Genesee and General Motors' Outsourcing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1996 Buick Century Owner's Manual

a BUICK The 1996 Buick Century Owner’s Manual Seats and Restraint Systems............................................................. 1-1 This section tells you how to use your seats and safety belts properly. It also explains “SRS” system. FeaturesandControls .................................................................. 2- 1 This section explains how to start and operate your Buick. Comfort Controls and Audio Systems..................................................... 3- 1 This section tells you how to adjust the ventilation and comfort controls and how to operate your audio system. YourDrivingandtheRoad .............................................................. 4-1 Here you’ll find helpful information and tips about the road and howto drive under different conditions. ProblemsontheRoad .................................................................. 5-1 This section tells you what to do if you have a problem while driving, such as a flat tire or overheated engine, etc. Service and Appearance Care............................................................ 6-1 Here the manual tells you how to keep your Buick running properly and looking good. Maintenanceschedule....... ...........................................................7-1 This section tells you when to perform vehicle maintenance and what fluids and lubricants to use. Customer Assistance Information ........................................................ 8-1 This section tells you how to contact Buick for assistance and how to get service publications. It also gives -

Reorganization Strengthened Delco to Deal with a Challenging

reorganization strengthened Delco to deal business that is succeeding. Employee byes are with a challenging competitive environment. disrupted, customer relationships must be pre· making possible new steps toward rightsizing served. shareholders need to be assured and sat· and structural cost reductions, accelerated Isfied even as the need to do daily banlc with technology introduction into GM's North the competitIOn continues. /\merican Operanons, and a realignment of Yet. at each stage in our company's history. International operations to sharpen focus on Hughes has always been a place where people profitable growth accept change as challenge - a company that's been too busy defining the future to be afraid As the fastest growing segment of Hughes of it. We are confident the changes we're mak· Electronics, Telecommunications and Space ing in 1997 will serve to solidify the one con· posted a 33% growth rate in 1996 - with total stant through Hughes' long history - securing revenues of $4.1 billion. Hughes Space and this company's legacy as an industry leader for Communications increased revenues by 21 %, years to come. Hughes Nerwork Systems broke the $1 billion revenue threshold for the first time, while the PanAmSat merger announcement marked a major milestone on the path to a truly global C. Michael Armstrong communications service. DIRECTV in the Chairman of the Board and United States, attained a subscriber base of 2.5 Chief Executive Officer million in early 1997, making it equivalent in size to the nation's seventh largest cable televi sion company. Using technology, talent and investment to lead in markets, to build new businesses, to cre Charles H. -

F Building Better ^ Krannert 'Products'

PURDUE UNIVERSITY SPRING 1999 f Building Better ^ Krannert 'Products' \m\ 1997-98 ANNUAL REPOR I Krannert Update, Spring 1999 published by Krannert School of Management, Purdue University Purdue University, West Lafayette, Indiana This digital edition was produced by the Digital Initiatives group of the Purdue Libraries Archives and Special Collections Department The original text was scanned at 400 ppi, 24 bit color and stored as uncompressed TIFF images Digital Initiatives Purdue University Libraries Archives and Special Collections http://e-archives.lib.purdue.edu July 2007 from the dean Dear Krannert Alumni and Friends, I'm delighted to repoil that in addition to fulfilling our mission of — K P A N NI-: P i i r- \ • preparing graduates who will be tomorrow's business leaders; i^ADUATt SCHC • supporting faculty who produce innovative research results and OF ^^^ practical applications; MANAGEMEN ' M • developing partnerships with industry for networking and .J^^Hs^Bb^ knowledge exchange; and • creating opportunities for lifelong leaming and professional II • development — we're in the planning stages to build a new management ^^^^^^^^R: ~-;^3r'wm,M If *• facility and renovate our current structure. P f Competition for students, employers of our graduates, and top faculty members has never been greater among the top 25 business schools. With the help of key alumni and friends, we've assessed our School's current and future needs in terms of facilities and technology as well as Krannert's potential for a successful capital campaign. As we hone our strategic edge, creating a high-tech, crossfunctional, team-oriented 21st century leaming environment has become a first priority for Krannert and Purdue. -

Cleanup Progresses at Former Factory Complex

Cleanup Progresses at Former Factory Complex Buick City Site Revitalizing Auto Communities Flint, Michigan November 2018 Environmental Response Trust The former General Motors-Buick City manufacturing complex is For more information undergoing environmental cleanup that will take several years to complete. If you need more information, have Buick City includes approximately 413 acres divided into the Northend questions or would like to be added (north of Leith Street) and the Southend (south of Leith Street) – see to the mailing list about the Buick attached Site Map. Revitalizing Auto Communities Environmental City site, please contact one of these Response (RACER) Trust is tasked with conducting the cleanup and individuals: marketing the property for sale and redevelopment. The U.S. Environmental Protection Agency (EPA) authorizes and oversees the Christopher Black required cleanup work with the support of the Michigan Department of EPA Project Manager Environmental Quality (DEQ). RCRA Corrective Action Section 2 312-886-1451 Two parcels (one on the Northend and one on the Southend), totaling [email protected] approximately 49 acres, have been sold and successfully redeveloped for EPA toll-free: 800-621-8431 new manufacturing operations. About 364 acres are still owned by EPA Region 5 RACER Trust and are available for purchase and redevelopment. RACER 77 W. Jackson Blvd. Trust continues to work on completion of the necessary environmental Chicago, IL 60604-3590 cleanup work for the entire 413-acre site. Environmental cleanup that is necessary because of GM’s historical operations remains RACER Trust’s Kevin Lund, PE responsibility, regardless of who owns the property. MDEQ Project Coordinator Redevelopment Support Site Conditions 517-513-1846 Buick City contains soil and groundwater (water below the surface) that is [email protected] contaminated with various petroleum products and chemicals that were Jackson District Office used as part of GM’s car and truck manufacturing. -

New United Motor Manufacturing, Inc

THE ‘LEARNING BUREAUCRACY’: NEW UNITED MOTOR MANUFACTURING, INC. By Paul S. Adler Downloaded from http://www-bcf.usc.edu/~padler/ THE ‘LEARNING BUREAUCRACY’: NEW UNITED MOTOR MANUFACTURING, INC. by Paul S. Adler School of Business Administration University of Southern California Los Angeles 90089-1421 Tel: (213) 740-0748 DRAFT 3.1 April 1992 Forthcoming in Barry M. Staw and Larry L. Cummings (eds.) Research in Organizational Behavior, Greenwich, CT: JAI Press. Acknowledgements: The research on which this study is based would not have been possible without the generous cooperation of managers, workers and union officials at NUMMI. Gary Robinson helped transcribe taped interviews with them and discern the key points. This article has benefitted from the comments of several NUMMI people and from the responses of many friends and colleagues: Chris Argyris, Joel Beinin, Christian Berggren, Bob Brenner, Clair Brown, El Buffa, Bob Cole, John Ettlie, Steve Frenkel, Don Gerwin, Meg Graham, Jan Hopland, Sandy Jacoby, Ed Lawler, Ann Majchrzak, Ruth Milkman, Michael Reich, Dick Scott, Bill Simon, David Stern, Steve Wheelwright, Bob Sutton, Lowell Turner, and Stephen Wood. My thinking has also been stimulated by the reaction of colleagues to presentations at the USC, Harvard Business School, NYU, UCLA, and UC Berkeley. My thanks to all these people, many of whom still disagree. 2 TABLE OF CONTENTS INTRODUCTION .................................................................................................... 3 RESEARCH METHODS......................................................................................... -

Get It Online

GET IT ONLINE ® ® ACCESS YOUR NEWSPAPER Detroit AutoScene DURING THE COVID-19 OUTBREAK DetroitAutoScene.com ® –Online (use either address) TechCenter News TechCenterNews.com LOOK FOR US IN PRINT VOL. 88 NO. 11 We Put a Face on the American Auto Industry MARCH 23, 2020 AS SOON AS POSSIBLE Huge Social Media Initiative Begun by Detroit Auto Scene The current COVID-19 crisis is changing the way a lot of business- es are operating, and Detroit Auto Scene is no exception. To better serve our readers, we are taking a deep dive into social media in order to get our content out. “Our Instagram and Facebook presence will enable our readers to better interact with the newspaper,” said Harley Nunley, the person in charge of social media at Detroit Auto Scene. “The paper can also be accessed by going to our Web site at http://detroitautoscene.com,” Nunley said. “This will open up the lines of communications.” Nunley added. “People can ask us questions and they can even post information on our Facebook page and even instant message me, and can comment on the pictures on our Instagram account.” Nunley said that accessing the pages should be easy. Simply go to Facebook or Instagram and type in “Detroit Auto Scene.” “Our new Facebook page is a business page,” Nunley said. “People shouldn’t confuse it with a personal page that is also under ‘Detroit Auto Scene.’ I would also like to say that these efforts are a work in progress and that we would really appreciate any feedback from The normally-packed parking lot at FCA’s Sterling Stamping plant was empty after FCA, like GM and Ford, shut readers on how we can build our social media efforts.” down production at all the company’s manufacturing facilities in North America. -

Michigan Auto Project Progress Report - December 2000 I Inaugural Progress Report Michigan Automotive Pollution Prevention Project

A VOLUNTARY POLLUTION PREVENTION AND RESOURCE CONSERVATION PARTNERSHIP ADMINISTERED BY: Michigan Department of Environmental Quality Environmental Assistance Division DECEMBER, 2000: 1st ISSUE John Engler, Governor • Russell J. Harding, Director www.deq.state.mi.us ACKNOWLEDGMENTS DaimlerChrysler Corporation, Ford Motor Company, General Motors Corporation and the Michigan Department of Environmental Quality (MDEQ) thank the Auto Project Stakeholder Group members for providing advice to the Auto Project partners and facilitating public information exchange. The Auto Companies and MDEQ also acknowledge the guidance and counsel provided by the US EPA Region V. CONTACTS FOR ADDITIONAL INFORMATION For information regarding the Michigan Automotive Pollution Prevention Project Progress Report, contact DaimlerChrysler, Ford, or General Motors at the addresses listed below or the Environmental Assistance Division of the Michigan Department of Environmental Quality at 1-800-662-9278. DaimlerChrysler Ford Doug Orf, CIMS 482-00-51 Sue Rokosz DaimlerChrysler Corporation Ford Motor Company 800 Chrysler Drive One Parklane Blvd., Suite 1400 Auburn Hills, MI 48326-2757 Dearborn, MI 48126 [email protected] [email protected] General Motors MDEQ Sandra Brewer, 482-303-300 Anita Singh Welch General Motors Corporation Environmental Assistance Division 465 W. Milwaukee Ave. Michigan Department of Environmental Quality Detroit, MI 48202 P.O. Box 30457 [email protected] Lansing, MI 48909 [email protected] Michigan Auto Project Progress Report - December 2000 i Inaugural Progress Report Michigan Automotive Pollution Prevention Project TABLE OF CONTENTS Page Foreward iv I. Executive Summary Project Overview 1 Activities and Accomplishments 4 Focus on Michigan 11 Auto Company Profiles II. DaimlerChrysler Corporation Project Status 12 Activities and Accomplishments 14 Focus on Michigan 16 III. -

Owner's Manual

yellowblue The 1999 Oldsmobile Cutlass Owner’s Manual 1-1 Seats and Restraint Systems This section tells you how to use your seats and safety belts properly. It also explains the “SRS” system. 2-1 Features and Controls This section explains how to start and operate your vehicle. 3-1 Comfort Controls and Audio Systems This section tells you how to adjust the ventilation and comfort controls and how to operate your audio system. 4-1 Your Driving and the Road Here you’ll find helpful information and tips about the road and how to drive under different conditions. 5-1 Problems on the Road This section tells you what to do if you have a problem while driving, such as a flat tire or overheated engine, etc. 6-1 Service and Appearance Care Here the manual tells you how to keep your vehicle running properly and looking good. 7-1 Maintenance Schedule This section tells you when to perform vehicle maintenance and what fluids and lubricants to use. 8-1 Customer Assistance Information This section tells you how to contact Oldsmobile for assistance and how to get service and owner publications. It also gives you information on “Reporting Safety Defects” on page 8-9. 9-1 Index Here’s an alphabetical listing of almost every subject in this manual. You can use it to quickly find something you want to read. i yellowblue We support voluntary technician certification. GENERAL MOTORS, GM, the GM Emblem, OLDSMOBILE, the OLDSMOBILE Rocket Emblem are registered trademarks and the name CUTLASS is a trademark of General Motors Corporation. -

SUPPLEMENTAL EXPERT WITNESS DESIGNATION on the Interested Parties in This Action by Placing Same in a Sealed Envelope, Addressed As Follows

1 SAMUEL J. MUIR (SBN 89883) STEPHEN B. LITCHFIELD (SBN 284951) 2 COLLINS COLLINS MUIR + STEWART LLP 3 1999 Harrison Street, Suite 1700 Oakland, CA 94612 4 (510) 844-5100 – FAX (510) 844-5101 5 Attorneys for Defendant McLARAND, VASQUEZ & PARTNERS, INC. (erroneously sued herein as MCLARLAND, VARQUEZ & PARTNERS, INC.) 6 7 8 SUPERIOR COURT OF THE STATE OF CALIFORNIA 9 COUNTY OF SANTA CLARA —DOWNTOWN DISTRICT 10 CILKER APARTMENTS, LLC, ) CASE NO. 1-13-CV-258281 Complex ) [Assigned to Hon. Peter H. Kirwan; Dept. 1] 11 Plaintiffs, ) ) McLARAND, VASQUEZ & PARTNERS, 12 vs. ) INC.’S SUPPLEMENTAL EXPERT WITNESS 13 ) DESIGNATION WESTERN NATIONAL CONSTRUCTION, ) 14 MCLARLAND, VARQUEZ & PARTNERS, ) INC., GROUP M ENGINEERS, GENTRY ) 15 ASSOCIATES CONSTRUCTION ) CONSULTANTS, LARCO INDUSTRIES, ) 16 FITCH PLASTERING, COURTNEY ) 17 WATERPROOFING, CELL CRETE, LOS ) NIETOS CONSTRUCTION, MADERA ) 18 FRAMING, KELLY DOOR, TARA ) COATNGS, LDI, ADM PAINTING, ) 19 ALLIANCE BUILDING PRODUCT, JOS. J. ) ALBANESE, ANDERSON TRUSS, ) Complaint Filed: 12/26/13 20 CALIFORNIA CLASSIC PAVERS, CASEY-) FAC Filed: 03/20/14 21 FOGIL CONCRETE CONTRACTORS, ) Trial Date: 02/01/16 CENTRAL COAST STAIRS, ) 22 COMMERCIAL ROOF MANAGEMENT, ) DAVEY ROOFING, INC., DEMETRIS ) 23 PAINTING II, INC., DOORWAY MFG., ) LANDSCAPE PROS, MULTI-BUILDING ) 24 STRUCTURES, PARK WEST, PYRAMID ) 25 BUILDERS, ROBECKS WELDING & ) FABRICATION, RYLOCK COMPANY, ) 26 SUMMIT WINDOW & PATIO DOOR, ) VANGUARD and DOES 1-100, inclusive, ) 27 ) Defendants. ) 28 _____________________________________) Collins Collins 19010 – EXPERT DESIGNATION OF MVP (SUPP) (12-04-15) Muir + Stewart LLP 1999 Harrison Street Suite 1700 1 Oakland, CA 94612 Phone (510) 844-5100 SUPPLEMENTAL EXPERT DESIGNATION OF McLARAND, VASQUEZ & PARTNERS Fax (510) 844-5101 1 WESTERN NATIONAL CONSTRUCTION, ) ) 2 Cross-Complainant, ) 3 ) vs. -

1996 Buick Riviera

I The 1.996 Buick Riviera Owner9$Manual i t We support voluntary technician certification. GENERAL MOTORS, GM and theGM Emblem, WE SUPPORT BUICK, the BUTCK Emblem and the name VOLUNTARY TECHNICIAN RIVERA, are registered trademarksof General CERTIFICATIONTHROUGH National Institutefor Motors Corporation. AUTOMOTIVE SERVICE This manual includesthe latest information atthe.time EXCELLENCE it was printed.We reserve the right tomake changes in the product after that time without further notice. For vehicles first sold in Canada, substitute.thename .. “General Motorsof Canada Limited”for hick Motor For Canadian Owners Who Prefer a.. Division wheneverit appears in this manual. French Language.Manual: Please keep this manual in your Buick,so it will be there Aux propribtaires canadiens: Vous powez vous if -you ever needit when you’reon the road.If you sell procurer un exemplaire dece guide enfraqais chez the vehicle, pleaseleave this manual init so the new votre concessionaireou au: owner can use it. DGN Marketing Services Ltd. 1500 Bonhill Rd. Mississauga, Ontario L5T 1C7 ’ Litho & U.S.A. CorporationMotors @CopyrightGeneral 1995 Part No. 25639453Edition A First ReservedAll Rights tj ii i b iii Durant also created a racingteam that won 500 racing Buick drew plentyof attention becauseit could chb trophies in 1909 and 1910, including successes at hills and run throughmud like no othef car. Buick's Indianapolis two years beforethe Indy 500 began. endurance and reliability were world famous. The success of Buick engines was visible not only on During World WarI, Buick built Liberty aircraft engines the race track, butin ,endurance tests acrossthe country as well'as Red Cross ambulancesso successfully that and aroundthe world. -

3W 4:30 X30 IE: 'X IM I.� 'X' AWA, 'X' X

I I I I I I I I I I Ij 3w 4:30 X30 IE: 'x IM i. 'x' AWA, 'x' x r - - - - - - - I $ I *6 son 1 I $1 $ $ r" I $ I $ 1 I S IF I I SPECIAL REPORT17O 1 I Transportation Research Board, National Academy of Sciences TRANSPORTATION RESEARCH BOARD 1976 Officers HAROLD L. MICHAEL, Chairman ROBERT N. HUNTER, Vice Chairman W. N. CAREY, JR., Executive Director Executive Committee HARVEY BROOKS, Chairman, Commission on Sociotechnical Systems, National Research Council (ex officio) ASAPH H. HALL, Federal Railroad Administrator, U.S. Department of Transportation (ex officio) ROBERT E. PATRICELLI, Urban Mass Transportation Administrator, U.S. Department of Transportation (ex officio) HENRIK E. STAFSETH, Executive Director, American Association of State Highway and Transportation Officials (ex officio) NORBERT T. TIEMANN, Federal Highway Administrator, U.S. Department of Transportation (ex officio) MILTON PIKARSKY, Chairman of the Board, Regional Transportation Authority (ex officio, Past Chairman, 1975) WARREN E. ALBERTS, Vice President, System Operations Services, United Airlines GEORGE H. ANDREWS, Vice President for Transportation Marketing, Sverdrup and Parcel GRANT BASTIAN, State Highway Engineer, Nevada Department of Highways KURT W. BAUER, Executive Director, Southeastern Wisconsin Regional Planning Commission LANGHORNE M. BOND, Secretary, illinois Department of Transportation MANUEL CARBALLO, Secretary, Wisconsin Department of Health and Social Services L. S. CRANE, President, Southern Railway System JAMES M. DAVEY, Consultant, Manchester, Michigan B. L. DeBERRY, Engineer-Director, Texas State Department of Highways and Public Transportation LOUIS J. GAMBACCINI, Vice President and General Manager, Port Authority Trans.Hudson Corporation HOWARD L. GAUTHIER, Professor, Department of Geography, Ohio State- University FRANK C. -

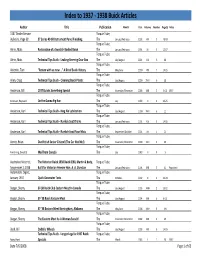

Index to 1937 ‐ 1938 Buick Articles

Index to 1937 ‐ 1938 Buick Articles Author Title Publication Month Year Volume Number Page(s) Notes 1937 Dealer Service Torque Tube, Bulletins, Page 38 37 Series 40‐60 Instrument Panel Finishing The January/February 2003 XXI 3 18‐19 Torque Tube, Ahrin, Mats Restoration of a Swedish Bodied Buick The January/February 1994 XII 3 12‐17 Torque Tube, Ahrin, Mats Technical Tips Buick ‐ Leaking Steering Gear Box The July/August 2001 XIX 6 18 Torque Tube, Alderink, Tom "Return with us now …" A Bit of Buick History The May/June 1990 VIII 7 14‐15 Torque Tube, Allen, Craig Technical Tips Buick ‐ Cleaning Buick Plastic The July/August 2000 XVIII 6 18 Torque Tube, Anderson, Bill 1937 Buicks Something Special The November/December 2003 XXII 2 8‐11 1937 Torque Tube, Anderson, Heyward On the Gunea Pig Run The July 1983 III 9 24‐25 Torque Tube, Anderson, Karl Technical Tips Buick ‐ King Pin Lubrication The July/August 2000 XVIII 6 21 Torque Tube, Anderson, Karl Technical Tips Buick ‐ Rumble Seat Drains The January/February 2001 XIX 3 14‐15 Torque Tube, Anderson, Karl Technical Tips Buick ‐ Rumble Seat Floor Mats The September/October 2001 XX 1 21 Torque Tube, Armer, Brian Our British Senior Citizen! (The Car Not Me!) The November/December 1999 XVIII 2 10 Torque Tube, Armstrong, Donald E. Mail from Canada The July 1983 III 9 3 Australian Motorist, The Victorian Buick 1938 Buick 8/90, Martin & body, Torque Tube, Sepyember 1, 1938 Built for Victorian Premier Hon. A. A. Dunstan The January/February 2004 XXII 3 11 Reprinted Automobile Digest, Torque Tube, January