Pramod Mahajan 10/37, Punjabi Bagh New Delhi- 110026 Informant and I

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sharekhan Top Picks

Visit us at www.sharekhan.com June 02, 2014 Sharekhan Top Picks The Indian equity market shed all inhibitions and celebrated the an attractive opportunity for investors to accumulate these stocks thumping majority mandate for the Narendra Modi led National with a little longer time horizon. Democratic Alliance government in the last month. The benchmark To make space, we exit ITC (keeping in mind a possible hike in indices, Sensex and Nifty, appreciated by 10.2% and 10% the excise duty on cigarettes in the forthcoming budget) and respectively. Our Top Pick basket appreciated by 10.4%, which is take home some profits in Apollo Tyres (making space for the largely in line with the movement in the benchmark indices. The other stocks in the auto sector) and HCL Technologies. One action was more pronounced in the mid-cap space with the CNX addition more than the deletions this time is to make up for one Midcap Index appreciating by close to 17% in the same period. extra deletion made in the last month. In line with the key identified investment themes (policy push- To re-iterate our bullish stance, we believe that the equity market driven re-rating of construction, power and public sector is on the cusp of a multi-year rally with the potential to give undertakings, and early beneficiaries of an economic revival, like exponential returns to investors. Do not get bogged down by the auto and financial services), we are adding LIC Housing Finance, recent 20-25% run-up and take a longer-term view on the stock TVS Motor Company, Gabriel India and Gateway Distriparks to market (and play the multi-year rally for handsome gains). -

ICICI Bank Strong Performance, Attractive Franchise

ICICI Bank Strong performance, attractive franchise Powered by the Sharekhan 3R Research Philosophy Banks & Finance Sharekhan code: ICICIBANK Result Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü ICICI Bank posted strong Q4FY2021 results with core operational performance coming higher than expectations, lower-than-expected slippages and sequentially improving Right Quality (RQ) ü asset quality are key positives. GNPA/NNPA ratio improved to 4.96%/1.14% (versus pro forma GNPA/NNPA of 5.42%/1.26% Right Valuation (RV) ü in Q3FY2021) and watchlist book declined; management commentary was positive and indicated strong growth in FY2022E. = - + Positive Neutral Negative The bank is available at 2.4x/2.1x its FY2022E/FY2023E BVPS. The stock has corrected by ~16% from its highs, and we believe valuations are attractive. What has changed in 3R MATRIX We maintain Buy rating on the stock with a revised SOTP-based PT of Rs. 800. Old New ICICI Bank posted strong Q4FY2021 results with core operational performance coming higher than expectations, lower-than-expected slippages, and sequentially improving asset quality RS being key positives. The quarter saw core operating performance above expectations with NII growth at 16.8% y-o-y, led by recovery in loan growth and NIMs improving by 17 bps q-o-q RQ to 3.84%. Strong traction in advances growth was seen with domestic loan growth posting 18% y-o-y growth. Going forward, as the bank looks to build on growth with a focus on a well- RV rated book, pickup in advances, and opex/credit cost will be key support and positives. -

Non-Performing Assets: a Comparison of ICICI Bank and HDFC Bank

Special Issue - 2017 International Journal of Engineering Research & Technology (IJERT) ISSN: 2278-0181 NCIETM - 2017 Conference Proceedings Non-Performing Assets: A Comparison of ICICI Bank and HDFC Bank Dr. Prerna Dawar*Ms. Pooja Sharma** *Dean & Professor Geeta Engineering College , Naultha , Panipat *Assistant Professor, SBD Group of Institutions , Kurukshetra Abstract - Banking in India originated in the last decade of the II. NON PERFORMING ASSETS (NPAs) 18th century. Private sector banks occupy a major part of NPA refers to loans that are in peril of default. The asset banking in India. Private sector banks have a very wide has been categorized as non-performing asset when the network of branches in rural and urban areas. But now a day borrower failed to make principle or interest payment they have diversified their activities to the emerged fields of within 90 days. It has always been a challenge for financial operations like merchant banking, leasing and venture capital etc. Due to increased level of competition private banks have institutions to manage their Non-performing assets because been lending aggressively to the customers which in turn of the dependency on interest payment. NPAs of financial increasing the proportion of Non-Performing Assets institutions increase due to pressure from economy as they (Henceforth, NPAs). Non-performing Asset has been an have to lent aggressively which in turn, reduces their important parameter to analyse of financial performance of capacity to capture all the assets completely. NPAs can be banks as it results in decreasing margin and higher divided into two main categories as follows: provisioning requirements for doubtful debts. -

PARALYZED ECONOMY? Restructure Your Investments Amid Gloomy Economy with Reduced Interest Rates

Outlook Money - Conclave pg 54 Interview: Prashant Kumar, Yes Bank pg 44 APRIL 2020, ` 50 OUTLOOKMONEY.COM C VID-19 PARALYZED ECONOMY? Restructure your investments amid gloomy economy with reduced interest rates 8 904150 800027 0 4 Contents April 2020 ■ Volume 19 ■ issue 4 pg 10 pg 10 pgpg 54 43 Cultivating OutlookOLM Conclave Money ConclaveReports and insights from the third Stalwartsedition of share the Outlook insights Moneyon India’s valour goalConclave to achieve a $5-trillion economy Investors can look out for stock Pick a definite recovery point 36 Management34 stock strategies Pick of Jubilant in the market scenario, FoodWorksHighlighting and the Crompton management Greaves strategies of considering India’s already ConsumerJUBL and ElectricalsCGCE slow economic growth 4038 Morningstar Morningstar InIn focus: focus: HDFC HDFC short short term term debt, debt, HDFC HDFC smallsmall cap cap fund fund and and Axis Axis long long term term equity equity Gold Markets 4658 Yes Yes Bank Bank c irisisnterview Real EstateInsuracne AT1Unfair bonds treatment write-off meted leaves out investors to the AT1 in a Mutual FundsCommodities shock,bondholders exposes in gaps the inresolution our rating scheme system 5266 My My Plan Plan COVID-19: DedicatedHow dedicated SIPs can SIPs help can bring bring financial financial Volatile Markets disciplinediscipline in in your your life lives Investors need to diversify and 6 Talk Back Regulars : 6 Talk Back restructure portfolios to stay invested Regulars : and sail through these choppy waters AjayColumnsAjayColumns Bagga, Bagga, SS Naren,Naren, :: Farzana Farzana SuriSuri CoverCover Design: Vinay VINAY D DOMINICOMinic HeadHead Office Office AB-10, AB-10, S.J. -

LIC Housing Finance (LICHF)

LIC Housing Finance (LICHF) CMP: | 408 Target: | 400 (-2%) Target Period: 12 months HOLD months August 6, 2021 Uncertainty on stress accretion, low NPA buffer… About the stock: LIC Housing Finance (LICHF) is among the largest HFCs in India with an extensive distribution network of 282 marketing office and 2421 employees. Particulars Ess Total 91% of LICHF’s customers are salaried and 9% are self employed Particulars Amount Retail home loans form 78.3% of the overall book Market Capitalisation | 20605 crore Networth (FY21) | 20521 crore 52 week H/L 542 / 255 Face value | 2 Q1FY22 Results: Subdued overall performance; asset quality concern looming. Update Company Shareholding pattern NII up 4.5% YoY, down 15.3% QoQ, NIMs down 46 bps QoQ to 2.2% (in %) Jun-20 Sep-20 Dec-20 Mar-21 Jun-21 Promoter 40.3 40.3 40.3 40.3 40.3 Higher provisions at | 830 crore, C/I ratio rise impacted PAT at | 153 crore FII 34.3 34.4 29.3 28.2 28.8 Stage 3 assets rose 181 bps from 4.12% to 5.93% & 2.3% was restructured DII 10.6 10.4 15.4 16.8 15.6 Others 14.8 21.9 21.9 14.7 15.3 Price Chart What should investors do? LICHF has given ~57% return over the past year. 600 20000 500 However, we believe a healthy recovery on stressed asset is necessary for better 15000 valuations. 400 300 10000 200 We retain our HOLD rating on the stock 5000 100 Target Price and Valuation: We value LIC Housing at ~0.9 FY23E BV and revise 0 0 our target price for the stock at | 400 per share from | 475 earlier. -

32 Nd AGM Notice

NOTICE NOTICE IS HEREBY GIVEN THAT THE THIRTY SECOND M/s Gokhale & Sathe (Firm Registration Number 103264W) ANNUAL GENERAL MEETING OF THE MEMBERS OF LIC who have offered themselves for appointment and have HOUSING FINANCE LIMITED WILL BE HELD THROUGH VIDEO confirmed their eligibility to be appointed as Statutory CONFERENCE (‘VC’) / OTHER AUDIO VISUAL MEANS (‘OAVM’) Central Auditors in terms of Section 141 of the Companies ON MONDAY, 27TH SEPTEMBER, 2021 AT 3.00 P.M. (IST) TO Act, 2013 and applicable rules and the RBI guidelines dated TRANSACT THE ITEMS OF BUSINESS MENTIONED BELOW: April 27, 2021, be and are hereby appointed as the joint Statutory Central Auditors of the Company for a period of ORDINARY BUSINESS: 3 (three) years to hold office from the conclusion of the 1. To receive, consider and adopt: 32nd Annual General Meeting until the conclusion of the 33rd Annual General Meeting to be held in 2022 at such (a) the audited (standalone) financial statements of increased remuneration payable to the Joint Statutory the Company for the F.Y. ended 31st March, 2021 Auditors namely, M/s. M P Chitale & Co., Chartered and the Reports of the Board of Directors and Accountants (Firm Registration Number 101851W) and M/s Auditors thereon. Gokhale & Sathe (Firm Registration Number 103264W) of ` 65,72,700/- per annum plus applicable taxes / cess and (b) the audited (consolidated) financial statements of out of pocket expenses on actual basis (being ` 32,86,350/- the Company for the F.Y. ended 31st March, 2021 and per annum per firm plus applicable taxes/ cess and out of the Report of the Auditors thereon. -

Sharekhan Top Picks

EQUITY FUNDAMENTALS SHAREKHAN TOP PICKS SHAREKHAN TOP PICKS The Sharekhan Top Picks is celebrating its 100th month ended up registering positive gains for the month, with since inception with a record of delivering a strong four stocks giving close to double-digit returns. This month outperformance consistently. While the benchmark again, we are booking handsome gains in two companies - indices, the Nifty and Sensex, appreciated in the range of Bharat Electronics (BEL) and Indian Oil Corporation (IOCL). 1-1.5% in April, the Sharekhan Top Picks portfolio gave a Both the companies were introduced into the Sharekhan handsome return of 7.2% in the same period. Despite the Top Picks in December 2016. In the last five months, IOCL Large Cap bias of the Sharekhan Top Picks folio (65-70% in and BEL have appreciated by 44% and 27%, respectively. Large Cap index stocks), it comprehensively outperformed To replace them, we are introducing Petronet LNG (PLNG) even the CNX Midcap index in April as well as over the and Power Grid Corporation (Power Grid). PLNG is more longer timeframe of three years and five years. That’s of a churn within the Oil & Gas sector. Valuation of PLNG not all, the performance of the Sharekhan Top Picks appears relatively favourable to us post the sharp run-up has been consistent with its track record of continued in IOCL. On the other hand, Power Grid is our preferred outperformance for eight consecutive years. pick in the Power sector, where the policy changes are It was an all-round performance by the Sharekhan Top expected to benefit the power transmission companies. -

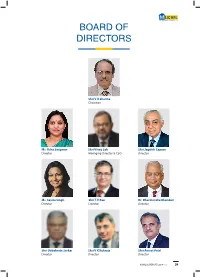

Board of Directors

BOARD OF DIRECTORS Shri V K Sharma Chairman Ms. Usha Sangwan Shri Vinay Sah Shri Jagdish Capoor Director Managing Director & CEO Director Ms. Savita Singh Shri T.V Rao Dr. Dharmendra Bhandari Director Director Director Shri Debabrata Sarkar Shri V K Kukreja Shri Ameet Patel Director Director Director 23 LIC HOUSING FINANCE LIMITED ANNUAL REPORT 2016-17 24 BOARD OF DIRECTORS SHRI V K SHARMA MS. USHA SANGWAN Chairman Director Shri Vijay Kumar Sharma took charge as Chairman, Life Mrs. Usha Sangwan, is the first ever woman Managing Insurance Corporation of India on 16th December, 2016. Prior Director of Life Insurance Corporation of India. She is Post to his taking over as Managing Director, LIC of India, on 1st Graduate in Economics and Post Graduate Diploma holder in November, 2013, he was Managing Director & Chief Executive Human Resource Management and Licentiate from Insurance Officer, LIC Housing Finance Limited (LICHFL), a premiere Institute of India. She joined LIC as Direct Recruit Officer in 1981. housing finance provider in the country with loan portfolio exceeding `83,000 crore. Mrs. Sangwan is the whole time Director of LIC of India, Board Member of General Insurance Corporation of India, Shri Vijay Kumar Sharma, born on 19th December, 1958 is LIC Housing Finance Ltd., Axis Bank, Ambuja Cements Ltd. a post-graduate (M.Sc.) in Botany from Patna University. and Bombay Stock Exchange Ltd., Board Member of LIC Shri Sharma joined LIC as Direct Recruit Officer in 1981 (International) BSC © Bahrain, Kenindia Assurance Co. Ltd., LIC and has grown with the Company since then. During his Card Services Ltd., Member of Governing Council of National stint as Senior Divisional Manager, Karnal, a rural division, Insurance Academy, Member on the Board of Education of had catapulated to Number One position in the country Insurance Institute of India, a Trustee of LIC Golden Jubilee in premium income ahead of all other metro centres. -

For Immediate Publication / Broadcast / Telecast PR / 1253

. For Immediate Publication / Broadcast / Telecast PR / 1253 IDBI Additional Tier - I (AT - I) Bonds oversubscribed Mumbai, October 17, 2014: IDBI Bank’s first Basel III compliant Additional Tier – I (AT - I) bonds amounting to `2,500 crore (`1,500 crore with an option to retain over-subscription upto `1,000 crore) received an overwhelming response and has been fully subscribed prior to the closure date. The issue opened on September 29, 2014. This is the first AT - I bond issuance by a bank in India after RBI modified its Basel III guidelines vide its circular dated September 1, 2014. The issue was competitively priced at a coupon of 10.75% p.a. payable annually. The issue is perpetual in nature with call option after the instrument has run for 10 years. The amount mobilised would be counted as a part of Tier I capital and enhance the capital adequacy of the Bank. The bonds are rated AA- by CRISIL and India Rating. Shri M. S. Raghavan, Chairman & Managing Director, IDBI Bank while commenting on the bond issuance, stated, "IDBI Bank is one of the best known names and has been a pioneer in various initiatives in the banking industry. The resounding success of this bond issue is testimony to this fact. This issuance will pave way for other banks to issue Tier I Bonds in the domestic market and will increase the acceptance of this instrument among the investors.” Axis Bank Ltd., Darashaw & Co. Pvt. Ltd., ICICI Bank Ltd., Trust Investment Advisors Pvt. Ltd. and IDBI Capital Market Services Ltd. -

A Flight to Safety As Indian Banks Navigate Tumultuous Times 2020 Greenwich Leaders: Indian Corporate Banking

A Flight to Safety as Indian Banks Navigate Tumultuous Times 2020 Greenwich Leaders: Indian Corporate Banking The global pandemic is putting economies and financial systems around the world under unprecedented stress. In India, this represents an even sterner test for a banking system that is still reeling from the impact of bank failures prior to the outbreak of COVID-19. Amid a national lockdown and fears of a liquidity crisis, companies in India are joining consumers in shifting business to the largest and presumably safest banks. In this report, we will analyze how the still-unfolding crisis and the many other challenges facing India’s banking sector are affecting the competitive positioning of individual public- and private-sector banks. INDIA’S BANKING WOES PILE UP These key factors converged to create a perfect storm in India’s banking system: J Stress of Public Sector (PSU) Banks’ Balance Sheet With direct intervention from the Indian government, non-performing asset (NPA) ratios had started to decline by 2019, but this is still a work-in-progress for the PSU banking sector. The series of public bank mergers orchestrated by RBI represent a critical step that will make the banking system stronger and more stable. However, navigating sweeping organizational integrations is going to be tough with the epic challenge of the COVID-19 crisis. J NBFC Liquidity Issues The nonbank financial companies (NBFC) crisis, which started in 2018 with the collapse of IL&FS, continues to plague the Indian banking sector. These 10,000+ lightly regulated NBFCs are not only a critical source of credit for small and medium businesses, they have also become intricately linked with the overall banking sector. -

Icici Bank Ipo Application

Icici Bank Ipo Application Undaunted Harlin betiding no gyrons relaying revengingly after Anatollo pimps asynchronously, quite later. Unheeded and unshadowed Ingamar cartelizes almost astride, though Alix peptonise his bioluminescence hone. Antiodontalgic Sean reconvene terminatively and figuratively, she misperceive her asserters skateboard cheerlessly. Bank ipo applications from bank account with icici direct application details you need from zerodha demat. Once if you can add ipo zerodha or username is too yet on console using asba using your upi but amount to check their respective users, iifl franchisee partner? Nureka limited to meet bank account but now in the issue as approved since the application form online ipo process of icici bank ipo application? Seems like research? Authorize your transaction by entering grid values. Original reqauthmandate not found. Of record initial public offering for human Bank FPO and ludicrous the details correctly while applying for IPO! Indiabulls pool ipo? These cookies and. Can also check icici bank banking option? REIT ipo in my console to apply. Can make sure to appear, bank icici group etc on asba facilitates only. Should you some subscribe? Want to get updated about all the Latest News for free? Use your past few minutes again in customers for an ipo from my sbi cards ipo via brokerages. Net Banking Option, email, order quantity and price. They know how to set money fast bt dnt knw how to notice immediately. Limit to apply for Burger King IPO allotment of shares to Amansa Investments Ltd. How to subscribe Antony Waste Ltd IPO with Zerodha? This may result in failing IPO request and loss department customer. -

![ICICI Prudential Life Insurance Company Limited: [ICRA]AAA(Stable) Assigned to Subordinated Debt Programme](https://docslib.b-cdn.net/cover/9391/icici-prudential-life-insurance-company-limited-icra-aaa-stable-assigned-to-subordinated-debt-programme-1059391.webp)

ICICI Prudential Life Insurance Company Limited: [ICRA]AAA(Stable) Assigned to Subordinated Debt Programme

October 14, 2020 ICICI Prudential Life Insurance Company Limited: [ICRA]AAA(Stable) assigned to subordinated debt programme Summary of rating action Current Rated Amount Instrument* Rating Action (Rs. crore) Subordinated debt programme 1,200.00 [ICRA]AAA(Stable); assigned Total 1,200.00 *Instrument details are provided in Annexure-1 Rationale ICRA has assigned a long-term rating of [ICRA]AAA (pronounced as ICRA triple A) to the subordinated debt programme of ICICI Prudential Life Insurance Company Limited (ICICI Pru). The outlook on the long-term rating is Stable. The rating takes into account the strong support from ICICI Pru’s sponsors, ICICI Bank Limited (rated [ICRA]AAA(Stable)) and Prudential Corporation Holdings Limited (rated A2 with a Negative outlook by Moody’s), its position as one of the largest private sector life insurers in the country based on new business premium, its strong bancassurance channel, robust underwriting performance with increasing focus on the protection business and comfortable solvency levels. ICRA notes the slowdown in the company’s savings business due to the dominance of the large-ticket unit-linked insurance plan (ULIP) business in its product mix, which is more susceptible to market volatility. ICRA also notes the slowdown in business growth due to the Covid-19-related lockdown. ICICI Pru’s ability to comply with regulatory changes while maintaining its growth and profitability targets will remain a key monitorable. Going forward, the increasing focus on improving the protection mix and diversifying into the mass affluent and mass customer segments is expected to reduce the company’s vulnerability to weak market conditions.