COMMISSION of the EUROPEAN COMMUNITIES Brussels, 4.4.2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daily Market Insights

DAILY MARKET INSIGHTS 16-Oct-19 Change Index points KSE 100 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KSE 100 Index 198 34,281 Contributing shares Closing Price - Rs. Pakistan Petroleum Limited.(XDXB) 2.73 2.44 39.81 114.61 Oil & Gas Development Company Ltd.(XD) 1.93 1.53 27.28 128.04 Pakistan State Oil Co Ltd.(XDXB) 4.24 3.00 19.63 145.80 Source: https://formerdps.psx.com.pk/ KSE 100 INDEX VOLUMES Today 94 5 days average 136 151 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Individuals Foreign Corporate Amount (Net) 193,157,194 (373,402,539) Buying / Selling sector wise composition All other Sectors 45.88% 3.18% Cement 14.37% 8.27% Oil and Gas Marketing Companies 10.71% 3.52% Textile Composite 2.67% 27.91% Commercial Banks 4.96% 22.12% Oil and Gas Exploration Companies 5.87% 18.80% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (287) (126) 5 days average (124) 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION PKGS Disclosure of Interest by Executives; purchased 11,100 shares at Rs. 295 each. The joint venture of Kohat E.L comprising Oil and Gas Development Company Limited (OGDCL) as operator (50%), Mari Petroleum Company Limited (MPCL) (33.33%) & Saif OGDC Energy Limited (SEL) (16.67%) has discovered gas & condensate from its exploratory efforts at Well Tough-01. -

PACRA Publications

SPONSOR | EVOLUTION OF A BUSINESS BEYOND NUMBERS! Presented | LSE Third ANNUAL BUSINESS RESEARCH CONFERENCE ON MANAGING BUSINESS IN PAKISTAN | Apr15 Who Is Sponsor? ONE WHO HAS THE FINAL SAY! Why Sponsor Is Important? Sustainability Longevity [Competitive Standing] [Beyond Generations] WHENEVER A BUSINESS RUNS OUT OF SPONSOR, CHANCES OF SURVIVAL DIMINISHES! Fate of Businesses – Classic Example The 22 FAMILIES OF PAKISTAN [1968] Rest in Peace Jalil Fancy Valika Bawany Ispahani Winners Survivors Khyber Dawood Saigol Beco Arag Ali Adamjee Hafiz Habib Colony Milwala Nishat Crescent Karim Gul Ahmed Gandhara Dada Sustainability How to bring it to a business? Sponsor of a Sustainable Business CREATES A BALANCE Business • Consistent revenue generation Reward acumen • ABILITY Experience • Staying afloat in times of Knowledge & financial distress (related & Risk Understanding • ADEQUACY unrelated) Risk Reward ADEQUACY OF ABILITY Sustainability Cycle • Right Opportunity • Money • Risk & Reward • Ownership Identify Incubate Monitor Operate • Governance • Control • Alignment • Competitiveness Sustainability Longevity How to bring it to a business? Sponsor | Typical Lifecycle Strategic Entrepreneur Investor Shareholder Ownership Ownership Ownership Strategy Strategy Strategy Management Management Management What we loose along this lifecycle? • Willingness The Correct Approach Longevity Matrix IT IS POSSIBLE TO HAVE SAME SPONSOR STRENGTH WHILE MOVING ALONG THE LIFE CYCLE Succession planning Corporatize Sponsorship Challenges Business Management Let’s -

Annual Report 2009 Toyota Tsusho Corporation

Toyota Tsusho Corporation Annual Report 2009 Report Annual Corporation Tsusho Toyota Annual Report 2009 Toyota Tsusho Corporation es nging Tim Seeking New Value in Challe The Toyota Tsusho Group’s long-term vision is to generate balanced earnings from automotive and non-automotive fields by 2015. Guided by this vision, we are working Toyota Tsusho to reinforce and organically fuse four unique business platforms—Resources and the Environment, Processing and Manufacturing Businesses, Logistics, and Product and at a Glance Market Development—to provide value-added functions and services that are matched to customer needs, offer support solutions addressing issues faced by customers and to generate new value. Machinery & Electronics Division Automotive Division Consumer Products, Services & Materials Division Business Strategies for the Automotive Field 2015 50 01 Annual Report 2009 One of our key competitive advantages lies in our global processing and logistics functions in the automotive field, which are grounded on the keywords of “real places, real things, reality,” along with our overseas automobile sales network. In the fields of produce & foodstuffs, energy & chemicals and electronics, other major business assets of ours include the extensive networks we have cultivated and developed worldwide, and our expertise in conducting large-scale business projects that span many years. Metals Division Energy & Chemicals Division Produce & Foodstuffs Division ld otive Fie Non-Autom Business Strategies for the Automotive Field 50 02 Toyota Tsusho -

Company Information

Saifullah Chattha Albaraka Bank (Pakistan) Limited Allied Bank Limited Askari Bank Limited Bank Alfalah Limited Burj Bank Limited Citibank N.A. Dubai Islamic Bank Pakistan Limited Faysal Bank Limited Habib Bank Limited Industrial & Commercial Bank of China KASB Bank Limited MCB Bank Limited Meezan Bank Limited National Bank of Pakistan NIB Bank Limited Standard Chartered Bank (Pakistan) Limited Standard Chartered Modaraba Summit Bank Limited United Bank Limited Phase-II K-Electric Limited (Formerly: Karachi Electric Supply Company Limited) Brief Review I am pleased to present the un-audited accounts of K-Electric Limited (KE) for the half year ended 31 December 2013 on behalf of the Board of Directors. Key operational and financial results are summarized below: JUL-DEC JU L-DEC 2013 2012 OPERATIONAL (UNITS - GWh) Units generated (net of auxiliary ) 4,192 4,145 Units purchase d 3,690 3,661 Total units available for distributio n 7,882 7,806 Units billed 5,831 5,581 Transmission & Distribution Losse s % 26.0% 28.5% (PKR - MILLIONS ) F INANCIAL Restated Revenue 95,601 94,346 Profit before taxation 4,234 849 Taxation – net 484 2,326 Profit for the period 4,718 3,175 Earnings per share - BASIC/DILUT ED (Rupees) 0.17 0.11 Earnings before Interest ,Tax, Depreciation and 14,624 13,404 Amortization (EBITDA ) NAME CHANGE OF THE COMPANY With the completion of 100 years of its existence and to start a new century with a renewed identity and a strong resolve of bringing progress and success, the company has been re-named as “K-Electric Limited” after obtaining requisite statutory approvals and completing all corporate actions, effective from 16 January 2014. -

Protecting Gul Ahmed Fashion from the Threat of Customer Neglect

Binary University of Management & Entrepreneurship Topic : Protecting Gul Ahmed Fashion from the threat of Customer Neglect in Pakistan Author Name: Nuslia Nushra Akhter Field: Master’s in Business Administration (2018) 0 PROTECTING GUL AHMED FASHION FROM THE THREAT OF CUSTOMER NEGLECT 1 Declaration I hereby certify that the work embodied in this Research Project (THESIS) is the result of original research and has not been submitted for a higher degree to any other University or Institution. NUSLIA NUSHRA AKHTER (Signed) 2 Acknowledgment I would like to take this opportunity to express my profound gratitude and deep regards to my Instructor, Mr. Farrukh Adeel for his exemplary guidance, monitoring and constant encouragement throughout the course. The support, help and guidance given by him and my family from time to time shall carry a long way in the journey of my life on which I am about to get on. I also take this opportunity to express a deep sense of gratitude to the employees of GUL AHMED for their support, valuable information and guidance, which helped me in completing this task through various stages. 3 Contents Abstract ........................................................................................................................................... 6 Chapter 1 Introduction .................................................................................................................. 7 1.1 Background of the Project ................................................................................................ 8 1.2 -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

Kifayah Market Insights 28 April 2021

DAILY MARKET INSIGHTS 28-Apr-2021 Change Index points KMI 30 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KMI 30 Index (437) 72,955 Contributing shares Closing Price - Rs. Oil & Gas Development Company Limited (2.42) (2.56) (135.40) 92.29 Pakistan Petroleum Limited (1.56) (1.84) (90.14) 83.19 Lucky Cement Limited (6.05) (0.70) (67.87) 854.12 KMI 30 INDEX VOLUMES Today 42 5 days average 58 59 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Other Organization Foreign Corporates Amount (Net) 566,619,364 (592,631,016) Buying / Selling sector wise composition Commercial Banks 85.94% 61.50% All other Sectors 5.20% 0.63% Technology and Communication 3.03% 8.32% Cement 0.13% 13.06% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (242) (163) 5 days average 20 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION Disclosure of Interest by a Substantial Shareholder, bought 3,950 shares at the average Packages Limited price of Rs. 473.19 each on 27 April 2021. The Company is pleased to announce the facility registration of its two new facilities from U.S. Food & Drug Administration duly verified by Registrar Corp, Virginia, USA. The Searle Company Limited This registration will enable Searle Company to export its consumer products, Dietary and Nutritional Supplements to the USA Makret. -

Individual Members As of March 2020

INDIVIDUAL MEMBERS IN GOOD STANDING AS OF MARCH 2020 S. NO CODE MEMBER NAME DESIGNATION ORGANIZATION 1 KI00056 Mr. A. Husain A. Basrai 2 KI00105 Mr. Aadil Riaz 3 KI12035 Mr. Aamar Hassan Chief Operating Officer Human Resource Solutions International 4 KI00212 Mr. Aamir Siddiqui 5 KI00116 Mr. Abbas D. Habib Chairman Bank Al Habib Limited. 6 KI03023 Mr. Abdul Aleem Director Finance Gul Ahmed Textile Mills Ltd. 7 KI96020 Mr. Abdul Ghafoor Ateeq 8 KI91007 Mr. Abdul Mateen 9 LI00044 Mr. Abdul Qadar Khatak Resident Director Premier Sugar Mills & Distillery Co. Ltd. 10 KI02037 Mr. Abdul Qadir Memon Chief Advisor A. Qadir & Company 11 KI12018 Mr. Abdul Rab Partner Deloitte Yousuf Adil Chartered Accountants KPMG Taseer Hadi & Co., Chartered 12 KI12031 Mr. Abdul Rauf Executive Director Accountants 13 LI00058 Mr. Abdul Razak Dawood Founder Descon Engineering Limited 14 KI06012 Mr. Abdul Rub Khan 15 KI02041 Mr. Abdul Wahid Tejani Chief Executive A. W. Tejani & Company 16 KI09009 Mr. Abdur Rahim 17 KI07010 Mr. Abid Siddiq Chief Executive Officer Textile Machinery Company 18 KI88005 Mr. Abrar Hasan Partner / Financial Advisory KPMG Taseer Hadi & Co., Chartered 19 KI06004 Syed Adnan Rizvi Services Accountants Mr. Ahmad Abdul Matin 20 KI02052 Managing Consultant Financial and Management Consultants Haqqani 21 LI92001 Mr. Ahmad Hasnain MD & CEO Allied Marketing (Pvt) Limited. 22 LI07001 Mr. Ahsan Imran Shaikh Chief Executive Officer Millat Equipment Limited. 23 KI00192 Mr. Ahsan Mehanti Page 1 of 11 S. NO CODE MEMBER NAME DESIGNATION ORGANIZATION 24 KI06031 Mr. Ahsan Qadir Munshi Administrator KIRAN Patients Welfare Society (KPWS) 25 KI13010 Mr. Ahsan Sarwar 26 KI00106 Mr. -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

Daily Market Insights

DAILY MARKET INSIGHTS 26-Feb-2020 Change Index points KSE 100 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KSE 100 Index (520) 38,338 Contributing shares Closing Price - Rs. Hub Power Company Limited. (2.97) (3.16) (63.20) 90.93 Engro Corporation Limited. (8.07) (2.60) (55.93) 302.49 Dawood Hercules Corporation Ltd. (7.02) (4.88) (48.03) 136.72 KSE 100 INDEX VOLUMES Today 118 5 days average 92 105 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Insurance Companies Companies Amount (Net) 683,285,725 (686,834,089) Buying / Selling sector wise composition Cement 23.84% 22.22% Commercial Banks 22.35% 8.15% Fertilizer 16.84% 50.56% All other Sectors 11.34% 10.61% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (391) (430) 5 days average (351) 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION Disclosure of Interest by Spouse of Non-Executive Director, bought 35,900 shares at a Engro Corporation Limited price of Rs. 312 each on Feb 25, 2020. The Board of Directors authorized the Company to formulate and propose the terms for a carve out of its local business segment into a wholly owned subsidiary. Furthermore, the Gul Ahmed Textile Mills Limited Company has also been authorized to incorporate a wholly owned subsidiary for the aforesaid purpose and appoint advisors for the same. -

Shariah Compliance Screening Report

Al-Hilal Shariah Advisors JUNE 2017 Shariah Compliance Screening Report Al-Hilal Shariah Advisors (Pvt.) Limited. INSIDE Key Highlights ................................ .......................................................................................................... 4 Shariah Compliant Companies ................................ ............................................................................... 8 Shariah Non - Compliant Companies .................................................................................................... 10 Suspended & Delisted Companies…………………………………………………………………………………………………...12 Approved list of Sukuk………………………………………………………………………………………………….....................13 Approved Islamic Banks & Windows for Placements……………….……………………………………………………….14 Approved list of charitable orginizations ............................................................................................. 15 Screening Guidelines for Equity Securities ........................................................................................... 16 Purification Guidelines .......................................................................................................................... 16 P a g e | 2 Al-Hilal Shariah Advisors (Pvt.) Limited. P a g e | 3 Al-Hilal Shariah Advisors (Pvt.) Limited. 14 July, 2017 KEY HIGHLIGHTS We have conducted Shariah compliance screening of 554 selected companies listed on the Pakistan Stock Exchange as per their latest financial statements (June’17), on the basis of the Shariah compliance -

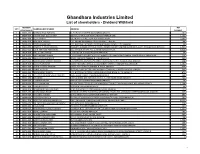

List of Shareholder-Dividend Withheld

Ghandhara Industries Limited List of shareholders - Dividend Withheld MEMBER NET SR # SHAREHOLDER'S NAME ADDRESS FOLIO PAR ID PAYABLE 1 00002-000 MISBAHUDDIN FAROOQI D-151 BLOCK-B NORTH NAZIMABADKARACHI. 461 2 00004-000 FARHAT AFZA BEGUM MST. 166 ABU BAKR BLOCK NEW GARDEN TOWN,LAHORE 1,302 3 00005-000 ALLAH RAKHA 135-MUMTAZ STREETGARHI SHAHOO,LAHORE. 3,293 4 00006-000 AKHTAR A. PERVEZ C/O. AMERICAN EXPRESS CO.87 THE MALL, LAHORE. 180 5 00008-000 DOST MUHAMMAD C/O. NATIONAL MOTORS LIMITEDHUB CHAUKI ROAD, S.I.T.E.KARACHI. 46 6 00010-000 JOSEPH F.P. MASCARENHAS MISQUITA GARDEN CATHOLIC COOP.HOUSING SOCIETY LIMITED BLOCK NO.A-3,OFF: RANDLE ROAD KARACHI. 1,544 7 00013-000 JOHN ANTHONY FERNANDES A-6, ANTHONIAN APT. NO. 1,ADAM ROAD,KARACHI. 5,004 8 00014-000 RIAZ UL HAQ HAMID C-103, BLOCK-XI, FEDERAL.B.AREAKARACHI. 69 9 00015-000 SAIED AHMAD SHAIKH C/O.COMMODORE (RETD) M. RAZI AHMED71/II, KHAYABAN-E-BAHRIA, PHASE-VD.H.A. KARACHI-46. 214 10 00016-000 GHULAM QAMAR KURD 292/8, AZIZABAD FEDERAL B. AREA,KARACHI. 129 11 00017-000 MUHAMMAD QAMAR HUSSAIN C/O.NATIONAL MOTORS LTD.HUB CHAUKI ROAD, S.I.T.E.,P.O.BOX-2706, KARACHI. 218 12 00018-000 AZMAT NAWAZISH AZMAT MOTORS LIMITED, SC-43,CHANDNI CHOWK, STADIUM ROAD,KARACHI. 1,585 13 00021-000 MIRZA HUSSAIN KASHANI HOUSE NO.R-1083/16,FEDERAL B. AREA, KARACHI 434 14 00023-000 RAHAT HUSSAIN PLOT NO.R-483, SECTOR 14-B,SHADMAN TOWN NO.2, NORTH KARACHI,KARACHI.