Swiss Tourism in Figures 2015 Structure and Industry Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Albulabanan Jarnvag.Ch På Rhätische Bahn I Schweiz

Albulabanan jarnvag.ch på Rhätische Bahn i Schweiz En skiss över Rhätische Bahns järnvägsnät i sydöstra Schweiz finns till höger. Albulabanan leder från Chur över Thusis och Filisur till St Moritz. Delen Thusis – St Moritz leder genom en mycket bergig terräng och hör till UNESCOs världskulturarv. För att kunna bygga denna fantastiska järnväg konstruerades många broar, viadukter och tunnlar. Banan är elektrifierad med enfas växelström 11 kV 16 2/3 Hz och är som hela Rhätische Bahn meterspårig Den meterspåriga Rhätische Bahn började 1889 som Landquart-Davos Bahn, se separat artikel. Denna första järnvägsdel förlängdes 1894-96 från Landquart över Chur till Thusis. Samma år som den delen blev färdig ändrades banans namn från Landquart-Davos Bahn till Rhätische Bahn (RhB). I slutet av 1800-talet skulle den stora dalen Engadin (Inn-dalen) med St. Moritz i Graubünden få järnvägsanslutning. För detta ändamål fanns det planer på att bygga banan dit från Davos över Septimerpasset, men till slut segrade ett annat förslag: att bygga banan från Thusis via Albula till kurorten St. Moritz i Engadin. Denna järnväg, kallad Albulabanan, byggdes 1898-1904 av som mest 5000 rallare. Banan är anlagd i bitvis mycket svår terräng, som krävt avancerade tekniska lösningar, bl.a. flera ingenjörstekninska mästerverk: Landwasserviadukten, Albulatunneln och avsnittet Bergün-Preda med de många spiraltunnlarna. Totalt måste det byggas 55 broar och 39 tunnlar längs den 62 km långa sträckan. Genom detta blev Albulabanan också en av de intressantaste järnvägarna över huvud taget. Hela Albulabanan blev därför UNESCO-världskulturarv 2008, tillsammans med den anslutande Berninabanan. Linjebeskrivning Albulabanan börjar i Thusis, där den som sagt ansluter till den tidigare byggda järnvägen Landquart – Chur – Thusis. -

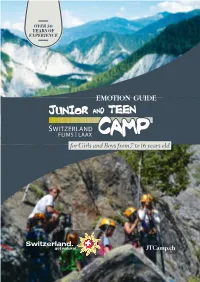

Emotion Guide

OVER 50 YEARS OF EXPERIENCE EMOTION GUIDE for Girls and Boys from 7 to 16 years old JTCamp.ch MIN 25 OVER 50 6 TO 16 FAMILY NATIONALITIES YEARS OF BOYS AND RUN EVERY EXPERIENCE GIRLS SUMMER LANGUAGE ROOMS FOR RATIO 1:5 1H 30 FROM COURSES IN 2 WITH TEACHER- ZURICH SMALL GROUPS EN-SUITE STUDENT AIRPORT OF MAX 8 BATHROOMS BREATHTAKING NATURE SUMMER CAMP, SWISS MADE FAMILY OPERATED BUSINESS WELCOME TO JUNIOR & TEEN CAMP, SWITZERLAND Running camps has always been a family affair for us. It is our passion and our commitment to welcome Children and Young adults for over 50 years. Our intensive program caters to the needs of all campers, whether they wish to concentrate on a particular sport or discover the full range of activities we offer. JTCamp’s multicultural and multilingual environment creates the perfect holiday setting for your loved ones. They will return home having experienced a summer full of fun, friendship, new knowledge and skills, and fan- tastic discoveries. Mr Bernard Repond | Mrs Rose-Marie Repond | Mr Gilles Repond Directors & Owners SWISS MADE ,1.30 HOURS TRAIN STATION, 20 MIN LOCATION Flims-Laax, a picturesque Swiss Mountain Village, is a summer paradise of green mountain pastures, glacier-fed rivers, and pristine lakes. The Caumasee, the largest lake in the area, is sourced from natural warm water springs and features islands and beautiful turquoise water. The Laaxersee also offers great swimming with countless aquatic activities such as canoeing, water trampoline and paddling. Located at an ideal 1000 meters, the average temperature in summer is around a very comfortable 22 Degres Celcius. -

June 2005 River City Stuff Ship Meeting with a Club Ride Followed by the Our Thunderhill Rider Improvement Day on President’S Sunday

BMW MOA Club #210 & BMWRA Club #104 Catch us on the Web at WWW.RCB.ORG June 2005 River City Stuff ship meeting with a club ride followed by The our Thunderhill rider improvement day on President’s Sunday. Many of us will be camping at President the facility Saturday night. Two weeks Gary Stofer 916-966-7910 Vice President Corner later (June 16-19) a lot of us will be at Dennis Allstead 530-306-9070 by Gary Stofer John Day, Oregon for the Chief Joseph Secretary Linda Stofer 916-966-7910 rally. The weekend after that (June 24-26) Treasurer is our famous High Sierra Spaghetti Feed Ted Alvarez 916-457-7619 at Indian Creek campground, near Mar- Membership June is finally here and the riding/camping Bob Holleron 209-245-6245 season is in full swing. Jack and Lynell kleeville. This year Stan & Gloria Davis Newsletter will be putting the event together and they Kim Rydalch 209-521-8425 Klaushie put together a tremendous event at Web Master Lake Mendocino last month and mixing in promise a great time. See, I told you Bill Juhl 530-265-0203 Jim Cyran's GS riders made for a very well things were getting busy, and this is just a Directors through 2005 prelude to July when the serious riding Chris Schattie 707-763-7765 attended event. Great job you guys (and Justin Mabry 888-497-6617 gal). As usual, Lynell put together a gourmet starts: Top O The Rockies in Paonia, Colo- Hennie Cloete 916-965-7567 rado followed by the MOA Nation at Li- Rick Blake 916-927-BMW’0perator’ meal on Saturday as well as a nice breakfast Directors through 2006 Sunday. -

Hike the Swiss Alps 23Nd Annual | September 11-22, 2016

HIKE THE SWISS ALPS 23ND ANNUAL | SEPTEMBER 11-22, 2016 Guided by Virginia Van Der Veer & Terry De Wald Experience the Swiss Alps the best way of all – on foot with a small, congenial group of friends! Sponsored by Internationally-known Tanque Verde Ranch. Hiking Director, Virginia Van der Veer, and Terry DeWald, experienced mountaineer, lead the group limited to 15 guests. Having lived in Europe for many years, Virginia has in-depth knowledge of the customs of the people and places visited. She has experience guiding Alpine hiking tours and is fluent in German. Terry has mountaineering experience in the Alps and has guided hikers in Switzerland. INCLUDED IN PACKAGE… • Guided intermediate level day-hikes in spectacular scenery. • Opportunities for easy walks or more advanced hiking daily. • 5 nights hotel in Kandersteg, an alpine village paradise. • 1 day trip to Zermatt with views of the Matterhorn. • 5 nights hotel in Wengen with views of the Eiger and Jungfrau. • 2 nights in 4-star Swissotel, Zurich. • Hearty breakfast buffets daily. • 3 or 4-course dinners daily. • Swiss Rail Pass, allowing unlimited travel on Swiss railroads, lake streamers, PTT buses and city transports. • Day-trip to world-famous Zermatt at the foot of the Matterhorn. Opportunity for day-hike with views of the world’s most photographed mountain. • Visit to Lucerne. TOUR PRICING… Tour price $4,595(single supplement is $325 if required) Tour begins and ends in Zurich. A deposit of $800 is due at booking. Full payment is due at the Ranch by July 15. Early booking is advised due to small group size. -

Federal Councillor Alain Berset and His Meteoric Rise Traditions

THE MAGAZINE FOR THE SWISS ABROAD jANuARy 2012 / NO.1 Federal Councillor Alain Berset and his meteoric rise Traditions: the UNESCO list and Switzerland Iouri Podladtchikov: an incredible talent Glacier Express in the Goms Valley, Valais The magic of panoramic Altitude 4000 If you want to admire an Winter views. exceptional view of around Allow yourself to be captivated by the passing 29 mountain tops reaching peaks of over 4000 meters, landscapes on board Switzerland’s most includingSwitzerland’s famous panoramic train. highest mountain, the Pointe Dufour, a trip to the The Glacier Express links the An unforgettable journey Gornergrat is a must. It can Tip 1 two most important regions Since its first journey in easily be reached by cog- in the Swiss Alps, Valais and 1930, the Glacier Express wheel railway from Zermatt. MySwitzerland.com Graubünden. On board, you has lost none of its magic, Webcode: A41609 will travel through 91 tunnels particularly in Winter. It took and cross 291 bridges be- 50 years before trains were Winter sports tween Zermatt, the home able to run on the impass- The Oberalp Pass in of the Matterhorn, and able mountain section of the Graubünden is transformed St.Moritz, the glamorous Furka in Winter! in Winter into a playground station of the Engadin. In for tobogganing enthusi- its panorama cars, a journey NetworkSwitzerland asts,skiers, snowboarders of over seven hours will seem Register at and hikers. The view of the like just a few minutes, as the MySwitzerland.com/asoby Urseren Valley and the views of nature in Winter are 31 March 2012 and win mountains of the Gotthard Tip 2 so magnificent. -

Marketing Strategy

Strategy and planning. 2020 – 22 Full speed ahead for 2020. Martin Nydegger 4 CEO Switzerland Tourism Assignment 10 A strong brand calls for a strong strategy. Objectives However, such a strategy can only be effective if it is widely known and put into everyday 16 practice. Marketing strategy 22 Five tourism objectives and eight focus Markets areas provide guidance here. Each year, our 24 240-strong team inspires prospective holiday- Communication mix makers and corporate clients in 22 markets with over 3,600 marketing activities on behalf of 32 Switzerland. This takes time, money and a great Campaigns deal of energy. Like our guests, we turn to 46 Switzerland’s natural wonders to recharge our Product development batteries. 48 I need revitalisation. Organisation There are around 1,500 lakes where Let’s all absorb and share this energy! Let’s you can cool down in Switzerland. kick off the exciting journey into the future These range from the idyllic waters of 50 Lake Silvaplana to Lake Geneva, the of Swiss tourism. Controlling second-largest lake in Central Europe. Silvaplana, © Switzerland Tourism / Filip Zuan Silvaplana, © Switzerland Tourism Strategy and planning 2020 – 22 3 Assignment What does ST is a corporation under public law and is dedicated to Switzerland Tourism do? the following tasks on behalf of the Confederation: Any country, however beautiful, needs to be marketed and 1 2 3 promoted. That’s why Switzerland Tourism (ST) was tasked by the Swiss Confederation with promoting domestic and Basic role Role in promoting Advisory role ST has overall respon- cooperation ST proactively shares international tourism demand for Switzerland as a holiday, travel sibility for tourism ST encourages the the insights from and conference destination. -

Climate Change and Tourism in Switzerland : a Survey on Impacts, Vulnerability and Possible Adaptation Measures

Climate Change and Tourism in Switzerland : a Survey on Impacts, Vulnerability and Possible Adaptation Measures Cecilia Matasci, Juan‐Carlos Altamirano‐Cabrera 1 Research group on the Economics and Management of the Environment Swiss Federal Institute of Technology Lausanne, CH1015 Lausanne, Switzerland, [email protected] The tourism industry is particularly affected by climate change, being very climate‐ and weather‐ dependent. Moreover, particularly in the Alpine region, it is specially exposed to natural hazards. Nonetheless, this industry is an important pillar of the Swiss economy, providing employment and generating income. Then, it becomes essential to reduce its vulnerability and starting implementing adaptation measures. In order to do so, it is important to define which areas face which problems and to recognize vulnerability hot spots. This motivation comes from the prospect that the largest environmental, social and economic damages are likely to be concentrated in vulnerable areas. This article presents an overview of the current state of the knowledge on the impacts, the vulnerability and the possible adaptation measures of the tourism industry in relation to climate change. Moreover, it presents different methods that could help assessing this vulnerability, referring in particular to the Swiss situation. This is the first step toward the establishment of the vulnerability analysis and the consequent examination of possible adaptation measures. Keywords: climate change, adaptation, vulnerability, tourism, Switzerland Introduction Climate change is a global phenomenon, but its effects occur on a local scale. Moreover, these effects have a clear impact on economic activities. An example of an activity heavily affected is tourism. Tourism is closely interlinked with climate change both as culprit and as victim. -

Graubünden for Mountain Enthusiasts

Graubünden for mountain enthusiasts The Alpine Summer Switzerland’s No. 1 holiday destination. Welcome, Allegra, Benvenuti to Graubünden © Andrea Badrutt “Lake Flix”, above Savognin 2 Welcome, Allegra, Benvenuti to Graubünden 1000 peaks, 150 valleys and 615 lakes. Graubünden is a place where anyone can enjoy a summer holiday in pure and undisturbed harmony – “padschiifik” is the Romansh word we Bündner locals use – it means “peaceful”. Hiking access is made easy with a free cable car. Long distance bikers can take advantage of luggage transport facilities. Language lovers can enjoy the beautiful Romansh heard in the announcements on the Rhaetian Railway. With a total of 7,106 square kilometres, Graubünden is the biggest alpine playground in the world. Welcome, Allegra, Benvenuti to Graubünden. CCNR· 261110 3 With hiking and walking for all grades Hikers near the SAC lodge Tuoi © Andrea Badrutt 4 With hiking and walking for all grades www.graubunden.com/hiking 5 Heidi and Peter in Maienfeld, © Gaudenz Danuser Bündner Herrschaft 6 Heidi’s home www.graubunden.com 7 Bikers nears Brigels 8 Exhilarating mountain bike trails www.graubunden.com/biking 9 Host to the whole world © peterdonatsch.ch Cattle in the Prättigau. 10 Host to the whole world More about tradition in Graubünden www.graubunden.com/tradition 11 Rhaetian Railway on the Bernina Pass © Andrea Badrutt 12 Nature showcase www.graubunden.com/train-travel 13 Recommended for all ages © Engadin Scuol Tourismus www.graubunden.com/family 14 Scuol – a typical village of the Engadin 15 Graubünden Tourism Alexanderstrasse 24 CH-7001 Chur Tel. +41 (0)81 254 24 24 [email protected] www.graubunden.com Gross Furgga Discover Graubünden by train and bus. -

Die Geschlechter Der Gemeinde Flims

Die Geschlechter der Gemeinde Flims Autor(en): Anliker, Hermann Objekttyp: Article Zeitschrift: Bündner Monatsblatt : Zeitschrift für Bündner Geschichte, Landeskunde und Baukultur Band (Jahr): - (1960) Heft 11-12 PDF erstellt am: 08.10.2021 Persistenter Link: http://doi.org/10.5169/seals-397871 Nutzungsbedingungen Die ETH-Bibliothek ist Anbieterin der digitalisierten Zeitschriften. Sie besitzt keine Urheberrechte an den Inhalten der Zeitschriften. Die Rechte liegen in der Regel bei den Herausgebern. Die auf der Plattform e-periodica veröffentlichten Dokumente stehen für nicht-kommerzielle Zwecke in Lehre und Forschung sowie für die private Nutzung frei zur Verfügung. Einzelne Dateien oder Ausdrucke aus diesem Angebot können zusammen mit diesen Nutzungsbedingungen und den korrekten Herkunftsbezeichnungen weitergegeben werden. Das Veröffentlichen von Bildern in Print- und Online-Publikationen ist nur mit vorheriger Genehmigung der Rechteinhaber erlaubt. Die systematische Speicherung von Teilen des elektronischen Angebots auf anderen Servern bedarf ebenfalls des schriftlichen Einverständnisses der Rechteinhaber. Haftungsausschluss Alle Angaben erfolgen ohne Gewähr für Vollständigkeit oder Richtigkeit. Es wird keine Haftung übernommen für Schäden durch die Verwendung von Informationen aus diesem Online-Angebot oder durch das Fehlen von Informationen. Dies gilt auch für Inhalte Dritter, die über dieses Angebot zugänglich sind. Ein Dienst der ETH-Bibliothek ETH Zürich, Rämistrasse 101, 8092 Zürich, Schweiz, www.library.ethz.ch http://www.e-periodica.ch Die Geschlechter der Gemeinde Flims Von Hermann Anliker, Winterthur Die mit einem * versehenen Geschlechter leben heute noch in Flims oder waren noch vor kurzem hier ansässig. Die Daten zeigen, wann das Geschlecht zum erstenmal in den Dokumenten erwähnt ist. ABKÜRZUNGEN AT Alpteilung der Gemeinde im Jahre 1690 AvS Archiv von Salis, Malans GAP Capol-Sammlung des Bündner Staatsarchivs (Capoliana) CAS Gieri Casura, Bündner Wappenbuch des Vorderrheintals CD Th. -

Infoblatt-27-2006-2007.Pdf

Die Gemeinde informiert – Nr. 27 (2006/2007) Öffnungszeiten Gemeindebüro Mittwoch 14.00 – 18.00 Donnerstag 08.00 – 12.00 Telefon 027 / 470 28 56 Fax 027 / 470 28 61 E-mail [email protected] Homepage www.inden.ch Homepage neu gestaltet: www.inden.ch Inhaltsverzeichnis 1. Vorwort des Präsidenten Seite 2 2. Aus dem Gemeinderat Seite 3 3. Schlüsselerlebnis Inden Seite 7 4. Aus der Feuerwehr Seite 10 5. Erste GV der DalaKoop Seite 11 6. Neue Websites Seite 13 7. Im Winter sicher unterwegs Seite 14 8. Bericht der Gemeinderäte Seite 15 9. Allgemeine Informationen … wussten Sie schon, dass … Seite 18 10. LWL Erschliessung Seite 19 11. Herzlich willkommen Seite 20 12. Ziele 2007 Seite 21 13. Schlussgedanken Seite 22 – 1 – 1. Vorwort des Präsidenten Liebe Mitbürgerinnen und Mitbürger, Nicht ohne Stolz kann die Verwaltung auf • die Massnahmen für attraktives Woh- die vielseitigen Tätigkeiten im vergange- nen in unserem Dorf nen Jahr zurückblicken. • die Wiedereröffnung der Strasse Va- ren – Rumeling • die Unterzeichnung des Kooperati- onsvertrages mit den Gemeinden Leukerbad, Varen und Salgesch … gehören sicher zu den wichtigsten Ge- schäften im vergangenen Jahr, vor allem darum weil sie auch für die nächsten Jah- re zukunftsweisend sein werden. Allen welche mit viel Interesse und Herz- blut hier mitgearbeitet und ihre Ideen und Vorschläge eingebracht haben, ein herz- liches „Vergelts Gott“ Die Verwaltung freut sich weiterhin auf ihr Mitmachen und weitere Anregungen, denn es lohnt sich, erste Erfolge in allen Sparten stellen sich ein und das tut gut! • „ Inden – ein Schlüsselerlebnis der besonderen Art“ • die Gründung der Stiftung „Agitatus“ Schnyder Bernhard • die planerische Aufnahme der erhal- tenswerten Bauten Gemeindepräsident – 2 – 2. -

Price-Martin-F ... Rockies and Swiss Alps.Pdf

Price, Martin Francis (Ph.D., Geography) Mountain forests as common-property resources: management policies and their outcomes in the Colorado Rockies and the Swiss Alps. Thesis directed by Professor Jack D. Ives This is a historical, comparative study of the development, implementation, and results of policies for managing the forests of the Colorado Rockies and the Swiss Alps, with emphasis on two study areas in each region. The Pikes Peak (Colorado) and Davos (Switzerland) areas have been adjacent to regional urban centers since the late 19th century. The Summit (Colorado) and Aletsch (Switzerland) areas have experienced a rapid change from a resource-based to a tourism-based economy since the 1950s. The study's theoretical basis is that of common-property resources. Three primary outputs of the forests are considered: wood, recreation, and protection. The latter includes both the protection of watersheds and the protection of infrastructure and settlements from natural hazards. Forest management policies date back to the 13th century in Switzerland and the late 19th century in Colorado, but were generally unsuccessful in achieving their objectives. In the late 19th century, the early foresters in each region succeeded in placing the protection of mountain forests on regional, and then national, political agendas. In consequence, by the beginning of the 20th century, federal policies were in place to ensure the continued provision of the primary functions of the forests recognized at that time: protection and timber supply. During the 20th century, these policies have been expanded, with increasing emphasis on the provision of public goods. However, most policies have been reactive, not proactive. -

Das Neue Kurtaxenreglement Kurz Erklärt

Eine Informationsbroschüre der Gemeinden Bettmeralp, Fiesch, Fieschertal, Lax, Mörel-Filet und Riederalp Das neue Kurtaxenreglement kurz erklärt Ausgabe für die Gemeinde Riederalp Ein Baustein für den Gast von heute und die Destination von morgen Sehr geehrte Damen und Herren Die letzten Jahre haben uns gezeigt, dass wir als Destination unsere Zukunft selbst gestalten können. Das müssen wir, denn unsere Gäste werden zu Recht anspruchsvoller: Sie wollen ein umfangreiches Angebot, das doch einfach ist und vor allem aus einer Hand stammt. Sie wollen zunehmend digitale Angebote, die auf Knopfdruck verfügbar sind. Die Grundlage dafür legt unter anderem das neue Kurtaxen reglement, über das wir demnächst abstimmen. Wir stellen es Ihnen auf den folgenden Seiten vor und erläutern, wie es in unseren Augen die Aletsch Arena fit für die Zukunft macht. Unsere Destination hat bereits Beachtliches vollbracht. Wir haben, gestützt durch die Bevölkerung, drei Bergbahnunternehmen fusioniert und eine neue Destination gegründet. Das ist nicht selbstverständlich, gerade in Jahren, die wirtschaftlich nicht die einfachsten sind. Doch es zeigt, dass wir eine starke Destination sind, und als solche wollen wir uns weiterentwickeln – und eine lebendige Aletsch Arena bleiben. Wir danken für Ihre Unterstützung des neuen Kurtaxenreglements! Die Gemeindepräsidenten der Aletsch Arena: Alban Albrecht, Peter Albrecht, Peter Baehler, Iwan Eyholzer, Marco Imhasly, Bernhard Schwestermann Inhalt Die neuen Leistungen der e-Gästekarte Aletsch 4 Die vereinfachte Funktionsweise 6 Tarife und Finanzierungen 8 Das neue Kurtaxenreglement für die Gemeinde Riederalp 10 Nächste Schritte 14 2 Die drei Bestandteile des neuen Kurtaxenreglements e-Gästekarte Aletsch Jeder Übernachtungsgast hat Anspruch auf eine digitale Gäste- karte. Sie bietet umfangreiche Angebote: im Sommer zum Beispiel sämtliche Berg- und Sportbahnen – und das vom Tag der Anreise an.