Complete-Report-Catalog-2019.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

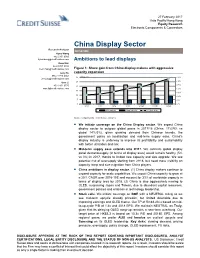

China Display Sector

27 February 2017 Asia Pacific/Hong Kong Equity Research Electronic Components & Connectors China Display Sector Research Analysts INITIATION Kyna Wong 852 2101 6950 [email protected] Ambitions to lead displays Keon Han 82 2 3707 3740 [email protected] Figure 1: Share gain from China display makers with aggressive Jerry Su capacity expansion 886 2 2715 6361 30 (M sq. m) 35% [email protected] 30% Sam Li 25 25% 852 2101 6775 20 [email protected] 20% 15 15% 10 10% 5 5% 0 0% 2012 2013 2014 2015 2016E 2017E 2018E WW capacity China capacity % China share Source: Company data, Credit Suisse estimates ■ We initiate coverage on the China Display sector. We expect China display sector to outgrow global peers in 2017/18 (China: 17%/9% vs global 14%/3%), given growing demand from Chinese brands, the government policy on localisation and mid-term supply ease. China's display industry is underway to improve its profitability and sustainability with better utilisation and mix. ■ Mid-term supply ease extends into 2H17. We estimate global display panel demand-supply (in terms of display area) would remain healthy (5% vs 3%) in 2017, thanks to limited new capacity and size upgrade. We see potential risk of oversupply starting from 2H18, but need more visibility on capacity ramp and size migration from China players. ■ China ambitions in display sector. (1) China display makers continue to expand capacity for scale capabilities. We expect China capacity to grow at a 25% CAGR over 2016-18E and account for 33% of worldwide capacity in terms of display area by 2018. -

CES 2016 Exhibitor Listing As of 1/19/16

CES 2016 Exhibitor Listing as of 1/19/16 Name Booth * Cosmopolitan Vdara Hospitality Suites 1 Esource Technology Co., Ltd. 26724 10 Vins 80642 12 Labs 73846 1Byone Products Inc. 21953 2 the Max Asia Pacific Ltd. 72163 2017 Exhibit Space Selection 81259 3 Legged Thing Ltd 12045 360fly 10417 360-G GmbH 81250 360Heros Inc 26417 3D Fuel 73113 3D Printlife 72323 3D Sound Labs 80442 3D Systems 72721 3D Vision Technologies Limited 6718 3DiVi Company 81532 3Dprintler.com 80655 3DRudder 81631 3Iware Co.,Ltd. 45005 3M 31411 3rd Dimension Industrial 3D Printing 73108 4DCulture Inc. 58005 4DDynamics 35483 4iiii Innovations, Inc. 73623 5V - All In One HC 81151 6SensorLabs BT31 Page 1 of 135 6sensorlabs / Nima 81339 7 Medical 81040 8 Locations Co., Ltd. 70572 8A Inc. 82831 A&A Merchandising Inc. 70567 A&D Medical 73939 A+E Networks Aria 36, Aria 53 AAC Technologies Holdings Inc. Suite 2910 AAMP Global 2809 Aaron Design 82839 Aaudio Imports Suite 30-116 AAUXX 73757 Abalta Technologies Suite 2460 ABC Trading Solution 74939 Abeeway 80463 Absolare USA LLC Suite 29-131 Absolue Creations Suite 30-312 Acadia Technology Inc. 20365 Acapella Audio Arts Suite 30-215 Accedo Palazzo 50707 Accele Electronics 1110 Accell 20322 Accenture Toscana 3804 Accugraphic Sales 82423 Accuphase Laboratory Suite 29-139 ACE CAD Enterprise Co., Ltd 55023 Ace Computers/Ace Digital Home 20318 ACE Marketing Inc. 59025 ACE Marketing Inc. 31622 ACECAD Digital Corp./Hongteli, DBA Solidtek 31814 USA Acelink Technology Co., Ltd. Suite 2660 Acen Co.,Ltd. 44015 Page 2 of 135 Acesonic USA 22039 A-Champs 74967 ACIGI, Fujiiryoki USA/Dr. -

CES 2019 – Lifestyle Futurism

CES 2019 – Lifestyle Futurism Chick Foxgrover EVP, creative technologies & innovation Lifestyle Futurism Since we're talking about tech all year continue its dominance, and Amazon Alongside work on wellbeing and care round these days, I made the annual grabs more of the retail universe, applications as well as education. pilgrimage to CES this year with certain becoming the no. 3 digital advertising expectations. That we'd see lot's of talk platform by simply showing up. Was there At CES, we are witnessing the emergence and evolution of the tools about 5G, continuing but less emphatic anything especially exciting waiting for for creating and managing the interest in autonomous driving and VR, us? even higher resolution TVs and nothing mechanics of our digital/physical lives. dramatically earth-shattering about Yes. CES IS very important. It’s an mobile phones. opportunity for the designers, engineers and manufacturers to Also, going into this year’s CES we’ve demonstrate their idealized vision of seen the beginnings of “tech-lash,” a our lives with near- and farther-future sobering realization of our responsibility versions of their products. The drive to to understand and direct the digitally transform and connect the built development of advanced technologies in environment and life activities continues. our lives, industries and societies. Every year we see more evidence of the iPhone sales are disappointing, fulfilling knitting together of life's systems: cars, worries about smartphone sale growth. homes, appliances, services and utilities. The duopoly of Google and Facebook Insights and Takeaways - 2019 • Samsung’s collaboration with Google (Assistant) and Apple for content augur a trend toward IoT integration pragmatism. -

Huawei Board of Directors

Huawei Board of Directors DIRECTOR CRISIS MANAGER MODERATOR Priscilla Layarda Brayden Ning Sharon Lee CRISIS ANALYSTS Sahreesh Nawar Victoria Wang Huiyang (Harry) Chen UTMUN 2020 Huawei Board of Directors Contents Content Disclaimer 3 UTMUN Policies 4 Equity Concerns and Accessibility Needs 4 A Letter from Your Director 5 Historical Context 7 Global Technological Landscape 8 Reasons for the Ban 8 Effects of the Ban 8 Huawei Business Model 12 Core Business 12 Value Proposition 12 Customer Segments and Customer Relationships 13 Key Partners 13 Key Resources 14 Governance Structure 15 Finances 17 Sanctions and Privacy Concerns 18 US-China Trade Tensions 18 Supply-Chain Concerns 18 Potential Loss of Market for Current Products 19 Legal Challenges 20 Privacy and Security Concerns 20 Long-Term Strategic Plan 21 Pace of Innovation 21 Brand Image in the US 21 1 UTMUN 2020 Huawei Board of Directors Mergers and Acquisitions 21 Growth Markets 22 New Products 22 Questions to Consider 24 Further Research 25 Bibliography 26 2 UTMUN 2020 Huawei Board of Directors Content Disclaimer At its core, Model United Nations (MUN) is a simulatory exercise of diplomatically embodying, presenting, hearing, dissecting, and negotiating various perspectives in debate. Such an exercise offers opportunities for delegates to meaningfully explore possibilities for conflict resolution on various issues and their complex, even controversial dimensions – which, we recognize, may be emotionally and intellectually challenging to engage with. As UTMUN seeks to provide an enriching educational experience that facilitates understanding of the real-world implications of issues, our committees’ contents may necessarily involve sensitive or controversial subject matter strictly for academic purposes. -

Las Estadísticas De Patentes: ¿Es Un Error Decidir Las Políticas De Innovación En Base a Los Datos De Patentes Publicados?

Las estadísticas de patentes: ¿es un error decidir las políticas de innovación en base a los datos de patentes publicados? Los Lunes de Patentes UB Patent Centre, Barcelona, 9 de marzo de 2020 Gian‐Lluís Ribechini Creus Ingeniero Industrial twitter: @gianlluis [email protected] 1 Índice 1) Una visión de los datos de solicitudes nacionales, europeas e internacionales 2) Sorpresas que dan los datos publicados 3) Cuando los datos no exponen la realidad 4) Los datos en España... ¿es razonable que sean tan malos? 5) Curiosidades y reflexiones sobre las estadísticas. Propuestas de mejora Fuentes de los datos: Las tablas y gráficos de esta presentación son de elaboración propia a partir de datos ofrecidos por la WIPO, la EPO y la OEPM. 2 1 Una visión de los datos de solicitudes nacionales, europeas e internacionales. 3 Solicitudes PCT ‐ período 2009‐2018 Número de solicitudes PCT Número de solicitudes PCT % Sistema de Paris Año Total variación anual 2009 155.402 -4,80% 2010 164.340 5,75% 2011 182.437 11,01% 2012 195.325 7,06% 2013 205.305 5,11% 2014 214.333 4,40% 2015 217.235 1,35% 2016 232.913 7,22% 2017 243.511 4,55% 2018 252.315 3,62% 4 Top 20 de países solicitantes de solicitudes PCT en 2018 Número de solicitudes PCT en 2018 por país de origen de la solicitud % acumulado % País origen de solicitud 2018 % acumulado solicitudes 2018/2017 1 United States of America 55.981 22,2% 22,2% 55.981 -1,2% 2 China 53.340 21,1% 43,3% 109.321 9,1% 3 Japan 49.703 19,7% 63,0% 159.024 3,1% 4 Germany 19.750 7,8% 70,9% 178.774 4,2% 5 Republic -

RF Front-End Module Comparison 2020 – Volume 4

REVERSE COSTING® – STRUCTURAL, PROCESS & COST REPORT RF Front-End Module Comparison 2020 – Volume 4 Technical and cost overview of the latest radio frequency front-end module technologies integrated in Asian based smartphones manufacturers. SP20524 - RF report by Stéphane ELISABETH LABORATORY ANALYSIS by Youssef EL GMILI October 2020 – Sample 22 bd Benoni Goullin 44200 NANTES - FRANCE +33 2 40 18 09 16 [email protected] www.systemplus.fr ©2020 by System Plus Consulting | SP20524 - RF Front-End Module Comparison 2020 – Volume 4 | Sample 1 Table of Contents Overview / Introduction 4 ✓ Die View And Dimensions o Executive Summary ✓ Estimated Front-End Bloc Diagram o Reverse Costing Methodology o AFEM-9206 vs. AFEM-8100 Company Profile 12 o HiSilicon – Front-End Analysis 83 o Huawei, OnePlus, Oppo, Vivo, Xiaomi, ZTE o Huawei P40 Pro – RFFE Architecture o Smartphones Teardown: o Front-End Analysis P40 Pro, 8 5G, Reno3 5G, X30 Pro 5G, Mi 10 Pro, Nubia Red Magic 5G o Hi6HD05V100 vs. SKY77643-61 o Summary of the analyzed RF components o Murata – Front-End Analysis 95 o Physical Analysis Summary 34 Huawei P40 Pro – RFFE Architecture o Front-End Analysis o Database Contains: Number of phones, LTE/5G bands per smartphones, Module in RF Area o 429 vs. SKY58255 o Comparative Analysis: o Qorvo – Front-End Analysis 111 RFFE Area, Design Win, Main Supplier, Function, OEMs main Supplier o Vivo X30 Pro vs. Xiaomi Mi 10 Pro 5G vs. Huawei P40 Pro – RFFE Physical Comparison 45 Architecture o Area Distribution per Supplier & Function o Front-End Module Analysis o o Die Design Win in Number & Area QM75005 vs. -

CES 2020 Exhibitor Listing As of 10/2/21

CES 2020 Exhibitor Listing as of 10/2/21 Name Booth * * Westgate Hospitality Suites * Renaissance Hospitality Suites * Vdara Hospitality Suites Venetian Palazzo Hospitality * Suites *ARIA. ARIA Hospitality Suites *Wynn Wynn Encore Hospitality Suites |pipe| 1708 1drop 61211 1MORE 36006 1nce GmbH 2518 1Valet, Inc. 42125 2 the Max Asia Pacific Ltd. 42152 20tree.ai 51726 24 Vision System 52960 24i Aria Hospitality Suites 24Notion 2J Antennas 2713 360Compliance 2517 3D Music 51548 3divisionlabs GmbH 36536 3drens 51441 3E 52836 3M 43731, 46449MR 42Maru Inc 53322 4AMPS Technologies 40835 4DAGE Technology Co., Ltd. 21653 4IND Co., Ltd. 61525 4moms 44758 4Paradigm 25622 4S Mapper 53322 6G Cool Ltd 52968 A&K Robotics 14739 A.I. Care LLC 20564, 46153 A.I.MATICS Inc. 6134 A1 Company 52780 A9 Co.,Ltd 52843 Venetian Palazzo Hospitality AAA Suites Renaissance Hospitality Suites 2, AAC Technologies Renaissance Hospitality Suites AAMP of America Westgate Hospitality Suites 41131, Venetian Palazzo AARP Hospitality Suites AAUXX 31427 AB Turn USA, Inc. 53185 Abalta Technologies Westgate Hospitality Suites Abbott 44355 ABEye 50615 Ability Opto-Electronics Technology Co., Ltd. 7932 Ablegrid Corp. 40570 abode 40724 Above Care Inc 51441 Abross 53302 ABUP Technology Co., Ltd 2817 Acapela Group 35829 Venetian Palazzo Hospitality Accedo Suites Accenture Access Explorer 51122 Accessory Power 31564 Acconeer Westgate Hospitality Suites Ace Computers 20941 ACE Marketing Inc. 61428 AceCAD Digital Corp. DBA Solidtek USA 32040 Aceinna 6738 Acesonic USA 36717 ACIGI, Fujiiryoki USA/Dr. Fuji 20436 Acoba 40619 AcoSolar Inc 30354 Acouva, Inc. 51776 Act Power Taiwan Co., Ltd. 60528 Actasys 53551 Action Star Technology Co., Ltd. -

MWC Barcelona 2020 MWC Barcelona

33.75 8.0M100 10.5 10.5 354.38m² 33.75 i i 15 10 10 OA8.9 OA8.7 OA8.5 a 15.63 54.49 13 13 13 13 13 13 Apple Fluge a 8.0I20 Goods Lift 8.1 Max Weight - 4000 Kg Tree Size - 2.36m x 3.5m Door Width - 2.67m 8.0I50 S Door Height - 2.17m 195m² 130m² 130m² a a 15.81 15.81 Blue 15 10 10 Ant 23.76 23.76 20 gsmExchange OA8.11 15.63247.11m² 8.0I10 15.63 a a 8.08 8.08 Registration 20 20 OA8 dc 126.29m² 1294.68m² Optima 8.01 EXIT ONLY 15.63 57.1854.49 h 14.06 8.0H60 g FAST TRACK 7 4 4 4 4 4 4 4 6 6 4 4 4 4 4 4 4 CC8.16 CC8.15 CC8.14 CC8.13 CC8.12 CC8.11 CC8.10 CC8.9 CC8.8 CC8.7 CC8.6 CC8.5 CC8.4 CC8.3 CC8.2 CC8.1 OA8.3 8.0H50 3.5 3.5 3.5 3.5 a OpenX Limited MoPub 20 400m² HALL 4.5 21m² 4.521m² GSMA 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 8 SPA 8 8 SPA 8 8 SPA 8 8 8 8 8 20 Macom Meeting AlgoriX AppsFlyer Condor Condor Condor OA8.13 Nexign Nexign Nexign Nexign Taptica CC8.Tech2 10 10 6 6 Electronics Electronics Electronics ASA ASA Room 2 4.5 4.5 Rigging 10.13m² 6.36 CC8.Tech1 a 10.13m² 6.36 10 10 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 32m² 27.37 27.37 26.74 26.74 a 4 4 4 4 4 4 4 4 4 4 4 4 4 4 Blue Ant 70m² Badge 7 Cloakroom CC8 Rooms 20 200m² Fast Track 10 10 8 8 5 5 10 CC8.26 CC8.21 CC8.20 CC8.19 20 Goods Lift 8.2 CC8.30 CC8.28 6.36 CC8.17 Max Weight - 6000 Kg 4.5 4.5 Size - 2.36m x 5.28m CC8.Tech4 OA8.15 a Door Width - 2.69m 6.36 10.13m² Door Height - 2.78m GSMA CC8.Tech3 GSMA 8 Collection 8 8 8 8 8 8 10.13m² 8 8 8 Smaato8 8 8 8 Meeting 6 6 Meeting GSMA Room 3 CC8.24 CC8.23 Inc. -

Smartphone Foldable Phones Are Just the Beginning— Stretchable, Wearable Displays Are Already in the Laboratory P

GALLIUM NITRIDE VACUUM TUBES GREENHOUSE-GAS HOW LOW CAN GETS READY FOR 6G OF THE COLD WAR SENSING SATELLITES LATENCY GO? Jump in efficiency Nine wild devices Microsatellites spot Wireless researchers astounds experts you’ve never heard of methane—for a profit push the limits P. 07 P. 30 P. 38 P. 44 FOR THE TECHNOLOGY INSIDER | 11.20 The Incredible BENDABLE Smartphone Foldable phones are just the beginning— stretchable, wearable displays are already in the laboratory P. 24 Keep pushing the limits! Congratulations to Peter Grutter and his group at the Nanoscience & SPM Lab at McGill University on bridging the gap between high spatial and ultrafast temporal resolution to advance molecular and quantum electronics. Observing 100 fs non-linear Megan Cowie, Nanoscience & SPM Group, optical interactions and quantized vibration-modified McGill University electron transfer in single molecules with AFM are impressive achievements that set new standards at the forefront of scientific research. We are excited to continue our collaboration and look forward to finding new ways of using lock-in amplifiers and boxcar averagers to push the limits of SPM applications. Zurich www.zhinst.com Instruments Your Application. Measured. CONTENTS_11.20 30 THE 9 GREATEST 38 MICRO- 44 BREAKING 06 NEWS DISPLAYS VACUUM TUBES SATELLITES SPOT THE MILLISECOND 16 HANDS ON YOU’VE NEVER MYSTERY METHANE BARRIER It will take 20 CROSSTALK HEARD OF These LEAKS Keeping a lot of tricks to push 52 PAST FORWARD THAT BEND tubes excel where carbon-capping network latencies solid-state devices schemes on track below 1 millisecond. fall short. needs tech that can go By Shivendra Panwar AND STRETCH By Carter M. -

Advance Program 2020 Virtual Display Week International Symposium

ADVANCE PROGRAM 2020 VIRTUAL DISPLAY WEEK INTERNATIONAL SYMPOSIUM August 3-7, 2020 (Monday – Friday) Session 1: Annual SID Business Meeting Session 2: Opening Remarks / Keynote Addresses 2.1: Keynote Address 1: Robert Wisnieff, IBM T.J. Watson Research Center 2.2: Keynote Address 2: David Luebke, NVIDIA Corp. 2.3: Keynote Address 3: Michael Heckmeier, Merck KGaA 2.4 Keynote Address 4: Frank Ko, AU Optronics Corp. Session 3: 8K, High Resolution LCDs (Liquid Crystal Technology) Chair: Miyoshi Ayama, Utsunomiya University Co-Chair: Philip Chen, National Chiao Tung University 3.1: Invited Paper: Super Bright 8K LCD with 10,000 nit has been Realized with Excellent Light-Resistance Characteristics of IGZO TFT Backplane Jun Nishimura, Sharp Corp. Display Device Company, Kameyama, Japan 3.2: Invited Paper: A Wide Color Gamut LCD with a Polarized Laser Backlight Shinichi Komura, Japan Display Inc., Mobara, Japan 3.3: Novel Microstructure Film to Improve Viewing Angle of Multi-Domain Polymer Sustained Alignment LCD Kun-Cheng Tien, AU Optronics, Hsinchu, Taiwan Roc 3.4: Novel LCD Pixel Design with Extra Large Aperture Ratio for PsVA Mode Display Surigalatu Borjigin, Shenzhen China Star Optoelectronics Semiconductor Display Technology Co.Ltd., Shenzhen, China 3.5: Late-News Paper: Two-Dimensionally Aligned Array with 1µm Pixel Pitch Using Ferroelectric Liquid Crystal Pixels for Holography Application Shintaro Aso, Japan Broadcasting Corporation, Tokyo, Japan Session 4: Automotive Display Components (Automotive/Vehicular Displays and HMI Technologies) -

5G Device Ecosystem

5G Device Ecosystem Prepared by GSA based on data from the GSA Analyser for Mobile Broadband Devices (GAMBoD) August 2019 © Copyright 2019 Global mobile Suppliers Association 1 Key facts In the first half of 2019, the number of announced 5G devices grew rapidly, starting with a few announcements and then gathering pace as operators in various parts of the world launched their first commercial 5G services. We can expect the device ecosystem to continue to grow quickly and GSA will be tracking and reporting regularly on 5G device launch announcements. Its GAMBoD database will contain key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular publication. By the first week of August, GSA had identified: Thirteen announced form factors (phones, hotspots, indoor CPE, outdoor CPE, laptops, modules, snap-on dongles/adapters, enterprise routers, IoT routers, drones, a switch, a USB terminal and robot). Forty-one vendors that had announced available or forthcoming 5G devices, including sub-brands separately (plus four in partnership with Sunsea). 100 announced One hundred announced devices, up from 90 at the end of June (excluding 5G devices in regional variants, re-badged devices, phones that can be upgraded using a total, excluding separate adapter, and prototypes not expected to be commercialised): regional variants and • 26 phones (plus regional variants); at least nine of which are now prototypes not commercially available expected to be commercialised • eight hotspots (plus regional variants); at least three of which are now commercially available • 26 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices) at least eight of which are now believed to be commercially available • 28 modules • two snap-on dongles/adapters • two routers, • two IoT routers • two drones • one laptop • one switch • one USB terminal • one robot. -

Journal 2418

Iris um Oifig Maoine Intleachtúla na hÉireann Journal of the Intellectual Property Office of Ireland Iml. 95 Cill Chainnigh 19 August 2020 Uimh. 2418 CLÁR INNSTE Cuid I Cuid II Paitinní Trádmharcanna Leath Leath Official Notice 2997 Official Notice 1534 Applications for Patents 3000 Applications for Trade Marks 1536 Applications Published 3001 Oppositions under Section 43 1565 Patents Granted 3005 Application(s) Amended 1565 European Patents Granted 3006 Application(s) Withdrawn 1566 Applications Withdrawn, Deemed Withdrawn or Trade Marks Registered 1567 Refused 3168 Trade Marks Renewed 1568 Patents Lapsed 3168 Unpaid Renewal Fees 1570 Request for Grant of Supplementary Protection Trade Marks Removed 1575 Certificate 3169 Leave to Alter Registered Trade Mark(s) Supplementary Protection Certificate Granted 3170 Granted 1579 Supplementary Protection Certificate Withdrawn 3170 International Registrations under the Madrid Protocol 1580 International Trade Marks Protected 1596 Dearachtaí Designs Information under the 2001 Act Designs Registered 3171 The Journal of the Intellectual Property Office of Ireland is published fortnightly. Each issue is freely available to view or download from our website at www.ipoi.gov.ie © Rialtas na hÉireann, 2020 © Government of Ireland, 2020 2997 (19/08/2020) Journal of the Intellectual Property Office of Ireland (No. 2418) Iris um Oifig Maoine Intleachtúla na hÉireann Journal of the Intellectual Property Office of Ireland Cuid I Paitinní agus Dearachtaí No. 2418 Wednesday, 19 August, 2020 NOTE: The office does not guarantee the accuracy of its publications nor undertake any responsibility for errors or omissions or their consequences. In this Part of the Journal, a reference to a section is to a section of the Patents Act, 1992 unless otherwise stated.