1 an Introduction to Indian Banking System

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNEXURE I BRANCH NAME ZONE NAME ADDRESS LAND LINE NO. E-MAIL ID NARANPURA AHMEDABAD 5 Nrusinh Park Societyvijay Nagar Char Rast

ANNEXURE I LAND LINE BRANCH NAME ZONE NAME ADDRESS e-MAIL ID NO. 5 Nrusinh Park SocietyVijay Nagar Char RastaNear Ankur Char NARANPURA AHMEDABAD rastaNaranpuraAHMEDABAD 7927470681 [email protected] Dixit BungalowDaxini SocietyMani DAXINI SOCIETY AHMEDABAD NagarDAXINI SOCIETYAHMEDABAD 7925460922 [email protected] "Mukhi Corner"P T College Cross RoadNarayan Nagar PALDI AHMEDABAD RoadPaldiAHMEDABAD 7926671176 [email protected] KRISHNA COMPLEXOFF S G ROADOPP.DEVASHISH S G ROAD AHMEDABAD SCHOOLBODEKDEVAHMEDABAD 079 26871482 [email protected] SANTRAM ROADOPPOSIT NADIAD AHMEDABAD FOUNTAINNADIADNADIADKHEDA 0268-2566367 [email protected] RAJKOT AHMEDABAD " TORAL "Subhash RoadRAJKOTRAJKOT 0281-2234362 [email protected] Plot No. 4, The Adress Businee HUBB/H SD VESU AHMEDABAD Jain SchoolNear Big BazarVesuSurat 9974630908 [email protected] Janta Super MarketRaj Mahal MEHSANA AHMEDABAD RoadMAHSANAMEHSANA 02762-221327 [email protected] Kantawala DelaUndivakharBHAVNAGARKHAR BHAVNAGAR AHMEDABAD GATEBHAVNAGAR 0278 2423305 [email protected] SHOP NO. 23-28CORNER POINT COMPLEXOPP SEJAL APARTMENTCITY ATHWA LINES AHMEDABAD LIGHTSURAT 2612220047 [email protected] NO:1 8TH CROSS, 7TH MAIN, II BLOCK, ASHOKA PILLAR BANGALORE JAYANAGAR, BANGALORE 560011 8026564581 [email protected] NO 905/5, NEW NO 21, BHARANI, 6TH CROSS, AYYAPPA NAGAR, JALAHALLI, BANGALORE ABBIGERE BANGALORE 560090 9449864193 [email protected] L-82A, 15th Cross, 5th MainSector-6HSR HSR LAYOUT BANGALORE LayoutBANGALORE -

Official Site, Telegram, Facebook, Instagram, Instamojo

Page 1 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo All SUPER Current Affairs Product Worth Rs 1200 @ 399/- ( DEAL Of The Year ) Page 2 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo SUPER Current Affairs MCQ PDF 3rd August 2021 By Dream Big Institution: (SUPER Current Affairs) © Copyright 2021 Q.World Sanskrit Day 2021 was celebrated on ___________. A) 3 August C) 5 August B) 4 August D) 6 August Answer - A Sanskrit Day is celebrated every year on Shraavana Poornima, which is the full moon day in the month of Shraavana in the Hindu calendar. In 2020, Sanskrit Day was celebrated on August 3, while in 2019 it was celebrated on 15 August. Sanskrit language is believed to be originated in India around 3,500 years ago. Q.Nikol Pashinyan has been re-appointed as the Prime Minister of which country? A) Ukraine C) Turkey B) Armenia D) Lebanon Answer - B Nikol Pashinyan has been re-appointed as Armenia’s Prime Minister by President Armen Sarkissian. Pashinyan was first appointed as the prime minister in 2018. About Armenia: Capital: Yerevan Currency: Armenian dram President: Armen Sargsyan Page 3 Follow us: Official Site, Telegram, Facebook, Instagram, Instamojo Q.Min Aung Hlaing has taken charge as the Prime Minister of which country? A) Bangladesh C) Thailand B) Laos D) Myanmar Answer - D The Chief of the Myanmar military, Senior General Min Aung Hlaing has taken over as the interim prime minister of the country on August 01, 2021. About Myanmar Capital: Naypyitaw; Currency: Kyat. NEWLY Elected -

Influence of Merger on Performance of Indian Banks: a Case Study

Journal of Poverty, Investment and Development www.iiste.org ISSN 2422-846X An International Peer-reviewed Journal Vol.32, 2017 Influence of Merger on Performance of Indian Banks: A Case Study Gopal Chandra Mondal Research Scholar, Dept. of Economics, Vidyasagar University, India& Chief Financial Officer,IDFC Foundation,New Delhi, India Dr Mihir Kumar Pal Professor,Dept. Of Economics, Vidyasagar University, India Dr Sarbapriya Ray* Assistant Professor, Dept. of Commerce, Vivekananda College, Under University of Calcutta, Kolkata,India Abstract The study attempts to critically analyze and evaluate the impact of merger of Nedungadi bank and Punjab National Bank on their operating performance in terms of different financial parameters. Most of the financial indicators of Nedungadi bank and Punjab National Bank display significant improvement in their operational performance during post merger period. Therefore, the results of the study reveal that average financial ratios of sampled banks in Indian banking sector showed a remarkable and significant improvement in terms of liquidity, profitability, and stakeolders wealth. Keywords: Merger, India, Nedungadi bank, Punjab National Bank. 1. Introduction: Concept of merger and acquisition has become very trendy in present day situation, especially, after liberalization initiated in India since 1991. The emergent tendency towards mergers and acquisitions (M&As) world-wide, has been ignited by intensifying competition. Mergers and acquisitions have been taking place in corporate as well as banking sector to abolish financial, operation and managerial weakness as well as to augment growth and expansion , to create shareholders value, stimulate health of the organization with a view to confront challenges in the face of stiff competitive in globalized environment. -

INDIAN BANKING SECTOR – a PARADIGM SHIFT Original

IF : 4.547 | IC Value 80.26 VolumeVOLUME-6, : 3 | Issue ISSUE-6, : 11 | November JUNE-2017 2014 • ISSN • ISSN No No 2277 2277 - -8160 8179 Original Research Paper Commerce INDIAN BANKING SECTOR – A PARADIGM SHIFT Snehal Kotak Research Scholar, Dept of Commerce, Nims University Associate Professor, Humanities, Social Sciences and Commerce, NIMS University Dr. Mukesh Kumar Co-Author ABSTRACT With the potential to become the fth largest banking industry in the world by 2020 and third largest by 2025 according to KPMG-CII report, India's banking and nancial sector is expanding rapidly. The Indian Banking industry is currently worth Rs. 81 trillion (US $ 1.31 trillion) and banks are now utilizing the latest technologies like internet and mobile devices to carry out transactions and communicate with the masses. The Indian banking sector consists of 26 public sector banks, 20 private sector banks and 43 foreign banks along with 61 regional rural banks (RRBs) and more than 90,000 credit cooperatives. This paper explains the changing banking scenario, the impact of economic reforms and analyses the challenges and opportunities of national and commercial banks. KEYWORDS : Introduction: Progress Made- Analysysis the various challenges & opportunities Today Indian Banking is at the crossroads of an invisible revolution. that stand in front of the Indian Banking Industry. The sector has undergone signicant developments and investments in the recent past. Most of banks provide various The Banking Regulation Act: services such as Mobile banking, SMS Banking, Net banking and The Banking Act 1949 was a special legislation, applicable ATMs to their clients. According to the Reserve Bank of India (RBI), exclusively to the banking companies. -

In the High Court of Judicature at Madras Dated

IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED: 10.11.2016 CORAM : The Hon'ble MR.SANJAY KISHAN KAUL, CHIEF JUSTICE, The Hon'ble MR.JUSTICE T.S.SIVAGNANAM AND The Hon'ble MR.JUSTICE R.MAHADEVAN W.P. Nos.2675, 253 and 9750 of 2011, 46458 of 2002, 27409 and 31060 of 2005, 6267 and 469 of 2006, 21496 of 2008, 21358 of 2009 THE ASSISTANT COMMISSIONER(CT) ANNA SALAI-III ASSESSMENT CIRCLE SIRE MANSION NO.621 ANNA SALAI CHENNAI-6. ..PETITIONER IN WP.2675/11 K.MAHENDRAN ..PETITIONER IN WP.253/11 THE COMMERCIAL TAX OFFICER-I COMMERCIAL TAXES DEPARTMENT OFFICE OF THE COMMISSIONER (CT) PUDUCHERRY ..PETITIONER IN WP.9750/11 INDIAN BANK REP BY BRANCH MANAGER, 245, POLLACHI ROAD, UDUMALPET-642126 ..PETITIONER IN WP.46458/02 INDIAN OVERSEAS BANK PONDICHERRY MAIN BRANCH BY ITS CHIEF MANAGER / CONSTITUTED ATTORNEY PONDICHERY. ..PETITIONER IN WP.27409/05 INDIAN BANK HARBOUR BRANCH REP. BY ITS ASSISTANT GENERAL MANAGER B. PANDA 66 RAJAJI SALAI CHENNAI -1. ..PETITIONER IN WP.31060/05 M/S.GUPTA & COMPANY REP. BY ITS MANAGING PARTNER DR.S.K.GUPTA NO.8 & 11 EKKADUTHANGAL ROAD GUINDY CHENNAI-32 ..PETITIONER IN WP.6267/06 INDIAN OVERSEAS BANK PERUNGULATHUR BRANCH CHENNAI-63 BY ITS SENIOR MANAGER / CONSTITUTED ATTORNEY...PETITIONER IN WP.469/06 ORIENTAL BANK OF COMMERCE, OVERSEAS BRANCH, REP.BY ITS CHIEF MANAGER, A.SRINIVAS SHARMA, PADMA COMPLEX, 467, MOUNT ROAD, CHENNAI-35 ..PETITIONER IN WP.2496/08 MIJAN SHOE FABRIC LTD., NO.57/28 VEPERY HIGH ROAD, PERIAMPET, CHENNAI. ..PETITIONER IN WP.21358/09 vs THE INDIAN OVERSEAS BANK REP. -

ACCEPTANCE of E-BANKING AMONG CUSTOMERS (An Empirical Investigation in India)

1 | Journal of Management and Science Vol.2, No.1 I SSN:2249-1260/EISSN:2250 -18 19 ACCEPTANCE OF E-BANKING AMONG CUSTOMERS (An Empirical Investigation in India) K.T. Geetha1 & V.Malarvizhi2 1Professor and 2Assistant Professor, Department of Economics, Avinashilingam Institute for home Science and Higher Education for Women Coimbatore -641043, TamilNadu, India Abstract Financial liberalization and technology revolution have allowed the developments of new and more efficient delivery and processing channels as well as more innovative products and services in banking industry. Banking institutions are facing competition not only from each other but also from non-bank financial intermediaries as well as from alternative sources of financing. Another strategic challenge facing banking institutions today is the growing and changing needs and expectations of consumers in tandem with increased education levels and growing wealth. Consumers are becoming increasingly discerning and have become more involved in their financial decisions. This paper investigates the factors which are affecting the acceptance of e- banking services among the customers and also indicates level of concern regarding security and privacy issues in Indian context. Primary data was collected from 200 respondents through a structured questionnaire. Descriptive statistics was used to explain demographic profile of respondents and Factor and Regression analyses were used to know the factors affecting e-banking services among customer in India. The finding depicts many factors -

BUSINESS PERSPECTIVE E-BANKING SYSTEMS in INDIA DIVYA NALLURI Harrisburg University of Science and Technology

Harrisburg University of Science and Technology Digital Commons at Harrisburg University Dissertations and Theses Project Management, Graduate (PMGT) Spring 4-9-2018 BUSINESS PERSPECTIVE E-BANKING SYSTEMS IN INDIA DIVYA NALLURI Harrisburg University of Science and Technology Follow this and additional works at: http://digitalcommons.harrisburgu.edu/pmgt_dandt Part of the Human Resources Management Commons, Interpersonal and Small Group Communication Commons, Management Information Systems Commons, and the Management Sciences and Quantitative Methods Commons Recommended Citation NALLURI, D. (2018). BUSINESS PERSPECTIVE E-BANKING SYSTEMS IN INDIA. Retrieved from http://digitalcommons.harrisburgu.edu/pmgt_dandt/36 This Thesis is brought to you for free and open access by the Project Management, Graduate (PMGT) at Digital Commons at Harrisburg University. It has been accepted for inclusion in Dissertations and Theses by an authorized administrator of Digital Commons at Harrisburg University. For more information, please contact [email protected]. Graduate Research Development BUSINESS PERSPECTIVE E-BANKING SYSTEMS IN INDIA by DIVYA NALLURI (168729) Harrisburg University of Science & Technology, Harrisburg, Pennsylvania. 1 | P a g e TABLE OF CONTENTS TABLE OF CONTENTS ............................................................................................................. 2 PREFACE ............................................................................................................................ 3 INTRODUCTION ............................................................................................................... -

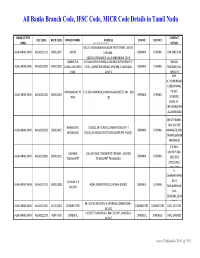

Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu

All Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu NAME OF THE CONTACT IFSC CODE MICR CODE BRANCH NAME ADDRESS CENTRE DISTRICT BANK www.Padasalai.Net DETAILS NO.19, PADMANABHA NAGAR FIRST STREET, ADYAR, ALLAHABAD BANK ALLA0211103 600010007 ADYAR CHENNAI - CHENNAI CHENNAI 044 24917036 600020,[email protected] AMBATTUR VIJAYALAKSHMIPURAM, 4A MURUGAPPA READY ST. BALRAJ, ALLAHABAD BANK ALLA0211909 600010012 VIJAYALAKSHMIPU EXTN., AMBATTUR VENKATAPURAM, TAMILNADU CHENNAI CHENNAI SHANKAR,044- RAM 600053 28546272 SHRI. N.CHANDRAMO ULEESWARAN, ANNANAGAR,CHE E-4, 3RD MAIN ROAD,ANNANAGAR (WEST),PIN - 600 PH NO : ALLAHABAD BANK ALLA0211042 600010004 CHENNAI CHENNAI NNAI 102 26263882, EMAIL ID : CHEANNA@CHE .ALLAHABADBA NK.CO.IN MR.ATHIRAMIL AKU K (CHIEF BANGALORE 1540/22,39 E-CROSS,22 MAIN ROAD,4TH T ALLAHABAD BANK ALLA0211819 560010005 CHENNAI CHENNAI MANAGER), MR. JAYANAGAR BLOCK,JAYANAGAR DIST-BANGLAORE,PIN- 560041 SWAINE(SENIOR MANAGER) C N RAVI, CHENNAI 144 GA ROAD,TONDIARPET CHENNAI - 600 081 MURTHY,044- ALLAHABAD BANK ALLA0211881 600010011 CHENNAI CHENNAI TONDIARPET TONDIARPET TAMILNADU 28522093 /28513081 / 28411083 S. SWAMINATHAN CHENNAI V P ,DR. K. ALLAHABAD BANK ALLA0211291 600010008 40/41,MOUNT ROAD,CHENNAI-600002 CHENNAI CHENNAI COLONY TAMINARASAN, 044- 28585641,2854 9262 98, MECRICAR ROAD, R.S.PURAM, COIMBATORE - ALLAHABAD BANK ALLA0210384 641010002 COIIMBATORE COIMBATORE COIMBOTORE 0422 2472333 641002 H1/H2 57 MAIN ROAD, RM COLONY , DINDIGUL- ALLAHABAD BANK ALLA0212319 NON MICR DINDIGUL DINDIGUL DINDIGUL -

State Bank of India

State Bank of India State Bank of India Type Public Traded as NSE: SBIN BSE: 500112 LSE: SBID BSE SENSEX Constituent Industry Banking, financial services Founded 1 July 1955 Headquarters Mumbai, Maharashtra, India Area served Worldwide Key people Pratip Chaudhuri (Chairman) Products Credit cards, consumer banking, corporate banking,finance and insurance,investment banking, mortgage loans, private banking, wealth management Revenue US$ 36.950 billion (2011) Profit US$ 3.202 billion (2011) Total assets US$ 359.237 billion (2011 Total equity US$ 20.854 billion (2011) Owner(s) Government of India Employees 292,215 (2012)[1] Website www.sbi.co.in State Bank of India (SBI) is a multinational banking and financial services company based in India. It is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2012, it had assets of US$501 billion and 15,003 branches, including 157 foreign offices, making it the largest banking and financial services company in India by assets.[2] The bank traces its ancestry to British India, through the Imperial Bank of India, to the founding in 1806 of the Bank of Calcutta, making it the oldest commercial bank in the Indian Subcontinent. Bank of Madras merged into the other two presidency banks—Bank of Calcutta and Bank of Bombay—to form the Imperial Bank of India, which in turn became the State Bank of India. Government of Indianationalised the Imperial Bank of India in 1955, with Reserve Bank of India taking a 60% stake, and renamed it the State Bank of India. In 2008, the government took over the stake held by the Reserve Bank of India. -

Agricultural Credit System in India: Evolution, Effectiveness and Innovations

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Gulati, Ashok; Juneja, Ritika Working Paper Agricultural credit system in India: Evolution, effectiveness and innovations ZEF Working Paper Series, No. 184 Provided in Cooperation with: Zentrum für Entwicklungsforschung / Center for Development Research (ZEF), University of Bonn Suggested Citation: Gulati, Ashok; Juneja, Ritika (2019) : Agricultural credit system in India: Evolution, effectiveness and innovations, ZEF Working Paper Series, No. 184, University of Bonn, Center for Development Research (ZEF), Bonn This Version is available at: http://hdl.handle.net/10419/206974 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend -

Banking Laws in India

Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 1 Course: CBIL-01 Banking Laws In India Vardhaman Mahaveer Open University, Kota 2 Course Development Committee CBIL-01 Chairman Prof. L. R. Gurjar Director (Academic) Vardhaman Mahaveer Open University, Kota Convener and Members Convener Dr. Yogesh Sharma, Asso. Professor Prof. H.B. Nanadwana Department of Law Director, SOCE Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota External Members: 1. Prof. Satish C. Shastri 2. Prof. V.K. Sharma Dean, Faculty of law, MITS, Laxmangarh Deptt.of Law Sikar, and Ex. Dean, J.N.Vyas University, Jodhpur University of Rajasthan, Jaipur (Raj.) 3. Dr. M.L. Pitaliya 4. Prof. (Dr.) Shefali Yadav Ex. Dean, MDS University, Ajmer Professor & Dean - Law Principal, Govt. P.G.College, Chittorgarh (Raj.) Dr. Shakuntala Misra National Rehabilitation University, Lucknow 5. Dr Yogendra Srivastava, Asso. Prof. School of Law, Jagran Lakecity University, Bhopal Editing and Course Writing Editor: Course Writer: Dr. Yogesh Sharma Dr Visvas Chauhan Convener, Department of Law State P. G. Law College, Bhopal Vardhaman Mahaveer Open niversity, Kota Academic and Administrative Management Prof. Vinay Kumar Pathak Prof. L.R. Gurjar Vice-Chancellor Director (Academic) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Prof. Karan Singh Dr. Anil Kumar Jain Director (MP&D) Additional Director (MP&D) Vardhaman Mahaveer Open University, Kota Vardhaman Mahaveer Open University, Kota Course Material Production Prof. Karan Singh Director (MP&D) Vardhaman Mahaveer Open University, Kota Production 2015 ISBN- All right reserved no part of this book may be reproduced in any form by mimeograph or any other means, without permission in writing from the V.M. -

Mergers and Acquisitions of Banks in Post-Reform India

SPECIAL ARTICLE Mergers and Acquisitions of Banks in Post-Reform India T R Bishnoi, Sofia Devi A major perspective of the Reserve Bank of India’s n the Reserve Bank of India’s (RBI) First Bi-monthly banking policy is to encourage competition, consolidate Monetary Policy Statement, 2014–15, Raghuram Rajan (2014) reviewed the progress on various developmental and restructure the system for financial stability. Mergers I programmes and also set out new regulatory measures. On and acquisitions have emerged as one of the common strengthening the banking structure, the second of “fi ve methods of consolidation, restructuring and pillars,” he mentioned the High Level Advisory Committee, strengthening of banks. There are several theoretical chaired by Bimal Jalan. The committee submitted its recom- mendations in February 2014 to RBI on the licensing of new justifications to analyse the M&A activities, like change in banks. RBI has started working on the framework for on-tap management, change in control, substantial acquisition, licensing as well as differentiated bank licences. “The intent is consolidation of the firms, merger or buyout of to expand the variety and effi ciency of players in the banking subsidiaries for size and efficiency, etc. The objective system while maintaining fi nancial stability. The Reserve Bank will also be open to banking mergers, provided competi- here is to examine the performance of banks after tion and stability are not compromised” (Rajan 2014). mergers. The hypothesis that there is no significant Mergers and acquisitions (M&A) have been one of the improvement after mergers is accepted in majority of measures of consolidation, restructuring and strengthening of cases—there are a few exceptions though.