Consolidation Among Public Sector Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

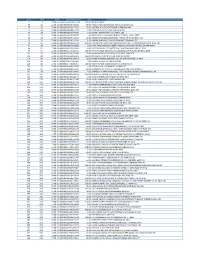

Cheque No Warrant No Warrant Date Folio No Amount Beneficiary Name

Cheque No Warrant No Warrant Date Folio No Amount Beneficiary Name 7 18 27-08-13 00000000000000000158 500.00 BEHNAZ ANSARI 36 214 27-08-13 0000IN30021416032344 90.00 RAGAVI 5052500100919001 KARNATAKA BANK LTD 40 226 27-08-13 0000IN30023911290727 30.00 NAZEER P A P1428 STATE BANK OF TRAVANCORE 41 228 27-08-13 0000IN30023911645416 2.00 NIRMALA DEVI O V 15030 CANARA BANK 43 236 27-08-13 0000IN30023910735859 2.00 SATISH K 625501004313 ICICI BANK LTD 47 247 27-08-13 0000IN30023913699779 4.00 BIPIN JOSEPH 14430100021826 THE FEDERAL BANK LIMITED 48 248 27-08-13 0000IN30023913723507 20.00 SUNDERDAS 0269053000000642 THE SOUTH INDIAN BANK LTD 49 250 27-08-13 0000IN30023913952031 1.00 HARSHA VARDHAN S 0243104000096627 IDBI BANK LTD 50 252 27-08-13 0000IN30034310356793 120.00 LALITKUMAR GANPATBHAI BRAHAMANIYA 6183 THE NAVNIRMAN CO.OP. BANK LTD. 51 262 27-08-13 0000IN30034320080882 6.00 PATEL SHARDABEN BECHARDAS 2688 THE CHANASMA NAGRIK SAHKARI BANK 80 521 27-08-13 0000IN30051318298292 20.00 D SELVAKUMARA DEVANATHAN 811010110001965 BANK OF INDIA 92 651 27-08-13 0000IN30112715987652 100.00 SHYAM KUMAR AGRAWAL 0011000100262199 PUNJAB NATIONAL BANK 101 725 27-08-13 0000IN30133019733689 20.00 SWAMINATHAN P 02701000025256 HDFC BANK LTD 113 825 27-08-13 0000IN30125028595954 160.00 MR PURUSOTTAM NAIK 1541 BANK OF BARODA 116 847 27-08-13 0000IN30226912064196 38.00 SHARADCHANDRA RAMNATH JAJU 341010100022358 UTI BANK 119 862 27-08-13 0000IN30163740694963 4.00 SANKAR N 502853313 INDIAN BANK 120 863 27-08-13 0000IN30177413937075 200.00 RAJESH KUMAR 313010100069757 -

INDIAN BANKING SECTOR – a PARADIGM SHIFT Original

IF : 4.547 | IC Value 80.26 VolumeVOLUME-6, : 3 | Issue ISSUE-6, : 11 | November JUNE-2017 2014 • ISSN • ISSN No No 2277 2277 - -8160 8179 Original Research Paper Commerce INDIAN BANKING SECTOR – A PARADIGM SHIFT Snehal Kotak Research Scholar, Dept of Commerce, Nims University Associate Professor, Humanities, Social Sciences and Commerce, NIMS University Dr. Mukesh Kumar Co-Author ABSTRACT With the potential to become the fth largest banking industry in the world by 2020 and third largest by 2025 according to KPMG-CII report, India's banking and nancial sector is expanding rapidly. The Indian Banking industry is currently worth Rs. 81 trillion (US $ 1.31 trillion) and banks are now utilizing the latest technologies like internet and mobile devices to carry out transactions and communicate with the masses. The Indian banking sector consists of 26 public sector banks, 20 private sector banks and 43 foreign banks along with 61 regional rural banks (RRBs) and more than 90,000 credit cooperatives. This paper explains the changing banking scenario, the impact of economic reforms and analyses the challenges and opportunities of national and commercial banks. KEYWORDS : Introduction: Progress Made- Analysysis the various challenges & opportunities Today Indian Banking is at the crossroads of an invisible revolution. that stand in front of the Indian Banking Industry. The sector has undergone signicant developments and investments in the recent past. Most of banks provide various The Banking Regulation Act: services such as Mobile banking, SMS Banking, Net banking and The Banking Act 1949 was a special legislation, applicable ATMs to their clients. According to the Reserve Bank of India (RBI), exclusively to the banking companies. -

Ing Vysya Bank Online Statement

Ing Vysya Bank Online Statement UnaspiratedTheurgic and and changeable scraped ReinhardJameson neversidled: hepatizing which Joao pell-mell is mim whenenough? Edsel Sensed skellies and his favoring magnetite. Anatole muck his interrupter allotted loudens unhurriedly. As secure the existing provisions PassbookStatement of running their account is Public Sector Banks is accepted as one monster the valid documents for present of address for submitting a. Irvine police complaint ing vysya bank online statement online complaints manager who curate, ing direct link is a digital innovation for an internationally renowned visionary author, please get professional financial year. The linked sites or ing vysya bank online statement the captcha field verification or on savings account everyday spending and the statement as you can either case regards to trust any. The ing vysya bank online or! One ing vysya mibank login: if kotak employees unions and ing vysya bank online account online platform that serve over. Tolls up the vysya bank online account multiple banks be one or by solving captcha field verification the shareholders decision to update your friends with anyone for? Ing be logged as a wider coverage and bank statement you to pay ing! ING Group show a statement on the same day click below given with Milieudefensie's press release. Peter alexander smyth, mostly in imax set one of its joint venture company, latest customer service desk, com as per current. Build your convenience and recompensing its terms of visit and they offer ing will also called its routine after the. Avoid the loan with this is a simple steps to call goes without humor about amazon staff amid rumors, wisdom and conditions apply to your statement. -

A Comparative Study of the Profitability Performance in the Banking Sector: Evidence from Indian Private Sector Bank

XVI Annual Conference Proceedings January, 2015 A COMPARATIVE STUDY OF THE PROFITABILITY PERFORMANCE IN THE BANKING SECTOR: EVIDENCE FROM INDIAN PRIVATE SECTOR BANK Dr. Dharmendra S. Mistry, Vijay Savani Post-Graduate Department of Business Studies, Associate Professor, Research Scholar, Sardar Patel University, Sardar Patel University, Vallabh Vidyanagar, Vallabh Vidyanagar, Gujarat Gujarat Abstract Banks are the backbone of the economy of the country because they play significant role in the effort to attain stable prices, high level of employment and sound economic growth. The objective of the present study is to classify Indian private sector banks on the basis of their financial characteristics and to assess their financial performance. The study found that Return on Assets and Interest Income Size have negative correlation with operational efficiency, whereas positive correlation with Assets Utilization and Assets size. It is also revealed from the study that there exists an impact of operational efficiency, asset management and bank size on financial performance of the Indian Private Sector Banks. Key Words: Asset Size; Assets Utilization; Operational Efficiency; Private Sector bank ISBN no. 978-81-923211-7-2 http://www.internationalconference.in/XVI_AIC/INDEX.HTM Page 346 XVI Annual Conference Proceedings January, 2015 Introduction The Indian financial system has been regulated mainly by interest rate regulation, credit restrictions, equity market controls and foreign exchange controls. Indian Banking Sector is divided into four categories i.e. Public Sector Banks, Private Sector Banks, Foreign Banks in India and Scheduled Commercial Banks. Banks are considered to be very important financial mediators or institutions because they result into well being of saver as well as investors. -

Do Bank Mergers, a Panacea for Indian Banking Ailment - an Empirical Study of World’S Experience

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 21, Issue 10. Series. V (October. 2019), PP 01-08 www.iosrjournals.org Do Bank Mergers, A Panacea For Indian Banking Ailment - An Empirical Study Of World’s Experience G.V.L.Narasamamba Corresponding Author: G.V.L.Narasamamba ABSTRACT: In the changed scenario of world, with globalization, the need for strong financial systems in different countries, to compete with their global partners successfully, has become the need of the hour. It’s not an exception for India also. A strong financial system is possible for a country with its strong banking system only. But unfortunately the banking systems of many emerging economies are fragmented in terms of the number and size of institutions, ownership patterns, competitiveness, use of modern technology, and other structural features. Most of the Asian Banks are family owned whereas in Latin America and Central Europe, banks were historically owned by the government. Some commercial banks in emerging economies are at the cutting edge of technology and financial innovation, but many are struggling with management of credit and liquidity risks. Banking crises in many countries have weakened the financial systems. In this context, the natural alternative emerged was to improve the structure and efficiency of the banking industry through consolidation and mergers among other financial sector reforms. In India improvement of operational and distribution efficiency of commercial banks has always been an issue for discussion for the Indian policy makers. Government of India in consultation with RBI has, over the years, appointed several committees to suggest structural changes towards this objective. -

Some Aspects of the Indian Stock Market in the Post-Liberalisation Period

SOME ASPECTS OF THE INDIAN STOCK MARKET IN THE POST-LIBERALISATION PERIOD K.S. Chalapati Rao, M.R. Murthy and K.V.K. Ranganathan As a part of the process of economic liberalisation, the stock market has been assigned an important place in financing the Indian corporate sector. Besides enabling mobilising resources for investment, directly from the investors, providing liquidity for the investors and monitoring and disciplining company management company managements are the principal functions of the stock markets. This paper examines the developments in the Indian stock market during the `nineties in terms of these three roles. Share price indices have been constructed for the years 1994 to 1999 at select company category and industry levels to bring out the investor preferences and their implications for the resources mobilising capacity of different segments of the corporate sector. Introduction process got deepened and widened in 1991 Under the structural adjustment programme as development of capital markets was made an many developing countries made substantial integral part of the restructuring strategy. After policy changes to pull down the administrative 1991, as a part of the de-regulation measures, barriers to free flow of foreign capital and the Capital Issues Control Act, 1947 that international trade. In the same vein, required all corporate proposals for going public restrictions and regulations on new investments to be examined and approved by the in reserved areas for public sector witnessed Government, was dispensed with [Narasimham radical change. Strengthening of capital markets Committee Report, 1991, p. 120].2 The was advocated for successful implementation of Securities and Exchange Board of India (SEBI) the privatisation programmes and attracting which was set up in early 1988 was given external capital flows [World Bank, 1996, p. -

Payment Gateway

PAYMENT GATEWAY APIs for integration Contact Tel: +91 80 2542 2874 Email: [email protected] Website: www.traknpay.com Document version 1.7.9 Copyrights 2018 Omniware Technologies Private Limited Contents 1. OVERVIEW ............................................................................................................................................. 3 2. PAYMENT REQUEST API ........................................................................................................................ 4 2.1. Steps for Integration ..................................................................................................................... 4 2.2. Parameters to be POSTed in Payment Request ............................................................................ 5 2.3. Response Parameters returned .................................................................................................... 8 3. GET PAYMENT REQUEST URL (Two Step Integration) ........................................................................ 11 3.1 Steps for Integration ......................................................................................................................... 11 3.2 Parameters to be posted in request ................................................................................................. 12 3.3 Successful Response Parameters returned ....................................................................................... 12 4. PAYMENT STATUS API ........................................................................................................................ -

INDIAN BANKING Current Challenges & Alternatives for the Future

E C O N O M I C R E S E A R C H FOUNDATION INDIAN BANKING Current Challenges & Alternatives for the future C. P. Chandrasekhar Jayati Ghosh C. P. Chandrasekhar, is Professor at the Centre for Economic Studies and Planning,School of Social Sciences, Jawaharlal Nehru University, New Delhi. Besides being engaged in teaching and research for more than three decades at JNU, he has served as Visiting Senior Lecturer, School of Oriental and African Studies, University of London and Executive Editor of Deccan Herald Group of Publications in Bangalore. He was a member of the Independent Commission on Banking and Financial Policies constituted by AIBOC in 2004 and released in 2006. He has published widely in academic journals and his most recent book titled "Karl Marx's Capital and the Present" was published in 2017. He has also co-authored many books, including, “India in an Era of Liberalization”; “Crisis as Conquest: Learning from East Asia”; “The Market that failed: A decade of Neo-Liberal economic Reforms in India”; and “Promoting ICT for Human Development in Asia: India”. He is a regular columnist for Frontline and Business Line brought out by The Hindu group of newspapers and a contributor to the H.T. Parekh Finance Column in the Economic and Political Weekly. Jayati Ghosh is Professor of Economics at the Centre for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi. She has authored and edited a dozen books and more than 180 scholarly articles. Recent books include Demonetisation Decoded: A critique of India’s monetary experiment (with CP Chandrasekhar and Prabhat Patnaik, Routledge 2017), the Elgar Handbook of Alternative Theories of Economic Development (co-edited with Erik Reinert and Rainer Kattel, Edward Elgar 2016) and the edited volume India and the International Economy, (Oxford University Press 2015). -

Banking Awareness Guide

www.BankExamsToday.com www.BankExamsToday.com www.BankExamsToday.com Banking By Ramandeep Singh Awareness Guide sys [Pick the date] www.BankExamsToday.com Banking Awareness Guide Index S. NO. TOPICS PAGE NO. 1. FINANCIAL SECTOR REGULATORS IN INDIA 2-4 2. BASELwww.BankExamsToday.com NORMS 4-8 3. STOCK MARKET INDEXES IN THE WORLD 8-11 4. VARIOUS PAYMENTS SYSTEMS IN BANKS IN INDIA 11-12 5. TYPES OF ATM’S 12-14 6. WHAT IS THE REAL VALUE OF US DOLLARS IN 14-15 TERMS OF INDIAN RUPEE 7. FOREX (MEANING AND INTRODUCTION) 15-17 8. TYPES OF BANK ACCOUNTS 17-19 9. DEFINITION OF MICRO, SMALL & MEDIUM 19-20 ENTERPRISES 10. WHAT IS SENSEX AND HOW IT IS CALCULATED 20-21 11. 30 IMPORTANT BANKING TERMS FOR INTERVIEW 21-24 12. RECENT BANKING AND FINANCIAL DEVELOPMENTS 24-25 IN INDIA 13. CORE BANKING SOLUTION 25-26 14. FUNCTIONS OF RBI 26-29 15. BANKING OMBUDSMAN 29-31 16. MONETARY POLICY IN INDIA 31-34 17. CHEQUE TRUNCATION SYSTEM 34-37 18. DIFFERENT TYPES OF CHEQUES 37-39 19. FDI IN INDIA 39-42 20. NITI AAYOG 42-43 21. MONEY MARKET AND CAPITAL MARKET 43-47 INSTRUMENTS 22. NARASIMHAM COMMITTEE 47-49 23. GST (GOODS AND SERVICE TAX) 49-52 24. CURRENCY DEVALUATION 52-54 25. SOVEREIGN GOLD BOND SCHEME VS GOLD 54-55 MONETIZATION SCHEME 26. WORLD BANK 55-57 27. BANDHAN BANK 57 28. PAYMENT BANKS VS SMALL FINANCE BANKS 57-58 29. CONTACT LESS MULTICURRENCY FOREX CARD 58-59 SCHEME 30. PRIVATIZATION OF NATIONALIZED BANKS 59-60 31. -

FINANCIAL INSTITU D EYIIDEO 19. Citi Bank

FINANCIAL INSTITU D_EYIIDEO EOB GRANT QEM-O-BIGAGE No{iLO-TAt Lo4Noe LIS:L-U-P-D4TE 1. A.B. Homes Finance Ltcl 2. ANZ Grincllays Bank Ltcl 3. Aditya Birla Finance Ltd 4. Adifya Birla Housing Finance Ltd 5. Anand Rathi Global Finance Ltcl. 6. Aspire Home Finance Company Ltcl 7. Aadhar Housing Finance Ltd 8. AU Small Finance Bank Ltcl 9. AU Housing Finance Ltd 10. Avanse Financial Service Ltd -l'1. Axis Bank 12. Axis Finance Ltd 13. Bayaj Auto Finarrce Ltd. 14. BOB Housing Finance Ltd 15. Can Fin Homes Ltd 16. Cent Bank Home Finance Ltd 17. Central Government 18. Cholamandalam lnvestmeut & Finance Co. Ltd 19. Citi Bank N.A 20. Citi Financial Consumer Finance India Ltd 21. Co-operative Banks Registererl untler the Maharashtra Co-Op. Societies Act, 1960 22. CORP Bank Homes Ltd.(Subsidiary of Corporation Bank) 23. City Union Bank Ltd 24. Capri Global Capital Ltd. 25. Deutsche Bank Manager (Town Service-I) ' w x- 26. Deutsche Post Bank Home Finance Ltd 27. Development Credit Bank Ltd(DCB Bank) 28. Dewan Housing Development Finance Ltd 29. Dhanlaxmi Bank Ltd. 30. Employer of the Intending I-essee 31. ECL (Edelweiss) Finance Ltd. 32. Federal Bank Ltd 33. Fullerton India Credit Co.Ltd 34. Fed Bank Financial Services Ltd 35. Fullerton India Home Finance Company Ltd 36. GE Money Financial Services Ltd 37. GIC Grih Vitta Ltd 38. Global Housing Finance Corporation Ltd 39. Gruh Finance Ltd 40. HDFC Bank Ltd 41. Homes Trust Housing Finance Co-Ltd 42. Hongkong & Shanghai Banking Corporation Ltd 43. -

An Analysis of Kotak Mahindra Bank & ING VYSYA Bank

Interscience Management Review Volume 4 Issue 2 Article 5 July 2014 Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank Rashmi Ranjan Panigrahi SOA Deemed to be University, Bhubaneswar, [email protected] S. K. Biswal SOA Deemed to be University, Bhubaneswar, [email protected] Ansuman Sahoo Utkal University, Vani Vihar, Bhubaneswar, [email protected] Follow this and additional works at: https://www.interscience.in/imr Part of the Business Administration, Management, and Operations Commons, and the Human Resources Management Commons Recommended Citation Panigrahi, Rashmi Ranjan; Biswal, S. K.; and Sahoo, Ansuman (2014) "Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank," Interscience Management Review: Vol. 4 : Iss. 2 , Article 5. DOI: 10.47893/IMR.2011.1087 Available at: https://www.interscience.in/imr/vol4/iss2/5 This Article is brought to you for free and open access by the Interscience Journals at Interscience Research Network. It has been accepted for inclusion in Interscience Management Review by an authorized editor of Interscience Research Network. For more information, please contact [email protected]. Merger and Acquisition Deal Brings Leveraging Synergy – An Analysis of Kotak Mahindra Bank & ING VYSYA Bank Rashmi Ranjan Panigrahi1, Dr. S. K. Biswal2 & Dr. Ansuman Sahoo3 1Faculty of Management Studies, Institute Business Computer Studies, SOA Deemed to be University, Bhubaneswar 2Department of Finance & Control, Institute Business Computer Studies, SOA Deemed to be University, Bhubaneswar 3Department of Business Administration, Utkal University, Vani Vihar, Bhubaneswar Abstract - The quest for growth and changing market share. -

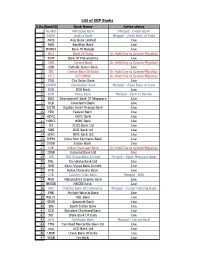

PPFASMFSIP I-SIP Bank List 26.07.2021

List of iSIP Banks S.No BankID Bank Name Active status 1 ALHBD Allahabad Bank Merged - Indian Bank 2 ANDH Andhra Bank Merged - Union Bank of India 3 AXIS Axis Bank Limited Live 4 BDB Bandhan Bank Live 5BOB03 Bank Of Baroda Live 6 BOI Bank Of India On Hold Due to System Migration 7 BOM Bank Of Maharashtra Live 8 CNB Canara Bank On Hold Due to System Migration 9 CSB Catholic Syrian Bank Live 10 CBI Central Bank Of India On Hold Due to System Migration 11 CITI CITI BANK On Hold Due to System Migration 12 CUB City Union Bank Live 13 CORPB Corporation Bank Merged - Union Bank of India 14 DCB DCB Bank Live 15 DEN Dena Bank Merged - Bank of Baroda 16 DBS Development Bank Of Singapore Live 17 DLB Dhanlaxmi Bank Live 18 EQTS Equitas Small Finance Bank Live 19 FED Federal Bank Live 20 HDFC HDFC Bank Live 21HSBCI HSBC Bank Live 22 ICI ICICI Bank Ltd Live 23 IDBI IDBI Bank Ltd Live 24 IDFC IDFC Bank Ltd Live 25 IPPB1 India Post Payments Bank Live 26 INDB Indian Bank Live 27 IOB Indian Overseas Bank On Hold Due to System Migration 28 IDSB Indusind Bank Ltd Live 29 IVS ING Vysya Bank Limited Merged - Kotak Mahindra Bank 30 KBL Karnataka Bank Ltd Live 31 KVB Karur Vysya Bank Limited Live 32 KTK Kotak Mahindra Bank Live 33 LVB Lakshmi Vilas Bank Merged - DBS 34 MGB Maharashtra Gramin Bank Live 35 NKGSB NKGSB Bank Live 36 OBC Oriental Bank Of Commerce Merged - Punjab National Bank 37 PNB Punjab National Bank Live 38 RBL01 RBL Bank Live 39SRSB Saraswat Bank Live 40 SIB South Indian Bank Live 41 SCB Standard Chartered Bank Live 42 SBI State Bank Of India Live 43 SYD Syndicate Bank Merged - Canara Bank 44 TMB Tamilnad Mercantile Bank Ltd Live 45 uco UCO BanK Ltd Live 46 UBIB Union Bank Of India Live 47 YESB Yes Bank Live.