Greater KL's Catalytic Developments

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MEDIA RELEASE for Immediate Release

MALAYSIAN RESOURCES CORPORATION BERHAD [Company No: 7994-D) Level 30, Menara Allianz Sentral, No. 203, Jalan Tun Sambanthan, Kuala Lumpur Sentral, P.O.Box 12640, 50470 Kuala Lumpur, Malaysia [tel] 603 2786 8080 / 603 2859 7070 [fax] 603 2780 5883 [url] www.mrcb.com • MEDIA RELEASE For Immediate Release Management Contract for Kwasa Utama Signed Between KUSB and MRCB Kuala Lumpur Sentral CBD, 28 October 2015 – Malaysian Resources Corporation Berhad (MRCB) is pleased to announce that it has signed a Management Contract with Kwasa Utama Sdn Bhd (KUSB) for the development of Kwasa Utama also known as Plot C8, located in the new Kwasa Damansara township in Sungai Buloh, Selangor Darul Ehsan. Signing the agreement for MRCB was YBhg Tan Sri Mohamad Salim Fateh Din, the company’s Group Managing Director, while KUSB was represented by its Executive Director, YBhg Dato’ Mohd Lotfy Mohd Noh. The witnesses to the signing were Encik Mohd Imran Tan Sri Mohamed Salim, MRCB’s Executive Director and Puan Nor Hazqiah Che Idris, Senior General Manager Corporate Services Kwasa Land Sdn Bhd. The Management Contract signing between KUSB and MRCB will kick off the 29.82-acre Kwasa Utama commercial development, which comprises 8 office towers, 1 block of hotel, 1 block of auditorium and 1 common facility block. In addition, Kwasa Utama development is located adjacent to Kwasa Sentral, which will make for an integrated Town Centre within the overall Kwasa Damansara Township, with direct connections to the MRT Line 1 (Sungai Buloh – Kajang Line) and future Line 2 (Sungai Buloh – Serdang – Putrajaya Line) . -

Budget 2021 Review

Budget 2021 Review: We shall chart your Supersized financial course towards But Spread Too Thin a profitable future. 7 November 2020 7 November 2020 KLCI 1519.64 @ 6 November 2020 Budget 2021 “A something for everyone budget but not sufficient to tackle the Malaysia Macro & Strategy sectors badly hit by Covid-19” NEUTRAL (maintain) 2020 KLCI Target: 1,650 Up/Downside: +8.6% Previous Target: 1,650 KLCI vs MSCI World, MSCI AxJ Budget 2021: Supersized but spread too thin MSCI World MSCI AxJ FBMKLCI 10% MSCI AxJ: 4.6% 5% With a 10% growth in total expenditure, Budget 2021 addresses the needs 0% MSCI World: 11.9% -5% of everyone. Including a surprise cut in taxes and a reduction in employee -10% FBMKLCI: -4.4% EPF contribution, focus remains on domestic demand to support growth in -15% the coming year -20% -25% This expansionary budget will result in a budget deficit of 5.4% of GDP in -30% 2021E. However, in the event of a prolonged and widespread lockdown due -35% Jan-20 Feb-20 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 to Covid-19, we think the government still has room to fiscal pump-prime Source: Bloomberg, Affin Hwang We expect the gloves to rally, as a key overhang is removed. Other sector Key market statistics beneficiaries are the Construction sector and Cellular operators. No 2020E 2021E additional taxes for the sin sector and BAT could also benefit from GDP growth (%) (5.0) 6.0 increased government focus to tackle the illicit cigarette market KLCI EPS growth (%) (21.0) 29.0 Source: Affin Hwang forecasts 2021 Economic Outlook and Fiscal Outlook – Government Financial Position Top calls for 2020 Based on the assessment and projection on the country’s economic prospects for 2021, the Ministry of Finance (MOF) expects real GDP growth to recover and expand Ticker Stock Rating Price TP by between 6.5% and 7.5% in 2021, rebounding from -4.5% estimated for (RM) (RM) Top buys: 2020. -

MRCB Announcement 22 Mar 2018

MALAYSIAN RESOURCES CORPORATION BERHAD (“MRCB” OR THE “COMPANY”) MANAGEMENT CONTRACT BETWEEN KWASA SENTRAL SDN BHD, A 70%-OWNED SUBSIDIARY OF MRCB (“KSSB”), AND MRCB LAND SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF MRCB (“MRCB LAND”), FOR THE APPOINTMENT OF MRCB LAND AS THE MANAGEMENT CONTRACTOR IN CONNECTION WITH THE DEVELOPMENT AND CONSTRUCTION OF A MIXED DEVELOPMENT IDENTIFIED TO BE THE TOWN CENTRE OF THE KWASA DAMANSARA TOWNSHIP, ON A PIECE OF LAND OWNED BY KSSB MEASURING 64.30 ACRES KNOWN AS MX-1, HELD UNDER HSD 315671, LOT NO. PT50854, MUKIM SUNGAI BULOH, DAERAH PETALING, SELANGOR DARUL EHSAN, FOR A PROVISIONAL TOTAL PROJECT SUM OF RM7,461,991,606 (“PROPOSED CONSTRUCTION”) 1. INTRODUCTION On behalf of the Board of Directors of MRCB (“ Board ”), RHB Investment Bank Berhad (“ RHB Investment Bank ”) wishes to announce that MRCB Land had on 22 March 2018 entered into a management contract with KSSB (“Employer ”), for the appointment of MRCB Land as the Management Contractor in connection with the development and construction of a mixed development identified to be the town centre of the Kwasa Damansara Township, on a piece of land owned by KSSB measuring 64.30 acres known as MX-1, held under HSD 315671, Lot No. PT50854, Mukim Sungai Buloh, Daerah Petaling, Selangor Darul Ehsan (“ Development ”), for a provisional total project sum of RM7,461,991,606 (“ Provisional Total Project Sum ”) (“ Management Contract ”). (KSSB and MRCB Land shall hereinafter be collectively referred to as the “ Parties ” and “ Party ” shall be construed accordingly). 2. DETAILS OF THE PROPOSED CONSTRUCTION 2.1 Background of the Development The Development, which will span approximately 12 years from 2018 to 2030, is expected to be a residential and commercial hub with a plot ratio of 1 to 3.5, of which 60% is designated for commercial use and the remaining 40% is designated for residential use. -

Malaysia Real Estate Highlights

RESEARCH REAL ESTATE HIGHLIGHTS 1ST HALF 2015 KUALA LUMPUR PENANG JOHOR BAHRU KOTA KINABALU KUALA LUMPUR HIGH END CONDOMINIUM MARKET (MPC) meeting in May in an effort to support economic growth and domestic HIGHLIGHTS consumption. • Softening demand in the SUPPLY & DEMAND high-end condominium With the completion of seven notable segment amid a cautious projects contributing an additional market. 1,296 units [includes projects that are physically completed but pending Madge Mansions issuance of Certificate of Completion • Lower volume of transactions and Compliance (CCC)], the cumulative expected to come on-stream. The KL in 1Q2015. supply of high end condominiums in City locality will account for circa 35% Kuala Lumpur stands at 39,610 units. (1,310 units) of the new supply; followed • Developers with niche high by Mont’ Kiara / Sri Hartamas with Approximately 45% (582 units) of the new 34% (1,256 units); KL Sentral / Pantai / end residential projects in KL completions are located in the Ampang Damansara Heights with 20% (734 units); City review products, pricing Hilir / U-Thant area, followed by some and the remaining 11% (425 units) from and marketing strategies in 26% (335 units) in the locality of KL City; the locality of Ampang Hilir / U-Thant. a challenging market with 16% (204 units) from the locality of KL lacklustre demand, impacted Sentral / Pantai / Damansara Heights Notable projects slated for completion by a general slowdown in the area; and 14% (175 units) from the Mont’ in KL City include Face Platinum Suites, economy, tight lending Kiara / Sri Hartamas locality. Le Nouvel, Mirage Residences as well as guidelines, weaker job market the delayed project of Crest Jalan Sultan The three completions in Ampang Hilir amongst other reasons. -

KWASA DAMANSARA Petaling Jaya Selangor Darul Ehsan

Draf Rancangan Kawasan Khas RKK KWASA DAMANSARA Petaling Jaya Selangor Darul Ehsan MAJLIS BANDARAYA PETALING JAYA Prepared Under The Provision Of Section 12A , Town And Country Planning Act 1976 (Act 172) Notis Ini Disediakan Di Bawah Peruntukan Seksyen 12A, Akta Perancangan Bandar Dan Desa 1976 (Akta 172) MAJLIS BANDARAYA PETALING JAYA MAC 2017 www.mbpj.gov.my Majlis Bandaraya Petaling Jaya pjkita Muka Hadapan : Penyediaan Awal Draf Rancangan Kawasan Khas (RKK) ini adalah sebagai dokumen sokongan kepada RKK kelak mengikut proses di bawah peruntukan Seksyen 16B(1), Seksyen 16B(2) dan Seksyen 16B(3) Akta Perancangan Bandar dan Desa, 1976 (Akta 172). Disediakan Oleh: MAJLIS BANDARAYA PETALING JAYA Jalan Yong Shook Lin 46675 Petaling Jaya Selangor Darul Ehsan. i KANDUNGAN Isi Kandungan Muka Surat 1.0 Tujuan 01 2.0 Peruntukan Perundangan 02 3.0 Prosedur Penyediaan Rancangan Kawasan Khas (RKK) 03 4.0 Keperluan Penyediaan 04 5.0 Latarbelakang Kawasan Kajian 05 • Pelan Sempadan Kawasan Kajian 05 • Pelan Lokasi 06 • Maklumat Tanah 07 6.0 Pelan Induk Keseluruhan Kwasa Damansara 09 7.0 Cadangan RKK Kwasa Damansara, Petaling Jaya 10 7.1 Matlamat 11 7.2 Cadangan Komponen Pembangunan 13 8.0 Kesimpulan 15 ii Tujuan Laporan ini disediakan untuk pemeriksaan Majlis telah mengadakan Mesyuarat 10semasa program publisiti awalan terhadap Jawatankuasa Teknikal Pengubahan proses Penyediaan Awal Draf Rancangan Rancangan Tempatan Petaling Jaya 1 , 2 Kawasan Khas (RKK) Kwasa Damansara, dan Rancangan – Rancangan Kawasan Petaling Jaya. Laporan ini boleh dijadikan Khas pada 23hb Januari 2017, 8hb Februari asas kepada pemilik tanah, pemaju, orang 2017 dan 14hb Februari 2017. awam, Badan-Badan Bukan Kerajaan (NGO) dan pihak - pihak yang berkepentingan untuk Keputusan ketiga – tiga mesyuarat tersebut mengemukakan sebarang cadangan dan telah dipersetujui di Mesyuarat pandangan sepanjang tempoh program Jawatankuasa Perancang Bandar Bil 2 pada publisiti dijalankan. -

Property Market Review 2018 / 2019 Contents

PROPERTY MARKET REVIEW 2018 / 2019 CONTENTS Foreword Property Northern 02 04 Market 07 Region Snapshot Central Southern East Coast 31 Region 57 Region 75 Region East Malaysia The Year Glossary 99 Region 115 Ahead 117 This publication is prepared by Rahim & Co Research for information only. It highlights only selected projects as examples in order to provide a general overview of property market trends. Whilst reasonable care has been exercised in preparing this document, it is subject to change without notice. Interested parties should not rely on the statements or representations made in this document but must satisfy themselves through their own investigation or otherwise as to the accuracy. This publication may not be reproduced in any form or in any manner, in part or as a whole, without writen permission from the publisher, Rahim & Co Research. The publisher accepts no responsibility or liability as to its accuracy or to any party for reliance on the contents of this publication. 2 FOREWORD by Tan Sri Dato’ (Dr) Abdul Rahim Abdul Rahman 2018 has been an eventful year for all Malaysians, as Speed Rail) project. This move was lauded by the World witnessed by Pakatan Harapan’s historical win in the 14th Bank, who is expecting Malaysia’s economy to expand at General Election. The word “Hope”, or in the parlance of 4.7% in 2019 and 4.6% in 2020 – a slower growth rate in the younger generation – “#Hope”, could well just be the the short term as a trade-off for greater stability ahead, theme to aptly define and summarize the current year and as the nation addresses its public sector debt and source possibly the year ahead. -

Missionos Project Profile

MissionOS Project Profile KVMRT 2 - Kuala Lumpur Building on the success of MissionOS on Line 1 of the Klang Valley MRT, Maxwell GeoSystems were appointed systems supplier for the Sungai Buloh–Serdang–Putrajaya line (MRT SSP) with an expanded to scope to look after instrumentation and TBM Process Control. The MissionOS system has been implemented by Gamuda to manage excavation progress and instrumentation data during the construction of the stations in retained excavations within difficult ground conditions. Gamuda were keen to build on Maxwell GeoSystems’ ability to manage effectively both ground investigation, instrument and tunnelling data in one platform and the configurability of the platform to their own requirements. Maxwell GeoSystems’ proprietary MissionOS integrates the construction and TBM data with the instrumentation data, providing a shared real-time “cause & effect” analysis resource, allowing project teams to predict and control the ground and ground-water movements. Gamuda also highly valued the audit and post processes The KVMRT Line 2 is one of three planned MRT rail lines which have enabled their teams to review and assimilate under Klang Valley Mass Rapid Transit Project by MRT Corp. huge quantities of data in very quick time reducing The Phase 1 between Kwasa Damansara and Kampung construction risk on the project. Batu expected to be operational by July 2021. The remaining line is expected to be operational in 2022. The approved rail alignment is 52.2km in length, of which 13.5km is underground. A total of 37 stations, 11 of them underground, will be built. The line will stretch from Sungai Buloh to Putrajaya and will include densely populated areas Sri Damansara, Kepong, Batu, Jalan Sultan Azlan Shah, Jalan Tun Razak, KLCC, Tun Razak Exchange, Kuchai Lama, Seri Kembangan and Cyberjaya. -

Annual Report 2008 Open to a Landscape of Borderless in 2008, Possibilities, Opportunities Southeast Asia and Capabilities

Bumiputra-Commerce Holdings Berhad (50841-W) Annual Report 2008 Open to a landscape of borderless In 2008, possibilities, opportunities Southeast Asia and capabilities. became our home. Contents Cover Rationale In 2008, Southeast Asia truly became our home with the completion 002 Five Year Group Financial Highlights 102 Statement on Corporate Governance of BCHB Group’s universal banking footprint across 4 major markets 004 Group Financial Highlights 122 Audit Committee Report - Malaysia, Indonesia, Singapore and Thailand. Children reflect our 006 Our Vision 127 Statement on Internal Control 007 Core Philosophies of the Group 134 Risk Management enthusiasm and excitement, and the growth and synergy opportunities 010 Corporate Profile 142 Notable Deals that lie ahead as we further explore prospects in the region. The 012 Corporate Structure 150 Notable Achievements inspiring Southeast Asian landmarks featured in the dividers aim to 013 Corporate History 156 Our Alliances invite all stakeholders to share our journey. With the largest retail 018 Chairman’s Message 158 International Advisory Panel network of 1,150 branches across the region, we continue to pursue 024 Performance Review by 159 Investor Relations Group Chief Executive an expanding horizon of initiatives for future growth. 160 Snapshot of Corporate Events 056 Corporate Information 174 Corporate Social Responsibility 058 Corporate Organisation Chart 190 Recreation 060 Board of Directors 191 Shareholders’ Statistics 062 Board of Directors’ Profiles 194 Top 10 Properties of the Group -

9 Mrt & Lrt Time Schedule & Line Route

9 mrt & lrt time schedule & line map MRT Kajang Line View In Website Mode The 9 mrt & lrt line (MRT Kajang Line) has 2 routes. For regular weekdays, their operation hours are: (1) Kajang: 6:00 AM - 11:30 PM (2) Sungai Buloh: 6:00 AM - 11:30 PM Use the Moovit App to ƒnd the closest 9 mrt & lrt station near you and ƒnd out when is the next 9 mrt & lrt arriving. Direction: Kajang 9 mrt & lrt Time Schedule 31 stops Kajang Route Timetable: VIEW LINE SCHEDULE Sunday 6:00 AM - 11:00 PM Monday 6:00 AM - 11:30 PM Sungai Buloh Tuesday 6:00 AM - 11:30 PM Kampung Selamat Wednesday 6:00 AM - 11:30 PM Kwasa Damansara Thursday 6:00 AM - 11:30 PM Kwasa Sentral Friday 6:00 AM - 11:30 PM Kota Damansara Saturday 6:00 AM - 11:30 PM Surian Mutiara Damansara 9 mrt & lrt Info Bandar Utama Direction: Kajang Stops: 31 Trip Duration: 77 min TTDI Line Summary: Sungai Buloh, Kampung Selamat, 40150 Jalan Damansara, Petaling Jaya Kwasa Damansara, Kwasa Sentral, Kota Damansara, Surian, Mutiara Damansara, Bandar Phileo Damansara Utama, TTDI, Phileo Damansara, Pusat Bandar Lebuhraya Sprint (Hubungan Damansara), Petaling Jaya Damansara, Semantan, Muzium Negara, Pasar Seni, Merdeka, Bukit Bintang, Tun Razak Exchange (Trx), Pusat Bandar Damansara Cochrane, Maluri, Taman Pertama, Taman Midah, Jalan Maarof, Kuala Lumpur Taman Mutiara, Taman Connaught, Taman Suntex, Sri Raya, Bandar Tun Hussein Onn, Batu 11 Cheras, Semantan Bukit Dukung, Sungai Jernih, Stadium Kajang, Kajang Muzium Negara Pasar Seni Merdeka Bukit Bintang Tun Razak Exchange (Trx) Cochrane Maluri Taman Pertama -

News Release for IMMEDIATE PUBLICATION 30 April 2021

news release FOR IMMEDIATE PUBLICATION 30 April 2021 Kwasa Land appoints Adenan Md Yusof as Managing Director KWASA DAMANSARA – Kwasa Land, a wholly-owned subsidiary of the Employees Provident Fund Board (EPF), has named Adenan Md Yusof as its Managing Director effective 3 May 2021. Adenan brings more than 30 years of corporate experience and expertise, having headed key portfolios in both the government and private sectors, with a focus on real estate investments and financial services. Adenan will take on the role held by Mohamad Hafiz Kassim who remains on the Board of Kwasa Land in his role as Head of EPF’s Real Estate Investment Department. Previously, Adenan was the Group Managing Director of Amanah Raya Berhad (ARB). Prior to that, he was the Chief Operating Officer at AmanahRaya-REIT Managers Sdn Bhd from 2010 to 2015 where he was instrumental in driving consistent incremental growth and stable, sustainable returns for the fund. He was also the Vice Chairman of the Malaysian REIT Managers Association and a member of its Regulatory Committee. Before his tenure with Amanah Raya, he served in key positions including General Manager of KUB Malaysia Berhad, Group General Manager of Terengganu Incorporated Sdn Bhd and Vice President of Special Projects at UDA Holdings Berhad – roles where he helmed property investment portfolios and strategies. An architect by training, he worked with several reputable architectural firms including Harry Weese and Associates and Lohan Associates in the United States, where he gained valuable experience in real estate through the development of residential offerings, 5-star hotels and office buildings. -

Circular (Final).Pdf

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. THISTHIS CIRCULARCIRCULAR ISIS IMPORTANTIMPORTANT ANDAND REQUIRESREQUIRES YOURYOUR IMMEDIATEIMMEDIATE ATTENTION.ATTENTION. If you are in any doubt as to the course of action to be taken, you should consult your stockbroker, bank manager, solicitor, If you are in any doubt as to the course of action to be taken, you should consult your stockbroker, bank manager, solicitor, accountant or other professional adviser immediately. accountantIfIf youyou areare ininor anyanyother doubtdoubt professional asas toto thethe adviser coursecourse immediately. ofof actionaction toto bebe taken,taken, youyou shouldshould consultconsult youryour stockbroker,stockbroker, bankbank manager,manager, solicitor,solicitor, THISaccountantaccountant CIRCULAR oror otherother IS professionalIMPORTANTprofessional adviseradviser AND REQUIRES immediately.immediately. YOUR IMMEDIATE ATTENTION. Bursa Malaysia Securities Berhad takes no responsibility for the contents of this Circular, makes no representation as to its Bursa Malaysia Securities Berhad takes no responsibility for the contents of this Circular, makes no representation as to its Ifaccuracy you are orin completenessany doubt as andto the expressly course disclaimsof action anyto be liability taken, whatsoever you should for consultany loss your howsoever stockbroker, arising bank from manager, or in reliance solicitor, upon accuracyBursaBursa MalaysiaMalaysia or completeness -

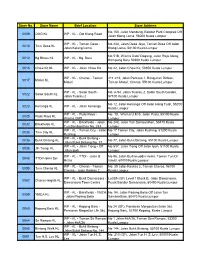

Store No. Store Name Brief Location Store Address 0009 OUG KL WP

Store No. Store Name Brief Location Store Address No 150, Jalan Mendung, Bandar Park Complek Off 0009 OUG KL WP - KL - Old Klang Road Jalan Klang Lama, 58000 Kuala Lumpur WP - KL - Taman Desa - No 23A, Jalan Desa Jaya, Taman Desa Off Jalan 0010 Tmn Desa KL Jalan Kelang Lama Klang Lama, 58100 Kuala Lumpur No 51B, Wisma Dato' Dagang, Jalan Raja Alang, 0012 Kg Bharu KL WP - KL - Kg. Baru Kampung Baru 50300 Kuala Lumpur 0016 Chow Kit KL WP - KL - Jalan Chow Kit No 42, Jalan Chow Kit, 50350 Kuala Lumpur WP - KL - Cheras - Taman 211-213, Jalan Perkasa 1, Bangunan Dirikon, 0017 Maluri KL Maluri Taman Maluri, Cheras, 55100 Kuala Lumpur WP - KL - Salak South - No. A-94, Jalan Tuanku 2, Salak South Garden, 0022 Salak South KL Jalan Tuanku 2 57100 Kuala Lumpur No 12, Jalan Kenanga Off Jalan Hang Tuah, 55200 0023 Kenanga KL WP - KL - Jalan Kenanga Kuala Lumpur WP - KL - Pudu Raya - No. 10, Wisma U.M.S, Jalan Pudu, 55100 Kuala 0025 Pudu Raya KL Wisma UMS Lumpur WP - KL - Brickfields - Jalan No 243, Jalan Tun Sambanthan, 50470 Kuala 0032 Brickfields KL Tun Sambanthan No. 243 Lumpur WP - KL - Taman City - Jalan No 17 Taman City, Jalan Kuching, 51200 Kuala 0035 Tmn City KL Kuching Lumpur WP - KL - Bukit Bintang - 0036 Bukit Bintang KL No 77, Jalan Bukit Bintang, 55100 Kuala Lumpur Jalan Bukit Bintang No. 77 WP - KL - Jalan Tiong - Off No 537, Jalan Tiong Off Jalan Ipoh, 51100 Kuala 0038 Jln Tiong KL Jalan Ipoh Lumpur WP - KL - TTDI - Jalan B.