Maxxelli Cici 2019 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

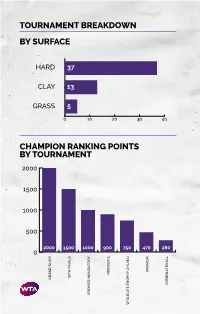

Tournament Breakdown by Surface Champion Ranking Points By

TOURNAMENT BREAKDOWN BY SURFACE HAR 37 CLAY 13 GRASS 5 0 10 20 30 40 CHAMPION RANKING POINTS BY TOURNAMENT 2000 1500 1000 500 2000 1500 1000 900 750 470 280 0 PREMIER PREMIER TA FINALS TA GRAN SLAM INTERNATIONAL PREMIER MANATORY TA ELITE TROPHY HUHAI TROPHY ELITE TA 55 WTA TOURNAMENTS BY REGION BY COUNTRY 8 CHINA 2 SPAIN 1 MOROCCO UNITED STATES 2 SWITZERLAND 7 OF AMERICA 1 NETHERLANDS 3 AUSTRALIA 1 AUSTRIA 1 NEW ZEALAND 3 GREAT BRITAIN 1 COLOMBIA 1 QATAR 3 RUSSIA 1 CZECH REPUBLIC 1 ROMANIA 2 CANADA 1 FRANCE 1 THAILAND 2 GERMANY 1 HONG KONG 1 TURKEY UNITED ARAB 2 ITALY 1 HUNGARY 1 EMIRATES 2 JAPAN 1 SOUTH KOREA 1 UZBEKISTAN 2 MEXICO 1 LUXEMBOURG TOURNAMENTS TOURNAMENTS International Tennis Federation As the world governing body of tennis, the Davis Cup by BNP Paribas and women’s Fed Cup by International Tennis Federation (ITF) is responsible for BNP Paribas are the largest annual international team every level of the sport including the regulation of competitions in sport and most prized in the ITF’s rules and the future development of the game. Based event portfolio. Both have a rich history and have in London, the ITF currently has 210 member nations consistently attracted the best players from each and six regional associations, which administer the passing generation. Further information is available at game in their respective areas, in close consultation www.daviscup.com and www.fedcup.com. with the ITF. The Olympic and Paralympic Tennis Events are also an The ITF is committed to promoting tennis around the important part of the ITF’s responsibilities, with the world and encouraging as many people as possible to 2020 events being held in Tokyo. -

Competitiveness Analysis of China's Main Coastal Ports

2019 International Conference on Economic Development and Management Science (EDMS 2019) Competitiveness analysis of China's main coastal ports Yu Zhua, * School of Economics and Management, Nanjing University of Science and Technology, Nanjing 210000, China; [email protected] *Corresponding author Keywords: China coastal ports above a certain size, competitive power analysis, factor analysis, cluster analysis Abstract: As a big trading power, China's main mode of transportation of international trade goods is sea transportation. Ports play an important role in China's economic development. Therefore, improving the competitiveness of coastal ports is an urgent problem facing the society at present. This paper selects 12 relevant indexes to establish a relatively comprehensive evaluation index system, and uses factor analysis and cluster analysis to evaluate and rank the competitiveness of China's 30 major coastal ports. 1. Introduction Port is the gathering point and hub of water and land transportation, the distribution center of import and export of industrial and agricultural products and foreign trade products, and the important node of logistics. With the continuous innovation of transportation mode and the rapid development of science and technology, ports play an increasingly important role in driving the economy, with increasingly rich functions and more important status and role. Meanwhile, the competition among ports is also increasingly fierce. In recent years, with the rapid development of China's economy and the promotion of "the Belt and Road Initiative", China's coastal ports have also been greatly developed. China has more than 18,000 kilometers of coastline, with superior natural conditions. With the introduction of the policy of reformation and opening, the human conditions are also excellent. -

Hong Kong SAR

China Data Supplement November 2006 J People’s Republic of China J Hong Kong SAR J Macau SAR J Taiwan ISSN 0943-7533 China aktuell Data Supplement – PRC, Hong Kong SAR, Macau SAR, Taiwan 1 Contents The Main National Leadership of the PRC 2 LIU Jen-Kai The Main Provincial Leadership of the PRC 30 LIU Jen-Kai Data on Changes in PRC Main Leadership 37 LIU Jen-Kai PRC Agreements with Foreign Countries 47 LIU Jen-Kai PRC Laws and Regulations 50 LIU Jen-Kai Hong Kong SAR 54 Political, Social and Economic Data LIU Jen-Kai Macau SAR 61 Political, Social and Economic Data LIU Jen-Kai Taiwan 65 Political, Social and Economic Data LIU Jen-Kai ISSN 0943-7533 All information given here is derived from generally accessible sources. Publisher/Distributor: GIGA Institute of Asian Affairs Rothenbaumchaussee 32 20148 Hamburg Germany Phone: +49 (0 40) 42 88 74-0 Fax: +49 (040) 4107945 2 November 2006 The Main National Leadership of the PRC LIU Jen-Kai Abbreviations and Explanatory Notes CCP CC Chinese Communist Party Central Committee CCa Central Committee, alternate member CCm Central Committee, member CCSm Central Committee Secretariat, member PBa Politburo, alternate member PBm Politburo, member Cdr. Commander Chp. Chairperson CPPCC Chinese People’s Political Consultative Conference CYL Communist Youth League Dep. P.C. Deputy Political Commissar Dir. Director exec. executive f female Gen.Man. General Manager Gen.Sec. General Secretary Hon.Chp. Honorary Chairperson H.V.-Chp. Honorary Vice-Chairperson MPC Municipal People’s Congress NPC National People’s Congress PCC Political Consultative Conference PLA People’s Liberation Army Pol.Com. -

Annual Report 2019 Core Values

China International Capital Corporation Limited (a joint stock limited company incorporated in the People's Republic of China) Stock code: 3908 Annual Report 2019 Core Values By the People and Professionalism and For the Nation Diligence People are our most valuable assets. We strive We develop our businesses up to the highest to attract, cultivate and retain the best people. professional standards, and nurture a high- Since inception, CICC has positioned itself as “a caliber team of financial professionals, who boast China-based investment bank with international international visions, diligently perform their duties perspectives”. It is our mission to serve the nation and share our corporate values. by promoting economic reform and long-term development of the capital markets. Innovation and Client Entrepreneurship First Innovation is the lasting force that drives CICC We always put our clients first. We develop and forward. Blessed with deep industry knowhow, maintain long-term relationships of trust with visionary leadership, close relationship with clients, our clients by truly safeguarding their interests and abundant execution experiences, CICC is and satisfying their needs. always prepared to embrace change and continue to deliver innovative products and quality services to our clients. Integrity Chinese Roots and International Reach We build our franchise upon the utmost professional integrity and highest ethical standards. As a China-based global investment bank, we are We value our franchise and never compromise on proud of -

By Wenrui MA

An Examination of the Application of Power Theory in the Context of the Chinese Seaport Sector by Wenrui MA A Thesis Submitted in Fulfilment of the Requirements for the Degree of Doctor of Philosophy of Cardiff University Logistics and Operations Management Section of Cardiff Business School, Cardiff University December 2016 DECLARATION This work has not been submitted in substance for any other degree or award at this or any other university or place of learning, nor is being submitted concurrently in candidature for any degree or other award. Signed ……… ………………… (candidate) Date …………14/03/2017……… STATEMENT 1 This thesis is being submitted in partial fulfilment of the requirements for the degree of PhD Signed ……… ………………………… (candidate) Date ………14/03/2017…… STATEMENT 2 This thesis is the result of my own independent work/investigation, except where otherwise stated. Other sources are acknowledged by explicit references. The views expressed are my own. Signed ………… ……………………… (candidate) Date …………14/03/2017… STATEMENT 3 I hereby give consent for my thesis, if accepted, to be available for photocopying and for inter-library loan, and for the title and summary to be made available to outside organisations. Signed …………… …………………… (candidate) Date …………14/03/2017… STATEMENT 4: PREVIOUSLY APPROVED BAR ON ACCESS I hereby give consent for my thesis, if accepted, to be available for photocopying and for inter-library loans after expiry of a bar on access previously approved by the Academic Standards & Quality Committee. Signed …………… …………………… (candidate) Date ……14/03/2017……… i Abstract Power is an essential attribute of all social systems. Nonetheless, the study of this topic has been greatly overlooked in the context of the maritime component of international supply chain management. -

Nation Shifts Focus to Tokyo Olympics

Thursday, September 6, 2018 CHINA DAILY HONG KONG EDITION 2 PAGE TWO Left: Zhao Shuai (left) wins the silver medal in the men’s taekwondo 63kilogram category at the Asian Games in Jakarta. Above: Swimmer Sun Yang won all four freestyle golds. Right: Sprinter Su Bingtian takes gold in the men’s 100meter final. PHOTOS BY WANG JING / CHINA DAILY Nation shifts By SHI FUTIAN in Jakarta sports traditionally dominated focus to Tokyo Jakarta Games served as a key According to the delegation, [email protected] globally by Asian countries, platform for China’s young ath the first is that many of its young such as table tennis, badmin letes to gain experience. The athletes are still short of experi Despite striking gold in a big ton, gymnastics and diving, Chi best example is the table tennis ence and need to gain it in the way at the 2018 Asian Games, na won 28 golds, an indication squad, which swept the five next two years. China’s sports delegation is of the country’s Olympic com golds on offer. Changes to the rules and the keeping a cool head as it faces petitiveness. Olympics However, none of the 10 Chi inclusion of new sports and dis challenges in repeating this suc For example, the diving team nese players in Jakarta had ciplines present another chal cess at the 2020 Tokyo Olym swept all 10 golds in Jakarta played at the Olympic Games lenge. Lastly, China’s traditional pics. along with six silvers. and only three had Asian Games dominance in events such as Memories from the Asian Shi Tingmao won two golds Challenges emerge after Asian Games success experience. -

UFI Info July/August 2019

UFI Info July/August 2019 To provide material or Info is published by Asia-Pacific Middle East-Africa Latin America comments, please contact: UFI Headquarters & Regional Office Regional Office Regional Office Monika Fourneaux-Ceskova European Regional Office Suite 4114, Hong Kong Plaza Info Salons Middle East Corferias, Colombia [email protected] 17, rue Louise Michel 188 Connaught Road West Office, Dubai, UAE T: +571 3445486 92300 Levallois-Perret Hong Kong, China T: +971 6 5991352 [email protected] T: +33 1 46 39 75 00 T: +852 2525 6129 [email protected] [email protected] [email protected] Contents Calendar of UFI events and meetings 03 Welcome from the UFI President 04 CEO Column 05 GED 06 Shanghai CEO Summit 09 Photo: Shanghai CEO Summit. Indian Exhibition Industry Association 10 Taitra’s Meettaiwan event 10 Vigilance 11 SDG database for the exhibition industry 12 86th UFI Global Congress 15 News from Europe 15 Photo: GED19. News from Asia-Pacific 16 News from Latin-America 16 ISU 17 EMD 18 VMA 18 International Fair Poster competition 19 Photo: EMD 2019. 2019 Marketing Award winner 20 2019 HR Award winner 21 2019 Sustainability Award winner 22 EEIA News from Brussels 23 UFI Blog 24 News updates from our Media Partners 25 Photo: Fiexpo Latinoamerica, Santiago, Chile. UFI Info | July/August 19 | 2 Calendar of UFI events and meetings 2019/2020 Open to all industry professionals Open to UFI members only By invitation only Meeting Date Location 86th UFI Global Congress 6 - 9 November 2019 Bangkok (Thailand) Global CEO Summit 5 - 7 February 2020 Rome (Italy) -

2019 China Military Power Report

OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China ANNUAL REPORT TO CONGRESS Military and Security Developments Involving the People’s Republic of China 2019 Office of the Secretary of Defense Preparation of this report cost the Department of Defense a total of approximately $181,000 in Fiscal Years 2018-2019. This includes $12,000 in expenses and $169,000 in DoD labor. Generated on 2019May02 RefID: E-1F4B924 OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China OFFICE OF THE SECRETARY OF DEFENSE Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China Annual Report to Congress: Military and Security Developments Involving the People’s Republic of China 2019 A Report to Congress Pursuant to the National Defense Authorization Act for Fiscal Year 2000, as Amended Section 1260, “Annual Report on Military and Security Developments Involving the People’s Republic of China,” of the National Defense Authorization Act for Fiscal Year 2019, Public Law 115-232, which amends the National Defense Authorization Act for Fiscal Year 2000, Section 1202, Public Law 106-65, provides that the Secretary of Defense shall submit a report “in both classified and unclassified form, on military and security developments involving the People’s Republic of China. The report shall address the current and probable future course of military-technological development of the People’s Liberation Army and the tenets and probable development of Chinese security strategy and military strategy, and of the military organizations and operational concepts supporting such development over the next 20 years. -

Australian Trade and Investment Commission Annual Report 2018–19 Australian Trade and Investment Commission Annual Report 2018–19

ANNUAL REPORT 2018–19 Austrade at a glance WHO ARE WE? OUR STAFF We are the Australian Trade and Investment Commission—or Austrade Austrade—and we’re responsible for promoting Australian trade, staff at investment and education to the world. We help Australian 1,073 30 June 2019, businesses grow by linking them to global export opportunities; 65 per cent of whom were we attract international investment to help Australia reach its employed in client-focused economic potential; we help startups innovate and go global and operations in Australia and we promote Australia’s leading-edge education services to the overseas. Staff turnover was world to help drive growth in this sector. Our tourism policy and 11.9 per cent and the gender programs also help to build a thriving tourism industry. balance was 58 per cent female and 42 per cent male. We also help Australian citizens by providing consular and passport services in designated overseas locations. WHERE WE WORK locations at OUR MISSION 117 30 June 2019, Our mission is to promote Australian exports and international including 79 overseas locations education, strengthen Australia’s tourism sector, and attract in 48 markets, with 14 of investment into Australia. We do this by providing quality advice those locations also providing and services to exporters, education institutions and investors, consular services on behalf including generating market information and insights, promoting of the Australian Government. Australian capabilities, making connections through an extensive Within Australia, Austrade had global network of contacts, leveraging the ‘badge of government’ 10 offices, complemented by a offshore, and working collaboratively with partner organisations. -

Newsletter 2020

NEWSLETTER 2020 POOVAMMA ENJOYING TRANSITION TO SENIOR STATESMAN ROLE IN DYNAMIC RELAY SQUAD M R Poovamma has travelled a long way from being the baby of the Indian athletics contingent in the 2008 Olympic Games in Beijing to being the elder FEATURED ATHLETE statesman in the 2018 Asian Games in Jakarta. She has experienced the transition, slipping into the new role MR Poovamma (Photo: 2014 Incheon Asian Games @Getty) effortlessly and enjoying the process, too. “It has been a different experience over the past couple of years. Till 2017, I was part of a squad that had runners who were either as old as me or a couple of years older. But now, most of the girls in the team are six or seven years younger than I am,” she says from Patiala. “On the track they see me as a competitor but outside, they look up to me like a member of their family.” The lockdown, forced by the Covid-19 outbreak, and the aftermath have given her the opportunity to don the leadership mantle. “For a couple of months, I managed the workout of the other girls. I enjoyed the role assigned to me,” says the 30-year-old. “We were able to maintain our fitness even during lockdown.” Poovamma reveals that the women’s relay squad trained in the lawn in the hostel premises. “It was a change off the track. We hung out together. It was not like it was a punishment, being forced to stay away from the track and the gym. Our coaches and Athletics Federation of India President Adille (Sumariwalla) sir and (Dr. -

Karst Development Mechanism and Characteristics Based on Comprehensive Exploration Along Jinan Metro, China

sustainability Article Karst Development Mechanism and Characteristics Based on Comprehensive Exploration along Jinan Metro, China Shangqu Sun 1,2, Liping Li 1,2,*, Jing Wang 1,2, Shaoshuai Shi 1,2 , Shuguang Song 3, Zhongdong Fang 1,2, Xingzhi Ba 1,2 and Hao Jin 1,2 1 Research Center of Geotechnical and Structural Engineering, Shandong University, Jinan 250061, China; [email protected] (S.Sun); [email protected] (J.W.); [email protected] (S.Shi); [email protected] (Z.F.); [email protected] (X.B.); [email protected] (H.J.) 2 School of Qilu Transportation, Shandong University, Jinan 250061, China 3 School of Transportation Engineering, Shandong Jianzhu University, Jinan 250101, China; [email protected] * Correspondence: [email protected] Received: 28 August 2018; Accepted: 19 September 2018; Published: 21 September 2018 Abstract: Jinan is the capital of Shandong Province and is famous for its spring water. Water conservation has become the consensus of Jinan citizens and the government and the community. The construction of metro engineering in Jinan has lagged behind other cities of the same scale for a long time. The key issue is the protection of spring water. When metro lines are constructed in Jinan karst area, the water-inrushing, quicksand, and piping hazards can easily occur, which can change the groundwater seepage environment and reduce spring discharge. Therefore, we try to reveal the development conditions, mechanism, and mode of karst area in Jinan. In addition, we propose the comprehensive optimizing method of “shallow-deep” and “region-target” suitable for exploration of karst areas along Jinan metro, and systematically study the development characteristics of the karst areas along Jinan metro, thus providing the basis for the shield tunnel to go through karst areas safely and protecting the springs in Jinan. -

Asia's Olympic

Official Newsletter of the Olympic Council of Asia Edition 51 - December 2020 ALL SET FOR SHANTOU MEET THE MASCOT FOR AYG 2021 OCA Games Update OCA Commi�ee News OCA Women in Sport OCA Sports Diary Contents Inside Sporting Asia Edition 51 – December 2020 3 President’s Message 10 4 – 9 Six pages of NOC News in Pictures 10 – 12 Inside the OCA 13 – 14 OCA Games Update: Sanya 2020, Shantou 2021 15 – 26 Countdown to 19th Asian Games 13 16 – 17 Two years to go to Hangzhou 2022 18 Geely Auto chairs sponsor club 19 Sport Climbing’s rock-solid venue 20 – 21 59 Pictograms in 40 sports 22 A ‘smart’ Asian Games 27 23 Hangzhou 2022 launches official magazine 24 – 25 Photo Gallery from countdown celebrations 26 Hi, Asian Games! 27 Asia’s Olympic Era: Tokyo 2020, Beijing 2022 31 28 – 31 Women in Sport 32 – 33 Road to Tokyo 2020 34 – 37 Obituary 38 News in Brief 33 39 OCA Sports Diary 40 Hangzhou 2022 Harmony of Colours OCA Sponsors’ Club * Page 02 President’s Message OCA HAS BIG ROLE TO PLAY IN OLYMPIC MOVEMENT’S RECOVERY IN 2021 Sporting Asia is the official newsletter of the Olympic Council of Asia, published quarterly. Executive Editor / Director General Husain Al-Musallam [email protected] Director, Int’l & NOC Relations Vinod Tiwari [email protected] Director, Asian Games Department Haider A. Farman [email protected] Editor Despite the difficult circumstances we Through our online meetings with the Jeremy Walker [email protected] have found ourselves in over the past few games organising committees over the past months, the spirit and professionalism of our few weeks, the OCA can feel the pride Executive Secretary Asian sports family has really shone behind the scenes and also appreciate the Nayaf Sraj through.