2020 Year-End Review: VSI Roundtable Discussion on the State of ADAS/AV

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Current and Future Natural Gas Demand in China and India

Global Gas/LNG Research Current and Future Natural Gas Demand in China and India By Miranda Wainberg Senior Energy Advisor Michelle Michot Foss, Ph.D. Chief Energy Economist and Program Manager Gürcan Gülen, Ph.D. Senior Energy Economist and Research Scientist Daniel Quijano Economist and Research Associate April 2017 April 2017, BEG/CEE China/India Gas Demand, Page 1 TABLE OF CONTENTS ESSENTIAL ACRONYMNS, UNITS AND CONVERSIONS ................................................................................................... 5 ACKNOWLEDGMENTS .................................................................................................................................................... 6 PREFACE ......................................................................................................................................................................... 7 INTRODUCTION ............................................................................................................................................................. 8 MACROECONOMIC CONTEXT FOR NATURAL GAS IN CHINA AND INDIA ...................................................................... 9 Composition of GDP and Employment Structure ...................................................................................................... 9 GDP Growth and Industrial Structures in China and India ...................................................................................... 11 Industrial overcapacity and debt in China ......................................................................................................... -

Occupational Characteristics and Management Measures of Sporadic

Occupational characteristics and management measures of sporadic COVID-19 outbreaks from June 2020 to January 2021 in China: the importance of tracking down “patient zero” Maohui Feng 1,a, Qiong Ling 2,a, Jun Xiong 3, Anne Manyande 4, Weiguo Xu 5, Boqi Xiang 6,* 1 Department of Gastrointestinal Surgery, Wuhan Peritoneal Cancer Clinical Medical Research Center, Zhongnan Hospital of Wuhan University, Hubei Key Laboratory of Tumor Biological Behaviors and Hubei Cancer Clinical Study Center, Wuhan 430071, Hubei, PR China; 2 Department of Anesthesiology, The Second Affiliated Hospital of Guangzhou University of Chinese Medicine, Guangzhou 510120, Guangdong, PR China; 3 Hepatobiliary Surgery Center, Union Hospital of Tongji Medical College, Huazhong University of Science and Technology, Wuhan, 430022, PR China; 4 School of Human and Social Sciences, University of West London, London, United Kingdom; 5 Department of Orthopedics, Tongji Hospital of Tongji Medical College, Huazhong University of Science and Technology, Wuhan 430030, PR China; 6 School of Public Health, University of Rutgers, New Brunswick, NJ 08854, USA. a These authors have contributed equally to this work. *Correspondence: Boqi Xiang, E-mail: [email protected] Abstract There are occupational disparities in the risk of contracting COVID-19. Occupational characteristics and work addresses play key roles in tracking down “patient zero”. The present descriptive analysis for occupational characteristics and management measures of sporadic COVID-19 outbreaks from June to December 2020 in China offers important new information to the international community at this stage of the pandemic. These data suggest that Chinese measures including tracking down “patient zero”, launching mass COVID-19 testing in the SARS-CoV-2-positive areas, designating a new high or medium-risk area, locking down the corresponding community or neighborhood in response to new COVID-19 cases and basing individual methods of protection on science, are effective in reducing transmission of the highly contagious SARS-CoV-2 across China. -

Innovent Biologics (1801

22 Jul 2021 CMB International Securities | Equity Research | Company Initiation Innovent Biologics (1801 HK) BUY (Initiation) Growing into a global biopharma company Target Price HK$120.91 Up/Downside +43.00% Current Price HK$84.55 Rich innovative drug pipelines. Innovent is a leading integrated biopharma company with comprehensive innovative pipelines including monoclonal antibodies (mAbs), bispecific antibodies (bsAbs), small molecules and CAR- China Healthcare Sector T therapies, covering oncology, autoimmune and metabolic diseases. Besides five marketed products (sintilimab, three biosimilars and pemigatinib), Jill Wu, CFA Innovent has six innovative drugs in pivotal clinical stage, including IBI306 (852) 3900 0842 (PCSK9 antibody), IBI310 (CTLA-4 antibody), IBI376 (PI3Kδ inhibitor), IBI326 [email protected] (BCMA-CART), taletrectinib (ROS1/NTRK inhibitor) and HQP1351 (olverembatinib, third-generation BCR-ABL TKI). In addition, Innovent has Sam Hu, PhD established a comprehensive innovative portfolio covering next-generation (852) 3900 0882 immuno-oncology (I/O) targets, including CD47/SIRPα, TIGT, LAG3, 4-1BB, [email protected] etc. It’s worth noting that Innovent is an early mover in CD47-SIRPα pathway with three assets under development, including clinical-stage IBI188 (a CD47 Jonathan Zhao antibody) and IBI322 (a PD-L1/CD47 bispecific antibody), and preclinical (852) 6359 1614 stage IBI397 (AL008, a SIRPα antibody). [email protected] Tyvyt being an early mover in large indications. After the approval for r/r- cHL in Dec 2018, Tyvyt has been approved by the NMPA for 1L ns-NSCLC, Mkt. Cap. (HK$ mn) 123,312 1L s-NSCLC and 1L HCC in 2021. These three large indications may be Avg. -

Post-Pandemic Reflections: Future Mobility COVID-19’S Potential Impact on the New Mobility Ecosystem

THEMATIC INSIGHTS Post-Pandemic Reflections: Future Mobility COVID-19’s potential impact on the new mobility ecosystem msci.com msci.com 1 Contents 04 Mobility-as-a-Service and the COVID-19 shock 06 Growing Pains in the Future Mobility Market 16 Mobility Services: Expansion and Acceleration 18 COVID-19: A Catalyst for Autonomous Delivery? 2 msci.com msci.com 3 Future Mobility A growing database collated by Neckermann Strategic Advisors has over Mobility-as- 700 public and private companies involved with different elements of the autonomous Mobility-as-a-Service (MaaS) value chain. a-Service A list that doesn’t yet include all the producers of electric, two-wheeled and public transport that contribute to the full and the mobility ecosystem. In the 1910s, the automotive industry was COVID-19 shock vast, and the rising tide was lifting every boat, albeit not profitably. However, by the time the Roaring Twenties came to an end in Even prior to the COVID-19 crisis, we discussed in our first Thematic 1929, the number of US auto manufacturers Insight1 how the world might be in the midst of the largest transformation had already fallen to 44, only to consolidate in mobility since the advent of the automobile some 120 years ago. Will much further after the Great Depression. the current pandemic prove to be a system shock that accelerates the It is, of course, tempting to see a parallel demise of inflexible and unprofitable business models and acts as a to the last five years in mobility. Just prior catalyst for the growth of more digital and service-oriented businesses in to the COVID-19 crisis, there were initial the mobility space? How might industry-wide headwinds affect the new signs of stress in this tapestry of privately- business models and technologies at least in the short-term? funded companies in the Future Mobility New industries naturally go through a series of iterations before becoming ecosystem. -

Weekly World Car Info By

WeeklyWeekly WorldWorld CarCar InfoInfo by 04/2020 Table of Content NEW MODEL LAUNCHES LATEST DEVELOPMENTS International Europe North America North America Russia China Japan NEW MODEL LAUNCHES INTERNATIONAL Major Mercedes-EQ Model Offensive: Six New Mercedes-EQ Launches by 2022 Mercedes-Benz has further detailed the expansion of its all electric EQ sub-brand with the announcement of six models all due to be launched by 2022. Although all of these models have been previously confirmed, it is the first time the manufacturer has listed dates for each of the six cars. • The S-Class-sized EQS will be the first of Mercedes’ Rastatt plant in Germany and in the new-generation EQ models to be launched, Beijing, China. in the first half of 2021, with production then • The larger EQB will also be launched in 2021, starting at the firm’s Sindelfingen plant in with production centred in Hungary and Beijing. Germany. • The final model to go into production before • Following the EQS next year will be the EQA, the end of next year will be the EQE, an E-Class- a GLA-based small SUV set to be produced at sized electric “business sedan”. European cars New Model Launches / International will be built at the firm’s plant in Bremen, The EV offensive will be complemented by an Germany, with production also starting in increase in plug-in hybrid models on offer. Beijing. More than 20 different PHEV variants are already • In 2022, Mercedes will introduce two SUVs on sale, but that will rise to 25 by 2025. -

Autonomous Vehicles “Pedal to the Metal Or Slamming on the Brakes?” Worldwide Regulation of Autonomous Vehicles Norton Rose Fulbright: Where Can We Take You Today?

Financial institutions Energy Infrastructure, mining and commodities Transport Technology and innovation Life sciences and healthcare Autonomous vehicles “Pedal to the metal or slamming on the brakes?” Worldwide regulation of autonomous vehicles Norton Rose Fulbright: Where can we take you today? Paul Keller Huw Evans Partner, New York Partner, London Tel + 1 212 318 3212 Tel + 44 20 7444 2110 [email protected] [email protected] Frank Henkel Barbara Li Partner, Munich Partner, Beijing Tel + 49 89 212148 456 Tel + 86 10 6535 3130 [email protected] [email protected] More than 50 locations, including Houston, New York, London, Toronto, Hong Kong, Singapore, Sydney, Johannesburg and Dubai. Attorney advertising Autonomous vehicles “Pedal to the metal or slamming on the brakes?” Worldwide regulation of autonomous vehicles Norton Rose Fulbright – September 2018 03 Contents I. Introduction 05 II. Australia 06 III. Canada 30 IV. China 35 V. France 39 VI. Germany 43 VII. Hong Kong 57 VIII. India 62 IX. Indonesia 74 X. Japan 77 XI. Mexico 86 XII. Monaco 89 XIII. Netherlands 92 XIV.Nordic Region (Denmark, Finland, Norway and Sweden) 99 XV. Poland 102 XVI. Russia 106 XVII. Singapore 111 XVIII. South Africa 123 XIX. South Korea 127 XX. Thailand 132 XXI. Turkey 134 XXII. United Kingdom 137 XXIII. United States 149 04 Norton Rose Fulbright – September 2018 Autonomous vehicles – “Pedal to the metal or slamming on the brakes?” Worldwide regulation of autonomous vehicles I. Introduction Norton Rose Fulbright’s third annual Autonomous Vehicle White Paper, its most ambitious to date, addresses the worldwide regulatory landscape facing the autonomous vehicle market. -

Honda RE4.I CR-V

Press Guide II Table of Contents Overview 1 Body 5 Dimensions 6 Interior 13 Safety 19 Chassis 22 Powertrain 29 Specifications 35 III IV Overview Celebrating its tenth year in Australia in 2007, the Honda CR-V sets a new direction in the compact SUV segment. With sedan like ride and handling and passenger interior, the all-new third generation 2007 Honda CR-V adds new levels of style, performance and refinement, while incorporating Honda’s recently-developed Advanced Compatibility Engineering (ACE) Body Structure, introduced on the 2007 Honda Legend. Introduced in Australia in 1997, the CR-V was Australia’s number one selling SUV in 2000 beating both the Toyota Landcruiser and Nissan Patrol. It was also the number one selling Honda in Australia in 1999, 2000, 2001 and 2002. And even in its twilight year in 2006, the second generation CR-V captured 13% of the 2006 full year compact SUV segment*. (* VFACTS Dec ’06) CR-V Background The CR-V broke new ground in the SUV/car crossover market with its long list of standard features, competitive pricing, renowned Honda quality and agile performance. It quickly set the benchmark for the segment. Not only did the CR-V help establish a new breed of small, smart and functional vehicles, it also established itself as one of the best-sellers in the segment. The CR-V was the first Honda-designed and engineered SUV, combining 4-wheel-drive capability and utility with passenger-car drivability, comfort and convenience. A truly a global product for Honda, being sold in more countries than any other Honda vehicle, the CR-V is among the best-selling vehicles for Honda, cumulatively reaching approximately 2.5 million customers in 160 different countries over its lifetime. -

Assessing the Sustainability Implications of Autonomous Vehicles: Recommendations for Research Community Practice

sustainability Review Assessing the Sustainability Implications of Autonomous Vehicles: Recommendations for Research Community Practice Eric Williams 1,*, Vivekananda Das 1 and Andrew Fisher 2 1 Golisano Institute for Sustainability, Rochester Institute of Technology, Rochester, NY 14623, USA; [email protected] 2 Environmental Resources Management, Fairport, NY 14450, USA; [email protected] * Correspondence: [email protected] Received: 3 February 2020; Accepted: 25 February 2020; Published: 3 March 2020 Abstract: Autonomous vehicles (AV) are poised to induce disruptive changes, with significant implications for the economy, the environment, and society. This article reviews prior research on AVs and society, and articulates future needs. Research to assess future societal change induced by AVs has grown dramatically in recent years. The critical challenge in assessing the societal implications of AVs is forecasting how consumers and businesses will use them. Researchers are predicting the future use of AVs by consumers through stated preference surveys, finding analogs in current behaviors, utility optimization models, and/or staging empirical “AV-equivalent” experiments. While progress is being made, it is important to recognize that potential behavioral change induced by AVs is massive in scope and that forecasts are difficult to validate. For example, AVs could result in many consumers abandoning private vehicles for ride-share services, vastly increased travel by minors, the elderly and other groups unable to drive, and/or increased recreation and commute miles driven due to increased utility of in-vehicle time. We argue that significantly increased efforts are needed from the AVs and society research community to ensure 1) the important behavioral changes are analyzed and 2) models are explicitly evaluated to characterize and reduce uncertainty. -

Aptiv Application to Test Automated Driving Systems (ADS)

Charles D. Baker. Governor Karyn E Polito. lJeutenant Governor massDOT Stephanie Pollack. MassDOT Secretary & CEO Massachusetts Department of Transportation Application to Test Automated Driving Systems on Public Ways in Massachusetts CONTACT INFORMA T/ON: Name of Organization: Aptiv Services US LLC and its affiliate nuTonomy, Inc. Primary Contact Person: Abe Ghabra Title: Managing Director, Las Vegas Technical Center Street Address of Company's Headquarters Office: 100 Northern Ave. Suite 200. City, Town of Headquarters Office: Boston State: MA Zip Code: 02210 Country: USA Website: https:ll www.aptlv.com/autonomous-mobllfty CERT/FICA TION: The Applicant certifies that all information contained within this application is true, accurate and complete to the best ofIts knowledge. /i~L /t:h-- Abe Ghabra 01 January 2020 Srgnature ofApplicant's Representative Printed Name Date of Signing Managing Director, Las Vegas Technical Center Position and Title Ten Park Plaza, Suite 4160, Boston, MA 0211 6 Tel. 857-368-4636, TTY: 857-368-0655 www.rnass.gov/massdot Application to Test Automated Driving Systems on Public Ways in Massachusetts Detailed Information Detail # 1: Experience with Automated Driving Systems (ADS) Detail # 2: Operational Design Domain Detail # 3: Summary of Training and Operations Protocol Detail # 4: First Responders Interaction Plan Detail # 5: Applicant’s Voluntary Safety Self-Assessment Detail # 6: Motor Vehicles in Testing Program Detail # 7: Drivers in Testing Program Detail # 8: Insurance Requirements Detail # 9: Additional Questions Note: Applicants should not disclose any confidential information or other material considered to be trade secrets, as the applications are considered to be public records. The Massachusetts Public Records Law applies to records created by or in the custody of a state or local agency, board or other government entity. -

World Energy Investment 2021 INTERNATIONAL ENERGY AGENCY

World Energy Investment 2021 INTERNATIONAL ENERGY AGENCY The IEA examines the IEA member IEA association full spectrum countries: countries: of energy issues including oil, gas and Australia Brazil coal supply and Austria China demand, renewable Belgium India energy technologies, electricity markets, Canada Indonesia energy efficiency, Czech Republic Morocco access to energy, Denmark Singapore demand side Estonia South Africa management and Finland Thailand much more. Through France its work, the IEA Germany advocates policies that Greece will enhance the Hungary reliability, affordability Ireland and sustainability of Italy energy in its 30 member countries, Japan 8 association countries Korea and beyond. Luxembourg Mexico Netherlands New Zealand Norway Poland Portugal Please note that this Slovak Republic publication is subject to Spain specific restrictions that limit its use and distribution. The Sweden terms and conditions are Switzerland available online at Turkey www.iea.org/t&c/ United Kingdom United States This publication and any map included herein are The European without prejudice to the Commission also status of or sovereignty over participates in the any territory, to the delimitation of international work of the IEA frontiers and boundaries and to the name of any territory, city or area. Source: IEA. All rights reserved. International Energy Agency Website: www.iea.org World Energy Investment 2021 Abstract Abstract This year’s edition of the World Energy Investment report presents the latest data and analysis of how energy investment flows are recovering from the shock of the Covid-19 pandemic, including full-year estimates of the outlook for 2021. It examines how investors are assessing risks and opportunities across all areas of fuel and electricity supply, efficiency and research and development, against a backdrop of a recovery in global energy demand as well as strengthened pledges from governments and the private sector to address climate change. -

Global Offering

蘇州貝康醫療股份有限公司 SUZHOU BASECARE MEDICAL CORPORATION LIMITED (A joint stock company incorporated in the People's Republic of China with limited liability) Stock Code: 2170 GLOBAL OFFERING Sole Sponsor, Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers Joint Bookrunners and Joint Lead Managers Joint Lead Manager IMPORTANT IMPORTANT: If you are in any doubt about any of the contents of this prospectus, you should seek independent professional advice. Suzhou Basecare Medical Corporation Limited 蘇州貝康醫療股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) GLOBAL OFFERING Number of Offer Shares under : 66,667,000 H Shares (subject to the the Global Offering Over-allotment Option) Number of Hong Kong Offer Shares : 6,667,000 H Shares (subject to adjustment) Number of International Offer Shares : 60,000,000 H Shares (subject to adjustment and the Over-allotment Option) Maximum Offer Price : HK$27.36 per H Share, plus brokerage of 1.0%, SFC transaction levy of 0.0027% and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong Dollars and subject to refund) Nominal Value : RMB1.00 per H Share Stock Code : 2170 Sole Sponsor, Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers Joint Bookrunners and Joint Lead Managers Joint Lead Manager Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness, and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. -

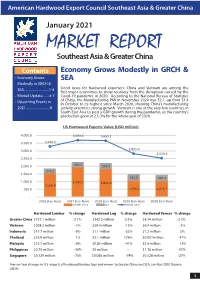

AHEC Market Report

American Hardwood Export Council Southeast Asia & Greater China January 2021 MARKET REPORT Southeast Asia & Greater China Contents Economy Grows Modestly in GRCH & • Economy Grows SEA Modestly in GRCH & SEA..............................1-4 Good news for hardwood exporters: China and Vietnam are among the first major economies to show recovery from the disruption caused by the • Market Update........4-7 Covid-19 pandemic in 2020. According to the National Bureau of Statistics • Upcoming Events in of China, the Manufacturing PMI in November 2020 was 52.1, up from 51.4 in October to its highest since March 2020, showing China’s manufacturing 2021.............................8 activity extend its strong growth. Vietnam is one of the very few countries in South East Asia to post a GDP growth during the pandemic, as the country’s production grew at 2.5-3% for the whole year of 2020. US Hardwood Exports Value (USD million) 4,000.0 3,693.6 3,665.1 3,500.0 3,290.3 2,825.0 3,000.0 2,528.6 2,500.0 2,000.0 304.5 341.4 272.2 1,500.0 361.6 342.3 1,000.0 1,949.2 1,841.6 1,556.8 500.0 1,096.4 1,076.7 - 2016 (Jan-Nov) 2017 (Jan-Nov) 2018 (Jan-Nov) 2019 (Jan-Nov) 2020 (Jan-Nov) Greater China SEA World Total Hardwood Lumber % change Hardwood Log % change Hardwood Veneer % change Greater China $727.1 million -2.7% $342.2 million 0.3% $4.74 million -2.7% Vietnam $208.3 million -1% $59.4 million -15% $6.4 million -3% Indonesia $17.7 million -9% $1.1 million -53% $7.2 million 5% Thailand $15.9 million 1% $2.1 million 179% $0.057million 47% Malaysia $13.7 million -6% $0.83 million -41% $5.6 million 12% Philippines $0.75 million -36% $0 million -- $1.16 million -33% Singapore $0.129 million -75% $0.065 million -74% $0.328 million -27% Year-on-Year changes in U.S.