3, 2012 Naomi Kabarungi-Wabyona ACODE Policy Dialogue Report Series, No. 17, 2013 ii A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue 2012 Published by ACODE P.O. Box 29836, Kampala - UGANDA Email: [email protected], [email protected] Website: http://www.acode-u.org Citation: Kabarungi, N. (2013). Uganda at 50: The Past, the Present and the Future. A Synthesis Report of the Proceedings of the “Uganda @ 50 in Four Hours” Dialogue. ACODE Policy Dialogue Report Series, No.17, 2013. Kampala. © ACODE 2013 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise without prior permission of the publisher. ACODE policy work is supported by generous donations from bilateral donors and charitable foundations. The reproduction or use of this publication for academic or charitable purpose or for purposes of informing public policy is exempted from this restriction. ISBN 978 9970 34 009 5 Cover Photo: A Cross section of participants attending the Uganda @50 in 4 Hours Dialogue held on October 3, 2012 at Sheraton Hotel in Kampala. -

Mobile Money Use in Uganda: a Preliminary Study

Mobile Money Use in Uganda: A Preliminary Study Ali NDIWALANA1/3, Olga MORAWCZYNSKI2, Oliver POPOV1/4 1Mid Sweden University, Sundsvall, Sweden 2Applab, Grameen Foundation, Kampala, Uganda 3Makerere University, Kampala, Uganda 4Stockholm University, Stockholm, Sweden Abstract: As mobile phones proliferate in the developing world and Mobile Network Operators (MNOs) look for ways to diversify from voice and SMS, mobile money has emerged as an opportunity. While currently used mainly for money transfers, mobile money advocates are enthusiastic about its capability to transform the financial fabric of society, particularly for the poor. We report on a study of mobile money users in Uganda across 3 MNOs. Besides understanding current usage of mobile money, we explore different daily financial transactions of respondents. We investigate the relative importance of these transactions, their frequency, and methods of payment used. Satisfaction with current payment methods and strength of intention to use mobile money if offered for these transactions are captured. The goal is to identify potential new ways to use mobile money in Uganda. 1. Introduction As mobile phones proliferate around the developing world, new services are emerging as mobile network operators (MNOs) diversify services to compliment voice and SMS in a progressively competitive environment where the goal is improving customer retention and reducing churn (Mendes, Alampay et al. 2007). A prominent emerging service is mobile money—a term used to loosely refer to money stored using the SIM (subscriber identity module) as an identifier as opposed to an account number in the conventional banking sense. A notational equivalent in value is then kept on the SIM within the mobile phone, which is also used to transmit payment instructions. -

STATUTORY INST RUMEN'ts

ST,,\TUTORY I NSTRUIlIENTS SUPPLEIIIENT No.4 1l th February,2l)05 STATUTORY INSTRUMENTS SUPPLEN1 ENT to The Llganda Ga.ette No. 6 lblune XCVlll dated I Irh l"ebruao, 2005 Printcd by UPPC. Entcbbe. by Order ot the Covemment. STATUTORY INST RUMEN'tS 2005 No. 6. The Stamps (Exemption of Uganda Telecom Limited ['rom Stamp Duty) Instrument, 2005. ( Urufur scction l0 of the Statnps Act, Cap. 342) Iir exencrsp of the powers conferred on the Ministcr responsiblc for finance by section l0 of the Stamps Act, thrs r'..^_.,. rr )r- lnstrument is made this 3rd day of Fcbruary, 2005. l. This Instrument may be cited as the Stamps (Exemption ( itxlion of Uganda Telecom Limited From Stamp Duty) Instrument, 2005. 2. The stamp duty chargeable under the provisions of l{cmission ofst:unp Section 2 of the Act and payable by Uganda Telecom Limited on dLrtv the debenture and mortgage of properties specififd in the Schedule executcd by Uganda Telecom Limited in/favour of Standard Chanered Bank Uganda Limited as security for a loan facility of thirty eight million five hundred thousand United States dollars rs remitted. SCHEDULE I. KYADONDO BLOCK 236 PLOT 102 LAND AT B\\'EYOGERERE 2. KYADONDO BLOCK 236 PLOT 403 LAND AT BWEYOGERERE 33 3. J\4ENCO BLOCK 40I PLOI' I 17 LAND AT BWEBANJA - DUNDU .1. FRV 203 FOLIO 9 BL'SIRO BUGANDA PLOT 5 APOLO SQUARE ENTEBBE 0.24 I TIECTARES 5. FRV 203 FOLIO 3 PLOT ON PORT BELL ROAD MBUYA 6. LRV 289.T FOLIO IO PLOT 5I KIBUGA BLOCK 8 N'lEtr-GO 7- I-RV 71'I FOLIO 14 PLOT 4I-43 KYAMBOGO 8 MENGO BLOCK 92 PLOI'206 LAND AT MPAMI 9. -

Mapping Uganda's Social Impact Investment Landscape

MAPPING UGANDA’S SOCIAL IMPACT INVESTMENT LANDSCAPE Joseph Kibombo Balikuddembe | Josephine Kaleebi This research is produced as part of the Platform for Uganda Green Growth (PLUG) research series KONRAD ADENAUER STIFTUNG UGANDA ACTADE Plot. 51A Prince Charles Drive, Kololo Plot 2, Agape Close | Ntinda, P.O. Box 647, Kampala/Uganda Kigoowa on Kiwatule Road T: +256-393-262011/2 P.O.BOX, 16452, Kampala Uganda www.kas.de/Uganda T: +256 414 664 616 www. actade.org Mapping SII in Uganda – Study Report November 2019 i DISCLAIMER Copyright ©KAS2020. Process maps, project plans, investigation results, opinions and supporting documentation to this document contain proprietary confidential information some or all of which may be legally privileged and/or subject to the provisions of privacy legislation. It is intended solely for the addressee. If you are not the intended recipient, you must not read, use, disclose, copy, print or disseminate the information contained within this document. Any views expressed are those of the authors. The electronic version of this document has been scanned for viruses and all reasonable precautions have been taken to ensure that no viruses are present. The authors do not accept responsibility for any loss or damage arising from the use of this document. Please notify the authors immediately by email if this document has been wrongly addressed or delivered. In giving these opinions, the authors do not accept or assume responsibility for any other purpose or to any other person to whom this report is shown or into whose hands it may come save where expressly agreed by the prior written consent of the author This document has been prepared solely for the KAS and ACTADE. -

Competition and Consumer Protection Scenario in Uganda

Competition and Consumer Protection Scenario in Uganda Consent Consumer Education Trust #0313 Competition and Consumer Protection Scenario in Uganda Consent CUTS Centre for Competition, Investment & Economic Regulation Consumer Education Trust Competition and Consumer Protection Scenario in Uganda Published by: CUTS Centre for Competition, Investment & Economic Regulation D-217, Bhaskar Marg, Bani Park, Jaipur 302 016, India Ph: +91.141.2207482, Fax: +91.141.2207486 Email: [email protected]/[email protected] Website: www.cuts.org Consent Consumer Education Trust Desai House, Plot 4 Parliament Avenue, GPO Box 1433, Kampala, Uganda Ph: +256.31.260431/2 Fax: +256.31.260432 Email: [email protected] Printed by: Jaipur Printers P. Ltd. Jaipur 302 001 ISBN 81-87222-85-9 © CUTS, 2003 #0313 SUGGESTED CONTRIBUTION Ush4000/INR100/US$5 Contents 1 General Background ........................................................... 5 1.1 UGANDA’S MACRO-ECONOMIC AND TRADE FRAMEWORK ................................................................... 5 1.2 STRUCTURE AND PERFORMANCE OF THE ECONOMY ............. 5 1.3 TRADE POLICY OVERVIEW ........................................................... 8 1.4 COMPETITION POLICY IN UGANDA .......................................... 10 2 Competition Policy and Law in Uganda ........................... 13 2.1 POWER SECTOR ........................................................................... 13 2.2 TELECOM ...................................................................................... 14 2.3 TRANSPORT .................................................................................