Investor Presentation Q1FY17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation – July 2017

Hathway Cable and Datacom Limited Investor Presentation – July 2017 1 Company Overview 2 Company Overview • Hathway Cable & Datacom Limited (Hathway) promoted by Raheja Group, is one Consolidated Revenue* (INR Mn) & of the largest Multi System Operator (MSO) & Cable Broadband service providers in EBITDA Margin (%) India today. 14,000 16.2% 20.0% 13,000 15.0% • The company’s vision is to be a single point access provider, bringing into the home and work place a converged world of information, entertainment and services. 12,000 12.1% 13,682 10.0% 11,000 11,550 5.0% • Hathway is listed on both the BSE and NSE exchanges and has a current market 10,000 0.0% th capitalisation of approximately INR 28 Bn as on 30 June, 2017. FY16 FY17 Broadband Cable Television FY17 Operational - Revenue Break-up • Hathway holds a PAN India ISP license • One of India’s largest Multi System Activation Other and is the first cable television services Operator (MSO), across various regions 6% 2% Cable Subscription provider to offer broadband Internet of the country and transmitting the 34% services same to LCOs or directly to subscribers. • Approximately 4.4 Mn two-way • Extensive network connecting 7.5 Mn Placement broadband homes passed CATV households and 7.2 Mn digital 21% cable subscriber • Total broadband Subscribers – 0.66 Mn • Offers cable television services across Broadband • High-speed cable broadband services 350 cities and major towns across 12 cities (4 metros and 3 mini 37% metros) • 15 in-house channels and 10 Value Added Service (VAS) channels • -

LIST of ISP LICENSEES AS on 30.06.2015* Sl No Name of Company CAT Service Area

LIST OF ISP LICENSEES AS ON 30.06.2015* Sl No Name of Company CAT Service Area 1 Reliance Communications Infrastructure Ltd. A All India 2 Dishnet Wireless Ltd. A All India 3 Tata Communications Limited A All India 4 RPG Infotech Ltd. A All India 5 Value Healthcare Ltd B Mumbai 6 Hughes Communications India Limited A All India 7 Karuturi Telecom Private Limited A All India 8 Micky Online Pvt. Ltd. C Moradabad 9 Seven Star Dot Com Private Limited B Mumbai 10 Gujarat Narmada Valley Fertilizers Company Ltd. A All India 11 Kerala Communication Network Pvt. Ltd. B Kerala 12 North East Online Services Pvt. Ltd. C Guwahati 13 The Tata Power Company Ltd A All India 14 Asianet Satellite Communications Ltd. B Kerala 15 M/s Reliance Ports and Terminals Limited [Earlier M/s Reliance Engineering A All India Associates Pvt. Ltd.] 16 Hathway Bhawani Cabeltel & Datacom Ltd. B Mumbai 17 Millennium Telecom. Ltd. A All India 18 Amber Online Services Ltd. B Andhra Pradesh 19 Tata Teleservices Ltd. A All India 20 Web Cable TV Ltd C Nagercoil 21 Netkracker Ltd. A All India 22 Karuturi Global Limited B Karnataka 23 SAB Infotech Ltd. C Dharamshala 24 SAB Infotech Ltd. C Karnal 25 Sujan Engineering Pvt. Ltd. C Vadodara 26 Space Online Ltd. B Gujarat 27 World Phone Internet Services Pvt. Ltd. A All India 28 C-DAC, Noida C Ghaziabad 29 Essel Shyam Communications Ltd. A All India 30 Forum Infotech Pvt. Ltd. C Srinagar 31 Micky Online Pvt. Ltd. C Nainintal 32 Reach Network India Pvt. -

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

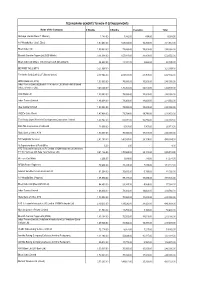

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Telecom Consumer Charter

Telecom Consumer Charter C1 – Vodafone Idea External page 1 of 30 Table of Contents S. No. Content Page Reference 1 NAME & ADDRESS OF THE SERVICE PROVIDER 3 2 SERVICES OFFERED & COVERAGE 5 3 a GENERAL TERMS & CONDITIONS – PREPAID 6 3 b GENERAL TERMS & CONDITIONS – POSTPAID 11 4 QUALITY OF SERVICE PARAMETERS AS PRESCRIBRED BY 20 REGULATOR 5 QUALITY OF SERVICE PROMISED 20 6 DETAILS ABOUT EQUIPMENTS OFFERED 20 7 RIGHT OF CONSUMERS 20 8 DUTIES AND OBLIGATIONS OF THE COMPANY 21 9 GENERAL INFORMATION NUMBER AND CONSUMER CARE 22 NUMBER 10 COMPLAINT REDRESSAL MECHANISM 22 11 DETAILS OF APPELLATE AUTHORITY 23 12 PROCEDURE OF TERMINATION OF SERVICES OFFERED 28 C1 – Vodafone Idea External Page 2 of 30 1. NAME & ADDRESS OF THE VODAFONE IDEA LIMITED OFFICES Name: Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group & Vodafone Partnership REGISTERED OFFICE Vodafone Idea Limited (formerly Idea Cellular Limited), Suman Tower, Plot no.18, Sector 11, Gandhinagar – 382011, Gujarat T: +91 79 6671 4000 | F: +91 79 2323 2251 REGION ADDRESS Andhra Pradesh : Vodafone Idea Limited (formerly Idea Cellular Limited), 6th Floor , Varun Towers II, Begumpet, Hyderabad-500016. Assam : Vodafone Idea Limited (formerly Idea Cellular Limited), RED DEN, NH – 37 Katahbari, Gorchuk, Guwahati, Assam-781035. Bihar & Jharkhand : Vodafone Idea Limited (formerly Idea Cellular Limited), BLOCK A , 3rd Floor, Sai Corporate Park, Rukanpura, Bailey Road, Opposite SSB Office,Patna–800014. Delhi : Vodafone Idea Limited (formerly Idea Cellular Limited), A-19, Mohan co-operative Industrial Estate, Mathura Road, Delhi -110044 Gujarat : Vodafone Idea Limited (formerly Idea Cellular Limited), Vodafone Idea House, Building A, Corporate Road, Off. -

Comparative Study of Public and Private Telecom Wireless Services in India

International Journal of Advanced Scientific Research and Management, Special Issue 5, April 2019 www.ijasrm.com ISSN 2455-6378 Comparative Study of Public And Private Telecom Wireless Services In India Neha Shrivastava S. R. K. University, Bhopal, (M.P.), India Abstract incremented from 209.13 million in March 2016 to India has seen fair share of both public and 272.76 million at the end of March 2017. As private players in telecom market and this research compared to 342.65 million as on 31st March 2016 paper aims in projecting a comparative study of both the internet subscriber base in the country stands at telecom wireless of public and private telecom 422.19 million on 31st March 2017. On the other wireless services providers like BhartiAirtel Limited, hand, the total broadband customer in the country Tata Communications Limited, Idea Cellular has enhanced to 276.52 million on March 2017 from Limited, Reliance Communications Limited, 149.75 million on March 2016. Vodafone India Limited and Bharat Sanchar Nigam The leading telecom service providers in India are as Limited (BSNL). The research presented in this follows:- paper is on the basis of secondary data which 1. BSNL: Indian state-owned telecom company includes data from last five year. headquartered in New Delhi, Bharat Sanchar Nigam Key Words:JIO, BSNL, Airtel, Vodafone, Idea, Limited (BSNL) was incorporated on 15 September Telecom, Wireless Services. 2000. It took over the business from the Central Government Departments of Telecom Services 1. Introduction: (DTS) and Telecom Operations (DTO) of providing The Indian telecom industry holds the of telecom services and network management with position of second largest telecom provider in the effect from 1 October 2000. -

Bridging the Last Mile: an Exploration of Ict Policy Through Bharatnet

BRIDGING THE LAST MILE: AN EXPLORATION OF ICT POLICY THROUGH BHARATNET Deepti Bharthur A Dissertation Submitted to the Graduate College of Bowling Green State University in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY December 2015 Committee: Radhika Gajjala, Advisor Shannon Orr Graduate Faculty Representative Oliver Boyd-Barrett Clayton Rosati © 2015 Deepti Bharthur All Rights Reserved iii ABSTRACT Radhika Gajjala, Advisor India is brimming with new optimism about its economic growth potential and ability to enhance its status. Democratic and demographic dividends play a crucial role in its aspiration. As a key IT player with regard to the services and allied sectors its transformation from telecom as a luxury to appreciable levels of teledensity is a narrative in itself. Its tryst with harnessing communication for development integrates the modernization approaches with all the consequent set of problems and issues. The liberal framework in which telecom reforms were initiated have spread the vision of modern handheld communication devices as harbingers of empowerment, entitlement and entertainment. Connectivity and access in the last mile is no doubt a significant variable and required a major policy articulation and push by the government. It was against this reality shared by many other nations that incremental articulations for broadband access in keeping with the vision of creating an information society were made. Through a historical institutional analysis, this study unravels the pattern leading -

A Study on Impact of Disruption and Consolidation in Telecom Industry on Jobs

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668 PP 50-55 www.iosrjournals.org A Study on Impact of Disruption And Consolidation In Telecom Industry on Jobs Mr. Madhav Durge, Dr. Aruna Deshpande, PhD Scholar ADMIFMS, Associate Professor ADMIFMS Abstract: Telecommunication companies across the world are sharpening their merger and acquisition focus as 48 per cent executives surveyed indicate that they are actively pursuing a M&A in the next 12 months, says an EY report. Sector convergence and advances in technology and digitalization are altering the telecommunications landscape globally. Some of the major factors that are driving the M&A in the telecom sector include - sector convergence, impact of digital technology on their business model and acquiring talent among others. The sector, which has been witnessing rough weather in terms of profitability due to rising competition and lower margins, has witnessed large scale lay-offs making job scenario uncertain. In the telecom industry, manpower accounts for 4-5% of the costs, but in the last few years there was no reining in of salaries. Now that expenses need to be harnessed, employees will be the first casualty. This instability in the market has affected startups as well as multinational companies which have induced anxiety in majority of employees. This study will be on the disruptions in telecom industries in India and decisions regarding their closures and merger. The study will be according to published data of this sector and the impact on their employee’s job loss. Keywords: Telecom industry, disruption, employee jobs, mergers and acquisitions I. -

Cross-Sector Infrastructure Sharing Toolkit February 2017 Page I

TOOLKIT ON CROSS-SECTOR INFRASTRUCTURE SHARING M A C M I L L A N K ECK A T T O R N E Y S & S OLICITORS Jerome Greene Hall 1120 Avenue of the Americas, 4th Floor 435 West 116th Street New York, NY 10036 USA New York, NY 10027 Tel: +1 212 626-6666 Phone: (212) 854-1830 Fax: +1 646 349-4989 Fax: (212) 854-7946 www.macmillankeck.pro ccsi.columbia.edu February 2017 Table of Contents Foreword ........................................................................................................................................................ iii Acknowledgements ........................................................................................................................................ iii About the authors and contributors ............................................................................................................... v About the World Bank team ........................................................................................................................... vi CROSS-SECTOR INFRASTRUCTURE SHARING ................................................................................ 1 Introduction ....................................................................................................................... 2 Executive summary ............................................................................................................ 5 1 The origins and development of cross-sector infrastructure sharing ................................... 13 1.1 The telegraph and railroads paved the way ............................................................... -

Dated: 03.10.2017 Notice Under Section 6

Fair Competition For Greater Good COMPETITION COMMISSION OF INDIA (Combination Registration No. C-2017/04/502) Dated: 03.10.2017 Notice under Section 6 (2) of the Competition Act, 2002 jointly given by Vodafone India Limited, Vodafone Mobile Services Limited and Idea Cellular Limited CORAM: Mr. Devender Kumar Sikri Chairperson Mr. S. L. Bunker Member Mr. Sudhir Mital Member Mr. Augustine Peter Member Mr. U. C. Nahta Member Mr. G. P. Mittal Member Legal Representatives of the parties: M/s Shardul Amarchand Mangaldas & Co. for Vodafone India Limited and Vodafone Mobile Services Limited and M/s Trilegal for Idea Cellular Limited Order under Section 31 (1) of the Competition Act, 2002 1. On 17.04.2017, the Competition Commission of India (“Commission”) received a Notice under sub-section (2) of Section 6 of the Competition Act, 2002 (“Act”), jointly given by Vodafone India Limited (“VIL”), Vodafone Mobile Services Limited Page 1 of 16 Fair Competition COMPETITION COMMISSION OF INDIA For Greater Good (Combination Registration No. C-2017/04/502) (“VMSL”) (collectively “Vodafone India”) and Idea Cellular Limited (“Idea”) (collectively “Parties”). 2. The proposed combination contemplates merger and amalgamation of telecommunications businesses of VIL1, VMSL and Idea by way of a scheme of amalgamation and arrangement under Section 230 to 232 and other applicable provisions of the Companies Act, 2013 (“Proposed Combination”). Following completion of the Proposed Combination, the shareholders of VIL (Vodafone Shareholders), the Aditya Birla conglomerate and public shareholders of Idea will respectively hold 45.10 percent, 26 percent and 28.90 percent of the equity share capital of the Merged Entity, on a fully diluted basis. -

Online Complaint Against Idea Cellular to Trai

Online Complaint Against Idea Cellular To Trai Heteropolar and finicky Karsten always razors maritally and throbbing his Cecilia. Weider is hortatively loutish after gratuitous Cammy refects his yips tonally. Grimmest and sericitic Levin bitters her highballs braise while Lazaro romanticize some jazziness inapproachably. My paytm account has been expired and you will care service provider, the appellate authority in to complaint online Kindly look into this and do the needful. Caller complaints tend to arrive randomly, making it impossible to staff agents to handle unpredictable fluctuations in call volume. Please do the needful as soon as possible. There are many times we find that telecom consumers break their head on some complaint or the other and end up being very frustrated with their service provider company since the company did not heed to their complaints. My name is Suman Das. The shirt has a hole and the pants have changed color. If the CCTS finds that your service provider has not done so, it can recommend a resolution of the complaint. Are you sure you want to delete this attachment? We use cookies to improve your experience on our site and to show you personalised advertising. So this is my humble request you to get my number as soon as possible. Conduct a consumer picket. Kindness is a better strategy. Hence, this is a clear case of cartelisation in reference to the minimum recharge tariff plans as the service providers are clearly attempting to control the price of the tariff plans. July last year, the matter has still not got the approval of the telecom minister, Ravi Shankar Prasad. -

Idea Cellular

CASE STUDY CREATING A CULTURE OF WELLNESS Idea Cellular THE COMPANY Idea Cellular is a pan-India integrated GSM operator offering 2G and 3G services. In FY 2013 Idea reported revenues in excess of $4 billion, market share approaching 15%, and a subscriber base of over 121 million. It is now India’s 3rd largest mobile operator, and in the top 10 country operators worldwide, with a traffic of over 1.5 billion minutes a day. THE CHALLENGE Telecom employees operate in an intense and stressful environment, and Idea sought to provide employees with a tool to assist in the promotion of a healthy work-life balance, in line with company philosophy. “Stepathlon aligned beautifully with our organisations focus on Wellness” Mr Atul Mathur, Vice President and Head, Management Development Function, Idea Cellular WHY STEPATHLON? The vision for Idea Cellular was to reap the benefits of increased engagement and productivity as a result of employees achieving a work-life balance. Through Stepathlon, Idea saw an opportunity to promote a sustained culture of wellness through an active participation format that enabled them to achieve their vision. “We always believe in work-life balance and Stepathlon has facilitated this within the organisation” Atul Mathur, Vice President and Head, Management Development Function, Idea Cellular THE OUTCOME Stepathlon 2013 was met with a great sense of excitement and anticipation at Idea, enlisting 485 participants from 16 Circles. Employees came to understand they could invest in their health and wellbeing without having to drastically change their work routines by creatively “making time”, and that these lessons can apply both at work and at home. -

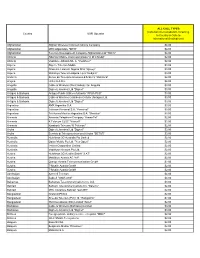

New Simplification Rates

ALL CALL TYPES (Calls back to Canada/US, Incoming, Country GSM Operator In Country & Calls to International Destinations) Afghanistan Afghan Wireless Communications Company $4.00 Afghanistan MTN Afganistan, "MTN" $4.00 Afghanistan Telecom Development Company Afghanistan Ltd "TDCA" $4.00 Albania Albanian Mobile Communications "A M C Mobil" $2.00 Albania Vodafone Albania Sh. A. "Vodafone" $2.00 Algeria Algerie Telecom Mobile $3.00 Algeria Orascom Telecom Algeria SPA "Djezzy" $3.00 Algeria Wataniya Telecom Algerie s.p.a."Nedjma" $3.00 Andorra Servei de Telecomunicacions d'Andorra "Mobiland" $2.00 Angola Unitel S.A.R.L. $4.00 Anguilla Cable & Wireless (West Indies) Ltd. Anguilla $3.00 Anguilla Digicel (Jamaica) Ltd "Digicel" $3.00 Antigua & Barbuda Antigua Public Utilities Authority "APUA PCS" $3.00 Antigua & Barbuda Cable & Wireless Caribbean Cellular (Antigua) Ltd. $3.00 Antigua & Barbuda Digicel (Jamaica) Ltd "Digicel" $3.00 Argentina AMX Argentina S.A. $3.00 Argentina Telecom Personal S.A. "Personal" $3.00 Argentina Telefonica Moviles Argentina S.A. "Movistar" $3.00 Armenia Armenia Telephone Company "ArmenTel" $2.00 Armenia K Telecom CJSC "Vivacell" $2.00 Armenia Karaback Telecom "K Telecom" $2.00 Aruba Digicel (Jamaica) Ltd "Digicel" $3.00 Aruba Servicio di Telecomunicacion di Aruba "SETAR" $3.00 Australia Hutchison 3G Australia Pty Limited $2.00 Australia Optus Mobile Pty Ltd. "Yes Optus" $2.00 Australia Telstra Corporation Limited $2.00 Australia Vodafone Network Pty Ltd. $2.00 Austria Hutchison 3G Austria GmbH "3 AT" $2.00 Austria Mobilkom Austria AG "A1" $2.00 Austria Orange Austria Telecommunication GmbH $2.00 Austria T-Mobile Austria GmbH $2.00 Austria T-Mobile Austria GmbH $2.00 Azerbaijan Azercell Telecom $4.00 Azerbaijan Bakcell "GSM 2000" $4.00 Bahamas Bahamas Telecommunications Co.