Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tata Iris Service Manual

Tata Iris Service Manual Read Tata Magic review and check the mileage, shades, interior images, specs, key features, pros and cons. Vast Service Network Tata Magic Iris has a length, width, height and wheelbase of2960mm,1512mm 3200 rpm and a maximum torque of 38 Nm at 2000 rpm and is mated with a four speed manual gearbox. Tata Magic Iris Features & Specifications. Van/Minibus, Manual, 611 cc, Diesel. Ex-Showroom Price (Delhi). Rs. 2,47,054. + View All Variants & Prices. Owners Manual & Service Book - Tata Motors Customer Care Tata Motors have launched Tata Magic Iris, a small four wheeler passenger vehicle which. 2013 Tata Iris (Auto Taxi). Vehicles » Commercial 2012 model tata 407 6 wheel BS3 manual engine. Vehicles ace HT good condition.Company service. NDTVAuto.com tata motors iris lcv homepage get latest tata motors iris lcv news, auto news, auto industry news, tata motors iris lcv photos, product review. cars - custom search: tata cars.10 by Top Speed India. new tata 3s service facility in pune - DOC513665 According to Tata motors spokesperson, Tata Magic IRIS is easy to drive, the women will find it easy to maneuver and it is quite comfortable Expect the Kite to get both automatic and manual transmissions as well. Tata Iris Service Manual Read/Download Established in 1945, Tata Motors is the first company of India engineering sector. Tata Motors, India's largest Automobile Tata Magic Iris CNG (4-seater). 1. Gumtree gives you latest data for Tata prices based on 2285 new or used car listings. Tata sells two minivans, the Tata Venture and the unique Tata Iris. -

Tata Magic Iris (5-Seater), Rs 2,81,000

Commercial Vehicles. Simplified. www.truckaurbus.com Tata Magic Iris (5-seater), Rs 2,81,000 Contact Info Name: TRUCK AUR BUS India E-mail: [email protected] TAB Department: Administration First Name: TRUCK AUR BUS Last Name: India About me: This account is automated. All Ads/Listing selection and placement on this page were determined automatically by a computer programme. For prompt responses and replies to queries contact support staff at: [email protected] or visit http://support.truckaurbus.com Additional Email: [email protected] QR-Code Scan with your mobile phone or tablet to visit the listing URL Listing details Common Reference TAB-573-14623613 Number: Title: Tata Magic Iris (5-seater) Condition: New Body Style: Others Description: A fully built mini van, used for intra-city traveling. Price: Rs 2,81,000 Engine & Transmission Engine: Tata 4NA, DI Watercooled Emission Norms: BS-III Engine Cylinders: 1 Displacement 611 page 1 / 4 Commercial Vehicles. Simplified. www.truckaurbus.com (cc): Max Power: 11 bhp @ 3000 rpm Max Torque: 31 Nm @ 1600-1800 rpm Transmission: Manual Clutch: 160 mm dia., Single plate dry friction diaphragm type Gearbox: 4-speed Fuel: Diesel Fuel Tank: 10 Litres Performance Turning Radius: 3500 mm Max Speed 50 (km/h): Structure & Dimensions Chassis Type: Monocoque Engine Location: Front Floor Type: Standard Axle 4-tyre vehicle Configuration: Tyres: Front: 145/80 R 12 - 6 PR Rear: 145/80 R 12 - 6 PR Wheelbase (mm): 1650 Overall Length 2960 (mm): Ground Clearance 140 (mm): Weights GVW / GCW 1110 (Kgs): Kerb Weight: 685 kgs page 2 / 4 Commercial Vehicles. -

Investor Presentation

Investor presentation 23 January 2013 PRIVATE & CONFIDENTIAL NOT FOR DISTRIBUTION Confidentiality and disclaimer IMPORTANT NOTICE The information contained in this presentation is strictly confidential and is provided by Jaguar Land Rover Automotive plc (the “Company”) to you solely for your reference to allow you to make an evaluation of the Company. Any reproduction, dissemination or onward transmission of this presentation or the information contained herein is strictly prohibited. By accepting delivery of this presentation you acknowledge and agree to comply with the foregoing restrictions. This presentation is only being provided to persons that are (i) “Qualified Institutional Buyers”, as defined in Rule 144A under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or (ii) non-US persons outside the United States, in compliance with Regulation S under the Securities Act. By attending this presentation or by reading the presentation slides, you warrant and acknowledge that you fall within one of the categories (i) and (ii) above. In the United Kingdom, this presentation has not been approved by an authorised person and is for distribution only to and directed only at, and addressed solely to, persons who (i) have professional experience in matters relating to investments falling within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc”) of the Order, or (iii) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of section 21 of the Financial Services and Markets Act 2000) in connection with the issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “Relevant Persons”). -

Annual Report 2018/19 (PDF)

JAGUAR LAND ROVER AUTOMOTIVE PLC Annual Report 2018/19 STRATEGIC REPORT 1 Introduction THIS YEAR MARKED A SERIES OF HISTORIC MILESTONES FOR JAGUAR LAND ROVER: TEN YEARS OF TATA OWNERSHIP, DURING WHICH WE HAVE ACHIEVED RECORD GROWTH AND REALISED THE POTENTIAL RATAN TATA SAW IN OUR TWO ICONIC BRANDS; FIFTY YEARS OF THE EXTRAORDINARY JAGUAR XJ, BOASTING A LUXURY SALOON BLOODLINE UNLIKE ANY OTHER; AND SEVENTY YEARS SINCE THE FIRST LAND ROVER MOBILISED COMMUNITIES AROUND THE WORLD. TODAY, WE ARE TRANSFORMING FOR TOMORROW. OUR VISION IS A WORLD OF SUSTAINABLE, SMART MOBILITY: DESTINATION ZERO. WE ARE DRIVING TOWARDS A FUTURE OF ZERO EMISSIONS, ZERO ACCIDENTS AND ZERO CONGESTION – EVEN ZERO WASTE. WE SEEK CONSCIOUS REDUCTIONS, EMBRACING THE CIRCULAR ECONOMY AND GIVING BACK TO SOCIETY. TECHNOLOGIES ARE CHANGING BUT THE CORE INGREDIENTS OF JAGUAR LAND ROVER REMAIN THE SAME: RESPONSIBLE BUSINESS PRACTICES, CUTTING-EDGE INNOVATION AND OUTSTANDING PRODUCTS THAT OFFER OUR CUSTOMERS A COMPELLING COMBINATION OF THE BEST BRITISH DESIGN AND ENGINEERING INTEGRITY. CUSTOMERS ARE AT THE HEART OF EVERYTHING WE DO. WHETHER GOING ABOVE AND BEYOND WITH LAND ROVER, OR BEING FEARLESSLY CREATIVE WITH JAGUAR, WE WILL ALWAYS DELIVER EXPERIENCES THAT PEOPLE LOVE, FOR LIFE. The Red Arrows over Solihull at Land Rover’s 70th anniversary celebration 2 JAGUAR LAND ROVER AUTOMOTIVE PLC ANNUAL REPORT 2018/19 STRATEGIC REPORT 3 Introduction CONTENTS FISCAL YEAR 2018/19 AT A GLANCE STRATEGIC REPORT FINANCIAL STATEMENTS 3 Introduction 98 Independent Auditor’s report to the members -

Tata Motors Annual Report

68th Annual Report 2012-13 CONTENTS FINANCIAL HIGHLIGHTS FINANCIAL STATEMENTS 36 Financial Performance Standalone Financial Statements 40 Summarised Balance Sheet 116 Independent Auditors’ Report and Statement of Profit and 120 Balance Sheet Loss Standalone 121 Profit and Loss Statement 42 Summarised Balance Sheet and Statement of Profit and 122 Cash Flow Statement Loss Consolidated 124 Notes to Accounts 44 Fund Flow Statement Consolidated Financial Statements 160 Independent Auditors’ Report STATUTORY REPORTS 162 Balance Sheet 45 Notice 163 Profit and Loss Statement 52 Directors’ Report 164 Cash Flow Statement 66 Management Discussion and 166 Notes to Accounts Analysis CORPORATE OVERVIEW Subsidiary Companies 98 Report on Corporate 02 Corporate Information Governance 197 Financial Highlights 03 Mission, Vision and Values 115 Secretarial Audit Report 200 Listed Securities 04 Chairman’s Statement 201 Financial Statistics 08 Board of Directors 12 Delivering Experiences Attendance Slip & Proxy Form 14 Key Performance Indicators 16 Products and Brands 18 Global Presence 20 Milestones 22 Driving Accountability 24 Focusing on Customers & Products 26 Emphasising Excellence 28 Delivering with Speed 30 Sustainability 34 Awards and Achievements ANNUAL GENERAL MEETING Date: Wednesday, August 21, 2013 Time: 3.00 p.m. Venue: Birla Matushri Sabhagar, 19, Sir Vithaldas Thackersey Marg, Mumbai 400 020 ANTICIPATING NEEDS. DELIVERING EXCITEMENT. At Tata Motors, we believe that our Our renewed commitment to these mobility needs of our customers. We are strengths stem from an organisation- pillars drives us to achieve our mission engaging with them at our dealerships wide culture which rests on four of anticipating and providing the best and adopting processes to ensure that pillars – Accountability, Customer & vehicles and experiences to excite our industry-leading practices form a key part Product Focus, Excellence and customers. -

European Car and Light Commercial Vehicle Production Outlook

European Car and Light Commercial Vehicle Production Outlook November 2012 SMMT, the 'S' symbol and the ‘Driving the motor industry’ brandline are trademarks of SMMT Ltd Contents Introduction and analysis overviews: Individual vehicle manufacturer reviews: About this report 3 BMW 61 Key Highlights 4 Daimler 68 Economic Background 10 Fiat (incl. Chrysler) 74 Automotive Market Overview 17 Ford 80 Overcapacity & Restructuring 22 GM 85 Demand Side Perspective 29 Honda 91 UK VM Summary 30 Hyundai-Kia 93 Production Outlook Overview 34 PSA 96 Country Rankings 48 Renault-Nissan-Dacia 102 Alternative Scenarios 52 Suzuki 111 Disclaimer 59 Tata – Jaguar Land Rover 112 Toyota 116 Volkswagen (incl. Porsche) 119 Aston Martin 128 Geely Volvo 129 Mitsubishi 132 SAIC MG 132 Saab-Spyker 132 Other Chinese – Chery and Great Wall 133 EUROPEAN CAR AND LCV PRODUCTION OUTLOOK REPORT November 2012 | Page 2 About this report This is the sixth 2012 Production Outlook report from AutoAnalysis. The next report will appear in January 2013. The views and projections contained in this report are those of the author, Ian Henry of AutoAnalysis. They do not represent an official SMMT view. The projections regarding new model timings, changes in production locations and the associated production volumes shown here have been compiled on the basis of information from a variety of sources. In most cases, the vehicle companies do not provide official information on which models will be made at which plants, nor do they provide detailed information on future volumes and timings. They have been prepared on the basis of judgments made by AutoAnalysis, taking into account the information, opinion and inside from a range of industry, press and analyst sources available at the time of compiling this report. -

Musk Urges Tesla Workers to Meet Customer Demand

CHINA DAILY | HONG KONG EDITION Monday, March 25, 2019 MOTORING | 19 NEW ARRIVALS Musk urges Tesla workers Sagitar stretching out with longer model FAW-Volkswagen launched its height, with a wheelbase stretch- all-new Sagitar Long-Wheelbase ing 2,731 mm. This is to optimize on Mar 18, in Sanya, South China’s interior space and offer a more to meet customer demand Hainan province. The sedan offers comfortable driver and passenger eight variants with two power- experience. The model has four train options at prices ranging kinds of driving modes: normal, Chinese and European buyers behind massive surge in company’s orders book from 131,800 yuan to 196,800 economic, sporty and individual- yuan ($19,620-$29,300). The ized, which can be tailored by the model sees upgrades in design, driver. Coupled with an advanced SAN FRANCISCO — On Thurs- performance, comfort and safety automatic driving system, includ- day, Tesla chief Elon Musk urged to target customers born in the ing an active lane keeping assist workers to make the “biggest 1980s and 1990s, who are believed system, emergency braking and wave” of deliveries in the electric to have higher requirements adaptive cruise control, the latest- carmaker’s history their top prior- for quality of life. The sedan is generation Sagitar not only rein- ity, Business Insider reported. 4,753 millimeters in length, 1,800 forces its driving safety, but also The news website posted a copy mm in width and 1,462 mm in improves its artificial intelligence. of an internal email from Musk rallying Tesla troops to pitch in with deliveries throughout Europe, China and North America. -

1 Co-Evolution of Policies and Firm Level Technological Capabilities in the Indian Automobile Industry Dinar Kale ESRC Innogen C

Co-evolution of Policies and Firm Level Technological Capabilities in the Indian Automobile Industry Dinar Kale ESRC Innogen Centre Development Policy and Practise, The Open University Email: [email protected] Abstract Innovation in form of new products, processes or forms of productive organisation brings growth to firms and development to economies and therefore it is important to understand sources of innovation and technological capabilities. In this context this paper explores sources of innovation and technological capability in the Indian automobile industry. In last decade Indian auto industry emerged as one of the fastest growing industry with increasing levels of technological sophistication in auto industries amongst emerging countries. This paper shows that industrial policy set up challenges for firm in form of constraint to develop products with higher local suppliers and helped development of auto component supplier industry. It also points out important role played by factors such as nature of demand and firm ownership in innovative capability development. Paper reveals key attributes of firm ownership which include managerial vision and diversified nature of businesses. The diversified nature of businesses has helped Indian auto firms in innovative capabilities by facilitating inter-sector learning. 1 1. Introduction In the global world innovation lies at the heart of the economic growth and development for countries and firms in advanced as well as developing countries. History is full of examples where lack of innovation has withered away the economies and firms precisely because those economies and firms lacked a “Schumpeterian vigour”. Schumpeter explained sweeping away of innovation-laggards by competition from radical new technologies as ‘creating destruction’. -

Circulation of Authorisation for Fitment of Speed Governor in All Kinds Of

MicroAutotech Speed Governor Approval List S. No. of TEST S.NO. Certificate Vehicle Model Set speed Certificate No. Issued Date AGENCY 1 1 Tata -407 LCV Diesel 40 TE/2004/322/CMVR/819 22/12/2004 VRDE 2 2 Tata LPT/SFC 1612 40 TE/2004/322/CMVR/889 9/4/2005 VRDE 3 3 Tata LPT 1615 TC Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 4 3.1 Tata LPT 1613 TC Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 5 3.2 Tata SK 1613 TC Tipper Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 6 3.3 Tata LPT 1109 Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 7 3.4 Tata 709 E Turbo Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 8 3.5 Tata LP 1512 TC Diesel 40 TE/2005/408/CMVR/1029 21/10/2005 VRDE 9 4 FJ 470 CNG High Roof Omni Bus (15 Seater) 40,50,60 TE/2005/409/CMVR/1074 9/1/2006 VRDE 10 5 Mahindra Voyger (Diesel) 40,50,60 TE/2005/403/CMVR/1072 9/1/2006 VRDE 11 6 Ashok Leyland Viking Bus- CNG 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 12 6.1 Eicher 10.59 RHD Cab & Body - CNG 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 13 6.2 HM RTV CNG Green Ranger-DA-ST-CB-15 Seater & its Variants :- 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 14 6.3 HM RTV CNG HR Passenger 16 Seater BS III 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 15 6.4 HM RTV CNG HR School Bus 16 Seater BS III 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 16 6.5 HM RTV CNG Passenger 16 Seater BS III 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 17 6.6 HM RTV CNG School Bus 16 Seater BS III 40,50,60 TE/2005/409/CMVR/1074/E-1 24/3/2006 VRDE 18 6.7 HM RTV CNG Ambulance -

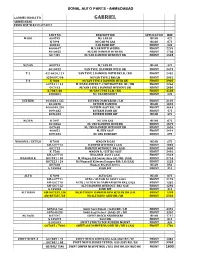

Gabriel India Ltd Gabriel Ahmedabad Price List W.E.F 01.07.2017

SONAL AUTO PARTS - AHMEDABAD GABRIEL INDIA LTD GABRIEL AHMEDABAD PRICE LIST W.E.F 01.07.2017 PART NO DESCRIPTION APPLICATION MRP M 800 600795 M/ CAR 89 REAR 421 K 7096 M/CAR 96 GAS REAR 673 400012 CAR BUSH KIT FRONT 223 4000047 M/CAR WITH SPRING FRONT 2239 4010055 M/CAR DAMPER WITH BK FRONT 1708 G0 7437 M/CAR DAMPER WITHOUT BK FRONT 1528 M/VAN 600793 M/ VAN 89 REAR 421 4010022 VAN TYPE 1DAMPER WITH BK FRONT 2473 T-2 4210020 / 21 VAN TYPE 2 DAMPER WITH BK LH / RH FRONT 2482 4200007/06 M/VAN TYPE 2 RH/LH FRONT 3031 T-3 K 7086 M/VAN TYPE 3 DAMPER WITK BK FRONT 2905 G07441 / 42 M/VAN DAMPER T-2 WITHOUT BK LH / RH FRONT 2266 G07443 M/VAN TYPE 3 DAMPER WITHOUT BK FRONT 2680 K 7087/88 M/VAN TYPE 3 LH / RH FRONT 3508 4200001 M/ VAN BUSH KIT FRONT 223 ESTEEM 4010031 /32 ESTEEM DAMPER RH / LH FRONT 2104 4010028 ESTEEM DAMPER REAR 1825 4000049 /50 ESTEEM ASSY RH / LH FRONT 3643 4094182 ESTEEM BUSH KIT FRONT 475 4094183 ESTEEM BUSH KIT REAR 475 M/ZEN K 7097 M/ ZEN GAS REAR 673 4010056 M/ ZEN DAMPER WITK BK FRONT 1879 G07438 M/ ZEN DAMPER WITHOUT BK FRONT 1654 400052 M/ZEN ASSY FRONT 2419 4094181 M/ ZEN BUSH KIT FRONT 295 WAGON R / ESTILO K 7099 WAGON R GAS REAR 673 AM-G07714 DAMPER WITH BK ( GAS) FRONT 1885 G07713 DAMPER WITHOUT BK ( GAS) FRONT 1600 K 7566 WAGON R / ESTILO ASSY FRONT 2491 AM-G07715 WAGON R ASSY ( GAS) FRONT 2518 WAGON R K K07331 / 30 M/Wagon R K Series Assy LH / RH (GAS) FRONT 2716 K07323 / 24 M/Wagon R K Series Damper RH/ LH (GAS) FRONT 1528 K07328 Wagon R GAS K Series REAR 853 G 105046 BUSH KIT FRONT 313 ALTO K 7098 ALTO GAS REAR -

Ti\Ti\ Motors Limited

G TATA SSE Limited Listing Compliance Department First Floor, New Trading Ring National Stock Exchange of India Ltd. Rotunda Building, P J Towers, Exchange Plaza, Sandra Kurla Complex, Dalal Street, Fort, Mumbai 400 001 Bandra(E), Mumbai 400 051 Kind Attn: Mr Khushro A. Bulsara Kind Attn: Mr Lokesh Bhandari General Manager & Head Senior Manager Listing Compliance & Legal Regulatory Listing & Compliance January 30, 2020 Sc. No.- 15870 Dear Sirs, Ref: ISIN: INE155A01022- Ordinary Shares IN9155A01020- 'A' Ordinary Shares Debt Securities on NSE & BSE Re: Retirement of Dr Ralf Speth - Executive Director & CEO of Jaguar LandRover Automotive Pic (JLR) Pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and with respect to the captioned matter, please find enclosed a press release issued by the Company which is self explanatory. This is for the information to the exchanges and the members. Yours faithfully, Tata Mo~sLimited 1\ ... s l... >1- H K Seth . Company Secretary TI\TI\ MOTORS LIMITED Bombay House 24 Homi Mody Street Mumbai 400 001 Tel 91 22 6665 8282 Fax 91 22 6665 7799 www.tatamotors.com CIN L28920MH 1945PLC004520 TATAMOTORS uTATA Connecting Asp ~rations for immediate use Mumbai, January 30, 2020: Mr Chandrasekaran, Chairman of Tata Sons, Tata Motors and Jaguar Land Rover plc would Like to announce that Professor Sir Ralf Speth has decided to retire from his current role as Executive Director and Chief Executive Officer of JLR at the end of his contract term in September 2020. "I want to thank Ralf for his passion and commitment over the Last 10 years. -

Fuel Consumption from Light Commercial Vehicles in India, Fiscal Year 2018–19

WORKING PAPER 2021-02 © 2021 INTERNATIONAL COUNCIL ON CLEAN TRANSPORTATION JANUARY 2021 Fuel consumption from light commercial vehicles in India, fiscal year 2018–19 Author: Ashok Deo Keywords: CO2 standards, fleet average fuel consumption, mini truck, pickup truck, greenhouse gas emissions Introduction This paper examines the fuel consumption of new light commercial vehicles (LCVs) sold in India in fiscal year (FY) 2018–19. These vehicles are the N1 segment in India, and passenger vehicles are the M1 category.1 LCVs in India are not yet subject to any carbon dioxide (CO2) emission standards, even though such standards apply to passenger cars and have proven effective in driving down test-cycle emission levels of new vehicles. This work establishes a baseline of fuel consumption for the N1 segment in India, to help regulators develop an effective CO2/fuel consumption standard. Additionally, we compare the N1 fleets for FY 2014–15, FY 2017–18, and FY 2018–19, understand the characteristics of the mini truck and pickup segments within the N1 category, and compare the performance of major LCV manufacturers in India in terms of fleet average fuel consumption. Finally, we assess the performance of India’s LCV fleet against the LCV fleet in the European Union, considering the differences in the curb weight and size of the vehicles, and examine the performance of LCV manufacturers if a star labeling standard or passenger car fuel consumption standards were to be applied. Background LCVs are used in India as “last-mile” connectivity to move goods to their final destination. The light-duty vehicle market was approximately 87% passenger cars and 13% LCVs in FY 2018 –19.2 This study focuses on India’s LCVs, which are bifurcated into two segments by the Society of Indian Automobile Manufacturers (SIAM), as shown in www.theicct.org Table 1.