DC Development Report: 2017/2018 Edition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jeff Barber, AIA, LEED®-AP Jeff's Design Talent Is Combined with A

32 Years of Experience Selected Project Experience Size (sq ft) Selected Project Experience Size (sq ft) Joined Gensler 1996 The Exchange at Potomac Yard, Town Center Master Plan & Architecture, National Business Park 310, LEED® Gold, Annapolis Junction, MD 250,000 Background Washington, DC 1,500,000 Ronald Reagan International Trade Center, Renovation Concept Master of Architecture, Yale School of Architecture, New Haven, CT 2000 Pennsylvania Avenue, Repositioning, Washington, DC 55,000 Design, Washington, DC 80,000 Bachelor of Science, Yale University, New Haven, CT 2100 2nd St Development Feasibility Study, Washington, DC 645,800 Service Employees International Union (SEIU) Headquarters, Registered Architect: New York Georgetown Day School 2015 PUD, Washington, DC 547,420 Washington, DC 195,000 Member, American Institute of Architects (AIA) Marymount University Ballston Center Redevelopment, U.S. Marshals Service Headquarters, Arlington, VA 355,571 Designated National Design Peer, U.S. General Services Administration Public Arlington, VA 165,000 National Geographic, Multiple Projects, LEED® Silver, Buildings Service, Design Excellence and the Arts Program 900 G Street NW, Washington, DC 108,974 Washington, DC 10,000 each USGBC LEED®–Accredited Professional 1700 Pennsylvannia Avenue, Added Density, Washington, DC 289,929 Hogan Lovells DC, Washington, DC 450,000 ® Jeff Barber, AIA, LEED -AP Confidential HQ Study, Washington, DC 800,000 Principal / Firmwide Design Experience Leader Selected Project Experience Size (sq ft) Department of -

Hq2 Impact Research & Analysis National Landing–Va

HQ2 IMPACT RESEARCH & ANALYSIS NATIONAL LANDING–VA AMAZON BACKGROUND In 1994, Jeff Bezos started Amazon in Seattle, WA, as an of commercial property in the nation. At its current growth online bookstore out of his garage, delivering books pace, Amazon will control more than one square foot of himself. Time magazine named Bezos the “Person of distribution space for every adult U.S. shopper by 2022. the Year” in 1999 when it recognized the company’s success in popularizing online shopping. After the Great The online retailer’s headquarters is located in the South Recession Amazon began to show its potential, attracting Lake Union neighborhood of Seattle, dubbed “Amazonia,” 615 million annual visitors to its website, while employing which encompasses over 8.1 million square feet of space in 17,000 people with real estate holdings encompassing 33 buildings and houses over 45,000 employees. Amazon 12 million square feet in 2008. Amazon has evolved into drove unprecedented job growth in Seattle, completely the largest Internet retailer in the world as measured by revitalized neighborhoods around its campus, and sparked revenue and market capitalization, surpassing $1.0 trillion an urban residential development boom. However, in value last September. Amazon’s rapid growth has also strained Seattle’s housing market, contributed to growing traffic congestion, Today, the world’s largest retailer employs over 575,000 full- and placed pressure on its public transportation system. and part-time workers and controls more than 158 million square feet of leased and owned office, industrial, and KING COUNTY MEDIAN SINGLE FAMILY HOME SALE PRICE retail property in the United States. -

Americaspeaks

AMERICASPEAKS ENGAGING CITIZEN VOICES IN GOVERNANCE Skyland Town Hall Meeting Report to the National Capital Revitalization Corporation November 13, 2004 Made Possible in part by a Grant from the Annie E. Casey Foundation Summary Report of Proceedings District residents from Wards 7 and 8 came together on Saturday, November 13 to set priorities for the redevelopment of Skyland Shopping Center. Over the course of the five hour meeting, participants listened to presentations about the redevelopment process, discussed the retail mix of the future site, considered its look and feel, and discussed how the community could best take advantage of economic opportunities created by the redevelopment. When asked to evaluate the Town Meeting, 100 percent of participants said they had learned something from their participation in the Town Meeting. Eighty-four percent of participants rated the meeting as “excellent” or “good” (49 percent rating it as “excellent”.) Ninety-one percent of participants rated the use of technology at the Town Meeting as “excellent” or “good” (82 percent rating it as “excellent). Seventy percent of participants said they were “very unsatisfied” with the mix of stores currently at Skyland. Similarly, 66 percent of participants said they were “very unsatisfied” with the physical condition of Skyland and 63 percent said they were “very unsatisfied” with the level of safety there. The heart of the meeting was a discussion of the future retail mix for the new Skyland Shopping Center. Participants first considered the kinds of stores that they would like to see in the site. After prioritizing the kinds of stores to go on the site, they identified specific brands for each of the top categories. -

International Business Guide

WASHINGTON, DC INTERNATIONAL BUSINESS GUIDE Contents 1 Welcome Letter — Mayor Muriel Bowser 2 Welcome Letter — DC Chamber of Commerce President & CEO Vincent Orange 3 Introduction 5 Why Washington, DC? 6 A Powerful Economy Infographic8 Awards and Recognition 9 Washington, DC — Demographics 11 Washington, DC — Economy 12 Federal Government 12 Retail and Federal Contractors 13 Real Estate and Construction 12 Professional and Business Services 13 Higher Education and Healthcare 12 Technology and Innovation 13 Creative Economy 12 Hospitality and Tourism 15 Washington, DC — An Obvious Choice For International Companies 16 The District — Map 19 Washington, DC — Wards 25 Establishing A Business in Washington, DC 25 Business Registration 27 Office Space 27 Permits and Licenses 27 Business and Professional Services 27 Finding Talent 27 Small Business Services 27 Taxes 27 Employment-related Visas 29 Business Resources 31 Business Incentives and Assistance 32 DC Government by the Letter / Acknowledgements D C C H A M B E R O F C O M M E R C E Dear Investor: Washington, DC, is a thriving global marketplace. With one of the most educated workforces in the country, stable economic growth, established research institutions, and a business-friendly government, it is no surprise the District of Columbia has experienced significant growth and transformation over the past decade. I am excited to present you with the second edition of the Washington, DC International Business Guide. This book highlights specific business justifications for expanding into the nation’s capital and guides foreign companies on how to establish a presence in Washington, DC. In these pages, you will find background on our strongest business sectors, economic indicators, and foreign direct investment trends. -

District Columbia

PUBLIC EDUCATION FACILITIES MASTER PLAN for the Appendices B - I DISTRICT of COLUMBIA AYERS SAINT GROSS ARCHITECTS + PLANNERS | FIELDNG NAIR INTERNATIONAL TABLE OF CONTENTS APPENDIX A: School Listing (See Master Plan) APPENDIX B: DCPS and Charter Schools Listing By Neighborhood Cluster ..................................... 1 APPENDIX C: Complete Enrollment, Capacity and Utilization Study ............................................... 7 APPENDIX D: Complete Population and Enrollment Forecast Study ............................................... 29 APPENDIX E: Demographic Analysis ................................................................................................ 51 APPENDIX F: Cluster Demographic Summary .................................................................................. 63 APPENDIX G: Complete Facility Condition, Quality and Efficacy Study ............................................ 157 APPENDIX H: DCPS Educational Facilities Effectiveness Instrument (EFEI) ...................................... 195 APPENDIX I: Neighborhood Attendance Participation .................................................................... 311 Cover Photograph: Capital City Public Charter School by Drew Angerer APPENDIX B: DCPS AND CHARTER SCHOOLS LISTING BY NEIGHBORHOOD CLUSTER Cluster Cluster Name DCPS Schools PCS Schools Number • Oyster-Adams Bilingual School (Adams) Kalorama Heights, Adams (Lower) 1 • Education Strengthens Families (Esf) PCS Morgan, Lanier Heights • H.D. Cooke Elementary School • Marie Reed Elementary School -

Ward 7 Heritage Guide

WARD 7 HERITAGE GUIDE A Discussion of Ward 7 Cultural and Heritage Resources Ward 7 Heritage Guide Text by Patsy M. Fletcher, DC Historic Preservation Office Design by Kim Elliott, DC Historic Preservation Office Published 2013 Unless stated otherwise, photographs and images are from the DC Office of Planning collection. This project has been funded in part by U.S. Department of the Interior, National Park Service Historic Preservation Fund grant funds, administered by the District of Columbia’s Historic Preservation Office. The contents and opinions contained in this publication do not necessarily reflect the views or policies of the U.S. Depart- ment of the Interior, nor does the mention of trade names or commercial products constitute endorsement or recommendation by the U.S. Department of the Interior. This program has received Federal financial assistance for the identification, protection, and/or rehabilitation of historic properties and cultural resources in the District of Columbia. Under Title VI of the Civil Rights Act of 1964 and Section 504 of the Rehabilitation Act of 1973, the U.S. Department of the Interior prohibits discrimination on the basis of race, color, national origin, or disability in its Federally assisted programs. If you believe that you have been discriminated against in any program, activity, or facility as described above, or if you desire further information, please write to: Office of Equal Opportunity, U.S. Department of the Interior, 1849 C Street, N.W., Washington, D.C. 20240. TABLE OF CONTENTS Introduction......................................................................................................................5 -

2020 Crystal Drive and 1770 Crystal Repositioning Drive Retail

Corporate O cers and Key Employees 2020 W. Matthew Kelly Moina Banerjee Chief Executive O cer Chief Financial O cer David Paul Kai Reynolds ANNUAL Chief Operating O cer Chief Development O cer George Xanders Steven A. Museles Chief Investment O cer Chief Legal O cer REPORT Angela Valdes Patrick Tyrrell Chief Accounting O cer Chief Administrative O cer Carey Goldberg Chief Human Resources O cer Board of Trustees Steven Roth Michael Glosserman JBG SMITH 2020 ANNUAL REPORT JBG SMITH2020 Chairman of the Board, Independent Trustee Independent Trustee Robert Stewart Charles E. Haldeman, Jr. Vice Chairman of the Board Independent Trustee W. Matthew Kelly Alisa M. Mall Chief Executive O cer Independent Trustee Phyllis Caldwell Carol Melton Independent Trustee Independent Trustee Scott Estes William J. Mulrow Independent Trustee Independent Trustee Alan S. Forman D. Ellen Shuman Independent Trustee Independent Trustee 4747 Bethesda Avenue, Suite 200 Bethesda, MD 20814 JBGSMITH.com | 240.333.3600 | NYSE: JBGS 1770 Crystal Drive and Crystal Drive Retail Repositioning West Half With over 50 years of The Bartlett experience in the Washington, DC region, JBG SMITH is the leader in investing, owning, managing, and developing office, retail, residential, and neighborhood assets. Our creativity and scale enable us 1900 Crystal Drive to be more than owners—we (South Tower in Foreground - Rendering) are placemakers who shape inspiring and engaging places, which we believe create value and have a positive impact in every community we touch. The Wren (Residential Amenity) 500 L’Enfant Plaza (Lobby) 1900 N Street 900 and 901 W Street 4747 Bethesda Avenue (Rooftop) February 23, 2021 To Our Fellow Shareholders: We hope this letter finds you healthy and out of harm’s way during these difficult times. -

Investment Holdings As of June 30, 2019

Investment Holdings As of June 30, 2019 Montana Board of Investments | Portfolio as of June 30, 2019 Transparency of the Montana Investment Holdings The Montana Board of Investment’s holdings file is a comprehensive listing of all manager funds, separately managed and commingled, and aggregated security positions. Securities are organized across common categories: Pension Pool, Asset Class, Manager Fund, Aggregated Individual Holdings, and Non-Pension Pools. Market values shown are in U.S. dollars. The market values shown in this document are for the individual investment holdings only and do not include any information on accounts for receivables or payables. Aggregated Individual Holdings represent securities held at our custodian bank and individual commingled accounts. The Investment Holdings Report is unaudited and may be subject to change. The audited Unified Investment Program Financial Statements, prepared on a June 30th fiscal year-end basis, will be made available once the Legislative Audit Division issues the Audit Opinion. Once issued, the Legislative Audit Division will have the Audit Opinion available online at https://www.leg.mt.gov/publications/audit/agency-search-report and the complete audited financial statements will also be available on the Board’s website http://investmentmt.com/AnnualReportsAudits. Additional information can be found at www.investmentmt.com Montana Board of Investments | Portfolio as of June 30, 2019 2 Table of Contents Consolidated Asset Pension Pool (CAPP) 4 CAPP - Domestic Equities 5 CAPP - International -

JBG SMITH Properties Annual Report 2021

JBG SMITH Properties Annual Report 2021 Form 10-K (NYSE:JBGS) Published: February 23rd, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___________ to ___________ Commission file number 001-37994 Graphic JBG SMITH PROPERTIES (Exact name of Registrant as specified in its charter) Maryland 81-4307010 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 4747 Bethesda Avenue Bethesda MD 20814 Suite 200 (Zip Code) (Address of Principal Executive Offices) Registrant's telephone number, including area code: (240) 333-3600 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Shares, par value $0.01 per share JBGS New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Y es ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

State of Washington, D.C.'S Neighborhoods A-3

State of Washington, D.C.’s Neighborhoods Prepared by Peter A. Tatian G. Thomas Kingsley Margery Austin Turner Jennifer Comey Randy Rosso Prepared for The Office of Planning The Government of the District of Columbia September 30, 2008 The Urban Institute 2100 M Street, NW Washington, DC 20037 UI project no. 08040-000-01 State of Washington, D.C.’s Neighborhoods ii TABLE OF CONTENTS Table of Contents ............................................................................................... ii Acknowledgments............................................................................................. vi About this Report ............................................................................................... 1 I. Introduction...................................................................................................... 3 II. Demographics................................................................................................. 9 Population......................................................................................................................9 Households..................................................................................................................13 III. Economy – Jobs and Income ..................................................................... 15 Employed Residents and Unemployment Rate...........................................................15 Poverty and Household Income ..................................................................................18 Public Assistance -

Fort Dupont Park Historic Resources Study Final Robinson & Associates

Fort Dupont Park Historic Resources Study Final Robinson & Associates, Inc. November 1, 2004 Page 1 ______________________________________________________________________________________ TABLE OF CONTENTS I. LIST OF ILLUSTRATIONS 2 II. PURPOSE AND METHODOLOGY 5 III. SUMMARY OF SIGNIFICANCE 6 IV. HISTORIC CONTEXT STATEMENT 20 1. Pre-Civil War History 20 2. 1861-65: The Civil War and Construction of Fort Dupont 25 3. Post-Civil War Changes to Washington and its Forts 38 4. The Planning and Construction of the Fort Drive 48 5. Creation of Fort Dupont Park 75 6. 1933-42: The Civilian Conservation Corps Camp at Fort Dupont Park 103 7. 1942-45: Antiaircraft Artillery Command Positioned in Fort Dupont Park 116 8. History of the Golf Course 121 9. 1938 through the 1970s: Continued Development of Fort Dupont Park 131 10. Recreational, Cultural, and African-American Family Use of Fort Dupont Park 145 11. Proposals for the Fort Circle Parks 152 12. Description of Fort Dupont Park Landscape Characteristics, Buildings and Structures 155 V. BIBLIOGRAPHY 178 VI. KEY PARK LEGISLATION 191 Fort Dupont Park Historic Resources Study Final Robinson & Associates, Inc. November 1, 2004 Page 2 ______________________________________________________________________________________ I. LIST OF ILLUSTRATIONS Figure 1 Fort Dupont Park is located in the southeast quadrant of Washington, D.C. 7 Figure 2 Fort Dupont Park urban context, 1995 8 Figure 3 Map of current Fort Dupont Park resources 19 Figure 4 Detail of the 1856-59 Boschke Topographical Map 24 Figure 5 Detail -

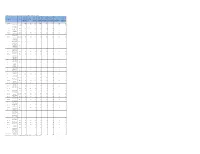

Neighborhood Cluster (NC)

2014 Population Projections and Growth (between 2014 to 2020) by Neighborhood Cluster Office of Office of Office of % change in projected % change in projected % change in projected % change in projected Office of Planning's Planning's Planning's Planning's number of 0-3 year number of number of number of 14-17 year Neighborhood Cluster Population Cluster Names Ward Population Population Population olds per 4-10 year olds per 11-13 year olds per olds per (NC) Forecast in 2014 Forecast in 2014 Forecast in 2014 Forecast in 2014 neighborhood cluster neighborhood cluster neighborhood cluster neighborhood cluster (Ages 4-10) (Ages 0-3) (Ages 11-13) (Ages 14-17) 2014_2020 2014_2020 2014_2020 2014_2020 Citywide 36,910 44,227 15,577 20,296 12% 47% 32% 12% Kalorama Heights, Cluster 1 Adams Morgan and Ward1 & 2 981 752 179 181 18% 136% 98% 50% Columbia Heights, Mt. Pleasant, Pleasant Cluster 2 Plains and Park View Ward 1 3,506 3,267 1,044 1,251 -1% 78% 45% 27% Howard University, Le Droit Park and Cluster 3 Cardozo/Shaw Ward 1,2 & 6 565 478 116 167 32% 120% 102% 6% Georgetown and Cluster 4 Burleith/Hillandale Ward 2 650 919 243 262 89% 39% 72% 47% West End, Foggy Cluster 5 Bottom, GWU Ward 2 350 213 30 23 161% 212% 207% 158% Dupont Circle and Connecticut Avenue/K Cluster 6 Street Ward 1 & 2 608 428 71 81 55% 169% 167% 65% Cluster 7 Shaw and Logan Circle Ward 2 & 6 958 890 262 316 15% 90% 58% 27% Downtown, Chinatown, Penn Quarters, Mount Vernon Square and Cluster 8 North Capitol Street Ward 2 & 6 876 967 300 371 24% 66% 66% 30% Southwest Employment