Global Offering

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Current and Future Natural Gas Demand in China and India

Global Gas/LNG Research Current and Future Natural Gas Demand in China and India By Miranda Wainberg Senior Energy Advisor Michelle Michot Foss, Ph.D. Chief Energy Economist and Program Manager Gürcan Gülen, Ph.D. Senior Energy Economist and Research Scientist Daniel Quijano Economist and Research Associate April 2017 April 2017, BEG/CEE China/India Gas Demand, Page 1 TABLE OF CONTENTS ESSENTIAL ACRONYMNS, UNITS AND CONVERSIONS ................................................................................................... 5 ACKNOWLEDGMENTS .................................................................................................................................................... 6 PREFACE ......................................................................................................................................................................... 7 INTRODUCTION ............................................................................................................................................................. 8 MACROECONOMIC CONTEXT FOR NATURAL GAS IN CHINA AND INDIA ...................................................................... 9 Composition of GDP and Employment Structure ...................................................................................................... 9 GDP Growth and Industrial Structures in China and India ...................................................................................... 11 Industrial overcapacity and debt in China ......................................................................................................... -

Occupational Characteristics and Management Measures of Sporadic

Occupational characteristics and management measures of sporadic COVID-19 outbreaks from June 2020 to January 2021 in China: the importance of tracking down “patient zero” Maohui Feng 1,a, Qiong Ling 2,a, Jun Xiong 3, Anne Manyande 4, Weiguo Xu 5, Boqi Xiang 6,* 1 Department of Gastrointestinal Surgery, Wuhan Peritoneal Cancer Clinical Medical Research Center, Zhongnan Hospital of Wuhan University, Hubei Key Laboratory of Tumor Biological Behaviors and Hubei Cancer Clinical Study Center, Wuhan 430071, Hubei, PR China; 2 Department of Anesthesiology, The Second Affiliated Hospital of Guangzhou University of Chinese Medicine, Guangzhou 510120, Guangdong, PR China; 3 Hepatobiliary Surgery Center, Union Hospital of Tongji Medical College, Huazhong University of Science and Technology, Wuhan, 430022, PR China; 4 School of Human and Social Sciences, University of West London, London, United Kingdom; 5 Department of Orthopedics, Tongji Hospital of Tongji Medical College, Huazhong University of Science and Technology, Wuhan 430030, PR China; 6 School of Public Health, University of Rutgers, New Brunswick, NJ 08854, USA. a These authors have contributed equally to this work. *Correspondence: Boqi Xiang, E-mail: [email protected] Abstract There are occupational disparities in the risk of contracting COVID-19. Occupational characteristics and work addresses play key roles in tracking down “patient zero”. The present descriptive analysis for occupational characteristics and management measures of sporadic COVID-19 outbreaks from June to December 2020 in China offers important new information to the international community at this stage of the pandemic. These data suggest that Chinese measures including tracking down “patient zero”, launching mass COVID-19 testing in the SARS-CoV-2-positive areas, designating a new high or medium-risk area, locking down the corresponding community or neighborhood in response to new COVID-19 cases and basing individual methods of protection on science, are effective in reducing transmission of the highly contagious SARS-CoV-2 across China. -

Innovent Biologics (1801

22 Jul 2021 CMB International Securities | Equity Research | Company Initiation Innovent Biologics (1801 HK) BUY (Initiation) Growing into a global biopharma company Target Price HK$120.91 Up/Downside +43.00% Current Price HK$84.55 Rich innovative drug pipelines. Innovent is a leading integrated biopharma company with comprehensive innovative pipelines including monoclonal antibodies (mAbs), bispecific antibodies (bsAbs), small molecules and CAR- China Healthcare Sector T therapies, covering oncology, autoimmune and metabolic diseases. Besides five marketed products (sintilimab, three biosimilars and pemigatinib), Jill Wu, CFA Innovent has six innovative drugs in pivotal clinical stage, including IBI306 (852) 3900 0842 (PCSK9 antibody), IBI310 (CTLA-4 antibody), IBI376 (PI3Kδ inhibitor), IBI326 [email protected] (BCMA-CART), taletrectinib (ROS1/NTRK inhibitor) and HQP1351 (olverembatinib, third-generation BCR-ABL TKI). In addition, Innovent has Sam Hu, PhD established a comprehensive innovative portfolio covering next-generation (852) 3900 0882 immuno-oncology (I/O) targets, including CD47/SIRPα, TIGT, LAG3, 4-1BB, [email protected] etc. It’s worth noting that Innovent is an early mover in CD47-SIRPα pathway with three assets under development, including clinical-stage IBI188 (a CD47 Jonathan Zhao antibody) and IBI322 (a PD-L1/CD47 bispecific antibody), and preclinical (852) 6359 1614 stage IBI397 (AL008, a SIRPα antibody). [email protected] Tyvyt being an early mover in large indications. After the approval for r/r- cHL in Dec 2018, Tyvyt has been approved by the NMPA for 1L ns-NSCLC, Mkt. Cap. (HK$ mn) 123,312 1L s-NSCLC and 1L HCC in 2021. These three large indications may be Avg. -

World Energy Investment 2021 INTERNATIONAL ENERGY AGENCY

World Energy Investment 2021 INTERNATIONAL ENERGY AGENCY The IEA examines the IEA member IEA association full spectrum countries: countries: of energy issues including oil, gas and Australia Brazil coal supply and Austria China demand, renewable Belgium India energy technologies, electricity markets, Canada Indonesia energy efficiency, Czech Republic Morocco access to energy, Denmark Singapore demand side Estonia South Africa management and Finland Thailand much more. Through France its work, the IEA Germany advocates policies that Greece will enhance the Hungary reliability, affordability Ireland and sustainability of Italy energy in its 30 member countries, Japan 8 association countries Korea and beyond. Luxembourg Mexico Netherlands New Zealand Norway Poland Portugal Please note that this Slovak Republic publication is subject to Spain specific restrictions that limit its use and distribution. The Sweden terms and conditions are Switzerland available online at Turkey www.iea.org/t&c/ United Kingdom United States This publication and any map included herein are The European without prejudice to the Commission also status of or sovereignty over participates in the any territory, to the delimitation of international work of the IEA frontiers and boundaries and to the name of any territory, city or area. Source: IEA. All rights reserved. International Energy Agency Website: www.iea.org World Energy Investment 2021 Abstract Abstract This year’s edition of the World Energy Investment report presents the latest data and analysis of how energy investment flows are recovering from the shock of the Covid-19 pandemic, including full-year estimates of the outlook for 2021. It examines how investors are assessing risks and opportunities across all areas of fuel and electricity supply, efficiency and research and development, against a backdrop of a recovery in global energy demand as well as strengthened pledges from governments and the private sector to address climate change. -

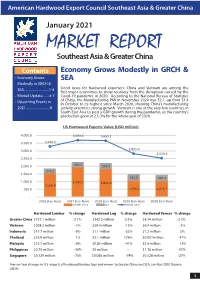

AHEC Market Report

American Hardwood Export Council Southeast Asia & Greater China January 2021 MARKET REPORT Southeast Asia & Greater China Contents Economy Grows Modestly in GRCH & • Economy Grows SEA Modestly in GRCH & SEA..............................1-4 Good news for hardwood exporters: China and Vietnam are among the first major economies to show recovery from the disruption caused by the • Market Update........4-7 Covid-19 pandemic in 2020. According to the National Bureau of Statistics • Upcoming Events in of China, the Manufacturing PMI in November 2020 was 52.1, up from 51.4 in October to its highest since March 2020, showing China’s manufacturing 2021.............................8 activity extend its strong growth. Vietnam is one of the very few countries in South East Asia to post a GDP growth during the pandemic, as the country’s production grew at 2.5-3% for the whole year of 2020. US Hardwood Exports Value (USD million) 4,000.0 3,693.6 3,665.1 3,500.0 3,290.3 2,825.0 3,000.0 2,528.6 2,500.0 2,000.0 304.5 341.4 272.2 1,500.0 361.6 342.3 1,000.0 1,949.2 1,841.6 1,556.8 500.0 1,096.4 1,076.7 - 2016 (Jan-Nov) 2017 (Jan-Nov) 2018 (Jan-Nov) 2019 (Jan-Nov) 2020 (Jan-Nov) Greater China SEA World Total Hardwood Lumber % change Hardwood Log % change Hardwood Veneer % change Greater China $727.1 million -2.7% $342.2 million 0.3% $4.74 million -2.7% Vietnam $208.3 million -1% $59.4 million -15% $6.4 million -3% Indonesia $17.7 million -9% $1.1 million -53% $7.2 million 5% Thailand $15.9 million 1% $2.1 million 179% $0.057million 47% Malaysia $13.7 million -6% $0.83 million -41% $5.6 million 12% Philippines $0.75 million -36% $0 million -- $1.16 million -33% Singapore $0.129 million -75% $0.065 million -74% $0.328 million -27% Year-on-Year changes in U.S. -

Securities and Exchange Commission Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. Commission File No. 001-35210 HC2 HOLDINGS, INC. (Exact name of registrant as specified in its charter) Delaware 54-1708481 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 450 Park Avenue, 29th Floor, New York, NY 10022 (Address of principal executive offices) (Zip Code) (212) 235-2690 (Registrant’s telephone number, including area code) _____________________________________________________________________________________________________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common Stock, par value $0.001 per share HCHC New York Stock Exchange Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Demand for Storage and Import of Natural Gas in China Until 2060: Simulation with a Dynamic Model

sustainability Article Demand for Storage and Import of Natural Gas in China until 2060: Simulation with a Dynamic Model Zhihua Chen * , Hui Wang, Tongxia Li and Ieongcheng Si The Belt and Road School, Beijing Normal University, Beijing 100875, China; [email protected] (H.W.); [email protected] (T.L.); [email protected] (I.S.) * Correspondence: [email protected] Abstract: China has been reforming its domestic natural gas market in recent years, while construc- tion of storage systems is lagging behind. As natural gas accounts for an increasing proportion due to the goal of carbon neutrality, large-scale gas storage appears to be necessary to satisfy the needs for gas peak shaving and national strategic security. Additionally, the domestic gas production in China cannot meet consumption demands, and imports will play a significant role on the supply side. This paper developed a system dynamics (SD) model and applied it to simulate gas market behaviors and estimated China’s gas storage capabilities and import demands over the next 40 years. To achieve carbon neutrality, it is necessary for China to make great progress in its energy intensity and improve its energy structure, which have a great impact on natural gas consumption. Thus, alternative scenarios were defined to discuss the changes in the gas market with different gas storage goals and environmental constraints. The results show that under low and medium carbon price scenarios, natural gas demand will continue to grow in the next 40 years, but it will be difficult to achieve the goal of carbon neutrality. -

Shanghai Junshi Biosciences Co., Ltd

IMPORTANT IMPORTANT: If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. SHANGHAI JUNSHI BIOSCIENCES CO., LTD.* 上海君實生物醫藥科技股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) GLOBAL OFFERING Total number of Offer Shares under the : 158,910,000 H Shares (subject to the Global Offering Over-allotment Option) Number of Hong Kong Offer Shares : 15,892,000 H Shares (subject to adjustment) Number of International Placing Shares : 143,018,000 H Shares (subject to adjustment and the Over-allotment Option) Offer Price : Not more than HK$20.38 per H Share and expected to be not less than HK$19.38 per H Share, plus brokerage of 1%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong Dollars, subject to refund) Nominal value : RMB1.00 per H Share Stock code : 1877 Sole Sponsor and Lead Global Coordinator Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers Joint Bookrunners and Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, having attached thereto the documents specified in “Documents Delivered to the Registrar of Companies and Available for Inspection – Documents Delivered to the Registrar of Companies in Hong Kong” in Appendix VI to this prospectus, has been registered by the Registrar of Companies in Hong Kong as required by section 342C of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). -

How China's Biggest Coal Power, Cement, and Steel

GETTING TO 30-60: HOW CHINA’S BIGGEST COAL POWER, CEMENT, AND STEEL CORPORATIONS ARE RESPONDING TO NATIONAL DECARBONIZATION PLEDGES BY EDMUND DOWNIE AUGUST 2021 ABOUT THE CENTER ON GLOBAL ENERGY POLICY The Center on Global Energy Policy at Columbia University SIPA advances smart, actionable and evidence-based energy and climate solutions through research, education and dialogue. Based at one of the world’s top research universities, what sets CGEP apart is our ability to communicate academic research, scholarship and insights in formats and on timescales that are useful to decision makers. We bridge the gap between academic research and policy — complementing and strengthening the world-class research already underway at Columbia University, while providing support, expertise, and policy recommendations to foster stronger, evidence-based policy. Recently, Columbia University President Lee Bollinger announced the creation of a new Climate School — the first in the nation — to tackle the most urgent environmental and public health challenges facing humanity. Visit us at www.energypolicy.columbia.edu @ColumbiaUEnergy ABOUT THE SCHOOL OF INTERNATIONAL AND PUBLIC AFFAIRS SIPA’s mission is to empower people to serve the global public interest. Our goal is to foster economic growth, sustainable development, social progress, and democratic governance by educating public policy professionals, producing policy-related research, and conveying the results to the world. Based in New York City, with a student body that is 50 percent international and educational partners in cities around the world, SIPA is the most global of public policy schools. For more information, please visit www.sipa.columbia.edu GETTING TO 30-60: HOW CHINA’S BIGGEST COAL POWER, CEMENT, AND STEEL CORPORATIONS ARE RESPONDING TO NATIONAL DECARBONIZATION PLEDGES BY EDMUND DOWNIE AUGUST 2021 Columbia University CGEP 1255 Amsterdam Ave. -

Sigma No 6/2019 1 Key Takeaways

No 6 /2019 01 Executive summary Sustaining resilience amid 04 Macroeconomic environment and slowing growth: global outlook economic and insurance 13 Insurance market outlook outlook 2020/21 24 From low to negative interest rates 32 Japanification: a global phenomenon, euro area most at risk 41 Recession scenario: what it could mean for insurers 46 Mid-end private health insurance in China: key pointers for success Executive summary Global growth will slow this and next Global growth remains weak and will slow over next two years. Last year marked the year. We are below consensus peak of the cycle, and our current forecasts for US and euro area growth of 1.6% and on the US and euro area, and expect 0.9% in 2020, respectively, are below consensus. The largest down revision is to our emerging Asia to outperform. forecasts for the euro area: the region is at risk of entering a period of low growth, low inflation and low interest rates, so-called “Japanification”. With lower levels of productivity and technical innovation, and an ageing population, the euro area will do well to weather the state of economic inertia as strongly as Japan has done since the 2000s. Overall, Asia will remain the engine of global growth, in particular its emerging economies: we forecast near 6% growth in India and China in 2020. The main threat to the growth outlook This year’s weakening growth came as trade tensions and geopolitical polarisation is a trade war. We expect global increased and, with low growth and low inflation, a U-turn in monetary policy back recession will be avoided. -

Dengue Situation Update Number 627 26 August 2021

Dengue Situation Update Number 627 26 August 2021 Update on the Dengue situation in the Western Pacific Region Northern Hemisphere Cambodia As of epidemiological week 32, 2021, a total of 1,002 dengue cases, including three deaths, have been reported in Cambodia for 2021. The number of cases reported weekly remains lower than the normal range of cases reported from 2015 to 2020 (Figure 1). The reported number of dengue cases is lower in all provinces compared to trends observed in 2020. Figure 1: Dengue cases reported weekly from 2021 vs 2020 Mean and Mean+2SD during 2015-2020, *excluding 2019 in Cambodia Source: Ministry of Health, Cambodia China In July 2021, three dengue cases and no deaths were reported in China. The trend in 2021 follows an expected seasonal trend (Figure 2). Figure 2: Dengue cases reported monthly from 2013-2021 in China Source: National Health Commission, China Dengue Situation Update Number 627 | 1 Lao People’s Democratic Republic During epidemiological week 32 of 2021, 28 dengue cases and no deaths were reported in Lao People’s Democratic Republic (Figure 3). The cumulative number of cases reported as of epidemiological week 32 2021 is 736; this is more than five times lower compared to the same period in 2020 when 4,155 cases were reported. The trend is within seasonally expected levels. Figure 3: Dengue cases reported weekly from 2015-2021 in Lao PRD Source: National Centre for Laboratory and Epidemiology, Ministry of Health, Lao PDR Malaysia During epidemiological week 33, 2021, a total of 410 dengue cases and no deaths were reported. -

Geographical and Epidemiological Characteristics of Sporadic

BRIEF RESEARCH REPORT published: 16 July 2021 doi: 10.3389/fmed.2021.654422 Geographical and Epidemiological Characteristics of Sporadic Coronavirus Disease 2019 Outbreaks From June to December 2020 in China: An Overview of Environment-To-Human Transmission Events Maohui Feng 1†, Qiong Ling 2†, Jun Xiong 3, Anne Manyande 4, Weiguo Xu 5 and Boqi Xiang 6* Edited by: Chaowei Yang, 1 Hubei Key Laboratory of Tumor Biological Behaviors and Hubei Cancer Clinical Study Center, Department of Mason University, United States Gastrointestinal Surgery, Wuhan Peritoneal Cancer Clinical Medical Research Center, Zhongnan Hospital of Wuhan University, Wuhan, China, 2 Department of Anesthesiology, The Second Affiliated Hospital of Guangzhou University of Reviewed by: Chinese Medicine, Guangzhou, China, 3 Hepatobiliary Surgery Center, Union Hospital of Tongji Medical College, Huazhong Yuhan Xing, University of Science and Technology, Wuhan, China, 4 School of Human and Social Sciences, University of West London, The Chinese University of Hong London, United Kingdom, 5 Department of Orthopedics, Tongji Hospital of Tongji Medical College, Huazhong University of Kong, China Science and Technology, Wuhan, China, 6 School of Public Health, Rutgers University, New Brunswick, NJ, United States Neda Nasheri, Health Canada, Canada *Correspondence: China quickly brought the severe acute respiratory syndrome coronavirus 2 under control Boqi Xiang during the early stage of 2020; thus, this generated sufficient confidence among the [email protected] public, which enabled them to respond to several sporadic coronavirus disease 2019 † These authors have contributed outbreaks. This article presents geographical and epidemiological characteristics of equally to this work several sporadic coronavirus disease 2019 outbreaks from June to December 2020 in Specialty section: China.