79Th Annual Report (2015-2016)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mr. Sudhin Kumar

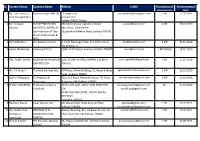

Sl. Contact Person Company Name Address E-Mail Description of Announcement Requirement Date 1 Mr. Sarojit Hazra/ West Bengal Webel Bhavan, Block EP&GP, Sector-V, Salt [email protected] 2 MT 17.07.2019 Mr. Sudhin Kumar Electronics Industry Lake, Bidhannagar, Kolkata: 700 091 Development Corporation Limited 2 CS Komal Jain Keonjhar Infrastructure 68/5C Ballygunge Place, Kolkata - 700019 [email protected]/kidco.komal@g 1 MT 16.07.2019 Development Company mail.com Limited 3 CS SHIKHA BAJAJ HINDUSTHAN UDYOG Trinity Plaza, 3rd Floor, 84/1A, Topsia [email protected] 2 MT 09.07.2019 LIMITED Road(South), Kolkata-700046 4 Ms. Kavita Balmer Lawrie & Co. 21, Netaji Subhas Road, Kolkata-700001 [email protected] 3 MT 29.06.2019 Bhavsar(CS) Ltd. 5 Neelam Arora SKSRN & ASSOCIATES 40, WESTON STREET , 2ND FLOOR ,ROOM [email protected] 2 MT 19.06.2019 NO. 20, KOLKATA-700013 6 Mr. Mahesh Shah Inter Corporate 1/1 Monica Building 9B, Lord Sinha Road, [email protected] 4 MT 15.06.2019 Financiers & Kolkata-700071, Near Shri Shikshayatan Consultants Ltd. College 7 Suyash Nahata East India Securities DA-14 Saltlake City, Sector-1 [email protected] 2 - 3 MT 14.06.2019 Limited Kolkata-700064 8 Priti Agarwal Precision Weldarc 46C Chowringhee Road, Everest House, Flat [email protected] 2 MT 14.06.2019 Limited 14G, 14th Floor, Kolkata-700071 9 Ms. Jyoti Purohit TM INTERNATIONAL TM International Logistics Limited [email protected] 1 MT 28.05.2019 LOGISTICS LIMITED (A 14th Floor, Tata Centre Joint Venture of Tata 43,Jawaharlal Nehru Road, Kolkata-700071 Steel/ IQ Martrade & NYK) 10 Mr. -

Sharekhan Top Picks

Visit us at www.sharekhan.com June 02, 2014 Sharekhan Top Picks The Indian equity market shed all inhibitions and celebrated the an attractive opportunity for investors to accumulate these stocks thumping majority mandate for the Narendra Modi led National with a little longer time horizon. Democratic Alliance government in the last month. The benchmark To make space, we exit ITC (keeping in mind a possible hike in indices, Sensex and Nifty, appreciated by 10.2% and 10% the excise duty on cigarettes in the forthcoming budget) and respectively. Our Top Pick basket appreciated by 10.4%, which is take home some profits in Apollo Tyres (making space for the largely in line with the movement in the benchmark indices. The other stocks in the auto sector) and HCL Technologies. One action was more pronounced in the mid-cap space with the CNX addition more than the deletions this time is to make up for one Midcap Index appreciating by close to 17% in the same period. extra deletion made in the last month. In line with the key identified investment themes (policy push- To re-iterate our bullish stance, we believe that the equity market driven re-rating of construction, power and public sector is on the cusp of a multi-year rally with the potential to give undertakings, and early beneficiaries of an economic revival, like exponential returns to investors. Do not get bogged down by the auto and financial services), we are adding LIC Housing Finance, recent 20-25% run-up and take a longer-term view on the stock TVS Motor Company, Gabriel India and Gateway Distriparks to market (and play the multi-year rally for handsome gains). -

Adaptive Measures for Suistanable Condition in Sunderban by Various Institutions

Journal of Xi’an Shiyou University, Natural Science Edition ISSN : 1673-064X ADAPTIVE MEASURES FOR SUISTANABLE CONDITION IN SUNDERBAN BY VARIOUS INSTITUTIONS Anupma Kumari Shailendra Kumar Singh Dept.of Zoology,Magadh University, Dept.of Zoology,Magadh University Bodhgaya,Bihar Bodhgaya,Bihar ABSTRACT Sunderban forest is shared between Bangladesh and India, it is the world’s largest, continuous coastal wetland. It covers an area of about one million hectares in the delta of the rivers Ganges, Brahmaputra, and Meghna. Enormous amounts of sediments carried by the river system contribute to the expansion and dynamics of this delta. The Sunderban area experiences subtropical monsoonal climate with an annual rainfall of 1,600–1,800 mm and occasional severe cyclonic storms [2]. The maximum elevation within the Sundarbans is only 10 m above the mean sea level. The western and eastern limits of the Sundarbans are defined by the course of the River Hooghly (a distributary of river Ganges) and River Baleshwar, respectively. About 60 % of the mangrove forests lie in the Khulna District of Bangladesh and the rest in the 24-Paragnas District of West Bengal (India). A large number of channels and creeks flow into larger rivers in the Sundarbans. The Sundarbans, shared between Bangladesh and India, is the world’s largest, continuous coastal wetland. It covers an area of about one million hectares in the delta of the rivers Ganges, Brahmaputra, and Meghna. Enormous amounts of sediments carried by the river system contribute to the expansion and dynamics of this delta. The Sundarbans area experiences subtropical monsoonal climate with an annual rainfall of 1600–1800 mm and occasional severe cyclonic storms [2]. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

Annual Report 2018-19 80Th Year Contents

Accelerating focussed growth Integrated Annual Report 2018-19 80th Year Contents Integrated Report Deep innovation expertise to harness the 01-57 best of science and serve the society. 01 Company Overview A passion to consistently push beyond 06 Our Diversified Science Led Portfolio 08 Performance Highlights for FY 2018-19 existing limits and rise above. 10 Board of Directors Combine innovation and passion with scale 12 Management Team and accelerated growth happens. 13 MD & CEO's Message 14 Integrated Value Chain This is how Tata Chemicals has emerged to be one of the world’s most reputed brands, revolutionising the 16 Business Model Explaining the Interlinkage of Capitals industry segments it has operated in its 18 Our Formula for Accelerating 80-year journey. Focussed Growth As we continue to nurture our inherent strengths, 21 Managing Risks, Maximising Returns we are undertaking many initiatives to accelerate our 24 Listening to and Engaging growth in focussed areas. with the Stakeholders 25 Addressing Material Issues Our multi-pronged strategy of customer-centric 26 Basic Chemistry Business product development and expansion into white spaces in our Consumer Products Business and capacity 32 Consumer Products Business augmentation programmes in our Specialty Products 38 Specialty Chemicals Business Business has laid a strong foundation for growth. 45 Intensifying Focus on Health & Safety Aligning our organisational structure and strategies 46 Innovating for a Better World with the revised segment reporting and the exit from 48 Growing Together non-core businesses has simplified our portfolio and are 50 Our Commitment to driving stronger synergies. Strong innovation drive is Sustainable Growth enabling us to tap the emerging areas and 53 Corporate Social Responsibility nurture the newly-seeded portfolio. -

LIC Housing Finance (LICHF)

LIC Housing Finance (LICHF) CMP: | 408 Target: | 400 (-2%) Target Period: 12 months HOLD months August 6, 2021 Uncertainty on stress accretion, low NPA buffer… About the stock: LIC Housing Finance (LICHF) is among the largest HFCs in India with an extensive distribution network of 282 marketing office and 2421 employees. Particulars Ess Total 91% of LICHF’s customers are salaried and 9% are self employed Particulars Amount Retail home loans form 78.3% of the overall book Market Capitalisation | 20605 crore Networth (FY21) | 20521 crore 52 week H/L 542 / 255 Face value | 2 Q1FY22 Results: Subdued overall performance; asset quality concern looming. Update Company Shareholding pattern NII up 4.5% YoY, down 15.3% QoQ, NIMs down 46 bps QoQ to 2.2% (in %) Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Promoter 40.3 40.3 40.3 40.3 40.3 Higher provisions at | 830 crore, C/I ratio rise impacted PAT at | 153 crore FII 34.3 34.4 29.3 28.2 28.8 Stage 3 assets rose 181 bps from 4.12% to 5.93% & 2.3% was restructured DII 10.6 10.4 15.4 16.8 15.6 Others 14.8 21.9 21.9 14.7 15.3 Price Chart What should investors do? LICHF has given ~57% return over the past year. 600 20000 500 However, we believe a healthy recovery on stressed asset is necessary for better 15000 valuations. 400 300 10000 200 We retain our HOLD rating on the stock 5000 100 Target Price and Valuation: We value LIC Housing at ~0.9 FY23E BV and revise 0 0 our target price for the stock at | 400 per share from | 475 earlier. -

32 Nd AGM Notice

NOTICE NOTICE IS HEREBY GIVEN THAT THE THIRTY SECOND M/s Gokhale & Sathe (Firm Registration Number 103264W) ANNUAL GENERAL MEETING OF THE MEMBERS OF LIC who have offered themselves for appointment and have HOUSING FINANCE LIMITED WILL BE HELD THROUGH VIDEO confirmed their eligibility to be appointed as Statutory CONFERENCE (‘VC’) / OTHER AUDIO VISUAL MEANS (‘OAVM’) Central Auditors in terms of Section 141 of the Companies ON MONDAY, 27TH SEPTEMBER, 2021 AT 3.00 P.M. (IST) TO Act, 2013 and applicable rules and the RBI guidelines dated TRANSACT THE ITEMS OF BUSINESS MENTIONED BELOW: April 27, 2021, be and are hereby appointed as the joint Statutory Central Auditors of the Company for a period of ORDINARY BUSINESS: 3 (three) years to hold office from the conclusion of the 1. To receive, consider and adopt: 32nd Annual General Meeting until the conclusion of the 33rd Annual General Meeting to be held in 2022 at such (a) the audited (standalone) financial statements of increased remuneration payable to the Joint Statutory the Company for the F.Y. ended 31st March, 2021 Auditors namely, M/s. M P Chitale & Co., Chartered and the Reports of the Board of Directors and Accountants (Firm Registration Number 101851W) and M/s Auditors thereon. Gokhale & Sathe (Firm Registration Number 103264W) of ` 65,72,700/- per annum plus applicable taxes / cess and (b) the audited (consolidated) financial statements of out of pocket expenses on actual basis (being ` 32,86,350/- the Company for the F.Y. ended 31st March, 2021 and per annum per firm plus applicable taxes/ cess and out of the Report of the Auditors thereon. -

Sharekhan Top Picks

EQUITY FUNDAMENTALS SHAREKHAN TOP PICKS SHAREKHAN TOP PICKS The Sharekhan Top Picks is celebrating its 100th month ended up registering positive gains for the month, with since inception with a record of delivering a strong four stocks giving close to double-digit returns. This month outperformance consistently. While the benchmark again, we are booking handsome gains in two companies - indices, the Nifty and Sensex, appreciated in the range of Bharat Electronics (BEL) and Indian Oil Corporation (IOCL). 1-1.5% in April, the Sharekhan Top Picks portfolio gave a Both the companies were introduced into the Sharekhan handsome return of 7.2% in the same period. Despite the Top Picks in December 2016. In the last five months, IOCL Large Cap bias of the Sharekhan Top Picks folio (65-70% in and BEL have appreciated by 44% and 27%, respectively. Large Cap index stocks), it comprehensively outperformed To replace them, we are introducing Petronet LNG (PLNG) even the CNX Midcap index in April as well as over the and Power Grid Corporation (Power Grid). PLNG is more longer timeframe of three years and five years. That’s of a churn within the Oil & Gas sector. Valuation of PLNG not all, the performance of the Sharekhan Top Picks appears relatively favourable to us post the sharp run-up has been consistent with its track record of continued in IOCL. On the other hand, Power Grid is our preferred outperformance for eight consecutive years. pick in the Power sector, where the policy changes are It was an all-round performance by the Sharekhan Top expected to benefit the power transmission companies. -

Sl. Contact Person Company Name Address E-Mail Description of Requirement Announcement Date 2 Mr. Ashwani Jaiswal TM INTERNATION

Sl. Contact Person Company Name Address E-Mail Description of Announcement Requirement Date 1 Mr. S.M. Varma, CS Supreme Paper Mills Ltd 12,Darga Road [email protected] 2 MT 17.10.2019 Cum Manager(A&F) Ground Floor Kolkata-700017.( India) 2 Mr. Ashwani TM INTERNATIONAL TM International Logistics Limited [email protected] 2 MT 16.10.2019 Jaiswal LOGISTICS LIMITED (A 14th Floor, Tata Centre Joint Venture of Tata 43,Jawaharlal Nehru Road, Kolkata-700071 Steel/ IQ Martrade & NYK) 3 Mr M Bhuteria A C Bhuteria and Co 2, India Exchange Place, 2nd Floor, Room [email protected] 3 MT 16.10.2019 10, Kolkata - 1 4 Sayan Mukherjee Sanmarg Pvt Ltd 160B, Chittaranjan Avenue, Kolkata-700007 [email protected] 2 MT (Male) 16.10.2019 5 MR. SUMIT SAHAL MURLIDHAR RATANLAL 15B, HEMANTA BASU SARANI, KOLKATA [email protected] 1 MT 15.10.2019 EXPORTS LTD 700 001 6 Mr. P K Ghosh Transafe Services Ltd. 6th Floor, Annex Building, 21, Netaji Subhas [email protected] 1 MT 15.10.2019 Road, Kolkata-700001 7 Sachin Chhaparia E Chhaparia & 33/1, N.S Road, Marshall House, 7th Floor, [email protected] 1 MT 15.10.2019 Associates Room no.748, Kolkata-700001 8 SHRISTI AGARWAL Practising Company 90 PHEARS LANE 2ND FLOOR ROOM NO [email protected]; MT 15.10.2019 Secretary 205 [email protected] NEAR POODAR COURT, BESIDE SHILPA BHAWAN KOLKATA -700012 9 Roshaan Davve Terai Tea Co. Ltd. 10, Government Place East 1st Floor, [email protected], 1 MT 03.10.2019 Kolkata-700069 [email protected] 10 Ms. -

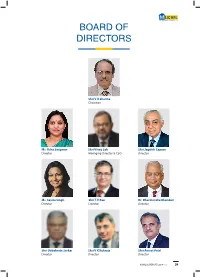

Board of Directors

BOARD OF DIRECTORS Shri V K Sharma Chairman Ms. Usha Sangwan Shri Vinay Sah Shri Jagdish Capoor Director Managing Director & CEO Director Ms. Savita Singh Shri T.V Rao Dr. Dharmendra Bhandari Director Director Director Shri Debabrata Sarkar Shri V K Kukreja Shri Ameet Patel Director Director Director 23 LIC HOUSING FINANCE LIMITED ANNUAL REPORT 2016-17 24 BOARD OF DIRECTORS SHRI V K SHARMA MS. USHA SANGWAN Chairman Director Shri Vijay Kumar Sharma took charge as Chairman, Life Mrs. Usha Sangwan, is the first ever woman Managing Insurance Corporation of India on 16th December, 2016. Prior Director of Life Insurance Corporation of India. She is Post to his taking over as Managing Director, LIC of India, on 1st Graduate in Economics and Post Graduate Diploma holder in November, 2013, he was Managing Director & Chief Executive Human Resource Management and Licentiate from Insurance Officer, LIC Housing Finance Limited (LICHFL), a premiere Institute of India. She joined LIC as Direct Recruit Officer in 1981. housing finance provider in the country with loan portfolio exceeding `83,000 crore. Mrs. Sangwan is the whole time Director of LIC of India, Board Member of General Insurance Corporation of India, Shri Vijay Kumar Sharma, born on 19th December, 1958 is LIC Housing Finance Ltd., Axis Bank, Ambuja Cements Ltd. a post-graduate (M.Sc.) in Botany from Patna University. and Bombay Stock Exchange Ltd., Board Member of LIC Shri Sharma joined LIC as Direct Recruit Officer in 1981 (International) BSC © Bahrain, Kenindia Assurance Co. Ltd., LIC and has grown with the Company since then. During his Card Services Ltd., Member of Governing Council of National stint as Senior Divisional Manager, Karnal, a rural division, Insurance Academy, Member on the Board of Education of had catapulated to Number One position in the country Insurance Institute of India, a Trustee of LIC Golden Jubilee in premium income ahead of all other metro centres. -

Library Catalogue

Id Access No Title Author Category Publisher Year 1 9277 Jawaharlal Nehru. An autobiography J. Nehru Autobiography, Nehru Indraprastha Press 1988 historical, Indian history, reference, Indian 2 587 India from Curzon to Nehru and after Durga Das Rupa & Co. 1977 independence historical, Indian history, reference, Indian 3 605 India from Curzon to Nehru and after Durga Das Rupa & Co. 1977 independence 4 3633 Jawaharlal Nehru. Rebel and Stateman B. R. Nanda Biography, Nehru, Historical Oxford University Press 1995 5 4420 Jawaharlal Nehru. A Communicator and Democratic Leader A. K. Damodaran Biography, Nehru, Historical Radiant Publlishers 1997 Indira Gandhi, 6 711 The Spirit of India. Vol 2 Biography, Nehru, Historical, Gandhi Asia Publishing House 1975 Abhinandan Granth Ministry of Information and 8 454 Builders of Modern India. Gopal Krishna Gokhale T.R. Deogirikar Biography 1964 Broadcasting Ministry of Information and 9 455 Builders of Modern India. Rajendra Prasad Kali Kinkar Data Biography, Prasad 1970 Broadcasting Ministry of Information and 10 456 Builders of Modern India. P.S.Sivaswami Aiyer K. Chandrasekharan Biography, Sivaswami, Aiyer 1969 Broadcasting Ministry of Information and 11 950 Speeches of Presidente V.V. Giri. Vol 2 V.V. Giri poitical, Biography, V.V. Giri, speeches 1977 Broadcasting Ministry of Information and 12 951 Speeches of President Rajendra Prasad Vol. 1 Rajendra Prasad Political, Biography, Rajendra Prasad 1973 Broadcasting Eminent Parliamentarians Monograph Series. 01 - Dr. Ram Manohar 13 2671 Biography, Manohar Lohia Lok Sabha 1990 Lohia Eminent Parliamentarians Monograph Series. 02 - Dr. Lanka 14 2672 Biography, Lanka Sunbdaram Lok Sabha 1990 Sunbdaram Eminent Parliamentarians Monograph Series. 04 - Pandit Nilakantha 15 2674 Biography, Nilakantha Lok Sabha 1990 Das Eminent Parliamentarians Monograph Series. -

Scheme Information Document for HSBC Ultra Short Duration Fund

Scheme Information Document HSBC Ultra Short Duration Fund (An open ended ultra-short term debt scheme investing in instruments such that the Macaulay Duration of the portfolio is between 3 months to 6 months) (Please refer Page no. 9 for explanation on MacaulayÊs duration) Continuous Offer of Units at NAV based prices The particulars of the Scheme have been prepared in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations 1996, as amended till date, and filed with Securities and Exchange Board of India (SEBI), along with a Due Diligence Certificate from the AMC. The units being offered for public subscription have not been approved or recommended by SEBI nor has SEBI certified the accuracy or adequacy of the Scheme Information Document. The Scheme Information Document sets forth concisely the information about the scheme that a prospective investor ought to know before investing. Before investing, investors should also ascertain about any further changes to this Scheme Information Document after the date of this Document from the Mutual Fund / Investor Service Centers / Website / Distributors or Brokers. Investors in the Scheme are not being offered any guaranteed / assured returns. Investors are advised to consult their Legal / Tax and other Professional Advisors in regard to tax/legal implications relating to their investments in the Scheme before making decision to invest in or redeem the Units. The investors are advised to refer to the Statement of Additional Information (SAI) for details of HSBC Mutual Fund, Tax and Legal issues and general information on www.assetmanagement.hsbc.co.in. SAI is incorporated by reference is legally a part of the Scheme Information Document.