Spotlight a Gravitational Shift to Shibuya November 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oshiage Yoshikatsu URL

Sumida ☎ 03-3829-6468 Oshiage Yoshikatsu URL http://www.hotpepper.jp/strJ000104266/ 5-10-2 Narihira, Sumida-ku 12 Mon.- Sun. 9 3 6 and Holidays 17:00 – 24:00 (Closing time: 22:30) Lunch only on Sundays and Holidays 11:30 – 14:00 (Open for dinner on Sundays and Holidays by reservation only) Irregular 4 min. walk from Oshiage Station Exit B1 on each line Signature menu とうきょう "Tsubaki," a snack set brimming Green Monjayaki (Ashitabaスカイツリー駅 Monja served with baguettes) with Tokyo ingredients OshiageOshiage Available Year-round Available Year-round Edo Tokyo vegetables, Tokyo milk, fi shes Yanagikubo wheat (Higashikurume), fl our (Ome), cabbages Ingredients Ingredients 北十間川 from Tokyo Islands, Sakura eggs, soybeans (produced in Tokyo), Ashitaba (from Tokyo Islands), ★ used used (from Hinode and Ome), TOKYO X Pork TOKYO X Pork sausage, Oshima butter (Izu Oshima Island) *Regarding seasoning, we use Tokyo produced seasonings in general, including Hingya salt. Tokyo Shamo Chicken Restaurant Sumida ☎ 03-6658-8208 Nezu Torihana〈Ryogoku Edo NOREN〉 URL http://www.tokyoshamo.com/ 1-3-20 Yokoami, Sumida-ku 12 9 3 6 Lunch 11:00 – 14:00 Dinner 17:00 – 21:30 Mondays (Tuesday if Monday is a holiday) Edo NOREN can be accessed directly via JR Ryogoku Station West Exit. Signature menu Tokyo Shamo Chicken Tokyo Shamo Chicken Course Meal Oyakodon Available Year-round Available Year-round ★ Ingredients Ingredients Tokyo Shamo Chicken Tokyo Shamo Chicken RyogokuRyogoku used used *Business hours and days when restaurants are closed may change. Please check the latest information on the store’s website, etc. 30 ☎ 03-3637-1533 Koto Kameido Masumoto Honten URL https://masumoto.co.jp/ 4-18-9 Kameido, Koto-ku 12 9 3 6 Mon-Fri 11:30 – 14:30/17:00 – 21:00 Weekends and Holidays 11:00 – 14:30/17:00 – 21:00 * Last Call: 19:30 Lunch last order: 14:00 Mondays or Tuesdays if a national holiday falls on Monday. -

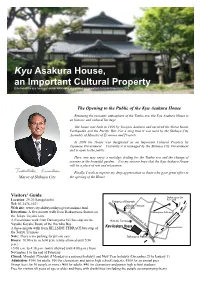

Kyu Asakura House,An Important Cultural Property

Kyu Asakura House, an Important Cultural Property Exterior of the kyu Asakura House, which was designated an Important Cultural Property in 2004 The Opening to the Public of the Kyu Asakura House Retaining the romantic atmosphere of the Taisho era, the Kyu Asakura House is an historic and cultural heritage. The house was built in 1919 by Torajiro Asakura and survived the Great Kanto Earthquake and the Pacific War. For a long time it was used by the Shibuya City Assembly of Ministry of Economy and Projects.. In 2004 the House was designated as an Important Cultural Property by Japanese Government. Currently it is managed by the Shibuya City Government and is open to the public. Here, one may enjoy a nostalgic feeling for the Taisho era and the change of seasons in the beautiful garden. It is my sincere hope that the Kyu Asakura House will be a place of rest and relaxation. Finally, I wish to express my deep appreciation to those who gave great effort to Mayor of Shibuya City the opening of the House. Visitors’ Guide Location: 29-20 Sarugakucho Tel: 03-3476-1021 Web site: www.city.shibuya.tokyo.jp/est/asakura.html Directions: A five-minute walk from Daikanyama Station on the Tokyu Toyoko Line A five-minute walk from Daikanyama Eki bus stop on the Yuyake Koyake Route of the Hachiko Bus A three-minute walk from HILLSIDE TERRACE bus stop of the Tokyu Transsés Note: There is no parking for private cars. Hours: 10:00 a.m. to 6:00 p.m. -

Grand Opening of MIYASHITA PARK Scheduled for June 2020

January 20, 2020 Shibuya City For immediate release Mitsui Fudosan Co., Ltd. <New mixed-use project integrating a park, retail facility, and hotel> Grand Opening of MIYASHITA PARK Scheduled for June 2020 A 330-meter-long in total, low-rise, mixed-use facility connecting neighborhoods around Shibuya as a “vertical urban park” Tokyo, Japan, January 20, 2020—Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, and the Shibuya City Office announced today that the city block where the New Miyashita Park Redevelopment Project is under way in Shibuya 1-chome and Jingumae 6-chome in Shibuya City will be called MIYASHITA PARK. Construction of MIYASHITA PARK is scheduled for completion in April 2020 and the grand opening is slated for June. Bird’s eye view of MIYASHITA PARK Entrance to the south block of MIYASHITA PARK <Main points of the MIYASHITA PARK project> 1) The project is the first public-private partnership (PPP)*1 between the Shibuya City Office and Mitsui Fudosan that utilizes the new “vertical urban park system” in Shibuya City. It is a new mixed-use project that integrates a park and parking lot, which are existing city facilities, with a retail facility and hotel. Its purpose is to create a safe and secure environment in Miyashita Park, Shibuya City that enhances the vibrance of the local area. 2) In addition to the park’s existing popular facilities like the skate park and climbing wall, a new multipurpose sports facility with a sand-coated surface and a plaza with a lawn spanning approximately 1,000 m2 will be set up for events. -

Huge City Model Communicates the Appeal of Tokyo -To Be Used by City in Presentation Given to IOC Evaluation Commission

Press Release 2009-04-17 Mori Building Co., Ltd. Mori Building provides support for Olympic and Paralympic bid Huge city model communicates the appeal of Tokyo -To be used by city in presentation given to IOC Evaluation Commission- At 17.0 m × 15.3 m, Japan's largest model With Tokyo making a bid to host the 2016 Olympic and Paralympic Games, Mori Building is cooperating with the city by providing a huge model of central Tokyo for use in the upcoming tour of the IOC Evaluation Commission. This model was created with original technology developed by Mori Building; it is on display at Tokyo Big Sight. Created at 1/1000 scale, the model incorporates Olympic-related facilities that would be constructed in the city, and it presents a very appealing and sophisticated representation of near-future Tokyo. The model's 17.0 m × 15.3 m size makes it the largest in Japan, and its fine detail and high impact communicate a very real and attractive picture of Tokyo. On public view until April 30 In support of the Tokyo Olympic and Paralympic bid, Mori Building is providing this city model as a tool that visually communicates the city's appeal in an easy-to-understand manner. From April 17 afternoon to 30, the model will be on display to the public in the Tokyo Big Sight entrance hall. We hope that many members of the general public will see it, and that it will further increase their interest in Tokyo. Mori Building independently created city model/CG pictures as a tool to facilitate an objective and panoramic comprehension of the city/landscape. -

Real Estate Sector 4 August 2015 Japan

Deutsche Bank Group Markets Research Industry Date Real estate sector 4 August 2015 Japan Real Estate Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] F.I.T.T. for investors Last dance Bubbles always come in different forms With the big cliff of April 2017 in sight, enjoy the last party like a driver careening to the cliff's brink. Japan is now painted in a completely optimistic light, with the pessimism which permeated Japan after the Great East Japan Earthquake in 2011 forgotten and expectations for the 2020 Tokyo Olympics riding high. The bank lending balance to the real estate sector is at a record high, and we expect bubble-like conditions in the real estate market to heighten due to increased investment in real estate to save on inheritance taxes. History repeats itself, but always in a slightly different form. We have no choice but to dance while the dance music continues to play. ________________________________________________________________________________________________________________ Deutsche Securities Inc. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 124/04/2015. Deutsche Bank Group Markets Research Japan Industry Date 4 August 2015 Real Estate Real estate sector FITT Research Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst Last dance (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] Bubbles always come in different forms Top picks With the big cliff of April 2017 in sight, enjoy the last party like a driver Mitsui Fudosan (8801.T),¥3,464 Buy careening to the cliff's brink. -

A Journey Through Our First 115 Years of History 1900 -設 2015 計 Nikken Sekkei 1900-2015: a Journey Through Our First 115 Years of History

日 建 A JOURNEY THROUGH OUR FIRST 115 YEARS OF HISTORY 1900 -設 2015 計 NIKKEN SEKKEI 1900-2015: A JOURNEY THROUGH OUR FIRST 115 YEARS OF HISTORY Summarised from the book “NIKKEN SEKKEI 1900 - 2015 . A 115 - Year Life Chronicle”; first edition published on June 1st, 2015. 序 Introduction NIKKEN SEKKEI 1900-2015 – A 115-Year Life Chronicle More than 115 years have passed since our foundation, and 65 years since our the restart aft er the war. Nikken Sekkei has developed into a professional service fi rm in architecture, city planning and environmental fi elds with 1,800 staff members, and more than 2,400 people in Nikken Group as a whole. In modern society, it is necessary for various experts to collaborate in order to face any unpredicted issues. Aft er the war, we started as a group of Planners / Architects / Engineers, but our professional fi elds had continued to deepen and expand. Nikken Group is now composed of Nikken Sekkei as the core, and 6 professional group companies over diff erent fi elds. Since its foundation, it has proceeded along with the history of Japan, developing and evolving through diff erent eras. Th e 115-Year Life Chronicle of Nikken Sekkei has been conceived for those who are professionally involved in diff erent aspect of architecture and for those who are interested in architecture and cities in general. 2015 spring. Nikken Sekkei Ltd., Chairman, Keiichi Okamoto *Keiichi Okamoto, Nikken Sekkei Ltd. Chairman until 2016. 年表 Chronological tableChronological The Edo Era The Meiji Era The Taisho Era The Showa Era The -

Shibuya City Industry and Tourism Vision

渋谷区 Shibuya City Preface Preface In October 2016, Shibuya City established the Shibuya City Basic Concept with the goal of becoming a mature international city on par with London, Paris, and New York. The goal is to use diversity as a driving force, with our vision of the future: 'Shibuya—turning difference into strength'. One element of the Basic Concept is setting a direction for the Shibuya City Long-Term Basic Plan of 'A city with businesses unafraid to take risks', which is a future vision of industry and tourism unique to Shibuya City. Each area in Shibuya City has its own unique charm with a collection of various businesses and shops, and a great number of visitors from inside Japan and overseas, making it a place overflowing with diversity. With the Tokyo Olympic and Paralympic Games being held this year, 2020 is our chance for Shibuya City to become a mature international city. In this regard, I believe we must make even further progress in industry and tourism policies for the future of the city. To accomplish this, I believe a plan that further details the policies in the Long-Term Basic Plan is necessary, which is why the Industry and Tourism Vision has been established. Industry and tourism in Shibuya City faces a wide range of challenges that must be tackled, including environmental improvements and safety issues for accepting inbound tourism and industry. In order to further revitalize the shopping districts and small to medium sized businesses in the city, I also believe it is important to take on new challenges such as building a startup ecosystem and nighttime economy. -

Ginza Opens As Building, a Trend-Setting Retail Harvest Club

CONTENTS MESSAGE FROM THE PRESIDENT 02 MESSAGE FROM THE PRESIDENT As a core company of the Tokyu Fudosan Holdings Group, 03 HISTORY OF TOKYU LAND CORPORATION We are creating a town to solve social issues through 05 ABOUT TOKYU FUDOSAN HOLDINGS GROUP value creation by cooperation. 06 GROUP’S MEDIUM- AND LONG-TERM MANAGEMENT PLAN 07 URBAN DEVELOPMENT THAT PROPOSES NEW LIFESTYLES 07 THE GREATER SHIBUYA AREA CONCEPT 09 LIFE STORY TOWN 11 URBAN DEVELOPMENT 25 RESIDENTIAL 33 WELLNESS 43 OVERSEAS BUSINESSES 47 REAL ESTATE SOLUTIONS Tokyu Land Corporation is a comprehensive real estate company the aging population and childcare through the joint development of with operations in urban development, residential property, wellness, condominiums and senior housing. In September 2017, we celebrated overseas businesses and more. We are a core company of Tokyu the opening of the town developed in the Setagaya Nakamachi Fudosan Holdings Group. Since our founding in 1953, we have Project, our first project for creating a town which fosters interactions 48 MAJOR AFFILIATES consistently worked to create value by launching new real estate between generations. 49 HOLDINGS STRUCTURE businesses. We have expanded our business domains in response to For the expansion of the scope of cyclical reinvestment business, changing times and societal changes, growing from development to we are expanding the applicable areas of the cyclical reinvestment 50 TOKYU GROUP PHILOSOPHY property management, real estate agency and, in particular, a retail business to infrastructure, hotels, resorts and residences for business encouraging work done by hand. These operations now run students, in our efforts to ensure the expansion of associated assets independently as Tokyu Community Corporation, Tokyu Livable, Inc. -

Results in FY2017 Presentation for Investments

Results in FY2017 Presentation for Investments May 14, 2018 Tokyu Corporation (9005) https://www.tokyu.co.jp/ Contents Ⅰ.Executive Summary 2 Ⅱ.Status of Management Plan Initiatives 8 Ⅲ.Status of Each Segment 21 Ⅳ.Details of Financial Results for FY2017 29 Ⅴ.Details of Financial Forecasts for FY2018 41 Forward-looking statements All statements contained in this document other than historical facts are forward-looking statements that reflect the judgments of the management of Tokyu Corporation based on information currently available. Actual results may differ materially from the statements. 。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。。 Tokyu Corporation 1 Ⅰ.Executive Summary 2 Main Points in the Results for FY2017 [Year-on-year comparison] Operating profit increased mainly due to increased revenue from the Company’s Railway Operations Business as a result of population growth in areas served by the Company’s railway lines. Profit attributable to owners of parent increased, mainly reflecting gain on the sale of fixed assets. [Comparison to February] Progress was made generally as forecast in February. Comparison with Results YoY Comparison (Billion yen) Forecasts as of Feb. Operating Revenue 1,138.6 + 21.2 (+ 1.9%) - 0.7 (- 0.1%) Operating Profit 82.9 + 4.9 (+ 6.3%) - 0.0 (- 0.1%) Recurring Profit 83.7 + 7.2 (+ 9.5%) + 1.0 (+ 1.3%) Profit attributable to owners 70.0 + 2.8 (+ 4.2%) + 0.0 (+ 0.1%) of parent Operating Profit by Segment Operating Profit by Segment 85.0 (Year-on-year Comparison) 85.0 (Comparison with the Feb. Forecast.) -

Experience and Track Record in Marunouchi

Otemachi Park Building, 1-1, Otemachi 1-chome, Chiyoda-ku, Tokyo 100-8133, Japan TEL +81-3-3287-5200 http://www.mec.co.jp/ Experience and Track Record in Marunouchi 1890 The construction of the area’s first modern office Building, Mitsubishi 1900 1890s – 1950s Ichigokan, was completed in 1894. Soon after, three-story redbrick office First Phase of Buildings began springing up, resulting in the area becoming known as the 1910 “London Block.” Development Following the opening of Tokyo Station in 1914, the area was further 1890s developed as a business center. American-style large reinforced concrete 1920 Dawning of a Full-Scale Buildings lined the streets. Along with the more functional look, the area Starting from Business Center Development was renamed the “New York Block.” Scratch 1940 Purchase of Marunouchi Land and Vision of a Major Business Center 1950 As Japan entered an era of heightened economic growth, there was a sharp 1960 1960s – 1980s increase in demand for office space. Through the Marunouchi remodeling plan that began in 1959, the area was rebuilt with large-scale office buildings, providing a considerable supply of highly integrated office space. 1970 Second Phase of Sixteen such buildings were constructed, increasing the total available floor Development space by more than five times. In addition, Naka-dori Avenue, stretching 1980 An Abundance of Large-Capacity from north to south through the Marunouchi area, was widened from 13 Office Buildings Reflecting a meters to 21 meters. The 1980s marked the appearance of high-rise buildings more than 100 The history of Tokyo’s Marunouchi 1990 Period of Rapid Economic Growth meters tall in the area. -

MAP Shibuya & Yoyogi-Hachiman

Old & New Go beyond Shibuya Crossing Shibuya & Yoyogi-hachiman <Neighborhood Walk> Once you arrive at Shibuya Station, head to the 3rd Discover More of Shibuya! floor `Urban Core` by using the pedestrian decks that The word “Shibuya” does not only refer to the Shibuya station connects directly to Shibuya Scramble Square. While area, but also the whole Shibuya-ku and neighboring areas. its popularity is set to skyrocket in November 2019, MAP Everyone knows the popular landmarks around Shibuya Station, don’t miss exploring the northern area of Oku-Shibuya such as the Hachiko statue, Shibuya Hikarie and SHIBUYA109 (includes Kamiyamacho, Udagawacho and Tomigaya) Comfort zone shopping mall, but there is so much more to explore – roadside where unique shops can be found. Each shop has shops and distinctive shopping streets in various areas of the with dainties and histories its own uniqueness and still, as youth as Shibuya’s city, historical and cultural facilities, parks etc. Discover all of culture. Drop by and grab some snacks and drinks, Shibuya by taking a long walk following this map. Old & New then head to Yoyogi Park if you feel like taking a break Shinjuku before exploring your next destinations. When you've finished with the youth culture, it’s time for Yoyogi Hachimangu Shrine. This shrine is dedicated to Hachiman, the god of protection from evil and Hatagaya SHIBUYA KU good luck. Their most popular festival is the Goldfish Sasazuka Festival, which is held in May and September. Harajuku Yoyogihachiman Tokyo is about the harmony between traditional and modern culture, and here you can feel both of them. -

Direct Station Connections and Retail Complexes,Features of Latest

NLI Research Institute November 26, 2012 Real Direct Station Connections and Retail Complexes, Estate Features of Latest Tokyo Grade-A Office Buildings Analysis Real Estate Investment Team, Financial Research Group Mamoru Masumiya [email protected] Report Summary ・ The Tokyo office vacancy rates remained high and very large sized office building rents in the Tokyo central three wards plunged to a historic low, as several large buildings were supplied mainly in the CBD in the first half of 2012. However, the pace of new supply is slowing down in the second half, and the grade-A building rents are recovering based on relatively low prices and tenant preference for buildings well prepared for disaster-prevention and energy-saving. ・ In the first half of this year, “Shibuya Hikarie” garnered attention both as a new retail complex and a skyscraper office which secured rents as high as those in the Marunouchi area. Just like “Shibuya Hikarie,” the latest Tokyo grade-A office buildings have features such as direct station connections and retail complexes. ・ In Tokyo, more than a few stations have very convenient access and large passenger numbers as many train lines cross each other forming the world’s most advanced urban train network. Tenants in station-connected buildings can enjoy shopping, dining and other services in and around their offices. Furthermore, considering recent intensifying weather conditions, it is likely that station-connected buildings will become even more popular hereafter. ・ Recently, an increasing number of grade-A buildings has been developed in Tokyo, and those stocks have become pretty sizable. As the competition within the grade-A category becomes more intense, factors such as access to the closest station and surrounding commercial development will be increasingly important in addition to the inherent value of each station and area.