Status and Trends in Louisiana's Freshwater

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Commercial Fishing Seasons in Alaska

Cook Inlet Yakutat SALMON JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC SALMON JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC Upper Cook Inlet coho Set Gillnet Commercial Fishing Chinook Gillnet sockeye Set Gillnet coho Gillnet SHELLFISH JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC pink Gillnet red/blue king crab Pot Seasons in Alaska Gillnet sockeye shrimp Pot/Trawl Pot/Trawl chum Gillnet scallop Dredge Dredge Lower Cook Inlet JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC pink Gillnet/Seine GROUNDFISH Alaska Department of Fish and Game sockeye Gillnet/Seine Pacific cod Longline/Jig/Pot Division of Commercial Fisheries chum Gillnet/Seine rockfish Jig P.O. Box 115526 HERRING JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC lingcod Jig Juneau, AK 99811-5526 sac roe and food/bait Gillnet (907) 465-4210 SHELLFISH JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC Southeast Alaska https://www.adfg.alaska.gov razor clam Shovel SALMON JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC hardshell clam Rake Chinook Winter Troll Spring Troll Summer Troll Winter Troll scallop Dredge This summary is intended as a general guide only and is non-bind- coho Seine/Gillnet/Troll GROUNDFISH JAN FEB MAR APR MAY JUNE JULY AUG SEPT OCT NOV DEC ing. For detailed regulatory information refer to local area offices. pink Seine/Gillnet Pacific cod Parallel State waters (Pot/Jig) Parallel sockeye Seine/Gillnet Season lengths indicated in this summary are subject to closure rockfish Bycatch only (mand. -

Thailand's Shrimp Culture Growing

Foreign Fishery Developments BURMA ':.. VIET ,' . .' NAM LAOS .............. Thailand's Shrimp ...... Culture Growing THAI LAND ,... ~samut Sangkhram :. ~amut Sakorn Pond cultivation ofblacktigerprawns, khlaarea. Songkhla's National Institute '. \ \ Bangkok........· Penaeus monodon, has brought sweep ofCoastal Aquaculture (NICA) has pro , ••~ Samut prokan ing economic change over the last2 years vided the technological foundation for the to the coastal areas of Songkhla and establishment of shrimp culture in this Nakhon Si Thammarat on the Malaysian area. Since 1982, NICA has operated a Peninsula (Fig. 1). Large, vertically inte large shrimp hatchery where wild brood grated aquaculture companies and small stock are reared on high-quality feeds in .... Gulf of () VIET scale rice farmers alike have invested optimum water temperature and salinity NAM heavily in the transformation of paddy conditions. The initial buyers ofNICA' s Thailand fields into semi-intensive ponds for shrimp postlarvae (pI) were small-scale Nakhon Si Thammarat shrimp raising. Theyhave alsodeveloped shrimp farmers surrounding Songkhla • Hua Sai Songkhla an impressive infrastructure ofelectrical Lake. .. Hot Yai and water supplies, feeder roads, shrimp Andaman hatcheries, shrimp nurseries, feed mills, Background Sea cold storage, and processing plants. Thailand's shrimp culture industry is Located within an hour's drive ofSong the fastest growing in Southeast Asia. In khla's new deep-waterport, the burgeon only 5 years, Thailand has outstripped its Figure 1.-Thailand and its major shrimp ing shrimp industry will have direct competitors to become the region's num culture area. access to international markets. Despite ber one producer. Thai shrimp harvests a price slump since May 1989, expansion in 1988 reached 55,000 metric tons (t), onall fronts-production, processingand a 320 percent increase over the 13,000 t marketing-continues at a feverish pace. -

An Overview of the Cuban Commercial Fishing Industry and Implications to the Florida Seafood Industry of Renewed Trade1 Chuck Adams2

Archival copy: for current recommendations see http://edis.ifas.ufl.edu or your local extension office. An Overview of the Cuban Commercial Fishing Industry and Implications to the Florida Seafood Industry of Renewed Trade1 Chuck Adams2 Abstract Introduction The Cuban seafood industry has long been an The commercial fishing industry of Cuba is an important supplier of certain high-valued seafood important source of fisheries products originating products for the world market. In addition, the from the Gulf of Mexico and Caribbean region. Cuba industry has historically played an important role in historically fielded a large distant-water fleet that was providing seafood products for domestic markets in engaged in the harvest of subtropical and temperate Cuba. Assistance from the Soviet Union led to the fisheries stocks. Cuba has more recently played an development of a large distant-water fleet, which increasingly important role in the world market for produced large volumes of low-valued seafood seafood products, particularly for high-valued finfish products. The nearshore fleets continue to produce and shellfish. However, given the evolution in the high-valued species for export markets. The loss of global political environment of the early 1990s, Soviet assistance, following the break up of the Cuba's commercial fishing industry has changed Soviet Union, has dramatically affected the manner dramatically. As a result, production emphasis has in which the Cuban fishing industry is conducted. shifted from high-volume, low-valued pelagic stocks More recently, management of nearshore fleets, to high-valued nearshore fisheries, aquaculture, and associated service industries, and processing facilities shrimp culture. -

Gulf-Shores-Seafood-Menu.Pdf

DESSERTS Fresh Produce Gulf Shores Key Lime Pie Fresh Steaks $12.99 Fresh Gulf Coast Shrimp Seafood & Meat Mini Key Lime Pie Fresh Fish ~ Scallops $2.49 King Crab Legs ~ Snow Crab Market Peanut Butter Fudge Crab Meat ~ Salads 921 Gulf Shores Parkway. Gulf Shores, AL 36542 (Across from Waterville) $12.99 Seafood Gumbo Order by Phone: 251.948.8456 Cookies-N-Cream BBQ Essentials Order Online: $12.99 Crab Cakes ~ Zatarains gulfshoresseafood.com Old Bay ~ Louisiana Brand WE CATER ANY EVENT Alligator Meat ~ Salads Cater Your Next Event With Us!!! House Specials: Dips Low Country Boil for 2: $18 Contact us to discuss catering for Low Country Boils Order (for 1): $10 your next event. MUCH More! 1lb.Large Shrimp, 2 pieces Sausage, Large or small, regardless of the venue 2 Ears Local Corn-on-Cob & 6 New Potatoes. Seasoned MILD, MEDIUM, or CAJUN or occasion, our professional staff, Gulf Shores along with the quality of our food, Seafood & Meat Market Royal Red Tails $10 will be a hit with your guests. 1/2 lb. Royal’s seasoned, Corn-on-Cob, 921 Gulf Shores Parkway. 3 Red Potatoes, and your choice of seasoning From simple family gatherings Gulf Shores, AL 36542 MILD, MEDIUM, or CAJUN to a backyard BBQ, or even a (Across from Waterville) Snow Crab & Shrimp $13 wedding reception on the beach - Order by Phone: 1/4 lb. Large Shrimp, 1 Snow Crab cluster, and every occasion between! 251.948.8456 Corn-on-Cob, 3 Red Potatoes, and your We offer a variety of menu Or Order Online choice of seasoning MILD, MEDIUM, or CAJUN options that will fit any budget. -

Fisheries Series Part II: Commercial Policy & Management for Commercial Fishing

SAILFISHVERSION 14 TEENS TAKE ON BILLFISH CONSERVATION FISHERIES SERIES Part II: Commercial POLICY & MANAGEMENT for Commercial Fishing All About AQUACULTURE RECAPTURE MAPS Jr. Angler Profile SALES DE LA BARRE Cutler Bay Academy Welcomes The Billfish Foundation & Carey Chen CONTENTS Inside this issue of Sailfish FFEATURESEATURES 3 Fisheries Series Part II: Commercial Fishing 5 Aquaculture 7 Policy & Management of Commercial Fisheries 8 Commercial Fishing Review Questions 9 Cutler Bay Academy Students Enjoy Visit from TBF & Carey Chen 10 Billfish Advocacy at South Broward High ALSO INSIDE Get Involved: Track your school’s climate impact Recapture Maps Jr Angler Profile – Sales de La Barre We would like to extend our gratitude to the Fleming Family Foundation and the William H. and Mattie Wattis Harris Foundation for their belief in education as an important conservation tool. The Billfish Founation, educators, students, parents, the ocean and the fish are grateful for our sponsors generous donation that made this issue of Sailfish possible. Copyright 2014 • The Billfish Foundation • Editor: Peter Chaibongsai • Associate Editor: Elizabeth Black • Graphic Designer: Jackie Marsolais Sister Publications: Billfish and Spearfish magazines • Published by The Billfish Foundation • For subscription information contact: [email protected] by Jorie Heilman COMMERCIAL FISHING by Jorie Heilman What provides nutrition to 3 billion people gear advanced, humans could pursue food Top left: Aquacage snapper farm. Top right: Korean fishing boat. Below top to bottom: worldwide and is relied upon by 500 sources that were farther off the coast. Fishing boat in India. Commercial longline boat. Fishermen in the Seychelles. Commercial million people for their livelihoods? The Fish traps and nets were among the fishermen on a dock fixing a net. -

Commercial Inland Fishing in Member Countries of the European Inland Fisheries Advisory Commission (EIFAC)

Commercial inland fishing in member countries of the European Inland Fisheries Advisory Commission (EIFAC): Operational environments, property rights regimes and socio-economic indicators Country Profiles May 2010 Mitchell, M., Vanberg, J. & Sipponen, M. EIFAC Ad Hoc Working Party on Socio-Economic Aspects of Inland Fisheries The designations employed and the presentation of material in this information product do not imply the expression of any opinion whatsoever on the part of the Food and Agriculture Organization of the United Nations (FAO) concerning the legal or development status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. The mention of specific companies or products of manufacturers, whether or not these have been patented, does not imply that these have been endorsed or recommended by FAO in preference to others of a similar nature that are not mentioned. The views expressed in this information product are those of the author(s) and do not necessarily reflect the views of FAO. All rights reserved. FAO encourages the reproduction and dissemination of material in this information product. Non-commercial uses will be authorized free of charge, upon request. Reproduction for resale or other commercial purposes, including educational purposes, may incur fees. Applications for permission to reproduce or disseminate FAO copyright materials, and all queries concerning rights and licences, should be addressed by e-mail to [email protected] or to the Chief, Publishing Policy and Support Branch, Office of Knowledge Exchange, Research and Extension, FAO, Viale delle Terme di Caracalla, 00153 Rome, Italy. © FAO 2012 All papers have been reproduced as submitted. -

Commercial Fishing Guide |

Texas Commercial Fishing regulations summary 2021 2022 SEPTEMBER 1, 2021 – AUGUST 31, 2022 Subject to updates by Texas Legislature or Texas Parks and Wildlife Commission TEXAS COMMERCIAL FISHING REGULATIONS SUMMARY This publication is a summary of current regulations that govern commercial fishing, meaning any activity involving taking or handling fresh or saltwater aquatic products for pay or for barter, sale or exchange. Recreational fishing regulations can be found at OutdoorAnnual.com or on the mobile app (download available at OutdoorAnnual.com). LIMITED-ENTRY AND BUYBACK PROGRAMS .......................................................................... 3 COMMERCIAL FISHERMAN LICENSE TYPES ........................................................................... 3 COMMERCIAL FISHING BOAT LICENSE TYPES ........................................................................ 6 BAIT DEALER LICENSE TYPES LICENCIAS PARA VENDER CARNADA .................................................................................... 7 WHOLESALE, RETAIL AND OTHER BUSINESS LICENSES AND PERMITS LICENCIAS Y PERMISOS COMERCIALES PARA NEGOCIOS MAYORISTAS Y MINORISTAS .......... 8 NONGAME FRESHWATER FISH (PERMIT) PERMISO PARA PESCADOS NO DEPORTIVOS EN AGUA DULCE ................................................ 12 BUYING AND SELLING AQUATIC PRODUCTS TAKEN FROM PUBLIC WATERS ............................. 13 FRESHWATER FISH ................................................................................................... 13 SALTWATER FISH ..................................................................................................... -

Commercial Fishing in SOUTH DAKOTA by Todd St

PAST, PRESENT AND FUTURE OF Commercial Fishing IN SOUTH DAKOTA By todd St. Sauver, GFP Fisheries program specialist If you have ever watched reality shows like Deadliest Catch, Swamp Pawn, Bottom Feeders or Alaska: Battle on the Bay, you are familiar with a few of the many types of commercial fishing practiced around the world. But did you know we have commercial fishing in South Dakota? What is commercial fishing? Put simply, it is catching fish or other aquatic animals to sell for profit. Commercial fishing operations can be small, with one person running a few hoop nets for catfish, or large, with massive trawlers and factory ships on the oceans. In the early 1800s, native game fish species were mainly valued as food sources and were commonly harvested by commercial fishermen. By the mid-1800s, these populations began to deplete, so additional sources of fish were considered. In an 1874 report by the newly-formed United States Fish Commission, Professor Spencer F. Baird suggested that the European carp (now called common carp) could solve the problem. Two years later, he again urged the Commission to consider introducing carp to the U.S. because of its ability to reproduce rapidly, grow fast, and live in waters native fish could not survive in. In 1877, the Commission made what may be the greatest fish management mistake in U.S. history. They imported 345 carp from Europe to ponds in Baltimore, Maryland. It was not long until the progeny produced by these fish were stocked into eastern lakes and rivers. Within four years, commercial fishermen were catching carp in Lake Erie and in the Illinois, Missouri and Mississippi Rivers. -

1 Assessment of Gear Efficiency for Harvesting Artisanal Giant Freshwater Prawn

Assessment of Gear Efficiency for Harvesting Artisanal Giant Freshwater Prawn (Macrobrachium Rosenbergii de Man) Fisheries from the Sundarbans Mangrove Ecosystem in Bangladesh Biplab Kumar Shaha1, Md. Mahmudul Alam2*, H. M. Rakibul Islam3, Lubna Alam4, Alokesh Kumar Ghosh5, Khan Kamal Uddin Ahmed6, Mazlin Mokhtar7 1Fisheries and Marine Resource Technology Discipline, Khulna University, Bangladesh 2Doctoral Student, Institute for Environment and Development (LESTARI), National University of Malaysia (UKM), Malaysia 3Scientific Officer, Bangladesh Fisheries Research Institute, Shrimp Research Station, Bagerhat, Bangladesh 4 Research Fellow, Institute for Environment and Development (LESTARI), National University of Malaysia (UKM), Malaysia 5Assistant Professor, Fisheries and Marine Resource TechnologyDiscipline, Khulna University, Bangladesh 6Chief Scientific Officer, Bangladesh Fisheries Research Institute. Shrimp Research Station, Bagerhat, Bangladesh 7Professor, Institute for Environment and Development (LESTARI), National University of Malaysia (UKM), Malaysia Citation Reference: Shaha, B.K., Alam, M.M., Islam, H.M.R., Alam, L., Ghosh, A.K., Ahmed, K.K.U., and Mokthar, M. 2014. Assessment of Gear Efficiency for Harvesting Artisanal Giant Freshwater Prawn (Macrobrachium Rosenbergii De Man) Fisheries from the Sundarbans Mangrove Ecosystem in Bangladesh. Research Journal of Fisheries and Hydrobiology, 9(2): 1126-1139. http://www.aensiweb.com/old/jasa/2- JASA_February_2014.html This is a pre-publication copy. The published article is copyrighted -

The Bait Shrimp Industry of the Gulf of Mexico

THE BAIT SHRIMP INDUSTRY OF TH E GULF OF MEXICO FISHERY LEAFLET No. 480 Revision of Fishery Leaflet No. 337 UNITED STATES DEPARTMENT OF THE INTERIOR FISH AND WILDLIFE SERVICE BUREAU OF COMMERCIAL FISHERIES WASHINGTON 25, D. C. THE BAIT SHRIMP INDUSTRY OF THE GULF OF MEXICO By Anthony Inglis and Edward Chin Bureau of Commercial Fisheries U. S . Fish and Wildlife Service Galveston, Texas CO TE TS Introduction ... 1 Kinds of shrimp in the bait fishery 1 General life history of the white shrimp 2 Bait shrimp industry of Galveston area, Texas Fishing gear and methods of operation 3 Transporting and holding me thods 3 Trade practices .... 5 Florida bait shrimp industry Fishing gear and methods of operation 7 Transporting and holding methods 9 Trade practices .... 10 Suggestions for holding live bait shrimp 10 Appendix I, Scientific names of species mentioned in text 12 Appendix II, Publications on biology of shrimp and bait shrimp industry ............ 13 THE BAIT SHRIMP INDUSTRY OF THE GULF OF MEXICO by Anthony Inglis and Edward Chin Fishery Research B1010gists INTRODUCTION Live shrimp is the preferred bait for sea trouts, redfish, flounders and most game fishes of the bays and inshore waters of the Gulf of Mexico. The use of shrimp for this purpose has given rise to a large bait industry in some areas. Approximately 39 million shrimp with a retail value of $500,000 were utilized by the bait industry in northeast Florida during a 12-month period in 1952-53. The bait catch on the west coast of Florida in 1955 amounted to almost 59 million shrimp with a retail value of nearly $2,000,000. -

Page: 1 Item Description Class Unit Of

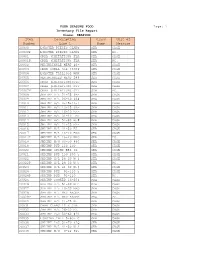

FOUR SEASONS FOOD Page: 1 Inventory File Report Class: SEAFOOD Item Description Class Unit of Number Line 1 Name Measure 20000 LOBSTER PIECES CLAW& SEA CASE 20000P LOBSTER PIECES CLAW& SEA PC. 20001 CRAB (IMITATION) FLA SEA CASE 20001P CRAB (IMITATION) FLA SEA PC. 20002 PERIWRINKLE MEAT 40- SEA CASE 20003 CRAB SHELL 3oz (300P SEA CASE 20004 LOBSTER TAIL10oz WAR SEA CASE 20005 PERIWINKLES MEAT 24# SEA CASE 20006 CRAB (IMITATION)STIC SEA CASE 20007 CRAB (IMITATION) STI SEA CASE 20007P CRAB (IMITATION) STI SEA PC. 20008 SHRIMP H/L 21-25 (B- SEA CASE 20009 SHRIMP H/L 26-30 40# SEA CASE 20010 SHRIMP H/L U-15&13-1 SEA CASE 20011 SHRIMP H/L 13-15 (B- SEA CASE 20012 SHRIMP H/L 16-20 EZ- SEA CASE 20013 SHRIMP H/L 31-40 EZ SEA CASE 20014 SHRIMP H/L 51-60 W.# SEA CASE 20015 SHRIMP H/L 21-25 EZ- SEA CASE 20016 SHRIMP H/L 41-50 EZ SEA CASE 20017 SHRIMP H/L 16-20 BRO SEA CASE 20017P SHRIMP H/L 16-20 BRO SEA PC. 20018 SHRIMP H/O 40-50 #40 SEA CASE 20019 SHRIMP PUD 110-130 SEA CASE 20020 SHRIMP SUSHI EBI 4L SEA CASE 20021 SHRIMP PUD 150-200 5 SEA CASE 20022 SHRIMP H/L 26-30 W 3 SEA CASE 20022P SHRIMP H/L 26-30 W 5 SEA PC. 20023 SHRIMP H/L 41-50 W.# SEA CASE 20024 SHRIMP PUD 91-110 5 SEA CASE 20024P SHRIMP PUD 91-110 SEA PC. -

Fishing Vessels Fishing Vessel Types

Fishery Basics – Fishing Vessels Fishing Vessel Types Fishing vessels are typically designed with a specific purpose. That purpose is to locate, catch, and preserve fish while out at sea. The planned operations of a vessel determine the overall size of the vessel, the arrangement of the deck, carrying capacity, as well as the machinery and types of equipment that will be supported by the vessel. Due to the inherent differences in fishing communities around the world, there is a wide range of types and styles of fishing vessels. Vessel sizes can range from the 2 m (6 ft) dug out canoes used in subsistence and artisanal fisheries, to factory ships that exceed 130 m (427 ft) in length. Commercial fishing vessels can also be characterized by a variety of criteria: types of fish (See Biology & Ecology) they catch, fishing gear and methods used (See Fishing Gear), capacity and processing capabilities, and the geographical origin of the vessel. In 2002, the United Nations Food and Agriculture Organization (FAO) estimated the world fishing fleet had approximately four million vessels, with an average vessel size ranging from 10-15 m (33-49 ft). Based on a quarterly catch statistics report, published by the Pacific Fisheries Information Network (PacFIN), approximately 1,950 vessels landed their catches in California ports. Due to the technological innovations that began in the 1950s, many fishing vessels are now classified as multi-purpose vessels, because of the ability to switch out gear types depending on the targeted species. However, single use vessels still exist in the world fishing fleet today.