Download Free PDF Here

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Banking Laws in India

Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 1 Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 2 Course Development Committee CBIL-01 Chairman Prof. L. R. Gurjar Director (Academic) Vardhaman Mahaveer Open University, Kota Convener and Members Convener Dr. Yogesh Sharma, Asso. Professor Prof. H.B. Nanadwana Department of Law Director, SOCE Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota External Members: 1. Prof. Satish C. Shastri 2. Prof. V.K. Sharma Dean, Faculty of law, MITS, Laxmangarh Deptt.of Law Sikar, and Ex. Dean, J.N.Vyas University, Jodhpur University of Rajasthan, Jaipur (Raj.) 3. Dr. M.L. Pitaliya 4. Prof. (Dr.) Shefali Yadav Ex. Dean, MDS University, Ajmer Professor & Dean - Law Principal, Govt. P.G.College, Chittorgarh (Raj.) Dr. Shakuntala Misra National Rehabilitation University, Lucknow 5. Dr Yogendra Srivastava, Asso. Prof. School of Law, Jagran Lakecity University, Bhopal Editing and Course Writing Editor: Course Writer: Dr. Yogesh Sharma Dr Visvas Chauhan Convener, Department of Law State P. G. Law College, Bhopal Vardhaman Mahaveer Open niversity, Kota Academic and Administrative Management Prof. Vinay Kumar Pathak Prof. L.R. Gurjar Vice-Chancellor Director (Academic) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Prof. Karan Singh Dr. Anil Kumar Jain Director (MP&D) Additional Director (MP&D) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Course Material Production Prof. Karan Singh Director (MP&D) Vardhaman Mahaveer Open University, Kota Production 2015 ISBN- All right reserved no part of this book may be reproduced in any form by mimeograph or any other means, without permission in writing from the V.M. -

Chennai District Origin of Chennai

DISTRICT PROFILE - 2017 CHENNAI DISTRICT ORIGIN OF CHENNAI Chennai, originally known as Madras Patnam, was located in the province of Tondaimandalam, an area lying between Pennar river of Nellore and the Pennar river of Cuddalore. The capital of the province was Kancheepuram.Tondaimandalam was ruled in the 2nd century A.D. by Tondaiman Ilam Tiraiyan, who was a representative of the Chola family at Kanchipuram. It is believed that Ilam Tiraiyan must have subdued Kurumbas, the original inhabitants of the region and established his rule over Tondaimandalam Chennai also known as Madras is the capital city of the Indian state of Tamil Nadu. Located on the Coromandel Coast off the Bay of Bengal, it is a major commercial, cultural, economic and educational center in South India. It is also known as the "Cultural Capital of South India" The area around Chennai had been part of successive South Indian kingdoms through centuries. The recorded history of the city began in the colonial times, specifically with the arrival of British East India Company and the establishment of Fort St. George in 1644. On Chennai's way to become a major naval port and presidency city by late eighteenth century. Following the independence of India, Chennai became the capital of Tamil Nadu and an important centre of regional politics that tended to bank on the Dravidian identity of the populace. According to the provisional results of 2011 census, the city had 4.68 million residents making it the sixth most populous city in India; the urban agglomeration, which comprises the city and its suburbs, was home to approximately 8.9 million, making it the fourth most populous metropolitan area in the country and 31st largest urban area in the world. -

An Analytical Study of Reforms and Their Impact on Indian Banking

International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), © Research India Publications http://www.ripublication.com An Analytical Study of Reforms and their Impact on Indian Banking Sector Neha Chadha Ph.D Scholar (Commerce) (2014-2017) Kalinga University, Raipur, C.G. Enrollment No. 15020108 (KU002MMXIV02010191) Abstract We are living in the fast changing world. With new emerging technologies and rapid expansion of internet e-mail etc. excess to global information and knowledge and to commodity markets worldwide is how much easier than before, in a bit to meet commitments to international institutional like world bank, IMF, WTO country after country is pulling down barriers to foreign trade and investment. The government of India has also followed suit with the result that quantitative restrictions on foreign trade are being dismantled speedily. On the domestic front there are clear signals of privatization and liberalization as licensing is being given up, controls are being dismantled, restrictive laws are being removed and the privatization is being used in almost all sectors. India is a developing economy with the low growth of GDP, low per capita income, rapid population growth existence of dualism, technological backwardness etc. At the time of independence it was a close economy with no FDI, no MNC‘s, restriction on currency movements, quota raj, permit raj, license raj and socialistic pattern of economy. 112 International Journal of Business Administration and Management. ISSN 2278-3660 Volume 7, Number 1 (2017), © Research India Publications http://www.ripublication.com Indian banking sector was also working in the close economy scenario. -

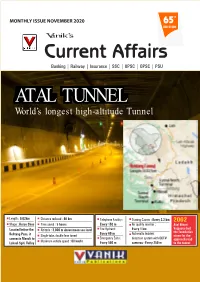

Magazine for the Month of November 2020

th MONTHLY ISSUE NOVEMBER 2020 65 EDITION Vanik’s Current Affairs Banking | Railway | Insurance | SSC | UPSC | OPSC | PSU ATAL TUNNEL World’s longest high-altitude Tunnel Length : 9.02km Distance reduced : 46 km Telephone Facility : Turning Cavern : Every 2.2 km 2002 Shape : Horse Shoe Time saved : 5 hours Every 150 m Air quality monitor : Atal Bihari Located below the Altitude : 3,000 m above mean sea level Fire Hydrant : Every 1 km Vajpayee laid Every 60 m Automatic incident the foundation Rohtang Pass, it Single-tube, double lane tunnel stone for the connects Manali to Emergency Exits : detection system with CCTV approach road Maximum vehicle speed : 80 km/hr Lahaul-Spiti Valley Every 500 m cameras : Every 250 m to the tunnel Contents Topics of the Month -------------------------------------------------------- 1 Economy -------------------------------------------------------- 28 RBI in News -------------------------------------------------------- 28 SBI in News --------------------------------------------------------- 30 Other Banks in News ------------------------------------------------ 31 Financial News ------------------------------------------------ 35 MOU and Agreement ------------------------------------------------ 37 Rating and Survey ------------------------------------------------ 38 Fund and Financial Allocation ------------------------------------- 39 Corporate Business and E-Business ------------------------------- 41 Committee and Its Head -------------------------------------------------------- 41 State News -------------------------------------------------------- -

Draft Letter of Offer for Private Circulation to the Equity Shareholders of the Bank Only

Draft Letter of Offer For private circulation to the equity shareholders of the Bank only THE DHANALAKSHMI BANK LIMITED (Incorporated on November 14, 1927 under the Indian Companies Act, 1913 with Registrar of Companies, Kerala) Registered Office : Dhanalakshmi Buildings, Naickanal, Thrissur - 680001 Tel : 0487-2335131, 2335177. Fax : 0487- 2335580; Email : [email protected] ,Website : www.dhanbank.com Contact person: Mr. Ravindran K. Warrier , Company Secretary and Compliance Officer FOR PRIVATE CIRCULATION TO THE EQUITY SHAREHOLDERS OF THE BANK ONLY Issue of [●] Equity Shares of Rs. 10 each for cash at a premium of Rs. [●]/- per Equity Share aggregating to Rs. 200 crores on rights basis to the existing Equity Shareholders of The Dhanalakshmi Bank Limited. (the “Bank”/“DBL”/the “Issuer”) in the ratio of [●] Equity Share[s] for every [●] Equity Share[s] (i.e. [●]:[●]) held as on the record date i.e. [●], 2007. The Issue Price is [●] times the face value of the Equity Shares of our Bank. GENERAL RISKS Investment in equity and equity related securities involve a degree of risk and investors should not invest any funds in this issue unless they can afford to take the risk of losing their investment. Investors are advised to read the risk factors carefully before taking an investment decision in this Issue. For taking an investment decision, investors must rely on their own examination of the Issuer and the Issue including the risks involved. The securities have not been recommended or approved by the Securities and Exchange Board of India (SEBI) nor does SEBI guarantee the accuracy or the adequacy of this document. -

Central Bank of India

CMYK Red Herring Prospectus Dated July 11, 2007 100% Book Built Issue Central Bank of India (Central Bank of India was originally incorporated on December 21, 1911 under provisions of the Indian Companies Act, 1882 as “The Central Bank of India Limited” with its head office at Mumbai (then known as Bombay). For details of change in name and head office, see the section titled “History and Certain Corporate Matters” on page 122 of this Red Herring Prospectus). (Constituted under the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 on July 19, 1969) Head Office: Chandermukhi, Nariman Point, Mumbai 400 021 Tel: (91 22) 6638 7828; Fax: (91 22) 2283 5198 Contact Person: S.R. Shukla; Email: [email protected]; Website: www.centralbankofindia.co.in PUBLIC ISSUE OF 80,000,000 EQUITY SHARES OF RS. 10 EACH (“EQUITY SHARES”) OF CENTRAL BANK OF INDIA (THE “BANK” OR THE “ISSUER”) FOR CASH AT A PRICE OF RS. [z] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF RS. [z] PER EQUITY SHARE) AGGREGATING RS. [z] MILLION (THE “ISSUE”). THE ISSUE INCLUDES A RESERVATION OF 4,000,000 EQUITY SHARES OF RS. 10 EACH FOR THE ELIGIBLE EMPLOYEES (THE “EMPLOYEE RESERVATION PORTION”). THE ISSUE LESS THE EMPLOYEE RESERVATION PORTION IS REFERRED TO AS THE “NET ISSUE”. THE ISSUE WILL CONSTITUTE 24.68% OF THE PRE ISSUE AND 19.80% OF THE POST ISSUE FULLY DILUTED PAID-UP EQUITY CAPITAL OF THE BANK. PRICE BAND: RS. 85 TO RS. 102 PER EQUITY SHARE OF FACE VALUE RS. 10 EACH. THE FACE VALUE OF THE EQUITY SHARES IS RS. -

AXIS/CO/CS/158/2021-22 5Th July, 2021 Chief Manager, Listing & Compliance Department National Stock Exchange of India Limi

AXIS/CO/CS/158/2021-22 5th July, 2021 Chief Manager, The Deputy General Manager, Listing & Compliance Department Listing Department National Stock Exchange of India Limited BSE Limited Exchange Plaza, 5th Floor 1st Floor, New Trading Ring, Plot No. C/1, “G” Block Rotunda Building Bandra-Kurla Complex P. J. Towers, ‘Dalal Street Fort, Bandra (E), Mumbai – 400 051 Mumbai – 400 001 NSE Symbol: AXISBANK BSE Scrip Code : 532215 Dear Sir(s), SUB: ANNUAL REPORT OF AXIS BANK LIMITED FOR THE FINANCIAL YEAR ENDED 31ST MARCH 2021, INCLUDING THE NOTICE OF 27TH ANNUAL GENERAL MEETING. REF: REGULATION 34 (1) OF THE SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2015 (“LISTING REGULATIONS”). We wish to inform you that the 27th Annual General Meeting (the “AGM”) of Axis Bank Limited (the “Bank”) will be held on Friday, 30th July 2021 at 10.00 A.M. through Video Conferencing, in compliance with the relevant provisions of the Companies Act, 2013 and the Rules made thereunder read with General Circular No. 14/ 2020 dated 8th April, 2020, General Circular No. 17/2020 dated 13th April, 2020, General Circular 20/ 2020 dated 5th May, 2020 and General Circular No. 02/2021 dated 13th January, 2021 issued by the Ministry of Corporate Affairs (the “MCA”), and Circular No. SEBI/ HO/ CFD/ CMD1/ CIR/ P/ 2020/79 dated 12th May, 2020 and Circular No. SEBI/ HO/ CFD/ CMD2/ CIR/ P/ 2021/11 dated 15th January, 2021, issued by the Securities and Exchange Board of India (the “SEBI”) (the “Relevant Circulars”). In terms of Regulation 34(1) of the Listing Regulations, please find enclosed herewith a soft copy of the Notice convening the 27th AGM and the Annual Report of the Bank for the Financial Year 2020- 21, for your ready reference and records. -

Banking Development in India

Journal of Economics and Sustainable Development www.iiste.org ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.5, No.24, 2014 Banking Development in India Rimple Saini 1 Dr. S.L. Lodha 2 1. Research Scholar, M.J.R.P. University, Jaipur Rajasthan-India 2. Former Associate Professor Economics, Rajasthan University Jaipur & M.D.S. University, Ajmer, Rajasthan, India. * E-mail of the corresponding author: [email protected] Abstract India has a long history of financial intermediation. The first bank in India was set up in 1770 and named as Bank of Hindustan. The earliest attempt to establish a Central Bank was in 1773. India was also a fore runner in terms of development of financial markets. By independence, India had a fairly well developed commercial banking system in existence. In 1951, there were 566 private commercial banks in India with 4151 branches, the majority of which were confined to large towns and cities. The Reserve Bank of India (the Central Bank of the Country) was established in 1935 as a shareholders institution like the Bank of England. The Reserve Bank of India became a state owned institution from January 1, 1949. It was only in this year that the Banking Regulation Act was enacted to provide a framework for regulation and supervision of commercial banking system. The institution building and development of the financial system was propelled by the planners after independence. The vision was to ensure that sectoral needs of credit to agriculture and industry were met in an organised manner. The RBI was vested with the major, responsibility of developing the institutional infrastructure in the financial system. -

Indian Bank Cover.Pmd

Red Herring Prospectus Dated January 17, 2007 100% Book Built Issue INDIAN BANK (Indian Bank was originally incorporated on March 5, 1907 under provisions of the Indian Companies Act, 1882 as "The Indian Bank Limited" with its head office at Chennai (then known as Madras). For details of change in name and head office, see the section titled "History and Certain Corporate Matters" on page 100 of this Red Herring Prospectus). (Constituted under the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 on July 19, 1969) Head Office: 66, Rajaji Salai, Chennai 600 001, India Tel: (91 44) 25260337; Fax: (91 44) 25263949 Contact Person: V. Ganesan; Email: [email protected]; Website: www.indianbank.in PUBLIC ISSUE OF 85,950,000 EQUITY SHARES OF RS. 10 EACH ("EQUITY SHARES") OF INDIAN BANK (THE "BANK" OR THE "ISSUER") FOR CASH AT A PRICE OF RS. [z] PER EQUITY SHARE (INCLUDING A SHARE PREMIUM OF RS. [z] PER EQUITY SHARE) AGGREGATING RS. [z] MILLION (THE "ISSUE"). THE ISSUE INCLUDES A RESERVATION OF 8,595,000 EQUITY SHARES OF RS. 10 EACH FOR THE ELIGIBLE EMPLOYEES (THE "EMPLOYEE RESERVATION PORTION"). THE ISSUE LESS THE EMPLOYEE RESERVATION PORTION IS REFERRED TO AS THE "NET ISSUE". THE ISSUE WILL CONSTITUTE 25 % OF THE PRE ISSUE AND 20 % OF THE POST ISSUE FULLY DILUTED PAID-UP EQUITY CAPITAL OF THE BANK. PRICE BAND: RS. 77 TO RS. 91 PER EQUITY SHARE OF FACE VALUE RS. 10 EACH. THE FACE VALUE OF THE EQUITY SHARES IS RS. 10. THE ISSUE PRICE IS 7.7 TIMES THE FACE VALUE AT THE LOWER END OF THE PRICE BAND AND 9.1 TIMES THE FACE VALUE AT THE HIGHER END OF THE PRICE BAND. -

News Analysis (17 Oct, 2018)

News Analysis (17 Oct, 2018) drishtiias.com/current-affairs-news-analysis-editorials/news-analysis/17-10-2018/print UN Report on FDI India attracted USD 22 billion of FDI flows in the first half of 2018, according to a UN Conference on Trade and Development (UNCTAD) report- ‘Investment Trends Monitor’. The report highlighted that said that in South Asia, India's FDI inflows contributed to the subregion’s 13% rise in FDI in the first half of the year. The report also states that the global foreign direct investment dropped by 41% in the same period due to tax reforms carried out by the US administration. These reforms have encouraged big firms in the US to bring back earnings from abroad, specially from Western European countries. The decline in FDI is happening mainly in wealthy, industrialized nations, especially in North America and Western Europe. The developing economies saw FDI flows declining “only slightly” in the first half of the year by 4%, compared with 2017. Other factors that have led to this decline are uncertainty about the detail and impact of tax reform and the potential impact of unresolved international trade disputes; such as the tit-for-tat tariffs imposed by the United States and China. In contrast to the overall decline in foreign investment, the report highlights a 42% increase in “greenfield” projects. These initiatives can involve building operations in a foreign country from scratch and they are seen an indicator of future trends. China was the largest recipient of FDI, attracting an estimated $ 70 billion in inflows in the first half of the year, followed by the UK with $ 65.5 billion, the US with $ 46.5 billion. -

Current Affairs Question Bank: October 2020

Current Affairs Question Bank: October 2020 CURRENT AFFAIRS QUES TION BANK: OCTOBER 2020 Q.1 Who among the following launched ‘Defence India Startup Challenge-4’ (DISC-4)? a) Manoj Mukund Naravane b) Bipin Rawat c) Rajnath Singh d) Ajay Kumar e) None of these Q.2 Who among the following announces Shanti Swarup Bhatnagar (SSB) Prize? a) ICMR b) NITI Aayog c) IIT Lucknow d) CSIR (Council of Scientific and Industrial Research) e) None of these Q.3 In which field Shanti Swarup Bhatnagar (SSB) Prizes are given? a) Science b) Art c) Social Service d) History e) None of these Q.4 Who signed SoI with Embassy of Netherland to support decarbonization and energy transition agenda? a) ONGC b) Power Grid Corporation c) Power Finance Corporation d) NITI Aayog e) None of these Q.5 Which bank launched ‘Ind Guru’, E-learning platform? a) Indian Overseas Bank b) Indian Bank c) IndusInd Bank d) Jammu and Kashmir Bank e) None of these 1 www.BankExamsToday.com Current Affairs Question Bank: October 2020 Q.6 Who among the following launched ‘Digital Suraksha Group Insurance’? a) Flipkart and Bajaj Allianz General Insurance b) Snapdeal and ICICI Bank c) Amazon and HDFC Ergo d) Myntra and IFFCO Tokio General Insurance e) None of these Q.7 Who among the following to undertake Sanitation Literacy Campaign in Karnataka? a) Karnataka Bank b) IIT Dharwad c) NABARD d) SBI e) None of these Q.8 When is International Day of Older Persons observed? a) 1st Oct b) 2nd Oct c) 3rd Oct d) 4th Oct e) None of these Q.9 India attended the 6th Joint Consultative Commission (JCC) -

Legal Fortnight February 2021 Edition, Volume

1 FOREWORD More has been said about the writing of lawyers and judges than of any other group, except, of course, poets and novelists. The difference is that while the latter has usually been admired for their writing, the public has almost always damned lawyers and judges for theirs. If this state of affairs has changed in recent times, it is only in that many lawyers and judges have now joined the rest of the world is complaining about the quality of legal prose. Our best wishes to all these student contributors, for their future endeavors. Our best wishes and assurance to the readers that this will add a lot to the knowledge after reading this perfect case compilation. It’s not just for the legal fraternity but for anyone who has an interest in the field of law. Vrinda Khanna& Nandini Mangla (Associate) All India Legal Forum 2 PREFACE All India Legal Forum is replenished with information to give students a ready reference to the various areas of legal issues and news. All India Legal Forum is a team of more than 400 law students across the country to tackle basic problems which a legal researcher faces in day to day life, putting forward the basic things needed for researching and drafting. The All India Legal forum strives at providing a valuable contribution to contemporary legal issues and development. The organization seeks to bring out a platform to provide resourceful insights on law-related topics for the ever-growing legal fraternity. All India Legal Forum doesn't just publish blogs but also guides the authors.