Brand Benchmark Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Restaurant Portfolio Investment Opportunity

RESTAURANT PORTFOLIO INVESTMENT OPPORTUNITY Burger King | Pontiac, MI Hardees | Columbia, SC Long John Silver’s | Cincinnati, OH Raising Cane’s | Blue Springs, MO Net Lease Restaurant Portfolio – Four Triple Net Lease Properties Available on an Individual or Portfolio Basis DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING PORTFOLIO OVERVIEW -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

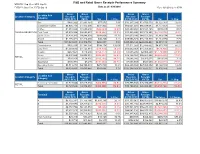

F&B and Retail Gross Receipts Performance Summary

F&B and Retail Gross Receipts Performance Summary MTD PFY: Sep 15 vs. MTD: Sep 16 FYTD PY: Sep 15 vs. FYTD: Sep 16 Data as of: 9/30/2016 Run: 12/1/2016 2:14:15 PM 12:00:00 AM Gross Gross Gross Gross Location Sub Location Category Receipts Receipts Receipts Receipts Category (MTD PFY) (MTD) Var % Chg (FYTD PFY) (FYTD) Var % Chg Bar $985,292 $1,063,164 $77,872 7.9% $10,237,209 $13,559,570 $3,322,361 32.5% Casual Dining/Bar $6,930,743 $7,472,696 $541,952 7.8% $83,051,037 $86,828,087 $3,777,051 4.5% Coffee $1,663,026 $1,620,456 ($42,569) (2.6%) $20,593,466 $21,123,745 $530,279 2.6% FOOD & BEVERAGE Fast Food $3,272,934 $2,653,679 ($619,254) (18.9%) $39,936,206 $37,772,391 ($2,163,816) (5.4%) Quick-Serve $3,439,385 $4,048,054 $608,669 17.7% $42,670,286 $44,553,560 $1,883,274 4.4% Snack $1,276,421 $1,316,689 $40,268 3.2% $15,056,923 $16,218,893 $1,161,970 7.7% Total $17,567,801 $18,174,738 $606,937 3.5% $211,545,128 $220,056,247 $8,511,119 4.0% Convenience $592,130 $1,341,304 $749,174 126.5% $7,511,263 $12,486,622 $4,975,359 66.2% Duty Free $1,203,685 $1,125,314 ($78,370) (6.5%) $15,632,363 $14,753,053 ($879,309) (5.6%) Kiosks $287,657 $118,240 ($169,417) (58.9%) $4,086,286 $2,906,298 ($1,179,988) (28.9%) News $2,597,882 $2,005,573 ($592,309) (22.8%) $32,124,769 $26,461,368 ($5,663,400) (17.6%) RETAIL News/Coffee $793,250 $678,050 ($115,199) (14.5%) $8,686,166 $9,305,677 $619,511 7.1% Spa/Salon $138,982 $7,429 ($131,553) (94.7%) $2,005,669 $541,657 ($1,464,012) (73.0%) Specialty Retail $3,711,278 $4,390,033 $678,755 18.3% $42,200,052 $47,368,052 -

Dunkin' Brands 2019 Annual Report

Dear Valued Shareholders, For more than 70 years, Dunkin’ has been at the heart of the communities we serve, keeping America running. We take a lot of pride in being part of our guests’ everyday routine. As the world navigates the global health challenges and seismic changes that will likely come as a result of COVID-19, it is essential for us to be there for our guests when they need us most – and to be their place of comfort during all of this uncertainty. We are grateful for the dedication Our results were a combination DUNKIN’ AND of our franchisees and crew of many things – starting with BASKIN-ROBBINS members, who make our brands outstanding execution of our stand tall every day. Together, segment plans and our continued WERE RANKED we are on a journey to evolve focus on delivering for customers. #1 AND #13 BRANDS and transform our brands Our recent strategic investments – IN THE 2020 to be more relevant for our including our espresso and digital FRANCHISE 500 customers – through a focus on platforms – are driving topline ISSUE OF menu innovation with broader results and delivering a better consumer appeal, reimagining the guest experience. Our asset-light, ENTREPRENEUR restaurant experience, growing 100-percent franchised business MAGAZINE our digital and delivery platforms, model continues to deliver strong and integrating both brands into flow through, and we are proud modern culture. of our collaborative relationships with our nearly 2,000 franchisee As we navigate the unchartered and licensee partners around the waters ahead, we will stay true to world. -

Tampa, Florida (The “Property”)

CHIPOTLE / STARBUCKS T A M P A, FLORIDA EXCLUSIVE OFFERING DISCLAIMER This Offering Memorandum has been prepared by Owner Representative Additional information and an opportunity to inspect the property will be made (“OREP”) for use by a limited number of parties to evaluate the potential available to interested and qualified prospective investors upon written request. acquisition of Chipotle / Starbucks, Tampa, Florida (the “Property”). All Owner and OREP each expressly reserve the right, at their sole discretion, to projections have been developed by OREP, Owner and designated sources, reject any or all expressions of interest or offers regarding the property and/or are based upon assumptions relating to the general economy, competition, and terminate discussions with any entity at any time with or without notice. Owner other factors beyond the control of OREP and Owner, and therefore are subject shall have no legal commitment or obligations to any entity reviewing this to variation. No representation is made by OREP or Owner as to the accuracy Offering Memorandum or making an offer to purchase the property unless and or completeness of the information contained herein, and nothing contained until such offer is approved by Owner, a written agreement for the purchase herein is or shall be relied on as a promise or representation as to the future of the property has been fully executed, delivered and approved by Owner performance of the Property. Although the information contained herein has and its legal counsel, and any obligations set by Owner thereunder have been been obtained from sources deemed to be reliable and believed to be correct, satisfied or waived. -

Wendy's International, Inc

Wendy’s International, Inc. John Barker SVP Corporate Affairs & Investor Relations June 9, 2008 Today’s Presentation Wendy’s Overview Activist investors: A case history… the last 3 years Wendy’s & Triarc Merger 2 Corporate Affairs Department Overview Strategic Planning Public Relations Meetings / Event Planning Community Relations Investor & Shareholder Relations Dave’s Legacy (financial disclosure) Oversee Wendy’s Major Events All major public disclosures Wendy’s International Internal Communications Foundation (System) Dave Thomas Foundation for Government Relations & Wendy’s Adoption Political Action Committee (PAC) Corporate & Investor website Issues Management Graphic Design for restaurants Crisis Management and system projects Consumer Communications & PR Services – A/V support Consumer Relations 3 Corporate Affairs Department CEO & President CEO & President *Wendy’s 3-Tour Challenge, High School Heisman, KeKerriirii And Andeersrsonon Home for the Holidays Senior VP Exec Asst Senior VP Corp Affairs & IR Michelle Lemmon Corp Affairs & IR JoJohnhn Ba Barkrkeerr Dave Thomas DirectDirectoorr DirectDirectoorr VPVP Public Public Affairs Affairs & & SVSVPP Foundation IRIR & & Financial Financial CoConsumernsumer & & PR PR IssueIssue M Maananagemengement t CommuCommunicationsnications MediaMedia Relat Relationsions CommuCommunicationsnications *Special MaryMary Sc Schelhell l DenDennyny Lynch Lynch OpOpeenn BoBobb Bert Bertiniini Events (Mktg) Mgr. IR and Strat Planning Analysis Director Govt Manager Manager Dir. System Dir. Sys Comms Project Mgr. Events Mgmt Kim Messner Relations Comms Internal Comms Comms Improvement & PAC Mgr. Planner Kevin Lundy Kitty Munger Open Tom Clemens Gary Talbott Mary Fry Joel Nepa Mgr. Shareholder Relations & Admin Asst Media Enterprise Disclosure Open Supv. Consumer Editorial Svcs Mgr. Media Producer Wal Ozello Marsha Gordon Relations Consultant Production Jane Frazier Jeff Nastali Brian Rolston Spec. -

Local Restaurants

Local Restaurants Deli, Café, Coffee, ice Cream Chipotle Chelley Belly 1710 Columbus Pike 740-369-6360 59 N. Sandusky Street 740-369-5792 Kentucky Fried Chicken Choffey’s Coffee & Confection 134 S. Sandusky Street 740-362-9583 17 W. Winter Street 740-417-9406 Long John Silver’s Dairy Depot 1165 Columbus Pike 740-363-2942 390 N. Sandusky Street 740-363-5297 Mc Donald’s Jimmy John’s 279 S. Sandusky Street 740-363-1713 47 N. Sandusky Street 740-362-0111 Taco Bell Ollie’s Fine Ice Cream 1167 S. Sandusky Street 740-369-0138 19 S. Franklin Street 740-363-6554 Tim Hortons/Cold Stone Creamery Orange Leaf 89 W. Williams Street 740-362-3203 24 Troy Road 740-362-1855 Victor’s Taco Shop Panera 186 S. Sandusky Street 740-362-8000 750 W. Central Avenue 740-362-1001 Wendy’s Something Sweet Coffee & Bakery 185 S. Sandusky Street 740-369-3332 2 N. Sandusky Street 740-369-5282 Pizza Starbucks 1740 Columbus Pike 740-362-1338 Amato’s Woodfired Pizza (no delivery) 8 S. Sandusky Street 740-369-8797 Subway 16 S. Sandusky Street 740-369-7827 Delco Pizza 523 Pennsylvania Avenue 740-363-0033 Whit’s Frozen Custard 31 N. Sandusky Street 740-362-0715 Domino’s Pizza 90 W. William Street 740-363-9824 Fast Food Donato’s Pizza Arby’s 122 S. Sandusky Street 740-362-0682 216 S. Sandusky Street 740-417-8113 Gabby’s Place Pizza and Subs Burger King 3120 Olentangy River Road 740-369-4619 168 S. Sandusky Street 740-363-8080 Hungry Howie’s Pizza St. -

Tim Hortons and Burger King Worldwide Provide Transaction Update and Set Election Deadlines

Tim Hortons and Burger King Worldwide Provide Transaction Update and Set Election Deadlines Oakville, Ontario and Miami, Florida; December 5, 2014: Tim Hortons Inc. (TSX, NYSE: THI) and Burger King Worldwide Inc. (NYSE: BKW) today confirmed that the proposed transaction to create a new global quick service restaurant leader operating two iconic, independent brands has been approved by the Minister of Industry under the Investment Canada Act (“ICA”). In connection with this announcement, the companies are providing the following further updates regarding the transaction. The companies have set the deadline for registered shareholders of Tim Hortons or Burger King Worldwide to make an election with respect to the form of consideration they wish to receive, subject to pro-ration, as of December 9, 2014, prior to 5:00 p.m. (EST), which is based on the current expectation that the transaction will be completed on December 12, 2014. Registered shareholders are reminded that if they wish to make an election, they must complete, sign and return a Letter of Transmittal and Election Form to Computershare Trust Company, as exchange agent, by the election deadline. Shareholders holding shares through a broker, investment dealer or other intermediary should carefully follow the instructions provided by such broker, investment dealer or other intermediary if they wish to make an election. Shareholders with questions should contact DF King at 866-828-6934 (English) or 866-796-1285 (French). Tim Hortons and Burger King Worldwide also confirmed today that the transaction has previously received regulatory clearance under the Hart-Scott-Rodino Act (USA), the Competition Act (Canada) and the Canada Transportation Act. -

Table-For-10-Ebook.Pdf

TABLE OF CONTENTS Click below to jump to that chapter Meet Kelly 03 Introduction 04 CHAPTER 1: Recruiting and Hiring 09 CHAPTER 2: Shift and Labor Management 12 CHAPTER 3: Routine Management 16 CHAPTER 4: Security and Loss Prevention 19 CHAPTER 5: Inventory & Order Management 23 CHAPTER 6: 3rd-Party Consolidation 28 CHAPTER 7: Online Ordering 32 CHAPTER 8: Marketing 38 CHAPTER 9: Guest Feedback 46 CHAPTER 10: Data Aggregation and Analytics 51 Conclusion 55 Table for 10 - Ten Restaurant Technologies Collaborating to Help You Thrive in an Era of Uncertainty 3 MEET KELLY Kelly MacPherson is the former Chief Information Officer for Burger King, Popeyes and Tim Hortons, and has held technology leadership positions for prominent global brands such as Abercrombie and Fitch, MICROS, Planet Hollywood, and Hard Rock Cafe. MacPherson is a global visionary with a 20-year record of bold decision-making and resolute transformation leadership, driving evolution of operational excellence for multibillion- dollar global enterprises in the hospitality and retail industry. A transformative change agent with impeccable customer orientation, strong problem-solving abilities, and intrinsic instincts to consistently raise the bar to enable businesses to deliver results. She pioneered guest receipt surveys, has successfully innovated technology through two major economic downturns, and looks forward to using her experience to guide brands through the “new normal.” Table for 10 - Ten Restaurant Technologies Collaborating to Help You Thrive in an Era of Uncertainty 4 Introduction I’ve worked with Ovation to help restaurant owners and operators think through the technology that will help bridge the gap between the “new normal” and becoming just “the normal.” Driving both top line growth and margin improvements through a “connected restaurant experience” will only come through a robust ecosystem of partners built on a scalable flexible architecture enabling a seamless flow of data. -

Wendy's HOF Case 2 07 03

Wendy’s International, Inc. 1 1 Executive Summary Case Study Name: Wendy’s International Industry: Retail/Food Key Company Stats (as of 12/31/02): System-wide Sales: $9.4 billion Total Annual Revenue: $2.7 billion # of restaurants: 8,811 in 26 countries Wendy's International, Inc. is one of the world's largest restaurant operating and franchising companies, with $9.3 billion in 2002 system-wide sales and three quality brands -- Wendy's, Tim Hortons, and Baja Fresh. Wendy’s vision is to be the quality leader in everything it does. Background/Business Problem: Wendy’s did not have a burning platform for implementing the BSC – in fact the company was doing well. Then a new CEO came on board charged with developing a new strategy. As always, Wendy’s was looking for ways to improve. Given the competitive environment of the quick service restaurant industry, and the high level of staff turnover endemic to the industry, Wendy’s was looking to differentiate itself competitively. With a keen appreciation of the importance of human capital and customer focus in this competitive environment, Wendy’s adopted the Balanced Scorecard in 2000 as a way to help it gather data, measure intangible assets, and better focus the business. The Change Undertaken: Wendy’s took steps to change the way it managed both staff turnover and customer retention through use of the Balanced Scorecard. Having measured various intangibles in the past, Wendy’s had no consolidated process for gathering the data. With well- focused efforts and communications, it lowered staff turnover from 170% to 140% per year. -

Retail Attraction Survey Results.Pdf

Retail Attraction Survey SurveyMonkey Q1 From what store and city was your last purchase from a retailer that exceeded $200? Answered: 232 Skipped: 11 # RESPONSES DATE 1 Best buy 9/10/2018 10:29 PM 2 Walmart - Jefferson City 8/14/2018 10:28 AM 3 Lowe’s in JC 8/10/2018 12:24 PM 4 Lowes. Jefferson City 8/10/2018 11:13 AM 5 Target - Jefferson City 8/10/2018 10:39 AM 6 multiple items: Walmart JC Stadium 8/10/2018 10:29 AM 7 Dicks 8/10/2018 7:34 AM 8 IKEA St. Louis 8/10/2018 12:48 AM 9 McKnight Tire, Jefferson City Wal-Mart, Jefferson City Sam's, Jefferson City 8/9/2018 11:05 PM 10 Wal-Mart 8/9/2018 4:10 PM 11 IKEA in st Louis 8/9/2018 3:45 PM 12 Best Buy, Jefferson City 8/9/2018 1:20 PM 13 Jefferson City, Lowe’s 8/9/2018 12:48 PM 14 Kohls, Columbia, MO 8/9/2018 11:48 AM 15 Walmart-school supplies and clothes 8/9/2018 10:19 AM 16 Lowe’s, Jefferson City 8/9/2018 10:14 AM 17 Jefferson City, Walmart 8/9/2018 8:59 AM 18 Nordstrom's, St Louis 8/9/2018 8:10 AM 19 Zales. Osage Beach 8/9/2018 6:37 AM 20 Children’s place, build a bear 8/9/2018 6:36 AM 21 Kirklands Branson 8/9/2018 6:31 AM 22 Sams 8/9/2018 5:38 AM 23 JC Mattress in Jefferson City 8/8/2018 11:46 PM 24 Walmart 8/8/2018 9:39 PM 25 Walmart, jefferson city 8/8/2018 8:22 PM 26 Scruggs, Jefferson City, MO 8/8/2018 7:33 PM 27 Lowes 8/8/2018 5:41 PM 28 Kohls, Jefferson City 8/8/2018 4:38 PM 29 Columbia, Soma 8/8/2018 3:51 PM 30 Will West Music & Sound, Lowe's 8/8/2018 11:35 AM 31 Walmart in Jefferson City 8/8/2018 10:28 AM 32 Staples jeff city 8/8/2018 6:08 AM 33 Probably car maintenance and service at Honda dealer in JC 8/7/2018 5:07 PM 34 Chico's Columbia, Missosuri 8/7/2018 3:00 PM 1 / 43 Retail Attraction Survey SurveyMonkey 35 Best Buy Columbia, MO 8/7/2018 2:49 PM 36 Walmart 8/7/2018 2:28 PM 37 Sunglass Hut 8/7/2018 1:00 PM 38 Homegoods 8/7/2018 12:49 PM 39 Walmart 8/7/2018 12:46 PM 40 Columbia Appliance Columbia MO. -

Starbucks Company Profile

Starbucks Company Profile September 2013 The Starbucks Story Our story began in 1971. Back then we were a roaster and retailer of whole bean and ground coffee, tea and spices with a single store in Seattle’s Pike Place Market. Today, we are privileged to connect with millions of customers every day with exceptional products and more than 19,000 retail stores in over 60 countries. Folklore Starbucks is named after the first mate in Herman Melville’s Moby Dick. Our logo is also inspired by the sea – featuring a twin‐tailed siren from Greek mythology. Starbucks Mission Our mission: to inspire and nurture the human spirit – one person, one cup and one neighborhood at a time. Our Coffee We’ve always believed in serving the best coffee possible. It's our goal for all of our coffee to be grown under the highest standards of quality, using ethical sourcing practices. Our coffee buyers personally travel to coffee farms in Latin America, Africa and Asia to select the highest quality beans. And our master roasters bring out the balance and rich flavor of the beans through the signature Starbucks Roast. Our Stores Our stores are a neighborhood gathering place for meeting friends and family. Our customers enjoy quality service, an inviting atmosphere and an exceptional beverage. Total stores: 19,209* (as of June 30, 2013) Argentina, Aruba, Australia, Austria, Bahamas, Bahrain, Belgium, Brazil, Bulgaria, Canada, Chile, China, Costa Rica, Curacao, Cyprus, Czech Republic, Denmark, Egypt, El Salvador, England, Finland, France, Germany, Greece, Guatemala, Hong Kong/Macau, Hungary, India, Indonesia, Ireland, Japan, Jordan, Kuwait, Lebanon, Malaysia, Mexico, Morocco, New Zealand, Netherlands, Northern Ireland, Oman, Peru, Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Scotland, Singapore, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, Turkey, United Arab Emirates, United States, Vietnam and Wales.