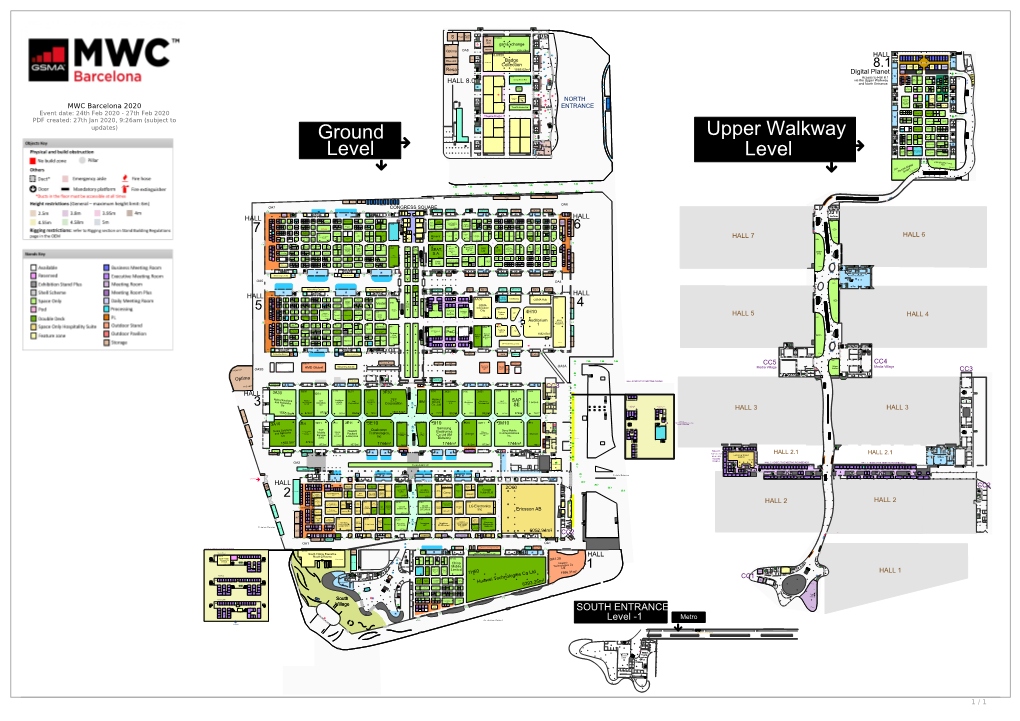

MWC Barcelona 2020 MWC Barcelona

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2G 3G 4G 5G > 181,400

Annual report 2019 Operational Results Infrastructure Network expansion MegaFon is the unrivalled leader in Russia 1 by number of base stations, with We are committed to maximising the speed and reliability of communications services for our subscribers, and are continuously investing in infrastructure and innovative technology. > 181,400 stations 2G 3G 4G 5G 1990s 2000s 2010s 2016–2019 Voice and SMS Mobile data and high- Mobile broadband and full- Ultrafast mobile internet, quality voice services scale IP network full-scale support of IoT ecosystems, and ultra-reliability MegaFon was the first in Russia to • provide 2G services in all • roll out a full-scale • launch the first 4G • demonstrate a record Russian regions commercial 3G network network (2012); connection speed • launch a commercial of 2.46 Gbit/s VoLTE network (2016); on a smartphone • demonstrate a data on a 5G network (2019); rate in excess of 1 Gbit/s • launch a 5G on a commercial lab – in collaboration smartphone (2018) with Saint Petersburg State University’s Graduate School of Management (2019) 1 According to Roscomnadzor as of 19 March 2020. 48 About MegaFon 14–35 Strategic report 36–81 Sustainability 82–109 Corporate governance, securities, and risk management 110–147 Financial statements and appendix 148–226 MegaFon’s base stations, ‘000 4G/LTE coverage, % 2019 70.0 50.7 60.7 181.4 2019 82 2018 70.5 49.4 49.6 169.5 2018 79 2017 69.1 48.0 40.6 157.7 2017 74 2G 3G 4G/LTE MegaFon’s strong portfolio of unique high-speed data 4G/LTE networks spectrum assets is an important competitive advantage. -

China Display Sector

27 February 2017 Asia Pacific/Hong Kong Equity Research Electronic Components & Connectors China Display Sector Research Analysts INITIATION Kyna Wong 852 2101 6950 [email protected] Ambitions to lead displays Keon Han 82 2 3707 3740 [email protected] Figure 1: Share gain from China display makers with aggressive Jerry Su capacity expansion 886 2 2715 6361 30 (M sq. m) 35% [email protected] 30% Sam Li 25 25% 852 2101 6775 20 [email protected] 20% 15 15% 10 10% 5 5% 0 0% 2012 2013 2014 2015 2016E 2017E 2018E WW capacity China capacity % China share Source: Company data, Credit Suisse estimates ■ We initiate coverage on the China Display sector. We expect China display sector to outgrow global peers in 2017/18 (China: 17%/9% vs global 14%/3%), given growing demand from Chinese brands, the government policy on localisation and mid-term supply ease. China's display industry is underway to improve its profitability and sustainability with better utilisation and mix. ■ Mid-term supply ease extends into 2H17. We estimate global display panel demand-supply (in terms of display area) would remain healthy (5% vs 3%) in 2017, thanks to limited new capacity and size upgrade. We see potential risk of oversupply starting from 2H18, but need more visibility on capacity ramp and size migration from China players. ■ China ambitions in display sector. (1) China display makers continue to expand capacity for scale capabilities. We expect China capacity to grow at a 25% CAGR over 2016-18E and account for 33% of worldwide capacity in terms of display area by 2018. -

CES 2016 Exhibitor Listing As of 1/19/16

CES 2016 Exhibitor Listing as of 1/19/16 Name Booth * Cosmopolitan Vdara Hospitality Suites 1 Esource Technology Co., Ltd. 26724 10 Vins 80642 12 Labs 73846 1Byone Products Inc. 21953 2 the Max Asia Pacific Ltd. 72163 2017 Exhibit Space Selection 81259 3 Legged Thing Ltd 12045 360fly 10417 360-G GmbH 81250 360Heros Inc 26417 3D Fuel 73113 3D Printlife 72323 3D Sound Labs 80442 3D Systems 72721 3D Vision Technologies Limited 6718 3DiVi Company 81532 3Dprintler.com 80655 3DRudder 81631 3Iware Co.,Ltd. 45005 3M 31411 3rd Dimension Industrial 3D Printing 73108 4DCulture Inc. 58005 4DDynamics 35483 4iiii Innovations, Inc. 73623 5V - All In One HC 81151 6SensorLabs BT31 Page 1 of 135 6sensorlabs / Nima 81339 7 Medical 81040 8 Locations Co., Ltd. 70572 8A Inc. 82831 A&A Merchandising Inc. 70567 A&D Medical 73939 A+E Networks Aria 36, Aria 53 AAC Technologies Holdings Inc. Suite 2910 AAMP Global 2809 Aaron Design 82839 Aaudio Imports Suite 30-116 AAUXX 73757 Abalta Technologies Suite 2460 ABC Trading Solution 74939 Abeeway 80463 Absolare USA LLC Suite 29-131 Absolue Creations Suite 30-312 Acadia Technology Inc. 20365 Acapella Audio Arts Suite 30-215 Accedo Palazzo 50707 Accele Electronics 1110 Accell 20322 Accenture Toscana 3804 Accugraphic Sales 82423 Accuphase Laboratory Suite 29-139 ACE CAD Enterprise Co., Ltd 55023 Ace Computers/Ace Digital Home 20318 ACE Marketing Inc. 59025 ACE Marketing Inc. 31622 ACECAD Digital Corp./Hongteli, DBA Solidtek 31814 USA Acelink Technology Co., Ltd. Suite 2660 Acen Co.,Ltd. 44015 Page 2 of 135 Acesonic USA 22039 A-Champs 74967 ACIGI, Fujiiryoki USA/Dr. -

Northern African Wireless Communications Is a Controlled Circulation Bi-Monthly Magazine

For communications professionals in north, west, east & central Africa NORTHERN AFRICAN WIRELESSCOMMUNICATIONS FEBRUARY/MARCH 2021 Volume 19 Number 6 l Satellite: a thing of the past or technology for the future? l The growing importance of FWA and Wi-Fi on the move l Sanjeev Verma of Squire Technologies on mobile fraud NAWC 2103 p1 (Cover).indd 1 07/04/2021 18:03 NEWS 4 SOUTHERN AFRICAN WIRELESS COMMUNICATIONS January/February 2019 NAWC 2011 p2.indd 4 09/11/2020 18:16 NORTHERN AFRICAN CONTENTS WIRELESSCOMMUNICATIONS FEBRUARY/ 5 NEWS u MARCH 2021 Connecting Europe with Africa u Algerian minister says ‘5G not a priority’ Volume 19 u TheAngle and ABS extend partnership Number 6 u South Sudan launches first ever 4G internet u Nexign helps CSPs 5 NEWS u Kenyan auditor raises concerns over fibre u Safaricom launches commercial 5G network 18 FEATURE u Tunisia launches first home-made satellite u TE and Libyans discuss joint cooperation Liquid Intelligent Technologies is u MTN Uganda and NITA launch health app a pan-African technology group with u Outages affect WIOCC clients across Africa capabilities across 14 countries, primarily u Expresso Senegal gets 4G green light in Sub-Saharan Africa. Established in u Libya seeks help from international partners 2005, Liquid has firmly established 13 WIRELESS BUSINESS itself as the leading pan-African digital WIOCC names new sales manager infrastructure provider with an extensive 24 FEATURE network spanning over 73,000 KM. Liquid 18 FEATURE Intelligent Technologies is redefining Shaping the future of satcoms Network, Cloud and Cyber Security offerings through strategic partnerships 22 INDUSTRY VIEW Necessity is the mother of invention with leading global players, innovative business applications, intelligent cloud 24 FEATURE services and world-class security to the 28 WIRELESS SOLUTIONS Fixed wireless access and Wi-Fi on the move African continent. -

2020 Annual Report

Online Annual Report Gazprom Neft Performance review Sustainable 2020 at a glance 62 Resource base and production development CONTENTS 81 Refining and manufacturing 4 Geographical footprint 94 Sales of oil and petroleum products 230 Sustainable development 6 Gazprom Neft at a glance 114 Financial performance 234 Health, safety and environment (HSE) 8 Gazprom Neft’s investment case 241 Environmental safety 10 2020 highlights 250 HR Management 12 Letter from the Chairman of the Board of Directors 254 Social policy Technological Strategic report development Appendices 264 Consolidated financial statements as at and for the year ended 31 December 2020, with the 16 Letter from the Chairman of the Management Board 122 Innovation management independent auditor’s report About the Report 18 Market overview 131 2020 highlights and key projects 355 Company history This Report by Public Joint Stock Company Gazprom Neft (“Gazprom 28 2020 challenges 135 Import substitution 367 Structure of the Gazprom Neft Group Neft PJSC”, the “company”) for 2020 includes the results of operational activities of Gazprom Neft PJSC and its subsidiaries, 34 2030 Strategy 370 Information on energy consumption at Gazprom collectively referred to as the Gazprom Neft Group (the “Group”). 38 Business model Neft Gazprom Neft PJSC is the parent company of the Group and provides consolidated information on the operational and financial 42 Company transformation 371 Excerpts from management’s discussion and performance of the Group’s key assets for this Annual Report. The analysis of financial condition and results of list of subsidiaries covered in this Report and Gazprom Neft PJSC’s 44 Digital transformation operations interest in their capital are disclosed in notes to the consolidated Governance system IFRS financial statements for 2020. -

Samena Trends March 2021

Feb-Mar, Volume 12, 2021 A SAMENA Telecommunications Council Publication www.samenacouncil.org S AMENA TRENDS FOR SAMENA TELECOMMUNICATIONS COUNCIL'S MEMBERS BUILDING DIGITAL ECONOMIES Eng. Olayan M. H.E. Hamad Obaid Al H.E. Dr. Mohamed Al Alwetaid Mansoori Tamimi Group CEO Director General Governor stc, Saudi Arabia TDRA, UAE CITC, Saudi Arabia THIS MONTH DIGITAL ECONOMIC GROWTH: FROM POLICY TO REALITY FEB-MAR, VOLUME 12, 2021 Contributing Editors Knowledge Contributions Publisher Izhar Ahmad BT SAMENA Telecommunications Council SAMENA Javaid Akhtar Malik China Mobile International Etisalat Subscriptions TRENDS goetzpartners [email protected] Huawei Editor-in-Chief Nexign Advertising Bocar A. BA Omantel [email protected] PCCW Global RIPE NCC SAMENA TRENDS Speedchecker [email protected] Tech Mahindra Tel: +971.4.364.2700 CONTENTS 04 EDITORIAL FEATURED 05 13 REGIONAL & MEMBERS UPDATES Members News Regional News 75 SATELLITE UPDATES Satellite News 87 WHOLESALE UPDATES Governor-CITC (Saudi Arabia) Wholesale News Speaks to SAMENA Council 07 93 TECHNOLOGY UPDATES Technology News The SAMENA TRENDS eMagazine is wholly owned and operated by The SAMENA 99 REGULATORY & POLICY UPDATES Telecommunications Council (SAMENA Regulatory News Council). Information in the eMagazine is not intended as professional services advice, A Snapshot of Regulatory and SAMENA Council disclaims any liability Activities in the SAMENA Region for use of specific information or results thereof. Articles and information contained Regulatory Activities DG-TDRA (UAE) Speaks to in this publication are the copyright of Beyond the SAMENA Region SAMENA Council SAMENA Telecommunications Council, (unless otherwise noted, described or stated) 09 and cannot be reproduced, copied or printed ARTICLES in any form without the express written 54 Etisalat Driving the Digital Future to permission of the publisher. -

CES 2019 – Lifestyle Futurism

CES 2019 – Lifestyle Futurism Chick Foxgrover EVP, creative technologies & innovation Lifestyle Futurism Since we're talking about tech all year continue its dominance, and Amazon Alongside work on wellbeing and care round these days, I made the annual grabs more of the retail universe, applications as well as education. pilgrimage to CES this year with certain becoming the no. 3 digital advertising expectations. That we'd see lot's of talk platform by simply showing up. Was there At CES, we are witnessing the emergence and evolution of the tools about 5G, continuing but less emphatic anything especially exciting waiting for for creating and managing the interest in autonomous driving and VR, us? even higher resolution TVs and nothing mechanics of our digital/physical lives. dramatically earth-shattering about Yes. CES IS very important. It’s an mobile phones. opportunity for the designers, engineers and manufacturers to Also, going into this year’s CES we’ve demonstrate their idealized vision of seen the beginnings of “tech-lash,” a our lives with near- and farther-future sobering realization of our responsibility versions of their products. The drive to to understand and direct the digitally transform and connect the built development of advanced technologies in environment and life activities continues. our lives, industries and societies. Every year we see more evidence of the iPhone sales are disappointing, fulfilling knitting together of life's systems: cars, worries about smartphone sale growth. homes, appliances, services and utilities. The duopoly of Google and Facebook Insights and Takeaways - 2019 • Samsung’s collaboration with Google (Assistant) and Apple for content augur a trend toward IoT integration pragmatism. -

Huawei Board of Directors

Huawei Board of Directors DIRECTOR CRISIS MANAGER MODERATOR Priscilla Layarda Brayden Ning Sharon Lee CRISIS ANALYSTS Sahreesh Nawar Victoria Wang Huiyang (Harry) Chen UTMUN 2020 Huawei Board of Directors Contents Content Disclaimer 3 UTMUN Policies 4 Equity Concerns and Accessibility Needs 4 A Letter from Your Director 5 Historical Context 7 Global Technological Landscape 8 Reasons for the Ban 8 Effects of the Ban 8 Huawei Business Model 12 Core Business 12 Value Proposition 12 Customer Segments and Customer Relationships 13 Key Partners 13 Key Resources 14 Governance Structure 15 Finances 17 Sanctions and Privacy Concerns 18 US-China Trade Tensions 18 Supply-Chain Concerns 18 Potential Loss of Market for Current Products 19 Legal Challenges 20 Privacy and Security Concerns 20 Long-Term Strategic Plan 21 Pace of Innovation 21 Brand Image in the US 21 1 UTMUN 2020 Huawei Board of Directors Mergers and Acquisitions 21 Growth Markets 22 New Products 22 Questions to Consider 24 Further Research 25 Bibliography 26 2 UTMUN 2020 Huawei Board of Directors Content Disclaimer At its core, Model United Nations (MUN) is a simulatory exercise of diplomatically embodying, presenting, hearing, dissecting, and negotiating various perspectives in debate. Such an exercise offers opportunities for delegates to meaningfully explore possibilities for conflict resolution on various issues and their complex, even controversial dimensions – which, we recognize, may be emotionally and intellectually challenging to engage with. As UTMUN seeks to provide an enriching educational experience that facilitates understanding of the real-world implications of issues, our committees’ contents may necessarily involve sensitive or controversial subject matter strictly for academic purposes. -

Computer Simulation of M2M Communication Subscriber Locating

Computer simulation of M2M communication subscriber locating Galina Kurcheeva Novosibirsk State Technical University Novosibirsk, 630073 [email protected] Georgy Klochkov Novosibirsk State University of Economics and Management Novosibirsk, 630099 [email protected] Maxim Bakaev Novosibirsk State Technical University Novosibirsk, 630073 [email protected] Abstract The potential for developing technologies of machine-to-machine com- munication for smart city projects to be implemented in Russia is dis- cussed. The necessity of developing technologies connecting devices of different types within a given location is substantiated. A model and a statement of the problem specifying the location of an item in a machine-to-machine communication system (Machine-to-Machine, M2M) at the required scale are proposed. In the study, a systemic ap- proach and a process approach are applied. The systemic approach al- lows separate machine-to-machine communication developments to be integrated into a smart city paradigm. The process approach allows the sequence of all the major technological and information processes to be implemented. In Russia, machine-to-machine communication has so far been developed for limited expanses. Implementation of the proposed model allows a transition to technologies which are close to mobile ap- plications and which may ensure machine-to-machine communication in the smart transport, smart energetics, smart house subsystems, and other areas of the smart city system. This development is designed to enhance mobility and efficiency of work; therefore, its commercial- ization is likely, which, in its turn, requires expansion of user-friendly functionality, like design, graphical interface, and other functions, in ac- cordance with the requirements of the information product consumer. -

Annual Report 2020 a Message from Nexign CEO Nexign Annual Report 2020

Annual Report 2020 A Message from Nexign CEO Nexign Annual Report 2020 In 2020 our life moved into virtual space. Habitual and much need- We were actively working on Nexign's product portfolio in order to ed physical contact, as well as face-to-face meetings, became in- support operators in the conditions of the 'new normal'. advisable and even dangerous. We all ended up in a digital world where communication with colleagues and relatives is maintained That is exactly why we developed the Nexign Instant BSS solution through a thin screen and friendly voices are heard only through that makes it possible to launch new business projects within less headphones. than 4 months. In this artificial space we had to deal with a number of urgent To develop the capabilities for omnichannel interaction with challenges. How do we continue to hold negotiations with new subscribers, Nexign purchased the company called STORM customers and carry out our obligations under existing projects Technologies, an expert in the area of digital user experience while in isolation? How can we support the team? How do we management. add new specialists to the team? How do we keep the high work standards that we are so used to? In addition, Nexign started developing the Open-Source-based Universal Digital Billing product. This way we will assist our I cannot claim that those challenges were completely new for us. customers in optimising TCO and adapting quicker to changing As any company with subdivisions based in different countries and business needs. regions, we tried to operate in such a way that our business process- es would not depend on a certain location on the map. -

Las Estadísticas De Patentes: ¿Es Un Error Decidir Las Políticas De Innovación En Base a Los Datos De Patentes Publicados?

Las estadísticas de patentes: ¿es un error decidir las políticas de innovación en base a los datos de patentes publicados? Los Lunes de Patentes UB Patent Centre, Barcelona, 9 de marzo de 2020 Gian‐Lluís Ribechini Creus Ingeniero Industrial twitter: @gianlluis [email protected] 1 Índice 1) Una visión de los datos de solicitudes nacionales, europeas e internacionales 2) Sorpresas que dan los datos publicados 3) Cuando los datos no exponen la realidad 4) Los datos en España... ¿es razonable que sean tan malos? 5) Curiosidades y reflexiones sobre las estadísticas. Propuestas de mejora Fuentes de los datos: Las tablas y gráficos de esta presentación son de elaboración propia a partir de datos ofrecidos por la WIPO, la EPO y la OEPM. 2 1 Una visión de los datos de solicitudes nacionales, europeas e internacionales. 3 Solicitudes PCT ‐ período 2009‐2018 Número de solicitudes PCT Número de solicitudes PCT % Sistema de Paris Año Total variación anual 2009 155.402 -4,80% 2010 164.340 5,75% 2011 182.437 11,01% 2012 195.325 7,06% 2013 205.305 5,11% 2014 214.333 4,40% 2015 217.235 1,35% 2016 232.913 7,22% 2017 243.511 4,55% 2018 252.315 3,62% 4 Top 20 de países solicitantes de solicitudes PCT en 2018 Número de solicitudes PCT en 2018 por país de origen de la solicitud % acumulado % País origen de solicitud 2018 % acumulado solicitudes 2018/2017 1 United States of America 55.981 22,2% 22,2% 55.981 -1,2% 2 China 53.340 21,1% 43,3% 109.321 9,1% 3 Japan 49.703 19,7% 63,0% 159.024 3,1% 4 Germany 19.750 7,8% 70,9% 178.774 4,2% 5 Republic -

Southern Asian Region SOUTHERN ASIAN

For communications professionals in the southern Asian region SOUTHERN ASIAN WIRELESSCOMMUNICATIONS Q1 2021 Volume 14 Number 1 l Satellite: a thing of the past or a thing of the future? l The growing importance of FWA and Wi-Fi on the move l Southern Asian mobile fraud, according to Evina Experts in RF over Fiber SASIA 21Q1 p1 (Cover).indd 1 01/04/2021 17:12 NEWS 4 SOUTHERN AFRICAN WIRELESS COMMUNICATIONS January/February 2019 SASIA 19Q4 p4 (Rajant).indd 4 01/04/2021 13:03 SOUTHERN ASIAN CONTENTS COMMUNICATIONSWIRELESS Q1 2021 5 NEWS 5 NEWS u Volume 14 Cambodia’s NIG going ahead u Globe sees traffic spike Number 1 u Nokia chosen for 5G rollout u NBTC considers payment for 5G licences u SES supplies broadband to villages u Etisalat launches 4G LTE service u Wireless Logic expands global footprint 18 FEATURE I u Thaicom searches for LEO partner u Bangladeshi players fork out ViaLite designs and manufactures u Pakistan’s internet disrupted RF over fiber links and systems for a u Maldives to Sri Lanka subsea cable goes live range of applications including Satcom, 13 WIRELESS BUSINESS LEO and MEO; transporting satellite Vyke and x-Mobility sign two new deals for signals between antennas and control APAC expansion rooms. The links are also used in Mil- 25 FEATURE II 18 FEATURE Aero, Defence, Broadcast, Cellular and Shaping the future of satcoms Network Timing etc. ViaLite’s links 22 INDUSTRY VIEW include: L-Band HTS, VSAT, C-Band Evina’s David Lofti explains how mobile (covering 500 MHz-7.5 GHz), Hyper- carriers can stop the financial havoc Wide Dynamic Range, Ultra-Wideband, 25 FEATURE UHF/VHF, Satellite IF, SIGINT, GPS & 28 WIRELESS SOLUTIONS Fixed wireless access and Wi-Fi on the move more.