United India Insurance Ties up with LICHFL Financial Services Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sharekhan Top Picks

Visit us at www.sharekhan.com June 02, 2014 Sharekhan Top Picks The Indian equity market shed all inhibitions and celebrated the an attractive opportunity for investors to accumulate these stocks thumping majority mandate for the Narendra Modi led National with a little longer time horizon. Democratic Alliance government in the last month. The benchmark To make space, we exit ITC (keeping in mind a possible hike in indices, Sensex and Nifty, appreciated by 10.2% and 10% the excise duty on cigarettes in the forthcoming budget) and respectively. Our Top Pick basket appreciated by 10.4%, which is take home some profits in Apollo Tyres (making space for the largely in line with the movement in the benchmark indices. The other stocks in the auto sector) and HCL Technologies. One action was more pronounced in the mid-cap space with the CNX addition more than the deletions this time is to make up for one Midcap Index appreciating by close to 17% in the same period. extra deletion made in the last month. In line with the key identified investment themes (policy push- To re-iterate our bullish stance, we believe that the equity market driven re-rating of construction, power and public sector is on the cusp of a multi-year rally with the potential to give undertakings, and early beneficiaries of an economic revival, like exponential returns to investors. Do not get bogged down by the auto and financial services), we are adding LIC Housing Finance, recent 20-25% run-up and take a longer-term view on the stock TVS Motor Company, Gabriel India and Gateway Distriparks to market (and play the multi-year rally for handsome gains). -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

LIC Housing Finance (LICHF)

LIC Housing Finance (LICHF) CMP: | 408 Target: | 400 (-2%) Target Period: 12 months HOLD months August 6, 2021 Uncertainty on stress accretion, low NPA buffer… About the stock: LIC Housing Finance (LICHF) is among the largest HFCs in India with an extensive distribution network of 282 marketing office and 2421 employees. Particulars Ess Total 91% of LICHF’s customers are salaried and 9% are self employed Particulars Amount Retail home loans form 78.3% of the overall book Market Capitalisation | 20605 crore Networth (FY21) | 20521 crore 52 week H/L 542 / 255 Face value | 2 Q1FY22 Results: Subdued overall performance; asset quality concern looming. Update Company Shareholding pattern NII up 4.5% YoY, down 15.3% QoQ, NIMs down 46 bps QoQ to 2.2% (in %) Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Promoter 40.3 40.3 40.3 40.3 40.3 Higher provisions at | 830 crore, C/I ratio rise impacted PAT at | 153 crore FII 34.3 34.4 29.3 28.2 28.8 Stage 3 assets rose 181 bps from 4.12% to 5.93% & 2.3% was restructured DII 10.6 10.4 15.4 16.8 15.6 Others 14.8 21.9 21.9 14.7 15.3 Price Chart What should investors do? LICHF has given ~57% return over the past year. 600 20000 500 However, we believe a healthy recovery on stressed asset is necessary for better 15000 valuations. 400 300 10000 200 We retain our HOLD rating on the stock 5000 100 Target Price and Valuation: We value LIC Housing at ~0.9 FY23E BV and revise 0 0 our target price for the stock at | 400 per share from | 475 earlier. -

32 Nd AGM Notice

NOTICE NOTICE IS HEREBY GIVEN THAT THE THIRTY SECOND M/s Gokhale & Sathe (Firm Registration Number 103264W) ANNUAL GENERAL MEETING OF THE MEMBERS OF LIC who have offered themselves for appointment and have HOUSING FINANCE LIMITED WILL BE HELD THROUGH VIDEO confirmed their eligibility to be appointed as Statutory CONFERENCE (‘VC’) / OTHER AUDIO VISUAL MEANS (‘OAVM’) Central Auditors in terms of Section 141 of the Companies ON MONDAY, 27TH SEPTEMBER, 2021 AT 3.00 P.M. (IST) TO Act, 2013 and applicable rules and the RBI guidelines dated TRANSACT THE ITEMS OF BUSINESS MENTIONED BELOW: April 27, 2021, be and are hereby appointed as the joint Statutory Central Auditors of the Company for a period of ORDINARY BUSINESS: 3 (three) years to hold office from the conclusion of the 1. To receive, consider and adopt: 32nd Annual General Meeting until the conclusion of the 33rd Annual General Meeting to be held in 2022 at such (a) the audited (standalone) financial statements of increased remuneration payable to the Joint Statutory the Company for the F.Y. ended 31st March, 2021 Auditors namely, M/s. M P Chitale & Co., Chartered and the Reports of the Board of Directors and Accountants (Firm Registration Number 101851W) and M/s Auditors thereon. Gokhale & Sathe (Firm Registration Number 103264W) of ` 65,72,700/- per annum plus applicable taxes / cess and (b) the audited (consolidated) financial statements of out of pocket expenses on actual basis (being ` 32,86,350/- the Company for the F.Y. ended 31st March, 2021 and per annum per firm plus applicable taxes/ cess and out of the Report of the Auditors thereon. -

Sharekhan Top Picks

EQUITY FUNDAMENTALS SHAREKHAN TOP PICKS SHAREKHAN TOP PICKS The Sharekhan Top Picks is celebrating its 100th month ended up registering positive gains for the month, with since inception with a record of delivering a strong four stocks giving close to double-digit returns. This month outperformance consistently. While the benchmark again, we are booking handsome gains in two companies - indices, the Nifty and Sensex, appreciated in the range of Bharat Electronics (BEL) and Indian Oil Corporation (IOCL). 1-1.5% in April, the Sharekhan Top Picks portfolio gave a Both the companies were introduced into the Sharekhan handsome return of 7.2% in the same period. Despite the Top Picks in December 2016. In the last five months, IOCL Large Cap bias of the Sharekhan Top Picks folio (65-70% in and BEL have appreciated by 44% and 27%, respectively. Large Cap index stocks), it comprehensively outperformed To replace them, we are introducing Petronet LNG (PLNG) even the CNX Midcap index in April as well as over the and Power Grid Corporation (Power Grid). PLNG is more longer timeframe of three years and five years. That’s of a churn within the Oil & Gas sector. Valuation of PLNG not all, the performance of the Sharekhan Top Picks appears relatively favourable to us post the sharp run-up has been consistent with its track record of continued in IOCL. On the other hand, Power Grid is our preferred outperformance for eight consecutive years. pick in the Power sector, where the policy changes are It was an all-round performance by the Sharekhan Top expected to benefit the power transmission companies. -

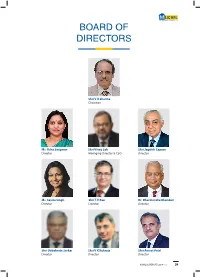

Board of Directors

BOARD OF DIRECTORS Shri V K Sharma Chairman Ms. Usha Sangwan Shri Vinay Sah Shri Jagdish Capoor Director Managing Director & CEO Director Ms. Savita Singh Shri T.V Rao Dr. Dharmendra Bhandari Director Director Director Shri Debabrata Sarkar Shri V K Kukreja Shri Ameet Patel Director Director Director 23 LIC HOUSING FINANCE LIMITED ANNUAL REPORT 2016-17 24 BOARD OF DIRECTORS SHRI V K SHARMA MS. USHA SANGWAN Chairman Director Shri Vijay Kumar Sharma took charge as Chairman, Life Mrs. Usha Sangwan, is the first ever woman Managing Insurance Corporation of India on 16th December, 2016. Prior Director of Life Insurance Corporation of India. She is Post to his taking over as Managing Director, LIC of India, on 1st Graduate in Economics and Post Graduate Diploma holder in November, 2013, he was Managing Director & Chief Executive Human Resource Management and Licentiate from Insurance Officer, LIC Housing Finance Limited (LICHFL), a premiere Institute of India. She joined LIC as Direct Recruit Officer in 1981. housing finance provider in the country with loan portfolio exceeding `83,000 crore. Mrs. Sangwan is the whole time Director of LIC of India, Board Member of General Insurance Corporation of India, Shri Vijay Kumar Sharma, born on 19th December, 1958 is LIC Housing Finance Ltd., Axis Bank, Ambuja Cements Ltd. a post-graduate (M.Sc.) in Botany from Patna University. and Bombay Stock Exchange Ltd., Board Member of LIC Shri Sharma joined LIC as Direct Recruit Officer in 1981 (International) BSC © Bahrain, Kenindia Assurance Co. Ltd., LIC and has grown with the Company since then. During his Card Services Ltd., Member of Governing Council of National stint as Senior Divisional Manager, Karnal, a rural division, Insurance Academy, Member on the Board of Education of had catapulated to Number One position in the country Insurance Institute of India, a Trustee of LIC Golden Jubilee in premium income ahead of all other metro centres. -

Scheme Information Document for HSBC Ultra Short Duration Fund

Scheme Information Document HSBC Ultra Short Duration Fund (An open ended ultra-short term debt scheme investing in instruments such that the Macaulay Duration of the portfolio is between 3 months to 6 months) (Please refer Page no. 9 for explanation on MacaulayÊs duration) Continuous Offer of Units at NAV based prices The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI), along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / Investor Service Centers / Website / Distributors or Brokers. Investors in the Scheme are not being offered any guaranteed / assured returns. Investors are advised to consult their Legal / Tax and other Professional Advisors in regard to tax/legal implications relating to their investments in the Scheme before making decision to invest in or redeem the Units. The investors are advised to refer to the Statement of Additional Information (SAI) for details of HSBC Mutual Fund, Tax and Legal issues and general information on www.assetmanagement.hsbc.co.in. SAI is incorporated by reference is legally a part of the Scheme Information Document. -

LIC Housing Finance Ltd. Corporate Deposit Scheme

APPLICATION FORM SANCHAY CORPORATE DEPOSIT SCHEME CRISIL CREDIT RATING FAAA / STABLE l ELIGIBILITY Body Corporates, Public Limited Companies, Private Limited Companies, Corporations, Statutory Board, Local Authorities, Banks, Financial Institutions and other such institutions as may be decided by the management. l MINIMUM DEPOSIT AMOUNT Companies can deposit a minimum of ` 20,000/- and in multiples of ` 1,000/- thereafter with no maximum limit on amount of deposit(s). l MODE OF ACCEPTANCE Deposit(s) shall be made by cheque in favour of "LIC Housing Finance Limited Collection A/c" and should be marked "Account Payee Only" or by transfer to LICHFL's below mentioned bank account through RTGS/NEFT. In case of Deposits for above ` 20 crore, a prior intimation must be served to LICHFL and amount must be credited before 11 A.M. for interest to accrue from same date. Beneficiary Name : LIC Housing Finance Limited Account Number : 919020003182009 Bank Name : Axis Bank IFSC Code : UTIB0000447 Branch Name : Cuffe Parade Branch MICR : 400211039 l INTEREST Interest shall be paid from the date of credit of cheque/RTGS/NEFT. Payment of interest (net of TDS- where applicable) will be made on due date through NACH. Wherever NACH facility is not available interest shall be paid by "Account Payee" Interest Warrant drawn in favour of the depositor. Interest will cease to accrue after the maturity date. Interest rates effective from 01.04.2021 on deposits upto ` 20 Crore* INTEREST RATE P.A. ON MATURITY UNDER TERM FOR YEARLY OPTION CUMULATIVE SCHEME Cumulative & Non-Cumulative Deposits. ` 20,000/- will become 1 YEAR 5.25% ` 21,050/- 18 MONTHS 5.50% ` 21,680/- 2 YEARS 5.65% ` 22,324/- 3 YEARS 5.75% ` 23,652/- 5 YEARS 5.75% ` 26,450/- *FOR RATE OF INTEREST ON DEPOSITS OF ABOVE ` 20 CRORE : PLEASE CONTACT CORPORATE OFFICE. -

Set Off GST Credits Against AGR Dues

THURSDAY, 27 FEBRUARY 2020 20 pages in 2 sections www.business-standard.com MUMBAI (CITY) ~9.00 VOLUME XXIV NUMBER 139 THE MARKETS ON WEDNESDAY Chg# Sensex 39,889.0 392.2 Nifty 11,678.5 119.4 ECONOMY & PUBLIC AFFAIRS P12 BACK PAGE P14 Nifty futures* 11,699.3 20.8 Dollar ~71.7 ~71.9** Euro ~78.0 ~77.9** FOUR IN 10 ‘VERY COMFORTABLE’ TENNIS STAR SHARAPOVA Brent crude ($/bbl)## 54.0## 54.3** Gold (10 gm)### ~42,484.0 ~153.0 WITH A WOMAN CEO: REPORT ANNOUNCES RETIREMENT *(Mar.) Premium on Nifty Spot; **Previous close; # Over previous close; ## At 9 pm IST; ### Market rate exclusive of VAT; Source: IBJA PUBLISHED SIMULTANEOUSLY FROM AHMEDABAD, BENGALURU, BHUBANESWAR, CHANDIGARH, CHENNAI, HYDERABAD, KOCHI, KOLKATA, LUCKNOW, MUMBAI (ALSO PRINTED IN BHOPAL), NEW DELHI AND PUNE PM ASKS DOVAL TO MONITOR SITUATION Voda Idea to govt: FM warns banks against IN RIOT-HIT AREAS trusting raters blindly Set off GST credits Stresses the need to improve branch-level connect with customers SOMESH JHA New Delhi, 26 February ‘EASE’ OF BANKING Finance Minister Nirmala against AGR dues Finance Minister Nirmala Sitharaman on Wednesday told Sitharaman unveiled EASE 3.0, a state-owned banks to not reform agenda for PSBs to follow Prime Minister Narendra Modi and Home Telco has sent a list of demands, “blindly” trust the credit scores this year. Some of its features are: Minister Amit Shah have asked National DoT preparing a relief package of loan seekers, and to focus on | Digitally-enabled doorstep Security Advisor Ajit Doval (pictured) to monitor improving branch-level connect facility for retail and MSME closely the situation in the riot-hit areas of MEGHA MANCHANDA Communications Committee with customers. -

LIC Housing Finance Limited 131, Maker Tower Premises, 13Th Floor, Cuffe Parade, Mumbai

CONFIDENTIAL LICHOUS/251763/NCD/20082020/3 December 8, 2020 Mr. Sudipto Sil Chief Financial Officer LIC Housing Finance Limited 131, Maker Tower premises, 13th Floor, Cuffe Parade, Mumbai. - 400005 Dear Mr. Sudipto Sil, Re: CRISIL Rating on the Rs.25000 Crore Non-Convertible Debentures of LIC Housing Finance Limited All ratings assigned by CRISIL are kept under continuous surveillance and review. Please refer to our rating letter dated November 10, 2020 bearing Ref. no.: LICHOUS/251763/NCD/20082020/2 Please find in the table below the rating outstanding for your company. S.No. Instrument Rated Amount (Rs. in Crore) Rating Outstanding 1 Non-Convertible Debentures 25000 CRISIL AAA/Stable In the event of your company not making the issue within a period of 180 days from the above date, or in the event of any change in the size or structure of your proposed issue, a fresh letter of revalidation from CRISIL will be necessary. As per our Rating Agreement, CRISIL would disseminate the rating along with outlook through its publications and other media, and keep the rating along with outlook under surveillance for the life of the instrument. CRISIL reserves the right to withdraw or revise the ratings assigned to the captioned instrument at any time, on the basis of new information, or unavailability of information or other circumstances, which CRISIL believes, may have an impact on the rating. As per the latest SEBI circular (reference number: CIR/IMD/DF/17/2013; dated October 22, 2013) on centralized database for corporate bonds/debentures, you are required to provide international securities identification number (ISIN; along with the reference number and the date of the rating letter) of all bond/debenture issuances made against this rating letter to us. -

CRISIL Indices Factsheet March 15 2021

CRISIL Indices Factsheet March 15, 2021 1 Table of Contents Constituent Details – 15 March 2021 ....................................................................................................... 3 Portfolio Parameters – 15 March 2021 ....................................................................................................38 Composite Index Weights .....................................................................................................................41 Features and Methodology....................................................................................................................51 Weighing Approach/Methodology..........................................................................................................57 List of CRISIL Indices – Objectives and Inception Dates .........................................................................72 Constituent Details – 15 March 2021 The securities that would form a part of the indices with effect from 15 March 2021 are as follows: Sr. Redemption Index Index ISIN Issuer/Security Name Coupon No Date* Weights Bharat Sanchar Nigam 1 INE103D08021 23-Sep-30 6.79% 7.46% Ltd. 06.79% 23-Sep-2030 FCI 06.65% (Series IX ) 2 INE861G08076 23-Oct-30 6.65% 10.00% 23-Oct-2030 HDFC 07.25% (Series X- 3 INE001A07SO0 17-Jun-30 7.25% 10.00% 006) 17-Jun-2030 IRFC 06.85% (Series 153) 4 INE053F07CS5 29-Oct-40 6.85% 10.00% 29-Oct-2040 L&T Infrastructure Fin 5 INE691I07EO1 08.10% (Series B of FY 28-Jun-30 8.10% 0.45% 2020-21) 28-Jun-2030 LICHF 08.70% (TRANCHE 6 INE115A07OB4 -

Profit Growth Might Moderate for Hfcs

BS APPS BS PRODUCTS BS SPECIALS BS E-PAPER SIGN IN SUBSCRIBE HOME MARKETS COMPANIES OPINION POLITICS TECHNOLOGY SPECIALS PF PORTFOLIO MY PAGE GALLERY News Stocks Commodities IPOs Mutual Funds Mutual Fund Tools Derivatives BS Fund Manager TRENDING ON BS #Demonetisation #TataVsMistry #TrumpAtWhiteHouse Search News You are here: Home » Markets » Features Profit growth might moderate Commodities GO for HFCs With scrip valuations at a premium to banks', analysts believe recent regulatory changes, plus sluggish demand in realty sector, might limit their prospects Hamsini Karthik | Mumbai December 23, 2015 Last Updated at 22:44 IST EXPAND October - A month of celebrations, got even bigger Ad Avail cash benefits of upto Rs 60000, start with a test drive. Enjoy Free Stock Trading Ad with Upstox At a time when banks were grappling with the pressure of non-performing assets (NPAs) and slowing credit growth, the stock market shifted its preference to housing finance companies (HFCs). However, with recent developments, analysts believe this shift could LIVE MARKET reduce in size and pace. BSE 26097.71 136.93 (0.53 %) The stock prices of Indiabulls Housing Finance, LIC Housing Finance and Dewan Housing Finance have ALSO READ NSE 8044.10 41.80 (0.52 %) more than doubled in the past two years. Even in the Indiabulls, developers host property show to boost sales in shorter timeframes of one, three, six and 12 months, Gandhinagar these have outperformed the benchmark S&P BSE NHB to launch over 80 new Sensex. The ability to shop for funds at a lower cost, housing finance companies, says top official maintain NPAs at levels visibly lower than at banks, thereby ensuring relatively subdued loan book Indiabulls Housing Finance hits record high after good Q1 delinquency, plus some regulatory advantages, made results HFCs a better bet.