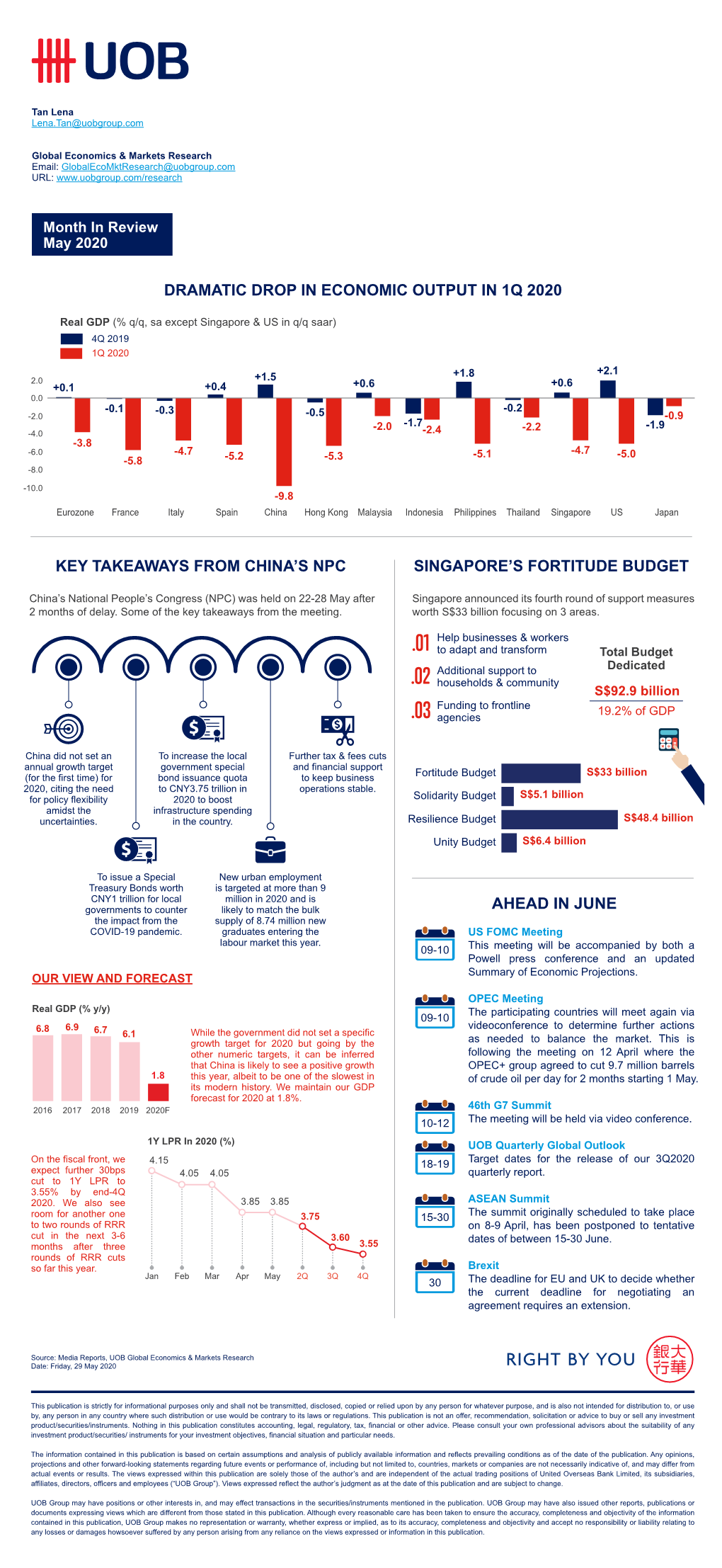

Dramatic Drop in Economic Output in 1Q 2020 Key

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

US to Host G7

US to host G7 May 14, 2020 Source: The Hindu Manifest pedagogy: G7 and G20 are two different power blocs in the world today who have gained significance with the growing multipolar world order. Hence it is necessary to read both from prelims as well as mains perspective. In news: Trump to host G7 meeting via video conference Placing it in syllabus: Multilateral groupings Dimensions: G7 history origin and headquarters Its contributions Criticisms against G7 and G20 as an alternative to it Content: The 46th G7 summit which was scheduled to be held through June 12, 2020, in Camp David, United States, will be conducted by video conference in response to the global coronavirus pandemic. Participants will include the leaders of the G7 member states as well as representatives of the European Union. The decision has come as nations around the world have sealed their borders and have banned travel to stop the virus’ spread. G7 history origin: G7 stands for “Group of Seven” industrialized nations. It used to be known as the G8 (Group of Eight) until 2014 when Russia was excluded because of its annexation of Crimea from Ukraine. France, Italy, Japan, the United Kingdom, the United States and West Germany formed the Group of Six in 1975 so that the noncommunist powers could come together to discuss important economic issues, global security etc… Canada joined the group in 1976. Russia joined in 1998 and signaled a cooperation between East and West after the Soviet Union’s collapse in 1991. The G7 is an informal bloc and takes no mandatory decisions, so the leaders’ declarations at the end of the summit are not binding. -

UNITED NATIONS ENVIRONMENT PROGRAMME MEDITERRANEAN ACTION PLAN 19 November 2019 Original: English

UNITED NATIONS UNEP/MED IG.24/Inf.10 UNITED NATIONS ENVIRONMENT PROGRAMME MEDITERRANEAN ACTION PLAN 19 November 2019 Original: English 21st Meeting of the Contracting Parties to the Convention for the Protection of the Marine Environment and the Coastal Region of the Mediterranean and its Protocols Naples, Italy, 2-5 December 2019 Agenda Item 6: Date and Place of the 22nd Meeting of the Contracting Parties Indicative Calendar of Main UNEP/MAP Meetings and Major International Events For environmental and cost-saving reasons, this document is printed in a limited number. Delegates are kindly requested to bring their copies to meetings and not to request additional copies. UNEP/MAP Athens, 2019 Note by the Secretariat With the view to facilitate the planning and participation at MAP meetings, the Secretariat has prepared for information purposes an indicative calendar of the main institutional meetings of the UNEP/MAP- Barcelona Convention system and of major international events of MAP relevance. In preparing this indicative calendar, the Secretariat took into account two important criteria: a) the Twenty Second Meeting of the Contracting Parties (COP 22) should be held before the end of 2021; and b) overlapping with already planned major global relevant meetings should be avoided. Dates and venues of the proposed UNEP/MAP-Barcelona Convention meetings will be confirmed and updated as appropriate at a later stage in consultation with the Bureau of the Contracting Parties. The Secretariat will review and update the calendar accordingly, and complete it with other policy, technical and thematic meetings of the MAP system, as appropriate. UNEP/MED IG.24/Inf.10 Page 1 A. -

IBPS CLERK CAPSULE for ALL COMPETITIVE EXAMS Exclusively Prepared for RACE Students Issue: 04 | Page : 102 | Topic : IBPS CAPSULE | Price: Not for Sale

IBPS CLERK CAPSULE for ALL COMPETITIVE EXAMS Exclusively prepared for RACE students Issue: 04 | Page : 102 | Topic : IBPS CAPSULE | Price: Not for Sale INDEX TOPIC Page No BANKING & FINANCIAL AWARENESS 2 LIST OF INDEXES BY VARIOUS ORGANISATIONS 11 GDP FORECAST OF INDIA BY VARIOUS ORGANISATION 15 LIST OF VARIOUS COMMITTEE & ITS HEAD 15 LOAN SANCTIONED BY NATIONAL AND INTERNATIONAL BANKS TO 17 INDIA PENALITY IMPOSED BY RBI TO VARIOUS BANKS IN INDIA 18 LIST OF ACQUISTION & MERGER 18 APPS/SCHEMES/FACILITY LAUNCHED BY VARIOUS 19 BANKS/ORGANISATIONS/COMPANY STATE NEWS 22 NATIONAL NEWS 38 IIT’S IN NEWS 46 NATIONAL SUMMITS 47 INTERNATIONAL SUMMITS 51 INTERNATIONAL NEWS 52 BUSINESS AND ECONOMY 60 LIST OF AGREEMENTS/MOU’S SIGNED 66 BRAND AMBASSADORS / APPOINTMENTS 68 AWARDS & HONOURS 70 BOOKS & AUTHORS 74 SPORTS NEWS 78 SCIENCE AND TECHNOLOGY 86 DEFENCE EXERCISES 93 IMPORTANT EVENTS OF THE DAY 94 OBITUARY 96 CABINET MINISTERS 2019 / LIST OF MINISTERS OF STATE 101 (INDEPENDENT CHARGE) CHIEF MINISTERS AND GOVERNORS 102 ________________________________________________________ 7601808080 / 9043303030 RACE Coaching Institute for Banking and Government Jobs www. RACEInstitute. in Courses Offered : BANK | SSC | RRB | TNPSC |KPSC 2 | IBPS CLERK CAPSULE | IBPS CLERK 2019 CAPSULE (JULY – NOVEMBER 2019) BANKING AND FINANCE Punjab & Sind Bank has set up a centralized hub named “Centralised MSME & Retail Group” (Cen MARG) for processing retail and Micro, Small and RBI gets the power to regulate housing finance companies instead Medium Enterprises (MSME) loans for better efficiency of branches in of NHB business acquisition. It is headquartered in New Delhi. Finance Minister Nirmala Sitharaman stated that India's central bank, Wilful defaults exceed $21 billion in India for the year 2018-19, Reserve Bank of India (RBI) will now be given power to takes over as the SBI holds the highest regulator of Housing Finance Firms(HFFs) instead of NHB(National Housing The state-owned banks in India stated that Rs. -

Capsule for Rrb Po/Asst & Niacl (Mains)

aa Is Now In CHENNAI | MADURAI | TRICHY | SALEM | COIMBATORE | CHANDIGARH | BANGALORE |ERODE | NAMAKKAL | PUDUCHERRY |THANJAVUR |TRIVANDRUM | ERNAKULAM |TIRUNELVELI |VELLORE | www.raceinstitute.in | www.bankersdaily.in CAPSULE FOR RRB PO/ASST & NIACL (MAINS). GENERAL AWARENESS & STATIC GK Exclusively prepared for RACE students Chennai: #1, South Usman Road, T Nagar. | Madurai: #24/21, Near MapillaiVinayagar Theatre, Kalavasal. | Trichy: opp BSNL office, Juman Center, 43 Promenade Road, Cantonment. | Salem: #209, Sonia Plaza / Muthu Complex, Junction Main Rd, State Bank Colony, Salem. | Coimbatore #545, 1st floor, Adjacent to SBI (DB Road Branch),DiwanBahadur Road, RS Puram, Coimbatore| Chandigarh| Bangalore|Erode |Namakkal |Puducherry |Thanjavur| Trivandrum| Ernakulam|Tirunelveli | Vellore | H.O: 7601808080 / 9043303030 | www.raceinstitute.in Chennai RACE Coaching Institute Pvt Ltd CAPSULE FOR RRB PO/ASST & NIACL (MAINS) BANKING & FINANCIAL AWARENESS RESERVE BANK OF INDIA (RBI) Third Bi-Monthly Monetary Policy Statement, 2018-19: Resolution of the Monetary Policy Committee (MPC): Reserve Bank of India Policy Rate Current Rate Previous Rate Repo Rate 6.50% 6. 25% Reverse Repo Rate 6.25% 6. 00% Marginal Standing 6.75% 6. 50% Facility Rate Bank Rate 6.75% 6. 50% CRR 4% (Unchanged) 4% SLR 19. 5% 19. 5% (Unchanged) ➢ The six-member monetary policy committee (MPC) of the Reserve Bank of India (RBI) has decided to increase the repo rate by 25 basis points to 6.5% due to inflation concerns. ➢ According to the RBI Annual Report, it was mentioned due to the evolving economic conditions, real GDP growth for 2018-19 is expected to increase to 7.4% from 6.7% in the previous year. -

Collection Agencies License Information As of 8/1/2019

COLLECTION AGENCIES LICENSE INFORMATION AS OF 8/1/2019 This information allows you to verify whether a collection agency is licensed by the State of Colorado. You may also determine whether there is any public record of action involving this office and the agency. The address listed is for the principal place of business. Contact our office for information on other branch office locations. Collection Agency Licenses Collection Agency Licenses are required in most cases to collect debts in default owed to others or that were originally owed to others. Only one license is required regardless of the number of branch offices. Generally, creditors collecting debts they originated or purchased before the debts were in default do not need a license. Licenses expire July 1 of each year and must be renewed at that time. "Status" Category The "Status" category provides the following information: A = license is active C = license has been cancelled D = license was denied E = license has expired due to failure to renew or maintain a surety bond/cash assignment R = license has been revoked "Action" Category In addition to the "Status" column that shows revocations, the "Action" category enables you to determine whether the licensee was subject to legal or administrative action by this office or the licensee entered into a voluntary settlement with this office. If the entry is "yes," the licensee may have been subject to one or more letters of admonition, suspension of the license, a judgment or order against the licensee, or other action, including payments (fines, penalties, consumer refunds, or other monetary payments.) Additionally, "yes" may mean that the licensee's records include a voluntary settlement or stipulation with this office. -

1. Environmental Update 2014.Vp

Canadian Environmentalists Canadian Environmentalists Environmental Up-Date 2020 Michael Bailey charge of Belleville Green Check, which conducted Currently: Bevan-Baker currently serves as the leader energy audits on area homes. He played a role in op of Prince Edward Island’s Green Party. He is the first Currently: Director of Operations, The Climate Summit - posing a coal-fired power plant at Point Aconi, Cape person to win a seat for the Green Party in the PEI legis (theclimatesummit.org), and Producer/Director at - Breton. Bennett also headed the national Climate Action Planetviews Productions, based in Honolulu, Hawaii. lature, having been elected in May 2015. He previously Network. He served as Communications Director for the ran for election 10 times, federally and provincially. Career: Bailey is a graduate of Al Gore’s The Climate Green Party of Canada and has worked closely with Career: Earned his Bachelor of Dental Surgery degree Project training program and is currently an authorized party leader Elizabeth May. from the University of Glasgow. After an unsuccessful presenter for the program. In addition to his documen- Contact: Friends of the Earth Canada, #200, 251 Bank run for office in the 2001 federal election, Bevan-Baker tary film work, Bailey was an official observer at the In- St., Ottawa, ON K2P 1X3; Phone: (613) 241-0085; Fax: worked with Liberal MP Joe Jordan to write the Canada ternational Whaling Commission and has been involved (613) 566-3449; e-mail: [email protected]; Well-Being Measurement Bill, which sought to establish in anti-whaling and dolphin protection initiatives, as well URL: foecanada.org the Genuine Progress Index, measuring the health of as other environmental and wildlife conservation pro- people, communities & eco-systems. -

Congress of the United States Washington, D.C

Congress of the United States Washington, D.C. 20515 May 29, 2020 President Donald J. Trump The White House 1600 Pennsylvania Avenue, NW Washington, DC 20500 Dear President Trump, As we navigate the devastation caused by the COVID-19 crisis, two things have become abundantly clear. First, China’s complete disregard for the international community has exerted an incalculable cost on our nation and the world. Secondly, holding China accountable and forcing them to play by the rules that they have agreed to is something we cannot do alone. To that end, as you prepare for the upcoming 46th G7 Summit we ask that you and your administration work in conjunction with our allies to counteract China’s efforts. In particular, it is vital that we work with our allies to ensure that international financial institutions (IFIs) require China to be transparent with their terms of credit as the world’s largest provider of development finance. In recent years, China has become a leader in providing capital to low- and middle-income countries throughout the world. Through the creation of the Belt and Road Initiative as well as the establishment of the Asian Infrastructure Bank, China has expanded its influence by financing projects to these countries without properly outlining the terms and conditions of the loans. This places low-income and emerging market countries at risk of falling into a debt trap that leads to unsustainable payment obligations to China. As emerging market countries seek additional liquidity as a result of the COVID-19 pandemic, China could further exert itself as provider of capital. -

Globalisation Inequalities in the Light of Globalisation

THE PONTIFICAL ACADEMY OF SOCIAL SCIENCES BETANCUR • CAMDESSUS • DASGUPTA • D’SOUZA • FARDEAU Miscellanea GOUDJO • GOULET • KIRCHHOF • LLACH • OUÉDRAOGO PAPINI • RAGA GIL • RAMIREZ • RICCARDI • SABOURIN 3 SUCHOCKA • VYMEˇ TALÍK • ZAMPETTI • ZUBRZYCKI Globalisation and Inequalities A SCIE I NT M I E A D R A V M C A S O A I C C I I A F I L I T V N M O P VATICAN CITY Proceedings of the Colloquium 2002 8-9 APRIL 2002 GLOBALISATION AND INEQUALITIES Address THE PONTIFICAL ACADEMY OF SOCIAL SCIENCES CASINA PIO IV, 00120 VATICAN CITY THE PONTIFICAL ACADEMY OF SOCIAL SCIENCES MISCELLANEA 3 Proceedings of the Colloquium on: GLOBALISATION AND INEQUALITIES 8-9 April 2002 SCIE IA NT M IA E R D V A M C A S O A C I I C A I F L I I T V N M O P VATICAN CITY 2002 The opinions expressed with absolute freedom during the presentation of the papers of this meeting, although published by the Academy, represent only the points of view of the participants and not those of the Academy. Editor of the Proceedings: Prof. LOUIS SABOURIN ISBN 88-86726-13-9 © Copyright 2002 THE PONTIFICAL ACADEMY OF SOCIAL SCIENCES VATICAN CITY The Pontifical Academy of Social Sciences, Casina Pio IV The Participants of the Eighth Plenary Session of 8-13 April 2002 The Participants of the Eighth Plenary Session of 8-13 April 2002 CONTENTS Introduction (L. Sabourin) ................................................................... XI Programme............................................................................................. XVIII List of Participants ................................................................................ XX SCIENTIFIC PAPERS PART I – Inequalities in the Light of Globalisation DENIS GOULET: Inequalities in the Light of Globalisation.................. -

Senate Section

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 116 CONGRESS, FIRST SESSION Vol. 165 WASHINGTON, TUESDAY, OCTOBER 22, 2019 No. 167 Senate The Senate met at 10 a.m. and was The Marine Corps has identified an- Democrats blocked a pay raise for our called to order by the President pro other one of the marines pictured in servicemembers because they would tempore (Mr. GRASSLEY). this photograph as Cpl Harold Keller of rather fight with the President. f Brooklyn, IA. We know that across the Capitol, for Keller never sought recognition or months now, Speaker PELOSI has been PRAYER fame. He never mentioned to his chil- blocking the USMCA and blocking the The Chaplain, Dr. Barry C. Black, of- dren that he had helped raise that flag. 176,000 new American jobs it would cre- fered the following prayer: He died in 1979, so he doesn’t know we ate. Let us pray. now know it is he in the photograph. This week offers another test. Soon Come, mighty King, robed in maj- Seventy-four years later, I am proud we will be voting on appropriations, esty. Your throne stands firm, even in that this Iowan is finally recognized and we will see whether our Demo- the midst of chaos. You speak, and it is for his role in making history. cratic friends really can put aside their done. I yield the floor. impeachment obsession long enough to Lord, You are our strength and I suggest the absence of a quorum. -

General Awareness Asked in RBI Grade-B Prelims (09Th Nov'19, 02Nd Shift)

General Awareness Asked in RBI Grade-B Prelims (09th Nov'19, 02nd shift) Q1. Mahathir Bin Mohamad is the present Prime Minister of which country? (a) Mauritius (b) Bhutan (c) Nigeria (d) Malaysia (e) Scotland Q2. Where was the AIBA Women’s World Boxing Championships held? (a) Ulan-Ude, Russia (b) Paris, France (c) Tokyo, Japan (d) Beijing, China (e) Seoul, South Korea Q3. Manju Rani is associated with which sport? (a) Cricket (b) Shooting (c) Chess (d) Badminton (e) Boxing Q4. The BRICS Culture Ministers’ meeting was held in? (a) Moscow, Russia (b) Beijing, China (c) Curitiba, Brazil (d) New Delhi, India (e) Curitiba, South Africa Q5. Where is the headquarters of UNESCO? (a) Geneva, Switzerland (b) Basel, Switzerland (c) Paris, France (d) New York, USA (e) Lausanne, Switzerland Q6. What is the theme of the International Day of the Girl Child Day? (a) A Skilled Girlforce (b) EMPOWER girls: emergency response and resilience planning (c) Girls' Progress = Goals' Progress: What Counts for Girls (d) Ending child marriage (e) GirlForce: Unscripted and Unstoppable 1 Adda247 | No. 1 APP for Banking & SSC Preparation Website: bankersadda.com | sscadda.com | store.adda247.com | Email: [email protected] Q7. The 2019 Booker Prize was won jointly by Margaret Atwood for The Testaments and Bernardine Evaristo for? (a) Girl, Woman, Other (b) Blonde Roots (c) Mr Loverman (d) Ten: New Poets (e) Island of Abraham Q8. Ben Stokes is associated with which sport? (a) Cricket (b) Boxing (c) Shooting (d) Cycling (e) Basket Ball Q9. Peter Handke has won the 2019 Nobel Prize in Literature. -

Monthly Current Affairs June 2020

UPSC WITH NIKHIL MONTHLY CURRENT AFFAIRS JUNE 2020 Any part of this document may not be reproduced or used in any manner whatsoever without the permission of UPSC with Nikhil - NAGPUR. [email protected] +91-70583 88488 www.upscwithnikhil.com TABLE OF CONTENT 1. POLITY AND GOVERNANCE ..................................... 3 4.4 COUNTRY BY COUNTRY REPORT ........................ 62 1.1 THE WARP AND WEFT OF RELIGIOUS LIBERTY ..... 3 5. ENVIRONMENT .................................................... 64 1.2 INDIA AND ITS ISLANDS ....................................... 5 5.1 FLOODING IN THE METROPOLITAN .................... 64 1.3 MPLADS SUSPENDED ........................................... 7 5.2 PEATLAND ......................................................... 65 1.4 ELECTRONIC VOTING MACHINE ........................... 9 5.3 CLIMATE CHANGE AND OUR COASTAL 1.5 SUPREME COURT RELAXES BS-IV DEADLINE ....... 11 INFRASTRUCTURE ................................................... 67 1.6 POLITICAL ADS - ‘ONLINE’ .................................. 13 5.4 CLIMATE CHANGE AND ETHICS .......................... 71 1.7 DECRIMINALIZATION OF ADULTERY ................... 14 5.5 SIXTH MASS EXTINCTION ................................... 73 1.8 SECRECY OF BALLOT .......................................... 15 5.6 OIL SPILL IN ARCTIC CIRCLE ................................ 74 1.9 CIVIL SERVICES BOARD (CSB) ............................. 15 6. SOCIAL ISSUES ...................................................... 75 2. INTERNATIONAL RELATIONS ................................ -

Gk-Update-19Th-Oct-2019

DAILY GK UPDATE 19th Oct F NATIONAL UPDATES: 1. Dr Jitendra Singh inaugurates 11th Nuclear Energy Conclave: The Union Minister of State for Development of North Eastern Region (I/C), MoS PMO, Personnel, Public Grievances & Pensions, Atomic Energy and Space, Dr Jitendra Singh inaugurated the 11th Edition of Nuclear Energy Conclave 2019 in New Delhi. The theme of the Conclave: “Economics of Nuclear Power- Innovation towards Safer & Cost-Effective Technologies”. It was organized by India Energy Forum (IEF). Government is setting up the nuclear plants in other parts of the country. A nuclear plant is coming up in the Gorakhpur of Haryana. 2. Rajnath Singh approves the proposal for admission of girl children in Sainik Schools: Defence Minister Rajnath Singh has approved a proposal for admission of girl children in Sainik Schools from academic session 2021-22 in a phased manner. The decision has been taken following the success of the pilot project started by the Ministry for admission of girl children in Sainik School Chhingchhip in Mizoram (2-years ago). The decision is in line with the objective of the government towards greater inclusiveness, gender equality, enabling greater participation of women in Armed Forces and strengthening the motto of ‘Beti Bachao, Beti Padhao'. Note: The Sainik Schools are a system of schools in India established and managed by the Sainik Schools Society under Ministry of Defence. 3. Anup Kumar Singh appointed as Director-General of NSG: A senior 1985-batch IPS officer of Gujarat cadre Anup Kumar Singh has been appointed as Director-General of the National Security Guard (NSG).