Official Site, Telegram, Facebook, Instagram, Instamojo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Compassionate and Visionary Leadership. Key Lessons of Social Democratic Governance in Times of Covid-19

PROGRESS IN EUROPE 31 Compassionate and visionary leadership Key lessons of Social Democratic governance in times of Covid-19 Ania Skrzypek The Covid-19 pandemic has triggered an unforeseen reaction from European citizens. People – the same people that until a year ago were very vocal in expressing their mistrust in politics and institutions – instinctively turned to their national government to receive care and cure in a moment of deep crisis. Furthermore, they found a feeling of mutual solidarity, particularly in the fi rst stages of the lockdown, and naturally longed for a more robust welfare state. These are not changes that one can consider permanent or long-term. Yet they have had signifi cant implications for politics and for political parties, and for the Social Democratic ones in particular, which are strongly committed to values such as solidarity, and have traditionally been cham- pions of the European welfare states. The new public mood has allowed for welfare policies to be recognised as essential, that during the 2008 fi nancial crisis were considered simply too costly. What is more, the crisis has offered the opportunity for the Social Democratic parties in government to set the direction rather than merely manage the crisis. Empathy and com- munication focused on safeguarding jobs have become fundamental tools for establishing a connection with the European people. At the end of 2020 social media were fl ooded by memes that would immortalise the passing year as a complete disaster. The depiction varied with some suggesting ‘all down the drain’ and others implicitly offering the hope that from the absolute low in which the world had found itself, there was no other way but upwards. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Introduction Banking in India

Introduction Banking in India Banking in India originated in the last decades of the 18th century. The first banks were The General Bank of India which started in 1786, and the Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the Bank of Calcutta in June 1806, which almost immediately became the Bank of Bengal. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras, all three of which were established under charters from the British East India Company. For many years the Presidency banks acted as quasi-central banks, as did their successors. The three banks merged in 1921 to form the Imperial Bank of India, which, upon India’s Independence became the State Bank of India. Origin of Banking in India Indian merchants in Calcutta established the Union Bank in 1839, but it failed in 1848 as a consequence of the economic crisis of 1848-49. The Allahabad Bank, established in 1865 and still functioning today, is the oldest Joint Stock bank in India. (Joint Stock Bank: A company that issues stock and requires shareholders to be held liable for the company’s debt) It was not the first though. That honor belongs to the Bank of Upper India, which was established in 1863, and which survived until 1913, when it failed, with some of its assets and liabilities being transferred to the Alliance Bank of Simla. When the American Civil War stopped the supply of cotton to Lancashire from the Confederate States, promoters opened banks to finance trading in Indian cotton. -

A Study on Customer Satisfaction of Bharat Interface for Money (BHIM)

International Journal of Innovative Technology and Exploring Engineering (IJITEE) ISSN: 2278-3075, Volume-8 Issue-6, April 2019 A Study on Customer Satisfaction of Bharat Interface for Money (BHIM) Anjali R, Suresh A Abstract: After demonetization on November 8th, 2016, India saw an increased use of different internet payment systems for Mobile banking saw its growth during the period of 2009- money transfer through various devices. NPCI (National 2010 with improvement in mobile internet services across Payments Corporation India) launched Bharat interface for India. SMS based applications along with mobile Money (BHIM) an application run on UPI (Unified Payment application compatible with smartphones offered improved Interface) in December 2016 to cater the growing online payment banking services to the customers. Apart from the bank’s needs. The different modes of digital payments saw a drastic mobile applications other applications like BHIM, Paytm, change in usage in the last 2 years. Though technological Tez etc. offered provided enhanced features that lead to easy innovations brought in efficiency and security in transactions, access to banking services. In addition to this, The Reserve many are still unwilling to adopt and use it. Earlier studies Bank of India has given approval to 80 Banks to start mobile related to adoption, importance of internet banking and payment systems attributed it to some factors which are linked to security, banking services including applications. Bharat Interface for ease of use and satisfaction level of customers. The purpose of money (BHIM) was launched after demonetization by this study is to unfold some factors which have an influence on National Payments Corporation (NPCI) by Prime Minister the customer satisfaction of BHIM application. -

The State Bank of Sikkim (Acquisition of Shares) and Miscellaneous Provisions Act, 1982 Act No

THE STATE BANK OF SIKKIM (ACQUISITION OF SHARES) AND MISCELLANEOUS PROVISIONS ACT, 1982 ACT NO. 62 OF 1982 [6th November, 1982.] An Act to provide, in the public interest, for the acquisition of certain shares of the State Bank of Sikkim for the purpose of better consolidation and extension of banking facilities in the State of Sikkim and for matters connected therewith or incidental thereto. WHEREAS for the purpose of better consolidation and extension of banking facilities in the State of Sikkim, it is expedient to provide for a single apex banking institution in that State, and for that purpose to provide for the acquisition of certain shares of the State Bank of Sikkim and for matters connected therewith or incidental thereto; BE it enacted by Parliament in the Thirty-third Year of the Republic of India as follows:— CHAPTER I PRELIMINARY 1. Short title and commencement.—(1) This Act may be called the State Bank of Sikkim (Acquisition of Shares) and Miscellaneous Provisions Act, 1982. (2) It shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint. 2. Definitions.—In this Act, unless the context otherwise requires,— (a) “appointed day” means the date on which this Act comes into force; (b) “co-operative bank” means the Sikkim State Co-operative Bank Limited, a society registered under the Sikkim Co-operative Societies Act, 1978 (Sikkim Act No. 12 of 1978); (c) “notification” means a notification published in the Official Gazette; (d) “prescribed” means prescribed by rules made -

Booklet on Measurement of Digital Payments

BOOKLET ON MEASUREMENT OF DIGITAL PAYMENTS Trends, Issues and Challenges Revised and Updated as on 9thMay 2017 Foreword A Committee on Digital Payments was constituted by the Ministry of Finance, Department of Economic Affairs under my Chairmanship to inter-alia recommend measures of promotion of Digital Payments Ecosystem in the country. The committee submitted its final report to Hon’ble Finance Minister in December 2016. One of the key recommendations of this committee is related to the development of a metric for Digital Payments. As a follow-up to this recommendation I constituted a group of Stakeholders under my chairmanship to prepare a document on the measurement issues of Digital Payments. Based on the inputs received from RBI and Office of CAG, a booklet was prepared by the group on this subject which was presented to Secretary, MeitY and Secretary, Department of Economic Affairs in the review meeting on the aforesaid Committee’s report held on 11th April 2017 at Ministry of Finance. The review meeting was chaired by Secretary, Department of Economic Affairs. This booklet has now been revised and updated with inputs received from RBI and CAG. The revised and updated booklet inter-alia provides valuable information on the trends in Digital Payments in 2016-17. This has captured the impact of demonetization on the growth of Digital Payments across various segments. Shri, B.N. Satpathy, Senior Consultant, NISG, MeitY and Shri. Suneet Mohan, Young Professional, NITI Aayog have played a key role in assisting me in revising and updating this booklet. This updated booklet will provide policy makers with suitable inputs for appropriate intervention for promoting Digital Payments. -

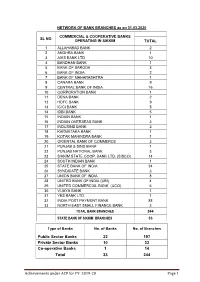

Achievements Under ACP for FY: 2019-20 Page 1 Public Sector Banks 22

NETWORK OF BANK BRANCHES as on 31.03.2020 COMMERCIAL & COOPERATIVE BANKS SL NO. OPERATING IN SIKKIM TOTAL 1 ALLAHABAD BANK 2 2 ANDHRA BANK 1 3 AXIS BANK LTD 10 4 BANDHAN BANK 1 5 BANK OF BARODA 3 6 BANK OF INDIA 2 7 BANK OF MAHARASHTRA 1 8 CANARA BANK 9 9 CENTRAL BANK OF INDIA 16 10 CORPORATION BANK 1 11 DENA BANK 2 12 HDFC BANK 9 13 ICICI BANK 5 14 IDBI BANK 5 15 INDIAN BANK 1 16 INDIAN OVERSEAS BANK 3 17 INDUSIND BANK 2 18 KARNATAKA BANK 1 19 KOTAK MAHINDRA BANK 1 20 ORIENTAL BANK OF COMMERCE 3 21 PUNJAB & SIND BANK 1 22 PUNJAB NATIONAL BANK 3 23 SIKKIM STATE COOP. BANK LTD. (SISCO) 14 24 SOUTH INDIAN BANK 1 25 STATE BANK OF INDIA 34 26 SYNDICATE BANK 3 27 UNION BANK OF INDIA 8 28 UNITED BANK OF INDIA (UBI) 4 29 UNITED COMMERCIAL BANK (UCO) 6 30 VIJAYA BANK 1 31 YES BANK LTD. 1 32 INDIA POST PAYMENT BANK 88 33 NORTH EAST SMALL FINANCE BANK 2 TOTAL BANK BRANCHES 244 STATE BANK OF SIKKIM BRANCHES 53 Type of Banks No. of Banks No. of Branches Public Sector Banks 22 197 Private Sector Banks 10 33 Co-operative Banks 1 14 Total 33 244 Achievements under ACP for FY: 2019-20 Page 1 DISTRICT-WISE BANK BRANCH as on 31.03.2020 NO. OF BRANCHES DISTRICT-WISE BANKS IN SIKKIM NORTH EAST SOUTH WEST TOTAL 1 ALLAHABAD BANK 0 2 0 0 2 2 ANDHRA BANK 0 1 0 0 1 3 AXIS BANK LTD 1 6 1 2 10 4 BANDHAN BANK 0 1 0 0 1 5 BANK OF BARODA 0 3 0 0 3 6 BANK OF INDIA 0 2 0 0 2 7 BANK OF MAHARASHTRA 0 1 0 0 1 8 CANARA BANK 1 5 2 1 9 9 CENTRAL BANK OF INDIA 1 8 1 6 16 10 CORPORATION BANK 0 1 0 0 1 11 DENA BANK 0 1 1 0 2 12 HDFC BANK LTD 0 6 3 0 9 13 ICICI BANK LTD 0 2 2 -

EAHL Newsletter

Special issue on legal landscape concerning the coronavirus outbreak – part II Mattsson, Titti; Kraft, Amelie 2020 Document Version: Publisher's PDF, also known as Version of record Link to publication Citation for published version (APA): Mattsson, T., & Kraft, A. (2020, Jun 20). Special issue on legal landscape concerning the coronavirus outbreak – part II. European Association of Health Law. Total number of authors: 2 Creative Commons License: Unspecified General rights Unless other specific re-use rights are stated the following general rights apply: Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain • You may freely distribute the URL identifying the publication in the public portal Read more about Creative commons licenses: https://creativecommons.org/licenses/ Take down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. LUND UNIVERSITY PO Box 117 221 00 Lund +46 46-222 00 00 Download date: 29. Sep. 2021 June 2020 EAHL Newsletter ISSN: 2708-2784 Special issue on legal landscape concerning the coronavirus outbreak – part II * The information presented in the reports reflects data at the time of submission EAHL EUROPEAN ASOCIATION OF HEALTH LAW Newsletter №3 / 2020 1 NEWSLETTER / EAHL June 2020 Message from the President Issue № 3 Dear EAHL members, Table of content I hope that you are all fine, despite the extra- 1. -

European Council 15-16 October 2020

OPTION 2 VARIATION FROM OPTION 1 > Using same grid to identity dierent types of patterns made up with lines BRUSSELS EUROPEAN COUNCIL 15-16 OCTOBER 2020 SWEDEN Stefan Löfven Prime Minister EUROPEAN COUNCIL Charles Michel President European Council EUROPEAN COMMISSION GERMANY Ursula von der Leyen President Angela Merkel Federal Chancellor EUROPEAN EXTERNAL ACTION SERVICE AUSTRIA Josep Borrell Fontelles Sebastian Kurz High Representative of the Union for Federal Chancellor Foreign Affairs and Security Policy GENERAL SECRETARIAT OF THE COUNCIL BELGIUM Jeppe Tranholm-Mikkelsen Alexander De Croo Secretary-General Prime Minister BULGARIA Boyko Borissov GUEST Prime Minister EUROPEAN PARLIAMENT CROATIA David Maria Sassoli Andrej Plenković President Prime Minister CYPRUS EUROPEAN COMMISSION Nicos Anastasiades Michel Barnier President of the Republic Chief Negotiator CZECHIA Andrej Babiš Prime Minister DENMARK Mette Frederiksen Prime Minister 12 october 2020 RS 292 2020 RS 292 2020 Trombino_151020.indd 1 14/10/2020 10:52:42 OPTION 2 VARIATION FROM OPTION 1 > Using same grid to identity dierent types of patterns made up with lines ÉIRE/IRELAND LUXEMBOURG Micheál Martin Xavier Bettel The Taoiseach Prime Minister ESTONIA MALTA Jüri Ratas Robert Abela Prime Minister Prime Minister FINLAND THE NETHERLANDS Sanna Marin Mark Rutte Prime Minister Prime Minister FRANCE POLAND Emmanuel Macron Mateusz Morawiecki President of the Republic Prime Minister GREECE PORTUGAL Kyriakos Mitsotakis António Costa Prime Minister Prime Minister HUNGARY ROMANIA Viktor Orbán Klaus Werner Iohannis Prime Minister President ITALY SLOVAKIA Giuseppe Conte Igor Matovič Prime Minister Prime Minister LATVIA SLOVENIA Krišjānis Kariņš Janez Janša Prime Minister Prime Minister LITHUANIA SPAIN Gitanas Nausėda Pedro Sánchez Pérez-Castejón President of the Republic Prime Minister RS 292 2020 Trombino_151020.indd 2 14/10/2020 10:52:54. -

List of Appellate Authority, S.P.I.O's & A.P.I.O

1 STATEMENT OF TRANSPARENCY OFFICER/APPELLATE AUTHORITY/SPIO/ASPIO RECEIVED FROM DEPARTMENTS/PSUs. Sl.No. Name of Department Appellate Authority SPIO ASPIO Phone No. & Fax No. & website 1. Animal Husbandry LF & 1. Dr. Sangay D.Bhutia, Addl. 1. Dr. P.K. Pradhan, l 1. Dr. N.M.Cintury, Jt. sikkim- VS Department Director (East) 9434127258 Direcor, (E&T) Director (West) ahvs.gov.in 2. Dr. S.K.Subba, Addl. 9434179031 9733047890 Director (North) 2. Dr. Puspa Kala Rai, 2. Dr. D.P.Pradhan, Jt. 9434241634 Director, (VS) Director (East) 3. Dr.Sanjay Pradhan, Jt. 9932706073 9609833698 Director (West) 9733051860 3. Dr. K.T. Bhutia, Jt. 4. Dr. Tilotama Bajgai, Jt. Director (North) Director (South) 9434179407 9434033008 4. Dr.Arthalal Rai, Dy. 5. Dr. N.T.Bhutia, Director Director (South) (VS) 9800815776 (a) Directorate of Fisheries Shri. Sunil Pradhan, Additional Shri C.S Rai, Jt. Director-II (i) Shri. Man Kumar Rai, sikkim- Director U.S/Gangtok/East ahvs.gov.in Mobile No: 9434109803 (ii) Shri Devi Bdr. Rai Jt. Director/East (iii) Shri Chuman Singh Rai, Jt.Director/South Dist. (iv) Shri Nagendra Dhakal , Dy. Director/North Dist. 2 2. Buildings & Housing Shri Kuldip Chettri, C.S 1. Shri M.N Dhakal, Spl. 1. Shri. Sonam Pinsto Bhutia, Department Secretary, (Adm.) DE (South) Gangtok 7319565234 9733017987 2. Shri Bidlat Rai, D.E (N/E) 2. Smt. Yogita Rai, Jt. Gnagtok 9647859299 3. Shri. Saurav T.Lepcha Chief Architect, Gangtok (HQ) - 9434408980 9434110063 4. Shri. Karma Yangtey, DE (Project I) Gangtok 3. Shri S.S Timsina D.E 9474529106 (N/E) 5. -

Statement by H.E. Robert Abela, Prime Minister of Malta at the High

Statement by H.E. Robert Abela, Prime Minister of Malta at the High-level meeting to commemorate the seventy-fifth Anniversary of the United Nations Item 128(a) 21 September 2020 “The future we want, the United Nations we need: reaffirming our collective commitment to multilateralism” Secretary General, President of the General Assembly, Excellencies, Ladies and Gentlemen It is highly significant that at the moment the world is gripped by a global pandemic, we come together through virtual means, to celebrate the 75th Anniversary of the United Nations. In a matter of weeks, the pandemic manifested itself as the largest global challenge in the history of the United Nations. As the Final Declaration, which we endorse today, rightly states, ‘There is no other global organization with the legitimacy, convening power and normative impact as the United Nations. No other global organization gives hope to so many people for a better world and can deliver the future we want. The urgency for all countries to come together, to fulfill the promise of the nations united, has rarely been greater.’ Mr President, Today, the 21st September, Malta celebrates 56 years of Independence, but what is also noteworthy is that Malta became the 114th member of the United Nations Organisation on the 1st December 1964, only a few weeks after gaining Independence. On the raising of the flag the then Maltese Prime Minister, Dr George Borg Olivier, emphasized Malta’s position between East and West, Europe and Africa, and spoke of Malta’s aspirations for peaceful development. Now that Malta had taken her place among the free nations, the Prime Minister pledged Malta’s contribution towards world peace in that, ‘spirit of heroic determination, in defence of traditional concepts of freedom and civilisation’, which have characterized Malta’s long history. -

Scheduled Commercial Banks in India T.Vinila

IJRDO - Journal of Business Management ISSN: 2455-6661 SCHEDULED COMMERCIAL BANKS IN INDIA T.VINILA Assistant Professor of Commerce Social Welfare Residential Govt Degree College(w) Chittoor. Ph.No:8897799816 Email :[email protected] Email Id: [email protected] _______________________________________________________________________ Abstract The Indian financial system remains bank dominated, even as the availability of finance from alternative sources has increased in recent years. During 2016-17, bank credit accounted for 35 per cent of the total flow of financial resources to the commercial sector. The persistent deterioration in the banks asset quality has dented the profitability and constrained the financial intermediation. Consequent deleveraging has resulted in historically low credit growth, although subdued demand, especially from industry, has also restrained credit off-take. Demonetisation of specified bank notes (SBNs) in November 2016 impacted the banking sector’s performance transitorily in the form of a surge of low-cost deposits and abundance of liquidity in the system, which speeded up transmission of interest rate reduction and altered banks’ balance sheet structures even as they were engaged in managing the process of currency withdrawal and replacement. The present study is on the deposit mobilization of scheduled Commercial Banks group wise in India taking into consideration the deposits, types of deposits, population wise deposits and credit limit. Key words: Banking reforms, Scheduled Commercial Banks. Introduction: Volume-4 | Issue-6 | June,2018 1 IJRDO - Journal of Business Management ISSN: 2455-6661 The scheduled commercial banks are those banks which are included in the second schedule of RBI Act 1934 and which carry out the normal business of banking such as accepting deposits, giving out loans and other banking services.