Banking Development in India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa](https://docslib.b-cdn.net/cover/7622/banking-law-time-1-30-hours-maximum-marks-100-tc-rd-dgk-u-tk-bl-%C3%A1-uiqflrdk-dks-u-kksysa-147622.webp)

BANKING LAW Time : 1:30 Hours Maximum Marks-100 Tc Rd Dgk U Tk;] Bl Á’Uiqflrdk Dks U [Kksysa

Á’uiqfLrdk Øekad Roll No.-------------------- Question Booklet No. Á’uiqfLrdk fljht O.M.R. Serial No. Question Booklet Series A L.L.B (Fifth Semester) Examination, 2021 LLB504 BANKING LAW Time : 1:30 Hours Maximum Marks-100 tc rd dgk u tk;] bl Á’uiqfLrdk dks u [kksysa funsZ’k % & 1. ijh{kkFkhZ vius vuqØekad] fo”k; ,oa Á’uiqfLrdk dh fljht dk fooj.k ;FkkLFkku lgh& lgh Hkjsa] vU;Fkk ewY;akdu esa fdlh Hkh Ádkj dh folaxfr dh n’kk esa mldh ftEesnkjh Lo;a ijh{kkFkhZ dh gksxhA 2. bl Á’uiqfLrdk esa 100 Á’u gSa] ftues ls dsoy 75 Á’uksa ds mRrj ijh{kkfFkZ;ksa }kjk fn;s tkus gSA ÁR;sd Á’u ds pkj oSdfYid mRrj Á’u ds uhps fn;s x;s gSaA bu pkjksa esa ls dsoy ,d gh mRrj lgh gSA ftl mRrj dks vki lgh ;k lcls mfpr le>rs gSa] vius mRrj i=d (O.M.R. ANSWER SHEET) esa mlds v{kj okys o`Rr dks dkys ;k uhys cky IokabV isu ls iwjk Hkj nsaA ;fn fdlh ijh{kkFkhZ }kjk fu/kkZfjr Á’uksa ls vf/kd Á’uksa ds mRrj fn;s tkrs gSa rks mlds }kjk gy fd;s x;s ÁFker% ;Fkk fufnZ”V Á’uksRrjksa dk gh ewY;kadu fd;k tk;sxkA 3. ÁR;sd Á’u ds vad leku gSaA vki ds ftrus mRrj lgh gksaxs] mUgha ds vuqlkj vad Ánku fd;s tk;saxsA 776 4. lHkh mRrj dsoy vksŒ,eŒvkjŒ mRrj i=d (O.M.R. -

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo All SUPER Current Affairs Product Worth Rs 1200 @ 399/- ( DEAL Of The Year ) Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 3rd August 2021 By Dream Big Institution: (SUPER Current Affairs) © Copyright 2021 Q.World Sanskrit Day 2021 was celebrated on ___________. A) 3 August C) 5 August B) 4 August D) 6 August Answer - A Sanskrit Day is celebrated every year on Shraavana Poornima, which is the full moon day in the month of Shraavana in the Hindu calendar. In 2020, Sanskrit Day was celebrated on August 3, while in 2019 it was celebrated on 15 August. Sanskrit language is believed to be originated in India around 3,500 years ago. Q.Nikol Pashinyan has been re-appointed as the Prime Minister of which country? A) Ukraine C) Turkey B) Armenia D) Lebanon Answer - B Nikol Pashinyan has been re-appointed as Armenia’s Prime Minister by President Armen Sarkissian. Pashinyan was first appointed as the prime minister in 2018. About Armenia: Capital: Yerevan Currency: Armenian dram President: Armen Sargsyan Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Q.Min Aung Hlaing has taken charge as the Prime Minister of which country? A) Bangladesh C) Thailand B) Laos D) Myanmar Answer - D The Chief of the Myanmar military, Senior General Min Aung Hlaing has taken over as the interim prime minister of the country on August 01, 2021. About Myanmar Capital: Naypyitaw; Currency: Kyat. NEWLY Elected -

Influence of Merger on Performance of Indian Banks: a Case Study

Journal of Poverty, Investment and Development www.iiste.org ISSN 2422-846X An International Peer-reviewed Journal Vol.32, 2017 Influence of Merger on Performance of Indian Banks: A Case Study Gopal Chandra Mondal Research Scholar, Dept. of Economics, Vidyasagar University, India& Chief Financial Officer,IDFC Foundation,New Delhi, India Dr Mihir Kumar Pal Professor,Dept. Of Economics, Vidyasagar University, India Dr Sarbapriya Ray* Assistant Professor, Dept. of Commerce, Vivekananda College, Under University of Calcutta, Kolkata,India Abstract The study attempts to critically analyze and evaluate the impact of merger of Nedungadi bank and Punjab National Bank on their operating performance in terms of different financial parameters. Most of the financial indicators of Nedungadi bank and Punjab National Bank display significant improvement in their operational performance during post merger period. Therefore, the results of the study reveal that average financial ratios of sampled banks in Indian banking sector showed a remarkable and significant improvement in terms of liquidity, profitability, and stakeolders wealth. Keywords: Merger, India, Nedungadi bank, Punjab National Bank. 1. Introduction: Concept of merger and acquisition has become very trendy in present day situation, especially, after liberalization initiated in India since 1991. The emergent tendency towards mergers and acquisitions (M&As) world-wide, has been ignited by intensifying competition. Mergers and acquisitions have been taking place in corporate as well as banking sector to abolish financial, operation and managerial weakness as well as to augment growth and expansion , to create shareholders value, stimulate health of the organization with a view to confront challenges in the face of stiff competitive in globalized environment. -

Bank Competition Using Networks: a Study on an Emerging Economy

Journal of Risk and Financial Management Article Bank Competition Using Networks: A Study on an Emerging Economy Molla Ramizur Rahman * and Arun Kumar Misra Vinod Gupta School of Management, Indian Institute of Technology Kharagpur, Kharagpur 721302, West Bengal, India; [email protected] * Correspondence: [email protected] Abstract: Interconnectedness among banks is a key distinguishing feature of the banking system. It helps mitigate liquidity problems but on the other hand, acts as a curse in propagating systemic risk at times of distress. Thus, as banks cannot function in isolation, this study uses the Contemporary Theory of Networks to examine banking competition in India for five distinct economic phases, emphasizing upon the Global Financial Crisis (GFC) and the ongoing COVID-19 pandemic. This paper proposes a Market Power Network Index (MPNI), which uses network parameters to measure banks’ market power. This network structure shows a formation of bank clusters that are involved in competition. Specifically, network properties, such as centroid, average path length, the distance of a node from the centroid, the total number of connections in the inter-bank market, and network density, do go on to explain banking competition. It is interesting to note that crisis periods witness a lower level of competition, with GFC bearing the least competition. The ongoing COVID-19 pandemic shows a lower trend, but it is of a higher magnitude than GFC. It was also found that big-sized, profitable, capital adequate, and public banks dominate the banking system. Notably, this study was conducted on a sample of 33 listed Indian banks from April 2008 to December 2020. -

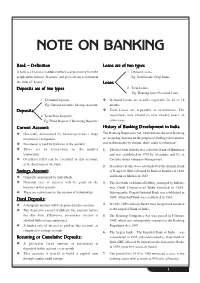

Note on Banking

NOTE ON BANKING Bank – Definition Loans are of two types A bank is a financial institution which accepts money from the 1. Demand Loans: people in the form of ‘Deposits’ and gives advances to them in Eg: Gold Loans, Crop loans. the form of “Loans”. Loans Deposits are of two types 2. Term Loans: Eg: Housing loan / Personal Loan. 1. Demand Deposits Y Demand Loans are usually repayable in 12 to 18 Eg: Current Account / Savings Account. months. Deposits Y Term Loans are repayable in instalments. The 2. Term/Time Deposits repayment may extend to over twenty years, in Eg: Fixed Deposits / Recurring Deposits. some cases. Current Account: History of Banking Development in India Y Generally maintained by businesspersons / large The Banking Regulation Act, 1949 defines the term Banking institutions / companies. as “accepting, deposits for the purpose of lending or investment, Y No interest is paid for balances in the account. and withdrawable by cheque, draft, order or otherwise”. Y There are no restrictions on the number 1. The first bank in India was called the Bank of Hindustan transactions. and was established in 1770 by Alexander and Co, at Y Overdraft (OD) can be extended in this account, Calcutta, under European Management. at the discretion of the bank. 2. Presidency Banks were established by the British: Bank Savings Account: of Bengal in 1806, followed by Bank of Bombay in 1840, Y Generally maintained by individuals. and Bank of Madras in 1843. Y Nominal rate of interest will be paid on the 3. The first bank with limited liability, managed by Indians, balances in this account. -

March 2020 Contents Àh$Mez {V{W : 14-05-2020

¶y{Z¶Z Ymam UNION DHARA AZwH«$‘{UH$m OZdar-_mM©, 2020 January-March 2020 Contents àH$meZ {V{W : 14-05-2020 ‘w»¶ ‘hmà~§YH$ (‘mZd g§gmYZ) · n[aÑí¶ 3 · goÝQ´>a ñàoS : >bmhm¡b Am¡a ñnr{V 38-39 ~«Ooída e‘m© · g§nmXH$s¶ 4 · HR Intregration in successful Chief General Manager (HR) Bank Amalgamation 40-42 Brajeshwar Sharma · g§dmXXmVm gå‘obZ 5 · {db¶/g‘m‘obZ ‘| ‘mZd 43 g§nmXH$ · gm{h˶ OJV go... 6-7 S>m°. gwb^m H$moao g§gmYZ nj · H$mì¶Ymam 8-9 Editor · Triveni Sangam... 44-45 Dr. Sulabha Kore · {db¶-g‘m‘obZ/The Rebirth 10-11 · Union elite - a niche banking 46-47 g§nmXH$s¶ gbmhH$ma · The Amalgamation of banks 12-13 A{dZme Hw$‘ma qgh · AmAmo, {‘b OmE§ h‘... 48 · ew^‘ñVw 14 Ho$. nr. AmMm¶© · Merger/Amalgamation of Banks 49-51 {ZVoe a§OZ · {eIa H$s Amoa... 15 · ^maVr¶ AW©ì¶dñWm na 52-53 Zdb {H$emoa Xr{jV · h‘mao H$bmH$ma 16-17 ~¢H$m| Ho$ {db¶Z H$m à^md Editorial Advisors Avinash Kumar Singh · h‘| Jd© h¡ 18 · ¶y{ZdZ 54-55 K. P. Acharya · Iob OJV go... 19 · Role of Employee in Merger/ 56 Nitesh Ranjan Amalgamation · EH$ ‘O~yV Ed§ ~‹S>r Q>r‘ 20 Naval Kishor Dixit · · Cultural Integration & 21 MaH$ H$m H$moZm 57 Printed and published by Dr. Sulabha Kore Amalgamation · on behalf of Union Bank of India and godm{Zd¥Îm OrdZ go.. -

Trevor Hart Banking in a New World: the Beginnings of ANZ Bank

Trevor Hart Banking in a new world: the beginnings of ANZ Bank Proceedings of the ICOMON meetings, held in conjunction with the ICOM Conference, Melbourne (Australia, 10-16 October, 1998), ed. by Peter Lane and John Sharples. Melbourne, Numismatic Association of Australia, Inc, 2000. 117 p. (NAA Special publication, 2). (English). pp. 39-46 Downloaded from: www.icomon.org BANKING IN A NEW WORLD THE BEGINNINGS OF ANZ BANK By Trevor Hart ANZ Bank, Melbourne, Australia For its first twenty-nine years proposed to the Government in Australia had no bank. The British England, the formation of "The New settlement of Australia began in South Wales Loan Bank" based on 1788, but Australia's first bank, the the bank at the Cape of Good Hope. Bank of New South Wales, did not In 1812 the government refused open until 1817. his proposal. Macquarie accepted this refusal but was still convinced of Australia was founded as a the need for a bank in the colony.4 In self-supporting penal colony and 1816 he acted again, this time monetary arrangements were ad hoc. "convening a meeting of the A local currency of small private magistrates, principal merchants and promissory notes grew up in gentlemen of Sydney ... at which my conjunction with the circulation of favourite measure of a bank was Government Store receipts. This led brought forward."5 Macquarie issued to a dual monetary standard in a 'charter' for seven years to the which 'currency' came to mean directors of the new bank (which "money of purely local was later disallowed by the British acceptability" and 'sterling' meant Government) and on 8 April 1817 "any form of money .. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Banking Laws in India

Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 1 Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 2 Course Development Committee CBIL-01 Chairman Prof. L. R. Gurjar Director (Academic) Vardhaman Mahaveer Open University, Kota Convener and Members Convener Dr. Yogesh Sharma, Asso. Professor Prof. H.B. Nanadwana Department of Law Director, SOCE Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota External Members: 1. Prof. Satish C. Shastri 2. Prof. V.K. Sharma Dean, Faculty of law, MITS, Laxmangarh Deptt.of Law Sikar, and Ex. Dean, J.N.Vyas University, Jodhpur University of Rajasthan, Jaipur (Raj.) 3. Dr. M.L. Pitaliya 4. Prof. (Dr.) Shefali Yadav Ex. Dean, MDS University, Ajmer Professor & Dean - Law Principal, Govt. P.G.College, Chittorgarh (Raj.) Dr. Shakuntala Misra National Rehabilitation University, Lucknow 5. Dr Yogendra Srivastava, Asso. Prof. School of Law, Jagran Lakecity University, Bhopal Editing and Course Writing Editor: Course Writer: Dr. Yogesh Sharma Dr Visvas Chauhan Convener, Department of Law State P. G. Law College, Bhopal Vardhaman Mahaveer Open niversity, Kota Academic and Administrative Management Prof. Vinay Kumar Pathak Prof. L.R. Gurjar Vice-Chancellor Director (Academic) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Prof. Karan Singh Dr. Anil Kumar Jain Director (MP&D) Additional Director (MP&D) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Course Material Production Prof. Karan Singh Director (MP&D) Vardhaman Mahaveer Open University, Kota Production 2015 ISBN- All right reserved no part of this book may be reproduced in any form by mimeograph or any other means, without permission in writing from the V.M. -

Mergers and Acquisitions of Banks in Post-Reform India

SPECIAL ARTICLE Mergers and Acquisitions of Banks in Post-Reform India T R Bishnoi, Sofia Devi A major perspective of the Reserve Bank of India’s n the Reserve Bank of India’s (RBI) First Bi-monthly banking policy is to encourage competition, consolidate Monetary Policy Statement, 2014–15, Raghuram Rajan (2014) reviewed the progress on various developmental and restructure the system for financial stability. Mergers I programmes and also set out new regulatory measures. On and acquisitions have emerged as one of the common strengthening the banking structure, the second of “fi ve methods of consolidation, restructuring and pillars,” he mentioned the High Level Advisory Committee, strengthening of banks. There are several theoretical chaired by Bimal Jalan. The committee submitted its recom- mendations in February 2014 to RBI on the licensing of new justifications to analyse the M&A activities, like change in banks. RBI has started working on the framework for on-tap management, change in control, substantial acquisition, licensing as well as differentiated bank licences. “The intent is consolidation of the firms, merger or buyout of to expand the variety and effi ciency of players in the banking subsidiaries for size and efficiency, etc. The objective system while maintaining fi nancial stability. The Reserve Bank will also be open to banking mergers, provided competi- here is to examine the performance of banks after tion and stability are not compromised” (Rajan 2014). mergers. The hypothesis that there is no significant Mergers and acquisitions (M&A) have been one of the improvement after mergers is accepted in majority of measures of consolidation, restructuring and strengthening of cases—there are a few exceptions though. -

Commercial Bank

Commercial bank An institution which accepts deposits, makes business loans, and offers related services. Commercial banks also allow for a variety of deposit accounts, such as checking, savings, and time deposit. These institutions are run to make a profit and owned by a group of individuals, yet some may be members of the Federal Reserve System. While commercial banks offer services to individuals, they are primarily concerned with receiving deposits and lending to businesses. Nature of Commercial Banks Commercial banks are an organization which normally performs certain financial transactions. It performs the twin task of accepting deposits from members of public and make advances to needy and worthy people form the society. When banks accept deposits its liabilities increase and it becomes a debtor, but when it makes advances its assets increases and it becomes a creditor. Banking transactions are socially and legally approved. It is responsible in maintaining the deposits of its account holders. Indian Banking Industry Banking in India originated in the first decade of 18th century with The General Bank of India coming into existence in 1786. This was followed by Bank of Hindustan. Both these banks are now defunct. The oldest bank in existence in India is the State Bank of India being established as "The Bank of Bengal" in Calcutta in June 1806. A couple of decades later, foreign banks like Credit Lyonnais started their Calcutta operations in the 1850s. At that point of time, Calcutta was the most active trading port, mainly due to the trade of the British Empire, and due to which banking activity took roots there and prospered. -

Introduction Banking in India

Introduction Banking in India Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India’s Independence became the State Bank of India. Origin of Banking in India Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company’s debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton.