Download General Studies Notes PDF for IAS Prelims from This Link

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bibliography

BIbLIOGRAPHY 2016 AFI Annual Report. (2017). Alliance for Financial Inclusion. Retrieved July 31, 2017, from https://www.afi-global.org/sites/default/files/publica- tions/2017-05/2016%20AFI%20Annual%20Report.pdf. A Law of the Abolition of Currencies in a Small Denomination and Rounding off a Fraction, July 15, 1953, Law No.60 (Shōgakutsūka no seiri oyobi shiharaikin no hasūkeisan ni kansuru hōritsu). Retrieved April 11, 2017, from https:// web.archive.org/web/20020628033108/http://www.shugiin.go.jp/itdb_ housei.nsf/html/houritsu/01619530715060.htm. About PBC. (2018, August 21). The People’s Bank of China. Retrieved August 21, 2018, from http://www.pbc.gov.cn/english/130712/index.html. About Us. Alliance for Financial Inclusion. Retrieved July 31, 2017, from https:// www.afi-global.org/about-us. AFI Official Members. Alliance for Financial Inclusion. Retrieved July 31, 2017, from https://www.afi-global.org/sites/default/files/inlinefiles/AFI%20 Official%20Members_8%20February%202018.pdf. Ahamed, L. (2009). Lords of Finance: The Bankers Who Broke the World. London: Penguin Books. Alderman, L., Kanter, J., Yardley, J., Ewing, J., Kitsantonis, N., Daley, S., Russell, K., Higgins, A., & Eavis, P. (2016, June 17). Explaining Greece’s Debt Crisis. The New York Times. Retrieved January 28, 2018, from https://www.nytimes. com/interactive/2016/business/international/greece-debt-crisis-euro.html. Alesina, A. (1988). Macroeconomics and Politics (S. Fischer, Ed.). NBER Macroeconomics Annual, 3, 13–62. Alesina, A. (1989). Politics and Business Cycles in Industrial Democracies. Economic Policy, 4(8), 57–98. © The Author(s) 2018 355 R. Ray Chaudhuri, Central Bank Independence, Regulations, and Monetary Policy, https://doi.org/10.1057/978-1-137-58912-5 356 BIBLIOGRAPHY Alesina, A., & Grilli, V. -

Xoom Rolls out Domestic Money Transfer Services in the U.S

Xoom Rolls Out Domestic Money Transfer Services in the U.S. November 12, 2019 PayPal's international money transfer service works with Walmart and Ria to offer cash pick-up in minutes at 4,700 Walmart and 175 Ria locations across the country SAN JOSE, Calif., Nov. 12, 2019 /PRNewswire/ -- Xoom, PayPal's international money transfer service, today rolled out the ability for customers to send money to recipients in the U.S. for the first time. Through strategic alliances with Walmart and Ria, Americans can now use Xoom to send money fast for cash pick-up typically in minutes at nearly 5,000 locations across the country*. Xoom's services potentially benefit more than 44 million foreign-born people in the U.S.1 who send remittances to family and friends in their home countries. With the introduction of domestic money transfer services, Xoom will now serve even more customers, including more than half of Americans who make domestic person-to-person (P2P) payments2. Using Xoom's mobile app or website, consumers will have the ability to send money quickly and securely for cash pick-up at any Walmart or Ria-owned store in the U.S. "Many of our customers in the U.S. already send money to loved ones in the country, and they usually prefer that the money is available right away," shared Julian King, Xoom's Vice President and General Manager. "This rollout reinforces our commitment to make money transfers fast, easy and affordable for everyone, whether they are at home or on-the-go." "At Ria, we are delighted to further consolidate our relationship with Xoom and Walmart," said Juan Bianchi, CEO of Euronet's Money Transfer Segment. -

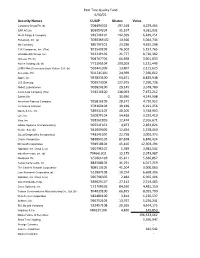

Pear Tree Quality Fund 6/30/21

Pear Tree Quality Fund 6/30/21 Security Names CUSIP Shares Value Compass Group Plc (b) '20449X302 197,348 4,229,464 SAP AG (b) '803054204 31,197 4,381,931 Wells Fargo & Company '949746101 142,399 6,449,251 Facebook, Inc. (a) '30303M102 14,566 5,064,744 3M Company '88579Y101 23,286 4,625,298 TJX Companies, Inc. (The) '872540109 76,502 5,157,765 UnitedHealth Group, Inc. '91324P102 21,777 8,720,382 Unilever Plc (b) '904767704 66,698 3,901,833 Roche Holding Ltd. (b) '771195104 109,203 5,131,449 LVMH Moët Hennessy-Louis Vuitton S.A. (b) '502441306 13,407 2,115,625 Accenture Plc 'G1151C101 24,969 7,360,612 Apple, Inc. '037833100 64,471 8,829,948 U.S. Bancorp '902973304 127,975 7,290,736 Abbott Laboratories '002824100 29,145 3,378,780 Coca-Cola Company (The) '191216100 138,093 7,472,212 Safran SA 0 30,650 4,249,998 American Express Company '025816109 28,572 4,720,952 Johnson & Johnson '478160104 38,189 6,291,256 Merck & Co., Inc. '589331107 48,205 3,748,903 Lyft, Inc. '55087P104 54,438 3,292,410 Visa, Inc. '92826C839 12,474 2,916,671 Adobe Systems Incorporated (a) '00724F101 4,873 2,853,824 Nestle, S.A. (b) '641069406 12,654 1,578,460 Quest Diagnostics Incorporated '74834L100 22,758 3,003,373 Oracle Corporation '68389X105 87,878 6,840,424 Microsoft Corporation '594918104 45,416 12,303,194 Alphabet, Inc. Class C (a) '02079K107 1,589 3,982,542 salesforce.com, inc. -

Thirteenth Session, Commencing at 2.30Pm INDIAN BANKNOTES

Thirteenth Session, Commencing at 2.30pm INDIAN BANKNOTES AN IMPORTANT COLLECTION OF INDIAN 3931* PAPER MONEY Bank of Hindostan, 16 sicca rupees, 183. Calcutta (P.S137; Jhun.1.4.3). Nearly very fi ne and rare. $3,000 Acquired mostly during the 1960s and 1970s, the highlights The Bank of Hindostan (1770-1832) was the fi rst bank to issue banknotes in of the following collection include a Bank of Hindostan 16 Bengal Presidency. They circulated in Calcutta and nearby neighbourhoods. Only a few notes were still in circulation when the bank closed in 1832. Sicca Rupees, c1830; a group of 45 Government of India one sided (uniface) notes of 5 rupees to 1000 rupees, from 1872 to 1918. This group contains two specimen 5 rupees of 1915, a 50 rupees and a 1000 rupees of 1918. There is a good selection of 1917 one rupee notes including a specimen, also an attractive example of a 2 rupees 8 annas. The George V section contains most types and signatures up to the 1000 rupees. One of the major highlights of the collection is the George V, 10 rupees specimen note that was given to visitors invited to the inauguration of the India Security Press on 14 April 1928. This distinct type has a larger portrait of George V and was never issued for circulation. The section also contains a specimen 5 rupees, two 50 rupees and eight different 100 rupees. Following this is the George VI section which is almost complete and includes six 100 rupees and two 1000 rupees. -

Biometric Cardholder Authentication Pioneering the Way with Security Why Digital Ids Won't Replace Physical Identity Cards

The Offi cial Publication of the International Card Manufacturers Association August 2021 Volume 31 • No. 4 Biometric Cardholder Authentication Pioneering the Way with Security Why Digital IDs Won’t Replace Physical Identity Cards Any Time Soon Selecting the Right Ink Technology for ID Card Printing Bringing Security to Contactless Biometric Payment Cards founder /executive director is published by CMA for ICMA. Please Enter the 2021 Élan Awards of Excellence! submit all articles, news releases and advertising to: | By Jeffrey E. Barnhart CARD MANUFACTURING™ C/O: CMA With hundreds of entries from around the globe each year, the Élan 191 Clarksville Road Awards of Excellence celebrate the world’s most impressive cards and Princeton Junction, New Jersey 08550 USA card technologies. The competition, which was designed to drive innovation within the card industry, recognizes Founder/Executive Director winners in three categories—card manufacturing, personalization & fulfillment and card Jeffrey E. Barnhart [email protected] suppliers. Judging is based on a quantifi able scoring system with criteria in nine categories. Winners will be announced during a special ceremony at the 2021 ICMA Card Manufacturing Operations and Member Experience Manager and Personalization EXPO from November 7-10 in Orlando, Florida. Michael Canino [email protected] Open to ICMA members only, entries for the 2021 Élan Awards of Excellence are due by Association Manager September 1. The competition honors world-class achievements in the following categories: Lynn McCullough [email protected] Secure Payments Cards; Loyalty, Promotional and Gift Cards; ID and Access Control Cards; Personalization & Fulfillment Product, Service or Project; Unique Innovation and Best Managing Editor Jennifer Kohlhepp Supplier/Vendor New Product, Service or Innovation. -

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo All SUPER Current Affairs Product Worth Rs 1200 @ 399/- ( DEAL Of The Year ) Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 3rd August 2021 By Dream Big Institution: (SUPER Current Affairs) © Copyright 2021 Q.World Sanskrit Day 2021 was celebrated on ___________. A) 3 August C) 5 August B) 4 August D) 6 August Answer - A Sanskrit Day is celebrated every year on Shraavana Poornima, which is the full moon day in the month of Shraavana in the Hindu calendar. In 2020, Sanskrit Day was celebrated on August 3, while in 2019 it was celebrated on 15 August. Sanskrit language is believed to be originated in India around 3,500 years ago. Q.Nikol Pashinyan has been re-appointed as the Prime Minister of which country? A) Ukraine C) Turkey B) Armenia D) Lebanon Answer - B Nikol Pashinyan has been re-appointed as Armenia’s Prime Minister by President Armen Sarkissian. Pashinyan was first appointed as the prime minister in 2018. About Armenia: Capital: Yerevan Currency: Armenian dram President: Armen Sargsyan Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Q.Min Aung Hlaing has taken charge as the Prime Minister of which country? A) Bangladesh C) Thailand B) Laos D) Myanmar Answer - D The Chief of the Myanmar military, Senior General Min Aung Hlaing has taken over as the interim prime minister of the country on August 01, 2021. About Myanmar Capital: Naypyitaw; Currency: Kyat. NEWLY Elected -

BANKNOTES of SRI LANKA

The BANKNOTES of the Socialist Republic of SRI LANKA In 1972 Ceylon became the Free, Sovereign and Independent Republic of Sri Lanka or Sri Lanka The Central Bank of Ceylon did not become the Central Bank of Sri Lanka until 1985. Central Bank of Ceylon Flora and Fauna Issue of 1979 - 1985 According to Owen Linzmayer, this series should be listed as a Ceylon issue. P-84/B338 P-83a 5 rupees P-85 B337 B339 2 rupees 10 rupees The SCWPM, however, lists this series as the beginning of the Sri Lanka issues. Flora and Fauna issue of the Bank of Ceylon P-86a/B340 20 rupees P-87a/341 50 rupees P-88a/B342 100 rupees Historical issue of the Bank of Ceylon Central Bank of Ceyon P-89a/B348 P-90a/B349 500 rupees 1000 rupees Stone relief of Upper Kothmale elephant from Dam Temple of the -- Sacred Tooth, Kandy Peacock -- Anuradhapura Temple From Ceylon to Sri Lanka Archaeological and Historical Issues 1982 - 1985 1987 -1990 Central Bank of Ceylon Central Bank of Sri Lanka Above: Temple of P-92b P-96a the Sacred Tooth B344b B101a Relic in Kandy. Dagoba Raja Maha Vihare Temple in Kelaniya. Archaeological and Historical Issue Central Bank of Ceylon and Central Bank of Sri Lanka 1982 – 1985 1987 – 1990 P-93 & 97 P-94 & 98 P-95 & 99 B345 & B102 B346 &B103 B347 & B104 20 rupees 50 rupees 100 rupees Moonstone Raja Maha Stone relief Steps Temple of Chinthe. -- -- -- Thuparama Headless Parliament Dagoba Buddha Building Temple To conserve space, only one example of each of the two Pick numbers are illustrated. -

November 16, 2018 Certificates of Authorisation Issued by the Reserve Bank of India Under the Payment and Settlement Syst

Date : November 16, 2018 Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India A. Certificates of Authorisation issued by the Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India The Payment and Settlement Systems Act, 2007 along with the Board for Regulation and Supervision of Payment and Settlement Systems Regulations, 2008 and the Payment and Settlement Systems Regulations, 2008 have come into effect from 12th August, 2008. The list of 'Payment System Operators’ authorised by the Reserve Bank of India to set up and operate in India under the Payment and Settlement Systems Act, 2007 is as under: Sr. Name of the Address of the Payment System Date of issue of No. Authorised Principal Office Authorised Authorisation Entity & Validity Period (given in brackets) Financial Market Infrastructure 1. The Clearing The Managing i. Securities 11.02.2009 Corporation of Director, segment covering India Ltd. Clearing Corp. of Govt Securities; India, ii. Forex 5th, 6th & 7th floor Settlement Trade World, Segment -do- “C” Wing Kamala comprising of sub- city, SB Marg, segments Lower Parel (West) a. USD-INR Mumbai 400 013 segment, -do- b. CLS segment – Continuous Linked Settlement (Settlement of Cross Currency -do- Deals), c. Forex Forward segment; iii. Rupee Derivatives -do- Segment-Rupee denominated trades in IRS & FRA. Retail Payments Organisation 2. National The Chief Executive i. National Payments Officer, Financial Switch Corporation of National Payments (NFS) 15.10.2009 India Corporation of ii. -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Banking Laws in India

Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 1 Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 2 Course Development Committee CBIL-01 Chairman Prof. L. R. Gurjar Director (Academic) Vardhaman Mahaveer Open University, Kota Convener and Members Convener Dr. Yogesh Sharma, Asso. Professor Prof. H.B. Nanadwana Department of Law Director, SOCE Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota External Members: 1. Prof. Satish C. Shastri 2. Prof. V.K. Sharma Dean, Faculty of law, MITS, Laxmangarh Deptt.of Law Sikar, and Ex. Dean, J.N.Vyas University, Jodhpur University of Rajasthan, Jaipur (Raj.) 3. Dr. M.L. Pitaliya 4. Prof. (Dr.) Shefali Yadav Ex. Dean, MDS University, Ajmer Professor & Dean - Law Principal, Govt. P.G.College, Chittorgarh (Raj.) Dr. Shakuntala Misra National Rehabilitation University, Lucknow 5. Dr Yogendra Srivastava, Asso. Prof. School of Law, Jagran Lakecity University, Bhopal Editing and Course Writing Editor: Course Writer: Dr. Yogesh Sharma Dr Visvas Chauhan Convener, Department of Law State P. G. Law College, Bhopal Vardhaman Mahaveer Open niversity, Kota Academic and Administrative Management Prof. Vinay Kumar Pathak Prof. L.R. Gurjar Vice-Chancellor Director (Academic) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Prof. Karan Singh Dr. Anil Kumar Jain Director (MP&D) Additional Director (MP&D) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Course Material Production Prof. Karan Singh Director (MP&D) Vardhaman Mahaveer Open University, Kota Production 2015 ISBN- All right reserved no part of this book may be reproduced in any form by mimeograph or any other means, without permission in writing from the V.M. -

A Relative Comparison of Financial Performance of State Bank of India and Axis Bank

Journal of Management (JOM) Volume 6, Issue 1, January – February 2019, pp. 162–169, Article ID: JOM_06_01_017 Available online at http://www.iaeme.com/JOM/issues.asp?JType=JOM&VType=6&IType=1 Journal Impact Factor (2019): 5.3165 (Calculated by GISI) www.jifactor.com ISSN Print: 2347-3940 and ISSN Online: 2347-3959 DOI: 10.34218/JOM.6.1.2019.017 © IAEME Publication A RELATIVE COMPARISON OF FINANCIAL PERFORMANCE OF STATE BANK OF INDIA AND AXIS BANK Premchand Kaila Research Scholar, Department of Management Studies, Jawaharlal Nehru Technological University Anantapur, Anantapuramu, India Dr. E. Lokanadha Reddy Professor, Department of Management Studies, Sri Venkateswara College of Engineering and Technology, R.V.S.Nagar, Chittoor, Andhra Pradesh, India Dr. T. Narayana Reddy Associate Professor, Department of Management Studies, Jawaharlal Nehru Technological University Anantapur, Anantapuramu, India ABSTRACT State Bank of India (SBI) and AXIS Bank are the two leading banks in India.one being a public sector and later one is private sector bank. Financial Performance and the efficient functioning of commercial banks are the major measuring attributes of a country’s financial system. For the comparison of bank’s position the study has applied Solvency ratios, Profitability ratios, and Management efficiency ratios on SBI and AXIS Bank. The study has identified that the banks have been maintaining their prescribed parameters and operating profitably. Further the study notices a difference in the efficiencies and performances of the Banks with regards to Investments, Net profit, Advances, Deposits, and Total assets. The study, tries to prove that SBI has a better performance AXIS Bank. -

Financial Technology M&A Update

Financial Technology M&A Update Q2 2016 July 15th, 2016 Table of Contents M&A Market Brief – Page 3-5 FinTech M&A Trends & Drivers – Page 6 Notable FinTech M&A Transactions, Q2 2016 – Page 7-9 Publicly Traded FinTech Firms (Valuation Table) – Page 10-11 M&A Spotlight: Mercury UK Holdco Ltd. / ISP Processing – Page 12 M&A Spotlight: Tech Mahindra / Target Group – Page 13 M&A Spotlight: BM&F Bovespa / Cetip – Page 14 M&A Spotlight: Blackboard Inc. / Higher One – Page 15 DISCLAIMER The information contained herein is of a general nature and is not intended to address the circumstances of any particular company, individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. We perform our own research and also use third party research. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. This is not an offer or recommendation to buy or sell securities nor is it a recommendation to merge, acquire, sell or exit a specific company or entity. We do not hold any equity or debt position in any of the securities listed herein as of the date of this report. Sources for our research and data include: MergerMarket, FT Partners, Wall Street Journal, S&P Capital IQ, Company Websites, SEC Filings, Bloomberg M&A Market Brief Q2 2016 M&A Activity Slows But Remains Promising Worldwide United States FinTech • Global M&A activity during the • The M&A climate in the United • Overall M&A activity across the second quarter of 2016 improved States is in the process of Financial Technology industry slightly over that of the first rebalancing after a record- remains robust YTD 2016.