Vote:779 Nansana Municipal Council Quarter4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Population by Parish

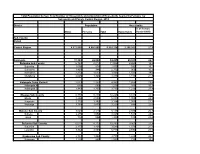

Total Population by Sex, Total Number of Households and proportion of Households headed by Females by Subcounty and Parish, Central Region, 2014 District Population Households % of Female Males Females Total Households Headed HHS Sub-County Parish Central Region 4,672,658 4,856,580 9,529,238 2,298,942 27.5 Kalangala 31,349 22,944 54,293 20,041 22.7 Bujumba Sub County 6,743 4,813 11,556 4,453 19.3 Bujumba 1,096 874 1,970 592 19.1 Bunyama 1,428 944 2,372 962 16.2 Bwendero 2,214 1,627 3,841 1,586 19.0 Mulabana 2,005 1,368 3,373 1,313 21.9 Kalangala Town Council 2,623 2,357 4,980 1,604 29.4 Kalangala A 680 590 1,270 385 35.8 Kalangala B 1,943 1,767 3,710 1,219 27.4 Mugoye Sub County 6,777 5,447 12,224 3,811 23.9 Bbeta 3,246 2,585 5,831 1,909 24.9 Kagulube 1,772 1,392 3,164 1,003 23.3 Kayunga 1,759 1,470 3,229 899 22.6 Bubeke Sub County 3,023 2,110 5,133 2,036 26.7 Bubeke 2,275 1,554 3,829 1,518 28.0 Jaana 748 556 1,304 518 23.0 Bufumira Sub County 6,019 4,273 10,292 3,967 22.8 Bufumira 2,177 1,404 3,581 1,373 21.4 Lulamba 3,842 2,869 6,711 2,594 23.5 Kyamuswa Sub County 2,733 1,998 4,731 1,820 20.3 Buwanga 1,226 865 2,091 770 19.5 Buzingo 1,507 1,133 2,640 1,050 20.9 Maziga Sub County 3,431 1,946 5,377 2,350 20.8 Buggala 2,190 1,228 3,418 1,484 21.4 Butulume 1,241 718 1,959 866 19.9 Kampala District 712,762 794,318 1,507,080 414,406 30.3 Central Division 37,435 37,733 75,168 23,142 32.7 Bukesa 4,326 4,711 9,037 2,809 37.0 Civic Centre 224 151 375 161 14.9 Industrial Area 383 262 645 259 13.9 Kagugube 2,983 3,246 6,229 2,608 42.7 Kamwokya -

The Uganda Gazette, General Notice No. 425 of 2021

LOCAL GOVERNMENT COUNCIL ELECTIONS, 2021 SCHEDULE OF ELECTION RESULTS FOR DISTRICT/CITY DIRECTLY ELECTED COUNCILLORS DISTRICT CONSTITUENCY ELECTORAL AREA SURNAME OTHER NAME PARTY VOTES STATUS ABIM LABWOR COUNTY ABIM KIYINGI OBIA BENARD INDEPENDENT 693 ABIM LABWOR COUNTY ABIM OMWONY ISAAC INNOCENT NRM 662 ABIM LABWOR COUNTY ABIM TOWN COUNCIL OKELLO GODFREY NRM 1,093 ABIM LABWOR COUNTY ABIM TOWN COUNCIL OWINY GORDON OBIN FDC 328 ABIM LABWOR COUNTY ABUK TOWN COUNCIL OGWANG JOHN MIKE INDEPENDENT 31 ABIM LABWOR COUNTY ABUK TOWN COUNCIL OKAWA KAKAS MOSES INDEPENDENT 14 ABIM LABWOR COUNTY ABUK TOWN COUNCIL OTOKE EMMANUEL GEORGE NRM 338 ABIM LABWOR COUNTY ALEREK OKECH GODFREY NRM Unopposed ABIM LABWOR COUNTY ALEREK TOWN COUNCIL OWINY PAUL ARTHUR NRM Unopposed ABIM LABWOR COUNTY ATUNGA ABALLA BENARD NRM 564 ABIM LABWOR COUNTY ATUNGA OKECH RICHARD INDEPENDENT 994 ABIM LABWOR COUNTY AWACH ODYEK SIMON PETER INDEPENDENT 458 ABIM LABWOR COUNTY AWACH OKELLO JOHN BOSCO NRM 1,237 ABIM LABWOR COUNTY CAMKOK ALOYO BEATRICE GLADIES NRM 163 ABIM LABWOR COUNTY CAMKOK OBANGAKENE POPE PAUL INDEPENDENT 15 ABIM LABWOR COUNTY KIRU TOWN COUNCIL ABURA CHARLES PHILIPS NRM 823 ABIM LABWOR COUNTY KIRU TOWN COUNCIL OCHIENG JOSEPH ANYING UPC 404 ABIM LABWOR COUNTY LOTUKEI OBUA TOM INDEPENDENT 146 ABIM LABWOR COUNTY LOTUKEI OGWANG GODWIN NRM 182 ABIM LABWOR COUNTY LOTUKEI OKELLO BISMARCK INNOCENT INDEPENDENT 356 ABIM LABWOR COUNTY MAGAMAGA OTHII CHARLES GORDON NRM Unopposed ABIM LABWOR COUNTY MORULEM OKELLO GEORGE ROBERT NRM 755 ABIM LABWOR COUNTY MORULEM OKELLO MUKASA -

Bachelor of Science in Software Engineering

BACHELOR OF SCIENCE IN SOFTWARE ENGINEERING COURSE CODE BSW INDEX NO NAME Al Yr SEX C'TRY SCHOOL 1 U0068/571 KATIRIMA Allan Phene Junior 2010 M U NTARE SCHOOL 2 U0956/965 SEMATIKO Douglas 2010 M U NAMIREMBE HILLSIDE S.S. 3 U1224/590 JUUKO Marvin 2010 M U ST MARY'S SS KITENDE 4 U0459/658 EKINAMUSHABIRE Preciou 2010 M U KAWEMPE MUSLIM SS 5 U0068/562 BYAMUGISHA Innocent 2010 M U NTARE SCHOOL 6 U0334/620 MUWONGE Bright Hosea 2010 M U UGANDA MARTYRS S.S., NAMUGONGO 7 U0068/585 MATSIKO Grace 2010 M U NTARE SCHOOL 8 U1223/634 NAMUTEBI Veronica 2010 F U SEETA HIGH SCHOOL 9 U0763/806 MUGISA Nicholas 2010 M U BUDDO SEC. SCHOOL 10 U0334/554 NAMPOGO Adrian Mwota 2010 M U UGANDA MARTYRS S.S., NAMUGONGO 11 U0063/552 NAKAYENGA Catherine 2010 F U MT.ST.MARY'S, NAMAGUNGA 12 U0956/960 MUGYENYI Martin 2010 M U NAMIREMBE HILLSIDE S.S. 13 U1085/517 AYESIGA Agnes 2010 F U BP CYPRIAN KIHANGIRE SS LUZIRA 14 U0794/590 ARINAITWE Tumusiime Bryan 2010 M U GREENHILL ACADEMY, KAMPALA 15 U0004/556 NAKALEMBE Margaret 2010 F U KING'S COLLEGE, BUDO 16 U1379/694 SSEGUJJA Conrad Micheal 2010 M U LUGAZI MIXED SEC. SCH. 17 U0082/579 NDYAMUHAKI Joseph 2010 M U ST.KAGGWA BUSHENYI HIGH SCH. 18 U1509/547 NALWADDA Dorothy 2010 F U COMPREHENSIVE COLLEGE KITETIKKA 19 U1224/813 OPIYO Brian Lamtoo 2010 M U ST MARY'S SS KITENDE 20 U0387/548 LUBEGA Edrin Evarest 2010 M U ST.PETER'S S S, NSAMBYA 21 U0068/607 NAHAMYA Colins 2010 M U NTARE SCHOOL 22 U0064/521 KABENGE Shem 2010 M U NAMILYANGO COLLEGE 23 U0064/502 AINOMUGISHA Solomon 2010 M U NAMILYANGO COLLEGE 24 U0459/694 NANKABIRWA Namusisi Linda 2010 F U KAWEMPE MUSLIM SS 25 U0030/709 MUBAZI Eric John 2010 M U KITANTE HILL SCHOOL 26 U0041/998 NANZIRI Bonita Beatrice 2010 F U LUBIRI SECONDARY SCHOOL 27 U0043/686 MUHEREZA Nicholas 2010 M U MAKERERE COLLEGE SCHOOL 28 U2339/533 SEBAGALA Charles 2010 M U ST. -

LINK Context Analysis Uganda Boosting Incomes Through Improved Access to Banana and Orange-Fleshed Sweet Potato Plant Materials

LINK Context Analysis Uganda Boosting Incomes through Improved Access to Banana and Orange-Fleshed Sweet Potato Plant Materials 1 | P a g e 2015 Table of Contents 3 Introduction to LINK: An Innovation Systems Approach to Development 6 Part I: Overview of the Challenge 17 Part II: Enabling Environment for Agribusiness 27 Part III: Key Actors in the Enabling Environment for Agribusiness 35 Part IV: Interactions: A focus on Value Chains 50 Part V: Outputs and Outcomes: Case Studies of Successful Seed Production and Distribution Systems Annexes 55 Annex I: References 64 Annex II: About the Global Knowledge Initiative 2 | P a g e 2015 Introduction to LINK: An Innovation Systems Approach to Development It is difficult to overstate the significance of science, technology, and innovation (STI) for economic and social development. According to the Organization for Economic Cooperation and Development (OECD), “Continuous technological change and innovation are among the main determinants of productivity growth and as such are necessary conditions for the welfare of nations and regions” (2001). Low levels of scientific and technological development harm least developed countries, where the comparative cost of missing out on the benefits of STI is far higher than in the OECD, in profound ways (Farley et al, 2007). As the UNIDO (the United Nations Industrial Development Organization) Position Paper on Innovation Systems for Development states: In the face of the opportunities presented by globalization, and the multiple challenges arising from poverty and resource scarcity, the ability to innovate relates not just to the ability to survive but the ability to thrive. Innovation lies at the heart of peoples’, firms’, sectors’, and countries’ ability to cope with change (Farley et al, 2007). -

™:Ixsrn J Prqtliiq A^Qr/Ollii by XZ'fuui“ Vj ^D>>Vxd ^Kjíláíd/LC

485 RC ftiMcrd at the "ly "y "W A A Published ,™:iXSrn j prQtliiQ a^Qr/Ollii by XZ'fUUi“ vj ^d>>vXd ^KJílÁíd/LC Authority Vol. CI No. 55 7th November, 2008 Price: Shs. 1500 CONTENTS Page General Notice No. 567 of 2008. The Electoral Commission—Notices ... ... 485-489 Kigezi Security Guards Ltd.—Notice ... ... 490 THE PARLIAMENTARY ELECTIONS ACT The Advocates Act —Notice ... ... ... 490 'ihe Companies Act —Notice ... ... ... 490 ACT NO 17 OF 2005 'The Trademarks Act—Notice ... ... ... 490 The Trademarks Act—Registration of Applications 490-491 SECTION 28(1) (b) Advertisements ... ... ... ... 491 -492 w;// SUPPLEMENTS AND No. 21 The Implementation of Government Assurances Bill, 2008. THE LOCAL GOVERNMENTS ACT Statutory Instruments No. 44— The Local Governments (Hoima Town Council) CAP 243 (Protection of Orphans and Vulnerable Children) Byelaws, 2008. SECTION 172 No. 45—The Local Governments (Bombo Town Council) (Welfare of Children. Orphans and Children Living NOTICE with HIV/AIDS) Byelaws, 2008. No. 46—-The Local Governments (Busia Town Council) PUBLICATION OF LIST OF NOMINATED (Orphans and Other Vulnerable Children) Byelaws, 2008. CANDIDATES FOR PURPOSES OF THE PARLIAMENTARY AND LOCAL GOVERNMENT General Notice No. 565 of 2008. COUNCIL BY ELECTION IN KYADONDO COUNTY THE LOCAL GOVERNMENTS ACT NORTH CONSTITUENCY, WAKISO DISTRICT CAP 243 SECTION 122 Notice is hereby given by the Electoral Commission in NOTICE PUBLICATION OF CAMPAIGN PERIOD FOR accordance with Section 18(l)(b) of the Parliamentary PURPOSES OF THE LOCAL GOVERNMENT Elections Act. No. 17 of 2005 and subject to Section 172 of COUNCIL BY-ELECTION IN KYADONDO COUNTY the Local Governments Act; Cap 243, that the list of NORTH CONSTITUENCY. -

Vote: 555 Wakiso District Structure of Budget Estimates - PART ONE

Local Government Budget Estimates Vote: 555 Wakiso District Structure of Budget Estimates - PART ONE A: Overview of Revenues and Expenditures B: Detailed Estimates of Revenue C: Detailed Estimates of Expenditure D: Status of Arrears Page 1 Local Government Budget Estimates Vote: 555 Wakiso District A: Overview of Revenues and Expenditures Revenue Performance and Plans 2012/13 2013/14 Approved Budget Receipts by End Approved Budget June UShs 000's 1. Locally Raised Revenues 2,144,169 1,791,635 3,239,245 2a. Discretionary Government Transfers 3,059,586 2,970,715 2,942,599 2b. Conditional Government Transfers 32,601,298 31,996,803 36,235,037 2c. Other Government Transfers 10,299,801 4,724,322 4,865,053 3. Local Development Grant 962,178 652,142 991,290 4. Donor Funding 0 795,158 Total Revenues 49,067,033 42,135,617 49,068,381 Expenditure Performance and Plans 2012/13 2013/14 Approved Budget Actual Approved Budget Expenditure by UShs 000's end of June 1a Administration 1,673,530 1,422,732 1,658,273 2 Finance 876,480 826,781 981,379 3 Statutory Bodies 996,706 786,619 1,242,096 4 Production and Marketing 3,314,816 3,219,151 3,191,107 5 Health 5,350,708 5,126,200 6,580,574 6 Education 24,488,156 23,891,768 27,393,555 7a Roads and Engineering 9,464,392 3,891,931 4,560,385 7b Water 1,007,375 652,692 972,899 8 Natural Resources 467,285 286,132 615,856 9 Community Based Services 848,277 724,202 712,587 10 Planning 409,569 422,709 983,878 11 Internal Audit 169,739 107,085 175,793 Page 2 Local Government Budget Estimates Vote: 555 Wakiso District 2012/13 2013/14 Approved Budget Actual Approved Budget Expenditure by UShs 000's end of June Grand Total 49,067,033 41,358,002 49,068,381 Wage Rec't: 24,004,735 23,918,051 27,484,152 Non Wage Rec't: 16,069,523 11,035,117 12,068,153 Domestic Dev't 8,992,775 6,404,834 8,720,918 Donor Dev't 0 0 795,158 Page 3 Local Government Budget Estimates Vote: 555 Wakiso District B: Detailed Estimates of Revenue 2012/13 2013/14 UShs 000's Approved Budget Receipts by End Approved Budget of June 1. -

BURNSIDE Public Disclosure Authorized

El 512 VOL. 4 § BURNSIDE Public Disclosure Authorized Uganda Electricity Transmission Company Limited Bujagali Interconnection Project Public Consultation and Disclosure Plan Public Disclosure Authorized Prepared by R.J. Burnside International Limited, Canada 292 Speedvale Avenue West, Unit 7 Guelph ON N1H 1C4 Canada Public Disclosure Authorized In association with Dillon Consulting Limited, Canada Ecological Writings #1, Inc., Canada Enviro and Industrial Consult (U)Ltd, Uganda Frederic Giovannetti, Consultant, France Tonkin & Taylor International Ltd., New Zealand December, 2006 Public Disclosure Authorized Uganda Electricity Transmission Company Limited i Bujagali Interconnection Project Public Consultation and Disclosure Plan December, 2006 Table of Contents 1.0 Introduction .................................................... 1.1 Project Description ........................................... 1 1.2 Applicable Laws, Regulations and Policies to Public Engagement ................................ 2 1.2.1 The Republic of Uganda ................................... 2 1.2.2 Project Lenders ........................................ 9 2.0 Stakeholder Analysis ............................................. 11 2.1 Areas of InfluencelStakeholders .................................. 11 2.2 Description of Stakeholders ..................................... 12 3.0 Stakeholder Engagement .......................................... 13 3.1 Previous Consultation Activities .................................. 13 3.2 Implemented Community Engagement Activities -

Designation of Tax Withholding Agents) Notice, 2018

LEGAL NOTICES SUPPLEMENT No. 7 29th June, 2018. LEGAL NOTICES SUPPLEMENT to The Uganda Gazette No. 33, Volume CXI, dated 29th June, 2018. Printed by UPPC, Entebbe, by Order of the Government. Legal Notice No.12 of 2018. THE VALUE ADDED TAX ACT, CAP. 349. The Value Added Tax (Designation of Tax Withholding Agents) Notice, 2018. (Under section 5(2) of the Value Added Tax Act, Cap. 349) IN EXERCISE of the powers conferred upon the Minister responsible for finance by section 5(2) of the Value Added Tax Act, this Notice is issued this 29th day of June, 2018. 1. Title. This Notice may be cited as the Value Added Tax (Designation of Tax Withholding Agents) Notice, 2018. 2. Commencement. This Notice shall come into force on the 1st day of July, 2018. 3. Designation of persons as tax withholding agents. The persons specified in the Schedule to this Notice are designated as value added tax withholding agents for purposes of section 5(2) of the Value Added Tax Act. 1 SCHEDULE LIST OF DESIGNATED TAX WITHOLDING AGENTS Paragraph 3 DS/N TIN TAXPAYER NAME 1 1002736889 A CHANCE FOR CHILDREN 2 1001837868 A GLOBAL HEALTH CARE PUBLIC FOUNDATION 3 1000025632 A.K. OILS AND FATS (U) LIMITED 4 1000024648 A.K. PLASTICS (U) LTD. 5 1000029802 AAR HEALTH SERVICES (U) LIMITED 6 1000025839 ABACUS PARENTERAL DRUGS LIMITED 7 1000024265 ABC CAPITAL BANK LIMITED 8 1008665988 ABIA MEMORIAL TECHNICAL INSTITUTE 9 1002804430 ABIM HOSPITAL 10 1000059344 ABUBAKER TECHNICAL SERVICES AND GENERAL SUPP 11 1000527788 ACTION AFRICA HELP UGANDA 12 1000042267 ACTION AID INTERNATIONAL -

The Uganda Gazette U

GAZETTE EXTRAORDINARY 1953 (7 f & 5 * Look The THE REPUBLIC OF UGANDA THE REPUBLIC OF UGANDA Registered at the -y- NO i AVAILABLE rOR LTB ' Published General Post Officefor transmission within East Africa as a Newspaper Uganda Gazette u Vol. CIV No. 62 17th October, 2011 Price: Shs. 1500 CONTENTS Page General Notice No. 587 of 2011. The Mining Act—Notice ... ... ... 1953 THE MARRIAGE ACT The Marriage Act—Notice ... ... ... 1953 [Cap. 251 Laws of Uganda, 2000] The Copyright and Neighbouring Rights Regulations— NOTICE Notice ... ... ... ... ... 1953 [Under Section 5 of the Act] The Companies Act—Notices ... ... 1954-1955 The Electoral Commission Act—Notice ... 1955 PLACE FOR CELEBRATION OF MARRIAGES The Trademarks Act—Alteration of a Registered In exercise of the powers conferred upon me by Section Trademark ... ... ... ... 1955 5 of the Marriage Act, I hereby licence the place of Public Advertisements.............. ... ... ... 1955-1960 Worship mentioned in the Schedule hereto to be place for SUPPLEMENT celebration of marriages. Statutory Instrument SCHEDULE No. 54—The Trade (Licensing) (Amendment of Schedule) (No. 2) Instrument, 2011. Church — Mission and Evangelism Ministries International Denomination — Pentecostal CORRIGENDUM Place — Plot No. 1536, 2640, 1639, This is to notify that the trademark No. 2011/43477 ‘UIS’ in Block 229, Ntebetebe the names of UGANDA INFLIGHT SERVICES LIMITED Sub-County —- Kira whose legal address is P.O. Box 728, Entebbe, advertised in County — Kira Town Council the Uganda Gazette Volume CIV No. 46 under General District — Wakiso Notice No. 418 of 2011 dated 15th July, 2011 was Region — B Uganda erroneously advertised in the names of UGANDA INFLIGHT SERVICES LIMITED. -

Report of the Committee on National Economy on the Finance the I(Ampala Metropolitan Transmission System 11

PARLIAMENT OF UGANDA rt I Its PAHt JAMI-N I ()F IHF Rl-l'Ulll lC ()F lr('Al.ll)A o REPORT OF THE COMMITTEE ON NATIONAL ECONOMY ON THE pRoposAL By GoVERNMENT TO BORROW UP TO JPY 13.6598N (US$ 125.1M1 FROM JAPAN TNTERNATTONAL COOPERATTON AGENCY (JrCAl TO FINANCE THE I(AMPALA METROPOLITAN TRANSMISSION SYSTEM IMPROVEMENT PROJECT. a G/ \ NW MARCH 2018 11,'- yA 'tL lA ffi\ 1.O Introduction Rt. Hon. Speaker, Hon. Members, the Committee on National Economy considered the request by Government to borrow JPY 13.659 billion (US$125.1M) from the .Iapan International Cooperation Agency (JICA) to finance the Kampala Mctropolitan Transmission System Improvement Project in accordance with Rule 175 (2) (b) of the Parliamentary Rules of Procedure. The request was presented to this House by the Hon. Minister of Finance, Planning and Economic Development on 9.5.2O17 and was accordingly referred to the Committee on National Economy for consideration. o The Committee considered and scrutinized the rcquest and now begs to report. 2.O METHODOLOGY 2.L Meetings The Committee held meetings with the following: i. The Minister of Finance, Planning and Economic Development; ii. The Minister of Energy and Mineral Development; and iii. Uganda Electricity Transmission Company Limited. a 2.2 Documentary review The Committee studied and made reference to the following documents The Ministbr of Finance, Planning and Economic Development's brief on the loan request; 11 The Draft Loan Agrccmcnt bctween Japan International Cooperation (.llCA) and thc (iovernment of Uganda; 2l,P.a g e \/n-- # \$\ lll The minutes of the discussion on the preparatory survey on Greater Kampala Metropolitan Area Transmission Systems Project between UETCL and .JICA(.J ur-rc,20 1 6) ; IV The final report on the preparatory survey on Greater Kampala Metropolitan Area Transmission Systems Project (Septemeber,20 16) ; V The Final Environment Impact Assessment Report (July, 2016); VI Final Report of the Abbreviated Resettlcment Action Plan (July, 2076); and v1l The Projcct Implementation Plan (Ui)TCl,, April 2Ol7). -

Classified Adverts

CLASSIFIED ADVERTS NEW VISION, Wednesday, September 1, 2010 35 PROPERTIES MAILO “With Trust & Honesty” LAND SITES HOSSANA REAL RABAI REAL ESTATES ...your place to call home LIMITED ESTATES LTD .....we settle you Well surveyed plots with HERITAGE SITES LTD GLORYLAND REAL ready Mailo land titles. 1. KAWANDA - Bombo ESTATES LTD. 'We shall not bend the truth to PLANNED PLOTS WITH CANAAN SITES 1. GAYAZA-ZIROBWE RD. make a sale' PRIVATE MAILO LAND WELL PLANNED AND Road with good view Well planned plots with Mailo 50 x 100ft - 2.5m 50 x 100ft - 7m Dealers in: Buying & Selling of TITLES ORGANISED ESTATES 100 x 100ft - 5m land titles, water and power. Land, Land Documentation, WITH MAILO LAND 100 x 100ft - 14m PLOT 20 OLD K’LA NEAR ST MATIA 1. ENTEBBE ROAD 1 Acre at 15m 1. KASANGATI - near town Sites Manager & Land TITLES,WATER, POWER MULUMBA CHURCH KISUBI -WAMALA- 2. GAYAZA-ZIROBWE 2. KAWUKU, ENTEBBE (1km) the estate has a Surveying. 1. VICTORIA GARDENS 1 Km from tarmac “FIRST STEP TO NEW HOME” BUZI on the shores of Lake ROAD - with lake developed neighbourhood 50 x 100ft - 4.5m view on the main road 1. Kawuku Entebbe Road. GET A HOME IN OUR WELL 50 x 100ft - 6.5m Victoria 1.5km from tarmac with a good view of PLANNED ESTATES: 60 x 100ft - 20m 100 x 100ft - 9m 50 x 100ft = 12m Kasangati Town and With beautiful view of SEVERAL PLOTS WITH 100 x 100ft - 13m 70 x 100ft - 24m 3. BULOBA-MITYANA RD. the Lake 2km from main road 100 x 100ft = 24m Gayaza Town MAILO LAND TITLES AT 2. -

Bachelor of Community Psychology (Eve)

MAKERERE UNIVERSITY ACADEMIC REGISTRAR'S DEPARTMENT ADMISSIONS, 2013/2014 ACADEMIC YEAR PRIVATE The following candidates have been admitted to the following programme: BACHELOR OF COMMUNITY PSYCHOLOGY NAME SEX C'TRY S/N REG NO DISTRICT StudentNo A'Level School 1 13/U/2620/EVE ABAHO Gideon M U MBARARA 213017804 RISE AND SHINE HIGH SCHOOL 2 13/U/2764/EVE ADIKIN Patience F U TORORO 213011985 BUDDO SEC. SCHOOL 3 13/U/2820/EVE AGABA Anold M U ISINGIRO 213005050 MUNTUYERA HIGH SCHOOL, KITUNGA 4 13/U/2880/EVE AGU Florence F U LIRA 213019960 MASHARIKI HIGH SCHOOL 5 13/U/2901/EVE AGWENG Tracy Onapa F U OYAM 213012367 KABOJJA SEC. SCHOOL 6 13/U/2914/EVE AHEBWA Babrah F U KAMPALA 213013934 NAMIREMBE HILLSIDE S.S. 7 13/U/3037/EVE AINEMBABAZI Janet F U JINJA 213019747 EDEN INTERNATIONAL SCHOOL 8 13/U/3057/EVE AINOBURABO Leah F U MBARARA 213013830 NAMIREMBE HILLSIDE S.S. 9 13/U/3124/EVE AKAMPURIRA Ritah Muhwezi F U RUKUNGIRI 213003920 BWERANYANGI GIRLS' SCHOOL 10 13/U/3184/EVE AKAO Norah Mitchel F U LIRA 213020140 SEETA HIGH SCHOOL-MUKONO 11 13/U/3343/EVE AKUMU Bridget Pamela F U GULU 213018002 KISAASI COLLEGE SCHOOL 12 13/U/3371/EVE ALELLE Gloria F U LIRA 213017449 GRACE HIGH SCHOOL 13 13/U/3751/EVE ARINAITWE Nalth Okot M U NTUNGAMO 213013636 VALLEY COLLEGE SS, BUSHENYI 14 13/U/3854/EVE ASIANZU Fiona F U ARUA 213009664 MARACHA SECONDARY SCHOOL 15 13/U/3947/EVE ASIO Ruth F U NGORA 213017156 NILE HIGH SCHOOL 16 13/U/4157/EVE ATWIJUKIRE Emmanuel M U NTUNGAMO 213013640 VALLEY COLLEGE SS, BUSHENYI 17 13/U/4162/EVE ATWINE Allen F U WAKISO 213008830 CALTEC ACADEMY, MAKERERE 18 13/U/4179/EVE ATWONGYEIRE Ronah F U BUSHENYI 213012879 ALLIANCE HIGH SCHOOL, NANSANA 19 13/U/4206/EVE AWEKO Elizabeth F U KITGUM 213003831 WANYANGE GIRLS SCHOOL 20 13/U/4280/EVE AYERA Givent M U KAMWENGE 213016855 MIDLAND HIGH SCHOOL 21 13/U/4316/EVE AZIKU Fiona Enaru F U ARUA 213018656 ST.