February 23, 2015

Kinross Gold Corporation (KGC-NYSE)

SUMMARY DATA

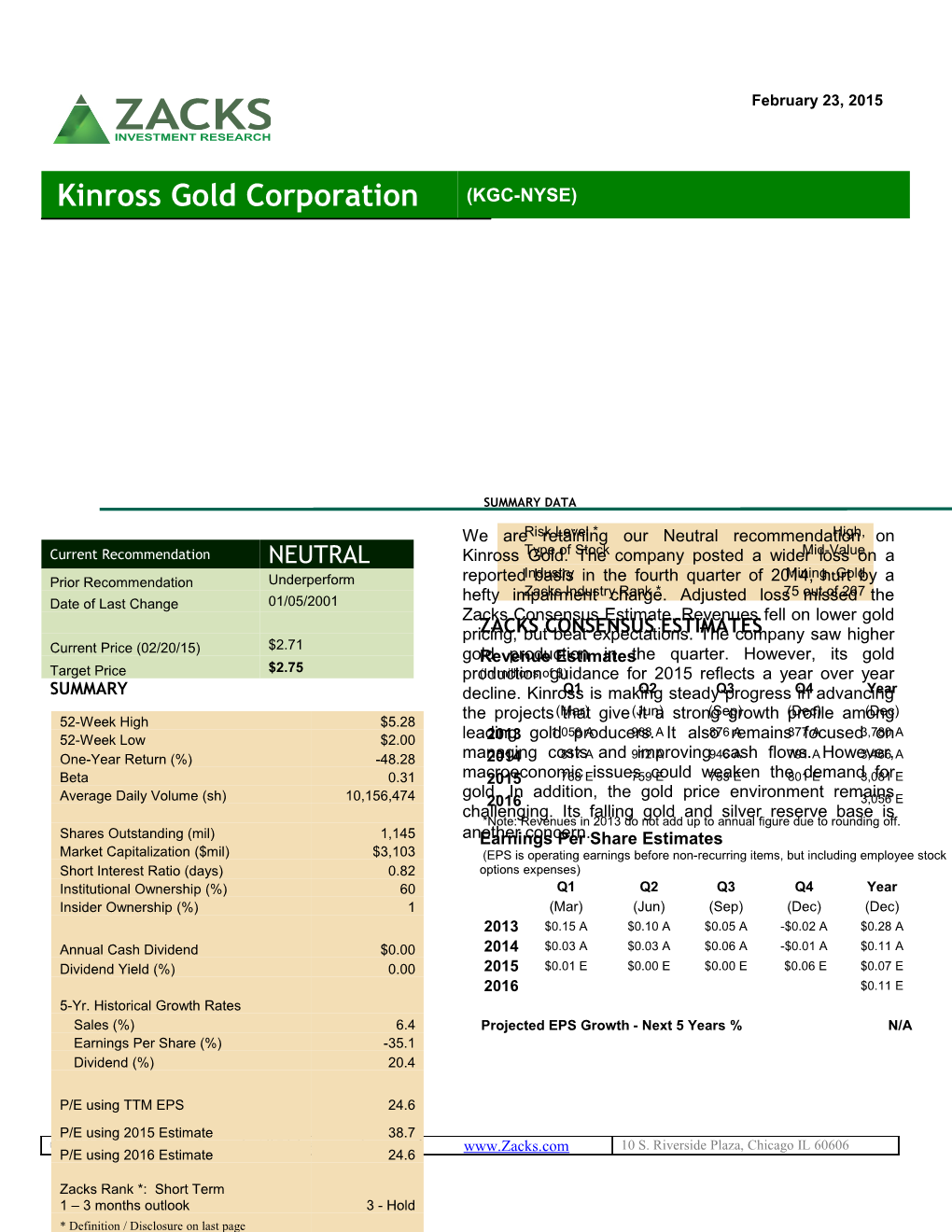

We areRisk retaining Level * our Neutral recommendationHigh, on Current Recommendation NEUTRAL Kinross TypeGold. of StockThe company posted a widerMid-Value loss on a Industry Mining -Gold Prior Recommendation Underperform reported basis in the fourth quarter of 2014, hurt by a hefty impairmentZacks Industry charge. Rank * Adjusted loss75 out missed of 267 the Date of Last Change 01/05/2001 Zacks Consensus Estimate. Revenues fell on lower gold pricing,ZACKS but CONSENSUS beat expectations. ESTIMATES The company saw higher $2.71 Current Price (02/20/15) goldRevenue production Estimates in the quarter. However, its gold Target Price $2.75 production(In millions of guidance $) for 2015 reflects a year over year SUMMARY decline. KinrossQ1 is makingQ2 steadyQ3 progress Q4in advancingYear the projects(Mar) that give(Jun) it a strong(Sep) growth (Dec)profile among(Dec) 52-Week High $5.28 1,058 A 968 A 876 A 877 A 3,780 A 52-Week Low $2.00 leading2013 gold producers. It also remains focused on One-Year Return (%) -48.28 managing2014 costs 817 A and 912 improving A 946 cash A flows.791 A However,3,466 A Beta 0.31 macroeconomic2015 768 E issues759 couldE weaken753 E the801 demand E 3,081 for E gold. In addition, the gold price environment remains Average Daily Volume (sh) 10,156,474 2016 3,056 E challenging. Its falling gold and silver reserve base is *Note: Revenues in 2013 do not add up to annual figure due to rounding off. Shares Outstanding (mil) 1,145 anotherEarnings concern Per .Share Estimates Market Capitalization ($mil) $3,103 (EPS is operating earnings before non-recurring items, but including employee stock Short Interest Ratio (days) 0.82 options expenses) Institutional Ownership (%) 60 Q1 Q2 Q3 Q4 Year Insider Ownership (%) 1 (Mar) (Jun) (Sep) (Dec) (Dec) 2013 $0.15 A $0.10 A $0.05 A -$0.02 A $0.28 A Annual Cash Dividend $0.00 2014 $0.03 A $0.03 A $0.06 A -$0.01 A $0.11 A Dividend Yield (%) 0.00 2015 $0.01 E $0.00 E $0.00 E $0.06 E $0.07 E 2016 $0.11 E 5-Yr. Historical Growth Rates Sales (%) 6.4 Projected EPS Growth - Next 5 Years % N/A Earnings Per Share (%) -35.1 Dividend (%) 20.4

P/E using TTM EPS 24.6 P/E using 2015 Estimate 38.7 © 2015 Zacks Investment Research, All Rights reserved. www.Zacks.com 10 S. Riverside Plaza, Chicago IL 60606 P/E using 2016 Estimate 24.6

Zacks Rank *: Short Term 1 – 3 months outlook 3 - Hold * Definition / Disclosure on last page Equity Research KGC | Page 2 OVERVIEW same time period. Moreover, the mine is expected to generate free cash flow of $2.2 billion during this period. However, Kinross Based in Ontario, Canada, Kinross Gold recently revealed that it will not move ahead Corporation (KGC) is primarily involved in the with the Tasiast expansion project as the exploration and operation of gold mines. It current gold pricing environment may not ranks among the top 10 gold mining companies allow it to fund the expansion. However, the in the world with 2014 production of 2.71 million company is confident that Tasiast mill gold equivalent ounces. The company holds expansion has the ability to contribute to its major assets in Canada, the U.S., and Russia, growth in the future. It will continue to and is primarily involved in the exploration and evaluate market conditions with a view for a operation of gold mines. It also produces and potential expansion. The company will also sells silver. remain focused on reducing operating costs at the mine. The company has facilities in the U.S., Canada, Brazil, Chile, Russia, and Africa, and caters to a Kinross’ second most important project is diverse clientele in Brazil, Chile, Canada, and also pretty much on track. Construction of Greece. It runs several mines, including Fort the Dvoinoye mine in Russia’s Chukotka Knox, Round Mountain and Kettle River- Region completed on time and within Buckhorn in the U.S.; Dvoinoye and Kupol in budget and commercial production started Russia; Maricunga in Chile; and Paracatu in in Oct 2013. First ore from development Brazil. The company’s development projects activities was delivered to the Kupol mine include La Coipa in Chile and Tasiast in during the second-quarter 2013. Study Mauritania. As of December 31, 2014, the confirmed that the mine would potentially company’s proven and probable mineral produce at a rate of around 1,000 tons of reserves were 34.4 million ounces of gold, 44 ore per day. Kinross expects the mine to million ounces of silver and 1.4 billion pounds of produce 235,000 to 300,000 gold equivalent copper. ounces a year in its first three years of full production, which will be incremental to gold produced from the Kupol underground mine. REASONS TO BUY Dvoinoye is the fourth mine that Kinross has operated in Russia. The low-cost mine reflects the company’s strong focus on Kinross has a world class gold deposit maximizing margins and cash flow at its under its jurisdiction in the form of Tasiast, existing operations as well as growth which is its primary focus to attain growth projects. The mine is expected to have a life targets. As Tasiast is an already operating of seven years. mine, it has a basic infrastructure and a well-documented mineral resource. Kinross, Kinross has decided on its development in March 2014, released encouraging priorities and will incur capital expenditure results from the full feasibility study on the accordingly. Moreover, Kinross is not going 38,000 ton per day (tpd) mill expansion over the top to develop its resources and which showed opportunities for significant will make capital spends out of the capital cash flows and production at lower costs. available with it. It has its priorities clearly The expansion has been designed to deploy defined and is focused on maintaining its the existing 8,000 tpd mill capacity at investment grade rating and also return Tasiast in addition to a new 30,000 tpd mill. cash to shareholders. As such, Kinross Average annual production from expanded reduced its capital expenditure in 2014 to Tasiast operation has been projected at $631.8 million from $1.26 billion in 2013. around 850,000 ounces at cash cost of Capital spending in 2015 is expected to be roughly $500 per ounce for the first 5 years around $725 million. The company has also starting 2018. Estimated mineral reserves identified savings opportunities on the from this mine are expected to increase general and administrative costs front. The almost 50% to 9.6 million ounces in the

Equity Research KGC | Page 3 integration of its North and South American Also, silver reserve dropped to 44 million regions into a single Americas region has ounces in 2014 from roughly 44.7 million a resulted in meaningful overhead cost year ago. The company has already made reduction opportunities. various acquisitions to increase its exploration activities and boost reserves. Kinross, in June 2012, completed the sale Although these acquisitions are likely to of its 50% interest in Brazil's Crixas gold help the company’s future growth, it remains mine to AngloGold Ashanti Ltd. (AU) in an vulnerable to integration risk. all cash deal worth $220 million. The divestment is in line with the company’s The decision to stop further development of philosophy of focusing on its core assets in Fruta del Norte (FDN) project in Ecuador a bid to improve its production profile by represents a setback for the company. turning its attention towards more important Kinross had been in talks with the assets. The sale is also in conjunction with Ecuadorian government regarding the Kinross’ strategy of optimizing its capital project. However, Kinross decided to halt expenditure program. It is focused on the FDN project after the government of spending cash on development moves only Ecuador and the company failed to agree out of its available capital. Hence, the on certain key economic and legal terms. proceeds from the transaction will help While an extension of the economic Kinross in developing its primary growth evaluation phase of the project for up to 18 projects. months or suspension the commencement of the exploitation phase was permissible under the Ecuadorian law, the government did not consented to such extension or REASONS TO SELL suspension. Additionally, the government did not support Kinross seeking a potential new partner or buyer for the project. The A sluggish global economy, especially in discontinuation of the FDN project will emerging markets like India, could weaken hinder the growth profile of Kinross and will the demand for gold. India, which absorbs further complicate its reserve position. about 50% of the world’s production has seen gold consumption slow down. A strong We also remain cautious about the dollar, weakness in the country’s currency company’s production costs given the and government’s move to cut imports to industry-wide cost pressures. Lower grades control the current account deficit could across most of the company’s mines and impede the Indian gold market. The Indian higher maintenance costs may contribute to government has imposed import restrictions higher costs. The company’s guidance for and increased the taxes on gold imports, production and all-in sustaining costs for which is affecting gold sales in the country. 2015 reflects year over year increase. The prevailing weak gold price environment represents another concern. Average realized gold prices fell roughly 5% year over year in the most recent quarter. Kinross has suspended its semi-annual dividend considering weak gold pricing and its negative impact on its cash flows.

Kinross’ current below-average reserve base is a concern, as it will compel the RECENT NEWS company to make acquisitions or search for exploration projects in a bid to replace reserves. The company’s proven and Kinross Gold Posts Loss in Q4, Beats on probable gold reserve fell to 34.4 million Revenues – February 10, 2015 ounces in 2014 from 42.8 million in 2013.

Equity Research KGC | Page 4 Kinross incurred a net loss of $1,473.5 million the prior-year quarter primarily as a result of the (or $1.29 per share) on a reported basis in the costs incurred at Paracatu, Maricunga, and fourth quarter of 2014, significantly wider than a Tasiast. Margin per gold equivalent ounce sold net loss of $740 million (or $0.65 a share) was $487 in the fourth quarter, down 3.2% from recorded in the year-ago quarter. the year-ago quarter.

The loss in the reported quarter resulted from Financial Review $932.2 million of after-tax non-cash impairment charge related to property, plant and equipment Adjusted operating cash flow was $197.6 and an inventory charge of $167.6 million. The million, down 11.3% from $222.8 million in the year-ago quarter’s results were dragged down prior-year quarter. Cash and cash equivalents by impairment charges of $544.8 million. were $983.5 million as of Dec 31, 2014, up roughly 34% year over year. Total long-term Adjusted (excluding one-time items) loss was a debt declined roughly 3% year over year to $0.01 per share in the fourth quarter compared $1,998.1 million. with adjusted loss of $0.02 recorded in the year-ago quarter. The results missed the Zacks Capital expenditures were $189.4 million for the Consensus Estimate of earnings of $0.01. The reported quarter versus $331.1 million in the bottom line was hit by lower gold prices. comparable period last year. The decrease was due to lower spending at Tasiast and Chirano. Revenues decreased roughly 9.8% year over year to $791.3 million in the reported quarter Growth Projects due to untimely gold shipments and reduced average realized gold price. However, revenues Kinross, after a comprehensive study, has came ahead of the Zacks Consensus Estimate decided not to move ahead with the Tasiast of $698 million. expansion project. The present gold price environment does not offer the company For full-year 2014, adjusted earnings were enough confidence to maintain a strong $0.11 per share, down roughly 61% from balance sheet and fund the expansion. earnings of $0.28 per share recorded in 2013. The results missed the Zacks Consensus Kinross is continuing with the pre-feasibility Estimate of $0.14. Reported net loss totaled study (PFS) of the La Coipa project that began $1,400 million or $1.22 per share versus a loss in second quarter of 2014 and is on track to be of $3,012.6 million or $2.64 per share in 2013. completed by third quarter of 2015.

For full-year 2014, revenues decreased 8.3% to Outlook $3,466.3 million from $3,779.5 million in 2013, but were ahead of the Zacks Consensus For 2015, Kinross expects to produce roughly Estimate of $3,456 million. 2.4-2.6 million gold equivalent ounces from its current operations. This outlook is lower than Operational Performance full-year 2014 production of 2.71 million owing to expected lower grades at Chirano, Kettle Attributable gold production was 672,051 River-Buckhorn and Dvoinoye due to mine equivalent ounces from continuing operations sequencing, and reduced production from the for the quarter, up around 4% year over year, Tasiast dump leach. The production guidance driven by higher production at the Kupol assumes power rationing in Ghana and segment and partly offset by the suspension of possibilities of power rationing in Brazil, which mining at La Coipa. Average realized gold price may affect operations in both countries. was $1,201 per ounce, down 5.3% from the year-ago quarter. Production in the first quarter of 2015 is anticipated to be lower year-over-year Production cost per gold equivalent ounce adversely affecting production cost of sales due decreased to $714 in the quarter from $765 in

Equity Research KGC | Page 5 to mine plan sequencing and seasonal impact measures taken by the company. All-in on the heap leach at Fort Knox. sustaining cost per gold equivalent ounces sold decreased 15% to $919 in the quarter from The company expects production cost of sales $1,082 in the year-ago quarter, mainly due to of $720-$780 per gold equivalent ounce in 2015 the decline in sustaining capital and exploration due to higher expected costs in West Africa. and business development costs, backed by Kinross also anticipates its all-in sustaining cost higher sales of gold equivalent ounces. for 2015 to be $1,000-$1,100 per gold equivalent ounce. Margin per gold equivalent ounce sold was $570 in the third quarter, down 3.6% from the year-ago quarter. Kinross Gold Tops Q3 Earnings & Revenue Estimates – November 5, 2014 Financial Review Kinross posted adjusted earnings of $70.1 million or $0.06 per share in the third quarter of Adjusted operating cash flow was $312 million, 2014, up nearly 29% from adjusted earnings of up 21.7% from $256.4 million in the prior-year $54.4 million or $0.05 per share in the year-ago quarter. Cash and cash equivalents came in at quarter, aided by an increase in gold sales. $835.9 million as of Sep 30, 2014, down 10.3% Earnings per share surpassed the Zacks year over year. Total long-term debt declined Consensus Estimate of $0.03. 3% year over year to $1,997.1 million.

On a reported basis, Kinross posted net loss of Capital expenditures fell to $153.5 million for $4.3 million, or a breakeven in the quarter, the reported quarter from $300.8 million in the compared to net earnings of $46.9 million, or comparable period last year. The decrease was $0.04 per share posted in the prior-year due to lower spending at Tasiast and Fort Knox. quarter. Net loss in the third quarter of 2014 resulted from higher delayed non-cash income Growth Projects tax expense in Chile, partly offset by higher revenues. Kinross, in Mar 2014, announced the Tasiast expansion feasibility study results. The study, Revenues increased roughly 8% year over year which is based on an optimal mill size of 38,000 to $945.7 million in the reported quarter due to t/d, produced promising results, indicating higher gold equivalent ounces sold from Kinross’ potential to generate significant Russia. Sales came ahead of the Zacks additional cash flow per share and production at Consensus Estimate of $840 million. overall lower costs. The optimization of the project’s construction scope was mostly Operational Performance completed in the third quarter with no material changes. The project is under progress for Gold production was 693,818 equivalent securing financing. The company is expected to ounces for the quarter, up around 2% year over make a decision on the Tasiast mill expansion year, mainly due to a rise in production at in 2015. Maricunga, backed by processing of higher grade ore from the Dvoinoye mine, offset by the Kinross, on Oct 21, 2014, announced that it will suspension of mining operations at La Coipa in ink an agreement with Fortress Minerals Corp. Oct 2013. Average realized gold price was to divest all of its interests in Aurelian $1,268 per ounce, down 4.7% from the year- Resources Inc. and the FDN project in Ecuador ago quarter. for $240 million in cash and shares.

Production cost per gold equivalent ounces fell Kinross expects to receive of $100–$190 million 5.7% to $698 in the third quarter from $740 in in cash depending on the net proceeds from the prior-year quarter due to sales of lower-cost Fortress' announced equity financing. The deal gold ounces from Russia and cost-reduction is anticipated to be completed by mid-Dec

Equity Research KGC | Page 6 2014, subject to Fortress’ shareholder and stock exchange approval, and that of the Ecuadorian Government.

Outlook

Kinross expects production for 2014 to be at the top end of its narrowed guidance range of 2.6– 2.7 million from the previous outlook of 2.5–2.7 million gold equivalent ounces. The company lowered its production cost of sales guidance for 2014 to $720–$750 from $730–$780 per gold equivalent ounce and its all-in sustaining costs guidance to $950–$990 from the previous outlook of $950–$1,050 per gold ounce sold for 2014.

The company also lowered its capital expenditure forecast for 2014 from $675 million to a range of $630–$650 million.

VALUATION

Currently, shares of Kinross are trading at 38.7x our 2015 EPS estimate of $0.07. The company’s current trailing 12-month earnings multiple is 24.6x, compared with the 62.1x average for the peer group and 19.3x for the S&P 500. Kinross is expected to gain from various exploration and acquisition activities. However, we remain concerned about its earnings volatility and pricing pressure. Our long-term Neutral recommendation on the stock indicates that it will perform in line with the broader market. Our price target of $2.75 is P/E P/E 5-Yr 5-Yr based on 39.3x our 2015 earnings estimate.P/E P/E Est. 5-Yr P/CF P/E High Low F1 F2 EPS Gr% (TTM) (TTM) (TTM) (TTM) Kinross Gold Corporation (KGC) 38.7 24.6 N/A 3.1 24.6 82.8 7.6

Industry Average 40.9 39.1 6.5 15.7 62.1 122.4 16.9 S&P 500 16.7 15.6 10.7 15.3 19.3 19.4 12.0

Goldcorp Inc. (GG) 28.3 23.3 5.7 13.0 34.5 56.1 16.6 Key IndicatorsAngloGold Ashanti Ltd. (AU) 10.4 9.7 3.4 29.7 31.7 3.6 Gold Fields Ltd. (GFI) 26.0 20.4 1.1 4.5 35.8 211.5 7.2 Agnico Eagle Mines Limited (AEM) 41.2 30.4 -0.8 12.8 36.8 110.8 19.2 TTM is trailing 12 months; F1 is 2015 and F2 is 2016, CF is operating cash flow

P/B Last P/B P/B ROE D/E Div Yield EV/EBITDA Qtr. 5-Yr High 5-Yr Low (TTM) Last Qtr. Last Qtr. (TTM) Kinross Gold Corporation (KGC) 0.6 2.3 0.4 1.3 0.4 0.0 -11.4

Industry Average 5.7 5.7 5.7 -93.3 -1.5 0.4 -1.0 S&P 500 5.3 9.8 Equity Research3.2 25.5 2.1 KGC | Page 7 Earnings Surprise and Estimate Revision History

DISCLOSURES & DEFINITIONS

The analysts contributing to this report do not hold any shares of KGC. The EPS and revenue forecasts are the Zacks Consensus estimates. Additionally, the analysts contributing to this report certify that the views expressed herein accurately reflect the analysts’ personal views as to the subject securities and issuers. Zacks certifies that no part of the analysts’ compensation was, is, or will be, directly or indirectly, related to the specific recommendation or views expressed by the analyst in the report. Additional information on the securities mentioned in this report is available upon request. This report is based on data obtained from sources we believe to be reliable, but is not guaranteed as to accuracy and does not purport to be complete. Because of individual objectives, the report should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed herein are subject to change. This report is not to be construed as an offer or the solicitation of an offer to buy or sell the securities herein mentioned. Zacks or its officers, employees or customers may have a position long or short in the securities mentioned and buy or sell the securities from time to time. Zacks uses the following rating system for the securities it covers. Outperform- Zacks expects that the subject company will outperform the broader U.S. equity market over the next six to twelve months. Neutral- Zacks expects that the company will perform in line with the broader U.S. equity market over the next six to twelve months. Underperform- Zacks expects the company will under perform the broader U.S. Equity market over the next six to twelve months. The current distribution of Zacks Ratings is as follows on the 1126 companies covered: Outperform - 15.7%, Neutral - 75.7%, Underperform – 7.8%. Data is as of midnight on the business day immediately prior to this publication.

Our recommendation for each stock is closely linked to the Zacks Rank, which results from a proprietary quantitative model using trends in earnings estimate revisions. This model is proven most effective for judging the timeliness of a stock over the next 1 to 3 months. The model assigns each stock a rank from 1 through 5. Zacks Rank 1 = Strong Buy. Zacks Rank 2 = Buy. Zacks Rank 3 = Hold. Zacks Rank 4 = Sell. Zacks Rank 5 = Strong Sell. We also provide a Zacks Industry Rank for each company which provides an idea of the near-term attractiveness of a company’s industry group. We have 264 industry groups in total. Thus, the Zacks Industry Rank is a number between 1 and 264. In terms of investment attractiveness, the higher the rank the better. Historically, the top half of the industries has outperformed the general market. In determining Risk Level, we rely on a proprietary quantitative model that divides the entire universe of stocks into five groups, based on each stock’s historical price volatility. The first group has stocks with the lowest values and are deemed Low Risk, while the 5th group has the highest values and are designated High Risk. Designations of Below-Average Risk, Average Risk, and Above-Average Risk correspond to the second, third, and fourth groups of stocks, respectively.

Equity Research KGC | Page 8